Laser Processing Equipment Market Size, Share & COVID-19 Impact Analysis, By Technology Type (Fiber Lasers, CO2, Solid State, and Others (Yag)), By Process Type (Cutting & Drilling, Welding, Marking & Engraving, Punching & Micro Machining, and Others (Heat Treatment)), By Function Type (Semi-Automatic and Robotic), By End Users (Automotive, Metal & Fabrication, Electronics, Energy & Power, and Others (Medical)), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

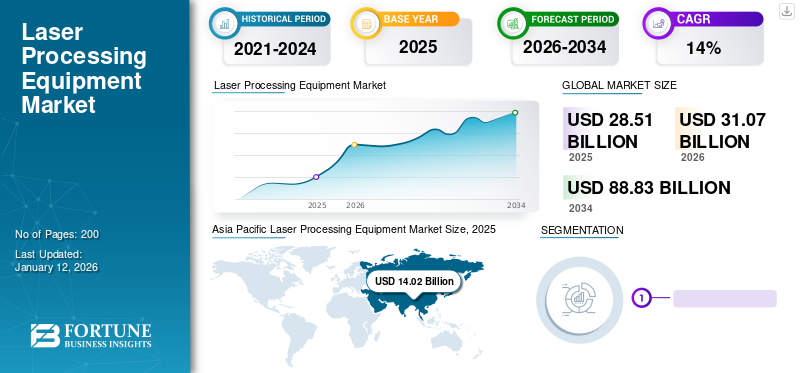

The global laser processing equipment market size was valued at USD 28.51 billion in 2025. The market is projected to grow from USD 31.07 billion in 2026 to USD 88.83 billion by 2034, exhibiting a CAGR of 14% during the forecast period. Asia Pacific dominated the laser processing equipment industry with a market share of 49.20% in 2025.

Laser processing is an advanced method of manufacturing products that uses primary laser processing machines to perform complex operations, such as metal cutting, welding, marking & engraving, punching, and others. Also, there is a robust demand for this technology as it provides streamlined operations and minimizes production downtime. Also, the prominent use of modern fiber lasers for manufacturing operations will fuel the market growth during the forecast period.

Global Laser Processing Equipment Market Overview

Market Size:

- 2025 Value: USD 28.51 billion

- 2026 Forecast Value: USD 31.07 billion

- 2034 Forecast Value: USD 88.83 billion

- CAGR: 14% (2026–2034)

Market Share:

- Regional Leader: Asia Pacific dominated the market with a 49.20% share in 2025, driven by strong automation in automotive and metal fabrication industries and supportive government policies.

- Leading Technology: The fiber laser segment is dominant, fueled by its rising use in high-precision applications like manufacturing medical devices and surgical tools.

- Leading Process Type: The welding segment leads the market, driven by rising global investment in infrastructure projects that require precise and high-strength welds.

- Leading Function Type: The robotic laser segment is growing fastest due to its ability to provide ultra-precision finishing and enhanced operational efficiency with minimal human intervention.

- Leading End-User: The automotive segment is set to dominate, as laser processing equipment is essential for high-capability, continuous production lines.

Industry Trends:

- Industry 4.0 & IoT Integration: Laser equipment is increasingly integrated with next-generation features like IIoT, data logging, and real-time process monitoring for more efficient operations.

- Shift to Advanced Fiber Lasers: The market is seeing robust demand for modern fiber lasers, which offer superior performance in a wide range of manufacturing operations.

- Rise of Automated Systems: A global shift toward automated and robotic laser systems is occurring to increase precision, enhance safety, and streamline production.

Driving Factors:

- Growing Industrialization: Rapid industrialization and heavy investment in manufacturing, fabrication, and automotive production are bolstering market growth.

- Demand for Precision Engineering: A major demand for precision equipment is emerging from the need for highly efficient, automated systems that can perform complex tasks.

- Growth in Electric Vehicles (EVs): The expanding EV market is boosting the adoption of laser cutting, welding, and punching machines for vehicle manufacturing.

- Supportive Government Policies: Government initiatives that promote industrialization and advanced manufacturing are expanding the application of laser equipment.

Restraining Factors:

- High Initial Cost: The high cost of installing laser processing equipment and the complexity of its parts place a significant financial burden on investors.

- Extended Return on Investment (ROI): High costs combined with the need for frequent maintenance can lead to extended periods for return on investment, hampering adoption.

- Frequent Maintenance Needs: The complex components used in laser machines require regular and often costly maintenance, which can suppress market growth.

Furthermore, rapid industrialization and supportive government policies are promoting and expanding the application of laser processing equipment across the automotive sector. Additionally, the increasing demand for electric vehicles in regions, such as Europe, Asia Pacific, and the U.S. is boosting the adoption of laser punching, cutting, and welding machines across the automotive, metal & fabrication, and consumer electronics industries.

COVID-19 IMPACT

Decreased Production Activities and Supply Chain Disruptions Impacted Market Revenue in Short Term

Global production capacities were hampered owing to the shortage of raw materials and supply chain delays. Also, the weakening demand for lasers in the sheet metal cutting & welding industry across production facilities impacted the revenues of key market players, which significantly slowed the market growth in the short term. Furthermore, the sluggish economic growth of prominent regions, such as North America and Europe decreased investments in production capacities and, in turn, jeopardized the demand for laser equipment. Thus, the above-mentioned factors caused economic pressure on the supply of goods, thereby negatively affecting the demand for laser process equipment in the short term.

- For instance, according to Laser Focus World, sales of lasers for sheet cutting in macro applications declined by 11% in 2019. They recovered by 3% in 2020, led by a significant recovery in the sales of fiber lasers.

Laser Processing Equipment Market Trends

Industry 4.0 and IoT feature Integration to Equipment Changing Trends of Modern Engineering

The changing scales of production across the globe have increased the need for modern engineering techniques in fabrication technology. Also, the development and integration of next-generation features, such as data logging and Industrial Internet of Things (IIOT), are accelerating the global market progress. Furthermore, modern engineering is growing exponentially with the introduction of innovative analytics features. Integration of Industry 4.0 into heavy-duty automated laser processing equipment for efficient operation will also bolster the market growth during the forecast period.

- For instance, in April 2022, Bharat Fritz Werner Group, India’s leading Industry 4.0 machines and solutions provider, launched its advanced 4000G DED laser machine. The machine would be equipped with complete 5-axis control with real-time process monitoring features.

Download Free sample to learn more about this report.

Laser Processing Equipment Market Growth Factor

Growing Industrial Applications and Demand for Precision Engineering to Bolster Market Progress

Industrialization has taken over several countries across the world with increased investments in manufacturing, fabrication, and automotive production lines. Also, global market players have experienced a major demand for precision engineering equipment to operate highly efficient feed-automated systems. These systems offer efficiency while performing precision engineering operations through offsetting optimal laser position. Such advancements in laser equipment will bolster the laser processing equipment market share during the forecast period.

- For instance, in September 2022, Epilog laser, CO2, and Fiber laser manufacturers launched a fusion maker laser system. The equipment is available in 30 and 40 configurations, having an engraving speed of 60 inches per second.

RESTRAINING FACTORS

Extended Return on Investments (ROI) and Delay in Supply to Hamper Product Demand

Laser processing tools utilize high laser machining for precision cut edges and high production capabilities, thereby significantly increasing the material processing efficiency. These factors often raise the installation cost and put a burden on investors. Also, the complex parts used in these machines need frequent maintenance, which will suppress the growth of the market in the short term.

Laser Processing Equipment Market Segmentation Analysis

By Technology Type Analysis

Advancements in Fiber Lasers to Boost Their Demand Among Various Industries

Based on technology, the market is classified into fiber laser, CO2, solid state, and others (Yag).

The fiber laser segment is estimated to dominate the market due to the rising use of this technology for producing implantable devices and surgical tools that need high-precision engineering and minimal exposure to rust. In contrast, the subsequent demand for CO2 and Solid lasers owing to its dominance use in metal sheets and immense structure fabrication significantly drives the demand for CO2 and solid lasers in short term. These lasers provide a higher deposition rate and better welding strength to the material, which will drive their demand significantly. Furthermore, Yag lasers have a minimal and specific application and are capable of providing high-quality, continuous, and pulsed output for engraving and marking. These features will increase the demand for these lasers. The solid state segment with the largest share 30.58% the market in 2026.

By Process Type Analysis

Rising Investments in Infrastructure Projects to Fuel Demand for Precise and Clean Welding Processes

Based on process type, the market is classified into cutting & drilling, welding, marking & engraving, punching & micro machining, and others (heat treatment).

The welding laser segment is estimated to dominate the market owing to the rising global investment in infrastructure projects, such as heavy structure and metal fabrication. These projects need precise welding and high strength to protect the structures from environmental impact. Furthermore, the demand for industrial lasers in cutting and drilling operations is rising in the metal fabrication industry for precise and measured engineering is augment to the boost growth of the cutting & drilling segment. Also, rising demand for surface finishing and metal utensils marking is predicted to drive for the use of marking & engraving, punching & micromachining, and other processes in near term future.

By Function Type Analysis

Demand for High Precision and Less Human Intervention to Boost Adoption of Robotic Lasers

Based on function type, the market is segmented into semi-automatic and robotic.

The robotic laser segment is expected to record the highest CAGR with a market share of 55.68% in 2026, owing to its ultra-precision finishing and minimized human intervention, which enhances operational efficiency. Also, there is a steady demand for semi-automatic lasers for human-guided and manual computer-aided design operations for metal fabrication and complex metal joining operations, which will drive the growth of the semi-automatic laser segment.

By End Users Analysis

To know how our report can help streamline your business, Speak to Analyst

Demand for High-Strength Mobility Solutions to Strengthen Adoption of Laser Cutters in Automotive Sector

Based on end-users, the market is divided into automotive, metal & fabrication, electronics, energy & power, and others (medical).

The automotive segment is set to dominate the market with 42.16% share in 2026, owing to the installation of continuous production lines. Laser processing equipment provides excellent operation capabilities to the machines operating in the production line. Furthermore, the rising use of laser cutting or engraving machines in ultra-precision and complex engraving operations is driving the demand for laser cutting and engraving equipment in metal fabrication and electronics manufacturing. Also, the energy & power and medical sectors is set to grow steadily due to the rising use precision laser engineering tools for material processing operations, including sheet metal cutting and welding.

REGIONAL INSIGHTS

The market is studied across the regions of North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific Laser Processing Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 14.02 billion in 2025 and USD 15.5 billion in 2026. The global laser processing equipment industry is growing extensively due to a large consumer base, rise in the consumption of finished goods, and strong use of automation in automotive and metal fabrication industries. Asia Pacific region lead the sales of vehicles due to supportive government policies that expand the regional market share in the long term. Also, the rising demand for structural rigidity and smooth surface finish for products, such as alloy wheels and metal cutting for making chassis is anticipated to drive the market revenue during forecast period.

China is dominating the Asia Pacific laser processing equipment market owing to rise in infrastructure development across the country’s mega cities that needs modern laser fabrication methods for tough manufacturing. Also, dominant user of laser cutting and welding for mass manufacturing in production line provide lucrative opportunities and set to dominate the laser cutting and welding application across automotive industry. Also, the strong demand for laser processing machines to produce advanced vehicles will bolster the demand for laser processing equipment in countries, such as India, South Korea, and Japan for the long term. The Japan market is projected to reach USD 3.05 billion by 2026, the China market is projected to reach USD 7.49 billion by 2026, and the India market is projected to reach USD 2.3 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

The market in North America is predicted to grow progressively with rising investment in manufacturing and food processing. Also, there is a high potential for using the laser processing equipment to develop infrastructure in countries, such as the U.S. and Mexico, which will further drive the regional market growth. The U.S. market is projected to reach USD 4.04 billion by 2026.

The Europe market is anticipated to grow moderately due to the formulation of sustainable product development future technologies which minimizes energy consumption during metal processing. Furthermore, these devices provide excellent operational capabilities which can minimize expenses and offer benefits in the long term. The UK market is projected to reach USD 1.16 billion by 2026, while the Germany market is projected to reach USD 1.35 billion by 2026.

The subtle demand for laser processing machines across the Middle East & Africa is due to the limited application of these devices in metal fabrication and manufacturing facilities. However, the substantial demand of laser cutting and welding beholds the market growth in the long term.

South America is forecasted to grow steadily as key companies across the region are focusing on expanding the manufacturing of the laser processing equipment.

List of Key Laser Processing Equipment Market Companies

Prominent Players Will Integrate IoT and Advanced Fiber Lasers to Maintain Market Dominance

Laser processing device manufacturers are poised to grow at a strong pace owing to the production of advanced machines. Manufacturers offering more advanced laser cutting and welding devices that minimize operational expenses are leading the market growth. Also, these companies are improving their product portfolios by integrating new and advanced IoT features into the laser equipment to provide real-time equipment information and improve production efficiency. This factor is set to bolster the demand for laser processing equipment during the forecast period.

- For instance, in June 2023, Trumpf Laser developed a versatile fiber laser that can manufacture core components for electric motors and hydrogen cells that come in the power range of 500 to 2000 watts.

List of Key Companies Profiled:

- Trumpf (Germany)

- Hanslaser (China)

- HGTECH (China)

- Bystronic (Switzerland)

- Jinan Bodor CNC Machine Co., Ltd. (China)

- Amada (Japan)

- Salvagnini (Italy)

- PrimaPower (Italy)

- Mazak (Japan)

- Messer (Germany)

- Mitsubishi (Japan)

- IGP Photonics (U.S.)

- Epilog Laser (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: xTool, a U.S. based laser tool manufacturer, has launched a precise and powerful 40W laser module with powerful capabilities. The equipment provides a precise laser cut and ultra-precision engraving features.

- October 2022: TRUMPF, a globally renowned laser equipment manufacturer, showcased the upgraded TRULaser 5000 series. The machine is equipped with an advanced fiber laser that provides twice the power of the earlier one with 24KW of output and can increase productivity by 80%.

- October 2022: BLM Group, a tube and laser technology manufacturer, launched its new LS7, which offers high productivity, high cutting speed, and accuracy.

- October 2022: HSG Laser Co, Ltd., a leading laser equipment manufacturer, launched its new smart tube laser cutting machine. The New T2 series machine bed is integrated with an independent high-sensitive servo that supports the rotating tube cutting.

- May 2022: Yamazaki Mazak, a leading machine tool manufacturer, launched the FG-400, an advanced 3D fiber laser cutting machine equipped with an efficient and energy-saving fiber oscillator laser that enables high productivity and energy efficiency.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as key market players, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that contributed to the growth of the market in recent years.

[haknxb32wl]

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology Type

By Process Type

By Function Type

By End Users

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 64.39 billion by 2032.

In 2024, the market was valued at USD 26.15 billion.

The market is projected to record a CAGR of 12.3% during the forecast period.

The fiber lasers technology type segment is expected to lead the market.

Growing industrial applications and high demand for precision engineering are the key factors driving the market growth.

Trumpf, Hanslaser, HGTECH, Bystronic, Jinan Bodor CNC Machine Co., Ltd., Amada, Salvagnini, PrimaPower, Mazak, Messer, Mitsubishi, IGP Photonics, and Epilog Laser are the top players in the market.

Asia Pacific holds the largest market share.

By end user, the automotive segment is expected to record a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us