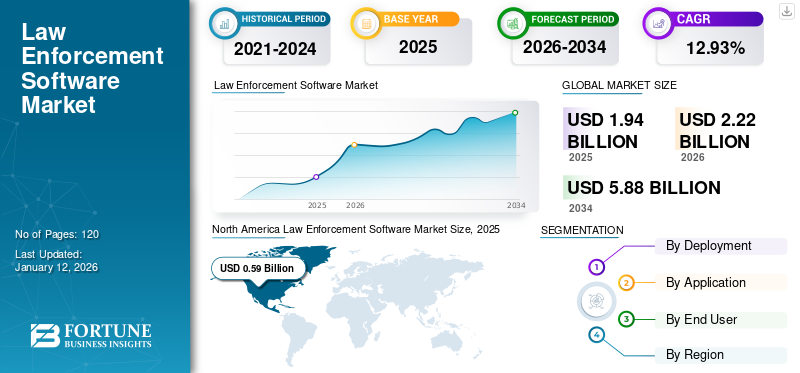

Law Enforcement Software Market Size, Share & Industry Analysis, By Deployment (Cloud-based and On-premise), By Application (Case Management, Incident Mapping, Dispatch Management, and Evidence Management), By End User (Government and Commercial), and Regional Forecast, 2026-2034

Law Enforcement Software Market Analysis 2026-2034

The global law enforcement software market was valued at USD 1.94 billion in 2025 and is projected to be worth USD 2.22 billion in 2026 and reach USD 5.88 billion by 2034, exhibiting a CAGR of 12.93% during the forecast period. North America dominated the law enforcement software market with a share of 30.41% in 2025.

Law enforcement software improves policing practices, builds community trust, helps reduce human error, and improves public safety and security. Demand for law enforcement software is increasing due to a rise in criminal activities such as ransomware attacks.

The software gives law enforcement the authority to control critical data for analysis, such as criminal databases and records, enabling access to data irrespective of the time and location. One of the major factors driving the growth of the software market in the coming years is the increasing demand for effective communication in law enforcement. This is important to ensure the safety of the law enforcement officer and increase success rates. Rising crime rates are forcing government officials and law enforcement agencies to use cutting-edge technology to improve public safety infrastructure.

Community-oriented policing is a strategy considered by law enforcement agencies given that it allows them to work closely with communities and improve their quality of life. Police officers and citizens are encouraged to work together to prevent crime through community-based policing. Cutting-edge technologies such as smart transportation, security equipment, and smart energy meters are used to build smart cities. Besides, governments and large corporations are investing in various technologies, such as smart utilities, public transport, and housing.

Several law enforcement software providers experienced significant losses due to the COVID-19 pandemic, which impacted the market negatively during the initial months of 2020. However, the market began to grow in the last quarter of 2020 as police and other law enforcement personnel adopted digitalization in their investigative procedures. Increasing demand for cloud-based solutions coupled with remote working increased the industry’s growth potential. During the pandemic, the cybercrime rate went up by 600% and due to this, there was a surge in product demand. The software was consistently installed across a wide range of public safety organizations across various countries to reduce the crime rate and protect against future incidents. The increasing criminal activities during the pandemic escalated the product demand, driving the law enforcement software market growth.

Law Enforcement Software Market Trends

Adoption of AR/VR for Law Enforcement Training

Law enforcement agencies use AR/VR tools for training purposes as well as for crime scene investigation and courtroom presentations. AR/VR tools have the potential to transform training, and improve skills, which makes it easier for enforcement officers. Companies in the market are focusing on providing innovative tools to enforcement agencies. For instance, in April 2018, Axom developed a system that is designed to train the police in a range of skills, including de-escalation of potentially violent situations and dealing with a public with hearing impairment or Alzheimer’s.

Apart from training, Augmented Reality (AR) is useful for officers as it helps them to stay aware of what is happening in their area and enhances their understanding of the situation with overlaid computer images. In China, a startup Xloong Technology, launched AR glasses in May 2017, that allow police to access license plate recognition functions and facial recognition function in real time. The product also helps the officers to identify suspects through data analytics. Furthermore, in the U.S., police officers use a system called Apex officer, that helps enforcement officials to train to respond to call where mental health is an issue.

Thus, the increasing adoption of AR/VR tools is driving the market growth.

Download Free sample to learn more about this report.

Law Enforcement Software Market Growth Factors

Increasing Demand for Smart Devices Across Enforcement Agencies to Propel Market Growth

Law enforcement organizations already use smart devices such as body-worn cameras and other devices to monitor and keep police officers safe in the field. A large volume of data is being generated through smart devices, and lots of data can potentially be used for investigation. Devices such as voice assistants and video doorbells have the capability to capture incidental going on in their surroundings. These are gradually becoming valuable sources of intelligence for detectives and enforcement officials searching for evidence.

In the U.S., data from Alexa Smart Speaker was used in a classroom to assist in a double murder case. Furthermore, data generated by the Fitbit fitness tracker is used by enforcement agencies to investigate criminal cases. More than 4,000 police forces have entered a partnership with video doorbell manufacturer Ring to access data captured from their device to assist with crime prevention and detection.

The data generated through smart devices is used for investigating criminal activities. This is boosting the law enforcement software market share.

RESTRAINING FACTORS

Government Regulations Regarding Data Security May Hamper the Market Growth

Strict government regulations on data security are restricting the market growth. Law enforcement agencies across the globe have a strong focus on intelligence and security. Intelligence offers law enforcement agencies with an actual means of solving crimes. On the other hand, security ensures that confidential information does not fall into wrong hands. The surveillance by law enforcement agencies assists in gathering huge information about any criminal activity before the event happens, in turn helping with establishing the occurrence of the crime.

Law enforcement software providers must adhere to government regulations and compliances to provide apt controls for the protection of crucial information. Some of these regulations comprise the Criminal Justice Information Services (CJIS) in the U.S. and the General Data Protection Regulation (GDPR) in Europe. The software is deployed for the management of personal information and helps law enforcers in the detection, investigation, or prosecution of criminal offences.

The above-mentioned factors may hamper the market growth.

Law Enforcement Software Market Segmentation Analysis

By Deployment Analysis

Adoption of Cloud-based Law Enforcement Software to Save Operational Costs to Boost Segment Growth

Based on deployment, the market is categorized into cloud-based and on-premise.

The cloud-based solutions segment dominated the market share of 63.02% in 2026 and is set to expand at a high CAGR during the forecast period. Switching to cloud-based software makes it easy for law enforcement agencies to remain compliant with federal policies and prevent the occurrence of security breaches, audits, and similar events. The adoption of cloud-based software is surging among enforcement agencies. The software helps enforcement agencies to save money and time.

The on-premise segment is slated to witness steady growth during the projected period. This comes as on-premise installations cost a significant amount of initial investment in both money and time and also maintaining employees for support and upkeep, increases the cost for enforcement agencies.

By Application Analysis

Adoption of Enforcement Software Propelled the Growth of Case Management Application Segment

By application, the market is segmented into case management, incident mapping, dispatch management, and evidence management.

The case management segment dominated the market in 2024. The product usage in case management helps enforcement agencies storing the digital records by decreasing the paperwork. It also helps in enabling quick access to information, improving transparency, issuing real-time updates, and centralizing data management.

The evidence management segment dominated the market share of 37.15% in 2024. Due to increasing activities such as accidents, vehicle theft, and others, the government has mandated the installation of cameras everywhere. Cameras is an essential tool in smart cities for law-enforcement. Enforcement agencies collect the data from the camera and it is used for collecting the evidence. Evidence management is used to prove the event’s circumstances so that agencies can test the collected evidence with confidence that the proof provided is related to the event.

However, the demand for law enforcement software is increasing for various applications.

By End User Analysis

To know how our report can help streamline your business, Speak to Analyst

Government Segment Dominated Due to Rising Adoption of Enforcement Software for Information Gathering

By end user, the market is classified into government and commercial.

The government segment dominated the market share of 40.05% in 2026 and is estimated to witness significant growth over the coming years. Adoption of enforcement software is increasing in government sector as the software helps enforcement officials to access a vast network of information gathered from state and federal agencies across the countries. By accessing billions of records, investigators, analysts, police officers, and other law enforcement professionals can identify the information they need which can be used to prove the crime.

Therefore, the adoption of enforcement software is increasing among government sector.

REGIONAL INSIGHTS

Geographically, the market has been studied across five major regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Law Enforcement Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 0.59 billion in 2025 and USD 0.66 billion in 2026. Also, the availability of sufficient IT technology and the formalization of lawmakers' workplaces are fueling regional market growth. In 2022, the U.S. community-policing initiatives were expanded and the Department of Justice announced USD 139 million funding for the digital policing initiative. Through this initiative, the local, federal, and state agencies prioritized their policing models to meet community needs. Furthermore, to train law enforcement officers on implicit bias, racial profiling and the related duty to intervene, and procedural justice, anti-bias initiatives were proposed with USD 42 million funding. The enforcement software is helping agencies boost departmental operations and improve enforcement processes in the region. Also, the region’s growth is attributed to presence of major players, including IBM Corporation, Motorola Solutions, Omnigo, and others. The U.S. market is projected to reach USD 0.48 billion by 2026.

Asia Pacific

Asia Pacific is set to expand with the maximum CAGR over the forecast period. This is due to the rising popularity of technological advanced products for law enforcement for preventing the criminal activities. The growth is due to breakthroughs, predefined standard activities to robotize the general examination process, and increasing awareness within government offices about the benefits of enforcement software. The Japan market is projected to reach USD 0.11 billion by 2026, the China market is projected to reach USD 0.17 billion by 2026, and the India market is projected to reach USD 0.12 billion by 2026.

Europe

The Europe market growth is owed to the increasing adoption of AI based facial recognition using video surveillance for law enforcement. Technologies such as predictive crime mapping are adopted by enforcement agencies and this is boosting the software demand in the region. The UK market is projected to reach USD 0.07 billion by 2026, and the Germany market is projected to reach USD 0.06 billion by 2026.

Middle East & Africa and South America

The Middle East & Africa and South America regions are also expected to witness steady growth during the forecast period. The increase in deployment of various technological advance products for enhancing public safety are the factors that are contributing to the market growth in South America and the Middle East & Africa regions.

Key Industry Players

Key Players Deploy Numerous Growth Strategies to Boost Their Market Share

Pivotal players focus on deploying partnerships, product launches, and other strategies. With strategic partnerships and collaborations, market players provide enforcement agencies with advanced features and innovative product offerings. The deployment of similar strategies is rising, considering the focus of industry players to increase their global presence.

- October 2022 – Omnigo entered a partnership with Digital Ally for integrating the Omnigo’s Investigation and Case Management Solution with Digital Ally’s video solutions for ensuring public safety.

List of Top Law Enforcement Software Companies:

- Omnigo (U.S.)

- LexisNexis (U.S.)

- Adashi (U.S.)

- Magnet AXIOM (Canada)

- Column Case Management (U.S.)

- Axon (U.S.)

- Matrix Pointe Software (U.S.)

- CivicEye (U.S.)

- LEFTA Systems (U.S.)

- eForce (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2023 – CivicEye, a provider of law enforcement software solutions, entered a partnership with FRONTLINE Public Safety Solution with an aim to integrate Civic RMS with FRONTLINE diverse range of products for improving public safety.

- April 2023 – Magnet Forensics partnered with Cowebs Technologies to enhance the investigation process. The partnership was aimed at aligning Magnet Forensics’s digital investigation solution with Cowebs’ open-source intelligence platform to offer end-to-end investigation capabilities.

- February 2023 – Fortinet launched the Cybercrime Atlas with support from Fortinet, Banco Santander, PayPal, and Microsoft. Cybercrime Atlas provides law enforcement and government agencies with unique visibility to stop and detect cybercrime across ecosystems and infrastructure and eliminate its infrastructure to help support the world.

- May 2022 – Omnigo, a provider of incident reporting, public safety and security management software solutions, launched CADblue. The product is a new computer-aided dispatch solution for meeting the demands of law enforcement and public safety.

- April 2022 – CivicEye introduced the Law Enforcement Empowerment Program as an opportunity for tribal law enforcement agencies to conduct Records Management System pilot program.

REPORT COVERAGE

The law enforcement software market report provides a detailed analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights competitive landscape. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.93% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Application

By End User

By Region

|

Frequently Asked Questions

According to a study by Fortune Business Insights, the global market is projected to reach USD 5.88 billion by 2034.

In 2025, the market size stood at USD 1.94 billion.

The market is projected to grow at a CAGR of 12.93% over the forecast period.

Based on application, the case management segment is anticipated to lead the market over the forecast period.

The growing demand for smart devices in enforcement agencies is set to drive the market growth over the forecast period.

Omingo, CivicEye, LexisNexis, Axon, and eForce are the top players in the market.

North America dominated the law enforcement software market with a share of 30.41% in 2025.

By end user, the government segment captures highest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us