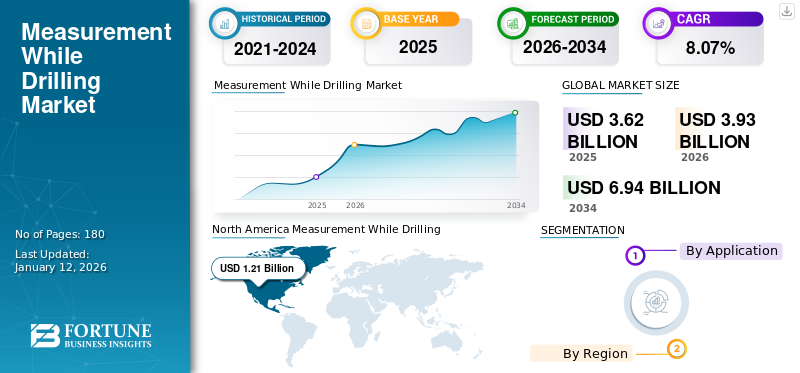

Measurement While Drilling (MWD) Market Size, Share & Industry Analysis, By Application (Onshore and Offshore {Shallow Water, Deepwater, and Ultra-Deepwater}) and Regional Forecast, 2026-2034

Measurement While Drilling Market Size and Future Outlook

The global Measurement While Drilling (MWD) market size was valued at USD 3.62 billion in 2025. It is projected to be worth USD 3.93 billion in 2026 and reach USD 6.94 billion by 2034, exhibiting a CAGR of 7.38% during the forecast period. North America dominated the Measurement While Drilling market with a market share of 33.39% in 2025.

Measurement While Drilling (MWD) refers to the integrated systems and tools used to collect, process, and analyze downhole data in real time during drilling operations. These services provide comprehensive measurements of various drilling parameters, including gamma ray, resistivity, porosity, and pressure, among others.

The global market is experiencing robust growth, primarily driven by the increasing demand for enhanced drilling efficiency and more accurate well placement in complex geological formations.

National Oilwell Varco (NOV) is one of the major players in the market. With a strong focus on innovation, NOV offers a wide range of MWD solutions that help increase efficiency and improve data transmission accuracy for drilling operations.

MARKET DYNAMICS

MARKET DRIVERS

Rising Complexity of Unconventional Resource Exploration Driving Demand for MWD Services

Increasing focus on developing unconventional resources, such as shale gas and tight oil resources, which are trapped within complex geological formations, demand greater precision and data collection during the drilling process. Horizontal drilling, a technique often employed in unconventional resource extraction, necessitates accurate directional control and real-time monitoring of borehole trajectory. MWD tools provide the essential data for steering the drill string within narrow sweet spots in the reservoir, maximizing resource recovery.

In the January 2023 report, the US Energy Information Administration (EIA) predicted that shale gas production would continue to grow in the U.S., highlighting the continued reliance on unconventional resources. This trend is mirrored globally, with countries such as Argentina and China investing heavily in shale gas development. This rising focus on unconventional resources directly translates to heightened demand for MWD services, as operators rely on its real-time data for precision steering and optimized well placement.

Environmental Concerns Fuels Demand for Measurement While Drilling (MWD) Technology

Governmental regulations are increasingly stringent on waste management and preventing subsurface contamination. MWD allows operators to monitor downhole conditions such as pressure and temperature in real-time. This data allows for immediate adjustments to drilling parameters, preventing issues such as wellbore collapse that can lead to lost drilling fluids and potential groundwater contamination. By proactively mitigating these risks, MWD enables operators to adhere to strict environmental regulations and avoid costly remediation efforts and potential penalties.

Increasingly, governmental bodies have been enacting legislation that requires drilling operations to minimize land usage and avoid sensitive environmental areas. MWD allows for precise directional drilling, enabling operators to steer the wellbore accurately toward the target reservoir with minimal deviation.

MARKET RESTRAINTS

High Cost of Entry is a Major Hurdle for Market Expansion

The substantial initial capital investment required is one of the most significant restraining factors for the widespread adoption and growth of the global Measurement While Driving (MWD). MWD technology relies on sophisticated and highly specialized equipment, which includes advanced sensors, telemetry systems, and ruggedized hardware capable of withstanding harsh downhole environments. The costs associated with designing, manufacturing, and deploying these technologies are considerable, creating a significant barrier to entry, especially for smaller exploration and production companies.

Furthermore, the maintenance and calibration of MWD tools are complex and demand skilled technicians, adding to the overall operational expenses. The price of a single MWD tool string can easily reach hundreds of thousands of dollars, making it a financially demanding investment and delaying its widespread adoption. The oil and gas industry's cyclical nature further exacerbates the challenge posed by high upfront costs.

MARKET OPPORTUNITIES

Untapped Potential of Geothermal Energy Exploration is a Major Opportunity Factor for Market

As countries strive to diversify their energy sources and reduce carbon emissions, geothermal energy is gaining traction. The technology involved in drilling for geothermal resources shares many similarities with oil and gas drilling, creating a natural synergy for MWD services. This includes utilizing MWD tools for accurate good placement, real-time formation evaluation, and optimizing drilling parameters in high-temperature environments, a crucial element in successfully tapping into deep geothermal reservoirs.

For instance, Iceland, a nation renowned for its geothermal utilization, continues to invest heavily in expanding its geothermal capacity. In November 2023, Landsvirkjun, the National Power Company of Iceland, announced plans to invest USD 100 million in new geothermal power projects, indicating a clear commitment to the technology. Such investments create direct demand for MWD services, offering a considerable growth opportunity for companies willing to adapt their expertise to the specific demands of geothermal exploration. This is especially significant given the increasing global focus on sustainable energy sources and the pressing need for cleaner alternatives to fossil fuels. Due to this factor, the Measurement While Drilling (MWD) market growth is expected during the forecast period.

MARKET CHALLENGES

Skills Shortage Limits Innovation and Growth in Market

A significant challenge for the market is the shortage of skilled personnel capable of operating and maintaining increasingly sophisticated MWD equipment and interpreting the complex data generated. The industry requires highly trained individuals with expertise in geophysics, geology, engineering, and data analysis. The ongoing "great crew change" with experienced workers retiring, coupled with a lack of adequate training initiatives, is exacerbating this problem, potentially hindering innovation and slowing down growth in the sector.

The growing need for skilled technicians and engineers in the oilfield services sector, particularly in the digital technology space, is a challenge for market players. Without a concerted effort to attract, train, and retain qualified personnel, the market risks slowing technological adoption and missing out on the full potential of innovations. Addressing this skills shortage through targeted training programs, partnerships with universities, and competitive compensation packages is crucial for ensuring the long-term health and sustainability of the MWD industry.

MEASUREMENT WHILE DRILLING (MWD) MARKET TRENDS

Increasing Focus on Drilling Optimization, Cost Reduction, and Safety Enhancement is a Latest Trend

The oil and gas industry is constantly seeking ways to reduce drilling costs and improve operational efficiency. MWD technology plays a crucial role in achieving these goals. By providing real-time data on drilling parameters such as borehole pressure, temperature, and inclination, MWD tools allow operators to proactively address potential problems, such as stuck pipe or wellbore instability. Early detection and mitigation of these issues can prevent costly downtime and equipment failure.

In October 2023, Schlumberger and Amazon Web Services (AWS) announced a collaboration with Schlumberger to develop and deploy AI-powered solutions for upstream oil and gas operations. This collaboration focuses on leveraging AWS's cloud infrastructure and AI/ML services to enhance Schlumberger's MWD and LWD (Logging While Drilling) capabilities, enabling faster data processing.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic significantly impacted the measurement while drilling market, causing project delays, supply chain disruptions, and reduced demand due to decreased oil and gas exploration and production activities. However, as economies recover and energy demand rises, the market is expected to rebound, driven by technological advancements, growing shale gas production, and the increasing adoption of drilling optimization solutions.

SEGMENTATION ANALYSIS

By Application

Consistent Investment in Land-Based Exploration is Strengthening Onshore Market

In terms of application, the market is bifurcated into onshore and offshore.

The onshore segment dominated the market share by 71.53% in 2026 due to its ease of operation and availability of resources. Onshore exploration is one of the reliable and traditional methods of extracting hydrocarbon from the wells. The cost of drilling is economical as compared to offshore drilling. Furthermore, the onshore segment offers more options for the storage and transport of the oil after it is extracted from the well.

The offshore market is fueled by the growing exploration and production activities in deepwater and ultra-deepwater environments that demand sophisticated technologies. Exploration in offshore drilling requires real-time data for safety and regulatory compliance, particularly those related to blowout preventer systems, and MWD is pivotal in fulfilling these criteria.

To know how our report can help streamline your business, Speak to Analyst

MEASUREMENT WHILE DRILLING (MWD) MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Shale Gas and Tight Oil Development & Well Trajectories, and Multi-Well Pads Drives Demand for MWD

The resurgence in shale gas and tight oil exploration and production primarily drives the North American MWD market. The need for precise well placement in horizontal drilling, crucial for maximizing resource extraction in these formations, is a significant factor. The regional market value in 2026 was USD 1.33 billion, and in 2025, the market value led the region by USD 1.21 billion.

Furthermore, advancements in MWD technology, specifically in areas such as rotary steerable systems, contribute to the region's growth.

North America Measurement While Drilling (MWD) Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

U.S.

Increased Drilling Activities in the Country Drives Demand for MWD

The U.S. market is expected to stand at USD 0.97 billion in 2026. Within North America, the U.S. holds the largest majority of the Measurement While Drilling market share. This dominance is due to the country's extensive drilling activities, particularly in shale plays such as the Permian Basin, Eagle Ford, and Bakken. The Permian Basin, contributing around 46% of crude oil and 20% of natural gas output in 2024, has increased production annually. With an annual production growth of 485-kilo barrels per day, equivalent to Colombia's consumption, the region dominates rig count activity and upstream sector investments.

Europe

Environmental Regulations Demand MWD for Enhanced Well Control

Europe region is to be anticipated as the fourth-largest market with USD 0.49 billion in 2026.

Europe's MWD market is propelled by the increasing focus on Enhanced Oil Recovery (EOR) techniques in mature oilfields, especially in the North Sea. As traditional reserves deplete, operators are turning to advanced drilling technologies such as MWD to optimize production and extend the lifespan of existing wells. A recent report by Westwood Global Energy highlighted an increase in investment in deep water exploration projects in the Norwegian Continental Shelf, further boosting the demand for MWD services. The market value in U.K. is expected to be USD 0.07 billion in 2026.

On the other hand, Norway is projecting to hit USD 0.10 billion and Russia is likely to hold USD 0.19 billion in 2025.

Asia Pacific

Increased Investment in Offshore Exploration and Production Activities for Increasing Energy Needs to Fuel Market Growth

Asia Pacific is anticipated to account for the second-highest market size of USD 0.94 billion in 2025, exhibiting the second-fastest growing CAGR of 9.55% during the forecast period.

The APAC region presents a strong growth opportunity, largely attributed to the rising energy demand in developing economies such as India and Indonesia. Government-led initiatives to increase domestic oil and gas production, coupled with the exploration of unconventional resources, require sophisticated drilling solutions. For instance, the Oil and Natural Gas Corporation (ONGC) in India is expanding its deep water exploration activities, thereby creating a greater need for MWD technologies. The market value in China is expected to be USD 0.44 billion in 2026.

On the other hand, India is projecting to hit USD 0.19 billion in 2026, and Thailand is likely to hold USD 0.11 billion in 2025.

China

Government Initiatives to Increase Domestic Oil and Gas Production, Coupled With Exploitation of Unconventional Resources to Drive Demand for MWD

China is a key player in the APAC MWD market, driven by its ambitious goals for energy security and increasing investment in offshore exploration. The country's focus on developing its shale gas resources also contributes significantly to MWD market growth. In November 2023, China National Petroleum Corporation (CNPC) announced significant progress in shale gas production in the Sichuan Basin, showing their commitment to growing even more. These production efforts rely heavily on advanced drilling methods, including MWD.

Latin America

Deepwater Exploration Projects and Enhanced Oil Recovery (EOR) Initiatives in Mature Fields to Drive Market Growth

The Latin American MWD market is experiencing growth due to significant offshore exploration and production activities in countries such as Brazil and Guyana. The pre-salt discoveries in the Santos Basin off the coast of Brazil have attracted substantial investment, creating a strong demand for MWD services in deepwater drilling. For instance, in 2021-2022, the Argentine government announced the implementation of a USD 5.1-billion subsidy program to encourage domestic shale gas production in the Vaca Muerta formation. This announcement attracted almost USD 5 billion in outside investment, along with at least a dozen new drilling rigs.

Middle East & Africa

Large-Scale Oilfield Development Projects and Need to Optimize Production from Existing Wells to Drive Market Growth

Middle East & Africa region is to be anticipated as the third-largest market with USD 0.68 billion in 2026. The MEA region is predominantly driven by established oil and gas giants in the Middle East, such as Saudi Arabia and the UAE. The focus of these countries is to improve and maximize their wells with advanced technology such as MWD. According to OPEC's 2023 annual statistical bulletin, countries such as Saudi Arabia consistently maintain high levels of oil production, necessitating the use of MWD to optimize drilling efficiency and reservoir characterization. In 2021, Egypt signed a billion-dollar deal with six different international oil companies, including Chevron and ExxonMobil, to search for oil and gas in its Mediterranean and Red Sea waters, with 23 wells in nine separate regions. On land, Apex International Energy discovered oil in the Western Desert as part of a three-well exploration plan. The GCC market size is estimated to be valued at USD 0.10 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Innovation and Collaborations Drives Competitive Landscape of MWD Market

The MWD market is characterized by a competitive landscape that includes both established players and innovative newcomers. As technological advancements continue to reshape the industry, companies are actively responding to market demands. By focusing on innovation, collaboration, and sustainable practices, players in the market are navigating the challenges ahead and capitalizing on growth opportunities in this vital segment of the oil and gas industry. For instance, in January 2025, National Oilwell Varco introduced an upgraded MWD system featuring enhanced telemetry capabilities and improved sensor accuracy, targeting deeper and more complex wellbores.

List of Key Measurement While Drilling (MWD) Companies Profiled:

- Schlumberger (U.S.)

- Halliburton (U.S.)

- Baker Hughes (U.S.)

- Weatherford (Switzerland)

- Nabors Industries (Bermuda)

- National Oilwell Varco (U.S.)

- Jindal Drilling & Industries Ltd (India)

- Cathedral Energy Services (Canada)

- Cougar Drilling Solutions (Canada)

- Sawafi (Saudi Arabia)

- Calmena Energy Services

- Leam Drilling Systems LLC (U.S.)

- COSL - China Oilfield Services Limited (China)

KEY INDUSTRY DEVELOPMENTS:

January 2024- SLB and Nabors Industries announced a collaboration aimed at expanding the use of automated drilling solutions for oil and gas operators and drilling contractors. This agreement will allow customers to integrate the drilling automation applications and rig operating systems from both companies, leading to better well construction performance and increased efficiency.

February 2023- SLB strategically acquired Gyrodata Incorporated, a global leader in gyroscopic wellbore positioning and survey technology, to enhance its Well Construction business capabilities. The acquisition integrates Gyrodata's advanced surveying technologies into SLB's existing portfolio, promising to deliver more innovative and precise drilling solutions to customers across the oil and gas industry and MWD services.

October 2021- Sawafi, a Saudi Arabian oilfield services company, acquired Newsco International Energy Services USA Inc., a leading U.S.-based provider of directional drilling and Measurement While Drilling (MWD) services. This acquisition aligns with Saudi Arabia's strategy to localize energy and drilling technologies and leverage American innovation. Sawafi considers this acquisition of a major directional drilling company a significant milestone.

August 2020- Sawafi Aljazeera Oilfield Products and Services Co. Ltd. and Enteq Upstream plc partnered to enable Sawafi to provide Measurement While Drilling (MWD) services. Enteq Upstream, a company listed on the London Stock Exchange, develops and supplies measurement, logging, and geosteering equipment.

March 2020- Dagang Nexchange Bhd (DNeX) secured a Pan Malaysia umbrella contract from Petronas Carigali for the provision of drilling services. Under the contract terms, DNeX is responsible for providing directional drilling, measurement, and logging while drilling.

Investment Analysis and Opportunities

- In August 2023, Halliburton Strategic Ventures, the venture capital arm of Halliburton, announced an investment into a promising AI-driven drilling analytics startup. The startup is developing proprietary algorithms that use MWD data to predict bit wear, optimize drilling parameters, and improve drilling efficiency.

- In 2023, Baker Hughes Partnered with Private Research Institute to develop next-generation MWD Sensors that can withstand extreme downhole conditions and provide more accurate and reliable data. The collaboration will focus on developing advanced materials, microelectronics, and sensor designs to improve the performance and longevity of MWD tools in challenging drilling environments.

Such partnerships and investments are pushing the boundaries of MWD technology and addressing the evolving needs of the upstream energy sector.

REPORT COVERAGE

The global Measurement While Drilling (MWD) market report delivers a detailed insight into the market and focuses on key aspects, such as leading companies in Measurement While Drilling (MWD). Besides, it offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, it encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.38% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

|

By Application

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 3.62 billion in 2025.

The market is likely to grow at a CAGR of 7.38% during the forecast period.

The onshore segment is expected to lead the market during the forecast period.

The market size of North America stood at USD 1.21 billion in 2025.

Spurring demand for advanced technology to optimize drilling The rising complexity of unconventional resource exploration is the key factor driving market growth.is driving the market.

Some of the top players in the market are Schlumberger, Halliburton, Baker Hughes, and others.

The global market size is expected to record a valuation of USD 6.94 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us