Microprocessor Market Size, Share & Industry Analysis, By Architecture (RISC, CISC, Hybrid, and Others), By Application (Computer, Mobile Devices and Tablets, Industrial, Consumer, Automotive, and Government), By Size (Less than 10 nm, 10 nm – 22 nm, and More than 28 nm), By Bit Size (4, 8, 16 bits, 32 bits, and 64 bits), By Core Count (Less than 4 Cores, 8 Cores, 16 Cores, and More than 32 Cores), and Regional Forecast, 2026– 2034

KEY MARKET INSIGHTS

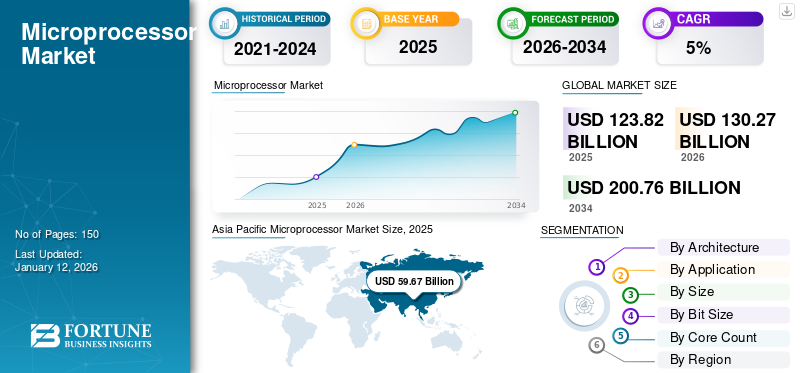

The global microprocessor market size was valued at USD 123.82 billion in 2025 and is projected to grow from USD 130.27 billion in 2026 to USD 200.76 billion by 2034, exhibiting a CAGR of 5.56% during the forecast period. Asia Pacific dominated the market with a share of 48.19% in 2025.

The market encompasses the designing, manufacturing, and distribution of MPUs (microprocessing units), which are integral components of electronic devices. This market is driven by the increasing demand for advanced computing technologies in industries including consumer electronics, automotive, healthcare, telecommunications, and industrial automation. Key players in the market include Intel, AMD, and Qualcomm, among others, along with emerging competitors. The market is characterized by rapid technological advancements, including smaller transistor nodes, improved energy efficiency, and integration of artificial intelligence capabilities.

-

- According to the World Intellectual Property Organization (WIPO), technology adoption in the mobility industry rose by 7.6% and electric vehicles saw a substantial increase of 6.1% between 2020 and 2021. This surge in electric vehicles is driving the significant growth of the market.

The COVID-19 pandemic significantly influenced and boosted the demand for computing devices due to the global shift to remote work and online education. However, supply chain disruptions and semiconductor shortages caused delays in production and delivery, impacting various industries reliant on MPUs.

MICROPROCESSOR MARKET TRENDS

Increasing Adoption of Customized and Application-Specific Processors to Fuel the Market

The increased adoption of customized and application-specific processors is fueled by the rising demand for high-performance and energy-efficient solutions tailored to specific industries and applications. Sectors such as automotive, healthcare, consumer electronics, and data centers are adopting processors designed to meet their unique requirements. For instance, the automotive industry leverages specialized microprocessors to enable advanced driver assistance systems (ADAS) and autonomous vehicle technologies. Similarly, data centers rely on AI-optimized processors to handle complex machine learning and artificial intelligence workloads efficiently.

Advancements in semiconductor manufacturing technologies, including smaller transistor nodes (such as 5 nm and 3 nm), have further facilitated the development of customized processors by enhancing computational power and energy efficiency. Additionally, the proliferation of IoT devices and edge computing applications has created a need for processors that balance performance with low power consumption. This trend is expected to accelerate as companies invest in research and development to create innovative, application-specific solutions, propelling the microprocessor market growth.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rising Adoption of MPUs in 5G-ready Devices to Drive Market Growth

The deployment of 5G network infrastructure is gaining momentum, driven by the increasing demand for smartphone-based powerful microprocessing units (MPUs) to fully leverage millimeter wave technology. The integration of MPUs in 5G-enabled mobile devices facilitates data throughput management, ultra-low latency, rapid data transfer, and real-time communication, thereby expanding the capabilities of applications in autonomous vehicles, remote healthcare, augmented reality, and smart city infrastructure.

Moreover, MPUs in smartphones and autonomous vehicle infotainment systems are required to process complex data and voice commands, broadening the application of MPUs. These units enable the efficient processing of voice commands in smart electric vehicles (EVs) while also recording vehicle performance data to optimize battery power management.

- In January 2022, Intel MobileEye introduced the EyeQ Ultra system-on-chip (SoC), specifically designed for autonomous vehicles. The EyeQ Ultra delivers 176 tera-operations per second, utilizing its advanced EyeQ architecture to meet the performance demands of electric autonomous vehicles.

Market Restraints

Reduced Rate of Performance in MPUs May Limit the Market Growth

Moore’s law predicted the doubling of MPUs processing speed and transistor count every two years since the 1970s, but it has recently shown slower progress.

- According to data from the World Intellectual Property Organization (WIPO), the increase in processing speed was only 21.4% from 2019 to 2021.

While the exponential growth in MPUs performance has been a key driver of market expansion, the ability to continue scaling transistor counts and increasing clock speeds has become increasingly difficult as technology approaches its physical limits. The reduced growth rate can be attributed to several factors, including limitations in semiconductor materials, power consumption, and heat dissipation, which constrain performance gains and hinder market expansion.

Market Opportunities

Expansion of the Internet of Things (IoT) Presents Significant Opportunities for Market Growth

The continued growth of Internet of Things (IoT) devices across various industries has increased the demand for MPUs that are optimized for specific IoT applications. These devices require MPUs that are compact, cost-effective, energy-efficient, and capable of handling real-time data processing and communication tasks. This growing need for specialized processors has led to the development of MPUs designed to operate effectively in IoT ecosystems, ensuring seamless connectivity and efficient performance.

Additionally, the rise of edge computing, which includes processing data closer to the source of generation rather than relying solely on centralized cloud infrastructures, further accelerates the demand for MPUs tailored to IoT devices. Edge devices require processors that balance power efficiency with computational capacity, enabling faster decision-making and reduced latency. Therefore, the increasing adoption of IoT and edge computing technologies will drive the growing demand for processors.

SEGMENTATION ANALYSIS

By Architecture

Rapid Innovations in RISC processors to Boost the Market

Based on architecture, the market is divided into RISC, CISC, hybrid, and others.

The reduced instruction set computer (RISC) segment held the highest market share of 43.85% in 2026, and is expected to grow at the highest CAGR over the forecast period. This is due to its efficient design, which allows for faster execution of instructions with lower power consumption, making it ideal for applications in mobile devices, embedded systems, and AI-driven technologies. Its simplicity and scalability in handling parallel tasks are key factors driving demand across various industries, contributing to its rapid market growth. For instance,

- In April 2023, the Ministry of Electronics and IT (MoS IT) revealed plans to launch India’s indigenous chipset by 2023-2024 through its Digital India RISC-V (DIR-V) program. The initiative aims to boost local chip development and establish India as a key player in the global RISC-V open-source chipset manufacturing movement.

The complex instruction set computing (CISC) segment holds the second largest market share, primarily due to its ability to execute complex instructions with fewer lines of assembly code. It is suitable for applications requiring high computational power, such as desktops and servers. While less power-efficient than RISC, CISC processors offer robust performance for legacy systems and high-end computing tasks, maintaining their strong presence in the market.

By Application

Rising Demand for Advanced Processors to Fuel the Computer Segment Growth

Based on application, the market is categorized into computer, mobile devices and tablets, industrial, consumer, automotive, and government.

The computers segment holds the highest microprocessor market share due to their widespread use in personal, business, and enterprise computing, which require powerful processors to handle complex tasks such as multitasking, gaming, and content creation. The consistent demand for high-performance processors in laptops, desktops, and workstations ensures that computers remain the largest segment of the market. The computers segment is expected to hold 31.05% of the market share in 2026.

The mobile devices and tablets segment is expected to grow at the highest CAGR over the forecast period due to the increasing demand for portable, high-performance devices with enhanced capabilities in areas such as gaming, streaming, and productivity. As consumers increasingly rely on smartphones and tablets for a wide range of functions, the need for energy-efficient, powerful MPUs tailored to these devices is driving segmental expansion.

The automotive segment is expected to grow at the highest CAGR of 8.83% over the forecast period.

By Size

Widespread Adoption of 10 nm to 22 nm in Various Industries to Drive the Segment Growth

Based on size, the market is distributed into less than 10 nm, 10 nm – 22 nm, and more than 28 nm.

The 10 nm – 22 nm segment is likely to hold 41.09% of the market share in 2026, due to the balance of performance, energy efficiency, and cost-effectiveness offered by these processors, making them widely used in mainstream consumer electronics, automotive systems, and industrial applications. These nodes represent a mature and reliable technology that is vital across a wide range of applications.

The less than 10nm segment is expected to grow at the highest CAGR of 7.02% over the forecast period. This is due to their ability to deliver superior performance, reduced power consumption, and higher transistor density, which are essential for advanced applications in AI, IoT, and high-performance computing. As industries increasingly adopt next-generation technologies, the demand for smaller, more efficient nodes is driving segment growth. For instance,

- In May 2022, AMD revealed its Ryzen 7000 series 5nm desktop processors, built on the Zen 4 architecture, during the Computex 2022 keynote. The processors offered AMS socket compatibility and twice the volume of L2 cache per core compared to prior versions.

To know how our report can help streamline your business, Speak to Analyst

By Bit Size

Rising Need for Low Power Consumption and Cost Efficiency to Boost the 4, 8, 16 Bits Segment Growth

Based on bit size, the market is divided into 4, 8, 16 bits, 32 bits, and 64 bits.

The 4, 8, 16 bits segment dominates the market due to their extensive use in embedded systems across industries such as automotive, consumer electronics, and industrial automation, where low power consumption and cost efficiency are critical. These processors are ideal for simple control and monitoring tasks, maintaining their widespread adoption in applications requiring basic functionality.

The 32 bits segment is anticipated to hold 44.30% of the market share in 2026 and grow at the highest CAGR over the forecast period. This is due to its increasing application in advanced technologies, such as IoT devices, artificial intelligence, and automotive systems, which demand higher processing power and memory capabilities. The ability of 32-bit processors to handle complex computations and support sophisticated functionalities positions them as a key enabler for next-generation devices and systems.

The 64 bits segment is projected to record a CAGR of 7.56% during the forecast period.

By Core Count

Capability to Handle Challenging Workloads in Various Sectors to Fuel the Segment Growth of 8 Cores Segment

Based on core count, the market is divided into less than 4 cores, 8 cores, 16 cores, and more than 32 cores.

The 8 cores segment is anticipated to dominate the market share by 38.87% in 2026, due to widespread adoption in high-performance computing, gaming, and professional applications, where a balance between power efficiency and multitasking capabilities is critical. Their versatility and ability to handle demanding workloads across various industries ensure their continued prominence in the market.

The 16 cores segment is expected to grow at the highest CAGR of 6.76% over the forecast period driven by the rising demand for advanced computing in areas such as artificial intelligence, data analytics, and server applications. Their superior parallel processing capabilities and efficiency in handling complex, resource-intensive tasks make them ideal for next-generation technologies, fueling rapid growth in this segment. For instance,

- In March 2023, Intel revealed its Arrow Lake-S microprocessors, supporting Z890, W880, B860, and Q870 motherboards. The processor featured 24 cores, further distributed into 8 performance cores and 16 efficiency cores, with additional support for DDR5 memory.

MICROPROCESSOR MARKET REGIONAL OUTLOOK

Based on geography, the market has been studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Microprocessor Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the market and is expected to grow at the highest CAGR over the forecast period due to the region’s strong presence of semiconductor manufacturing hubs and developing economies such as China and India. For instance,

- The 2022 report by Interos Inc. reveals that companies in Taiwan account for more than 60% of the global semiconductor manufacturing market share. Additionally, market concentration is notable, with just five companies controlling 88.6% of the global semiconductor manufacturing market.

The rapid adoption of advanced technologies, such as 5G, IoT, and AI, in industries such as consumer electronics, automotive, and industrial automation further accelerates market growth. Additionally, the growing demand for smartphones, laptops, and other electronic devices in emerging economies such as India and Southeast Asia contributes to the region’s dominance and high growth rate.

China leads the Asia Pacific market due to its strong semiconductor manufacturing ecosystem, supported by a vast network of foundries, assembly plants, and supply chain capabilities. The government initiatives to boost local production and reduce reliance on imports, coupled with investments in R&D for advanced technologies such as AI and IoT, further strengthening China’s dominance in the region. The market in China is estimated to be USD 23.18 billion in 2026.

India’s market size is foreseen to be valued at USD 4.36 billion and Japan is likely to be USD 8.71 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America to be anticipated the second-largest market with USD 42.52 billion in 2025, recording the second-largest CAGR of 5.33% during the forecast period due to its advanced technological ecosystem and the strong presence of leading players, including Intel, AMD, and Qualcomm. High investments in research and development, coupled with early adoption of emerging technologies such as AI and edge computing, drive significant demand in the region. The United States’ well-established data center infrastructure and growing focus on cloud computing are driving the demand for microprocessors in this region. Additionally, it is a major contributor in the region, driven by advancements in AI, IoT, and computing technologies. The U.S. market size is estimated to be USD 29.10 billion in 2025.

Europe

Europe is projected to be the third-largest market with a value of USD 30.44 billion in 2026. holds a significant share of the market, driven by its robust automotive industry, which increasingly relies on advanced MPUs for autonomous driving and electric vehicle systems. The region’s strong focus on industrial automation and renewable energy solutions further supports the demand for high-performance MPUs. Moreover, government initiatives to promote local semiconductor manufacturing and reduce reliance on imports strengthen Europe’s position in the global market. For instance,

- In December 2022, the European Union allocated approximately USD 288.2 million to the development of chips based on the open RISC-V architecture, with the goal of achieving technical independence. The funding, announced by the EuroHC Joint Undertaking, is intended to support projects focused on building high performance computers through the use of RISC-V hardware and software.

The market in U.K. is estimated to be USD 2.39 billion in 2026.

The Germany’s market size is foreseen to be valued at USD 2.40 billion and France’s likely to be USD 1.93 billion in 2026.

Middle East and Africa and South America

The Middle East & Africa is expected to accumulate a value of USD 6.41 billion in 2026 and the GCC market is projected to be USD 1.87 billion in 2026. The Middle East and Africa and South America markets are anticipated to grow at the slowest rate due to economic instability and limited industrial and technological advancements in the region. The consumer electronics sector primarily drives the demand for MPUs, but lower purchasing power and slower adoption of advanced technologies may hinder market growth. Additionally, the lack of significant local semiconductor manufacturing facilities and dependence on imports contribute to the region’s minimal growth rate.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Launch New Products to Strengthen Market Positions

Key players launch new product portfolios to enhance their market positions by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. Furthermore, companies in the market prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and expanding their market share in a rapidly evolving industry.

List of Companies Studied:

- Advanced Micro Devices, Inc. (U.S.)

- Toshiba Corporation (Japan)

- Intel Corporation (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Taiwan Semiconductor Manufacturing Company (Taiwan)

- NVIDIA Corporation (U.S.)

- Broadcom Inc. (U.S.)

- STMicroelectronics (Switzerland)

- NXP Semiconductors (Netherlands)

- IBM Corporation (U.S.)

- Arm Limited (U.K.)

- MediaTek Inc. (Taiwan)

- Samsung (South Korea)

- Huawei Technologies Co., Ltd. (China)

- Marvell (U.S.)

- Texas Instruments Incorporated (U.S.)

- Micron Technology, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In December 2024, Broadcom Inc., introduced its 3.5D eXtreme Dimension System in Package platform, aimed at enabling consumer AI firms to develop advanced custom accelerators or XPUs.

- In November 2024, NXP Semiconductors NV announced the launch of the i.MX 94 family. These processors are specifically designed for applications in programmable logic controllers (PLCs), industrial control, industrial telematics, and automotive gateways, and building and energy control systems.

- In November 2024, Qualcomm Technologies, Inc., introduced the Snapdragon 8 Elite Mobile Platform, claiming it as the most powerful and fastest mobile system-on-a-chip in the world. This platform incorporates advanced technologies, including the second-generation custom-built Qualcomm Oryon CPU, Qualcomm Adreno GPU, and an enhanced Qualcomm Hexagon NPU, for delivering transformative performance improvements.

- In September 2024, Qualcomm Technologies, Inc., expanded its Snapdragon X Series range with the release of the Snapdragon X Plus 8-core platform, offering extended battery life, exceptional performance, and AI-powered Copilot+ experiences to a broader audience.

- In August 2024, IBM unveiled architecture specifics for its IBM Spyre Accelerator and IBM Telum II Processor at Hot Chips 2024. These new technologies are aimed to enhance processing capacity in next-generation IBM Z mainframe systems significantly, facilitating the simultaneous use of traditional AI models and Large Language AI models through an innovative ensemble AI method.

- In May 2023, STMicroelectronics launched the second generation of its STM32 MPUs, featuring a new architecture designed to enhance performance and security for industrial and IoT edge applications. The new generation builds upon the existing ecosystem, offering improved capabilities to meet the evolving demands of these sectors.

- In March 2024, Toshiba initiated volume shipments of its SmartMCD Series gate driver ICs, which feature an embedded microcontroller (MCU). The initial product in the series, “TB9M003FG,” is specifically designed for sensorless control of three-phase brushless DC motors in automotive applications, including oil pumps, water pumps, fans, and blowers.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Investments in this technology have created significant opportunities for the market by driving innovation and enabling the development of advanced, high-performance processors. Increased funding in research and development has facilitated breakthroughs in areas such as AI, IoT, and edge computing, expanding the scope of microprocessor applications across various industries. Additionally, investments in manufacturing technologies, including smaller transistor nodes and improved fabrication processes, have enhanced processing power and energy efficiency, further accelerating market growth and opening new avenues for next-generation technologies. For instance,

- In October 2024, Intel launched the Intel Core Ultra 200S series processor range, built to enhance AI proficiencies for desktop platforms. The series features five unlocked processors with up to 8 next-gen performance cores and 16 next-gen efficient, delivering up to 14% higher performance in multi-threaded loads compared to the previous generation.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights vital industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years. The market segmentation is mentioned below:

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 5.56% from 2026 to 2034 |

|

|

Segmentation |

By Architecture, Application, Size, Bit Size, Core Count, and Region |

|

|

Segmentation |

By Architecture

By Application

By Size

By Bit Size

By Core Count

By Region

|

|

|

Companies Profiled in the Report |

|

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 200.76 billion by 2034.

In 2025, the market size stood at USD 123.82 billion.

The market is projected to grow at a CAGR of 5.56% during the forecast period.

Based on application, the computer segments leads the market.

The rising adoption of MPUs in 5G-ready devices is anticipated to drive market growth.

Advanced Micro Devices, Inc., Toshiba Corporation, Intel Corporation, and Qualcomm Technologies, Inc., are the top players in the market.

Asia Pacific holds the highest market share.

Asia Pacific is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us