Military Shelter Market Size, Share and Industry Analysis, By Type (Expandable, Personnel, Vehicle Mounted, Command Post, and Container), By Material (Composites and Metals), By Application (Military and Humanitarian Aid), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

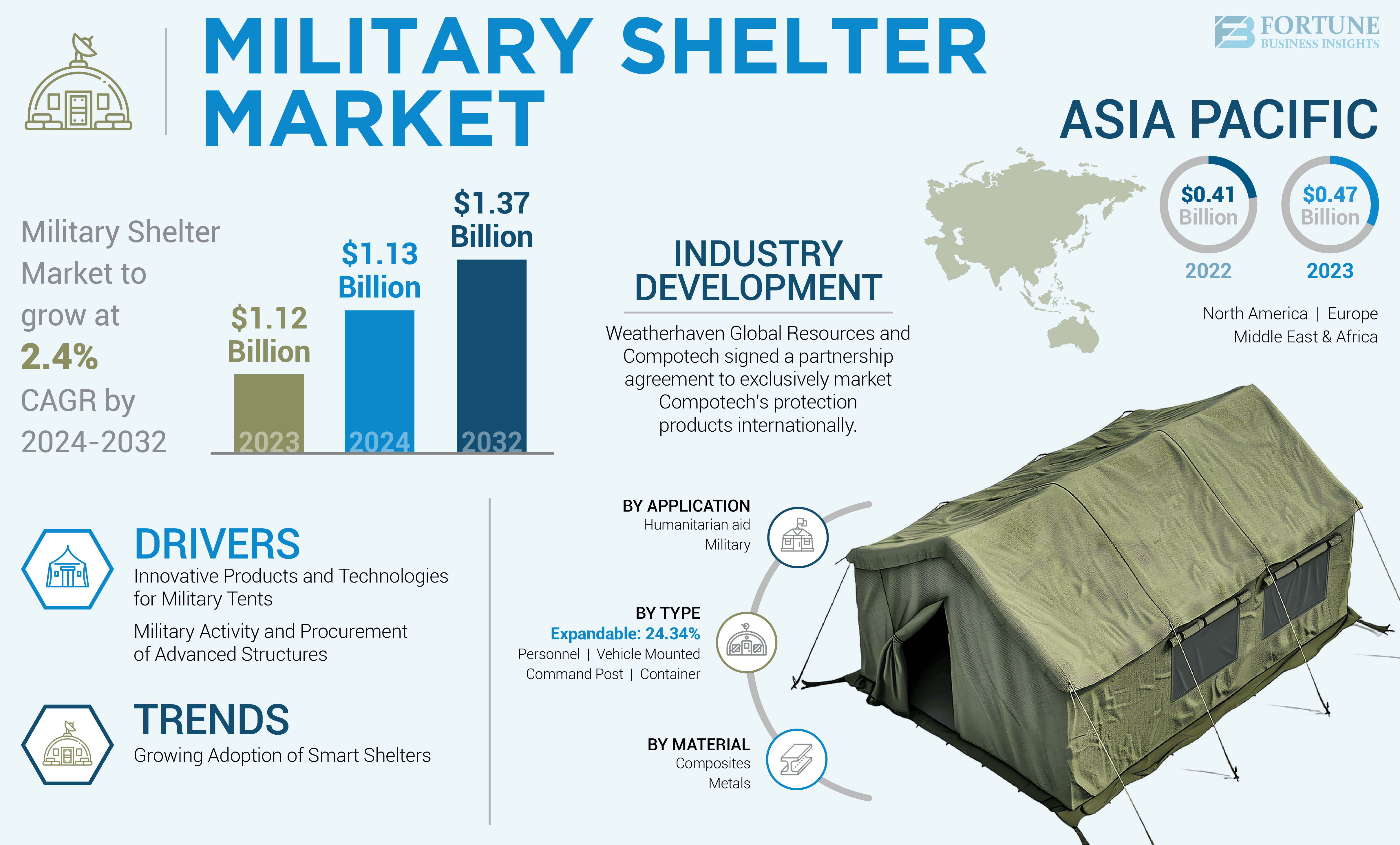

The global military shelter market size was valued at USD 1.12 billion in 2023 and is projected to grow from USD 1.13 billion in 2024 to USD 1.37 billion by 2032, exhibiting a CAGR of 2.4% during the forecast period. Asia Pacific dominated the military shelter market with a market share of 41.96% in 2023.

Military shelters are buildings that protect soldiers and military equipment around the world. They are designed to withstand the environment, such as temperature, rain, snow, humidity or sand. Various applications, such as tactical command centers, field hospitals, infantry housing and the protection of electronics equipment such as radios and computers, are covered by these shelters. They may be transported flat-packed and assembled on-site or prefabricated and transported by vehicle. Personnel can use a flexible construction system to build temporary structures that meet a variety of requirements and can be extended as needed. This system can be used as part of rapidly deployable shelters.

The market is driven by the government's aim to strengthen defense and security, leading to an increase in military spending worldwide. The U.S., China, India, the U.K., and Russia were the highest spenders in 2022. The alliance of NATO also deploys armies worldwide for peacekeeping operations and emergencies, which is expected to stimulate the growth of the global military shelter market.

Major companies around the world have been negatively affected by the COVID-19 pandemic. A number of OEMs faced significant supply shortages, which impacted the defense industry. The growth of the global military shelter market was hindered by a slowdown in the world economy, falling defense budgets, and supply chain disruption. The Indian Military Affairs (IMA) requested all of its defense forces to hold their capital attainments owing to the budget decrease as a consequence of the COVID-19 impact. The Indian Ministry of Defence abolished 9,300 posts from the Military Engineering Service on May 20th, 2020.

GLOBAL MILITARY SHELTER MARKET SNAPSHOT & HIGHLIGHTS

Market Size & Forecast:

- 2023 Market Size: USD 1.12 billion

- 2024 Market Size: USD 1.13 billion

- 2032 Forecast Market Size: USD 1.37 billion

- CAGR: 2.4% from 2024–2032

Market Share:

- Asia Pacific dominated the military shelter market with a 41.96% share in 2023, driven by rising defense spending across China, India, Japan, and South Korea and increased demand for modular, mobile shelters.

- By type, command post shelters held the largest share in 2023, fueled by the need for mobile operations centers in border surveillance and rapid deployment missions.

Key Country Highlights:

- United States: Market growth is supported by the U.S. Army’s procurement of rigid wall shelters under programs like ASF-RWS P1 and rising investment in mobile infrastructure for combat zones.

- India: Increasing cross-border tensions and demand for quickly deployable field infrastructure are driving the adoption of advanced modular shelters.

- China: Military modernization initiatives and expansion of field logistics capabilities are boosting demand for high-durability mobile shelters.

- Europe: Rising regional threats and defense cooperation initiatives are fueling investments in standardized military shelters across NATO member states.

Military Shelter Market Trends

Growing Adoption of Smart Shelters to Proliferate the Market Growth

Market growth is slated to be stimulated in the coming years due to the improvement of product quality, increasing demand for military tent products, and others. Due to advancements in material technology, there is a growing focus on lightweight and easily transportable shelters, leading to an increased emphasis on mobility in the field of shelter. Increasing demand for shelter products and services, driven by factors such as population growth, urbanization, or increased warfare activity, has led to an increase in product demand.

Smart shelter adoption is increasing, helping to expand the market for army shelters. In order to provide security and operating environments for the equipment and personnel of the armed forces, intelligent shelters offer enhanced capabilities and effectiveness. Focus on deployable shelters, including relocatable storage facilities, deployable hangars, and custom-built temporary military housing units, are all becoming increasingly important in the market. With companies such as Veldeman and Saab playing a major role in this segment, hangars are becoming the most popular for their transportable design.

For instance, in March 2023, IK Partners, a European private equity firm, agreed to invest in the Veldeman Group through its IK Small Cap III Fund. IK will acquire a minority interest from the existing management team and an individual investor group.

Download Free sample to learn more about this report.

Military Shelter Market Growth Factors

Development of Innovative Products and Technologies for Military Tents Support the Market Growth

The integration of cutting-edge technologies into military tents and shelters is revolutionizing the way armed forces operate in the field. Artificial intelligence and machine learning, for instance, enable advanced predictive maintenance and optimization of shelter resources, ensuring maximum efficiency and readiness. Blockchain technology enhances security and transparency in logistics and supply chain management, which is crucial for military operations, driving the global military shelter market growth.

Moreover, advanced power and environmental conditioning modules ensure that soldiers have a comfortable and safe environment even in harsh conditions. At the same time, modular designs offer flexibility and scalability to adapt to various mission requirements swiftly. Solar fabrics and alternative power sources such as fuel cells and batteries provide sustainable energy solutions, reducing reliance on traditional fuel sources and enhancing operational sustainability.

For instance, in April 2024, HDT GlobalHDT announced a contract for the supply of rigid wall shelters to the U.S. Army. The program, known as the Army Standard Family of Rigid Wall Shelters Phase 1 (ASF-RWS P1), consists of both expandable and non-expandable rigid wall shelters. The award underlines the dedication of HDT to innovation and excellence in providing warriors with expeditionary needs.

Increasing Military Activity and Procurement of Advanced Structures to Escalate the Market Growth

The procurement of advanced military structures plays a crucial role in enhancing national security by providing modern and effective defense capabilities. These advanced structures, equipped with cutting-edge technology and innovative features, contribute to strengthening a country's defense posture and readiness. In addition, market growth is propelled by the procurement of next-generation hangars, aircraft shelters, support networks for health care, and others.

For instance, Marshall signed a five-year contract with the Netherlands Ministry of Defense worth USD 128 million for the supply of military containers to the Dutch Armed Forces in December 2020. The company will deliver 1,400 military containers by 2023 as part of this agreement. Citing another instance, in September 2023, in order to accommodate hundreds of migrants, the U.S. government contracted with a private security firm to help set up winter camps such as encampments for heavy military tents. The contract was signed with GardaWorld Federal Services LLC, which would allow for the provision of critical services.

RESTRAINING FACTORS

Maintenance Issues, Number of Challenges, and Expensive Nature May Hamper the Market Growth

The high cost of military tents could also impact the market growth negatively, particularly in countries with limited defense budgets, and high maintenance costs and issues associated with shelters could hinder the market growth. In addition, the high initial investment required for the development and procurement of deployable shelters could also be a restraining factor for the growth of the global military shelter demand.

Furthermore, hangars for fighter aircraft are constructed of wood, metal, and cement at military bases, where they are kept and operated on a regular basis. Due to their unlimited structure and extensive interior space, these hangars are very difficult to keep up.

Military Shelter Market Segmentation Analysis

By Type Analysis

Command Post Segment Held the Leading Share due to Growing Demand for Border Security & Surveillance Activities

Based on type, the market for military shelter is segmented into expandable, personnel, command post, vehicle mounted, and container.

The command post segment held the largest share in 2023. With the increasing demand for command posts in various remote areas by military forces for border surveillance, security, and anti-terrorist activities, the segmental growth is growing significantly. For instance, in July 2023, the U.S. Army announced that it is working on creating more capable command post shelters for scattered operations. Under Command Post Integrated Infrastructure (CPI2) Increment 1, the army also seeks to reduce the command post’s physical signature for improved mobility and agility.

The expandable segment is estimated to be the fastest-growing segment during the forecast period. Increasing adoption of expandable shelters by various military forces in emerging countries is anticipated to foster the segmental growth. The dimensions of expandable shelters can also be changed as required. Therefore, military equipment and personnel are provided with a safe and efficient operating environment. In addition, it is poised to contribute to the growth of the market due to increased mobility, improved speed, and flexibility for dispersed fighting operations. In view of the rapidly expanding army forces and increasing concerns over soldier safety personnel, the expandable segment is expected to experience a significant expansion, thus propelling the global military shelter market growth.

To know how our report can help streamline your business, Speak to Analyst

By Material Analysis

Improved Performance in Extreme Weather Conditions to Favor Adoption of Composite Materials

By material, the market for military shelter is divided into composites and metals.

The composites segment accounted for the largest market share in 2023 and is estimated to be the fastest-growing segment during the forecast period of 2024-2032. This growth is attributed to the increasing demand and adoption of composite materials due to their properties such as high strength, low weight, and corrosion resistance, which make them an ideal material for shelters that need to be transported and set up quickly and efficiently in various environments.

The metals segment is slated to witness significant growth during the forecast period. The growth is attributed to the versatile and cost-effective nature of metals that are used in various applications, including tents, due to their high strength-to-weight ratio and ease of fabrication. Metal is also a sustainable material that can be recycled, which makes it an environmentally friendly choice for military tents. For instance, in January 2023, The Swedish Defense Materiel AdministrationFMV awarded Elbit Systems Ltd. a contract worth around USD 48 million for the supply of Technical High Mobility SheltersTHMS to Sweden's Army.

By Application Analysis

Military Segment Dominated Due to Rising Demand for Versatile Shelters from Key End Users

Based on application, the market for military shelter is categorized into military and humanitarian aid.

The military segment held the largest market share in 2023 and is estimated to be the fastest-growing segment during the forecast period. There is a growing demand for versatile shelters from major end users for military operations in remote areas, battleground situations, disaster relief operations, training and housing, border surveillance, and others. For instance, in October 2022, a five-year firm fixed price contract was awarded to the business of General Dynamic Mission Systems, which provides the U.S. Army with expandable and solid wall shelters for a period of up to 5 years. The Army will use the shelters for accommodation of missions in austere locations and to support different uses, such as healthcare facilities or command posts.

The humanitarian aid segment is anticipated to have significant growth during the forecast period. Humanitarian aid shelters are economical and efficient solutions for providing shelter in emergencies or medical facilities, which is driving the segment growth. They are often made of lightweight and durable materials that can be easily transported and assembled.

REGIONAL INSIGHTS

Regionally, the market is segmented into North America, Europe, the Asia Pacific, and the Middle East & Africa.

Asia Pacific Military Shelter Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific held the largest military shelter market share in 2023. The region is poised to witness significant growth during the forecast period, driven by increasing defense budgets in countries such as China, India, Japan, and South Korea. The market is fragmented as numerous players are involved in the development of shelters. A specialized product portfolio coupled with research & development activities is the prominent factor responsible for the growth of the market.

The market in Europe is estimated to be the fastest-growing during the forecast period. The region is expected to witness cross-border issues between countries, political unrest, and growing terrorism, which are poised to drive market growth. For instance, in January 2024, Estonia started building more public bomb shelters and making them mandatory in all newly constructed homes. In neighboring Latvia, the government is going through the second draft of mandatory military service legislation.

North America market for military shelter is slated to witness the highest growth during the forecast period. The greater demand for the product is owing to its lightweight, easy-to-handle, and transport properties, which is anticipated to escalate the market growth. In addition, the region is expected to grow at a significant CAGR during the forecast period, owing to increasing demand from major armed forces shelter solutions for the DoD and allied partners.

The Middle East & Africa is expected to witness moderate growth during the forecast period. The region's ongoing geopolitical tensions and conflicts are driving the demand for military tents and shelters to support military operations and peacekeeping efforts. In addition, the rising defense expenditure in countries across the Middle East is fueling the demand for advanced tactical equipment, including military tents and shelters.

KEY INDUSTRY PLAYERS

Key Players Are Focusing on the Development of Next Generation Shelters Through Research and Development to Enhance Their Position

The military shelter industry is highly fragmented, with several players involved in the development of shelters. The latest trends in the market include thermal shelters, composite shelters, and solar panel shelters, which key market players are developing to meet the evolving needs of defense forces. These key players are dominating the market due to their diversified product portfolio and research and development activities. Some of the major players in the military shelter industry include HDT Global, AAR, General Dynamics Corporation, Rapid Deployable Systems, LLC (Eureka!), and Saab AB, among others.

List of Top Military Shelter Companies:

- AAR (U.S.)

- Alaska Structures, Inc. (U.S.)

- Big Top Manufacturing (U.S.)

- DEW Engineering and Development ULC (Canada)

- General Dynamics Corporation (U.S.)

- J & J. Carter Limited (U.K.)

- Marshall Aerospace and Defense Group (U.K.)

- HDT Global (U.S.)

- Nordic Shelter (Norway)

- ROFI (Norway)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 – The Israeli defense ministry announced that it is purchasing 40,000 tents ahead of an evacuation of the southern Gaza city of Rafah, which Israel has said it plans to assault to destroy the remaining battalions of the Hamas militant group.

- November 2023 - At Base Williamtown, the Royal Australian Air Force tested a temporary shelter designed to protect and conceal aircraft from explosives and surveillance. This trial is part of an ongoing effort to inform the Air Force of future dispersed aircraft redeployment solutions that support agile operation concepts using alternative passive defense techniques and materials.

- October 2023 - In response to operational gaps in the context of an ongoing battle with China in Ladakh, India's Armed Forces entered emergency procurement contracts amounting to around USD 28 million. Acquisitions shall include missiles, weapons, ammunition, drones, communication systems, surveillance equipment, and vehicles. Overall, the army has won over 70 capital procurements, with 65 and 35 contracts signed between the Air Force and Navy.

- May 2023 –Weatherhaven Global Resources, a provider of temporary infrastructure solutions, and Compotech signed a partnership agreement to exclusively market Compotech's protection products internationally, starting in Canada, NATO, ANZAC, or Saudi Arabian markets.

- February 2023 - In southern Turkey and northern Syria, communities from all over the world continue to mobilize in order to provide urgent relief for more than 20 million people who have been affected by earthquakes. The President of Turkey has also said that in the area of 13.5 million earthquake victims, 1.6 million people are in demand for shelter.

REPORT COVERAGE

The global military tent/shelters market report provides a detailed analysis of the market insights. It focuses on key aspects such as leading companies, different types, materials used, and applications of shelters. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the developed market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 2.4% from 2024-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1.12 billion in 2023 and is projected to reach USD 1.37 billion by 2032.

Registering a CAGR of 2.4%, the market is slated to exhibit steady growth during the forecast period.

By application, the military segment occupied the largest share in 2023, owing to the growing demand for versatile shelters from key end users.

General Dynamics Corporation is the leading player in the global market.

The Asia Pacific dominated the market in terms of share in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us