Mobile Device Management (MDM) Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Type (SMEs and Large Enterprise), By End-User (BFSI, IT & Telecommunication, Government, Healthcare, Retail, and Others), and Regional Forecast, 2026-2034

Mobile Device Management (MDM) Market Size

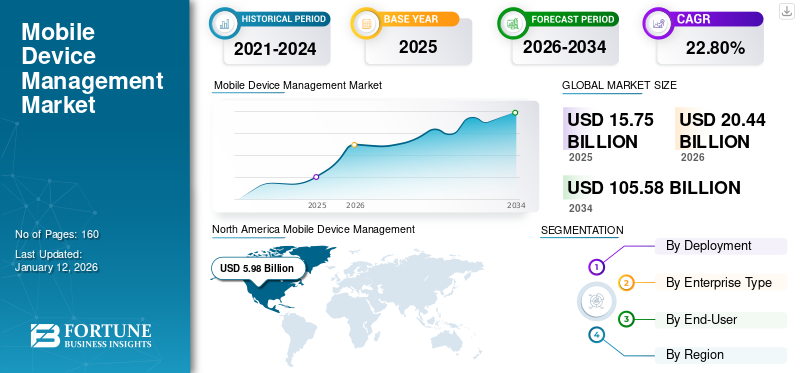

The global Mobile Device Management (MDM) market size was valued at USD 15.75 billion in 2025. The market is projected to grow from USD 20.44 billion in 2026 to USD 105.58 billion by 2034, exhibiting a CAGR of 22.80% during the forecast period. North America dominated the global market with a share of 37.90% in 2025.

In the scope of the study, we have included the players in the market, such as ManageEngine, providing solutions, including mobile application management, mobile security management, enterprise mobility management, and others. IBM Corporation provides Bring Your Own Device (BYOD) security, identity, access management, unified endpoint management solutions, and others.

The market is growing with the rising adoption of mobile-related software among various sectors such as BFSI and IT & telecommunication. This software includes security management, app management, and others. End-use organizations deploy this software to ensure information is retrieved and stored safely.

Furthermore, to increase their profitability across different geographies, leading competitors utilize various methods such as product launches, mergers, and acquisitions. For instance,

- In May 2021, Samsung launched "Galaxy Enterprise Edition" enterprise mobile device management services in Australia. This factor allows for better management of Samsung device fleets throughout their operations while supporting improved performance and security in various settings.

- In December 2020, Google LLC launched "Android enterprise essentials," a mobile management and security solution for small and medium-sized businesses. The new service offers the elements of mobile device management and capabilities that allow small firms to mandate their staff to use a lock screen and encryption to safeguard company data.

The COVID-19 pandemic forced most of the industries to work remotely. Working from home more frequently creates a risk of regulatory shortages and exposes sensitive data at risk. In multiple sectors, companies utilize MDM solutions to control security features to avoid trouble and embrace security-related approaches. This factor provides the market with immense potential. For instance,

- In August 2020, Mobile Guardian, a provider of MDM solutions in education, launched the COVID-19 relief grant for K-12 schools in the U.S. The USD 1 million software funding helps schools with online student safety, virtual classroom administration, and cloud-based device software maintenance for iOS, Android, ChromeOS, and macOS devices on and off campus.

Mobile Device Management (MDM) Market Trends

Increased Adoption of Bring Your Own Device (BYOD) in Various Industries to Drive Market

The shift in focus of organizations from traditional work to the BYOD model is one of the growing trends. Companies find it more challenging to secure a corporate network as the number of individuals working from home increases. As a result, more companies are adopting the "bring your own device" strategy. Large companies in various industries, including government, healthcare, retail, and others, are implementing BYOD in several business applications. Associations use this method to increase production efficiency while minimizing hardware maintenance and equipment acquisition expenses. Players focus on creative product debuts to grow their global geographic presence. For instance,

- In October 2020, Crestron Electronics, Inc. launched the "Crestron One" app with mobile room control that allows complete monitoring from any personal device. Crestron ONE enables touchless room management by offering employee navigation, room automation, and content sharing from their mobile device.

Download Free sample to learn more about this report.

Mobile Device Management (MDM) Market Growth Factors

Rising Adoption of Mobility Culture among Organizations to Aid Market Growth

Personal equipment, which mainly offers more advanced capabilities than company-owned devices and allows work to be done at any time and from any location, is one of the key driving factors behind this culture. Several people's primary choice of workplace technology has changed to smartphones and tablets. While mobility is becoming increasingly prevalent in academic and corporate sectors, it also necessitates more robust data and content security to prevent the misuse of business-critical data. As a result, enterprises are forced to employ mobile security protocols such as mobile device management. IT experts can now manage Chromebooks, smartphones, tablets, and kiosks from a single interface.

With an MDM platform, enterprises can safeguard their business-sensitive information accessed by enterprises' devices. It can organize policies to make sure that passwords with the stated complexity and password codes protect the device against illegal access.

For instance,

- According to the GSMA's Mobile Economy 2021 report, approximately 5.2 billion users subscribed to mobile services in 2020, with smartphones accounting for 65% of interconnection. This number is expected to rise to approximately 5.8 billion by 2025, with smartphones accounting for 80% of connections.

RESTRAINING FACTORS

High Implementation Cost of MDM Solution in SMEs and Security Issues to Restrict Market Growth

Due to the high implementation costs of MDM systems, small & medium enterprises cannot provide an efficient MDM solution, limiting the growth of the MDM market. Furthermore, MDM services come with a slew of charges, including integration, consulting, maintenance, installation, and updates, limiting the market growth.

Both with the user and the device, BYOD generates several risk factors. Corrupt password handling, operating system susceptibilities, and illegal applications are just some of the problems that arise from MDM. Moreover, even if the device is secure, BYOD has many compliance issues.

Mobile Device Management (MDM) Market Segmentation Analysis

By Deployment Analysis

Cloud to Hold Major Market Share Owing to Increasing Adoption of Cloud-based Solutions

Based on deployment, the market is divided into cloud and on-premises.

Due to its smooth, scalable, and flexible features, the cloud segment is expected to hold the highest market share during the forecast period and is anticipated to record the fastest CAGR, accounting for 79.70% in 2026. Cloud-based solutions provide IT workers with enhanced functionality such as remote management, enrollment, locking, and device safeguarding. Modern mobile devices operate on various operating systems, requiring new product performance regularly to keep them working smoothly. Furthermore, prominent market participants are collaborating and partnering with each other to develop innovative cloud-based solutions. For instance,

- In May 2022, VMware, Inc. and Wipro Limited entered a partnership that enables consumers to explore cloud flexibility while maintaining business control as companies implement their strategic transformation. With this partnership, Wipro Full Stride cloud services are combined with VMware Cross-Cloud services to enable global enterprises to enhance app modernization while lowering the cost, complexity, and risk of cloud migration.

The on-premises segment is expected to grow considerably due to the rising demand for managed MDM systems, as on-premises MDM offers better security as it is available within the enterprise’s network, just like any other server in the network. Hence, various businesses prefer on-premises MDM deployment.

By Enterprise Type Analysis

Large Enterprise to Hold Major Market Share Owing to Rising Investments to Adopt MDM Solutions

Based on enterprise type, the market is bifurcated into SMEs and large enterprise.

The large enterprise segment had the largest market with a share of 56.74% in 2026. This is primarily due to leading players, such as VMware, Inc., Microsoft Corporation, and others, increasing their IT and cloud security solution investments and product launches worldwide. For instance,

- In March 2022, IBM Corporation launched a cloud service to provide key management across hybrid and multi-cloud systems. These cloud services assist enterprises in reducing the risk of cyberattacks and insider threats to sensitive files.

The Small & Medium Enterprises (SMEs) segment is predicted to record the highest CAGR during the forecast period as the number of startups in various countries, such as India, Japan, and France has increased. A mobile-first approach makes sense in this regard, and SMEs are better equipped to succeed by collaborating with a mobile device management application. These factors will contribute to the growth of mobile device management solutions across SMEs.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

High-security Solutions Fuel the Healthcare Sector to Grow

Based on end-user, the market is categorized into BFSI, IT & telecommunication, government, healthcare, retail, and others (transportation, education, and others).

Among these, the healthcare segment holds the largest mobile device management market share, owing to high-value data and content that need security-related treatment. The healthcare segment frequently requires higher security than other enterprises for protecting information & sensitive documents. MDM utilizes automation solutions to help healthcare organizations comply with rules and improve operational efficiency. Additionally, the demand for secure & reliable MDM has grown as the number of in-home health aides and remote patient monitoring increases. MDM improves healthcare companies by securing their devices and data while complying with the Health Insurance Portability and Accountability Act (HIPAA) and industry laws. MDM also simplifies deploying devices and configuring them following corporate requirements.

The retail segment is predicted to record a leading CAGR during the forecast period. It is attributed to increased data-related privacy, security concerns, and the launching of various solutions and services by retail vendors. For instance, in December 2021, PMC announced an in-store mobile device management guide. This factor will help retailers capture customer data and clientele.

The IT & telecommunication segment is expected to grow at a considerable CAGR during the forecast period, accounting for a 21.66% market share in 2026. A significant amount of data has been used in the IT & telecom sector for business process management, security management, application management, and confidentiality of data. Increasing concerns about data security and the need for MDM solutions in IT & telecom will surge the demand in the industry in the coming years.

REGIONAL INSIGHTS

The market is divided into five major regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South America.

North American

North America Mobile Device Management (MDM) Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The North American market captured around 37.90% share in 2025, within a global market valued at USD 15.75 billion. The region's growth is attributed to multinational companies actively upgrading their mobile IT infrastructure to address the demands of changing competitive environments and keep up with the significant regional variation in compliance rules. Even though the region is more developed, it will continue to grow as major enterprises expand their implementations and utilize customized application development tools and mobile collaboration software. Major regional companies are focusing on offering innovative management software services and increasing partnerships to increase their global footprint. The U.S. market is projected to reach USD 4.26 billion by 2026. For instance,

- In March 2022, Scalefusion, a provider of mobile device management systems, partnered with Bounce Back Technologies, one of the UAE's technology solution providers. The collaboration intends to provide organizations in the UAE with the best-in-class device management and automation capabilities.

- In June 2020, BlackBerry Limited and Bell Technologies partnered to provide enterprise customers with enhanced Mobile Threat Defense. This alliance intends to offer endpoint security expertise to Canadian enterprise clients worldwide since it is necessary to be alert about security, including network and mobile device management.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to record the highest CAGR during the projection period. Rising urbanization and surging demand for managing an expanding number of mobile devices are some of the areas that are likely to offer opportunities to MDM providers. Economies such as India and China are expected to surge the demand for MDM in this region, thereby leading to the mobile device management market growth in APAC. The Japan market is projected to reach USD 0.95 billion by 2026, the China market is projected to reach USD 1.68 billion by 2026, and the India market is projected to reach USD 1.33 billion by 2026.

Europe

The market in Europe shows considerable growth in adoption practices and rising awareness of data security concerns. Germany, Spain, and the U.K. have the most significant adoption rates for MDM solutions. Companies are rapidly adopting mobility solutions to minimize hardware costs and increase productivity, which dominate the market of this region. The UK market is projected to reach USD 1.1 billion by 2026, while the Germany market is projected to reach USD 1.15 billion by 2026. For instance,

- In November 2021, PMC, the U.K.-based company, announced the latest mobile device management support and security services to assist retailers and B2C enterprises in managing the complexity that comes with the rise of mobile devices.

Middle East & Africa, and South America

The Middle East & Africa, and South America are expected to grow rapidly. The rise of government projects, cloud and Big Data adoption, and the advent of technological innovation have contributed to the market growth.

List of Key Companies in Mobile Device Management (MDM) Market

Market Leaders Focus on Expanding their Product Offerings to Extend Global Reach

Key players in the global market focus on developing and offering MDM-related products and services worldwide. Soti, Inc. provides extensive professional, enterprise content management, application, and location services.

- In August 2020, Soti, Inc. launched MobiControl v15.2., an enterprise mobility management solution. SOTI MobiControl is part of the SOTI ONE Platform that simplifies EMM by allowing enterprises to securely control any device or endpoint, despite form factor or operating system, throughout its lifecycle.

List of Key Companies Profiled:

- VMware Inc. (U.S.)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Checkpoint Software Technologies Ltd. (Israel)

- Soti Inc. (Canada)

- Scalefusion (India)

- Citrix Systems Inc. (U.S.)

- Miradore Ltd. (Finland)

- Hexnode (U.S.)

- Codeproof Technologies Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – ASBIS signed a distribution contract with ProMobi Technologies for the expansion of the Scalefusion UEM software. The collaboration allowed Cyprus-based ASBIS to improve its distribution product line with mobile device management solutions.

- July 2023 – Samsung, in collaboration with Microsoft, introduced the first on-device, mobile hardware-driven device attestation solution that operates the same on both firm and personal devices. The on-device, mobile hardware-empowered device attestation solution is accessible on Samsung Galaxy1 smartphones and integrated with security from Microsoft Intune.

- June 2023 – GoTo announced the launch of a new mobile device management solution for GoTo Resolve, helping IT teams protect, manage, and set up company-owned and BYOD devices. The GoTo Resolve MDM solution makes sure that the compliance requirements are met and simplifies device management by running Android, iOS, Windows OS, and macOS, irrespective of the location.

- February 2023 – Checkpoint Software Technologies Ltd. and Samsung Electronics partnered to develop a solution that would help organizations protect their mobile devices and sensitive data from cyber-attacks.

- January 2023 – Ivanti and Lookout, Inc. extended their partnership to enhance mobile security with the help of Lookout Mobile Endpoint Security. This is a cloud-based solution that would help organizations to accelerate cloud adoption.

- May 2022 – Scalefusion launched "Scalefusion Android MDM SDK". The Android MDM SDK is a secure and reliable set of APIs designed to make application development in enterprise environments more accessible while assuring improved end-user experience. The Android MDM SDK enables app developers to handle enterprise use cases with minimal code changes while providing a first-class user experience on Android devices managed by Scalefusion.

REPORT COVERAGE

The research report offers qualitative and quantitative insights on the product and a detailed analysis of market size & growth rate for all possible segments in the market. The report also elaborates on market dynamics, emerging trends, and the competitive landscape.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 22.80% from 2026 to 2034 |

|

Unit |

Values (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By End-User

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 15.75 billion in 2025.

By 2034, the market value is expected to reach USD 105.58 billion.

The market is expected to record a CAGR of 22.80% during the forecast period of 2026-2034.

North America dominated the global market with a share of 37.90% in 2025.

Rising adoption of mobility culture among organizations is a key market driver.

By end-user, the retail segment is expected to record a leading CAGR during the forecast period.

VMWare, Inc. Check Point Software Technologies Ltd., and IBM Corporation are the top companies in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us