Password Management Market Size, Share & Industry Analysis, By Application (Self-service Password Management, Enterprise Password Management), By Deployment (On-premise, Cloud), By Access Type (Mobile Devices, Desktops, Voice-enabled Password Systems), By Industry (BFSI, Healthcare, Retail, Government and Public Sector, IT and Telecom, Manufacturing, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

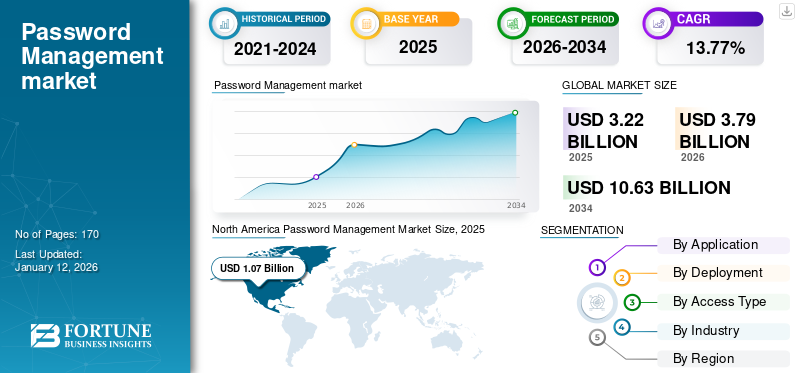

The global password management market was valued at USD 3.22 billion in 2025. The market is projected to grow from USD 3.79 billion in 2026 and reach USD 10.63 billion by 2034, exhibiting a CAGR of 13.77% during the forecast period. North America dominated the global password management market with a share of 33.17% in 2025.

The process of managing and protecting passwords from their inception to termination by implementing certain procedures is known as password management. The approach requires the adoption of centralized password management procedures. Its two main categories are self-service management and enterprise management.

With the rise of remote work culture in various companies, the demand for password management systems is increasing. Driven by the advancement of digitalization, passwords are becoming more popular. As a result, the need for a centralized password management system has increased and the development of the systems has accelerated. Furthermore, the market is growing due to the rising demand for simple authentication techniques.

While individuals and businesses continue to rely on traditional approaches to password management, hackers are leveraging new tools and attacks. This highlights the importance of adopting optimal password management practices to address security concerns. Additionally, customers' cybersecurity concerns are accelerating the growth of the market. However, the lack of knowledge among individuals and companies and technological limitations are hindering the market expansion.

The COVID-19 pandemic changed the regular working norms by introducing work-from-home and remote jobs. According to Deloitte, more than half a million people were affected by breaches, such as stolen credentials and phishing attacks, between February and March 2020. This augmented the password management market growth by strengthening enterprises' security factors and providing additional management features to cater to multiple consumer needs. Hence, the pandemic introduced industries to digitalization and digital transformation. As the trend grew, numerous industries started implementing password manager solutions. This positively impacted the market, which is estimated to showcase speedy growth in the upcoming years.

Password Management Market Trends

Implementation of Biometrics and Password Conditions by Emerging Industries to Fuel the Market Growth

Hackers frequently target digital identities that have weak password policies. Businesses tackle these attacks by implementing biometric login services, including face recognition, fingerprint, and voice-enabled systems. These aid in reducing the hassle of managing multiple alphanumeric passwords and improving secureness. Furthermore, it helps strengthen their data security systems. According to a LastPass report, employees in SMEs maintain an average of 85 passwords, whereas employees in large enterprises utilize an average of 24 passwords.

Numerous vendors utilize Multi-Factor Authentication (MFA) and regular ‘captcha’ checks to safeguard their client’s identities while maintaining a positive user experience. SMS texting and other software authentication applications are the most often utilized verification techniques. According to a report by LoginRadius, 28.3% of businesses provide MFA. Additionally, according to LastPass, technology and software industries are quickly adopting MFA-based password management software due to compliance regulations, followed by education and BFSI industries.

Download Free sample to learn more about this report.

Password Management Market Growth Factors

Regulatory Compliances and Increasing Technological Enhancements to Drive Market Growth

The regulatory agencies’ requirements for reporting companies’ Anti-Money Laundering (AML) and KYC compliances are getting stringent. The Financial Action Task Force (FATF) expanded the list of reporting businesses and suggested that member nations compel lawyers, art dealers, and providers of virtual assets to do AML checks on their consumers.

A notable technological development took place in the recent 10 years. More and more companies are making investments in biometric-based, next generation identity verification systems that are supported by Artificial Intelligence (AI). According to a Spiceworks report, 90% of enterprises deployed biometric technologies to enhance their security in password management solutions.

Such factors positively impact the industries by delivering better security measures and reducing hassle, which plays a vital role to propel the market growth.

RESTRAINING FACTORS

Increasing Number of Cybersecurity Issues and Privacy Management to Hinder Industry Expansion

Numerous enterprises don’t prioritize the security measures implicated by data loss and consumers' privacy concerns. According to Verizon Data Breach report 2019, 60% of the cyber-attacks were targeted toward mid-sized industries and 43% toward small enterprises. Poor construction, app-management issues, and password manager flaws lead to data losses, business losses, and financial losses, limiting the company's overall growth.

For instance, in August 2022, LastPass suffered a major cyber-attack, which resulted in data leaks, exposed encrypted vaults, and numerous password leaks. The company’s market share was significantly reduced and received lawsuits for consumer privacy and vault breaches.

The above factor depicts the importance of prioritizing security features to enhance the data management of the business. It is vital to maintain data integrity through vigilant analysis before the implementation of password management solutions.

Password Management Market Segmentation Analysis

By Application Analysis

Self-Service Solutions to Record Appreciable Surge as they Help to Address Issues Faster

Self-service password management empowers the operation team of organizations, which alleviates numerous calls to the helpdesk with a share of 55.78% in 2026. It helps employees to address issues faster and more effectively for the queries that entail human intervention, resulting in improved user experience. According to SailPoint Inc, the clientele was saving nearly USD 250,000 per year due to implementation of self-service capabilities. It also enables a protected self-service platform for resetting accounts and unlocking passwords, while giving the staff time to spend on more complex projects or user issues.

Privileged user password manager or enterprise password management is a division of credentials that provide security permissions and elevated access across systems and applications. Based on our analysis, self-service password security is expected to dominate the market share with a healthy CAGR over the forecast period.

By Deployment Analysis

Managing Passwords through Cloud to Enhance Remote Workforce and Propel Market Growth

By deployment, the market is bifurcated into cloud and on-premise. Cloud-based solutions are expected to lead the market and grow at a highest CAGR throughout the forecast period.

Cloud-based password managers store and manage passwords, which improves data personalization, facilitates collaboration, and enhances security measures with a share of 79.10% in 2026. For instance, in September 2022, Jumpcloud launched the Jumpcloud Password Manager, which included a decentralized hybrid infrastructure consisting of cloud and offline password management. These types of solutions provide support even offline, which improves consumer experience and includes machine-generated, master, social, and connected password suggestions. The solutions utilize the cloud abilities to handle end-to-end encryption and decryption of passwords.

By Access Type Analysis

Surge in Protection and Privatization of Passwords in Internet Connected Devices to Propel Growth of the Market

The market is divided into mobile devices (smartphones, laptops, tablets), desktops, and voice-enabled password systems by access type contributing 39.49% globally in 2026. These days, all computing devices are virtually connected. Smartphones, tablets, laptops, desktops, and even some other electronic devices communicate through the internet. This connectivity increases the demand for password manager solutions which work on every networking device, providing additional flexibility.

The usage of multiple devices enhances automatic synchronization across those devices, which increases consumer experience and prevents data loss. Additionally, the surging propagation of employee and enterprise devices increases the number of password revelation pathways. Employees carry remote devices to their workplace (bring your own devices or BYOD) and access confidential and personal information using less rigorous password practices, without IT department control or supervision. These devices also aid in multi-factor authentication, which adds functionality to boost the deployment in multiple industries.

To know how our report can help streamline your business, Speak to Analyst

By Industry Analysis

Increasing Demand for Cyber Risk Assessment and Security Measures in Equipment Leasing and Finance to Drive Industry Growth

Based on industry, the market is classified into BFSI, healthcare, retail, government and public sector, IT and telecom, manufacturing, and others (education, energy, and others).

The IT and telecom sector is poised to hold the largest market share 22.53% in 2026. This is due to the vast implementation of networking services and infrastructure expansions in several countries. Employees in the IT industry prefer automated services, which boosts the demand for password manager solutions. These factors, including increasing fraud and consumer rights compliances, are fueling the growth of the market. For instance, the California Consumer Privacy Act (CCPA) was enforced in the U.S. to handle public data and provide assistance toward data breaches. According to LastPass, employees in the telecommunications and technological industries generally maintain an average of 78 to 81 passwords per user, which propels the application of password manager solutions.

Healthcare organizations hold a vast number of patient records, making patient health information (PHI) a highly coveted item on data markets. On average, each company handles over 500 digital accounts and access to more than 11 million patient files for healthcare employees. The growth in Electronic Health Records (EHRs), telehealth platforms, and remote patient care has increased the demand for sensitive data, resulting in an upsurge in ransomware and cyber-attacks.

In 2021, HIMSS reported that 70% of the healthcare providers were data breached, which resulted in a USD 9.23 million financial loss. These factors play an important role in increasing the deployment of password managers in the healthcare industry, which aids in easy onboarding and off-boarding, among other features such as single sign-on and two-factor authentication. The market share from the healthcare industry is estimated to grow at the highest CAGR due to higher data sensitivity and privacy subjects.

REGIONAL INSIGHTS

Based on geography, the market has been analyzed across North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into several dominating countries.

North America Password Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.07 billion in 2025 and USD 1.24 billion in 2026. the global password management market. It has taken a significant lead in technology adoption and infrastructure development, which resulted in an upsurge in remote working opportunities. Additionally, the increasing deployment of cloud-based solutions, the presence of numerous key players, and digital transformation in the U.S. and Canada are among the key factors driving the market growth across North America.The U.S. market is projected to reach USD 0.87 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

The Asia Pacific region is expected to be a highly dynamic growth area, offering vast potential for market expansion. It is projected to depict the highest CAGR during the forecast period. The widespread adoption of innovative technologies such as IoT devices and cloud adoption drives the growth of password management solutions and platforms. According to Omidia and Telenor, Asia-Pacific countries are expected to integrate 38.9 billion IoT devices in 2030, which contributes to their increasing market share.The Japan market is projected to reach USD 0.18 billion by 2026, the China market is projected to reach USD 0.29 billion by 2026, and the India market is projected to reach USD 0.15 billion by 2026.

Europe is set to hold the second-largest share in the global market due to the presence of players such as My1Login and Micro Focus, among others. For instance, in June 2022, My1Login was recognized for providing innovative identity management solutions during the European SC awards. The company enabled their clientele to improve their password management by integrating zero trust encryption and password-less authentication, which enhanced security.The UK market is projected to reach USD 0.18 billion by 2026, while the Germany market is projected to reach USD 0.23 billion by 2026.

The rising productivity in manufacturing and consumer goods and digital transformation in the Middle East, Africa, and South America are expected to drive the demand for password management solutions.

According to IDC, Saudi Arabia spent USD 32.9 billion on IT and telecom industries in 2021. Additionally, NEOM invested USD 500 billion into megacity visions which support the industry initiatives for digital transformation. These industries have become a key economic indicator in the Middle East & Africa, with the manufacturing sector likely to exhibit steady growth in the coming years. This leads to a growing need for integrating password managers into systems for enhanced data management and security.

Key Industry Players

Cloud Integration and Product Innovations to Enhance the Market Growth

Leading market players are introducing innovative password manager solutions to meet the needs of consumers. They strive to improve their existing product line for a more user-friendly, convenient, and secure user experience. The companies are also focusing on cloud integration as well as collaborations, partnerships, and acquisitions to enhance business models and industry growth.

List of Top Password Management Companies

- Avatier Corporation (U.S.)

- SailPoint Technologies Inc. (U.S.)

- Dell Technologies Inc. (U.S.)

- Zoho Corporation (India)

- Micro Focus International PLC. (U.K.)

- My1Login Limited (U.K.)

- LastPass (LogMeIn Inc.) (U.S.)

- Bitwarden Inc. (U.S.)

- 1Password (AgileBits Inc.) (Canada)

- Keeper Security Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2023 – ExpressVPN announced the official launch of its password manager, ExpressVPN Keys. These keys help people manage their passwords and enjoy a secure and effortless online experience and are designed for security and convenience.

- November 2022 – 1Password completed the acquisition of Passage Identity, which developed authentication platforms that aided organizations in integrating biometric and passwordless login techniques. The acquisition resulted in the implementation of Face ID, Touch ID, and Windows Hello to enhance consumer experience and boost business growth.

- July 2022 – Google updated its password managers by including several highly requested features to aid consumers, such as auto-login, credential saving, and password generation, among others. This resulted in enhanced market growth due to higher utilization of the Google Chrome browser for web surfing and remote working.

- June 2022 – Lookout Inc. acquired SaferPass, which provides secure and simple password managers for enterprises and individuals. The acquisition resulted in delivering proactive security platforms to safeguard user data and privacy while expanding the business footprint.

- January 2022 – Keepers Security launched Secrets Manager, which secured infrastructure credentials such as certificates, API keys, access keys, and database passwords, among others. The solution included cloud-based integration, with a zero-knowledge security model similar to their enterprise password management platform.

REPORT COVERAGE

The report provides leading business insights across various regions to improve business decisions and judgment, considering the market. Furthermore, the report provides key insights into the recent developments as well as a thorough review of emerging technologies. It also emphasizes the major growth-stimulating factors and elements, which provides an in-depth understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.77% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

By Deployment

By Access Type

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is projected to reach USD 10.63 billion by 2034.

In 2025, the market stood at USD 3.22 billion.

The market is projected to grow at a CAGR of 13.77% during the forecast period (2026-2034).

By deployment, the cloud segment is likely to lead the market.

The market growth is expected to be driven by regulatory compliances and increasing technological enhancements.

Avatier Corporation, SailPoint Technologies Inc., LastPass, My1Login Ltd., Keeper Security Inc., 1Password, and Zoho Corporation are the top players in the market.

North America is expected to hold the highest market share.

By industry, the healthcare segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us