Satellite Internet Market Size, Share & Industry Analysis, By Frequency Band Type (L-band, C-band, K-band, and X-band), By End-user (Commercial/Enterprise Users (Banking, Government (Maritime and Aviation), Mining, Media and Broadcasting, Construction, Transportation, Others), and Residential/Individual Users), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

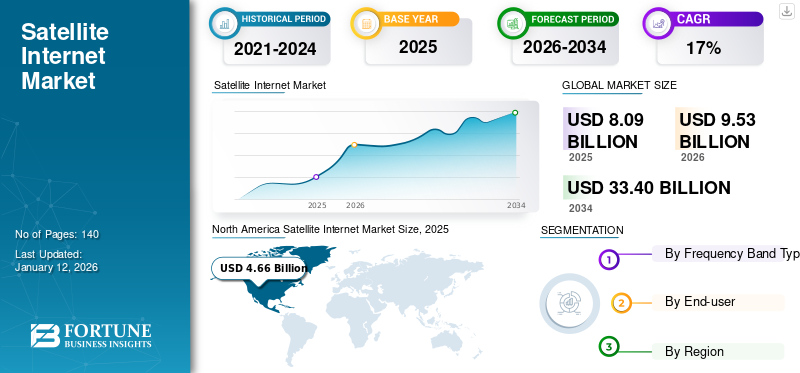

The global satellite internet market size was valued at USD 8.09 billion in 2025 and is projected to grow from USD 9.53 billion in 2026 to USD 33.4 billion by 2034, exhibiting a CAGR of 17% during the forecast period. North America dominated the global market with a share of 57.60% in 2025.

The satellite internet market comprises a commercial ecosystem focused on providing broadband connections through satellite communication systems. It involves satellite operators, ground infrastructure manufacturers, and service providers utilizing geostationary or low Earth orbit satellites. Technical components include satellite transponders, modulation schemes, and diverse frequency bands such as L band, C band, K band, and X band. Regulatory frameworks, satellite technology advancements, and competition among industry stakeholders influence the market dynamics.

Furthermore, the increased reliance on remote work and digital communication has driven a surge in demand for satellite internet services. The inherent capability of satellite technology to provide connectivity in remote and underserved areas became particularly pronounced during lockdowns and social distancing measures, highlighting its strategic importance and positively impacting the market throughout the COVID-19 pandemic.

Satellite Internet Market Trends

Introduction of Low Earth Orbit (LEO) Satellite Constellations to Surge Market Growth

The proliferation of low Earth orbit (LEO) satellite constellations is a notable trend in the market. With their Starlink project and OneWeb, companies, such as SpaceX are deploying prominent constellations of small satellites in LEO to provide global broadband coverage. The potential to reduce latency significantly compared to traditional geostationary satellites is expected to fuel the market. LEO satellites orbit at lower altitudes, resulting in shorter signal travel times and improved responsiveness, addressing a fundamental limitation of satellite internet.

The advent of LEO constellations is also characterized by increased competition and efforts to enhance satellite technology. The number of satellites deployed allows for better redundancy and improved network reliability. Technological advancements, such as advanced beamforming and phased-array antennas on satellites, contribute to efficient data transmission and reception. This trend is reshaping the market landscape, offering promising prospects for enhanced performance and expanded coverage, especially in remote areas.

However, the increased number of satellites in LEO has raised concerns about orbital debris and potential interference with astronomical observations. Mitigating these challenges requires ongoing efforts in space debris management and coordination among satellite operators to ensure the sustainable growth of LEO satellite constellations. Despite these challenges, the trend toward LEO constellations signifies a transformative shift, fueling the satellite internet market growth.

Download Free sample to learn more about this report.

Satellite Internet Market Growth Factors

Increasing Demand for High Speed Connectivity in Underserved Regions to Fuel Market Growth

The increasing demand for high speed internet access, particularly in underserved or remote regions, is a prominent driver propelling the satellite internet market share. Traditional terrestrial infrastructure faces limitations in reaching these areas, making this technology a compelling solution. Geostationary and low Earth orbit satellites enable global coverage, ensuring connectivity even in challenging terrains.

In addition, the demand for bandwidth-intensive applications, such as video streaming, online gaming, and telecommuting, fuels the need for high-throughput satellite services. Advanced frequency bands, such as Ka-band and Ku-band and sophisticated modulation techniques enhance data transfer rates and overall performance. This growing need for data-intensive applications, specifically in a world increasingly reliant on digital services, underscores the crucial role of this technology in meeting these escalating connectivity demands.

Mega-constellations comprising numerous small satellites in low Earth orbit have revolutionized the market landscape. These constellations promise lower latency and increased capacity, addressing previous concerns about lag in satellite communication (SATCOM). This technological evolution, exemplified by projects such as Starlink, to significantly drive the market by enhancing the overall efficiency and demand for satellite internet services.

RESTRAINING FACTORS

Delays in Signal Travel Time to and From the Satellites to Impede Market Expansion

The inherent latency associated with geostationary satellites due to their higher orbital altitudes is a notable restraint in the market. The signal travel time to and from these satellites introduces delays, impacting real-time applications that demand low latency. Despite technological advancements, mitigating this latency challenge remains a fundamental limitation of traditional satellite communication. This constraint mainly affects sectors relying on instantaneous data transmission, such as online gaming and video conferencing, highlighting the need for innovative solutions to enhance the competitiveness of satellite internet in low-latency-dependent applications.

Satellite Internet Market Segmentation Analysis

By Frequency Band Type Analysis

C-Band Dominates with Surge in Need for Reliable Data Communication

By frequency band type, the market is bifurcated into L-band, C-band, K-band, and X-band.

The C-band segment dominated the market accounting for 33.59% market share in 2026. Among them, the C-band holds the highest revenue share as it offers a reliable balance between signal reduction and atmospheric interference, making it suitable for long-distance communication and reliable data transmission. This makes it particularly beneficial for satellite communication, especially in areas with challenging weather conditions or dense atmospheric interference. The C-band is widely adopted in various satellite communication applications, including broadcasting, telecommunications, and broadband internet services.

The K-band segment is estimated to hold the highest CAGR in the market as the Ku band offers higher data transfer rates and bandwidth than lower frequency bands such as the C-band. This makes it suitable for high-speed internet services, particularly broadband applications requiring large data volumes. Additionally, technological advancements, such as improved modulation techniques, higher capacity transponders, and better antenna technologies have led to more efficient satellite systems and ground infrastructure supporting Ku band operations. Furthermore, the increasing demand for broadband connectivity, driven by rising internet penetration, growing demand for video streaming services, and the proliferation of IoT devices, fuels the adoption of K-band services.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Higher Bandwidth Requirements by Commercial/Enterprise Users to Surge Segment Growth

Based on end-user, the market is segmented into commercial/enterprise users and residential/individual users.

Among them, the commercial/enterprise users segment holds the highest market with a share of 78.73% in 2026, as businesses and industries often require reliable and high-speed internet connectivity to support various operations, such as data transmission, communication, and remote monitoring. The technology offers a viable solution for these users, especially in remote or rural areas where terrestrial infrastructure may be lacking or insufficient. Additionally, industrial and enterprise users typically have higher bandwidth requirements and are willing to invest in premium services to meet their needs. This includes sectors, such as banking, government (maritime and aviation), mining, media and broadcasting, construction, and transportation, where reliable connectivity is critical for operational efficiency, safety, and productivity.

The residential/individual users segment is anticipated to hold an average CAGR owing to the growing demand for high-speed internet access among households, especially in rural and underserved areas where traditional terrestrial broadband infrastructure is limited or unavailable. Additionally, technological advancements in satellite communication systems, such as the deployment of low Earth orbit (LEO) satellite constellations and modulation techniques, have improved the performance and affordability of its services. Furthermore, the increasing trend of remote work, online education, streaming services, and smart home applications further fuels the demand for residential satellite internet services.

REGIONAL INSIGHTS

The report includes market research across five regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into leading countries.

North America Satellite Internet Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 4.66 billion in 2025 and USD 5.45 billion in 2026, holds the maximum share, characterized by the deployment of advanced satellite communication technologies aiming to provide high-speed connectivity across the region. Key players, including SpaceX's Starlink and Hughes Network Systems, employ low Earth orbit (LEO) satellite constellations to enhance broadband services.The U.S. market is projected to reach USD 4.18 billion by 2026. For instance,

- Starlink's mega-constellation, featuring thousands of small satellites, aims to address connectivity gaps, especially in rural and remote areas, by leveraging advanced frequency bands, such as Ka-band, for improved data transfer rates. Additionally, technological innovations in modulation schemes and frequency utilization, exemplified by Viasat's high-capacity ViaSat-3 satellite system, enhance data transmission capabilities.

Asia Pacific satellite internet market showcases the highest growth rate owing to the increasing demand for broadband connectivity across diverse geographical landscapes. Leading regional satellite operators, such as ChinaSatCom and SES Networks, deploy geostationary and non-geostationary satellite constellations to offer high-throughput services. The Japan market is projected to reach USD 0.40 billion by 2026, the China market is projected to reach USD 0.57 billion by 2026, and the India market is projected to reach USD 0.35 billion by 2026.

For instance,

- China's BeiDou Navigation Satellite System (BDS) is crucial in augmenting regional satellite connectivity. The utilization of advanced frequency bands, such as Ka-band and Ku-band, along with innovative modulation techniques, contributes to optimizing data transfer rates and enhancing overall performance in providing its services.

Regulatory frameworks within the region, including spectrum allocation policies and licensing requirements, significantly influence market dynamics. Furthermore, the ongoing technological advancements and strategic collaborations among key industry players are shaping the landscape, addressing the region's increasing connectivity needs, especially in remote and underserved areas.

Europe’s growth is marked by the strategic integration of advanced satellite communication technologies to address the demand for high-speed connectivity. Prominent satellite operators in the region, such as Eutelsat and SES, leverage geostationary and non-geostationary satellite constellations to provide broadband services. These constellations employ sophisticated frequency bands, including Ka-band and Ku-band, enhancing data transfer rates and optimizing overall performance.The UK market is projected to reach USD 0.49 billion by 2026, while the Germany market is projected to reach USD 0.23 billion by 2026 For instance,

- Eutelsat's Konnect VHTS satellite, which utilizes high throughput satellite (HTS) technology, highlights the region's commitment to deploying advanced solutions for efficient broadband connectivity.

Regulatory frameworks, including spectrum allocation and licensing policies, play a pivotal role in shaping the competitive landscape of the European market.

The markets in South America and the Middle East & Africa are witnessing an average growth rate owing to strategic integration of advanced satellite communication technologies to address connectivity challenges and expand broadband services. In South America, operators such as Hispasat and Intelsat leverage geostationary satellites, employing frequency bands such as C-band and Ku-band for comprehensive coverage. The region is actively exploring advancements in satellite design and modulation techniques to enhance overall performance. For instance, Hispasat's Amazonas Nexus satellite exemplifies the region's commitment to providing reliable and high-throughput satellite internet services.

In the Middle East & Africa, satellite operators, such as Arabsat and Yahsat, are crucial in providing connectivity, especially in remote and underserved areas. The deployment of High Throughput Satellites (HTS) and non-geostationary satellite constellations is gaining prominence to meet the increasing demand for broadband services.

Key Industry Players

Key Players Launching New Products to Strengthen Market Positioning Drives Market Growth

Players in satellite internet are actively creating advanced solutions to cater to customer demands. They also focus on enhancing their existing product portfolio to deliver flexible solutions with unique attributes. Furthermore, these organizations proactively pursue collaboration, acquisitions, and partnerships to bolster their product offerings.

List of Top Satellite Internet Companies

- Starlink (UAE)

- Hughes Network Systems, LLC (U.S.)

- Viasat, Inc. (U.S.)

- Singtel (Singapore)

- EchoStar Corporation (U.S.)

- EUTELSAT COMMUNICATIONS SA (France)

- Telesat (Canada)

- Speedcast (U.S.)

- Embratel (Brazil)

- SKY Perfect JSAT Holdings Inc. (Japan)

KEY INDUSTRY DEVELOPMENTS

- January 2024: Singtel collaborates with Starlink to boost maritime digital solutions, integrating AI, 5G, and edge computing for improved safety and efficiency. Starlink's LEO broadband service enhances connectivity, enabling real-time data analysis and cost reduction. This complements Singtel's iSHIP solutions, ensuring uninterrupted coverage during maritime journeys, even in remote locations. The partnership aims to optimize efficiency and reliability in maritime operations.

- December 2023: Hughes Network Systems, LLC, an EchoStar company, launched HughesNet high-speed satellite internet plans utilizing capacity from the new Hughes JUPITER 3 satellite. These plans provide faster speeds with unlimited data and incorporate low-latency HughesNet Fusion and Whole Home Wi-Fi, allowing customers to connect, stream, and play from any location.

- November 2023: The Indian National Space Promotion and Authorization Centre (IN-SPACE) granted official approval to Eutelsat OneWeb's satellite constellation to provide capacity in India. This marks a significant milestone, with OneWeb India Communication Private Limited becoming the first organization authorized by IN-SPACE to provide Low Earth Orbit (LEO) satellite constellation capacity in the country.

- September 2023: SpaceX, led by Elon Musk, secured a substantial agreement with satellite operator Telesat. The deal encompasses 14 launches for Telesat's Lightspeed internet satellites, utilizing SpaceX's Falcon 9 rocket. Scheduled to initiate in 2026, Telesat CEO Dan Goldberg emphasized Falcon 9's value proposition in this significant partnership.

- May 2023: Nelco and Telesat achieved a milestone by successfully conducting India's first in-orbit demonstration of high-speed broadband connectivity. Using Telesat's Phase 1 Low Earth Orbit (LEO) satellite marks a significant advancement in introducing next-generation satellite communication technologies to the country, as stated officially.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on vital aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report includes insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Frequency Band Type

By End-user

By Region

|

Frequently Asked Questions

The market is projected to reach USD 33.4 billion by 2034.

In 2025, the market was valued at USD 8.09 billion.

The market is projected to grow at a CAGR of 17% during the forecast period.

Commercial/enterprise users is the leading end-user segment in the market.

Rising demand for high-speed connectivity in underserved regions drives market growth.

Starlink, Hughes Network Systems, LLC, Viasat, Inc., and Singtel are the top players in the market.

North America is expected to hold the highest market share.

By frequency band type, the K-band is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us