Smart Insulin Pens Market Size, Share & Industry Analysis, By Connectivity (Bluetooth and Near Field Communication), By Indication (Type 1 Diabetes and Type 2 Diabetes), By Distribution Channel (Hospital Pharmacies and Retail & Online Pharmacies), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

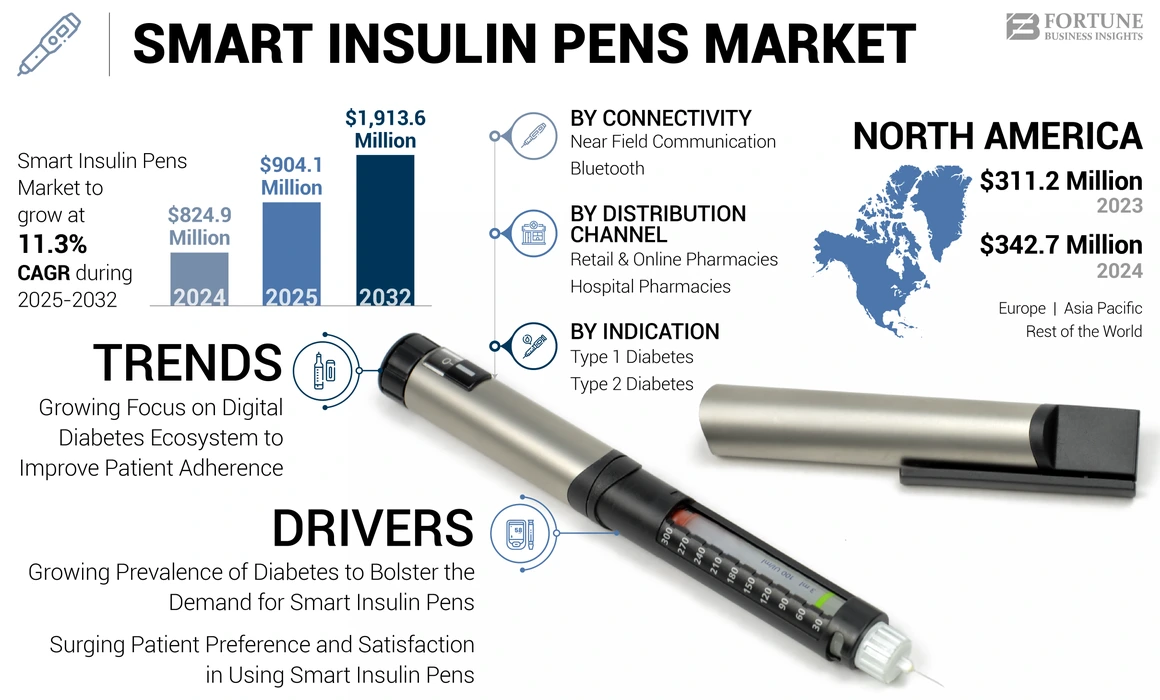

The global smart insulin pens market size was valued at USD 824.9 million in 2024. The market is projected to grow from USD 904.1 million in 2025 to USD 1,913.6 million by 2032, exhibiting a CAGR of 11.3% during the forecast period. North America dominated the smart insulin pens market with a market share of 41.54% in 2024.

Smart or connected insulin pens are wireless and reusable insulin injectors integrated with an intuitive app that tracks dosing information and recommends insulin doses for diabetic patients. These pens can be connected to apps such as Mysugr, FreeStyle LibreLink, Glooko, and others. They offer time tracking and amounts of insulin injected, allowing users to input glucose levels, exercise regimens, and carbohydrate consumption. These pens also work efficiently with short-acting insulin cartridges such as Humalog, Novolog, Fiasp, and others.

The increasing occurrence of diabetes, growing awareness among diabetic patients about new technologies, rising innovations by key companies leading to new product introduction, and increasing adoption of these pens in developed countries are the key factors contributing to smart insulin pens market growth. Additionally, the advantages associated with connected pens, such as less injection site pain, improved adherence, more accurate dosing, and greater patient satisfaction, are expected to influence the adoption rate and propel the demand for these pens.

The COVID-19 pandemic impacted the demand and usage of connected pens, leading to an overall negative impact on the market. The pandemic witnessed reduced patient visits to healthcare facilities such as hospitals and diabetic centers, leading to a decline in the number of prescriptions for connected pens, thereby fewer people visiting pharmacies.

- For instance, according to the data published by the Centers for Disease Control and Prevention (CDC) in May 2022, a 10.0% decline in visits for the hyperglycemic crisis was observed during the initial phase of the pandemic. In addition, adults between the ages 18 to 29 reported difficulty getting diabetes medications.

Moreover, disruptions in the distribution chain interrupted the availability of these pens among retail stores, resulting in a drop in sales. In addition, the economic downturn due to the pandemic caused consumers to be more cost-conscious, which led to low demand for high-priced connected insulin pens. The high cost of connected insulin pens was a major factor that hampered the new sales and the companies' overall revenue. Thus, due to the above factors, the demand for connected insulin pens reduced drastically during the pandemic, leading to a drop in product sales.

Global Smart Insulin Pens Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 824.9 million

- 2025 Market Size: USD 904.1 million

- 2032 Forecast Market Size: USD 1,913.6 million

- CAGR: 11.3% from 2025–2032

Market Share:

- Region: North America dominated the market with a 41.54% share in 2024. This is due to the high adoption of connected insulin pens, a significant insured population, easy healthcare access, and a higher average cost of the products in the region.

- By Connectivity: The Bluetooth segment held the largest market share. Bluetooth technology is more widely adopted and supported across various devices and platforms, and many of the available smart insulin pens utilize this connectivity method for its reliability and longer range.

Key Country Highlights:

- Japan: The market is driven by an emerging start-up environment and increasing awareness about managing diabetes with technologically advanced products. Strategic partnerships, such as the one between BIOCORP and Novo Nordisk A/S to develop smart sensors for insulin pens, are also fueling innovation.

- United States: Market growth is supported by strong patient preference, with studies showing 75% of diabetic adults would prefer a connected pen. Favorable commercial insurance offers, such as Medtronic's program for its InPen, are also making these advanced devices more accessible to patients.

- China: The market is expanding with key regulatory approvals that increase product availability. For instance, in September 2022, the National Medical Products Administration (NMPA) granted marketing approval for Novo Nordisk's Novopen 6 smart insulin pen.

- Europe: Growth is fueled by a high prevalence of diabetes, with 61 million people affected, and significant healthcare expenditure on advanced treatments. Key developments include new product launches, such as Novo Nordisk making its NovoPen 6 and NovoPen Echo Plus available for NHS patients in the U.K.

Smart Insulin Pens Market Trends

Rising Focus on Digital Diabetes Ecosystem to Improve Patient Adherence

The extensive adoption of the Internet of Medical Things (IoMT) and the increase in digital health tools have led to the mass creation of new tools in medical care. The integration of IoMT with an insulin pen has made the device smart by embedding physiological and behavioral sensors within the device. With the advanced technology integration, the potential of these devices may reshape a connected diabetes care ecosystem for providers, patients, and health systems, leading to overcoming problems such as poor insulin adherence, incorrect insulin initiation and titration, and medication errors.

- For instance, according to a study published by the American Diabetes Association in August 2021, with the continuous use of smart insulin pens, 50.0% of clinics reported seeing improved medication adherence and improved glycemic management in patients using SIPs, 64.0% reported seeing improved dose accuracy, and 59.0% reported seeing improved confidence in dosing. In addition, 50.0% of clinics reported that SIP use could potentially improve relationships between caregivers and children/adolescents with diabetes and visit quality. Thus, the technology evolution has led to improvements in managing diabetes with improved patient adherence toward glucose monitoring.

Similarly, several healthcare companies are launching mobile applications to measure their blood glucose levels on their smartphones. This application eliminates the necessity to use separate medical devices for tracking blood glucose levels.

- For instance, in November 2023, Abbott launched a digital health tool, FreeStyle LibreLink, in India. This integrated digital platform enabled individuals to effectively manage their diabetes with simple monitoring, insightful analysis, and seamless connectivity.

Moreover, growing alliances between pharmaceutical and medical technology firms are expected to develop a strong market base by combining insulin pens with different insulins. Such alliances are encouraging multiple companies to create their platforms or devices, thus playing a crucial role in modernizing diabetes care.

Download Free sample to learn more about this report.

Smart Insulin Pens Market Growth Factors

Rising Incidence of Diabetes to Propel the Demand for Smart Insulin Pens

A sedentary lifestyle, including lack of exercise, improper diet, stress, and others, is one of the major factors behind the increasing incidence of diabetes. Genetic mutations, hormonal diseases, chronic pancreatitis, cystic fibrosis, and medications are also responsible for inducing diabetes. Both type 1 and type 2 diabetes patients use insulin; however, type 1 diabetic patients are characterized by low insulin production and require daily insulin administration.

- For instance, according to the International Diabetes Federation (IDF), in 2021, around 537 million adults aged 20-79 years had diabetes, and by 2030, the number of diabetic patients is anticipated to reach 643 million. Also, by 2045, the total number of people diagnosed with diabetes is anticipated to reach 783 million.

- According to an article published by The Lancet in October 2022, there were about 8.4 million individuals worldwide with type 1 diabetes in 2021, and the prevalent cases are expected to reach between 13.5 - 17.4 million in 2040, indicating a 60-107% rise.

Moreover, advancements and the availability of multiple treatment options for the management of blood glucose levels is boosting patients to self-manage using auto-injectors, including connected insulin pens. Thus, the factors mentioned above, including the rapidly rising patient pool, are anticipated to drive the demand for these pens during the forecast period.

Increasing Patient Preference and Satisfaction in Using Smart Insulin Pens to Drive Market Growth

The advantages associated with smart insulin pens, including high accuracy in dose calculation, are leading to rising clinical outcomes among diabetic patients. Patients prefer insulin pens over insulin vials and syringes due to their higher level of satisfaction and ease of use. Additionally, individuals utilizing smart insulin pens experienced lower rates of hospitalization for diabetes-related issues. These pens are helping patients to adhere to the prescribed insulin dose with reminders and regular glucose monitoring further enhancing patient compliance, leading to improvement in the self-management of diabetes. In addition, the American Diabetes Association (ADA) and the European Association for the Study of Diabetes have identified patients’ choices as important factors influencing medication decisions along with other factors.

- For instance, according to research published in February 2023 on diabetic patients revealed the three most important characteristics of injectable medication. Based on the survey, 59.5% of patients responded that confidence in administering the correct dose is a major factor, 53.2% responded ease of selecting the correct dose, and 47.4% responded that overall ease of using the injection device is the major factor during self-management.

- According to a study published in November 2022, 75.0% of diabetic adults in the U.S. and U.K. would prefer to inject insulin with an insulin pen connected to a mobile app rather than with a non-connected insulin pen. The advanced features, such as an automatic log of insulin doses and recording of blood sugar levels, shifted the patient's preferences toward SIP from non-connected pens.

Thus, the increasing therapy outcomes and the rising inclination of patients toward these pens are driving market growth.

RESTRAINING FACTORS

High Cost and Limited Availability of Smart Insulin Pens in Emerging Countries to Limit Adoption

Smart insulin pens are technologically advanced and innovative; therefore, they are comparatively high in price. The high cost creates a barrier to product adoption, particularly for many uninsured people. In addition, for the insured population, coverage for the connected insulin pens may be limited or not provided at all, further limiting the adoption of the product and thereby hampering market growth.

- For instance, according to the WHO 2022 report, around 30% of the world’s population still cannot access essential services.

- According to The Commonwealth Fund, despite being a high-income country, 8.6% of the U.S. population was uninsured in 2021.

Furthermore, the integration of cutting-edge technology into smart insulin pens has resulted in a relatively higher price point than conventional insulin pens. This is anticipated to result in lesser adoption in low- and middle-income countries.

Moreover, the high cost can limit their availability in certain regions or healthcare settings, which further influences the prescribing decisions of prescriber, particularly in low or middle-income countries. Furthermore, the wide availability of low-cost products such as conventional insulin pens, syringes, and vials is another factor gaining traction among diabetic patients, hindering the adoption of these pens and hampering market growth.

Smart Insulin Pens Market Segmentation Analysis

By Connectivity Analysis

Bluetooth Segment to Dominate Due to its High Adoption and Availability

Based on connectivity, the market is bifurcated into Bluetooth and Near Field Communication (NFC). The Bluetooth segment held a significant market share in 2024 due to Bluetooth connectivity with many products and its high availability. Moreover, Bluetooth technology is more widely adopted and supported across various devices and platforms. In addition, the technology offers a longer range of connectivity, up to around 100 meters, allowing more flexibility toward usage. Owing to the several advantages, many market players have developed connected insulin pens with Bluetooth connectivity. Many European companies, including Emperra GmbH, pendiq, Cambridge Consultants Ltd., and others, have also introduced their products with Bluetooth connectivity and witnessed a wide adoption in Europe.

- For instance, Pendiq 2.0 pens can store the last 1,000 entries of injection dates, times, and quantities, and users can view these entries on an OLED display. The pen’s Bluetooth compatibility allows it to transmit the data to a proprietary smartphone app called Dialife, which is available for Android and Apple smartphones. The pen also has a USB cable to transmit data to a computer and recharge the pen battery.

The NFC segment is anticipated to grow significantly during the forecast period. The segment growth can be attributed to rising technological innovation, making it more secure, reliable, fast data transfer, and easy-to-use capabilities. The features associated with NFC are gaining market players' attention, focusing on enhanced user experience.

To know how our report can help streamline your business, Speak to Analyst

By Indication Analysis

Type 1 Diabetes Segment to Capture Major Market Share due to Rising Product Adoption among Type 1 Patients

Based on indication, the market is bifurcated into type 1 diabetes and type 2 diabetes. The type 1 diabetes segment captured a substantial market share in 2024, attributed to the increasing awareness about self-management and the rapidly increasing number of insulin-dependent patients worldwide.

- For instance, according to an article published in September 2022, the global prevalence of type 1 Diabetes is expected to double by 2040. The same study revealed that Australia, Canada, Luxembourg, and the U.S. estimated that in 2021, around 3.1 million people died due to poor care for type 1 diabetes.

Moreover, the type 2 diabetes segment is anticipated to grow significantly during the forecast period. Around 90% of diabetic patients are diagnosed with type 2 diabetes, constituting a significant proportion. The growing predominance of type 2 diabetes and increasing patient preference for innovative technologies leads to orienting more users toward these pens, thereby propelling the segment growth during the forecast period.

- For instance, as per data published by the Centers for Disease Control and Prevention in April 2023, around 38.0 million Americans are diagnosed with diabetes and 90.0-95.0% of them are suffering from type 2 diabetes.

By Distribution Channel Analysis

Hospital Pharmacies Segment to Lead the Way with Flourished Procurement Facilities and Easy Accessibility

Based on distribution channel, the market is segmented into hospital pharmacies and retail & online pharmacies. The hospital pharmacies segment is anticipated to hold a significant market share during the forecast period due to the advanced procurement facilities, easy access, and availability of these pens. Many studies found that hospitals and pharmacies have more streamlined supply chain channels, encouraging physicians to pursue evidence-based prescribing. In addition, the rate of hospitalization for diabetes has increased in the past ten years.

Moreover, the retail & online pharmacies segment is anticipated to grow rapidly during the forecast period. The rapid growth of the segment can be attributed to more residential settings around community pharmacies, a shift in customer preference toward online pharmacies due to long waiting hours in retail pharmacies, and easy access to required products, among other factors.

- For instance, according to a study published in the Journal of the American Pharmacists Association in August 2022, around 88.9% of the U.S. population lives within 5 miles of a community pharmacy, leading to the vast majority of Americans having access to pharmacies.

Thus, the abovementioned factors are anticipated to propel the segment’s growth during the forecast period.

REGIONAL INSIGHTS

Geographically, the market is segmented into North America, Europe, Asia Pacific, and the rest of the world.

North America Smart Insulin Pens Market Size, 2019-2032 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market and generated a revenue of USD 342.7 million in 2024. The rising adoption of connected insulin pens and the significantly higher cost of the product in the U.S. compared to other countries are the major factors behind the comparatively large market size in the region. In addition, a significant insured population, offers and initiatives by key market players, and easy healthcare access are propelling the regional growth.

- For instance, according to Medtronic, people with commercial insurance in the U.S. may get InPen, a smart insulin pen of Medtronic, for as little as USD 35 per prescribed InPen. The offer is open for patients with commercial prescription insurance and other patients who are not enrolled in any government-funded program that pays for prescription devices or treatments.

Europe accounted for the second largest market share in 2024. The rising number of diabetes cases, the presence of key market players in the region, rising expenditure for the advanced treatment of diabetes, and reimbursement for medical devices are a few critical factors propelling market growth in the region.

- For instance, according to the medtech Europe report published in September 2022, there are 61 million people in Europe living with diabetes, which is equivalent to the entire population of Italy. The same report revealed that in 2021, the total expenditure in Europe on the advanced treatment of diabetes and its complications was USD 189 billion, which accounts for 19.6% of global expenditure in 2021.

Asia Pacific smart insulin pens market is anticipated to grow significantly during the forecast period. The growth in the region can be attributed to the emerging start-up environment, increasing prevalence of lifestyle diseases, and growing awareness about diabetes management with technologically advanced products.

Furthermore, several pharmaceutical companies are undergoing collaboration for the development of smart sensors and technologically advanced insulin pens to enhance diabetes treatment.

- For instance, in October 2022, BIOCORP and Novo Nordisk A/S entered into a partnership for the development of Mallya, a smart sensor that directly attaches to the FlexTouch insulin pens of Novo Nordisk.

In the rest of the world, the market is still emerging, and limited or no product availability in low-income countries is expected to lead to gradual growth in the market during the forecast period.

Key Industry Players

Technological Collaboration and Partnership by Market Players to Contribute Market Growth

Novo Nordisk A/S, Medtronic, and Emperra GmbH accounted for the major share in the market in 2024. The dominance of these players is due to significant investment in research and development, leading to the introduction of new products, a supportive regulatory environment, and a growing focus on customer education and awareness about self-management.

- For instance, in September 2022, Medtronic PLC announced its partnership with Jennifer Stone, a Disney actress. The partnership aimed to raise awareness about advanced technologies and promote Medtronic’s InPen, a smart insulin pen for people who are living with type 1 diabetes.

Moreover, a strong focus on strategic partnerships with other industry players is expected to help support companies in expanding their global footprints. For instance, in March 2023, Novo Nordisk A/S announced its collaboration with Diabeloop SA. The collaboration aimed to focus on the integration of Novo Nordisk’s connected insulin pens, NovoPen 6, and NovoPen Echo Plus, with DBL-4pen.

List of Top Smart Insulin Pens Companies:

- Novo Nordisk A/S (Denmark)

- Medtronic (Ireland)

- Ypsomed AG (Switzerland)

- Emperra GmbH (Germany)

- Pendiq (Germany)

- Jiangsu Deflu Medical Device Co. (China)

- Cambridge Consultants Ltd. (U.K.)

- Diabnext (France)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: Novo Nordisk A/S announced that the company intends to acquire Biocorp, a French medical devices company. The acquisition aims to develop a new connected insulin pen with Biocorp’s technology and expertise.

- October 2022: Novo Nordisk A/S announced the launch of smart insulin pens in Ireland, including NovoPen 6 and NovoPen Echo Plus.

- September 2022: Novo Nordisk A/S received marketing approval in China from the National Medical Products Administration (NMPA) for Novopen 6, a smart insulin pen that automatically stores the time of injections and the number of insulin units taken by users.

- March 2022: Novo Nordisk A/S announced that the company has made NovoPen 6 and NovoPen Echo Plus available for NHS patients in the U.K. The availability of smart insulin pens increased access to devices and helped diabetic patients monitor and record dosing information efficiently.

- August 2020: Medtronic announced the acquisition of Companion Medical, manufacturer of InPen. The acquisition aimed to expand Medtronic’s product portfolio and serve a huge diabetic patient pool with InPen.

REPORT COVERAGE

The market research report provides detailed information regarding various insights into the market, including growth drivers, restraints, challenges, competitive landscape, and regional analysis. It further offers analytical insights about market trends and estimations to illustrate the forthcoming investment opportunities. The market is quantitatively analyzed from 2019 to 2032 to provide the financial competency of the market. The information gathered in the report has been taken from several primary and secondary sources.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

2025 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Connectivity

|

|

By Indication

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 904.1 million in 2025 to USD 1,913.6 million by 2032.

In 2024, the North America market stood at USD 342.7 million.

Growing at a CAGR of 11.3%, the market is expected to exhibit steady growth during the forecast period (2025-2032).

Based on connectivity, the Bluetooth segment is expected to be the leading segment during the forecast period.

The rising prevalence of diabetes and rising patient preference for smart insulin pens due to its satisfaction are the key factors driving the growth of the market.

Novo Nordisk A/S, Medtronic, Emperra GmbH, and Pendiq are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us