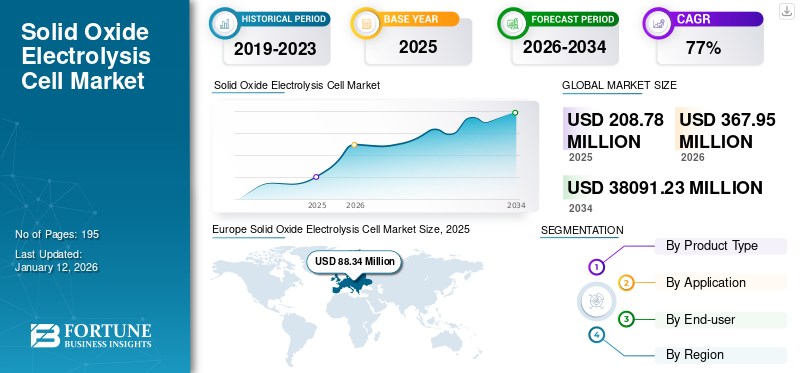

Solid Oxide Electrolysis Cell Market Size, Share & Industry Analysis, By Product Type (Tubular and Others), By Application (Industrial Processes, Hydrogen Production, Fuel Production, and Others), By End-user (Power Plant, Refineries, and Others), and Regional Forecast, 2025-2032

Solid Oxide Electrolysis Cell Market Size

The global solid oxide electrolysis cell market size was valued at USD 118.71 million in 2024 and is projected to grow from USD 208.78 million in 2025 to USD 11,687.75 million by 2032, exhibiting a CAGR of 77.71% during the forecast period. Europe dominated the global market with a share of 41.11% in 2024.

Tomorrow’s cutting-edge technology will require electronics that can withstand extreme conditions. The type of devices that are under work-in-progress is working to benefit high-temperature semiconductors, next-generation fuel cells, and Solid Oxide Electrolysis Cells (SOEC), which could have applications in the automotive, energy, and aerospace industries. NASA established a solid oxide electrolysis cell, allowed on April 22nd on the NASA Mars 2020 Rover Perseverance to make oxygen from gas in the Martian atmosphere. NASA hopes this prototype will one day lead to equipment that allows astronauts to create rocket fuel and breathable air while on Mars.

The COVID-19 pandemic heated the race for leadership in clean hydrogen, as many countries recognize the importance of hydrogen for speaking about the twin challenges of climate change and economic recovery from COVID-19. Significant shares of countries' stimulus funds have been earmarked for hydrogen projects, bringing hydrogen into the realm of geo-economics’ competition. Hydrogen produced from renewable energy sources is called green hydrogen, which can satisfy the UN goal by storing the electric grid at times of massive demand.

Solid Oxide Electrolysis Cell Market Trends

High-Temperature Metal Supported Electrolysis Cell Spreading in the Market

Electrolysis cells utilize a direct electrochemical current to drive a non-spontaneous reaction, such as the splitting of water to produce oxygen and hydrogen. High-temperature solid oxide electrolysis cells typically operate in the range of 500 to 900°C and utilize ceramic oxide electrolyte layers that primarily conduct either oxide ions or protons. Operation at such high temperatures provides distinct benefits over commercially available Proton Exchange Membrane (PEM) and Alkaline Exchange Membrane (AEM) electrolyzers that operate between room temperature and ~100°C. In particular, inexpensive non-platinum group materials can be used as catalysts, the ceramic membrane is impermeable, and so high-purity products are easily obtained. Electrical energy and total energy demand is lower due to the enthalpy difference between liquid water and steam and in-situ consumption of resistive heat from the cell and external sources.

Download Free sample to learn more about this report.

Solid Oxide Electrolysis Cell Market Growth Factors

Increasing Green Hydrogen Production to Drive the SOEC Market

Hydrogen is fast, establishing itself as the fuel of the future, whether it's for power generation or powering the next generation of Fuel Cell Electric Vehicles (FCEVs). Therefore, ways to generate, transport, and utilize it to fuel this energy transition are consistently being developed and optimized. Amongst these, electrolysis is a major Power-to-X (PtX) solution pathway to produce green hydrogen using electricity and water. Solid oxide electrolysis cell offers a more efficient way to generate hydrogen. Solid oxide electrolysis cell technology stands for the decarbonization opportunities it offers for a future focused on the net-zero carbon emissions goals by 2050 of checking greenhouse gas (GHG) emissions and limiting global temperature rise to under 1.5 degrees Celsius (℃).

Solid oxide electrolysis cells can make green hydrogen using surplus electricity from wind turbines along with other sustainable sources. This hydrogen can later be stored in fuel cells & then be reconverted into electricity depending upon the demand, safeguarding safe energy storage when production exceeds demand. Solid oxide electrolysis cell development will remain well into the future even after it accomplishes complete marketability. Whereas it surely needs to meet the cost targets, an improved understanding of the processes during electrolysis will keep resilient increased performance and lifetime gains areas where it requires to be proven. Green hydrogen is measured as a clean and sustainable energy carrier, and the increasing production of green hydrogen is expected to propel the solid oxide electrolysis cell market growth.

Increasing Awareness about Renewable Energy Sources to Boost Market Growth

Energy consumption & environmental pollution caused by traditional fossil-energy-based energy systems have led to a series of severe problems in human life. Therefore, increasing focus on using clean and renewable energy globally is boosting the solid oxide electrolysis cell market share. Wind energy and solar energy, which are renewable energy sources, are now broadly utilized and, in the future, will become the primary energy source. However, a vital piece of these renewable energy sources is intermittent supply. Wind energy depends on climatic conditions, and sunlight & tides have cycles through the day.

To overcome these drawbacks, energy conversion and storage technologies are urgently required. Electrolytic cell technology has received more attention due to its high efficiency, environmental friendliness, and wide applications. It can be seen that SOECs are the most effective type due to their low cost and high efficiency. SOECs can cleanly and efficiently convert redundant renewable energy (solar, wind, and tidal energy) into chemical energy, which plays a dynamic role in the peak fill of the power grid, especially under the background of vigorously developing renewable energy.

RESTRAINING FACTORS

Challenges on the Durability and Long-term Stability to Hamper Market Growth

Long-term system durability is a crucial challenge to the increased economic competitiveness and more widespread industrial implementation of SOEC technology in the future. The reliable long-term performance of an SOEC stack system requires all components to be thermally stable. The long-term and large-scale deployment of SOEC technology also currently faces the challenge of electrode and electrolyte durability. Degradation-related issues still hamper the commercial breakthrough of solid oxide fuel cells.

Most SOECs that perform well do not possess good stability. The severe working conditions of SOFC have several diverse degradation processes, which arise from each component and their interactions, making it challenging to fulfil the long-term stability requirements.

Alternative electrodes still have certain limitations regarding their catalytic activity or ionic and electronic conductivity or stability under operating conditions. These limitations can lead to insufficient performance and durability of the cells.

Solid Oxide Electrolysis Cell Market Segmentation Analysis

By Product Type Analysis

Tubular Segment Leads the Market due to its Varied Usage

Based on product type, the market is segmented into tubular and others.

The tubular segment is dominating the market as the tubular geometry enables a compact design, high power density, and exceptional thermal management, making tubular solid oxide electrolysis cells ideal for applications that need high power density and long-term durability. With tubular solid oxide fuel cells, the fuel & oxidant are provided to the fuel cell through separate tubes, which are draped around a central electrode.

Other segment, like planar, is taking over the market after tubular due to high efficiency, low manufacturing cost, and better current collection. However, high temperature generates sealing & thermos-mechanical stress problems; these issues are now resolved by developing improved sealing materials.

By Application Analysis

Hydrogen Production Segment Dominates the Market Owing to Its Growing Adoption as Alternative Fuel

Based on application, the market is segmented into industrial processes, hydrogen production, fuel production, and others.

The hydrogen production segment is dominating the market owing to the fact that hydrogen currently appears to be the only promising alternative fuel to decarbonize hard-to-abate (HTA) sectors. Hydrogen fuel cells and electric power generation could be integrated at a wind or solar farm to allow flexibility in storing electricity when the wind is not gusting or the sun is not shining.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Power Plant Segment Dominates as It’s an Unavoidable and Essential Need for Power Generation

Based on end-user, the market is segmented into power plant, refineries, and others.

The power plant segment dominates the market as cells do not require water during regular operation. Equally, thermal power plants need significant quantities of water for cooling. In fact, the primary use of water in the U.S. is for cooling power plants. To produce one megawatt per hour for a year, thermoelectric power generation for the U.S. grid withdraws approximately 156 million gallons of water. The use of excess heat produced by the fuel cell for heating purposes in a cogeneration application further increases the overall efficiency by over 80%.

This high efficiency delivers financial benefits and minimizes the environmental footprint since solid oxide fuel cells commonly use natural gas as fuel in comparison to traditional power plants using coal as fuel. Solid oxide fuel cells also don’t emit sulfur oxides and particulate matter

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific and the Rest of the World.

Europe Solid Oxide Electrolysis Cell Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the global solid oxide electrolysis cell market in 2023. Electrolyzers are surging in Europe due to renewable energy expansion and green hydrogen demand. European countries aim to reduce carbon emissions, fostering hydrogen production from renewable sources by electrolysis. Governments incentivize electrolyzer adoption through subsidies, aligning with ambitious climate targets. Industries seek clean hydrogen for decarbonization, driving electrolyzer demand.

Asia Pacific is the second largest region in the solid oxide electrolysis market, owing to the region's huge oil and gas demand. While the market for oil transmission administrations has mostly been observed as open, lawmakers have anticipated endeavors to direct free admittance to the market of fuel production.

China’s Sinopec broadcasted that the nation’s first 10,000-ton green hydrogen demonstration project had positively produced hydrogen, & the output hydrogen was piped to local petroleum refining enterprises to substitute the existing natural gas fossil energy as a power source. The project has effectively realized the whole procedure from production to utilization of green hydrogen, which also symbolises the first time that China has understood the whole industrial chain integration of a 10,000-ton green hydrogen refining project.

North America comprises developed nations, such as the U.S. and Canada, which holds a probable huge market for hydrogen production & fuel production, which fuels market growth. Canada’s first commercial-scale green hydrogen and ammonia production project, developed by World Energy GH2 Inc. and backed by Korean conglomerate SK Group, will be utilizing both SOEC and PEM electrolyzers from two different suppliers. Specifically, the SOEC equipment will come from Bloom Energy Corp, while Siemens Energy AG will deliver the PEM systems.

Key Industry Players

Key Participants Focus on Expanding their Product Capabilities and New Product Development

The global market includes a few global players and numerous small & medium-scale players. New product development has been the main market strategy adopted by major players. For instance, in November 2022, Bloom Energy Corporation launched its high-volume commercial electrolyzer line at the Newark facility of the company. This is increasing the company’s generating capacity of electrolyzers to two gigawatts. The award-winning expertise is the most energy-efficient design to produce clean hydrogen to date.

Major players operating in the market are Siemens Energy, Elcogen AS, Bloomenergy, Nexceris and Fuel Cell Energy, Ballard Power Systems Inc., OxEon Energy, LLC, ITM Power, and others. The major companies have more than half of the market share and many regional and local players for various applications dominates the remaining market.

List of Top Solid Oxide Electrolysis Cell Companies:

- Siemens Energy (Germany)

- Elcogen AS (Estonia)

- Bloomenergy (U.S.)

- Nexceris (U.S.)

- Fuel Cell Energy (U.S.)

- Ballard Power Systems Inc. (Canada)

- OxEon Energy LLC (U.S.)

- ITM Power (U.K.)

- Redox Power Systems (U.S.)

- Bosch (Germany)

KEY INDUSTRY DEVELOPMENTS:

- November 2023 - Phoenix Motor Inc., a leading electrification solutions provider for medium-duty vehicles, today announced that its EdisonFuture subsidiary has launched a new Alkaline Electrolyzer solution, in addition to its existing proton exchange membrane, for the production of green hydrogen products.

- September 2023 - Casale SA and Next Hydrogen Solutions Inc. signed a (MOU)memorandum of understanding to cultivate green ammonia and methanol systems that integrate Next Hydrogen’s electrolysis technology & products. These companies will combine their collective experience & capabilities to accelerate and scale up green ammonia and methanol plants connected to renewable energy sources.

- March 2023 – Toyota's newly developed electrolysing equipment that yields hydrogen from water, using the fuel cell stack & other technologies from the Mirai fuel cell electric sedan. This gear will be put into operation in a Denso plant in Japan in March 2023 & will serve as a working demonstration intended to help promote its wider uptake in the future.

- November 2022 - Bloom Energy Corporation launched its high-volume commercial electrolyzer line at the company's Newark facility, simultaneously increasing the company’s generating capacity of electrolyzers to two gigawatts. The award-winning expertise is the most energy-efficient design to produce clean hydrogen to date.

- April 2022 - Doosan Fuel Cell entered into a partnership with Ballard Power Systems, a Canadian producer of Polymer-Electrolyte Membrane Fuel Cells (PEMFC), to cultivate a hydrogen fuel cell system for mobility. PEMFC is being developed primarily for transport applications along with stationary & portable fuel-cell applications due to its high energy efficiency, simple structure and excellent durability.

REPORT COVERAGE

The market research reports grant a complete industry assessment by proposing valuable insights, facts, industry-related information, competitive landscape, and past data. Various methodologies and approaches are accepted to make expressive assumptions and views to formulate the global Solid Oxide Electrolysis Cell market analysis.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 77.71% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global solid oxide electrolysis cell market was USD 118.71 million in 2024.

The global market is projected to grow at a CAGR of 77.71% over the forecast period.

The market size of Europe stood at USD 48.80 million in 2024.

Based on the application, hydrogen production holds the dominant share in the global market.

The global market size is expected to reach USD 11,687.75 million by 2032.

The key market driver is the increasing green hydrogen production driving the SOEC market.

The top players in the market are Siemens Energy, Elcogen AS, Bloomenergy, and Nexceris, among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us