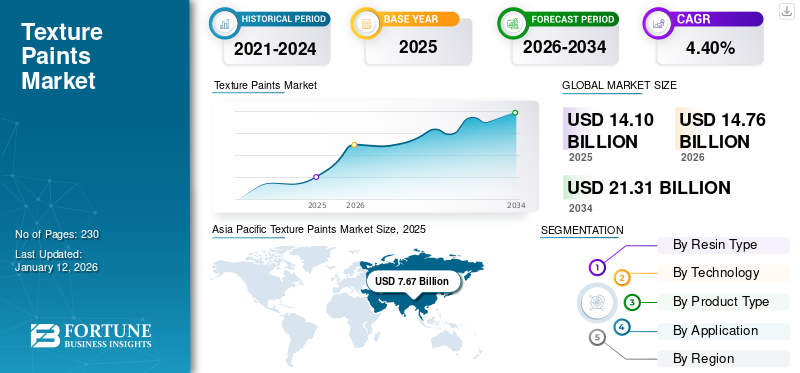

Texture Paints Market Size, Share & Industry Analysis, By Resin Type (Acrylic and Others), By Technology (Water-Based and Solvent-Based), By Product Type (Interior and Exterior), By Application (Residential and Non-Residential), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global texture paints market size was valued at USD 14.10 billion in 2025. The market is projected to grow from USD 14.76 billion in 2026 to USD 21.31 billion by 2034, exhibiting a CAGR of 4.40% during the forecast period. Asia Pacific dominated the texture paints market with a market share of 54% in 2025.

Texture paints are specialized coatings that create a textured surface on walls or other surfaces, adding depth and visual interest to the finish. These paints contain additives, such as sand, silica, or other granular materials, to achieve paint texture types or textured effects. They come in various forms, such as coarse, medium, or fine texture, allowing for different design possibilities. They are commonly used to mask imperfections on walls, enhance aesthetic appeal, and provide a tactile experience in interior and exterior spaces.

The increasing demand from several end-user industries, such as construction, drives the growth of the global market. These paints are increasingly used for the interior design of houses. Additionally, the demand for residential structural paints for decorating or repainting is one of the major drivers fueling the market growth. Their application in the enhancement of commercial and residential spaces is likely to increase the demand for texture paints in the construction sector.

GLOBAL TEXTURE PAINTS MARKET SNAPSHOT & HIGHLIGHTS

Market Size & Forecast:

- 2025 Market Size: USD 14.10 billion

- 2026 Market Size: USD 14.76 billion

- 2034 Forecast Market Size: USD 21.31 billion

- CAGR: 4.40% from 2026–2034

Market Share:

- Asia Pacific dominated the global texture paints market in 2025 with a 54% share, valued at USD 7.67 billion, up from USD 8.07 billion in 2026. The region’s growth is driven by expanding residential and non-residential construction in China, India, and Japan. The interior segment is expected to grow fastest, fueled by increasing consumer demand for personalized home décor.

- By resin type, acrylic dominated the market in 2024, favored for its durability and versatility in various environmental conditions.

- By technology, water-based texture paints held the leading share, supported by eco-friendly attributes such as low VOC emissions and faster drying times.

- The residential application segment led the market in 2024, driven by increased demand for decorative and functional coatings in home design and remodeling projects.

Key Country Highlights:

- China: Drives Asia Pacific’s dominance, with rising urban population and booming residential construction.

- India: Increased infrastructure spending and a growing middle-class population are boosting interior design trends and textured paint demand.

- Japan: Demand supported by modern renovation projects and aging infrastructure maintenance.

- United States: North American market is projected to expand, fueled by increasing construction of commercial buildings and growing consumer preference for high-performance decorative coatings.

- Germany, U.K., France: In Europe, restoration of historic buildings and investment in modern housing are boosting demand for texture paints.

- Brazil, Peru, Colombia: Latin America benefits from public and private infrastructure expansion and rising maintenance spending.

- Saudi Arabia, South Africa: Middle East & Africa sees strong growth, supported by large-scale residential and infrastructure developments under national visions like Saudi Vision 2030.

COVID-19 IMPACT

Supply Chain Disruptions Amid COVID-19 Pandemic Hampered Market Growth

The COVID-19 pandemic disrupted the supply chain of companies operating in the paint and coatings sector. Companies concentrated on managing the orders, inventory levels, and in-transit shipments amid the pandemic. During this pandemic, companies were constantly implementing advanced techniques to stabilize their operations at production units. Similarly, suppliers emphasized on smooth logistics and raw material distribution amid the COVID-19 outbreak.

Texture Paints Market Trends

Superior Properties of Texture Paints over Standard Paints Provides Beneficial Market Opportunities

Texture paints offer enhanced durability and resistance to wear and tear. The textured finish can help conceal minor imperfections on surfaces, providing long-lasting and visually appealing coatings. Additionally, the texture in these paints adds a tactile dimension to surfaces, contributing to a unique aesthetic. This aesthetic appeal is a key factor in the preference for these paints in both residential and non-residential sectors. The ability to create various textures, such as smooth, coarse, or patterned finish, allows for customization and meets diverse design requirements.

Moreover, these paints often have better coverage and hide blemishes more effectively than regular paints. This feature reduces the need for extensive surface preparation, making it a practical choice for both professional and DIY enthusiasts. Furthermore, the evolving trends in interior and exterior design also drives the product demand. Consumer seeks innovation and unique ways to enhance their living or working space, and the use of texture painting techniques will provide a versatile means for achieving these goals. The superior properties, including enhanced durability, aesthetic versatility, better coverage, and additional functional benefits, drive the growth of the market as they meet the evolving demand of consumers in the paints and coatings industry. Asia Pacific witnessed a texture paints market growth from USD 6.93 billion in 2023 to USD 7.29 billion in 2024.

Download Free sample to learn more about this report.

Texture Paints Market Growth Factors

Increase in Construction Activities to Assist in Market Expansion

The construction industry is expected to rise by almost USD 8 trillion by 2032. An increase in construction activities and government investments in various public infrastructure projects is likely to support the market. There is an increased demand for aesthetic enhancements in building structures. They provide not only decorative appeal but also serve functional purposes, such as covering imperfections and adding durability.

Additionally, builders and homeowners alike are increasingly opting for texture paints due to their ability to create visually appealing surfaces and mask irregularities in walls. The growing trend of modern architecture, coupled with the desire for personalized and unique texture paint designs, further fuels the demand for these paints. Moreover, these paints offer advantages, such as moisture resistance and ease of maintenance, making them a practical choice for various environments. The construction industry’s expansion contributes to a larger customer base for paint manufacturers, fostering innovation and diverse product offerings.

RESTRAINING FACTORS

Harmful Effect on Human Health to Hamper Market Growth

Although texture paints are widely used across residential and non-residential sectors, the presence of chemicals used in these paints hampers the market growth. These effects may include respiratory issues due to Volatile Organic Compounds (VOCs) emitted during application and drying. Prolonged exposure to such compounds can contribute to indoor air pollution, potentially causing or exacerbating respiratory conditions. Additionally, some of these paints contain allergens or irritants, posing risks to individuals with sensitives or allergies. Manufacturers addressing these health concerns through the development of low-VOC or VOC-free alternatives could mitigate these challenges and promote the texture paints market growth by aligning with health-conscious consumer preferences.

Texture Paints Market Segmentation Analysis

By Resin Type Analysis

Acrylic Segment Accounted for the Larger Share Due to its Superior Properties

Based on resin type, the market is divided into acrylic and others.

The acrylic segment held the larger texture paints market share of 88.62% in 2026 due to its versatile and durable properties. Acrylic resin forms a strong and resilient film when it dries, making it resistant to wear and tear. This durability is particularly advantageous for this type of paints, which may be subjected to various environmental conditions.

The others segment includes epoxy, polyester and other resins. Epoxy resin is used due to its protective and mechanical properties. They are used as binders for coating applications to enhance the coating durability for metal and floor applications. Properties such as durability, chemical resistance, toughness, good curing, excellent adhesion, excellent water resistivity, and abrasion resistance making it suitable for protecting metals and other surfaces. Epoxy resins are primarily used in the manufacture of paints and coatings, adhesives, sealers, primers, plastics, flooring, and other materials that are preferably used in building and construction applications. A rise in per-capita disposable income, along with an increase in building and construction activities, shall augment the market growth for epoxy resins during the forecast period.

By Technology Analysis

Water-Based Segment Led owing to Environment-Friendly and No VOC Emission Properties

Based on technology, the market is segmented into water-based and solvent-based.

The water-based segment held the dominant market share 84.89% in 2026. The segment will retain its leading position due to its advantages, including quick drying, no VOC emissions, and easier application.

Solvent-based paints are produced by utilizing organic compounds used for humid and harsh environments. These paints are used in applications, including exterior coatings of buildings and industrial metals & equipment. The increasing industrialization across the globe will drive the segment growth.

By Product Type Analysis

Interior Segment to Register Faster-growth Due to Higher Product Demand for Interior Decoration

Based on product type, the market is segmented into interior and exterior.

The interior segment is estimated to grow at a higher CAGR during the forecast period share contributing 73.58% globally in 2026. The increasing use of texture paint arts for interior decoration is a key factor that is boosting the segment growth. These paints provide a unique and visually appealing surface compared to traditional flat paints. They can be used to create various effects, such as stucco, sand, or metallic finishes, adding character to interior spaces. The huge expenditure on interior decoration is expected to create growth opportunities for the segment.

The exterior textured paints provide an extra layer of protection for the building against weather elements, such as rain, wind, and sunlight, helping to prevent damage and deterioration of the underlying surfaces. These textured paints can also hide imperfections on the exterior walls, offering a visually appealing and uniform appearance.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Higher Demand from Personalized Home Décor Boosted Residential Segment Growth

Based on application, the market is segmented into residential and non-residential.

The residential segment held the largest market share 75.41% in 2026 and is expected to dominate the market during the forecast period due to the rise in demand for personalized and customized home décor. The increased use of these paints as a means of achieving substantive interior and exterior design has led to the demand for paints from residential applications for the past few years.

The non-residential segment is also anticipated to increase rapidly due to these paints being increasingly utilized for aesthetic and functional purposes in commercial spaces.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific Texture Paints Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific accounted for a share of 54.2% of the global market in 2024. The leading share is attributed to an increase in construction and building activities in China, India, and Japan. Rapid expansion of residential and non-residential infrastructures is driving the demand for these paints. They are widely used in decorating furniture, windows, and walls. The rapid growth of the residential construction sector in China due to the growing population is fostering the market growth. The Japan market is projected to reach USD 0.83 billion by 2026, the China market is projected to reach USD 3.61 billion by 2026, and the India market is projected to reach USD 2.38 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is predicted to register remarkable growth in the global market. An increase in the consumption of paints for construction applications in the U.S. is assisting market growth in the region. The increasing commercial spaces and rising demand for appealing decorative paints will drive market growth in the region. The U.S. market is projected to reach USD 1.56 billion by 2026.

Europe

The expansion of the building sector in Europe, particularly in countries, such as Germany, the U.K., and France, is boosting product demand. The demand for texture paints in the region is anticipated to rise as a result of the rising number of restoration and rehabilitation projects in historic structures and sites. The UK market is projected to reach USD 0.46 billion by 2026, while the Germany market is projected to reach USD 1.07 billion by 2026.

Latin America

In Latin America, a rise in maintenance spending and the expansion of the public and private sector infrastructure in countries, including Brazil, Peru, and Colombia is fueling the market expansion.

Middle East & Africa

The Middle East & Africa is expected to witness significant growth in the market. Saudi Arabia and South Africa are leading countries in the region due to the flourishing construction industry. The rise of infrastructure and large residential projects in the region is anticipated to drive product demand.

KEY INDUSTRY PLAYERS

Leading Players Focus on Acquisitions to Maintain Their Dominance

The global texture paints market share is fragmented, with key players operating in the industry as Asian Paints Ltd., Akzo Nobel N.V., Nippon Paint Holdings Co., Ltd., Berger Paints India Limited, and PPG Industries Inc. Most producers are engaged in increasing their businesses to maintain competitiveness in the industry and reduce new entrants’ threats. Leading companies are competing with international and regional participants with strong distribution networks, regulatory know-how, and providers. They signed contracts, acquisitions, and strategic partnerships with other market leaders to expand their existing markets.

List of Top Texture Paints Companies:

- Asian Paints Ltd (India)

- Akzo Nobel N.V (Netherlands)

- Nippon Paint Holdings Co., Ltd. (Japan)

- Berger Paints India Limited (India)

- PPG Industries Inc. (U.S.)

- Kansai Nerolac Paints Limited (India)

- The Sherwin-Williams Company (U.S.)

- DuluxGroup Limited (U.K.)

- BASF SE (Germany)

- Hempel A/S (Denmark)

KEY INDUSTRY DEVELOPMENTS:

- June 2021: PPG acquired a Nordic paint and coatings company, Tikkurila. It will assist PPG in increasing paint and coatings options that will include Tikkurila’s environment-friendly decorative products and high-quality industrial coatings.

- June 2021: AkzoNobel acquired Grupo Orbis, a paints and coatings maker. This acquisition will allow AkzoNobel to expand its position in South and Central America.

- June 2021: AkxoNobel collaborated with TNW with a mission to create innovation in the paints and coatings industry. With extensive experience in media and events, the global digital brand TNW will extend AkzoNobel’s invitation to join the largest collaborative innovation ecosystem in the paints and coatings industry.

REPORT COVERAGE

The research report provides both qualitative & quantitative insights on Texture Paints across the world. Quantitative insights include market sizing in terms of value across each segment and region profiled in the scope of study. Also, it provides market analysis and growth rates of resin type, technology, product type, application, and key counties across each region. Qualitative insight covers the elaborative analysis of key market drivers, restraints, growth opportunities, and industry trends related to the market. The competitive landscape section covers detailed company profiling of the key players operating in the industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

CAGR (2025-2032) |

CAGR of 4.40% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Resin Type

|

|

By Technology

|

|

|

By Product Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 14.10 billion in 2025 and is projected to reach USD 21.31 billion by 2034.

Growing at a CAGR of 4.40%, the market will exhibit steady growth in the forecast period.

The residential segment was the leading application in the market.

The rising demand for better-quality paints is anticipated to drive market growth.

In 2025, the Asia Pacific dominated the market with a value of USD 7.67 billion.

Asian Paints Ltd., Akzo Nobel N.V., Nippon Paint Holdings Co. Ltd., Berger Paints India Limited, and PPG Industries Inc. are a few of the leading players in the market.

The growing construction industry and rising preference for innovative paint solutions are the factors driving product adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us