Viral Clearance Market Size, Share & Industry Analysis, By Method (Viral Removal Method [Chromatography, Filtration, and Precipitation], Viral Inactivation Method [pH Modification, Solvent Detergent (S/D), Pasteurization, & Dry Heat], and Viral Detection Method [Next Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), In vivo Assay, & In vitro assay]), By Application (Blood and Blood, Products, Recombinant Proteins, Cellular & Gene Therapy Products, & Vaccines), By End-user (Pharmaceutical and Biotech Industry, Academic Research Institutes, & CROs), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

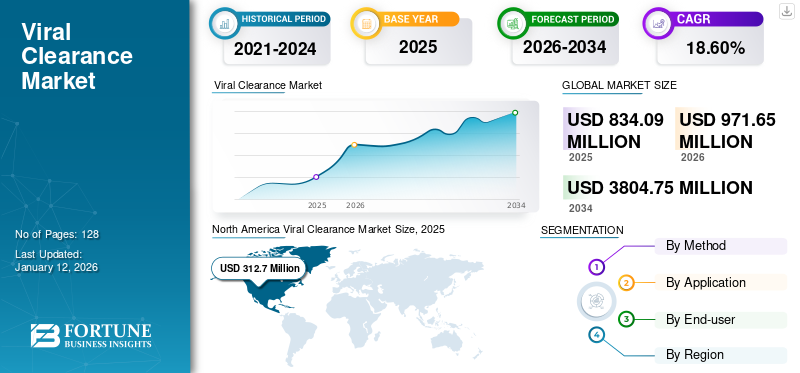

The global viral clearance market size was valued at USD 834.1 million in 2025. The market is projected to grow from USD 971.65 million in 2026 to USD 3,804.75 million by 2034, exhibiting a CAGR of 18.60% during the forecast period. North America dominated the viral clearance market with a market share of 37.50% in 2025.

Therapeutics derived from plants, animals, or humans are more prone to viral contamination. In order to make sure that the biopharmaceuticals are free from contamination, viral clearance studies are performed. The increasing development and manufacturing of biopharmaceuticals derived from biologics, such as vaccines, cell and gene therapeutics, recombinant proteins, and others, has fueled the demand for these studies.

- For instance, as per the data published by BMJ Publishing Group Limited in March 2021, the global annual production of vaccines is around 5.00 billion doses.

Many small or mid-sized biopharmaceutical and biotechnological companies are more inclined toward outsourcing viral clearance studies for their products for convenient and efficient outputs. Therefore, the rising demand for biopharmaceuticals and the increasing number of biopharmaceuticals in the pipeline has fueled the demand for these studies.

Moreover, during the COVID-19 pandemic, the market experienced slow growth in its revenue due to the lockdown restriction and the reduced manufacturing capacity of pharmaceutical and biotechnology companies in order to control the spread of the virus. However, in 2021, the market experienced significant growth. This growth was attributed to the increase in the number of clinical trials and increase in demand for novel and effective vaccines for COVID-19.

Global Viral Clearance Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 834.1 million

- 2026 Market Size: USD 971.65 million

- 2034 Forecast Market Size: USD 3804.75 million

- CAGR: 18.60% from 2026–2034

Market Share:

- North America dominated the viral clearance market with a 37.50% share in 2025, driven by a strong biotechnology and life sciences research ecosystem, increasing number of clinical trials, and robust pharmaceutical manufacturing capacities.

- By method, the viral removal segment is expected to maintain its dominance owing to its high efficiency, rising R&D investments, and increasing demand for vaccines and biologics globally.

Key Country Highlights:

- United States: Growth is driven by an increase in clinical trials, a well-established pharmaceutical industry, and regulatory requirements for viral safety during biologics development.

- Europe: The presence of a strong biotechnology base, rising R&D initiatives by biotechnological companies, and expansion activities by key players support market expansion.

- China: Focused efforts on facility expansions for viral clearance services and a growing domestic biopharmaceutical sector drive the market in the region.

- Japan: Increasing pharmaceutical R&D expenditure, emphasis on biologics manufacturing, and regulatory compliance requirements boost demand for viral clearance studies.

Viral Clearance Market Trends

Growing Focus of Market Players on Facility Expansion is the Latest Trend

The prevalence of chronic diseases, such as diabetes, cancer, cardiovascular disorders, and others, is increasing significantly. For instance, in September 2023, according to the data published by the World Health Organization (WHO), cardiovascular diseases caused 17.9 million deaths globally, followed by cancer, which accounted for 9.3 million deaths, while chronic respiratory diseases caused 4.1 million deaths.

Thus, due to this rising burden of chronic diseases, many pharmaceutical and biotechnology companies have increased their focus on developing and manufacturing biosimilars and drugs. Biological products used for human use have to pass through viral clearance studies every time they are manufactured to remove viral contamination. Due to this, there has been an increasing demand for these services.

Thus, to meet this increasing demand for viral clearance services, the market players have expanded their facilities to enhance their accessibility to pharmaceutical and biotechnology companies.

- For instance, in September 2022, Merck KGaA announced the opening of a viral clearance (VC) laboratory as part of the first building phase of its new China Biologics Testing Center. The VC laboratory allows pharmaceutical and biotechnology companies to conduct these studies locally, from pre-clinical development to commercialization.

The increasing focus of the market players on expanding their facilities and service offerings is expected to enhance the service offerings of these companies globally.

Download Free sample to learn more about this report.

Viral Clearance Market Growth Factors

Increasing R&D Expenditure by Biopharmaceutical and Biotechnology Companies Fuel Market Growth

The prevalence of various chronic diseases, such as diabetes, cardiovascular disorders, cancer, and others, has been increasing significantly. For instance, according to the World Health Organization (WHO), cancer accounted for 10 million deaths globally in the year 2020.

This increased prevalence has resulted in a rising need to develop novel drugs to treat various diseases, resulting in an increased focus of biopharmaceutical and biotechnology companies on applying significant resources to develop new medications and technologies for various disease indications.

- For instance, according to the data published by the Department of Science & Technology in March 2023, the gross expenditure on total R&D in India increased steadily from USD 7,290.2 million in 2010 – 2011 to USD 15,426.6 million in 2020 – 2021, which is more than double. Out of the total R&D expenditure during 2020 - 2021, drugs and pharmaceuticals accounted for the maximum proportion of 33.6%.

Every biological drug has to pass through viral clearance during its development. Therefore, the increasing focus of pharmaceutical companies on developing and commercializing biologically derived therapeutics for effective treatment has been fueling the demand for these studies.

- For instance, as per the U.S. FDA, in March 2021, Celgene Corporation, a Bristol-Myers Squibb Company, got ABECMA approval to treat relapsed/refractory multiple myeloma in adult patients.

The increasing burden of chronic diseases has resulted in a growing focus on pharmaceutical and biotech companies increasing their R&D expenditure to develop novel biologics, increasing the demand for these services and thereby driving the viral clearance market growth.

Increasing Regulations on Viral Safety to Spike Industry Development

Viral clearance studies are an essential step for developing biologics and are necessary to ensure product safety. Regulatory bodies strongly focus on ensuring these tests are conducted and expect high-quality data to support them, especially for IND and BLA approvals. It is crucial to be familiar with the process and regulatory requirements and have expertise in the key areas of these processes for strategic planning, which can lead to time, effort, and money savings.

In order to reduce the risk of transmission of viruses, regulations on the safety of pharmaceutical products have been developed over the past decades.

- For instance, the International Council for Harmonisation (ICH), in 2022, published guidelines on viral safety evaluation of biotechnology products derived from cell lines of human or animal origin for the testing and evaluating of the viral safety of biotechnology products. These guidelines provide detailed information for biopharmaceutical manufacturers about what data should be submitted in marketing applications and registration packages for biological products derived from cell lines of human or animal origin. This guideline also sets specific tests that need to be performed for different viruses in order to attain virus clearance.

Such guidelines on viral safety evaluation for biotechnology product development have increased the need for the services to conduct studies more effectively.

RESTRAINING FACTORS

High Costs Associated with Novel Technologies of Viral Clearance to Limit Market Growth

The increasing development of biopharmaceuticals has fueled the demand for viral clearance services. However, the high cost associated with the technologies used for these studies has restricted global market growth.

- For instance, as per the data published by Axion Analytical Laboratories, Inc. in 2022, the cost of a gas chromatography system was estimated to be approximately USD 30,000 to USD 50,000.

- Moreover, according to an article published by uHPLCs in June 2023, a High-tech manufacturer of HPLC consumables and accessories, stated that its Agilent 1290 Infinity II LC HPLC system costs approximately USD 60,000 to USD 100,000.

Moreover, as the service providers compete with pharmaceutical, biotechnology, medical device companies, and academic & research institutions for qualified and experienced scientists, these service providers face challenges in attracting and retaining highly qualified experts.

In order to effectively compete with other players, particularly small-scale analytical testing providers, service provider companies must provide higher compensation and other incentives. In the coming years, this lack of experienced specialists could hamper the adoption of new technologies, thereby limiting the virus clearance market growth.

Viral Clearance Market Segmentation Analysis

By Method Analysis

Viral Removal Segment to Dominate Owing to its High Efficiency

Based on method, the market is classified into viral removal method, viral inactivation method, and viral detection method. The viral removal method is further sub-segmented into chromatography, filtration, and precipitation. Similarly, the viral inactivation method is sub-segmented into pH modification, solvent detergent (S/D), pasteurization, dry heat, and others. Also, the viral detection segment is further sub-segmented into next generation sequencing (NGS), polymerase chain reaction (PCR), in vivo assay, in vitro assay, and others.

The viral removal method segment dominated the market with a share of 14.85% in 2026. The segment’s growth is primarily attributable to the growing investments in R&D by the major players in the market and the increasing demand for vaccines and other biopharmaceuticals globally.

- For instance, as per the Pharmaceutical Research and Manufacturers of America (PhRMA) trade group in 2022, PhRMA's member companies' research and development (R&D) expenditure reached the highest level of record of USD 102.3 billion worldwide in 2022.

The viral inactivation method segment is anticipated to exhibit strong growth during the forecast period. The increasing approval of new therapeutics, such as plasma proteins and gene therapy products, is expected to fuel the segment’s growth during the forecast period.

- For instance, according to an article published by Springer Nature Limited, in 2023, the Food and Drug Administration (FDA) approved 55 new drugs as small molecule and biologics.

Furthermore, the viral detection segment is expected to grow at a considerable CAGR. Viral detection is an important step in the viral clearing process as it determines how virus removal or inactivation can be used. This factor has been fueling the growth of the viral removal segment.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Increasing Demand for Vaccines Drives the Vaccine Segment’s Growth

Based on application, the market is segmented into vaccines, blood & blood products, recombinant proteins, cellular & gene therapy products, and others.

The vaccines segment dominated the market with a share of 12.03% in 2026. The segment’s dominance is attributed to the increased demand for vaccines against chronic and infectious diseases, such as measles, polio, hepatitis, cervical cancer, and others.

- For instance, in July 2023, according to the World Health Organization (WHO), the proportion of children receiving a first dose of measles vaccine increased from 81.0% in 2021 to 83.0% in 2022.

The blood & blood products segment is anticipated to expand substantially during the upcoming years. The growth of the segment is attributed to the high demand for blood transfusions and therapeutic products derived from blood components.

- For instance, in June 2023, as per data released by the World Health Organization (WHO), the median blood donation rate in high-income countries was 31.5 donations per 1000 people. About 118.5 million blood donations are collected worldwide. This increase in the number of blood donations positively impacted the demand for virus clearance services for blood transfusion and the manufacturing of blood products.

The cellular & gene therapy products segment is expected to grow at the highest CAGR during the forecast period. The growth is attributed to the increasing use of cellular therapies in treating various disorders, growing public and private funding for stem cell research, rising awareness about stem cell therapies, and the use of tissue-based therapies to treat various diseases.

By End-user Analysis

Increasing Biopharmaceutical Development to Boost the Pharmaceutical and Biotech Industry Segment’s Growth

Based on end-user, the market is segmented into pharmaceutical and biotech industry, academic research institutes, CROs, and others.

The pharmaceutical and biotech industry segment dominated the market with a share of 22.93% in 2026. The mandatory requirement of virus removal and inactivation by regulatory authorities during the development of biotherapeutics and other biological products is responsible for the segment’s dominance.

- For instance, as per the Food and Drugs Administration (FDA), as of January 2022, there are 33 FDA-approved biosimilars, 21 of which are available in the U.S.

The CROs segment is anticipated to expand at a substantial CAGR during the forecast period, 2025-2032. The segment's growth is due to the pharmaceutical companies' increased outsourcing of early-phase development services and clinical and laboratory testing services.

- For instance, in January 2023, Premier Research, a global clinical research organization (CRO), announced a strategic partnership with CENTOGENE N.V. to provide end-to-end support to the company in rare disease clinical trials.

The academic and research institutes segment is expected to grow at the highest CAGR during the forecast period. The growing number of research and studies on new drug development by research institutes is anticipated to accelerate the segment's growth globally.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Viral Clearance Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market in North America reached USD 312.7 Million in 2025 and is anticipated to grow strongly during the forecast period. Factors such as the presence of national institutes supporting biotechnology and life science research, growth in the pharmaceutical industry, and the increasing number of clinical trials in high-income countries foster the demand for viral clearance in the region.

- For instance, as per the World Health Organization (WHO) and International Clinical Trials Registry Platform (ICTRP), the annual number of registered clinical trials in the U.S. increased from 7,462 in 2010 to 9,901 in 2022.

Europe

Europe is expected to experience the second-highest growth in the market owing to the strong foundation of biotechnology in European countries, such as France and Germany, and the increase in the amount of research and development initiatives and spending by biotechnological companies in the region.

- For instance, CRISPR Therapeutics, a European biotechnology company, spent around USD 461.6 million on R&D activities in 2022, an increase of 35.5% compared to the previous year.

Asia Pacific

Simultaneously, Asia Pacific may expand in the coming years. This growth is attributed to the increase in generics development and manufacturing, the surge in funding for medical research, and a large number of CROs in the region.

Latin American and the Middle East & Africa

The Latin American and the Middle East & Africa may witness slow growth owing to the rising healthcare expenditures and increasing demand for biopharmaceuticals.

Key Industry Players

Market Players Focus on Strong and Diverse Product Portfolio to Drive Market Growth

Market players, such as Merck KGaA, Charles River, Wuxi Biologics, and Kedrion, accounted for a significant global viral clearance market share in 2024. These players' strong focus on expanding their development and manufacturing facility to enhance their service offerings has fueled their revenue growth.

- In November 2021, WuXi Biologics announced the official opening of its advanced therapies testing facility, including 140,000 square feet of laboratories, to enhance the company’s Contract Testing, Development, and Manufacturing Organization (CTDMO) business model by tripling the company’s previous testing capacity to meet the increasing needs of customers in cell and gene therapy industry.

Other key players, such as Kedrion, Sartorius AG, Texcell, and Clean Cells, have been enhancing their services and expanding their presence in new countries. For instance, in January 2022, Kedrion announced that the company has been focusing on expanding its presence in Turkey through its subsidiary Betaphar.

List of Top Viral Clearance Companies:

- Merck KGaA (Germany)

- Charles River Laboratories (U.S.)

- WuXi Biologics (China)

- Texcell (France)

- Vironova (Sweden)

- Kedrion (Italy)

- Clean Cells (France)

- ViruSure GmbH (Austria)

- Sartorius AG (Germany)

- Syngene International Limited (India)

- Microbiologics (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: Texcell announced the expansion of its viral clearance and biosafety facility in Frederick, U.S., by opening a 27,000 sq.-ft. facility in the same city. This expansion aimed to enhance its service offerings.

- December 2022: WuXi Biologics opened a Biosafety Testing Center facility in Lin-gang, Shanghai. The company strengthened its service offerings and presence in China with this expansion.

- April 2022: WuXi Biologics awarded the bioprocessing excellence in viral clearance and safety accolade for the second time at the Asia-Pacific Bioprocessing Excellence Awards (ABEA) event.

- January 2022: Texcell announced the expansion of its facility in the U.S. to increase capabilities for all its service lines, including customized R&D cell culture, GLP viral clearance studies, and select GMP assay capabilities for viral safety testing.

- December 2021: ViruSure GmbH announced the acquisition of Bionique Testing Laboratories LLC., the U.S.-based leader in mycoplasma testing services for the biologics and life-sciences industries. With this acquisition, the company aimed at enhancing its service offerings for viral clearance.

REPORT COVERAGE

The viral clearance market research report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product type, and applications. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.60% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Method

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 971.65 million in 2026 to USD 3,804.75 million by 2034.

The market is expected to exhibit steady growth at a CAGR of 18.60% during the forecast period (2026-203).

By method, the viral removal method segment is set to lead the market.

Increasing investment in pharmaceutical and biotechnology industries and rising demand for vaccines and other biotherapeutic agents are expected to drive the market growth.

Merck KGaA, Charles River, Wuxi Biologics, Sartorius AG, and Kedrion are the top players in the market.

North America dominated the viral clearance market with a market share of 37.50% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us