Gene Therapy Market Size, Share & Industry Analysis by Product (Zolgensma, Luxturna, Roctavian, and Others), By Vector Type (Viral Vectors and Non-Viral Vectors), By Indication (Genetic Disorders, Ophthalmology, Hematology, and Others), By End User (Hospitals & Clinics, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

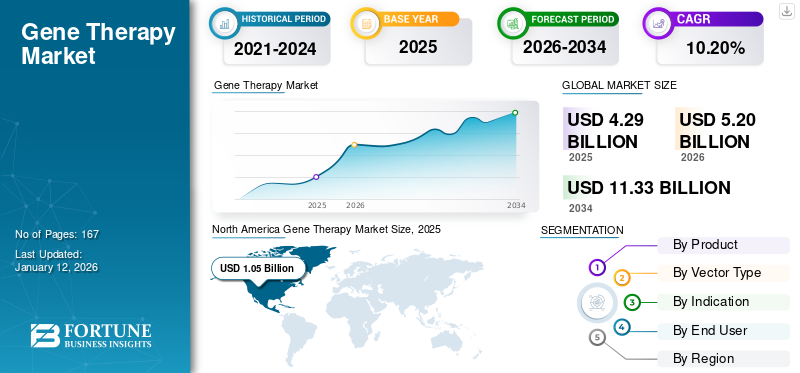

The global gene therapy market size was valued at USD 4.29 billion in 2025. The market is projected to grow from USD 5.2 billion in 2026 to USD 11.33 billion by 2034, exhibiting a CAGR of 10.20% during the forecast period. North america dominated the gene therapy market with a market share of 24.60% in 2025.

Gene therapy is a technique that utilizes genes to treat, prevent, or cure a disease or medical disorder. The techniques add new copies of a gene or replace defective or missing genes in patients’ cells. These therapies are highly effective against various congenital genetic disorders, such as sickle cell anemia, as well as acquired disorders such as leukemia. The increasing prevalence of genetic disorders and rare diseases is expected to augment the demand for these therapies and drive the market growth.

Furthermore, advancements in genetic therapy, increasing research and development, funding opportunities, along with new products launches and their subsequent regulatory approvals by governing bodies are anticipated to support the growth of the market.

- For instance, in June 2025, SpliceBio received series B funding of USD 127.7 million for advancements in gene therapy.

Furthermore, the market encompasses several major players with Novartis AG and F. Hoffmann-La Roche Ltd, at the forefront. Broad portfolio with innovative product launches and strong initiatives aimed at the expansion of geographical presence have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Rising Burden of Genetic Disorders to Augment the Demand for Gene Therapies

The increasing burden of genetic disorders such as spinal muscular atrophy, hemophilia, β-thalassemia, and inherited retinal diseases globally is expected to heighten product demand, driving gene therapy market growth. The rising prevalence has led to an escalated demand for curative treatments combating the root cause.

- For instance, the World Federation of Hemophilia reported 218,804 patients with hemophilia in 2023.

MARKET RESTRAINTS

High Cost of Gene Therapies Limiting Patient Access May Hamper Market Growth

One of the major factors hampering the growth of the market is the high cost of gene therapies, limiting access to patients. Such a higher cost creates a financial barrier for patients, payers, and healthcare systems. This financial barrier reduces patient adoption and also pressures payers to weigh cost-effectiveness against long-term clinical benefits, hampering the adoption of these novel therapies.

- For instance, in December 2022, CSL received approval from the U.S. FDA for the first gene therapy for hemophilia B. The one-time treatment costs a whopping USD 3.5 million. Such a high cost creates a financial barrier, restricting easy adoption.

MARKET OPPORTUNITIES

Advancements in Gene Delivery Systems to Offer Significant Growth Opportunities

The development of pipeline candidates for advancement in the gene delivery method offers lucrative growth opportunities in the market. These advancements overcome the challenges of inefficient and non-specific delivery of genetic material, avoiding triggering of the immune response. Advances in gene delivery systems tackle these challenges to improve tissue specificity, reduce immune activation, and simplify large-scale production. The vectors currently used face certain challenges, such as limited payload capacity, production bottlenecks, and scalability. Such developments are poised to offer market expansion opportunities over the forecast period.

- For instance, in May 2025, Dyno Therapeutics, Inc., launched three new adeno-associated virus (AAV) capsid gene delivery vectors targeting the eye, musculoskeletal system, and central nervous system (CNS). These new capsids are more efficient and deliver the therapeutic genes more specifically.

GENE THERAPY MARKET TRENDS

Emphasis on Improving Manufacturing Scalability is a Prominent Trend in the Market

Emphasis on improving manufacturing scalability is one of the prominent trends observed in the market due to the growing demand for viral vectors and the rising number of clinical candidates. To cater to such increasing demand, key companies are directing their resources toward the expansion of manufacturing capability, integrating next-generation bioprocessing technologies, automated systems, and modular facilities, enabling them to achieve higher yields and consistent quality.

- For instance, in October 2024, the Cell and Gene Therapy catapult partnered with Pharmaron Biologics (UK) Ltd and Complement Therapeutics and received a USD 1.5 million grant from the U.K. Transforming Medicines Manufacturing (TMM) Programme. The funding aimed to reduce the costs of AAV production for gene therapies and improve manufacturing scalability for vector supply to accelerate treatment access.

- Similarly, in January 2021, Adverum invested USD 80.0 million into a North Carolina viral vector facility to support gene therapy candidate ADVM-022.

Download Free sample to learn more about this report.

MARKET CHALLENGES

Maintenance of Clinical Efficiency over a Longer Period of Time Poses a Significant Challenge for Market Growth

One of the major challenges in the market is maintaining the clinical efficiency of gene therapy over a longer period of time. While these therapies provide strong initial responses, the transgene expression declines over time due to various factors such as immune responses, promoter silencing, or loss of modified cells. It also makes long-term monitoring and follow-up studies essential, adding to both clinical and economic burden.

- For instance, in August 2020, BioMarin received a CRL (complete response letter) from the U.S. FDA for valoctocogene roxaparvovec gene therapy for the treatment of severe hemophilia A. The U.S. FDA rejected approval of the therapy due to a lack of sufficient data to support the durability of the effect.

Segmentation Analysis

By Product

Zolgensma’s Efficiency and Durability in Gene Expression to Drive Segmental Dominance

The market, on the basis of product, is classified into Zolgensma, Luxturna, Roctavian, and others.

The Zolgensma segment held a dominant market share in 2024. The segment’s value is estimated to be USD 1.24 billion in 2025. The high market share of the product is due to its proven durability. Furthermore, the drug offers treatment for spinal muscular atrophy (SMA), which is a relatively more common and life-threatening condition in infants. This broadens the patient base for the product, augmenting demand. Due to these factors, the segment is projected to dominate the market.

- For instance, in March 2023, Novartis AG shared data demonstrating durability up to 7.5 years post-dosing of Zolgensma for the treatment of spinal muscular atrophy (SMA).

Such developments are expected to drive the segmental growth.

The Roctavian segment is projected to grow at a CAGR of 38.72% over the forecast period.

By Vector Type

Targeted Delivery of Genetic Material by Viral Vectors to Support Segmental Growth

Based on vector type, the market is segmented into viral vectors and non-viral vectors.

The viral vector segment held the dominating market share of 98.46% in 2026. Viral vectors are increasingly used in gene therapy as they offer much higher transduction efficiency, targeted delivery of genetic material, and long-lasting permanent expression into the host genome. Due to these factors, the viral vector segment is anticipated to hold a leading market share.

- In June 2025, Sarepta Therapeutics, Inc. received platform technology designation by the U.S. FDA for the AAV vector used in the investigational gene therapy SRP-9003 for the treatment of limb-girdle muscular dystrophy type 2E/R4.

To know how our report can help streamline your business, Speak to Analyst

The non-viral segment is set to flourish at a growth rate of 57.65% during the forecast period.

By Indication

Increasing Focus on Personalized Therapy for Genetic Disorders to Fuel Segmental Growth

In terms of indication, the market is categorized into genetic disorders, ophthalmology, hematology, and others.

The genetic disorders segment dominated the global gene therapy market share in 2024. In 2025, the segment is anticipated to dominate with 31.4% share. The application of gene therapies supports the unmet need for curative treatments for genetic disorders. The increasing use of personalized gene therapies for treatment is estimated to drive the growth of the segment. Due to these factors, various key companies are focusing on investment in novel gene therapies, leading to growth.

- For instance, in May 2025, CureDuchenne invested USD 1.0 million in Entos Pharmaceuticals to support the development of a new gene therapy for Duchenne muscular dystrophy (DMD). The initiative aimed to overcome the limitations of existing gene therapies.

The ophthalmology segment is expected to grow at a CAGR of 19.35% over the forecast period.

By End User

Clinical Trials at Hospitals & Clinics to Reinforce the Dominance of the Segment

Based on end user, the market is segmented into hospitals & clinics, specialty clinics, and others.

The hospitals & clinics segment dominated the global gene therapy market share 55.96% in 2026. The hospitals & clinics act in a central role for the gene therapies market. They provide ethical oversight and rigorous monitoring of these gene therapies. In addition, they are a hub for phase 3 clinical trials for gene therapy, which reinforces the dominance of this segment with a share of 55.99% in 2025.

- For instance, in May 2025, the National Institutes of Health (NIH) reported that an infant with a rare, incurable disease, carbamoyl phosphate synthetase 1 (CPS1) deficiency, responded positively to the personalized gene therapy treatment at the Children’s Hospital of Philadelphia.

In addition, the specialty clinics segment is projected to grow at a CAGR of 19.29% during the study period.

Gene Therapy Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Gene Therapy Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America held a dominant share in 2025, valued at USD 1.05 billion, and also accounted for a leading share in 2026, with USD 1.12 billion. The factors influencing the high share of the region are increasing research and development endeavors, new product launches, robust healthcare infrastructure, rapid FDA approvals of novel gene therapies, the presence of leading biotech and pharma players, and strong venture capital and government funding. In 2026, the U.S. market is estimated to have reached USD 1.04 billion.

- In April 2025, Abeona Therapeutics Inc. received approval from the U.S. FDA for ZEVASKYN gene-modified cellular sheets as the first and only autologous cell-based gene therapy for the treatment of wounds in adult and pediatric patients with recessive dystrophic epidermolysis bullosa.

Europe and Asia Pacific

Other regional markets, such as Europe and the Asia Pacific, are anticipated to witness notable growth in the coming years. During the forecast period, the Europe region is projected to record a growth rate of 7.82%, which is the second highest amongst all the regions, and touch a valuation of USD 2.32 billion in 2025. This growth is primarily driven due to the supportive regulatory pathways, strong research collaborations across academic centers, and national reimbursement initiatives to enhance access. Backed by these factors, the U.K. is expected to have reached a valuation of USD 0.47 billion, Germany, USD 0.71 billion in 2026 and France, USD 0.39 billion, in 2025. After Europe, the market in the Asia Pacific region is estimated to have reached USD 0.53 billion in 2026 and secure the position of the third-largest region in the global market. In the Asia Pacific, the India and China markets are estimated to have reached USD 0.04 billion and USD 0.19 billion respectively in 2026.

Latin America and the Middle East & Africa

Over the forecast period, the Latin America and Middle East & Africa regions would witness moderate growth in this market. The Latin America market, in 2026, is set to have recorded a valuation of USD 0.48 billion. The rising incidence of genetic disorders and the need for biomarker discovery further drive usage in these regions. In the Middle East & Africa, the GCC market is set to have touched a value of USD 0.07 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

New Product Launches and Strategic Collaboration among Key Players to Support their Leading Position

The global gene therapy market shows a semi-concentrated structure with numerous small- to mid-size companies aggressively operating globally. These players are aimed at focusing on product innovation, research and development, strategic partnerships, and geographic expansion.

Novartis AG, F. Hoffmann-La Roche Ltd, and BioMarin Pharmaceutical Inc. Inc., are some of the dominating players in the market. A comprehensive range of gene therapies, global presence through a strong distribution network, and collaborations with research and academic institutes are a few characteristics of these players that support their dominance.

Apart from this, other prominent players in the market include CSL, Vertex Pharmaceuticals Incorporated, Krystal Biotech, Inc., Rocket Pharmaceuticals, Dyno Therapeutics, Inc., and others. These companies are undertaking various strategic initiatives, such as increasing investments in R&D and partnerships with pharmaceutical companies, to enhance their market presence.

LIST OF KEY GENE THERAPY COMPANIES PROFILED

- Novartis AG (Switzerland)

- Hoffmann-La Roche Ltd (Switzerland)

- BioMarin Pharmaceutical Inc. (U.S.)

- CSL (Australia)

- Vertex Pharmaceuticals Incorporated (U.S.)

- Krystal Biotech, Inc. (U.S.)

- Rocket Pharmaceuticals (U.S.)

- Dyno Therapeutics, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Ensoma, Inc., received clearance from the U.S. FDA for the Investigational New Drug (IND) application for its lead program EN-374, a vivo HSC-Directed gene insertion therapy for the treatment of X-linked chronic granulomatous disease (X-CGD), a rare genetic disorder.

- February 2025: CSL showcased positive results from the HOPE-B study, confirming the long-term durability and safety of a one-time infusion of HEMGENIX (etranacogene dezaparvovec-drlb) for adults living with hemophilia B.

- November 2024: Hoffmann-La Roche Ltd entered definitive agreement with Poseida Therapeutics, Inc. The acquisition equipped the company with an R&D portfolio of pre-clinical and clinical-stage off-the-shelf CAR-T therapies, manufacturing capabilities, and technology platforms.

- December 2023: Vertex Pharmaceuticals Incorporated, in collaboration with CRISPR Therapeutics, received the U.S. FDA approval for CASGEVY, a CRISPR/Cas9 genome-edited cell therapy, for the treatment of SCD (sickle cell disease) in patients aged 12 years and above with recurrent VOCs (vaso-occlusive crises).

- May 2023: Krystal Biotech, Inc., received the U.S. FDA approval for VYJUVEK for the treatment of patients six months of age or older with dystrophic epidermolysis bullosa (DEB).

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.20% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product · Zolgensma · Luxturna · Roctavian · Others |

|

By Vector Product · Viral Vectors · Non-Viral Vectors |

|

|

By Indication · Genetic Disorders · Ophthalmology · Hematology · Others |

|

|

By End User · Hospitals & Clinics · Specialty Clinics · Others |

|

|

By Geography · North America (By Product, Vector Type, Indication, End User, and Country) o U.S. o Canada · Europe (By Product, Vector Type, Indication, End User, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Product, Vector Type, Indication, End User, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Product, Vector Type, Indication, End User, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Product, Vector Type, Indication, End User, and Country/Sub-region) o GCC o South Africa · Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 5.2 billion in 2026 and is projected to reach USD 11.33 billion by 2034.

In 2025, the North America market value stood at USD 1.05 billion.

The market is expected to exhibit a CAGR of 10.20% during the forecast period of 2026-2034.

In 2025, the Zolgensma segment led the market by product.

The key factors driving the market are the rising demand for gene therapies due to the increasing prevalence of genetic disorders, advancements in gene therapy technology, and research and development activities.

Novartis AG, CSL, and F. Hoffmann-La Roche Ltd., are some of the prominent players in the market.

North america dominated the gene therapy market with a market share of 24.60% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us