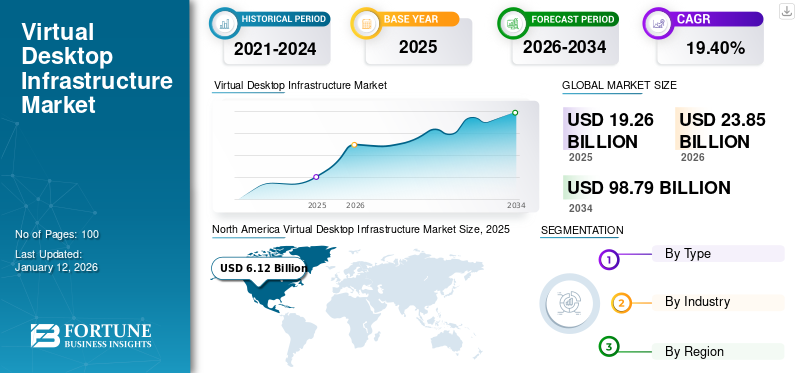

Virtual Desktop Infrastructure Market Size, Share & Industry Analysis, By Type (Persistent and Non-persistent), By Industry (IT & Telecom, BFSI, Retail & E-commerce, Government, Education, Manufacturing, Healthcare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global virtual desktop infrastructure market was valued at USD 19.26 billion in 2025. The market is projected to be worth USD 23.85 billion in 2026 and reach USD 98.79 billion by 2034, exhibiting a CAGR of 19.40% during the forecast period. North America dominated the global market with a share of 31.70% in 2025.

Businesses across the globe are embracing digitalization because it offers significant opportunities to use automation and digital technologies to transform business models and existing processes, thereby increasing revenue and operational efficiency. Workplaces have emerged in current years due to the proliferation of smart devices, the introduction of the Internet of Things (IoT), artificial intelligence (AI), and cloud computing. Increasing demand for end-to-end business processes, higher operational efficiency, and reduced human error are driving the growth of digital transformation in a variety of enterprises. Switching to virtual desktops has several benefits, including a more seamless and collaborative way to work regardless of location.

Virtual desktop infrastructure solutions combine PaaS and IaaS to give your employees a secure desktop to access their data, apps, files, and communications. However, the most important benefits of virtual desktop infrastructure are system, communication and data security. Virtual desktop infrastructure offers a high level of protection for employers who allow employees to bring their own devices to the workplace.

The pandemic and associated shift to remote work caused a lot of technical disruption, much of it centered on how companies deliver IT services to their employees. According to TechTarget, about 67% of companies have adopted remote work policies in the wake of the pandemic and plan to make remote work opportunities available to their employees even after the pandemic.

Virtual Desktop Infrastructure Market Trends

Growing Focus on Data Security and Compliance to Boost Market Growth

Advancements in virtualization technology have led to the widespread adoption of virtual desktop infrastructure. Due to rising high-profile data breaches and cyber-attacks, businesses are increasingly prioritizing security and compliance regarding desktop virtualization solutions. Cybersecurity Ventures predicted that the cost of cybercrime is expected to reach around USD 10.5 trillion by 2025. Cybersecurity attacks emphasize the importance of implementing strong security measures such as desktop virtualization to minimize the risk.

As cloud VDI stores user data on a central server and employees access their work environment and data through secure virtual desktops, enterprises are increasingly adopting cloud VDI for security reasons. This prevents sensitive data from being stored on the user's device and reduces the risk of unauthorized access through social engineering attacks.

For instance, in September 2022, cybercriminals attacked Uber with a text message. The attacker tricked an Uber employee into disclosing password details and initiated a sequence of events that compromised the company’s IT systems. In the Uber attack, if the company had deployed VDI, the attacker couldn't access the sensitive data, as the data is stored on a central server. However, it becomes more difficult for the attacker to access confidential information.

Therefore, organizations are adopting desktop virtualization solutions to ensure security, and this is increasing the virtual desktop infrastructure market growth.

Download Free sample to learn more about this report.

Virtual Desktop Infrastructure Market Growth Factors

Adoption of BYOD and Hosted Desktop among Enterprises to Drive Market Growth

The impact of digitalization makes it increasingly essential to centralize the comfort and expectations of employees while acknowledging the sensitivity of information rights from intellectual property, employee correspondence, finances, and more. Due to this, the adoption of BYOD (Bring Your Device) and hosted desktops is increasing.

According to a survey by Cisco Systems, around 82% of enterprises' IT departments enable BYOD programs. BYOD and hosted desktops help enterprises ensure business continuity and growth, allowing employees to maintain focus on the task rather than on adjusting to new technologies or systems. According to the report, BYOD work-from-home employees work an extra two hours as their travelling time is saved. Hosted desktops, essentially virtual desktops (DaaS), also have a proven track record of increasing efficiency and driving market growth.

Thus, the adoption of BYOD and hosted desktops among enterprises is driving market growth.

RESTRAINING FACTORS

Lack of Awareness and High Implementation Cost to Hamper Market Growth

Less awareness regarding desktop virtualization among end-users is one of the major reasons restricting the market growth. Also, the lack of training from organizations to educate their employees about virtual desktop infrastructure to decrease the data threats is hampering the market growth.

VDIs are perceived as costly investments that slowly respond to the company’s ROI. It often requires investment in thin clients in addition to costly expansion of existing network and storage infrastructure. Vendors including Microsoft have minimized the cost of virtual desktop operating system licenses and simplified the pricing scheme. However, desktop virtualization can still be expensive.

The above factors may hamper the market growth over the forecast period.

Virtual Desktop Infrastructure Market Segmentation Analysis

By Type Analysis

Rising Adoption of Non-persistent VDI Owing to Lower Storage Cost to Boost the Market Growth

Based on type, the market is categorized into persistent VDI and non-persistent VDI.

Non-persistent VDI is expected to showcase a high CAGR during the forecast period as the adoption of non-persistent VDI is increasing. The adoption is rising as this type of VDI is easier to support, has lower storage cost, and less expensive disaster recovery and business continuity options. Non-persistent VDI are more secure as even in the case of security breach, it can be rebooted to clean.

The Persistent VDI segment dominated the market accounting for 56.19% market share in 2026.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Product Adoption for Securing the Customer Data to Showcase High CAGR in BFSI Sector

Based on industry, the market is fragmented into IT & telecom, BFSI, retail & e-commerce, government, education, manufacturing, healthcare, and others.

The IT & telecom segment is projected to dominate the market with a share of 18.03% in 2026. The BFSI segment is expected to showcase rapid growth rate over the study period owing to the increasing cybercrimes in the sector. An Accenture report estimates that cybercrime against financial institutions totaled USD 18.5 million. This comes as financial institutions work with sensitive customer data, which hackers can exploit to compromise businesses or demand ransoms. However, banks are adopting virtual desktop infrastructure for improving the operational efficiency and to secure their client data.

The deployment of VDI in healthcare is expected to witness considerable growth in coming years as implementation of desktop virtualization in healthcare allows organizations to have better control over user endpoint devices. Besides, it helps to reduce the login time for doctors so that they can spend more time with patients. Adoption is increasing in healthcare as the data breaches have risen and desktop virtualization protects sensitive patient information through end to end security. Medical data is very valuable on the dark web and it costs up to USD 1,000 per record as medical records hold permanent, unalterable information including medical history and patient identity.

However, for security purpose, the adoption of virtual desktop infrastructure is increasing among industries.

REGIONAL INSIGHTS

Geographically, the market is studied across five major regions including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further categorized into countries.

North America Virtual Desktop Infrastructure Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The virtual desktop infrastructure market share in North America was maximum in 2024 as the adoption of cloud deployment among enterprises is increasing. More than 25% of employees in the U.S. work remotely and this number is expected to grow over the coming years. The rise in remote and flexible work environment is driving the market growth in the region. The presence of prominent providers including VMware, Microsoft Corporation, Citrix, AWS, and others contributes to region’s desktop virtualization based application adoption. The U.S. market is projected to reach USD 4.52 billion by 2026.

Asia Pacific

The Asia Pacific is expected to grow with the maximum CAGR over the study period. This is due to the increasing demand for cloud solutions. Many small and medium-sized businesses in the region are implementing virtual desktop solutions to improve productivity and reduce business complexity. Besides this, government regulations to support IT infrastructure are further expected to drive the market growth in the region. Furthermore, rising digitalization initiatives and BYOD trend among enterprises across the Asia Pacific region have propelled the demand for desktop virtualization solutions. Such factors are expected to propel the regional market growth over the analysis period. The Japan market is projected to reach USD 1.16 billion by 2026, the China market is projected to reach USD 1.49 billion by 2026, and the India market is projected to reach USD 1.15 billion by 2026.

Key Industry Players

Key Providers Adopt Various Growth Strategies to Boost their Market Share

Industry players are focusing on adopting strategies, including product launches, partnerships, acquisitions, and other strategies. These companies are offering solutions to support the rising number of remote workers globally. Also, with strategic partnership and collaboration, the market players are providing enterprises with efficient and secured access to the work infrastructure. The acquisition strategy is on the rise, considering the players are aiming to enhance the presence and expertise to support remote workforce across the globe.

List of Top Virtual Desktop Infrastructure Companies

- Microsoft Corporation (U.S.)

- Citrix Systems, Inc. (Vista Equity Partners Management, LLC) (U.S.)

- Cisco Systems, Inc. (U.S.)

- HPE (U.S.)

- Google LLC (U.S.)

- Amazon Web Services, Inc. (U.S.)

- VMware Inc. (U.S.)

- IBM Corporation (U.S.)

- V2 Cloud (U.S.)

- Nutanix (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2024 – Cisco and NVIDIA help organizations easily and quickly deploy and manage secure AI infrastructure. These companies have delivered data center environments that enable a hybrid workforce with AI-powered conferencing, flexible workspaces, and virtual desktop infrastructure.

- August 2023 – VMware announced the latest AI integrations for its Anywhere Workspace platform. This automatically drives new vulnerability management use cases, optimizes the employee experience, and simplifies application lifecycle management. VMware Anywhere Workspace unifies virtual desktop infrastructure and apps, unified endpoint management (UEM), and security to create a secure workplace anywhere.

- June 2023 – Agile Directive entered a partnership with Kasm Technologies to provide on-demand virtual desktops, browser isolation technology, and secure remote access for digital workspace.

- September 2022 – Amazon Web Services introduced Amazon Workspace Core, an addition to the VDI solution portfolio. Amazon Workspace Core comprises a set of APIs that third-party VDI software providers use.

- July 2022 – Nerdio entered a partnership with Rimo3 to simplify and accelerate the enterprise journey to Microsoft’s public cloud. The partnership would help enterprises deploy the Azure virtual desktop easily.

REPORT COVERAGE

The market report provides a detailed analysis and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Industry

By Region

|

Frequently Asked Questions

According to a study by Fortune Business Insights, the global market is projected to reach USD 98.79 billion by 2034.

In 2026, the market size stood at USD 23.85 billion.

The market is projected to grow at a CAGR of 19.40% over the forecast period.

The non-persistent VDI type is anticipated to lead the market.

The adoption of BYOD among organizations is driving market growth.

Citrix Systems, Inc., Cisco Systems, Inc., IBM Corporation, Google LLC, Amazon Web Services, Inc., and VMware Inc. are the top players in the market.

North America dominated the global market with a share of 31.70% in 2025.

By industry, the BFSI sector is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us