Remote Desktop Software Market Size, Share & Industry Analysis, By Deployment (Cloud and On-Premise), By Enterprise Type (Small & Medium Enterprises, and Large Enterprises), By End-User (BFSI, Healthcare, IT & Telecom, Government, Manufacturing, Education, and Others), and Regional Forecast, 2026-2034

Remote Desktop Software Market Size

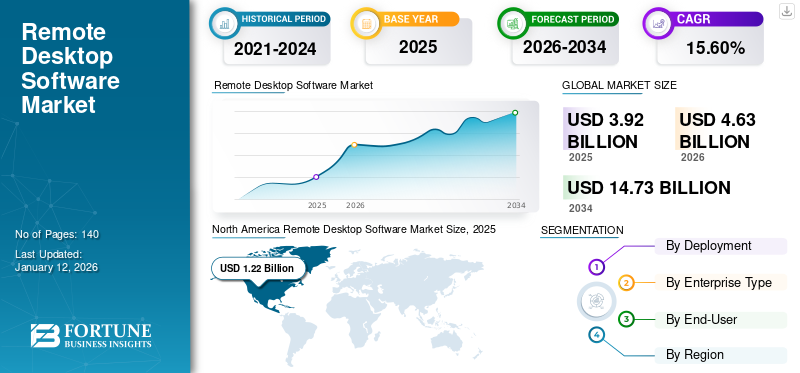

The global remote desktop software market size was valued at USD 3.92 billion in 2025 and is projected to grow from USD 4.63 billion in 2026 to USD 14.73 billion by 2034, exhibiting a CAGR of 15.60% during the forecast period. North America dominated the global remote desktop software market with a share of 31.30% in 2025. Additionally, the U.S. remote desktop software market is projected to grow significantly, reaching an estimated value of USD 2,038.6 million by 2032.

Remote desktop software allows a local operator to have full access to the desktop ecosystem and the properties of a remote computer. Usually, retrieving the remote desktop from a computer requires software to be deployed and arranged on both the computers, as they both must be motorized on and linked to the Internet. The operator logs into the remote setup interface on the native computer, and upon verification at the remote computer, the user is granted access to its desktop environment.

The market is witnessing significant growth owing to the increasing adoption of work-from-home practices. The software can offer real-time access to company data from remote locations. The increasing adoption of “bring your own device” policies in enterprises has increased the demand for remote access software. The software is in high demand in industries such as healthcare, education, IT, and telecom due to its ability to provide work flexibility. Moreover, the outbreak of the pandemic increased demand for the software. Major players in the market are adopting various strategies such as mergers, acquisitions, collaborations, and partnerships. For instance:

In January 2021, TeamViewer acquired Xaleon, the Austrian provider of customer engagement software. Xaleon’s product comes with GDPR-compliant for small screen sharing web sessions that work without the need to install and transfer users’ data.

The increasing mandate to work remotely due to the COVID-19 pandemic forced industries to use digital software to keep their business running, and this promoted remote desktop software to comply with social distancing norms. Large-scale organizations adopt remote desktop software to provide work-from-home facilities to employees. This has increased the demand for this type of software among organizations. For instance, TeamViewer Group stated that the adoption of remote software solutions increased by 75% in Q1 2020 as companies rapidly shifted towards remote working practices. Therefore, the pandemic has increased the demand for the software.

Remote Desktop Software Market Trends

Growing Remote Learning Practices to Drive Remote Desktop Software Market Growth

Distance education and e-learning are increasing in popularity and substantial demand with the expansion and development of technology. Distance learning is used by educational universities, institutes, and education systems to provide maximum reach for their student base across several nations. Similarly, institutes and universities are also witnessing the increasing adoption of distance learning enrolment around the globe. According to We Forum Organizations, in 2020, globally, an estimated over 1.2 billion children from 186 countries affected were being out of the classroom. Thus, education is shifted to an online learning platform, which propelled the demand for software for teachers and students across the globe.

In 2019, global Edu-tech investments reached around USD 18.66 billion, as per the We Forum Organization. Even after COVID-19, there has been high adoption and growth of remote software technology in the education sector. According to the We Forum Organization Report, the overall edu-tech market of online education is expected to reach USD 350 billion by 2025.

Remote learning provides flexibility in the learning process and provides teaching experiences and advanced learning. The growing popularity of e-learning and distance learning education is driving the demand for the market to support education providers in assisting students. Further, with growing remote learning adoption, software providers have launched advanced remote desktop solutions to support distance learning. For instance,

- August 2021 – Teradici, the remote computing software solutions provider, launched Remote macOS to access devices in Apple’s Mac laptops and desktops. In July 2021, HP Inc. acquired Teradici, a remote computing vendor that supports the remote accessibility of Apple’s Mac devices.

Download Free sample to learn more about this report.

Remote Desktop Software Market Growth Factors

Adoption of Bring Your Own Device Policy to Drive the Market Growth

The Bring Your Own Device (BYOD) policy is witnessing growing implementation across industries owing to its advantages, such as flexible teamwork time, member satisfaction, and enhanced security. According to the Cyber Talk Organization Report in 2020, around 67% of companies around the globe have endorsed the BYOD strategy. Also, an estimated 34% of employees' productivity has increased with BYOD devices. The BYOD offers flexibility to employees in selecting the devices as per their choice and requirements. Hence, the solution offers access to any device from any location to provide real-time access.

BYOD offers numerous benefits to businesses, such as minimized operational costs as enterprises do not need to purchase new devices for every team member or new carrier strategies linked with those endpoints. It also provides employees with enhanced flexibility as it allows them to leverage their preference for devices and work from anywhere at any time as per their convenience. Other benefits include higher mobility, familiarity, enhanced productivity, and many more.

The end-users can access the company’s data while working from any remote location. This improves business growth and employee efficiency. However, companies are concerned about endpoint data breaches owing to the BYOD trend. This drives the demand for cloud-based remote software solutions. According to SOTI Inc. 2020, BYOD increases the popularity of cloud-based remote access software due to increased security risk.

RESTRAINING FACTORS

Slow Internet Network and Downtime to Obstruct Market Growth

The remote desktop software requires resilient internet connections from both ends, from the client’s and the server’s sides, to work remotely. The minor internet connection issue may hinder connectivity and affect ongoing activities. Thus, for proper workflow and remote work management, robust internet connectivity is required. Similarly, inconsistency and low-performance service can cause the total stoppage of the systems, which may hinder market growth.

During downtime or low internet connection, the network remains inaccessible until the required service is not provided. This can hamper business operations and cost a considerable amount for the organizations. Thus, inefficient internet connectivity and network service might inhibit the demand for market growth.

Remote Desktop Software Market Segmentation Analysis

By Deployment Analysis

Rapid Shift toward Cloud Services to Propel Demand for Cloud-based Remote Desktop Software

Based on the deployment, the market is bifurcated into cloud and on-premise.

The cloud-based deployment segment accounted market share of 52.68% in 2026. The cloud-based is gaining rapid growth as the majority of organizations are shifting toward cloud service. According to the IDC Report 2020, 56% of Indian companies are expected to seek cloud software due to the growing remote work. Also, cloud-based software offers a low maintenance cost, easy installation, and can be extended to meet increasing business requirements. This is likely to drive the demand for cloud-based remote desktop tools.

The on-premises software is placed locally on the organization’s server and offers more security and direct control over the configuration and management. Organizations and enterprises with a large number of desktops and network systems are likely to implement on-premises software. However, the high maintenance cost and regular upgrades are compelling the organizations to search for other secured options.

By Enterprise Type Analysis

Work-From-Home Practice in Large Enterprises to Drive Market Growth

Based on the Enterprise Type, the market is categorized into small & medium enterprises and large enterprises.

The small and medium enterprises segment is expected to record a leading CAGR during the forecast period due to the increasing demand for work-from-home solutions. Small desktop tools support SMEs to reduce the additional cost associated with power & water consumption, ample space, office maintenance, and other required expenses.

The large enterprises segment accounted for the highest market share of 60.14% in 2026, owing to the surge in the Bring Your Own Device (BYOD) policy. Furthermore, to boost employee efficiency and productivity, large enterprises offer work-from-home facilities to their employees, strengthening the demand for software.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Rapid Popularity of E-learning and Distant Learning in the Education Sector to Fuel Remote Desktop Software Demand

Based on the end-user, the market is divided into healthcare, BFSI, government, education, IT & telecom, manufacturing, and others (media and entertainment).

The IT & telecom industry is expected to dominate the market with the highest market share of 21.35% in 2026. IT and telecom have the maximum users of this software due to the huge employee pool around the globe. Further, the surge in the adoption of cloud and other advanced digital solutions across the IT & telecom sector is driving the demand for market growth.

The education segment is projected to register the highest CAGR during the forecast period. Education is gaining popularity during the forecast period owing to the increasing demand for online courses, e-learning, and distance learning programs around the globe. The software helps teachers and students access the institution’s computer lab from remote locations. The COVID-19 impact has significantly affected the education institute and the learning process of students. For example, according to Splashtop Inc., the company witnessed a 700% increase in its learning customer base for implementing remote software across colleges and schools from June to August 2020. Similarly, the manufacturing industry is adopting remote desktop tools for managing and guiding remotely during the COVID-19 pandemic.

Healthcare is gaining steady growth owing to the increasing demand for remote health check-ups, telemedicine, and connected and implanted devices. This connected technology helps healthcare providers and patients remotely check and update patient data using a remote desktop. According to the HIPAA compliance plan, the software providers offer remote management software that is likely to drive the remote desktop software market share.

REGIONAL INSIGHTS

North America

North America Remote Desktop Software Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.22 billion in 2025 and USD 1.43 billion in 2026, due to the rapid adoption of the cloud. The U.S. dominated the market in 2024, owing to the increasing adoption of work-from-home norms across industries. According to a survey by Talent Works of hiring managers in the U.S. conducted in April 2021, 90% of top executives expected to continue working from home. Also, the significant presence of key software providers in countries such as the U.S. and Canada is driving market growth. Mexico has gained steady growth after the outbreak of coronavirus. The U.S. market is projected to reach USD 1.07 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

South America

South America is expected to achieve continued growth owing to the COVID-19 crisis, as a comparatively massive number of employees have opted for remote work environments. Companies in Brazil also witnessed the effective implementation of remote working solutions to gain real-time access. For instance, in September 2020, Brazil’s TiFlux collaborated with Splashtop Inc. to provide remote access solutions for the IT sector in South America. This is likely to drive the growth of the market in the region.

Asia Pacific

Asia Pacific is expected to record the highest CAGR during the forecast period. The growth is owing to the adoption of advanced digital technologies for supporting employees in executing industry operations. The growing employee base and high cost of working spaces further drive the demand for this market in countries such as India, China, South Korea, and Australia. China is extensively deploying technologies such as artificial intelligence, the Internet of Things, and connected devices that can support remote management for employees. Similarly, India has witnessed a sharp shift towards cloud-based software solutions, which is expected to drive market growth. The Japan market is projected to reach USD 0.21 billion by 2026, the China market is projected to reach USD 0.28 billion by 2026, and the India market is projected to reach USD 0.24 billion by 2026.

Europe

Likewise, Europe is also growing at a significant pace during the forecast period. Industries across countries, such as Germany, the U.K., Italy, and France, continuously introduce remote working environment software solutions to boost employees’ productivity and achieve business growth. The increasing adoption of technologies, including the Internet of Things, virtual reality, artificial intelligence, and connected devices, supports remote working solutions in the region. The UK market is projected to reach USD 0.16 billion by 2026, and the Germany market is projected to reach USD 0.19 billion by 2026. For instance,

- In June 2020, Splashtop Inc. expanded its product portfolio for the European Union (EU) for enterprises and individuals in this region. The company launched its remote access software in Europe to increase productivity, support work-from-home policies, and provide remote IT support. The company has launched its remote-access solution across the German-based cloud data centre for local user databases to support Euro currency.

Key Industry Players

Key Players Aim to Offer Advanced Tools by Completing Strategic Acquisition and Collaboration

Key players in the market are offering cloud-based software platforms and other services. Similarly, key players such as BeyondTrust Corporation, AnyDesk Software GmbH, VMware, Inc., TeamViewer Group, Microsoft Corporation, and others are expanding their business by completing partnership and collaboration strategies. For instance,

List of Top Remote Desktop Software Companies:

- TeamViewer Group (Germany)

- LogMeIn, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- VMware, Inc. (U.S.)

- Citrix Systems, Inc. (U.S.)

- Jump Desktop (Phase Five Systems) (UAE)

- ConnectWise, LLC (U.S.)

- Zoho Corporation Pvt. Ltd. (India)

- AnyDesk Software GmbH (Germany)

- Splashtop Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 – TeamViewer, in collaboration with Almer, introduced an innovative AR (Augmented Reality) bundle with a subscription-driven software/hardware bundle and combined marketing activities. The new bundle comprises a compressed Almer Arc AR headset fortified with TeamViewer’s top device-agnostic augmented reality remote provision solution, xAssist.

- November 2023 – Microsoft introduced the Windows App, which enables users to connect to their PCs distantly from their iPads, iPhones, and other devices. It offers a safe way to access virtual apps or remote PCs and desktops made accessible by an administrator.

- October 2023 – Kaspersky and TSplus collaborated to develop cyber-immune desktop solutions for remote workers. Both firms would cooperate to improve their solutions and determine the market requirements in cyber immune endpoints.

- March 2023 – TeamViewer announced the launch of TeamUP, a global partner program. The new program comprises various benefits for its channel partners and brings an easy-to-use and wholly new combined partner portal.

- June 2022 – Corel acquired Awingu, a provider of secure remote access technology. The acquisition gave end users added flexibility and freedom to work securely from anywhere.

REPORT COVERAGE

The global remote desktop software market report highlights leading regions across the world to offer a better understanding of the user. Furthermore, the report provides insights into the latest industry trends and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.60% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

Deployment, Enterprise Type, End-User, and Region |

|

Segmentation |

By Deployment

By Enterprise Type

By End-User

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 14.73 billion by 2034.

In 2025, the market was valued at USD 3.92 billion.

The market is projected to record a CAGR of 15.60%.

By end-user, the IT & telecom segment is likely to lead the market with the highest share during the forecast period.

Growing demand for Bring Your Own Devices is likely to drive the market growth.

TeamViewer Group, ConnectWise, LLC., Zoho Corporation Pvt. Ltd., AnyDesk Software GmbH, Microsoft Corporation, VMware, Inc., BeyondTrust Corporation, Splashtop Inc., and Citrix Systems, Inc., among others, are the top players in the market.

North America dominated the global remote desktop software market with a share of 31.30% in 2025.

Asia Pacific is expected to record the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us