Wellhead Equipment Market Size, Share & Industry Analysis, By Type (Conventional Wellhead, Subsea Wellhead, Mudline Wellhead, Dual Completion Wellhead, Christmas Tree Wellhead, and Others), By Component (Casing Heads, Casing Spools, Blowout Preventers, Tubing Adapters, Valves, and Others), By Application (Onshore and Offshore), By Pressure Rating (Low Pressure (Up to 3,000 psi), Medium Pressure (3,000-10,000 psi), and High Pressure (Above 10,000 psi)), By Solution Type (Products and Services), By End-User (Oil & Gas Operators and Service Companies), and Regional Forecast, 2026-2034

Wellhead Equipment Market Size

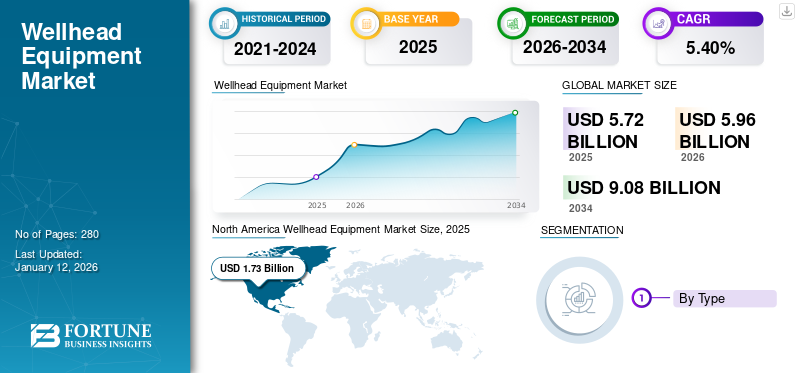

The global wellhead equipment market size was valued at USD 5.72 billion in 2025. The market is projected to grow from USD 5.96 billion in 2026 to USD 9.08 billion by 2034, exhibiting a CAGR of 5.40% during the forecast period. North America dominated the global market with a share of 30.20% in 2026.

Wellhead equipment is a mechanical device that is installed on top of an oil and gas well. It is used to control oil and gas production, manage pressure, and provide access to various applications in the oil and gas sector. Casing spools, casing heads, valves, blowout preventers, and tubing head adapter are some of the components used in industrial drilling and exploration activities. Several oil and gas companies generally adopt it, as do service companies operating in the oil and gas sector. The equipment can be reused and refurbished for other drilling and well operations. In this scope, we have covered the sales generated by products and services.

The rising demand for global energy has led to an increase in exploration and drilling activities, driving the demand for such equipment for extracting oil and gas, which fuels the market growth. For instance, according to World Oil, global oil drilling activities increased by 13.8% in 2023 compared to 2022. In addition, the depletion of easily accessible onshore oil wells has led to increased offshore exploration and drilling activities across economies such as China, Russia, India, and others, including deep-water and ultra-deepwater environments. This challenging environment requires efficient equipment with the capability of handling high-pressure, corrosive environments, and the ability to work under high temperatures, which creates the demand for such equipment and bolsters the growth of the market. For instance, according to the analysis, Dril-Quip Inc quotes that, in 2023, around 3,029 offshore wells will be drilled globally, and this number of wells is anticipated to reach up to 3,578 offshore wells by 2030.

The COVID-19 pandemic significantly impacted the global market owing to reduced oil & gas demand, disruption in the raw material supply chain, and a delay in exploration and drilling activities across the globe. Moreover, this industry will adopt new technologies and practices that may lead to long-term improvements in efficiency and sustainability after the COVID-19 pandemic.

Wellhead Equipment Market Trends

Technological Advancements in Such Products to Fuel Market Growth

Major players such as Schlumberger NV, Baker Hughes, Cactus Inc, TechnipFMC Plc, and others are introducing Internet of Things (IoT) enabled wellhead; Artificial Intelligence (AI) enabled, High-Pressure High Temperature (HPHT) equipment; and subsea wellhead systems. They are also introducing new innovative next-generation blowout preventers, which assemble with such equipment. These new technological advancements in such products can allow real-time monitoring, predictive maintenance capabilities, and advanced sealing technology capable of working under extremely high temperatures and high pressure.

The advancements in such equipment helps ensure greater efficiency, safety, and environmental sustainability, in alignment with the need for the oil and gas sector. For instance, in May 2022, Baker Hughes launched a new subsea equipment for oil and gas drilling activities. It offers features that require lower construction costs and low installation costs. It has a pressure rating of 20,000 psi. Such rising technological advancements constitute the latest trend in the market.

Download Free sample to learn more about this report.

Wellhead Equipment Market Growth Factors

Rising Oil and Gas Drilling and Exploration Activities to Drive Market Growth

Global energy consumption continues to grow, driven by population growth and industrialization, particularly in emerging economies. This necessitates increased exploration and production of oil and gas, driving the demand for such equipment. The development of unconventional resources such as shale gas, tight oil, and deep-water reserves requires advanced equipment to handle challenging extraction conditions.

Moreover, the rising number of onshore and offshore wells across the globe, which need such equipment for the drilling and exploration of oil and gas, fuels the market growth. For instance, according to World Oil, the number of offshore wells across the globe increased by 14.7% in 2023 compared to 2022. In addition, rapid economic growth and industrialization in emerging markets increase the demand for energy, driving exploration and drilling activities, which creates the demand for wellhead equipment.

RESTRAINING FACTORS

High Capital Initial Investment to Hinder Market Growth

Wellhead equipment often requires a significant upfront investment, including installation and maintenance charges. This equipment can be a barrier for small and medium-scale enterprises. The costs associated with installing and setting up equipment facilities, including installation, infrastructure, and project preparation, can be high. The capital investment in equipment manufacturing ranges from USD 50,000 to USD 500,000. Moreover, this equipment can be regularly inspected, maintained, and serviced to ensure optimal performance and for safety purposes.

Wellhead Equipment Market Segmentation Analysis

By Type Analysis

Conventional Wellhead Segment Dominates Market Due to Rising Adoption on Onshore Field

Based on type, the market is divided into conventional wellhead, subsea wellhead, mudline wellhead, dual completion wellhead, Christmas tree wellhead, and others.

According to our estimates, the conventional wellhead segment dominated and held the largest wellhead equipment market share in 2023 due to the rising adoption of such products for oil drilling and exploration activities. Moreover, the equipment offers features such as cost-effectiveness, the ability to control pressure control, pressure monitoring and pumping, reservoir isolation, multiple barrier systems for good control, and compatibility with a wide range of equipment in oil and rig operation, which fuels the market growth. The convetional wellhead segment will account for 27.68% market share in 2026.

The Christmas tree wellhead segment is projected to grow substantially during the forecast period. This is owing to factors such as increasing offshore and deep-water drilling activities, enhanced safety and environmental regulations, and reliability in harsh weather conditions.

The subsea wellhead segment is anticipated to grow steadily during the forecast period owing to rising adoption of such equipment for offshore applications and increasing deep water. Ultra-deep-water drilling and exploration activities, which enhance the demand for such equipment to drive the market growth. For instance, according to source of Adlittle, the global investment in the deepwater drilling and exploration activities reach up to USD 1,200 billion for 2020 to 2030.

Mudline wellhead and dual completion wellhead are anticipated to grow moderately during the forecast period. This is driven by its cost-effective solutions, helping to maximize production efficiency, and rising offshore drilling and exploration, creating the demand for such equipment.

The others segment consists of unitized wellheads and geothermal wellheads. This segment is growing at a decent growth rate owing to its features, such as compact size, reduced installation cost, and improved reliability of drilling and exploration operations.

To know how our report can help streamline your business, Speak to Analyst

By Component Analysis

Blowout Preventers Segment Leads with Rising Stringent Safety and Environmental Regulation

Based on component, the market is segmented into casing heads, casing spools, blowout preventers, tubing adapters, valves, and others. Others consist of choke manifolds and flanges.

As per our estimates, the blowout preventers segment dominates the market as it is critical safety equipment installed on wellheads to prevent uncontrolled release of oil and gas during drilling and exploration activities. Moreover, a stringent regulatory environment and increasing focus on wall safety and environmental protection will drive the growth of the market. The blowout preventers segment is expected to account for 24.33% of the market in 2026.

The casing heads segment is anticipated to grow at a substantial growth rate during the forecast period. This has been recorded as it is a very essential component that is used to install on the top of wellhead wells. In addition, rising global energy demand in developing economies drives exploration and drilling activities.

The casing spools, valves, and tubing adapters segments are anticipated to grow steadily during the forecast period. The segment’s growth is credited to increasing drilling activities, rising technological advancements, and advancements in completion technology.

The others segment includes choke manifolds, flanges, and suspension systems test plugs and is projected to grow decently during the forecast period. This is owing to expansion in the oil and gas sector and rising deep and ultra-deep water drilling projects, which creates the demand for such equipment.

By Application Analysis

Onshore Segment to Hold Dominating Position with Growing Energy Demand Globally

Based on application, the market is segmented into onshore and offshore.

As per our study, the onshore segment is projected to dominate the market and grow at a substantial rate during the forecast period. This is owing to the rise in global energy demand, which continues to drive onshore drilling activities, particularly in regions rich in unconventional oil and gas resources such as shale and tight oil formations. Increasing exploration and drilling activities in land-based projects drive the growth of the market. The onshore segment is anticipated to hold a dominant market share of 66.61% in 2026.

The offshore segment is growing steadily due to increasing drilling and exploration activities in marine environments and deep water environments, which require specialized and highly robust wellhead systems.

By Pressure Rating Analysis

Medium Pressure Wellheads Dominated the Market Due to Rising Adoption from Conventional and Unconventional Environment

Based on pressure rating, the market is segmented into low pressure (up to 3,000 psi), medium pressure (3,000-10,000 psi), and high pressure (above 10,000 psi).

As per our estimates, the medium pressure (3,000-10,000 psi) segment dominated the market in terms of share in 2023 and is projected to grow substantially during the forecast period. It is due to the rising investment in the drilling and exploration activities, which drives the demand for such equipment. For instance, according to the International Energy Agency (IEA), the drilling activities investment across the globe is anticipated to grow by 20% by 2025. The medium pressure (3,000- 10,000 psi) segment is projected to dominate the market with a share of 48.32% in 2026.

The wellhead equipment with low pressure (up to 3,000 psi) pressure rating is anticipated to grow steadily. These types of equipment are associated with conventional oil & gas production, shallow wells, and in water injection wells. Moreover, it offers several features that are cost-efficient and easy to install and maintain.

The high pressure (above 10,000 psi) segment is anticipated to grow moderately during the forecast period. The equipment is used in deep water, ultra-deep-water applications, and also used in high-pressure/high-temperature environments.

By Solution Type Analysis

Services Set to Hold Leading Position with Increasing Drilling and Exploration Activities Globally

Based on solution type, the market is segmented into products and services.

As per our estimates, the services segment dominated the market in terms of share in 2023 owing to wellhead equipment requiring various services such as installation, maintenance, commissioning, optimization, testing services. In addition, some of these systems require periodic maintenance. As technology advances, there are services that offer upgrades and retrofits to existing wellhead systems to improve efficiency, safety, and compliance with new regulations.

The products segment is projected to grow at a substantial rate during the forecast period. The products are essential for maintaining well integrity, controlling pressure, ensuring operational safety, and maintaining safety of well operation.

By End-User Analysis

Oil & Gas Operators are Leading End-users Due to their Rising Equipment Adoption

Based on end-user, the market is segmented into oil & gas operators and service companies.

As per our estimates, the oil & gas operators segment dominated the market in terms of share in 2023 given that oil and gas operators are the prime end-users of such equipment. They are adopted for drilling and exploration activities of oil and gas resources.

The service companies segment is projected to grow moderately during the forecast period as these companies provide installation, maintenance, and optimization services required for the wellhead equipment market.

REGIONAL INSIGHTS

The market covers five major regions mainly as North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Wellhead Equipment Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America held the largest market share in 2023 due to growth in drilling and exploration activities in the U.S., Canada, and Mexico and rapid industrialization. In addition, strong presence of key players such as Cactus Inc, Baker Hughes, and Dril-Quip Inc., among others, in the region acts as the driving factor. Moreover, rising investment in drilling and oil exploration projects, which creates the demand for such equipment, drives the growth of the North American market. For instance, according to the source of the World Refining Association, North America is projected to witness 558 new oil and gas projects from 2024 to 2028.

U.S. Set to Dominate Market Owing to Increasing Exploration and Production Activities

The U.S. dominates the global market owing to its large oil and gas production capacity. This is due to factors such as continuous growth in exploration and production activities and stringent regulations and safety norms. For instance, in January 2023, Pason Systems Inc planned to invest around USD 25 million in Intelligent Wellhead Systems Inc. Such investment in wellhead installation drives the market growth. The U.S. market is estimated to reach USD 1.28 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is anticipated to exhibit the highest growth during the forecast period due to increased exploration and drilling activities across economies such as India, China, and Japan, among others. Supportive government policies and initiatives aimed at increasing domestic oil and gas production are also driving market growth. The overall economic growth in the region is leading to higher energy consumption, which in turn is driving the need for increased oil and gas production. This economic growth is fostering new exploration activities and investment in wellhead equipment. The Japan market is forecast to reach USD 0.22 billion by 2026, the China market is set to reach USD 0.58 billion by 2026, and the India market is likely to reach USD 0.26 billion by 2026.

Europe

Europe is anticipated to grow steadily, owing to mature offshore fields, enhancing oil recovery techniques, and expansion of new oil and gas projects. This creates the demand for such equipment for efficient handling of oil and gas exploration operations. The UK market is expected to reach USD 0.10 billion by 2026, while the Germany market is anticipated to reach USD 0.09 billion by 2026.

Rest of The World

The Middle East & Africa and South America are anticipated to grow moderately during the forecast period. The rising drilling and exploration activities in the Middle East, strong investment in oil & gas projects, and adoption of advanced technologies to improve efficiency and safety in oil production operations are set to fuel the wellhead equipment market growth.

KEY INDUSTRY PLAYERS

Market Players Adopt Acquisitions, Agreements, and Product Launches as Key Strategies to Gain an Edge

Key players such as Schlumberger NV, Baker Hughes, Delta Corporation, Dril-Quip Inc, Cactus Inc, and Ethos Energy Group Ltd, and among others, are engaged in product launches, acquisitions, and agreements as key approaches, to gain an edge in the market. For instance, in July 2024, Schlumberger NV signed a joint venture agreement with TotalEnergies (TTE) for installing 13 wellhead equipment for development for the Kaminho project, based in Angola. The basic aim of this joint venture was to improve the production of oil in Angola.

List of Top Wellhead Equipment Companies:

- Baker Hughes (U.S.)

- Cactus Inc (U.S.)

- Caterpillar Inc (SPM Oil and Gas) (Canada)

- Delta Corporation (U.S.)

- Dril-Quip Inc (U.S.)

- Ethos Energy Group Limited (U.S.)

- Jereh Group (China)

- Schlumberger NV (U.S.)

- TechnipFMC Plc (U.K.)

- Weatherford International Plc (U.S.)

KEY INDUSTRY DEVELOPMENT:

- June 2024: Ethos Energy Group Limited launched a new facility in Oberhausen, Germany. The basic aim of opening this manufacturing facility was to improve the production capacity of wellhead equipment.

- July 2023: Dril-Quip Inc acquired Great North, deals in well construction, wellhead equipment, and related services. The acquisition was done for around USD 80 million. The basic aim of this acquisition was to expand their market presence in well construction and services.

- June 2023: Dril-Quip Inc installed a BigBore IIe wellhead system for a drilling and exploration project in Santos Basin, Brazil. This drilling project has a dimension of 18 3/4” and a depth of 2002 meters under water. It is designed to improve the production capacity of oil and gas.

- March 2023: Cactus Inc acquired FlexSteel Holdings Inc, which manufactures steel pipes and pipe connections. The basic aim of this acquisition was to improve the production capacity of spoolable pipes and pipe connections.

- February 2022: Dril-Quip Inc signed a collaboration agreement with Aker Solutions ASA for providing a subsea wellhead and injection system for oil and gas exploration activities. In addition, an agreement was made to improve the product portfolio of Christmas tree wellhead and wellhead components.

REPORT COVERAGE

The report provides an in-depth analysis of the industry dynamics and competitive landscape. The report also provides market estimation and forecast based on type, component, application, pressure rating, solution type, end-user, and regions. It provides various key insights, recent industry developments in the market such as mergers & acquisitions, macro, and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Component

By Application

By Pressure Rating

By Solution Type

By End User

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market was valued at USD 5.72 billion in 2025.

In 2034, the market is expected to reach USD 9.08 billion.

The market is projected to grow at a CAGR of 5.40% during the forecast period.

By type, the conventional wellhead segment led the market in 2025.

The rising number of oil and gas drilling and exploration activities is a key factor poised to drive the growth of market.

Baker Hughes, Cactus Inc, Caterpillar Inc (SPM Oil and Gas), Delta Corporation, Dril-Quip Inc, Ethos Energy Group Limited, Jereh Group, Schlumberger NV, TechnipFMC Plc, and Weatherford International Plc are the leading companies in this market.

North America held the largest market with a share of 30.2% in 2025, owing to the presence of stringent safety and environmental regulations.

Rising technological advancements in the wellhead equipment is the latest trend in the market.

Based on solution type, the services segment led the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us