Portable Gas Leak Detector Market Size, Share & COVID-19 Impact Analysis, By Sensor Type (Electrochemical, Catalytic Bead Sensors, Photo-ionization, Infrared Point, Optical, Ultrasonic, and Others), By Technology (Single Gas and Multi Gas), By Product Type (Wearable and Non-Wearable), By End-user (Oil and Gas, Energy and Power, Electronics, Steel, Shipbuilding and Shipping, Firefighting and Rescue, Civil Engineering and Construction, and Others (Laboratory)), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

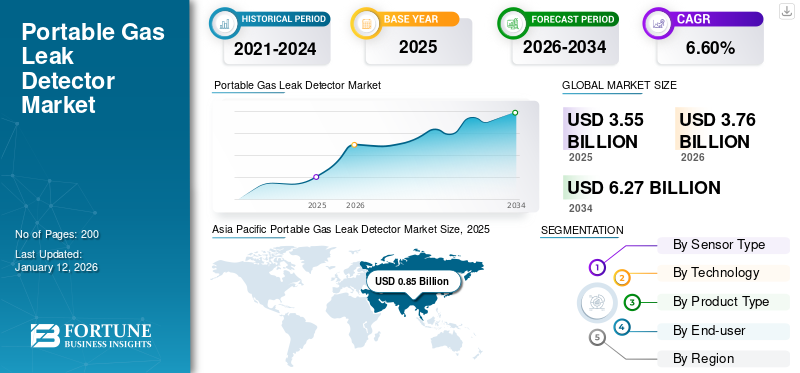

The global portable gas leak detector market size was valued at USD 3.55 billion in 2025. The market is projected to grow from USD 3.76 billion in 2026 to USD 6.27 billion by 2034, exhibiting a CAGR of 6.60% during the forecast period. The Asia Pacific dominated global market with a share of 23.80% in 2025.

A portable gas leak detector is a device that examines and monitors the presence of hazardous, inflammable, and potentially fatal gases on the premises. Rising environmental concerns and strict government norms to control gas emissions in industrial sectors and public zones will bolster the demand for portable gas detectors.

Global Portable Gas Leak Detector Market Overview

Market Size:

- 2025 Value: USD 3.55 billion

- 2026 Value: USD 3.76 billion

- 2034 Forecast Value: USD 6.27 billion

- CAGR: 6.60% (2026–2034)

Market Share:

- Asia Pacific Share (2025): 23.80%

Industry Trends:

- Enhanced User Interface & IoT Integration: Real-time monitoring, data logging, remote control; AI live monitoring, estimation, and examination

- IoT Real-Time Monitoring & AI Analytics: IoT-enabled monitoring and AI-driven insights for operations

- Smart Home IoT Adoption: IoT-connected gas detectors in smart homes and commercial spaces

- Digitalization of Detection: Cloud, big data analytics, and remote management capabilities

Driving Factors:

- Occupational Safety Regulations: Strong adoption due to safety and regulatory requirements

- Industrialization & Gas Infrastructure Growth: Expansion of gas infrastructure and industrial activity

- Digitalization & Connectivity: Widespread digitalization enabling remote sensing and connected devices

- IoT Adoption Across Industries: Broad use of IoT for monitoring and analytics across sectors

- End-User Sector Growth: Oil & Gas, Energy, Electronics, Steel, Shipbuilding, Firefighting & Rescue, Civil Engineering & Construction, and others

Moreover, the growing demand for sustainable and green homes has pushed the construction of smart homes equipped with the latest IoT and WiFi-connected gas detectors. Manufacturers also embed these portable solutions with features, such as Artificial Intelligence (AI) live monitoring, estimation, and examination, to boost their demand across regional markets. However, market volatility and manufacturers' production constraints can impact the market in the short term.

COVID-19 IMPACT

Stagnant Infrastructure and Industrial Growth Deficit Caused by COVID-19 Impacted Market Growth

The COVID-19 pandemic restructured the global trade situation with unexpected business occurrence scenarios, significantly impacting trade flows. It affected the global economic growth that considerably decreased infrastructure funds, decelerating the demand for portable gas detectors for a short term. However, post-pandemic supply constraint and shortage of fossil fuel resources expanded the possibilities for the gas exploration industry, significantly surging the demand for portable gas leak detectors across the oil & gas sector.

Portable Gas Leak Detector Market Trends

Enhanced User Interface and IoT Integration to Boost Product Demand for Commercial Use

Portable gas detector manufacturers are focused on incorporating wireless connectivity and IoT technology. These technologies enable real-time monitoring, data logging, and access to systems that can be remotely controlled, thereby improving the efficiency and effectiveness of portable gas detectors. Also, manufacturers are concentrating on developing a user-friendly interface, boosting the adoption of gas leak detectors that comprise intuitive displays and real-time alerts. These technologies simplify device operation and control, and enhance user experience, pushing the product demand. These advancements will boost the portable gas leak detector market growth during the forecast period.

- For instance, in October 2024, Industrial Scientific, a leading gas detection system manufacturer, introduced a PRO5 monitor equipped with a photoionization detector PID sensor.

Download Free sample to learn more about this report.

Portable Gas Leak Detector Market Growth Factors

Focus on Occupational Safety and Growing Industrialization to Drive Market Growth

The ongoing industrialization in emerging economies is expanding the operations of existing industries. The need for safety devices in industrial facilities to ensure early detection of potentially hazardous gases has become paramount. Furthermore, strict safety regulations in industries to ensure occupational safety led to an increased adoption of portable gas leak detectors.

- For instance, in January 2025, Blackline Safety, a portable gas leak detector manufacturer, developed an innovative wearable detector to detect lone workers on the premises.

RESTRAINING FACTORS

Technical Limitations and High Cost of Ownership to Restrain Market Growth

Portable gas leak detectors are more precise in the early detection of hazardous industrial gases. Thus, it is expensive to procure such equipment for industrial safety. Also, some equipment must comply more with industrial use as many of them are not sensitive to unrecognized gases. They have certain limitations such as sensitivity, detection range, and lack of accuracy. These devices have a performance deficit and can offer varied evaluation. Thus, they need calibration from time to time. These are some of the technological restraints affecting the market growth.

Portable Gas Leak Detector Market Segmentation Analysis

By Sensor Type Analysis

Demand for Portable Electrochemical Detectors to Increase due to their Rising Commercial Uses

Based on sensor type, the market is classified into electrochemical, catalytic bead sensors, photo-ionization, infrared point, optical, ultrasonic, and others (semiconductor, infrared imaging, holographic).

Growing commercial use of portable electrochemical detectors for identifying gas leakages at public sites, such as malls and commercial complexes, led to the dominance of the electrochemical segment. catalytic bead sensors Segment Dominate with a share of 32.95% in 2026. Also, its simplified construction and easy to use characteristics are driving the demand for electrochemical sensor types across the industrial sector. Additionally, rising use of new-age detection systems based on technologies, such as catalytic bead sensors, photo-ionization, infrared points, and optical & ultrasonic systems, will create a stable product demand across industries. However, the other categories of gas detectors are expected to observe a slow demand.

By Technology Analysis

Rising Gas Exploration and Precision Capabilities to Boost Use of Single Gas Leak Detectors

By technology, the market is segmented into single gas and multi gas.

The single gas segment is set to dominate the market share. Concerns about the negative effects of using high-carbon fossil fuels and solid fuels led to their replacement with sustainable solutions in gas exploration projects. Also, private players involved in sustainable solutions, such as hydrogen and methane, have raised the demand for gas leak detectors. Also, precision gas detection for effective processing and piping is surging the demand for single gas leak detectors.

Rise in the number of commercial end-users of multi gas detectors for industrial safety and precise detection in smaller areas will create a sustainable demand for multi gas leak detection systems. The multi gas segment is set to dominate the market with a share of 68.90% in 2026.

By Product Type Analysis

Non-Wearable Detectors to Dominate the Market with their Growing Commercial Use

By product type, the market is categorized into wearable and non-wearable.

The non-wearable segment is anticipated to dominate the market with a share of 71.09% in 2026. Expanding gas infrastructure has boosted the product demand for commercial use across many industries. Also, easy mobility and commercial availability will fuel the adoption of non-wearable portable gas leak detectors across industries to offer precise monitoring. Also, the demand for off-field gas inspection and refrigeration gas detection services will sustain the demand for wearable portable gas leak detectors in the long term.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Sustainability and Safety Concerns to Boost Product Use among the Oil & Gas Segment

Based on end-user, the market is bifurcated into oil and gas, energy and power, electronics, steel, shipbuilding and shipping, firefighting and rescue, civil engineering and construction, and others.

Growing expansion of commercial and industrial infrastructure across the globe for gas exploration activities has raised the demand for portable gas detection systems across the oil and gas industry. Additionally, increasing environmental sustainability issues and safety concerns owing to carbon neutrality goals set by the oil & gas industry will be anticipated to increase the portable gas leak detector market share during the forecast period.

However, the growing commercialization of natural gas and developing countries’ transition to no-smoke fuels, such as LPG and CNG, will sustain the demand for portable gas detectors in energy & power, steel, shipbuilding, and shipping industries. Portable gas detectors ensure safety across the energy & power, steel, civil engineering, and construction sectors. However, limited use of devices for safety in labor-driven industries will maintain subsequent demand across shipping, firefighting & rescue, and other gas inspection services. Such factors drive the growth of this segment.

REGIONAL INSIGHTS

The market has been studied across North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific Portable Gas Leak Detector Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Strong growth for industrialization and commercial sites globally and expanding global share of the gas industry are estimated to support the growth of portable gas detectors in the long term. Furthermore, growing concerns and regulatory compliance aligned with environmental and occupational health concerns across developed nations raise the demand for portable gas detection systems.

Asia Pacific

The Asia Pacific market is projected to grow extensively and account for the largest market share due to the strong expansion of gas infrastructure across developed countries such as China and Japan. Another factor driving the growth of the Asia Pacific market is the booming economy of India due to its transition to Liquefied Natural Gas (LNG). Also, the growing demand for gas-based fuels, such as hydrogen and methane, across South Asia is estimated to bolster the demand for portable gas leak detectors.

- For instance, in February 2024, India’s leading LNG public company Petronet announced a USD 5.3 billion investment over the next five years to expand the gas infrastructure across the country.

Europe

To know how our report can help streamline your business, Speak to Analyst

Europe is projected to grow steadily and will hold a significant market share after North America due to the rising geopolitical tension between the European Union and Russia. Countries in Europe, which are highly dependent on the gas industry for energy generation have shifted their focus on the growth of gas infrastructure. Also, the adoption of green fuels, such as hydrogen and methane, across the U.K. and Germany is projected to spur the demand for portable gas leak detectors in the coming years.

- For instance, in July 2021, New Cosmos Electric Co. Ltd., a leading gas detection equipment manufacturer, started the sale of its new XP-3000II series portable gas detectors that can be used in various applications, such as explosion risk prevention and high sensitivity measurement.

North America

The North America market might record slow growth due to recession and less investment in gas infrastructure development. However, the U.S.’ strong technological innovations and leadership in manufacturing are helping the region regain its lead position. However, strict industrial safety advisories and regulations are the factors driving the adoption of portable gas detectors.

- For instance, in April 2025, Ion Science, a leading gas detector manufacturer, offered a trade-off solution to replace the existing Tiger series gas detectors with advanced handheld VOC detectors.

Middle East & Africa

The Middle East & Africa is the driver of the world economy as the preference for renewable energy has overtaken the demand for fossil fuels. The Middle East & Africa market growth has experienced a leisurely downfall. However, adoption of advanced technologies and availability of methane and other flammable gases in this region are estimated to help the region maintain a modest growth.

South America

South America is a slow growing region due to sluggish industrial development and minimalistic investments in the region’s gas infrastructure. Also, South America’s unstable economy and fewer explored resources may further decelerate its growth.

KEY INDUSTRY PLAYERS

Product and End-user Diversification Strategies to Help Key Market Players Boost Market Presence

Players operating in this market have observed a deliberate growth of the safety detection industry in the regional market owing to economic downfall and disturbed trades across the globe. However, the product demand has resurrected broadly due to the adoption of diversification strategies by end-users across various industries such as oil & gas, construction, steel, and energy & power. Further, only some players expanded their market share post-pandemic by laying production diversification goals and offering technologically advanced products.

List of Top Portable Gas Leak Detector Companies

- Draeger (Germany)

- Bacharach (U.S.)

- Emerson Electric (U.S.)

- ABB Ltd. (Switzerland)

- General Electric (U.S.)

- Honeywell International (U.S.)

- Danfoss (Denmark)

- RIKEN KEIKI (Japan)

- PCE Deutschland GmbH (Germany)

- SENSIT Technologies (U.S.)

- Senko Co., Ltd (Japan)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Industrial Scientific launched and made its new portable gas detector Ventis Pro5 available for its clients across the EU and the Middle East.

- November 2024: Ion Science, a leading gas detector manufacturer, launched its next-generation Tiger XT VOC gas detector equipped with push-to-release button, allowing secure and simple operation.

- November 2024: Metravi, a global gas detector manufacturer, launched its multi-gas detector named GD-09-4M, which can detect explosive gases, oxygen, carbon monoxide, and hydrogen sulfide simultaneously and continuously.

- November 2024: International Gas Detector (IGD), a global gas detection system manufacturer, launched its new CO2 portable gas detector that claims to have the longest average sensor life and provides PPM and VOL measurements.

- June 2024: International Gas Detectors, a global supplier, embedded its new sensor technology in the Mpower Portables range, offering N2O 10-1,000 ppm and a dual range for CH4 and CO2 at 50-50,000 ppm.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product types, and leading end-users. Besides, it offers insights into the market trends and highlights key industry developments. Also, the report provides a detailed analysis of each product in terms of its segment share. It encompasses several factors that have contributed to the market’s growth in recent years. Additionally, it allows the business stakeholders to forecast the market’s potential and strategies adopted by competitors to leap ahead in the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Sensor Type

By Technology

By Product Type

By End-user

By Region

|

Frequently Asked Questions

The market is projected to reach USD 6.27 billion by 2034.

In 2025, the market was valued at USD 3.55 billion.

The market is projected to record a CAGR of 6.60% during the forecast period.

Across technology, single gas is expected to lead the market.

Focus on occupational safety and growing industrialization are the key factors driving the market growth.

The top players operating in the market are Draeger, Bacharach, Emerson Electric, ABB Ltd, General Electric, Honeywell International, Danfoss, RIKEN KEIKI, PCE Deutschland GmbH, SENSIT Technologies, and Senko Detection.

Asia Pacific is expected to hold the largest market share.

By end-user, the oil and gas segment is expected to record remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us