Distributed Temperature Sensing Market Size, Share & Industry Analysis, By Scattering Method (Rayleigh Scattering Effect, Raman Scattering Effect, and Brillouin Scattering Effect), By Operating Principle (Optical Time Domain Reflectometry (OTDR) and Optical Frequency Domain Reflectometry (OFDR)), By Fiber Type (Single-mode Fibers and Multi-mode Fibers), By Application (Oil & Gas, Power Cable Monitoring, Fiber Detection, Process & Pipeline Monitoring, Environmental Monitoring, and Others), and Regional Forecast, 2026 - 2034

DISTRIBUTED TEMPERATURE SENSING MARKET SIZE AND FUTURE OUTLOOK

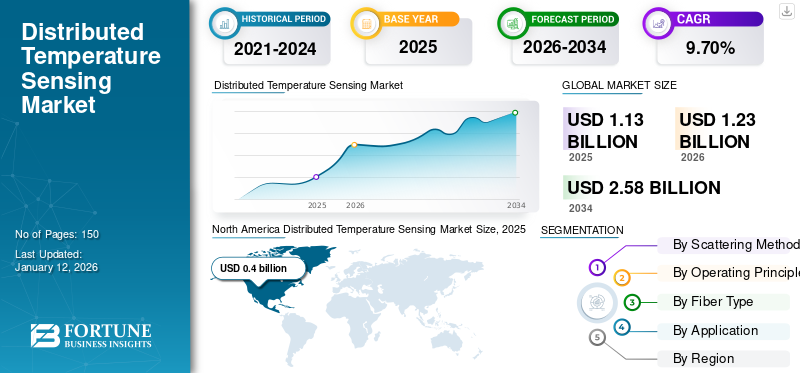

The global distributed temperature sensing market size was valued at USD 1.13 billion in 2024 and is projected to grow from USD 1.23 billion in 2025 to USD 2.58 billion by 2034, exhibiting a CAGR of 9.70% during the forecast period. North America dominated the market with a share of 34.99% in 2025.

Distributed Temperature Sensing (DTS) systems are optical fiber-based devices that measure temperature throughout the length of a fiber optic sensing cable. DTS relies on the Raman or Brillouin scattering effect to acquire precise temperature readings. In contrast to the conventional electrical temperature measurement techniques (such as thermocouples and RTDs), the entire length of the fiber optic cable serves as the temperature sensor. Distributed temperature sensing can deliver thousands of accurate, detailed temperature measurements over extensive distances. Unlike traditional electrical temperature measurement methods, distributed temperature sensing offers a cost-efficient alternative for obtaining precise, high-resolution temperature data.

The global market is poised for significant growth, driven by the increasing demand for real-time monitoring in industries such as oil & gas, renewable energy, and infrastructure. Advancements in fiber optic technologies, stricter regulations, and increasing applications in harsh environments will drive the product’s adoption. Key players in the market include Halliburton (U.S.), AP Sensing GmbH (Germany), and OFS Fitel, LLC (U.S.), with products such as BF04433 and F79696 modules. The market's future will see technological innovations concentrated on increasing the launch of energy-efficient solutions and technological advancements in extreme conditions.

Generative AI Impact

Generative AI to be Widely Used in DTS Systems to Improve Their Functioning

Generative AI significantly impacts the DTS market by enhancing the system’s capabilities, improving efficiency, and driving innovation. This form of AI can process large volumes of temperature data collected by DTS systems, identifying complex patterns and anomalies more accurately and quickly than traditional methods. It enables predictive maintenance by generating simulations of potential system failures or temperature deviations, minimizing downtime and operational risks. Thus, this factor also boosts the growth of the market.

DISTRIBUTED TEMPERATURE SENSING MARKET TRENDS

Integration With Smart Cities and Infrastructure to Fuel Market Growth

When cities become smarter and more connected, distributed temperature sensing plays a vital role in monitoring important infrastructure, such as railways, tunnels, bridges, and others. The ability of these systems to detect temperature fluctuations that may indicate structural faults or prospective failures increases the safety and ability of urban infrastructure to withstand disruptions. In this, DTS systems are used to monitor temperature profiles in tunnels, bridges, railways, and buildings, ensuring safety and structural integrity. In smart cities, these systems detect fire hazards, overheating, or thermal anomalies, enabling proactive maintenance and reducing risks. Additionally, smart grids incorporate DTS to monitor high-voltage power cables, transformers, and substations for hotspots or thermal imbalances. This ensures energy efficiency, minimizes downtime, and supports renewable energy integration. Hence, these factors will accelerate the market growth.

MARKET DYNAMICS

Market Drivers

Rising Demand for Labor Safety at Workplaces Globally to Boost Market Growth

The market's perception of a company greatly relies on the safety of its employees and equipment. As a result, organizations have prioritized safety and protection. According to data from the International Association of Drilling Contractors (IADC), the recorded incidence rate per 20,000 man-hours rose from 0.46 in 2016 to 0.68 in 2018. DTS systems enhance safety in various work environments, especially in hazardous settings. One of the main advantages of utilizing these systems is their ability to monitor the temperature in real-time along the entire length of a cable rather than at just specific points, thereby serving as an efficient fire detection system. Their resilience to extreme conditions makes DTS systems crucial for enhancing safety protocols. This factor will significantly fuel the market’s growth.

Market Restraints

High Design and Manufacturing Costs Can Hamper Usage of DTS Systems

DTS systems rely on optical cables that are sensitive to strain. Any bending during the installation process can harm these systems. The optical fiber cables must be installed carefully, as improper handling can lead to breakage. Despite significant advancements in the design of sensor cables, inadequate deployment fails the entire DTS system. Since installing this system involves substantial financial investments, such failures may deter customers from utilizing the technology in future projects. Therefore, careful attention is essential during the installation of DTS systems. Technical difficulties when deploying sensor cables are a significant limitation affecting the growth of the DTS market. Nevertheless, advancements in technology in the coming years are anticipated to minimize physical damage to optical cables, which will lessen the impact of this issue on the market. Consequently, these challenges will pose obstacles to expanding the global market.

Market Opportunities

Increasing Safety Norms and Supportive Government Policies Related to Leakage Detection in DTS to Create Numerous Market Opportunities

The swift growth of urban areas and industries has enhanced construction efforts and escalated the risks linked to such activities. Construction zones and industrial facilities contain extensive electrical wiring, and even a minor incident can endanger the workers and residents in the vicinity. Likewise, pipelines for transporting oil and gas represent a risk to employees and nearby communities, as even a small leak can result in significant damage.

Additionally, leaking equipment, such as pumps, valves, connectors, sampling connections, compressors, pressure relief devices, and open-ended lines across various sectors, are significant emitters of Volatile Organic Compounds (VOCs) and Volatile Hazardous Air Pollutants (VHAPs). The primary sources of these leaks are refineries and the chemical industry. As regulations concerning emission standards become more stringent, the demand for distributed fiber optic sensors is expected to rise, mainly due to their ability to detect leaks in pipelines. This can significantly contribute to the monitoring of emission standards. Consequently, more companies are adopting DTS systems for safety reasons. For instance,

- Organizations, such as the Occupational Safety and Health Administration (OSHA) and the National Fire Protection Association (NFPA), are dedicated to ensuring the safety of individuals and preventing fires, thereby encouraging the utilization of fire safety equipment in work environments.

These factors will drive the market's growth in the coming years.

SEGMENTATION ANALYSIS

By Scattering Method

Detailed Spatial Temperature Profiles through Raman Scattering Effect Propelled Segment Growth

On the basis of the scattering method, the market is categorized into Rayleigh scattering effect, Raman scattering effect, and Brillouin scattering effect.

The Raman scattering effect segment held the largest market share by 55.19% in 2024. This scattering effect offers continuous, distributed temperature measurements along the entire length of an optical fiber cable, thereby providing detailed spatial temperature profiles over long distances. Additionally, optical fibers used in the Raman scattering effect are robust and resistant to harsh environmental conditions, making them ideal for industrial and remote applications. These factors will drive the segment’s growth.

Additionally, the Rayleigh scattering effect is expected to record the highest CAGR during the forecast period. This effect provides detailed temperature profiles along the entire length of an optical fiber cable. It can detect temperature variations at fine time intervals, often down to centimeters. Furthermore, it enables temperature monitoring along the fiber cable rather than at discrete points. Also, it offers a complete profile for thermal monitoring. These factors will boost the segment’s growth.

By Operating Principle

Enhanced Features of Optical Time Domain Reflectometry (OTDR) Among Several Industries Boosted Segment Growth

On the basis of operating principle, the market is categorized into Optical Time Domain Reflectometry (OTDR) and Optical Frequency Domain Reflectometry (OFDR).

The Optical Time Domain Reflectometry (OTDR) segment held the largest market share in 2024. This operating principle is utilized in most Distributed Temperature Sensing (DTS) systems. It offers reliable measurements and is less affected by problems, such as reflections and bends in fibers and accessories. Moreover, when combined with DTS, OTDR principles help users track temperature variations over long distances. Additionally, employing OTDR and DTS optical fibers offers advantages such as cost-effectiveness, high sensitivity, and the ability to detect subtle temperature changes. The increasing usage of this principle in sectors such as oil & gas, power utilities, management of critical infrastructure, environmental monitoring, and others is one of the primary factors fueling the growth of this segment. The Optical Time Domain Reflectometry (OTDR) segment is projected to hold 64.24% of the market share in 2025.

The Optical Frequency Domain Reflectometry (OFDR) segment is expected to record the highest CAGR of 11.49% during the forecast period. This is due to the improved functionalities of combining OFDR with DTS, including higher spatial resolution, precise temperature measurements, and intricate analysis necessary for real-time monitoring. As a result, these factors will contribute to the segment's expansion.

By Fiber Type

Advantages of Single-Mode Fibers in Sensing and Monitoring Applications Boosted Their Demand

On the basis of fiber type, the market is categorized into single-mode fibers and multi-mode fibers.

The single-mode fibers segment held the largest market share in 2024. This dominance is attributed to reasons such as their small core diameter, reduced modal dispersion, enhanced performance capabilities, ability to transmit signals over long distances, and advantages, such as improved resolution and resistance to electromagnetic interference. The demand for this type of fiber is mainly fueled by its applications in fields, such as fire detection, environmental monitoring, disaster management, and oil & gas, among others. The single-mode fibers segment is likely to hold 58.67% of the market share in 2025.

The multi-mode fibers segment is expected to register the highest CAGR of 11.86% during the forecast period. This growth is primarily attributed to its increasing application in short-term uses, affordability, enhanced sensitivity for localized applications, and simplicity in both use and installation. Their rising applications in areas, such as leak detection, fire detection, and industrial process monitoring will significantly contribute to the demand for multi-mode fibers. These factors are driving the expansion of the segment.

By Application

To know how our report can help streamline your business, Speak to Analyst

Oil & Gas Segment Held Dominance Due to Increasing Demand for Safer Temperature Monitoring Methods

On the basis of application, the market is categorized into oil & gas, power cable monitoring, fire detection, process & pipeline monitoring, environmental monitoring, and others.

The oil & gas application segment held the largest global distributed temperature sensing market share in 2024. The rising demand for safer temperature monitoring methods, precise data transmission, and cost-effective solutions is the main catalyst behind this segment's expansion. Moreover, growing concern for the safety of workers who operate in harsh conditions for extended periods also plays a role in its development. Therefore, this factor will accelerate the growth of the market. The oil & gas application segment is expected to hold 25.74% of the market share in 2025.

Moreover, the process & pipeline monitoring application segment is expected to record the highest CAGR of 13.38% during the forecast period. DTS is widely utilized in assessing the integrity of pipelines, monitoring downhole conditions, identifying leaks & blockages, managing reactors & storage tanks in the chemical sector, and measuring groundwater flow, among other applications. Benefits, such as real-time monitoring, cost-effectiveness, durability, and other additional advantages are driving this segment’s growth.

DISTRIBUTED TEMPERATURE SENSING MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America Distributed Temperature Sensing Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America held the highest market value of USD 0.4 billion in 2025. The region has been witnessing substantial growth driven by several factors, including rising demand in the oil & gas industry, increased usage in the power utility sector, heightened adoption of industrial process monitoring systems, and the presence of leading companies. Additionally, the existence of major industry players, such as Schlumberger Limited, Halliburton Company, and OFS Fitel, is a significant contributor to the rising demand for DTS systems in the region. Moreover, the ongoing construction activities and growth of power transmission cables in technologically advanced nations within North America, such as the U.S. and Canada, are enhancing the expansion of the market in this region. The U.S. market is estimated to hit USD 243.86 million in 2025.

Download Free sample to learn more about this report.

Asia Pacific

Meanwhile, Asia Pacific is anticipated to witness the highest CAGR in the global market from 2025 and 2032. The region is anticipated to be the second-largest market with USD 332.32 million in 2025, recording the second-largest CAGR of 12.30% during the forecast period. Rising urbanization and high demand for electrical transmission in the region are anticipated to promote the adoption of distributed temperature sensor systems. Additionally, the growing number of oil & gas and chemical facilities in countries, such as China and India is likely to boost the need for temperature and environmental monitoring solutions. These factors will drive the global distributed temperature sensing market growth in the region. The market in China is estimated to be USD 0.09 million in 2026.

Japan’s market size is foreseen to be valued at USD 0.1 billion and India is likely to be USD 0.07 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is projected to be the third-largest market with a value of USD 186.26 million in 2025, exhibiting a steady growth over the forecast period. Factors contributing to this market’s expansion include rising investments in sustainability efforts to minimize carbon emissions, adherence to regulatory requirements, technological advancements, heightened emphasis on worker safety, increasing investments in infrastructure, and more. The rising demand in sectors with challenging working environments is driving the market's growth in the region. The market in U.K. is estimated to be USD 0.05 million in 2026.

The Germany’s market size is foreseen to be valued at USD 0.05 million in 2026 and France’s likely to be USD 33.17 million in 2025.

Middle East & Africa and South America

Middle East & African region is to be anticipated the fourth-largest market with USD 122.20 million in 2025. The markets in the Middle East & Africa and South America are still developing but show significant potential for growth. The rising demand in oil & gas, environmental monitoring, and fire detection sectors will fuel this market’s development. In addition, the knowledge and skills of DTS equipment and service providers have been enhanced, further supporting the market’s growth in the region. The GCC countries’ market is likely to hold USD 38.79 million in 2025.

Similarly, the South American market is expected to grow moderately. Governments across the region must invest significantly in research and development to support market development. However, the region's economic challenges and incomplete technological infrastructure may restrict the market's growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Players to Adopt Merger & Acquisition Strategies to Expand Their Operations

Some of the top market players are trying to expand their global business footprint by launching customized solutions for specific sectors. They are also engaging in acquisitions and partnerships to establish a strong foothold in various regions across the globe. They are also developing effective marketing strategies and launching new solutions to sustain themselves in the market.

List of Distributed Temperature Sensing Companies Studied

- AP Sensing GmbH (Germany)

- Bandweaver Technologies (China)

- HALLIBURTON (U.S.)

- NXT Photonics A/S (Germany)

- OFS Fitel, LLC (U.S.)

- OPTROMIX (U.S.)

- Sensornet Limited (U.K.)

- Silixa Ltd. (U.K.)

- Yokogawa Electric Corporation (Japan)

- Sumitomo Electric Industries, Ltd. (Japan)

- Weatherford International PLC (Switzerland)

- Schlumberger Limited (U.S.)

- Omnisens SA (Switzerland)

- Omicron Electronics (Austria)

- AVENCOM (Kazakhstan)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Halliburton Company launched the Intelli suite of diagnostic wireline logging services for good intervention. The new offering delivers a comprehensive diagnostic well intervention package to customers.

- November 2024: SLB introduced Stream, a high-speed intelligent telemetry system that enhances drilling accuracy and efficiency for intricate wells. The new offering delivers continuous, high-speed, fidelity, real-time measurements of subsurface conditions without any data constraints, even at great depths and in the most difficult environments.

- July 2024: VIAVI Solutions Inc. launched NITRO Fiber Sensing, a comprehensive real-time monitoring and analytics solution designed for essential infrastructure, including oil, gas, electrical power transmission, water pipelines, border & perimeter security, and data center connections. The deployment of optical cables across various sectors facilitates precise and reliable monitoring while adhering to security regulations and catering to the distinct requirements of each customer.

- March 2023: AP Sensing introduced its third-generation fiber-optic Linear Heat Detection (LHD) system known as the N45-Series. This series offers customers an economical option that is simple to install, requires minimal maintenance, is resistant to electromagnetic interference (EMI), and delivers accurate location tracking and monitoring of fire incidents.

- February 2021: LUNA introduced a new measurement solution designed to provide more precise and dependable high-definition distributed temperature readings by utilizing advanced fiber-optic sensing technology. The introduction of the sensor was expected to offer the most precise data in these demanding installations.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The distributed temperature sensing market is focused on research & development activities to develop more advanced, efficient, and cost-effective solutions. Companies are gradually collaborating with small organizations, providing opportunities for merger and acquisition strategies. Expanding product offerings for new applications and industrial sectors will give enterprises a competitive advantage and help them expand their offerings and reach across the global landscape. Emphasis on understanding customers' requirements and developing solutions that suit their needs and market trends will also help them acquire a new customer base. The companies’ collected technology and production capacity to develop and deliver quality and cost-competitive products rapidly can contribute to market players' business growth.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects, such as leading companies, product/service types, and top product applications. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.70% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Scattering Method, By Operating Principle, By Fiber Type, By Application, and Region |

|

Segmentation |

By Scattering Method

By Operating Principle

By Fiber Type

By Application

By Region

|

|

Companies Profiled in the Report |

AP Sensing GmbH (Germany), Bandweaver Technologies (China), HALLIBURTON (U.S.), NXT Photonics A/S (Germany), OFS Fitel, LLC (U.S.), OPTROMIX (U.S.), Sensornet Limited (U.K.), Silixa Ltd. (U.K.), Yokogawa Electric Corporation (Japan), and Sumitomo Electric Industries, Ltd.(Japan) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 2.58 billion by 2034.

In 2025, the market was valued at USD 1.13 billion.

The market is projected to record a CAGR of 9.70% during the forecast period.

The Raman scattering effect segment led the market in 2025.

Rising demand for labor safety at workplaces across the globe is the key factor driving the market’s growth.

AP Sensing GmbH (Germany), Bandweaver Technologies (China), HALLIBURTON (U.S.), NXT Photonics A/S (Germany), OFS Fitel, LLC (U.S.), OPTROMIX (U.S.), Sensornet Limited (U.K.), Silixa Ltd. (U.K.), Yokogawa Electric Corporation (Japan), and Sumitomo Electric Industries, Ltd. (Japan) are the top players in the market.

North America held the highest market share in 2025.

By application, the process & pipeline monitoring segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us