Women’s Health Devices Market Size, Share & Industry Analysis, By Application (General Health & Wellness, Cancers & Other Chronic Diseases, Reproductive Health, Pregnancy & Nursing Care, Pelvic & Uterine Healthcare, and Others), By End-user (Hospitals & Clinics, Home Healthcare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

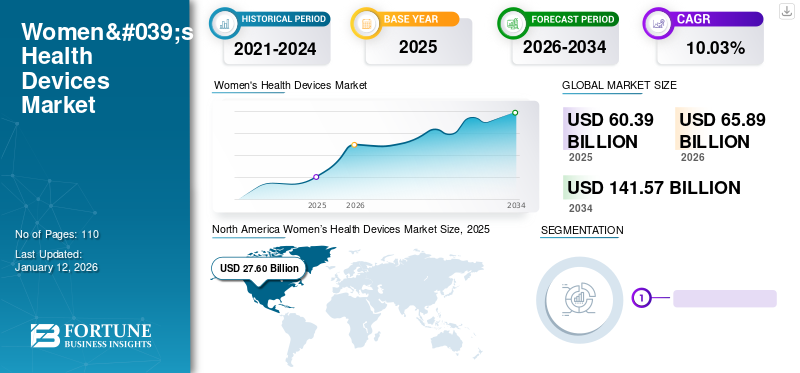

The global women’s health devices market size was valued at USD 60.39 billion in 2025 and is projected to grow from USD 65.89 billion in 2026 to USD 141.57 billion by 2034, exhibiting a CAGR of 10.03% during the forecast period. North America dominated the women’s health devices market with a market share of 45.70% in 2025.

In terms of the prevailing global scenario, there has been a strong increase in women’s health expenditure. This rise in the expenditure towards women’s health is primarily due to the growing awareness of female health issues and the sustained increase in the disposable incomes of women across the world. Furthermore, the increased prevalence of female cancers such as breast and ovarian cancer and other diseases such as uterine fibroids is expected to drive the market strongly. Similarly, in terms of female demographics shift, the increasingly younger generation of women is expected to adopt these products intensely. These positive trends are expected to drive growth opportunity in the global market.

Such positive developments in the women’s health space have motivated a diverse set of companies with various application areas to engage in the R&D of new products. This led to a strong number of product launches in the forecast period, ranging from diagnostic and monitoring devices to therapeutic devices. For instance, in December 2021, F. Hoffmann-La Roche Ltd launched the cobas PIK3CA Mutation Test for patients diagnosed with advanced or metastatic breast cancer in countries that accept the CE mark. Such developments are expected to provide the impetus for growth in the market.

Global Women’s Health Devices Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 55.45 billion

- 2026 Market Size: USD 60.39 billion

- 2034 Forecast Market Size: USD 115.64 billion

- CAGR: 10.03% from 2026–2034

Market Share:

- Region: North America dominated the market with a 45.57% share in 2024. The region's growth is driven by strong healthcare expenditure on women's health and a comparatively higher demand for technologically advanced devices.

- By Application: The Cancers & Other Chronic Diseases segment accounted for the largest market share in 2024. This is attributed to the increased prevalence of a wide range of female cancers, which is expected to lead to an increased demand for effective diagnostic and therapeutic health devices.

Key Country Highlights:

- Japan: The market is driven by increasing awareness about technologically advanced women’s health devices. Prominent Japanese diagnostic companies are also receiving approvals for their products in other major Asian markets, contributing to regional growth.

- United States: Growth is fueled by strong government initiatives, such as the FDA's Health of Women Program Strategic Plan, and significant investment in R&D. There is also a high prevalence of conditions such as urinary incontinence and a strong demand for advanced diagnostic tests.

- China: As a key country in the fastest-growing Asia Pacific region, the market is propelled by improvements in healthcare infrastructure and an increase in approvals for advanced diagnostic reagents for conditions like breast cancer.

- Europe: The market is driven by strong women's healthcare expenditure and a high prevalence of female cancers. For instance, an estimated 55,000 women are diagnosed with breast cancer annually in the U.K., which boosts the demand for related health devices.

COVID-19 IMPACT

Limited Hospitals Visits due to COVID-19 Pandemic Negatively Impact Market Growth

The COVID-19 pandemic had a negative impact on the global market as the lockdowns imposed across the world limited the visits to various healthcare professionals. Similarly, significant market players experienced an inevitable decline in their sales due to multiple disturbances in the supply chain during the pandemic (2020).

For instance, one of the major global players, such as CooperSurgical Inc.’s fertility segment, recorded significant declines in their revenues of 11.2% in 2020. However, the market witnessed a recovery in terms of sales of 39.2% in 2021.

Furthermore, another key factor aiding the global market's rebound is the robust ongoing adoption of telemedicine during and after the pandemic. The growing trend of telemedicine enables the greater adoption of women's health devices. Such factors are expected to accomplish sustainable growth during the forecast period.

LATEST TRENDS

Download Free sample to learn more about this report.

Robust Investment Initiatives by Key Players is a Prominent Trend

One of the most prevalent trends witnessed in the market is that several investment initiatives are being undertaken, which is anticipated to contribute strongly to the market's growth. There are numerous advantages of this strong momentum of investment initiatives. Some of the benefits of these initiatives include greater availability of more convenient and affordable options, which leads to greater adoption of these medical devices. Furthermore, these investment opportunities are expected to give rise to the launches of innovative products.

- In February 2021, Base raised a seed round of USD 3.4 million to scale up affordable at-home lab testing.

- According to an article published in Forbes in 2020, in the past 12 months: the female technology market space received almost USD 800.0 million in terms of funding.

Hence, these new global women’s health devices market trends are expected to open up a new female population base for the companies engaged in the market and are expected to significantly contribute to the surge of the market in the forecast period.

WOMEN’S HEALTH DEVICES MARKET GROWTH FACTORS

Increased Awareness of Women's Health Issues to Strongly Drives the Market Growth

In terms of modern demographics, the female population worldwide has experienced significant increases in proportion. Furthermore, worldwide healthcare infrastructure, especially in emerging countries, is expected to improve significantly. Hence, these improvements in overall healthcare parameters across the globe have also extremely heightened awareness and sensitivity to women’s health issues. Such positive market dynamics have surged the global women’s health devices market growth in the forecast period.

The demand for medical devices for the diagnosis & treatment of women's health diseases, such as a wide range of female cancers, has increased tremendously over the past few years owing to the substantial growth in the female patient population. Numerous research studies have indicated that the prevalence of women's health diseases has significantly increased over the past few decades. In order to reduce the mortality rate in female patients suffering from critical diseases, several governments have undertaken initiatives to promote and protect women’s health. For instance, in January 2022, the U.S. Food and Drug Administration’s Center for Devices and Radiological Health (CDRH) released the Health of Women Program Strategic Plan to promote and protect women's health.

Similarly, the Office on Women's Health at the U.S. Department of Health and Human Services in the U.S. organizes several awareness programs linked to women’s diseases, such as breast cancer, hypertension, human papillomavirus (HPV), and mental health wellness. These awareness campaigns have contributed immensely to making women aware of these critical illnesses, especially younger generation of females. These campaigns have led several women to adopt various medical devices, such as oncology diagnostics, for early and preventive care. All these factors are anticipated to lead to a surge in the patient population, expected to drive the market growth for women’s health devices in the forecast period.

Rise in Prevalence of Diseases Pertaining to Women's Health to Augment Market Growth

The overall prevalence of women's health diseases has increased dramatically over the past few decades owing to several factors, including technological improvements in diagnostic devices and heightened awareness leading to the adoption of preventive care. This significant rise in the incidence has led to a large patient population suffering from debilitating and chronic conditions which severely affect the patient's daily functioning and have severe implications for their mortality.

For instance, there has been a greater prevalence of female cancers, such as cervical cancer, which can be treated early and effectively if women are screened in an efficient manner. For instance, according to data published by World Health Organization (WHO) in 2022, cervical cancer is the 4th most common cancer among women, with estimated 604,000 new cases in 2020. Such a strong prevalence of female diseases has increased demand for a wide range of women’s health devices. Furthermore, this has led to the engagement of a number of medical device companies in the R&D initiatives to develop effective devices for the diagnosis, treatment, and management of women's health diseases. These R&D initiatives are anticipated to lead to robust growth for the market in the forecast period.

RESTRAINING FACTORS

Lack of Market Penetration in Emerging Regions to Restrain Market Growth

Despite a critical and increased need for women's health devices, the awareness about various women’s diseases is low amongst the general population in emerging regions, unlike the developed countries. There is a considerable lack of understanding about multiple symptoms of women's health diseases that can be treated or corrected easily with proper diagnostics and treatment devices. Individuals in these emerging countries do not visit healthcare professionals regularly unless there is a major or severe symptomatic condition. The symptoms of certain women's health diseases, such as female cancers, often are absent in the majority of the cases and are not accurately diagnosed, which drastically reduces the patient pool that can be treated. These would significantly hamper the women’s survival rates in these countries.

For instance, according to the article published by Rural Development Trust in 2022, discussing women’s sexual and reproductive health is still taboo in many areas of India. According to Global Nutrition Report 2017, about 51.0 per cent of Indian women between 15 to 49 years are suffering from anemia. Also, according to the Ministry of Health and Family Welfare, the Maternal Maternity Ratio (MMR) is 113 in India. This means 113 deaths per 100,000 live births occurred between 2016 and 2018. In emerging regions of sub-Saharan Africa, the average fertility rate has fallen drastically over the past decades. Although, it still stands at 4.6 and is considered unsustainably high. This distinct lack of awareness is attributable to the absence of prominent and more technologically advanced women’s health devices in these regions. This lack of market penetration in emerging areas severely limits the market growth in the forecast period, as these regions often have untapped market potential.

SEGMENTATION

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Demand for Effective Health Devices Enable Cancers & Other Chronic Diseases Segment to Hold the Largest Share

Based on application, the global market can be segmented into general health & wellness, cancers & other chronic diseases, reproductive health, pregnancy & nursing care, pelvic & uterine healthcare, and others.

The cancers & other chronic diseases segment accounting for 34.74% of the market share in 2026, attributable to the increased prevalence of a wide range of female cancers. This strong surge in cancer cases in women is expected to lead to an increased demand for effective health devices, which is anticipated further to drive the segment's growth.

The pregnancy & nursing care segment accounted for the second-highest market share in 2024 Due to the growing demand and adoption of several critical women’s health devices, such as pregnancy diagnostics and breast pumps is contributing to the segment’s growth.

The reproductive health segment was expected to account for the third-largest segment in the global market size in 2024. One of the contributing factors to the strong market share of the segment was the increased demand for female contraceptive devices.

The pelvic & uterine healthcare segment is also expected to witness strong growth prospects due to the strong demand for female urinary incontinence devices. As per a study published by American Urological Association Education and Research, Inc. on June 2021, there is a high prevalence of urinary incontinence among the U.S. women population, and many reports that urinary incontinence affects their daily activities. The study analyzed data of 15,003 women aged ≥20 years from the 2005–2016 National Health and Nutrition Examination Survey and concluded that the prevalence of urinary incontinence was 53.0%. Increased demand for medical devices such as breast implants is expected to drive the general health & wellness segment during the forecast period.

By End-user Analysis

Patient Convenience Contributed to Home Healthcare Segment to Grow at the Highest CAGR in 2025-2032

Based on the end-user, the market is segmented into hospitals & clinics, home healthcare, and others.

The hospitals & clinics segment dominated the market with a 59.42% share in 2026. The segment's dominance is attributable to the strong flow of patients in these end-user settings for diagnosing and treating several diseases linked to women’s health, including various cancers. Similarly, several companies are engaged in strategic initiatives to expand their reach to end users. For instance, in October 2022, Unified Women's Healthcare acquired Gennev. This acquisition has expanded Unified's portfolio by including menopause-relief offerings across the U.S. Such initiatives promote the segment's growth.

The home healthcare segment is expected to grow at the highest rate, owing to the increased usage of women's health devices in these settings due to the greater degree of ease and convenience for the patients. The others segment is expected to witness a comparatively lower CAGR in the forecast period.

REGIONAL INSIGHTS

North America Women’s Health Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Based on region, the global market can be segmented into North America, Europe, Asia Pacific, and the rest of the world.

North America

The market size in North America stood at USD 25.32 billion in 2024, and the region is expected to account for the largest market during the forecast period. Strong healthcare expenditure for women’s health and the comparatively stronger demand for technologically advanced devices which is set to contribute to the region’s dominance. For instance, in October 2022, the government of Canada partnered with Gender Equality and Youth to the National Women’s Health Research Initiative (NWHRI) with support of an investment of USD 20.0 million over five years provided in Budget 2021. Such trends are expected to drive the region’s growth during the forecast period.

Europe

Europe accounted for the second-highest market revenue share in 2024, attributable to the strong women's healthcare expenditure in key European countries and a substantial female population in Europe. For instance, according to Breast Cancer Now, in 2021, an estimated 55,000 women are diagnosed with breast cancer annually in the U.K. The high prevalence of female cancers in key European countries is expected to drive growth in the region. The UK market is valued at USD 2.85 billion by 2026, while the Germany market is valued at USD 4.48 billion by 2026.

Asia Pacific

The Asia Pacific region is estimated to witness the strongest CAGR during the forecast period of 2026-34. The improvement in healthcare infrastructure in Asian countries, the growing prevalence of women’s diseases, and the increasing awareness about technologically advanced women’s health devices are driving the market growth in the region. In January 2020, Japanese diagnostics company Sysmex announced that they had received Class III approval from China’s National Medical Products Administration for its Lynoamp BC in vitro diagnostic reagent for breast cancer. Such prominent product approvals in the region, coupled with an increase in healthcare expenditure, are expected to contribute to the growth in the region strongly. The Japan market is valued at USD 3.87 billion by 2026, the China market is valued at USD 4.68 billion by 2026, and the India market is valued at USD 2.2 billion by 2026.

Rest of the World

The Rest of the World comprises developing regions such as Latin America and, the Middle East & Africa. These regions accounted for a lower global market share in the forecast period. However, increased awareness of female health issues coupled with the greater presence of prominent companies in these regions is expected to lead to positive growth rates in the forecast period.

KEY INDUSTRY PLAYERS

Diverse Portfolio of F. Hoffmann-La Roche Ltd. and Boston Scientific Corporation Contributes to their Market Dominance

In terms of the competitive landscape, the market has the presence of several companies of various sizes with a diverse product portfolios with wide application areas. In the current market scenario, F. Hoffmann-La Roche Ltd dominates the market, primarily due to the company’s diagnostics portfolio, which has several products catering to female health issues. Some of the application areas of women’s health that F. Hoffmann-La Roche Ltd addresses include several types of female cancers, pregnancy, and fertility. Other prominent players include Boston Scientific Corporation, which has a strong portfolio dedicated to pelvic health medical devices.

Other companies such as CooperSurgical Inc., Coloplast A/S, and Hologic Inc. also account for a strong global market share due to their product offerings and rising strategic initiatives. In February 2022, CooperSurgical, Inc. acquired Cook Medical's reproductive health portfolio for USD 875.0 million. It includes medical devices for fertility, obstetrics, gynecology and in vitro fertilization.

Furthermore, increasing investment initiatives in the women’s health devices industry are expected to give rise to several emerging companies that may increase their market share in the forecast period.

LIST OF KEY COMPANIES PROFILED IN WOMEN’S HEALTH DEVICES MARKET:

- Coloplast A/S (Denmark)

- Hologic Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- ALLERGAN (AbbVie, Inc.) (U.S.)

- BD (Becton, Dickinson, and Company) (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- CooperSurgical Inc. (The Cooper Companies, Inc.) (U.S.)

- Caldera Medical (U.S.)

- Reckitt Benckiser Group PLC (U.K.)

KEY INDUSTRY DEVELOPMENTS

- December 2022: CooperSurgical, Inc. partnered with Ostro to launch a new consumer engagement solution for CooperSurgical's hormone-free IUD, Paragard. Paragard is an FDA-approved intrauterine device that prevents pregnancy up to 10 years.

- November 2022: Aspira Women’s Health launched OvaWatch to assess ovarian cancer risk.

- October 2022: Aspira Women's Health Inc. announced a co-marketing and distribution collaboration with BioReference, one of the largest full-service speciality laboratories in the U.S. Under this agreement, the two companies co-market and distribute Ova1Plus, which combines Aspira's FDA-cleared blood tests, Ova1 and OVERA. It detects the risk of ovarian malignancy in women with adnexal masses before surgery.

- October 2022: BioSkryb Genomics signed a multi-year agreement with Cooper Genomics to license BioSkryb’s proprietary genomic amplification technology. Cooper Genomics will utilize BioSkryb technology to enhance its preimplantation genetic testing (PGT) capabilities.

- September 2022: Innovative Health Diagnostic launched a new direct-to-consumer test, Anti-Mullerian Hormone (AMH).

REPORT COVERAGE

The global women’s health devices market research report provides a detailed market analysis. It focuses on key aspects such as the prevalence of key disease indications, key countries/ regions, 2022, overview: start-ups and innovations in the market, and key industry developments – mergers, acquisitions, and partnerships. Additionally, it includes an overview of new product launches and the impact of COVID-19 on the global market. Besides these, the report offers insights into market trends and highlights key strategies by market players in this industry. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.03% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Application, End-user, and Region |

|

By Application |

|

|

By End-user |

|

|

By Region |

|

Frequently Asked Questions

The global women’s health devices market size is projected to grow from $65.89 billion in 2026 to $141.57 billion by 2034, at a CAGR of 10.03%

In 2025, North America stood at USD 27.60 billion.

Registering a CAGR of 10.03%, the market will exhibit steady growth in the forecast period (2026-2034).

The cancers & other chronic diseases segment is expected to lead this market during the forecast period.

The increasing prevalence of womens diseases, new product launches, and the surging research and development initiatives for womens health devices are key factors driving the markets growth.

F. Hoffmann-La Roche Ltd. and Boston Scientific Corporation are the major players in this market.

North America dominated the market in terms of share in 2025.

The increasing demand for womens health devices, growing awareness of issues relating to female health, and various investment initiatives for developing advanced products are expected to drive the adoption of the products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us