Asia Pacific Architectural Window Films Market Size, Share & Industry Analysis, By Product Type (Sun Control Film, Decorative Film, Safety & Security Film, Privacy Film, and Others), By Application (Residential and Commercial), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

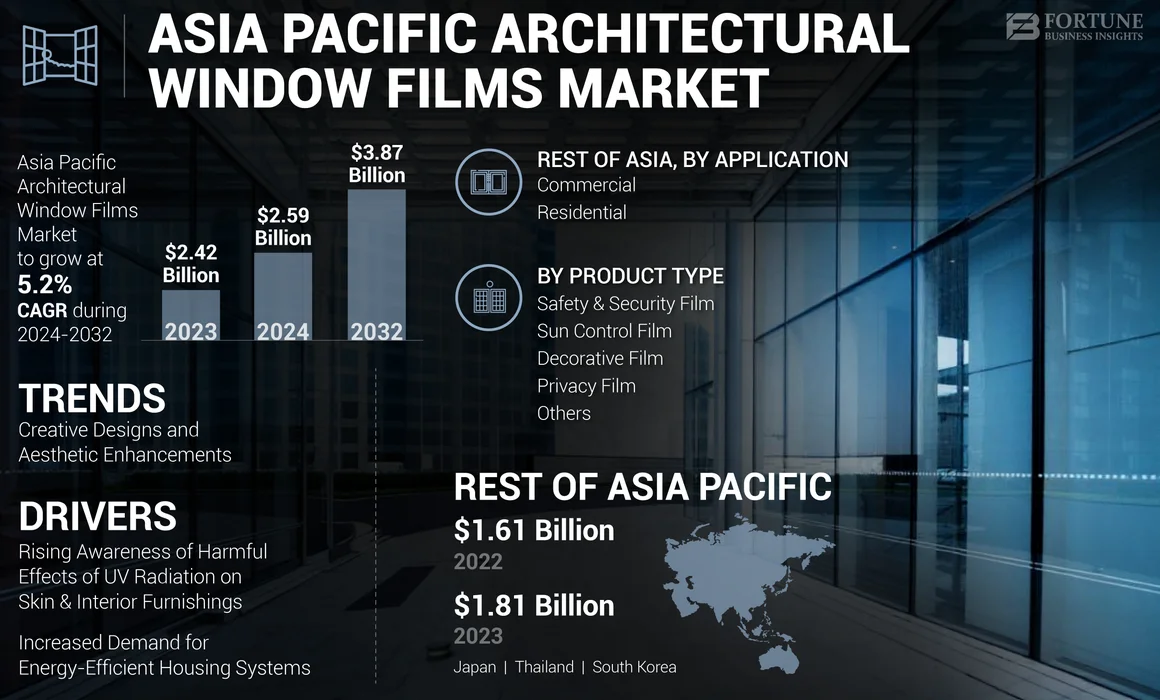

The Asia Pacific architectural window films market size was valued at USD 2.42 billion in 2023. The market is projected to grow from USD 2.59 billion in 2024 to USD 3.87 billion by 2032, exhibiting a CAGR of 5.2% during the forecast period. Toray Industries, Inc., FUJIFILM Holdings Corporation, 3M, Nitto Denko Corporation, and Sekisui Chemical Co., Ltd. are the key players operating in the market.

Architectural window films are a versatile solution designed to enhance the aesthetics and functionality of glass surfaces in commercial and residential spaces. The film can improve energy efficiency by reducing heat gain and glare while providing privacy and UV protection. The film is available in various designs and tinted options; it allows for the creative customization of interiors while maintaining transparency.

Market Dynamics

Market Drivers

Rising Awareness of the Harmful Effects of UV Radiation on Skin and Interior Furnishings is Driving the Market

Architectural window films are specialized materials applied to glass surfaces in residential and commercial spaces. They serve various purposes, including reducing heat and glare, enhancing privacy, and protecting against UV rays.

Prolonged exposure to UV radiation can lead to skin conditions such as sunburn, premature aging, and increased risks of skin cancer. Growing awareness of these risks has led individuals to seek protective measures. Moreover, UV radiation can fade and damage furniture, flooring, and artwork. This understanding has made homeowners and businesses more conscious of protecting their interior investments.

Health organizations and environmental groups have launched campaigns to increase public education about the dangers of UV exposure. Some regions are enforcing stricter building regulations regarding UV protection, further pushing demand for window films. A shift toward home safety and sustainability encourages the adoption of window films as a protective measure.

Most architectural films can block up to 99% of UV rays, safeguarding skin and interior spaces. These films can also reduce heat gain, leading to lower energy costs and improved comfort indoors. In addition, various films are available in different tints and shades, enhancing the visual appeal of buildings while providing privacy.

New film technologies, including self-cleaning options and more effective UV-blocking capabilities, are emerging. Increased commercial building projects focusing on energy efficiency and occupant safety drive the market growth. Homeowners are increasingly recognizing window films' benefits for aesthetic and protective measures. Thus, the architecture window films market is expected to grow, driven by innovations and a greater understanding of their benefits.

Increased Demand for Energy-Efficient Housing Systems is Expected to Drive Market Growth

The rising demand for energy-efficient housing systems is expected to drive market growth over the forecast period. Architectural window films help minimize energy consumption and fulfill the threshold of energy efficiency standards, resulting in efficient cooling and lowering the maintenance cost of buildings.

Moreover, the increasing adoption of energy-efficient housing systems to support the green building concept and the rising government initiative to construct green buildings will promote market growth. For Instance, energy-efficient windows can lower household energy bills by an average of 12%, while replacing single-pane windows can save between 1,006 to 6,205 pounds of CO2 annually per household. In addition, a typical household saves around USD 500 per year on utility bills due to improvements in appliance efficiency driven by federal standards and ENERGY STAR certification.

According to the World Green Building Council, green buildings contribute to decreasing negative environmental impacts by conserving water, energy, and natural resources, generating energy, and boosting biodiversity. Moreover, according to IEA, investment in energy efficiency reached a record high of USD 600 billion in 2022, spurred by government initiatives and the rising popularity of electric vehicles.

Hence, the growing industrialization & urbanization in developing countries, such as China and India, increasing innovation in green buildings, and rapid expansion of the construction industry will boost the demand for window films.

Market Restraints

High Initial Costs of Window Films to Hinder Market Growth

Architectural window films are increasingly recognized for their benefits, including energy efficiency, UV protection, glare reduction, and aesthetic enhancement. However, the market faces significant challenges, particularly due to the high initial costs associated with these films. The initial costs of window films can be steep due to several reasons, such as material quality, installation expenses, custom solutions, and market pricing.

The presence of alternative solutions, such as traditional window replacements or other energy-saving technologies, can further complicate the market dynamics. If these alternatives are perceived as more cost-effective, they may hinder potential customers from choosing window films. Many consumers may be reluctant to invest in window films due to the initial expense, despite the long-term savings on energy bills and enhanced comfort. This hesitance can slow down adoption rates, particularly in markets where awareness of the benefits is low.

For Instance, professional installation can add USD 3 to USD 8 per square foot. This cost varies based on the complexity of the installation, geographic location, and the number of windows being treated. For specialized films (e.g., security or anti-glare), installation costs can be even higher, reaching USD 10 to USD 20 per square foot. If old window films need to be removed before the new installation, this can incur additional costs ranging from USD 1 to USD 4 per square foot, depending on the difficulty of removal.

The high costs may lead to market segmentation, where only higher-end residential and commercial projects opt for architectural films. This could limit the overall market size and growth potential, as lower-income segments may remain underserved.

Download Free sample to learn more about this report.

Market Opportunities

Increasing Adoption of Switchable Smart Films to Create Growth Opportunities

Switchable smart films are gaining importance in the construction industry due to their capabilities, including energy conservation, thermal insulation, reducing glare, and aesthetic appeal.

Furthermore, switchable smart films allow consumers to convert conventional glass into smart glass by installing the films on it. They also transform existing glass windows, acrylic screens, partitions, plexiglass, or other transparent surfaces into instant switchable privacy. Moreover, the growing demand for smart films in commercial offices to conduct meetings while maintaining privacy and offering personal spaces will promote the Asia Pacific architectural window films market growth.

For Instance, according to an article in the Royal Society of Chemistry, Thermochromic materials are crucial in developing smart windows. These windows can significantly enhance energy efficiency in buildings by modulating light transmittance based on temperature changes. These materials undergo a reversible phase transition, allowing them to switch between transparent and opaque states, thereby controlling solar radiation and improving indoor comfort.

Market Challenges

Limited Consumer Awareness to act as Challenge for Market Growth

The limited consumer awareness about window films presents a significant challenge for market growth. Despite the numerous benefits of these films, such as energy efficiency, UV protection, and enhanced privacy, many potential customers remain uninformed about their functionalities and advantages.

Comprehensive educational efforts are necessary to inform consumers about window film installations' long-term benefits and cost savings. Without effective marketing strategies to build awareness, the market may struggle to reach its full potential. The limited awareness not only restricts immediate consumer interest but also affects the overall growth trajectory of the window film market. As noted, even in developing markets, there is often little or no knowledge about the benefits of these films, which can act as a drag on growth.

Thus, addressing the challenge of limited consumer awareness is crucial for maximizing the demand for window films. The industry can unlock significant growth potential by implementing strategic marketing initiatives and focusing on education.

Asia Pacific Architectural Window Films Market Trends

Creative Designs and Aesthetic Enhancements to Create a New Market Trend

Decorative window films are increasingly popular for their ability to enhance the aesthetics and functionality of spaces. These films offer various styles, textures, and applications that can transform ordinary glass into stunning focal points while providing privacy, light control, and decorative appeal.

Compared to traditional glass treatments, such as etched or stained glass, decorative films are an affordable alternative that provides similar visual benefits without the high cost. In addition, most decorative window films are easy to apply and can be done as a DIY project with minimal tools required. They can also be removed without damaging the underlying glass.

Decorative window films offer endless designs, from minimalist stripes to intricate patterns, allowing for extensive personalization options that cater to diverse tastes and styles. They serve as an innovative way to enhance the aesthetic appeal of any space while offering practical benefits, such as privacy and light control. With a wide range of styles available—from frosted and stained-glass effects to geometric patterns—these films provide endless opportunities for creativity in residential and commercial environments.

Impact of COVID-19

The COVID-19 pandemic led to widespread halts in residential and commercial construction projects across Asia. Lockdowns and restrictions resulted in a notable decrease in demand for window films as many projects were postponed or canceled.

As restrictions ease and construction activities pick up, the architectural window film market is anticipated to rebound. The increasing focus on energy efficiency and sustainability will likely drive demand for window films that offer UV protection and energy conservation benefits.

Segmentation Analysis

By Product Type

Sun Control Film Segment Held Largest Market Share Due to Energy-Saving Capabilities

Based on product type, the market is segmented into sun control film, decorative film, safety & security film, privacy film, and others. The sun or solar control films segment held a major Asia Pacific architectural window films market share in 2023 and is anticipated to dominate due to effectively reduced heat transfer from outside, lowering cooling costs and energy consumption in buildings. This is particularly beneficial in countries with high temperatures with significant air conditioning use.

Decorative film is an innovative solution that enhances privacy and aesthetics while allowing natural light to filter through. Available in a variety of designs, colors, and patterns, it can transform the appearance of windows, making them a focal point in any room. This film is easy to install and can be removed without damaging the glass, making it a versatile and cost-effective option for traditional window treatments.

Safety and security films are transparent layers applied to glass surfaces, enhancing their strength and shatter resistance. Designed to protect against accidental breakage, theft, and natural disasters, these films provide an added layer of safety for residential and commercial properties. They can deter intruders by making breaking the glass more difficult while reducing the risk of injury from shattered shards.

By Application

Commercial Segment to Hold Major Share Due to Rise in Product Demand from Corporate Houses

Based on application, the market is segmented into residential and commercial. In 2023, the commercial segment accounted for the highest market share and may continue its dominance during the foreseeable period. Commercial films are essential for businesses looking to optimize their building's performance and aesthetics. These films are particularly valuable in commercial settings, where large glass surfaces can lead to excessive heat gain and glare, affecting team member comfort and productivity. By applying high-performance window films, businesses can dramatically reduce solar heat gain, leading to a more consistent and pleasant climate within the workspace.

Residential window films are specially engineered coatings designed to be applied to residential windows for various beneficial purposes. These films enhance energy efficiency by reflecting heat and blocking harmful UV rays. This can lead to a more comfortable indoor environment, reducing reliance on air conditioning in warmer months and lowering energy bills. Furthermore, safety and security are key advantages of residential window films. These films can hold shattered glass in place during break-ins or extreme weather conditions, protecting occupants from potential injuries. Additionally, many films offer a warranty period that provides homeowners peace of mind, knowing they are investing in a durable product.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific Architectural Window Films Market Country Outlook

The Rest of Asia Pacific accounted for the leading market share in 2023, valued at USD 1.81 billion. The rest of Asia Pacific includes China, India, Malaysia, Indonesia, and other major markets. Rapid industrial growth and investments in infrastructure in these countries are significantly driving the demand for architectural films. Major companies, such as Saint-Gobain & 3M, have boosted their production capabilities by focusing on residential and commercial applications.

The construction industry in China is a vital sector, contributing significantly to the nation's economy and reflecting its rapid urbanization and infrastructure development. As part of the government's 14th Five-Year Plan, this sector is expected to benefit from increased domestic tourism and retail activity.

To know how our report can help streamline your business, Speak to Analyst

Rapid industrialization, increasing infrastructure development, residential and commercial real estate expansion, and construction of bridge tunnels and subways are the major factors in Japan's booming construction industry. This results in increased adoption of smart switchable films and sun-control films.

Pharmaceuticals, construction and engineering, chemicals and petrochemicals, and construction and engineering are the leading industries in Thailand. Expanding these industries will fuel the growth of the commercial segment and increase the demand for window films. Moreover, the increasingly worse summer weather conditions fuel the demand for aesthetic buildings, which would help with heat protection. This increases the utilization of sun-control films in Thailand.

For Instance, The Thai government is set to approve a new energy-saving program targeting public sector agencies, aiming for a savings of 585 million kilowatt-hours annually. This initiative will utilize an Energy Service Company (ESCO) model to facilitate the installation of solar panels and other energy-saving measures through long-term contracts with government entities.

The housing market in South Korea is continuing to strengthen, aided by lower interest rates. In recent years, foreigners have been buying more houses in South Korea despite the country's reputation for being difficult to manage. The housing market is exceptional, with large key money deposits and extensive government intervention. This increases the demand for decorative and sun-control films in the residential sector.

For Instance, South Korean researchers have developed advanced smart window films that can adjust transparency through mechanical pressure. This technology allows windows to switch from transparent to opaque quickly, significantly advancing energy-efficient building materials. The research by Korea University and KAIST teams aims to enhance indoor temperature control and reduce energy consumption in buildings.

Competitive Landscape

Key Industry Players

Companies are Focusing on Strategic Partnerships and Acquisitions to Strengthen their Market Reach

Key players operating in the architectural window films market are Toray Industries, Inc., FUJIFILM Holdings Corporation, 3M, Nitto Denko Corporation, and Sekisui Chemical Co., Ltd. Most of the key producers are focusing on acquisitions, new product launches, and strategic partnerships to enhance their product portfolios, broaden their market reach, and gain a competitive edge over other key participants.

Key Players in the Asia Pacific Architectural Window Films Market

To know how our report can help streamline your business, Speak to Analyst

The largest players operating in the market are Toray Industries, Inc., FUJIFILM Holdings Corporation, 3M, Nitto Denko Corporation, and Sekisui Chemical Co., Ltd. The market is fragmented, with the top five players accounting for around 45% of the market share.

LIST OF KEY ASIA PACIFIC ARCHITECTURAL WINDOW FILM COMPANIES PROFILED:

- Nitto Denko Corporation (Japan)

- Konica Minolta, Inc. (Japan)

- Toray Industries, Inc. (Japan)

- Saint-Gobain (France)

- LINTEC Corporation (Japan)

- 3M (U.S)

- FUJIFILM Holdings Corporation (Japan)

- Avery Dennison Corporation (U.S)

- Sekisui Chemical Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS

- October 2024 – Avery Dennison Graphics Solutions launched SkyWay Bird Film, designed to significantly minimize bird collisions with windows, protect wildlife, and comply with building regulations.

- October 2024 - Sekisui Chemical Co., Ltd. decided to increase the price of S-LEC PVB interlayer film for laminated glass. This price adjustment applies to all types of S-LEC films in all countries, with a revision ratio of 6-15%.

- September 2024 - Avery Dennison launched its new Auravate Decorative Window Film Series, offering an economical retrofit option to upgrade current glass windows, doors, showers, partitions, and additional surfaces. The films in the Auravate Series are designed for both residential and commercial use.

- April 2022 -Avery Dennison launched all-new dusted crystal decorative architectural window film. The film has a unique, first-to-market wet-apply quick-release adhesive that allows it to be adjusted during installation and readily removed after drying, leaving almost little trace on the glass. This launch will help the company to serve its products in schools, corporate meeting spaces, hospitality reception areas, medical offices, and glass partitions applications.

- November 2020 – Konica Minolta, Inc. announced the opening of the Innovation Garden OSAKA Center at its R&D facility near Takatsuki Station. This center will leverage imaging IoT/AI and high-speed processing technologies to drive business creation and technology development in the Kansai area.

REPORT COVERAGE

The market research report provides detailed market analysis and focuses on crucial aspects, such as leading companies, materials, products, and applications. In addition, it offers insights into building window film market trends and highlights vital industry developments. It includes historical data & forecasts revenue growth at regional and country levels and analyzes the industry's latest market dynamics and opportunities. In addition to the factors mentioned above, the report encompasses various factors contributing to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.2% from 2024 to 2032 |

|

Unit |

Value (USD Billion) and Volume (Million Square Feet) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the Asia Pacific market size was valued at USD 2.42 billion in 2023 and is projected to reach USD 3.87 billion by 2032.

Growing at a CAGR of 5.2%, the market will exhibit considerable growth over the forecast period.

The commercial segment was the leading application in the market in 2023.

Rising awareness of the harmful effects of UV radiation to drive market growth.

The key trend in the market includes creative designs and aesthetic enhancements.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us