Asia Pacific Food Service Market Size, Share & Industry Analysis, By Type (Full Service Restaurants, Quick Service Restaurants, Institutes, and Others), By Service Type (Dine-In, Takeout, and Delivery), By Restaurant Type (Chained and Independent), and Regional Forecast, 2025-2034

KEY MARKET INSIGHTS

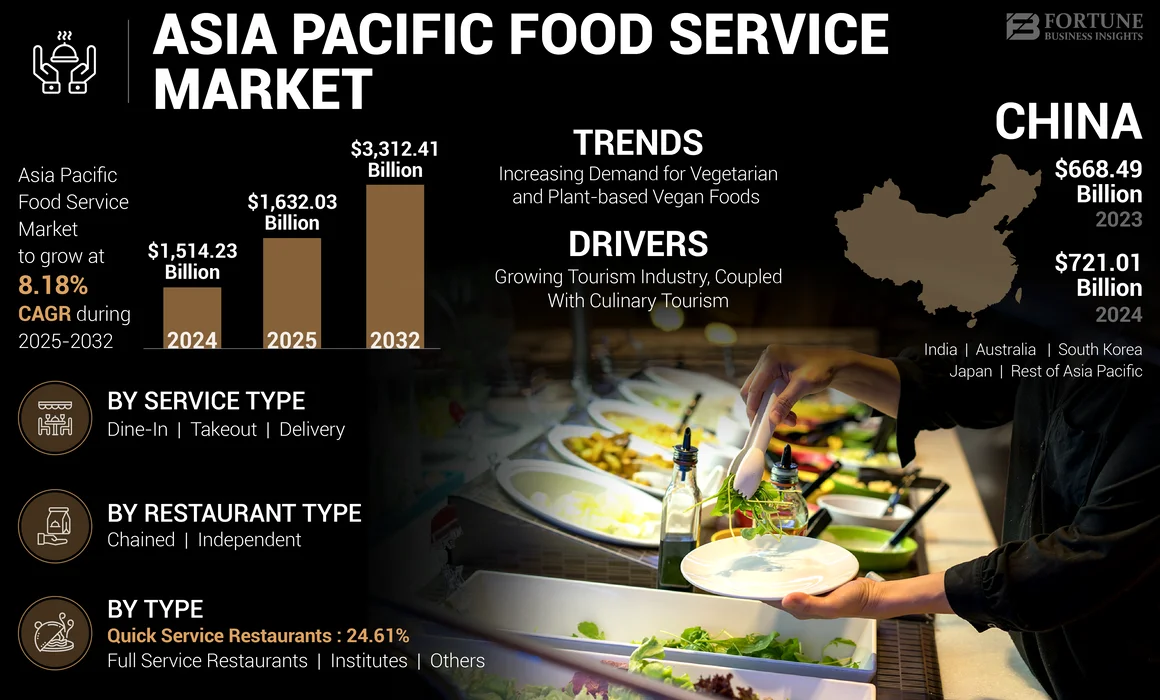

The Asia Pacific food service market size was valued at USD 1,514.23 billion in 2024. The market is projected to grow from USD 1,632.03 billion in 2025 to USD 3,312.41 billion by 2034, exhibiting a CAGR of 8.18% during the forecast period.

The restaurant industry encompasses businesses that prepare, distribute, and serve food and beverages to customers, representing the last step in the food supply chain. It includes a variety of establishments, such as full-service restaurants, quick-service restaurants, and other outlets that serve meals and snacks for immediate consumption. These establishments can offer options, including self-service, full-service, take-away, and online delivery.

The market is experiencing significant growth driven by factors, such as rapid urbanization, increasing disposable incomes, and evolving consumer preferences for convenience and diverse dining options. The key players operating in the market include Starbucks Corporation, McDonald’s Corporation, Yum Brands, Restaurants Brands International, and Domino’s Pizza.

Asia Pacific Food Service Market Overview

Market Size & Forecast:

- 2024 Market Size: USD 1,514.23 billion

- 2025 Market Size: USD 1,632.03 billion

- 2034 Forecast Market Size: USD 3,312.41 billion

- CAGR: 8.18% from 2025–2034

Market Share:

- Asia Pacific dominates the global food service market, driven by rapid urbanization, increasing disposable incomes, and evolving consumer preferences for convenience and diverse dining options. The full-service restaurant segment held the largest market share in 2024, supported by rising consumer spending on quality dining experiences.

- By service type, the dine-in segment led the market, benefiting from cultural preferences in Asia where dining is seen as a social activity. Independent restaurants dominated the market by restaurant type due to their strong local connections, innovative offerings, and agility in meeting evolving consumer demands.

Key Country Highlights:

- China: Leads the Asia Pacific food service market with strong economic growth, increasing middle-class income, and widespread digital adoption. Restaurants in China rapidly shifted to online platforms, recording a 22% revenue increase via digital channels from 2021 to 2022.

- India: Fastest-growing country in the region, fueled by infrastructure growth, urbanization, and a tech-savvy young population embracing online food delivery platforms. Quick-service and casual dining restaurants are expanding rapidly across tier 1, 2, and 3 cities.

Market Dynamics

Market Drivers

Growing Tourism Industry and Culinary Tourism, Boosts Restaurants Market Expansion in Asia Pacific

The augmenting tourism industry is significantly boosting the Asia Pacific food service market share, particularly through the rise of culinary tourism in the region. This factor is characterized by an increasing number of travelers who seek authentic local dining experiences, which in turn drives demand for food-related services. According to the World Food Travel Association, about 34% of tourists choose destinations based on their culinary offerings. This indicates that authentic food is becoming a primary motivator for travel, as visitors seek to understand local cultures through their culinary traditions in Asia Pacific.

Increased Spending on Food Consumption Out of Home to Drive Market Growth

Household income growth and the rise of dual-income homes in developing economies are the major factors attracting consumers to consume food outdoors. With the increasing number of working women in employment, families frequently visit restaurants or order food options from outside. This factor helps increase the revenue of dine-in establishments, thus contributing positively to the market's growth.

The rapid expansion of varied-format restaurants outlets is gaining popularity across major emerging markets globally, while franchising remains one of the most popular models. With the majority of the millennial population leaning toward fast food consumption, their spending on quick service restaurants is increasing as compared to traditional family restaurants.

Market Restraints

Poor Supply Chain Management and High Cost of Raw Materials Hinder Market Growth

The Asia Pacific food service sector is heavily reliant on a complex supply chain that includes farmers, distributors, and logistics providers. Disruptions caused by climate change, natural disasters, or geopolitical tensions can lead to price volatility, shortages, and inconsistencies in food quality. Additionally, there is increasing pressure to adopt sustainable practices throughout the supply chain, which complicates operations as businesses strive to balance cost-effectiveness with environmental responsibility. Moreover, the availability and pricing of vital raw materials such as meat, dairy, and grains are subject to fluctuations due to various factors, including climate change and geopolitical tensions. This volatility can severely impact the profitability of restaurants businesses, making it difficult for them to maintain stable pricing for consumers.

Market Opportunities

Digitalization of Business Processes and Technological Advancements Provides Huge Opportunities for Market Growth

The Asia Pacific food service market growth is significantly influenced by the digital transformation of business processes, which is reshaping the industry landscape. The COVID-19 pandemic accelerated the shift toward digitalization as consumers increasingly favored online ordering and delivery services. This trend has led restaurant businesses to enhance their online presence and boost their direct-to-consumer sales channels. According to the U.S. Department of Agriculture (USDA), the pandemic accelerated the growth of China’s delivery service, as dining in restaurants was prohibited in many cities. Moreover, the rise of mobile apps for ordering and payment has also revolutionized the dining experience. Consumers increasingly prefer convenience, leading to a surge in online food delivery services and cloud kitchens.

Market Challenges

Labor Scarcity to Pose Challenge for Market Growth

A critical issue faced by the market is labor scarcity. Many businesses face difficulties in hiring sufficient staff, particularly full-time employees. For instance, surveys indicate that over half of Japanese companies are struggling to fill positions in the hospitality sector. This shortage not only affects service quality but also increases operational costs as businesses may need to offer higher wages or incentives to attract workers.

Asia Pacific Food Service Market Trends

Increasing Demand for Vegetarian and Plant-based Vegan Foods

Veganism is a new food trend that is growing intensely across the globe. Vegans avoid eating dairy products, eggs, or any other animal-derived ingredients. The term flex is often used to describe people who still consume meat and dairy products but want to reduce their consumption. Economic growth in the Asia Pacific region has resulted in higher disposable incomes. As consumers have more financial resources, they are willing to spend on premium food products, including vegan options. This trend is particularly evident in urban areas where incomes are rising rapidly. Growing concerns about environmental sustainability are prompting consumers to reduce their meat consumption and opt for plant-based alternatives. Awareness of the environmental impact of animal agriculture, including greenhouse gas emissions, has led to a preference for vegan diets among environmentally conscious consumers.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic profoundly affected the restaurant industry across the Asia Pacific region, leading to significant disruptions, shifts in consumer behavior, and accelerated technological adoption. At the beginning of the pandemic, stringent lockdown measures were implemented across Asia Pacific countries. These included the closure of restaurants, shopping malls, and entertainment venues, which directly impacted restaurant operations. Many establishments faced substantial revenue losses due to reduced foot traffic and mandatory closures. For instance, in China, nearly half of Haagen-Dazs ice cream stores were temporarily shut down during the initial months of 2020. The crisis accelerated the adoption of digital technologies within the restaurant sector. Operators increasingly turned to contactless dining options and virtual kitchens to meet changing consumer restaurants demands while ensuring safety.

Segmentation Analysis

By Type

Growing Consumers' Spending on Quality Dining Boosted Full Service Restaurant Segment Expansion

Based on type, the market has been segmented into full service restaurants, quick service restaurants, institutes, and others. The full service restaurants segment dominated the market in 2024. Consumers in the Asia Pacific region are increasingly seeking comprehensive dining experiences that offer meals, ambiance, and other related services. FSRs provide a sit-down meal with table service, appealing to those seeking a more relaxed dining atmosphere. As disposable incomes increase across the region, consumers are willing to spend more on quality dining experiences. This economic growth supports the expansion of FSRs, particularly in markets such as China, where middle-class income is expanding rapidly.

The quick service restaurants segment is expected to grow significantly in the forecast period. International QSR chains such as McDonald's, KFC, and Domino's have established a strong presence in the Asia Pacific market through aggressive expansion strategies, including franchising and local partnerships. Their brand recognition contributes significantly to consumer trust and preference, further solidifying their market position in the region.

The institute types include the canteens and catering services available at institute levels, such as hospitals, schools, colleges, and movie theatres. This food consumption is a new trend compared to traditional full-service and fast-food restaurants.

To know how our report can help streamline your business, Speak to Analyst

By Service Type

Rising Emphasis on Community and Hospitality Fuels Dine-In Segment Growth

Based on service type, the market has been segmented into dine-in, takeout, and delivery. The dine-in segment dominates the market. In many Asian cultures, dining is not only about food; it is a social activity that emphasizes community and hospitality. Dine-in restaurants provide an experience that fosters social interactions among family, friends, and colleagues. This cultural aspect contributes to the sustained prominence of dine-in options despite the rise of delivery services.

The takeout segment is expected to grow significantly over the forecast period. The proliferation of smartphone usage and internet connectivity has made online ordering more accessible. Consumers are increasingly using mobile apps and digital platforms to order food, which enhances convenience and boosts the takeout segment's growth.

There is a notable shift toward convenience foods and meal delivery services as part of modern lifestyles. The preference for ready-to-eat meals and meal kit delivery services are indicative of changing consumer demands.

By Restaurant Type

Surging Demand for Innovative and Creative Dishes Propels Independent Segment Growth

In terms of restaurant type, the market has been segmented into chained and independent. The independent segment dominates the market. Independent restaurants often foster a strong connection with their local communities. They cater to unique tastes and preferences, which helps build customer loyalty and repeat business. This close relationship enables them to adapt quickly to changing consumer demands, making them more agile compared to larger chains.

Independent establishments are frequently viewed as trendsetters in the restaurant industry as they offer innovative and creative dishes that are not typically found in chain restaurants, attracting food enthusiasts seeking distinctive dining experiences. This uniqueness is a significant driver for consumers looking for something beyond standard fare.

The chained segment is expected to grow significantly during the forecast period. Chained restaurants benefit from standardized menus and operational processes, ensuring consistent quality across multiple locations. This uniformity is appealing to consumers who expect the same experience regardless of which outlet they visit. Chained restaurants can leverage economies of scale in purchasing, marketing, and distribution, allowing them to offer competitive pricing while maintaining profitability. This advantage is particularly significant in a price-sensitive market such as Asia Pacific.

Asia Pacific Food Service Market Country Outlook

China

China dominates the Asia Pacific food service market due to its large population, strong economic growth, and rich culinary traditions. Its rapidly increasing middle-class income and urbanization have fostered a thriving dining-out culture, boosting demand for diverse restaurant options. Continuous innovation in dining experiences, along with the adoption of technology-driven solutions, has further propelled China's restaurants market. The presence of a well-established and robust distribution channel helped the companies to recover quickly from the pandemic. Food service industries are rapidly adopting digitization strategies to improve their services and introduce applications so that consumers can easily place their order online. This helps them to boost the use of online platforms to place orders for meals in these restaurants. According to the United States Department of Agriculture (USDA), several restaurants in China effectively shifted their in-person sales to online sales, with restaurants collectively experiencing a 22% rise in revenue via online platforms from 2021 to 2022.

India

India is the fastest-growing region in the Asia Pacific food service market. India's economy has witnessed significant growth in the past few years. Rapid infrastructure growth and urbanization have led to the instant growth of the country's organized restaurants sector. There is a growing number of tech-savvy young consumers who are increasingly dining out or ordering food items through online food ordering applications. The different restaurant formats cater to different segments of consumers in the country. For instance, casual dining restaurants mainly target consumers who reside in tier 1 and tier 2 cities. Additionally, quick-service restaurants mainly target consumers who reside in tier 1, tier 2, and tier 3 cities.

Competitive Landscape

Key Market Players

The Asia Pacific food service market is highly fragmented and competitive, with large food service companies and small players competing against each other to expand their market share. Some of the major players in the food service industry include McDonald’s Corporation, Haidilao International Holding Ltd., Yum! Brands, Inc., Luckin Coffee Inc., and Starbucks Limited.

Yum! Brands, Inc. is the global leader in food categories, and its operating brands include KFC, Pizza Hut, and Taco Bell. The company has opened 54,000 restaurants worldwide, and they operate in around 155 countries worldwide. Brands such as KFC and Pizza Hut have a long and rich history of developing a wide assortment of pizza and chicken items and have been successful in expanding their presence in other countries.

Starbucks Corporation is another well-known and popular coffee and beverage-producing company in the world. It has established a 5,000-store milestone across Asia Pacific. The brand is popular in the market due to its unique ambiance and consumer experience.

McDonald’s Corporation is also one of the largest fast-food restaurants in the world. It is strongly focused on providing high-quality customer service and adopts strong marketing campaigns and promotional events to attract customers. The company makes use of factory-line assembly design in its commercial kitchens to prepare its products and deliver them quickly to consumers.

List of Key Asia Pacific Food Service Companies Profiled

- Cj Freshway Corporation (South Korea)

- Dunkin (Inspire Brands) (U.S.)

- Haidilao International Holding Ltd. (China)

- Luckin Coffee Inc. (China)

- McDonald’s Corporation (U.S.)

- Papa John's International, Inc. (U.S.)

- Restaurant Brands International Inc. (Canada)

- Starbucks Corporation (U.S.)

- Subway IP LLC (U.S.)

- Yum! Brands, Inc. (U.S.)

Key Industry Developments

- January 2025 – Domino's Pizza expanded its presence in Mainland China by opening 14 new stores across 13 cities during the holiday season, specifically targeting the Christmas and New Year period. This expansion is part of DPC Dash Ltd.'s strategy to enhance its footprint in the fast-growing Chinese market.

- December 2024 – McDonald's Japan unveiled its first-ever collaboration with the iconic anime series Neon Genesis Evangelion. The collaboration includes three transforming toys that morph from classic McDonald's items (such as burgers and fries).

- November 2024 – Starbucks opened a unique café in South Korea, offering patrons a view of North Korea from the Aegibong Peace Ecopark in Gimpo City. The new 30-seat coffee shop is strategically located atop an observation tower near the Demilitarized Zone (DMZ), approximately 20 miles north of Seoul.

- January 2024 – Sodexo, a French food services and facilities management company, strengthened its position in the food services market in Mainland China by completing the acquisition of the Compass Group's business in the region.

- October 2022 – Xiao Chi Jie (XCJ), a direct-to-consumer Chinese food brand, successfully raised USD 10 million in a Series A funding round led by Imaginary Ventures. This funding will support the company's expansion and enhance its product offerings, which include frozen soup dumplings, Chinese barbecue skewers, and noodle kits.

Report Coverage

The Asia Pacific food service market research report analyzes the market insights and market in-depth. It highlights crucial aspects such as prominent companies, the food service market segmentation, and the competitive landscape. Besides this, it provides insights into the market outlook demand and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2021-2023 |

|

Growth Rate |

CAGR of 8.18% from 2025 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Service Type

By Restaurant Type

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the market size was valued at USD 1,514.23 billion in 2024 and is anticipated to record a valuation of USD 3,312.41 billion by 2034.

Fortune Business Insights says that the market value will be at USD 1,632.03 billion in 2025.

The market is projected to grow at a significant CAGR of 8.18% during the forecast period of 2025-2034.

By type, the full service restaurants segment is predicted to dominate the market during the forecast period of 2025-2034.

The growing tourism industry, coupled with culinary tourism, is likely to drive the demand in the market.

McDonald’s Corporation, Yum Brands, Starbucks Corporation, and others are some of the leading players in the region.

China dominated the regional market in 2024.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us