Australia Wind Turbine Operation and Maintenance Market Size, Share & Industry Analysis, By Type (Scheduled and Unscheduled), By Location (Onshore and Offshore), and Country Forecast, 2025-2032

Australia Wind Turbine Operation and Maintenance Market Size

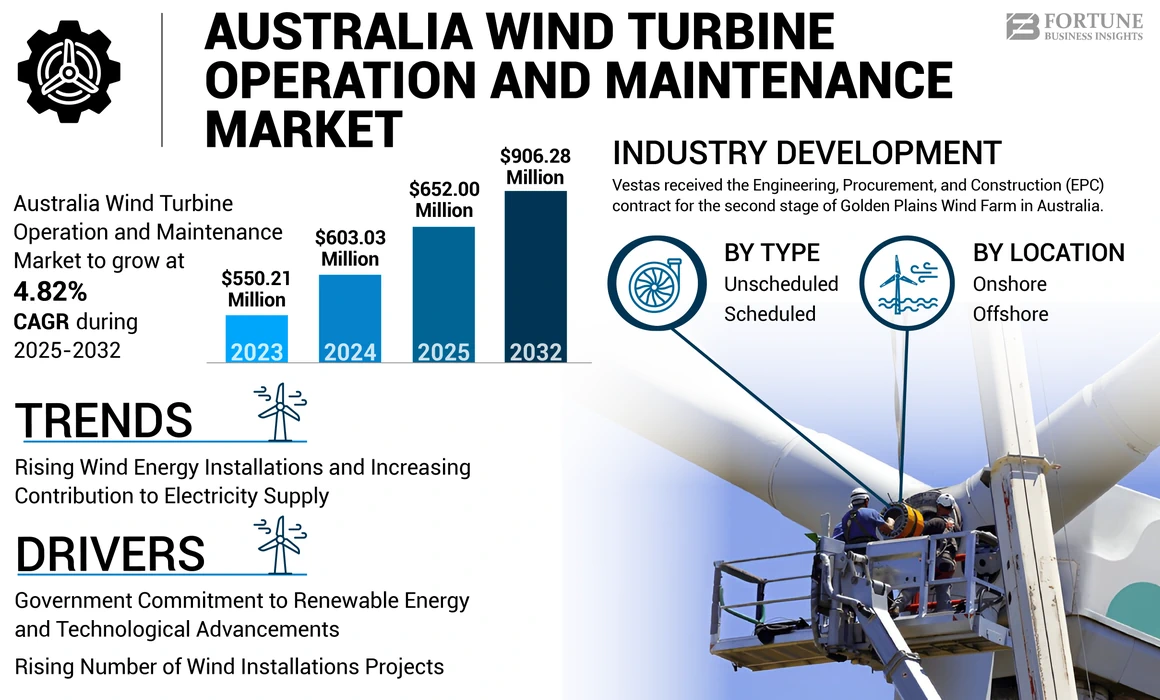

The Australia wind turbine operation and maintenance market size was valued at USD 603.03 million in 2024. The market is projected to grow from USD 652.00 million in 2025 to USD 906.28 million by 2032, exhibiting a CAGR of 4.82% during the forecast period.

Wind turbine operation and maintenance processes are pivotal to keeping wind farms in working condition. To avoid failure, several components, blades, generators, and gearboxes require regular condition monitoring. Without proper maintenance, there is a risk of failure that can affect productivity. Increasing investments in wind energy as an alternative energy resource will positively influence the market in the coming years.

Australia currently lacks offshore wind energy, however the Offshore Wind Turbine Board is taking initiatives to change this. The first official offshore wind zone is in Victoria's Gipps continent, with plans to install up to 200 wind turbines, the closest being 7 kilometers from the sea. The project would be one of the major wind farms in the world, with construction potentially beginning in 2025. Furthermore, wind was Australia's leading source of clean energy in 2023, contributing 39.4% of share in the country's clean energy and 13.4% of Australia's total electricity.

The wind turbine operation and maintenance service providers faced problems such as staff reductions during the COVID-19 pandemic. Wind farm operators prioritized staff assignments such as turbine blade operations and repairs. In addition, repairs that required in-person interactions were postponed to comply with social distancing guidelines and minimize the risk of spreading COVID-19.

The outbreak of COVID-19 occurred when the execution of wind farm projects in the country was at its peak. Australia has an ambitious target of achieving 174 GW of wind energy. In this context, Forest Wind, one of Australia's most significant wind projects with a planned capacity of 1.2 GW, has been delayed by 15 months due to COVID-19 pandemic. Initially, Forest Wind's installation was scheduled to begin in 2021, but the timeline were pushed back to the second half of 2023, and construction is likely to stop with new updates in 2024.

Australia Wind Turbine Operation and Maintenance Market Trends

Rising Wind Energy Installations and Increasing Contribution to Electricity Supply

Wind turbine power is Australia's single most important renewable energy source, which contributed 13.4% of the electricity supply in 2023 and 39.4% of the total renewable energy supply. The combined capacity of large and small-scale renewable energy projects reached from 5 GW in 2022 to 5.9 GW in 2023. In 2023, the new wind energy installation totaled 942 MW from seven commissioned wind farms. Wind power alone accounted for 33.9% of energy generation in the country, making it the highest among renewable energy sources in Australia.

Wind energy technology in the country accounts for 33.2% of renewable energy generation and 13.2% of electricity production. The rise in wind energy's contribution to electricity generation will drive market growth. Furthermore, renewable energy development is likely to boost the wind energy sector and, consequently, the wind turbine operation and maintenance market.

Download Free sample to learn more about this report.

Australia Wind Turbine Operation and Maintenance Market Growth Factors

Government Commitment to Renewable Energy and Technological Advancements to Stimulate Market Expansion

Australia has a wide range of wind resources, mainly situated in Bass Strait in the southern part of the country. Winds in the North of Australia are generated through trade winds and monsoon wind systems. Wind conditions along the country's coastline are becoming ideal sites for installing wind turbines, making the future of Australia's wind industry promising. As technology advances, wind power becomes even more efficient and cost-effective. In addition, the Australian government's commitment to increasing renewable energy capacity provides a robust policy framework to support the Australia wind turbine operation and maintenance market growth.

Wind power will play an important role as the country attempts to reduce its carbon footprint and move toward a sustainable energy future. With continued investment and innovation, Australia's wind industry will significantly contribute to the country's clean energy goals in the coming years, creating a more sustainable future.

For instance, Hornsdale is a 316.8 MW onshore wind power project located in South Australia. The project is presently active and has been developed in multiple phases. The project was commissioned in July 2016 and is developed by Megawatt Capital Investments and Neoen. Moreover, the project generates 1,050,000 MWh of electricity annually and supplies enough clean energy to power 180,000 households, offsetting 1,250,000 tons of carbon dioxide (CO2) emissions each year. The project cost was estimated at USD 660 million.

Rising Number of Wind Installations Projects across the Country to Aid Market Expansion

Australia has many new wind installation projects planned for next year. Projects such as Dulacca Wind Farms, Queensland, Golden Plains Wind Farms, and Rokewood, are among the largest in the country. Golden Plains will be Australia's largest wind farm to date when commissioning begins in the last quarter of 2024. The wind farm is anticipated to produce electricity for more than 750,000 homes and has a projected energy production capacity of 1,330 MW. Furthermore, the Dulacca wind farm is presently under construction and will be completed by 2024. The project is designed to operate effectively, utilizing less than 2% of the total surface area for its current land use, with a projected energy production capacity of 180 MW.

In addition, according to the Clean Energy Council, six wind farms were commissioned in 2022, adding 5 GW of innovative generation capacity, marking the largest increase in the history of the Australian wind industry. By the end of 2022, 26 wind farms with a more than 9 GW capacity were under construction or operational nationwide, highlighting a robust expansion in both energy production and the wind turbine O&M market.

RESTRAINING FACTORS

Increasing Role of Technology in Wind Energy Might Reduce Operational & Maintenance (O&M) Cost

Wind farm owners are seeking innovative methods and techniques to reduce operating and maintenance costs, resulting in greater profitability for longer wind turbine operations. Essentially, the industry is seeking data analysis, automation, Artificial Intelligence (AI), and smart technology to ensure the effective wind turbine operation and maintenance with minimal human intervention.

Key future trends in wind turbine O&M include the use of drone technology, automation, and artificial intelligence. Currently, O&M is performed manually in both onshore and offshore wind turbines. Logistics and supply chain aspects represent a significant portion of O&M costs, prompting investment in robotics, aerial and underwater surveillance drones, and artificial intelligence development to improve power generation efficiency, reduce cost, ensure timely maintenance, and prolong turbine lifespan. According to a study conducted by the world's leading wind energy experts at Lawrence Berkeley National Laboratory, technological and commercial developments will further reduce the cost of wind energy. Experts expect costs to drop from 17% to 35% by 2035 and from 37% to 49% by 2050 due to more extensive and well-organized wind farms, lower capital and operating costs, and other advances. Therefore, technological development holds significant potential for boosting operational efficiency and reducing wind turbine operation and maintenance costs

Australia Wind Turbine Operation and Maintenance Market Segmentation Analysis

By Type Analysis

Unscheduled Segment to Lead Backed by Growing Number of Unexpected Events

Based on type, the market is segmented into scheduled and unscheduled.

The unscheduled type dominates the segment and held the largest Australia wind turbine operation and maintenance market share in 2024. Unscheduled maintenance implies unplanned failures of a wind turbine, and unplanned failures lead to lost sales. The consequences and costs of managing component failures can quickly add up. Failures of wind turbine components can lead to unscheduled downtime, meaning higher maintenance and repair costs for the operator, potentially voiding the manufacturer's warranty, production, inability to meet peak electricity demand, and loss of income. Additionally, any repair or replacement of large parts often requires expensive rental of cranes and other equipment. With higher maintenance cost adding to total capital expenditure increases the market size drastically. This results in an increased market share for unscheduled wind turbine operation and maintenance.

In January 2024, after the unscheduled maintenance work done in the onshore wind turbine project in New South Wales, GE Vernova signed an agreement with an Australian company, Squadron, for turbine supply to the site. Further, GE signed a deal to supply turbines for Squadron’s next two projects, the 400-MW Jeremiah wind farm and 700-MW Spicers Creek in New South Wales.

Scheduled maintenance in the Australia wind turbine operation and maintenance market refers to planned and regular maintenance activities performed on wind turbines to ensure their proper functioning and prolong lifespan. Scheduled maintenance includes repairs upstream of the tower and refurbishment downstream of the tower, which helps to reduce the total cost of energy production and extend the life of the wind turbine. In general, preventative maintenance should be performed two or three times a year. With the planned outline, scheduled wind turbine operation and maintenance type is growing steadily in the market.

To know how our report can help streamline your business, Speak to Analyst

By Location Analysis

Onshore Segment Holds Complete Share Due to No Offshore Wind Farms in Australia

Based on location, the market is segmented into onshore and offshore, where onshore dominates the market in Australia. Many new projects in onshore locations are under construction in the country. Australia as a whole is well-equipped to generate onshore wind energy, particularly in Western Australia, Southern Australia, Western Victoria, Northern Tasmania, and the New South Wales and Queensland highlands. According to the Global Wind Energy Council (GWEC), it has contributed 31.8 thousand gigawatt hours of electricity nationwide by 2023. Australia's geographical diversity and extensive coastline make it an ideal location for onshore wind energy generation. Victoria and South Australia have been pioneers in this field, generating around 11.8 thousand and 6.3 thousand gigawatt hours of electricity from wind energy respectively.

For example, in January 2024, the construction of an onshore wind turbine named Uungula Wind Farm project in the New South Wales part of the country is being developed by Squadron Energy for a capacity of 414 MW. The project is estimated to be completed by 2026.

Australia currently has no offshore wind energy and the first official offshore wind zone is off the land coast of the Gipps in Victoria. With government taking initiatives for the same, it is planning to install about 200 wind turbines with closest proximity of 7 kilometers offshore. The project would be one of the largest wind farms and is estimated to start in 2025.

KEY INDUSTRY PLAYERS

Vestas Holds a Major Share Owing to its Product Offerings and Innovative Technologies

Vestas has a major wind turbine operation and maintenance market share due to its wide range of services and strong brand value. The company primarily invests in developing new technologies to make labor-intensive operation and maintenance more cost-effective and accessible. Vestas offers a range of cost-effective wind technologies, products, and services, supported by an experienced research and development department in Australia wind turbine operation and maintenance industry. With installations of more than 136 GW across 84 countries, the company operates 117 GW of wind turbines globally. In Australia alone, there are over 5 GW of wind turbines in operation.

LIST OF TOP AUSTRALIA WIND TURBINE OPERATION AND MAINTENANCE COMPANIES:

- Vestas (Denmark)

- Siemens Gamesa Renewable Energy S.A. (Spain)

- GE (U.S.)

- Goldwind (China)

- Wind Turbine Services Australia (Australia)

- G&S Abseiling (Australia)

- Australian Wind Services (Australia)

- Worley (Australia)

- Cosmic Group (Australia)

- Professional Wind (Australia)

- Alpha Offshore (Denmark)

- Direct Wind Services (Australia)

- Suzlon Energy Limited (India)

- Rigcom (Australia)

- Ropepro High Access Services (Australia)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: Vestas received the Engineering, Procurement, and Construction (EPC) contract for the second stage of Golden Plains Wind Farm in Australia. The second stage will comprise 93 Vestas’ V162-6.2 MW wind turbines from the EnVentus platform. Upon completion of the first and second stages, Vestas will also provide a ~30-year service and maintenance agreement (AOM5000), guaranteeing optimal energy production into the Australian grid.

- December 2022: Palisade Investment Firm based in California acquired 49% shares in Goldwind Company’s project in Victoria, Australia, named Stockyard Hill Wind Farm. It is one of the largest wind farms in Australia’s National Electricity Grid Systems, providing 528 MW each year and powering 425,000 households.

- September 2022: Vestas Wind Systems, a Danish company, received an order of 104 MW for the Pinta y Guindalera wind farm in Valladolid, Spain. The agreement comprises the supply and installation of 23 V150 4.5 MW wind turbines and a 10-year active output management examination contract. In addition, the project would also benefit from Vestas' strong presence in Spain. The company manufactures V150 blades at its blade factory in Daimiel (Ciudad Real) for both the 4MW and EnVentus platforms.

- September 2022: Vestas in partnership with Mercury, secured an order of 43 MW for Kaiwera Downs Wind Farm in New Zealand. The project would feature 10 V136-4.2 MW wind turbines operating in 4.3 MW operating modes, supplied and installed by Vestas. Upon completion, the company would supply a 30-year Active Output Management 5000 service and maintenance agreement to optimize energy production, ensuring long-term operational reliability and efficiency for Mercury’s wind farm investment.

- October 2021: Worley was awarded Operation & Maintenance (O&M) contracts for eight Pacific Hydro wind farms in Victoria, Australia. Under the new agreement, Worley would provide asset management to improve uptime and maximize fleet performance, as well as remote monitoring, operations, and maintenance services for Pacific Hydro's six Victorian wind farms.

REPORT COVERAGE

The research report highlights leading companies in the country to understand the user better. Furthermore, the report provides insights into the latest industry trends and analyzes rapidly deployed technologies. It further highlights some growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.82% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type and Location |

|

Segmentation |

By Type

|

|

By Location

|

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 603.03 million in 2024 and is projected to reach USD 906.28 million by 2032.

The unscheduled segment holds the leading market position.

The market will likely grow at a CAGR of 4.82% during the forecast period (2025-2032).

Vestas and Siemens Gamesa are some of the major players operating in the market.

By location, the onshore segment dominates the market during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us