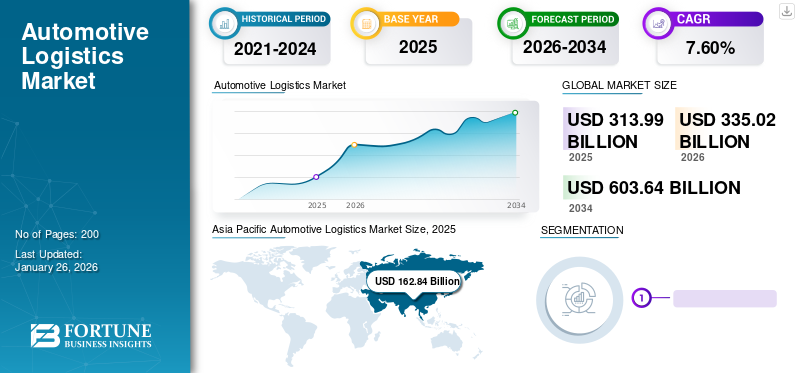

Automotive Logistics Market Size, Share & Industry Analysis, By Activity (Warehousing & Handling, Transportation & Handling), By Type (Finished Vehicle, Automobile Parts), By Mode of Transport (Roadways, Airways, Maritime, Railways), By Distribution (Domestic, International), and Regional Forecast, 2026-2034

Automotive Logistics Market Size & Trends

The global automotive logistics market size was valued at USD 313.99 billion in 2025 and is projected to grow from USD 335.02 billion in 2026 to USD 603.64 billion by 2034, growing at a CAGR of 7.60% from 2026 to 2034. The Asia-Pacific region dominated the industry with a market share of 51.86% in 2025. Automotive Logistics Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 71.75 Billion By 2032

The automotive logistics market is growth is driven by increased efficiency in vehicle logistics, digital transformation of supply chains, and the adoption of cost-effective third-party logistics (3PL) models.

Automotive logistics is the entity flow of the automotive producer’s vehicles, components, spare parts, and raw materials in the process of automotive purchase, production, and sales. Logistics in the automotive industry include inbound transportation management of raw materials and components, garage transportation management of the production process, and vehicle and spare parts transportation management, including distribution processing delivery, object purchasing, loading and unloading, storage, transportation, and information processing. With the rapid development of the automotive industry, automotive logistics is instrumental in reducing costs across the supply chain.

Download Free sample to learn more about this report.

Impact of COVID-19 on the Automotive Logistics Industry

The COVID-19 pandemic prompted automakers to diversify supply chains by localizing production due to risks from heavy reliance on a single region. Most vehicle semiconductors came from Taiwan and China, but capacity constraints post-lockdown led to unmet demand. Shortages of materials, such as steel, emerged from Q3 of 2020 as automakers aimed to replenish inventories. In March 2021, Governments, including the EU and the U.S., introduced plans to support critical supply chains, aiming to reduce reliance on Asian and U.S. semiconductor supplies and boost domestic production. Thus, the pandemic halted globalization and caused a significant realignment of automotive supply chains, affecting market growth.

LATEST INDUSTRY TRENDS

The Trend of Third-party Logistics Will Positively Influence Growth

Strengthening the division of labor is the future trend of the automotive supply chain. Functions, such as distribution and parts production, will be separated from manufacturing enterprises. Furthermore, part of logistical management functions will be entrusted to third-party logistics (3PL) to reduce investment and operating costs. Using 3PL enables companies to gain more market information, extend operations in an asset-less way to all corners of the world, and enter international markets more rapidly. Hence, the 3PL model will become the leading form of logistics in the automotive industry.

MARKET DRIVERS

Increasing Efficiency in Finished Vehicle Logistics (FVL) Operations will Drive Market Growth

By increasing operational efficiency, fewer trucks will be required. For instance, NVD, an Irish vehicle distributor, optimized its logistical process with intelligent solutions. NVD has shortened customer lead times and doubled its productivity as they can now load 8-10 cars on a truck within 45 minutes. In comparison, more than 3 hours are consumed in this process across Eastern European facilities. Hence, the increasing efficiency in FVL will drive the market growth rate over the forecast period.

Digitalization of Operations to Augment Market Growth

The increasing adoption of software-based systems by automakers to manage the logistical processes has been delivering substantial benefits, such as the surging supply chain transparency and operational efficiency. For instance, General Motors was an early adopter of the Outbound Logistics Software. During the pandemic-induced crisis, the software (which includes onboard asset telematics and geofencing technology, among other technologies) has delivered considerably better visibility in-vehicle delivery, better truck utilization and is being used to ramp up deliveries to companies’ dealers. Hence, the digitalization of operations will positively influence the growth of the market during the forecast period.

RESTRAINING FACTORS

Shortage of Truck Drivers to Restrain Growth Worldwide

Freight rates have increased rapidly over the last few years. The shortage of truck drivers is a key factor for the higher costs. The trend of decreased driver supply and increasing transport demand from automakers is expected to continue during the forecast period. For instance, according to the German Freight Forwarding and Logistics Association (DSLV), in Germany, 30,000 drivers on average retire every year. However, only around 2,000 fully trained truck drivers are available for replacement which amounts to a shortage of 45,000 drivers in Germany alone. Similarly, according to the American Trucking Association, there is a shortage of more than 60,000 qualified truck drivers in the U.S. Hence, these factors may restrain the automotive logistics market growth.

Automotive Logistics Market Segmentation Analysis

By Activity Analysis

Transportation & Handling Segment to Hold Largest Share Owing to Increasing Adoption of Telematics

By activity, the market is segmented into transportation & handling and warehousing & handling. The transportation & handling segment held the largest share of the market share 79.77% in 2026. Companies are actively investing in data-driven solutions to increase transportation efficiency. For instance, certain telematics solutions can effectively manage a truck’s route, and if there is a delay in the delivery of components, the data can be transmitted to the plant in real-time. Hence, a plant shutdown can be avoided, and automobile manufacturers can quickly manage & resolve the issue. Hence, these factors will drive the growth of this segment.

The warehousing & handling segment is anticipated to exhibit a higher CAGR during the forecast period. The rising demand for light commercial vehicles in emerging economies and the increasing demand for expanding the capacity in warehouses and storage facilities are attributed to the growth of this segment.

By Distribution Analysis

Domestic Segment Dominated in 2023 due to Large Scale Production in Emerging Economies

Based on distribution, the market is segmented into domestic and international. The domestic segment held the largest share of the market with a share of 61.85% in 2026. There is an increase in the number of supportive policies in countries such as India and China to incentivize local production. Furthermore, the easy movement of auto parts and raw materials facilitated by the European Union (EU) across EU countries is fueling the growth of this segment.

The international segment is expected to show good growth in the market. The increasing demand for luxury vehicles and the relaxation of import duties in developing countries will positively influence the growth of this segment.

By Type Analysis

Automobile Parts Segment Dominated in 2023 Propelled by Expansion of E-commerce Sector

By type, the market is segmented into the finished vehicle and automobile parts. The automobile parts segment dominated the market share 72.01% in 2026. This segment accounts for the revenue generated from both aftermarket dealers and original equipment manufacturers from spare parts transportation management.

The increasing adoption of omnichannel strategies, such as e-commerce, is fueling this segment's rapid growth as it enables companies to provide a large variety of products with on-time delivery. Furthermore, the increasing stringency of emission regulations is propelling the demand for aftermarket parts to upgrade the existing vehicle fleets. Hence, these factors will drive the growth of this segment during the forecast period.

The finished vehicle segment is also expected to show considerable growth in the market. Zero-emission vehicle mandates in several developed countries are fueling the demand for electric vehicles (EVs). Furthermore, government incentives, such as tax exemptions, tax credits, purchase rebates, and fee waivers (for parking and charging, among others) are also attributed to the increasing demand for EVs. These factors are expected to boost the growth of the segment during the forecast period.

By Mode of Transport Analysis

To know how our report can help streamline your business, Speak to Analyst

Roadways Segment Dominated in 2023 Fueled by Technological Advancements of Infrastructure

By the mode of transport, the market is segmented into roadways, railways, maritime, and airways. The roadways segment dominated the market share 75.97% in 2025. Factors such as low costs and the deployment of intelligent transport systems in regions such as Europe, which allows for high-level connectivity, platooning, and the potential for automated driving, are boosting the growth of the roadways segment. The maritime segment is anticipated to show substantial growth in the market due to the increasing availability of high-performing port services and high-quality infrastructure enabling the elimination of extra costs for transport operators, shippers, and consumers.

REGIONAL ANALYSIS

Asia Pacific Automotive Logistics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Regional Market Trends

Asia Pacific held the largest automotive logistics market share and stood at USD 144.52 billion in 2023. Factors such as the rising demand for vehicles, availability of raw materials, and low wages are responsible for the exponential growth of automobile production in this region. Furthermore, the presence of major OEMs, such as Honda, Toyota, Hyundai, and BYD that are focused on localizing their production to reduce operational costs and export vehicles to various countries and regions, such as the U.S. and Europe are also responsible for the growth of the automotive industry in this region. Hence, to optimize the supply chain, there is an increasing demand among OEMs for logistical services for transportation, assembly, & storage activities.The Japan market is projected to reach USD 34.85 billion by 2026, the China market is projected to reach USD 54.07 billion by 2026, and the India market is projected to reach USD 40.5 billion by 2026.

Europe held a considerable share in 2023. Major players in the region are focused on expanding their presence in Europe and providing vehicle logistics services in the region. For instance, In March 2024, Dunkerque-Port signed an agreement with CEVA Logistics for a 9.5-hectare plot in the eastern Port of Dunkirk. CEVA aimed to establish a vehicle logistics park linked to maritime flows. It is supposed to include reception, storage, and loading areas. Development is aimed to begin in October 2024, with projections of handling 47,000 vehicles annually, reaching 95,000 by March 2025. CEVA planned a workshop for vehicle preparation and detailing, with a paint shop and electric charging stations. Expansion plans included doubling capacity to 8,700 parking spaces.The UK market is projected to reach USD 15.56 billion by 2026, while the Germany market is projected to reach USD 14.66 billion by 2026.

North America is expected to exhibit steady growth during the forecast period. The optimized performance of multimodal logistical chains and improved infrastructure that are helping to reduce logistical costs are boosting the growth of the market in this region.The U.S. market is projected to reach USD 46.06 billion by 2026.

KEY COMPANY INSIGHTS

Strategic Partnerships by CEVA Logistics and GEFCO to Strengthen their Leading Positions in the Market

The automotive logistics market comprises established and emerging players operating at global, regional, and domestic levels. Major companies offer comprehensive logistics services tailored to the automotive industry. They provide transportation, warehousing, and distribution solutions to automotive manufacturers and suppliers. Companies form partnerships with OEM automotive companies to expand their business and establish long-term relations with major automotive players. On the other hand, domestic or regional players are focused on developing advanced technologies that the company utilizes in optimizing operations.

Deutsche Post AG, DB Schenker, and Kuehne + Nagel are considered among the leading players in the market. DB Schenker is a leading logistics provider with a significant presence in the automotive sector. It offers a wide range of logistics services, including land, air, and ocean freight transportation, as well as contract logistics solutions, to support the automotive supply chain.

LIST OF KEY COMPANIES PROFILED:

- DB Schenker (Essen, Germany)

- BLG LOGISTICS GROUP AG & Co. KG (Bremen, Germany)

- CEVA Logistics (Baar, Switzerland)

- Kuehne+Nagel (Feusisberg, Switzerland)

- Expeditors International (Washington, U.S.)

- DSV (Hedehusene, Denmark)

- XPO Logistics, Inc. (Connecticut, United States)

- Deutsche Post AG (Bonn, Germany)

- SINOTRANS Limited (Beijing, China)

- C.H. Robinson Worldwide, Inc. (Minnesota, United States)

- GEFCO (Paris, France)

- Ryder System, Inc. (Florida, U.S.)

- Schnellecke group ag & co. Kg (Wolfsburg, Germany)

- Penske Automotive Group, Inc. (Michigan, U.S.)

RECENT INDUSTRY DEVELOPMENTS:

- February 2024 - ORTEC, a global provider of leading end-to-end supply chain solutions developed specifically for the operational needs of manufacturers, retailers, and distributors, introduced a state-of-the-art solution purpose-fit for the operational needs of the manufacturing and finished goods logistics industries. ORTEC's Manufacturing Solution Suite provides valuable insights and planning tools that help companies optimize their supply chain and reduce costs.

- November 2023 - Maersk, a globally recognized logistics firm, and Nissan Motor Co., Ltd., a prominent international automotive corporation, formed a long-term partnership focused on sustainable, resilient, and competitive end-to-end logistics. The company announced the grand opening of the Wuhan Warehousing and Distribution facility in China.

- November 2023 - SYCN Auto Logistics, a trailblazer in the automotive logistics industry, participated at the VINCUE UNLEASHED conference, which took place from November 13th to 15th in Kansas City, Missouri. UNLEASHED is designed to bring together VINCUE users, industry partners, and thought leaders inside and outside of the automotive sector to unleash the power of people, processes, and technology to optimize inventory operations.

- March 2023 - Prilo attended the Automotive Logistics & Supply Chain Europe 2023. The event was a premier gathering of professionals in the automotive logistics and supply chain industry. Among the attendees were vehicle manufacturing giants and OEMs, such as BMW, Volkswagen, Renault, Ford, General Motors, Nissan, Audi, Toyota, and Volvo, as well as LSPs, such as Kuehne + Nagel, DB Schenker, DHL, Geodis, and Priority Freight. Companies offering logistic solutions and support, such as Prilo or Blue Yonder, were also present at the conference halls at Kameha Grand Bonn from March 21st to 23rd, 2023.

- November 2022 - VinFast, Vietnam's pioneering global electric vehicle manufacturer, and INFORM, a top provider of AI-based optimization software, formed a strategic global partnership for electric vehicle logistics management. INFORM provided advanced software solutions, including Transport Management Software (TMS) and a Yard Management System (YMS) to VinFast. These solutions optimize processes from vehicle ordering to delivery, enhancing efficiency and sustainability. VinFast monitors its EV logistics, optimizing processes from ordering to delivery and recalls.

REPORT COVERAGE

The global automotive logistics market research report covers a detailed analysis of the industry and focuses on key aspects, such as leading companies, product types, and leading applications of the product. Besides this, it offers insights into the key market trends and highlights key industry developments. In addition to the aforementioned factors, the report delivers an in-depth market analysis of several factors that have contributed to its growth over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Distribution

|

|

By Mode of Transport

|

|

|

By Activity

|

|

|

By Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 313.99 billion in 2025 and is projected to reach USD 603.64 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 162.84 billion.

Registering a CAGR of 7.60%, the market will exhibit good growth over the forecast period (2026-2034).

The roadways segment is expected to lead this market during the forecast period.

The digitalization of operations is the key factor driving the growth of the market.

CEVA Logistics, DB Schenker, and GEFCO are the major players in the global market.

Asia Pacific held the largest automotive logistics market share in in 2025.

The increasing efficiency of finished vehicle logistical operations is expected to drive the adoption of automotive logistics during the forecast period.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us