Autonomous Earthmoving Equipment Market Size, Share & Industry Analysis, By Equipment Type (Excavators, Loaders, Bulldozers, Graders, Dump Trucks, and Others), By Application (Construction, Mining, Agriculture, Infrastructure Development, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

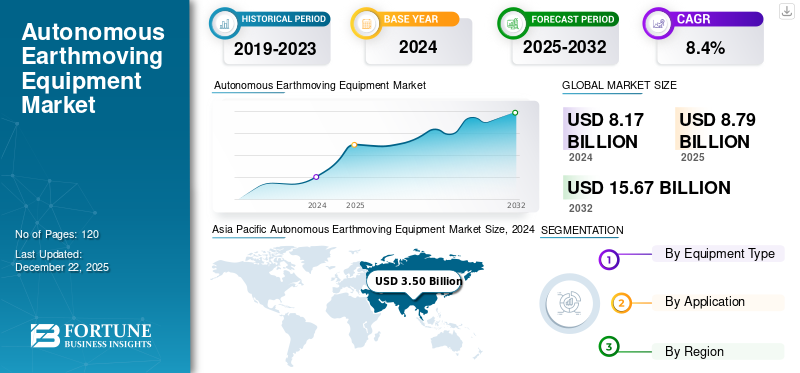

The global autonomous earthmoving equipment market size was valued at USD 8.17 billion in 2024 and is projected to grow from USD 8.79 billion in 2025 to USD 15.67 billion by 2032, exhibiting a CAGR of 8.4% during the forecast period. Asia Pacific dominated the global market with a share of 42.83% in 2024.

The global automated earthmoving equipment market is significantly growing because of advancements in automation, artificial intelligence, and GPS technologies. These machines include autonomous excavators, bulldozers, and loaders, which are increasingly used across mining, construction, and infrastructure projects to enhance safety, precision, as well as operational efficiency. Rising labor costs, coupled with demand for continuous operations in hazardous environments, are further boosting the demand for autonomous earthmoving machinery. Key players dominating the global market include Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery, and Liebherr. These players are heavily investing in R&D as well as forming strategic partnerships in order to expand their autonomous equipment portfolios.

Download Free sample to learn more about this report.

Global Autonomous Earthmoving Equipment Market Overview

Market Size:

- 2024 Value: USD 8.17 billion

- 2025 Value: USD 8.79 billion

- 2032 Forecast Value: USD 15.67 billion

- CAGR: 8.4% (2025–2032)

Market Share:

- Regional Leader: Asia Pacific led the market in 2024, with regional revenue around USD 3.50 billion

- Equipment Type Leader: Excavators were the dominant equipment category, capturing the largest market share

- End-User Leader: Primary application remains in earthmoving operations, driven by large-scale infrastructure and site preparation projects

Industry Trends:

- Deployment of semi‑ and fully autonomous earthmoving machinery such as excavators and bulldozers to enhance efficiency and reduce human error

- Growing retrofitting of existing machines through modular autonomy kits enabling remote or autonomous operation

- Manufacturers expanding use cases across sectors like agriculture, logging, port logistics, and infrastructure via remote supervised multi-machine setups

Driving Factors:

- Labor shortages in construction and mining sectors driving demand for automation

- Need for enhanced site safety, cost savings, and productivity gains through autonomous operation

- Rising infrastructure investments and high-volume earthmoving driven by urbanization and development

- OEM innovation and expansion by companies such as Caterpillar, Komatsu, Volvo, and others boosting adoption of autonomous capabilities

Furthermore, the market is poised for robust expansion, with a strong CAGR projected over the forecast period. Emerging economies such as India and China are playing a vital role in driving market growth, owing to extensive infrastructure development as well as digital transformation in the construction and mining sectors. Moreover, integration with telematics and the shift toward electric and sustainable machinery are creating new opportunities for innovation.

IMPACT OF TARIFFS

Tariffs on Imported Components Increase Costs and Disrupt Supply Chains, Hindering Market Growth

Recent tariff implementations on imported industrial and technological components have led to a rise in production costs for autonomous earthmoving equipment, especially affecting global manufacturers who are heavily reliant on cross-border supply chains. These tariffs have also disrupted the availability of key inputs such as sensors, semiconductors, and precision parts, resulting in price hikes as well as potential delays in equipment delivery. Consequently, manufacturing companies may either pass on costs to end users or adjust their sourcing strategies, which may temporarily slow down the autonomous earthmoving equipment market growth in some regions.

MARKET DYNAMICS

MARKET TRENDS

Integration of Advanced Path Planning Software to Emerge as Trend in the Global Market

One prominent trend that is shaping the global autonomous earthmoving equipment market is the growing level of integration of advanced path‑planning software into heavy machinery. Manufacturers these days are increasingly equipping excavators, bulldozers, and graders with AI‑driven algorithms that can autonomously compute optimal routes, adjust to changing terrain, and adapt to real‑time obstacles without human intervention.

For instance, in February 2023, Trimble launched cutting‑edge path‑planning technology that automates trajectory, speed, and task sequencing across various earthmoving tasks.

This trend has not only enhanced the operational efficiency and precision but also has significantly boosted safety by minimizing manual handling in unstable environments. Moreover, as path‑planning systems become more advanced and interoperable across equipment brands, full autonomy will become progressively attainable, thus paving the way for a smarter and more integrated jobsite ecosystems.

MARKET DRIVERS

Rising Labor Shortages Driving Automation in Earthmoving Operations

One of the primary drivers, which is advancing the global autonomous earthmoving equipment market, is the increasing shortage of skilled labor, especially in the construction and mining sectors. Many developed economies are facing the problem of the aging workforce, since the younger population is showcasing reduced interest in physically demanding jobs. This labor gap is encouraging companies to seek automated solutions that can maintain productivity without relying heavily on manual operators.

These autonomous systems not only reduce dependency on human labor but also offer consistent performance continuously. Further, technologies such as GPS, LiDAR, and machine learning, autonomous equipment further enhance the operational efficiency, safety, and cost-effectiveness.

MARKET RESTRAINTS

High Initial Cost Associated with Integrating Autonomous Earthmoving Equipment to Limit Market Expansion

One of the biggest restraints of the global autonomous earthmoving equipment market is the high initial investment as well as integration cost. Autonomous machinery usually requires advanced technologies such as sensors, AI systems, telematics, and real-time data processing, which substantially increases the upfront production cost in comparison to traditional equipment. Additionally, smaller contractors and firms especially in developing regions, often lack the financial standing as well as digital infrastructure required to adopt such sophisticated systems, thus limiting their penetration in the global market. This cost barrier also delays return on investment, which further discourages adoption, specifically among price-sensitive end users.

MARKET OPPORTUNITIES

Booming Infrastructure in Emerging Economies Creating Demand for Automation

The burgeoning infrastructure development in emerging economies such as India is creating a lucrative opportunity for the autonomous earthmoving equipment market. Factors such as urbanization, government-initiated infrastructure development, and foreign investment in roads, railways, and smart cities are creating a demand for scalable and efficient construction solutions.

With project timelines becoming more and more constricted and labor availability becoming increasingly unpredictable, the demand for automated and remotely operated equipment is expected to rise. This heightened focus on infrastructure is encouraging equipment manufacturers to develop autonomous solutions for high-growth markets, thus opening up new sources of revenue and enabling the growth of the global market.

Segmentation Analysis

By Equipment Type

Widespread Application in Construction Drives Excavators Segment Growth

Based on equipment type, the market is classified into excavators, loaders, bulldozers, graders, dump trucks, and others.

Excavators hold the largest autonomous earthmoving equipment market share owing to their extensive application in the construction and mining industry; further, early integration with autonomous systems has helped the market grow. Their versatility in various operations such as digging, demolition, and trenching makes them a priority for automation investments.

Dump trucks are expected to witness the highest CAGR over the forecast period, owing to their growing usage in autonomous mining operations. Continuous requirement of hauling, along with improvements in fleet automation and safety systems, supports their rapid adoption.

Loaders are increasingly appreciated for their vital function in material handling and site preparation. The incorporation of automation significantly improves their efficiency in performing repetitive loading and transportation tasks, particularly in major construction projects.

Bulldozers are being automated more and more for grading and land clearing. Their use is facilitated through the combination of GPS and blade control technologies that enhance productivity and accuracy.

Graders are taking advantage of autonomous features that allow for accurate surface leveling. Adoption of this product is slower, but demand is increasing in infrastructure and road construction applications where high precision is needed.

The other segment includes specialized machinery such as scrapers and trenchers. Although it has a smaller volume, it shows steady growth driven by niche uses and remote operation technology innovations.

By Application

Construction Sector to Dominate Global Market Owing to High Adoption of Autonomous Machinery

Based on application, the market is divided into construction, mining, agriculture, infrastructure development, and others.

The building sector has the largest market share because there is a common requirement for autonomous machinery in domestic, commercial, and industrial projects. Automation is employed to boost efficiency, minimize reliance on labor, and enhance security in complex worksites.

Mining will experience the highest Compound Annual Growth Rate (CAGR) based on the growing adoption of autonomous haulage and drilling systems. The need for operations 24/7 in remote and risk-prone environments makes mining the top industry to automate.

The farm industry is increasingly embracing autonomous earthmoving machines for land leveling and irrigation systems. Precision agriculture and labor shortages are motivating the use of such machines in commercial agriculture.

Infrastructure expansion is a leading growth area, where governments are investing large amounts in transportation, utilities, and smart city initiatives. Autonomous technology is being utilized to ensure project timeliness and enhance construction accuracy.

The others segment includes applications such as defense and disaster recovery. Despite being relatively smaller in scope, these applications take advantage of remoteness capabilities and automation in challenging or dangerous environments.

Autonomous Earthmoving Equipment Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America

Asia Pacific Autonomous Earthmoving Equipment Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds a significant share of the global market, owing to the region’s early technology adoption, a strong presence of the construction and mining sectors, and a shortage of skilled labor. The U.S. is the leading country in the region with hefty investments in the modernization of infrastructure as well as smart construction initiatives. The presence of leading players such as Caterpillar and Deere & Company, along with government support for automation and digitization, has further fueled market growth.

Europe

Stringent labor safety regulations, environmental standards, and a growing push toward sustainable construction practices characterize the European market for autonomous earthmoving equipment. Germany and the U.K. are frontrunners in adopting autonomous solutions to enhance productivity and reduce emissions at the same time. High investment in R&D as well as strong collaboration between OEMs and tech firms support innovation, making Europe a key hub for advanced autonomous equipment development.

Asia Pacific

Asia Pacific holds the highest share of the global market, and is also the fastest-growing region due to rapid urbanization and large-scale infrastructure projects in developing countries. China, India, and Japan are experiencing growing demand for automation due to challenges such as a shortage of skilled workers. The region further benefits from a strong local manufacturing base.

Middle East & Africa

The Middle East & Africa region holds a considerable market share, it is still gradually adopting autonomous earthmoving equipment, and the demand in the region is mostly driven by large-scale construction projects in GCC countries such as the UAE and Saudi Arabia, and increasing mining activities in African nations. While the market is still in its early stages, growing infrastructure investments in the region are boosting the market growth.

Latin America

Latin American market growth for autonomous earthmoving equipment is comparatively small. Moreover, it is steadily increasing, with Mexico, Brazil, Argentina, and Chile leading the adoption, mainly in mining and large-scale infrastructure sectors. The region’s economic volatility, along with limited access to advanced technology, has been one of the major constraints. Additionally, the rising demand for automation solutions, coupled with foreign investments, is slowly increasing the adoption rates.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous R&D Development Along With Early Adoption of Technology by Key Companies Resulted in Their Dominating Position

Key players in the global market are mainly characterized by their strong R&D capabilities as well as robust global distribution network, and they are among the early adopters of Artificial Intelligence AI and telematics technology. These companies aim to develop integrated autonomous solutions, which combine hardware, software, and data analytics to improve machine performance as well as safety. They are known for forming strategic partnerships with tech companies and investing in retrofitting technologies to expand their reach across both new and existing equipment fleets. Their strong brand reputation strengthens their market leadership, large capital investment capability, as well as their commitment to innovation.

LIST OF KEY AUTONOMOUS EARTHMOVING EQUIPMENT COMPANIES PROFILED

- Caterpillar Inc. (U.S.)

- Komatsu Ltd. (Japan)

- Volvo Group (Sweden)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Deere & Company (U.S.)

- CNH Industrial N.V. (Netherlands)

- Doosan Infracore (South Korea)

- SANY Group (China)

- JCB (U.K.)

- Liebherr Group (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- October 2024: Teleo announced that they are expanding their autonomous heavy equipment technology portfolio into new industries other than construction such as pulp & paper, logging, port logistics, and agriculture, by securing 34 machine orders as well as nine customer deals, while allowing one of the operator to supervise multiple machines remotely and thus improving safety and efficiency.

- October 2023: Position Partners collaborated with Teleo, a U.S.-based company that builds autonomous technologies for heavy equipment. Under the partnership, Position Partners will provide full Teleo remote-operated and autonomous solutions across Australia, New Zealand, and Southeast Asia.

- July 2023: Caterpillar launched the new Cat 299D3 Compact Track Loader (CTL), their first semi-autonomous construction machine, which was showcased at the Cat Trial 12 event in Arizona. This CTL can be remotely controlled or operated in semi-autonomous mode using a simple tablet connected through Wi-Fi.

- September 2022: Shantui, in partnership with Huazhong University of Science and Technology, launched the world’s first fully autonomous, unmanned bulldozer. The bulldozer operates by leveraging advanced computing, positioning, and 5G technology.

- March 2022: SafeAI and MACA have collaborated to retrofit 100 mining vehicles in Australia along with AI-powered autonomous technology from SafeAI. This partnership aims to build Australia’s largest autonomous heavy equipment fleet, improving safety, productivity, and cost-effectiveness at mine sites.

REPORT COVERAGE

The global autonomous earthmoving equipment market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market during the forecast period. It offers information on the adoption of autonomous earthmoving equipment in key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions, and a number of equipment manufacturers in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.4% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 8.17 billion in 2024 and is projected to reach USD 15.67 billion by 2032.

In 2024, the market value stood at USD 3.50 billion.

The market is expected to exhibit a CAGR of 8.4% during the forecast period of 2025-2032.

The excavator segment led the market by equipment type.

Rising labor shortages are one of the key factors driving the market.

Caterpillar Inc., Komatsu Ltd., Volvo Group, Hitachi Construction Machinery Co., Ltd., Deere & Company are the top players in the market.

Asia Pacific dominated the market in 2024.

Major factors expected to favor the adoption of construction equipment include increased efficiency and productivity, enhanced safety, cost savings, sustainability, and labor shortages.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us