Aviation Blockchain Market Size, Share, Industry Analysis, By End Use (Airlines, Airports, and Others), By Function (Record Keeping and Transactions), By Application (Cargo and Baggage Tracking, Passenger Identity Management, Flight and Crew Data Management, Supply Chain Management, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

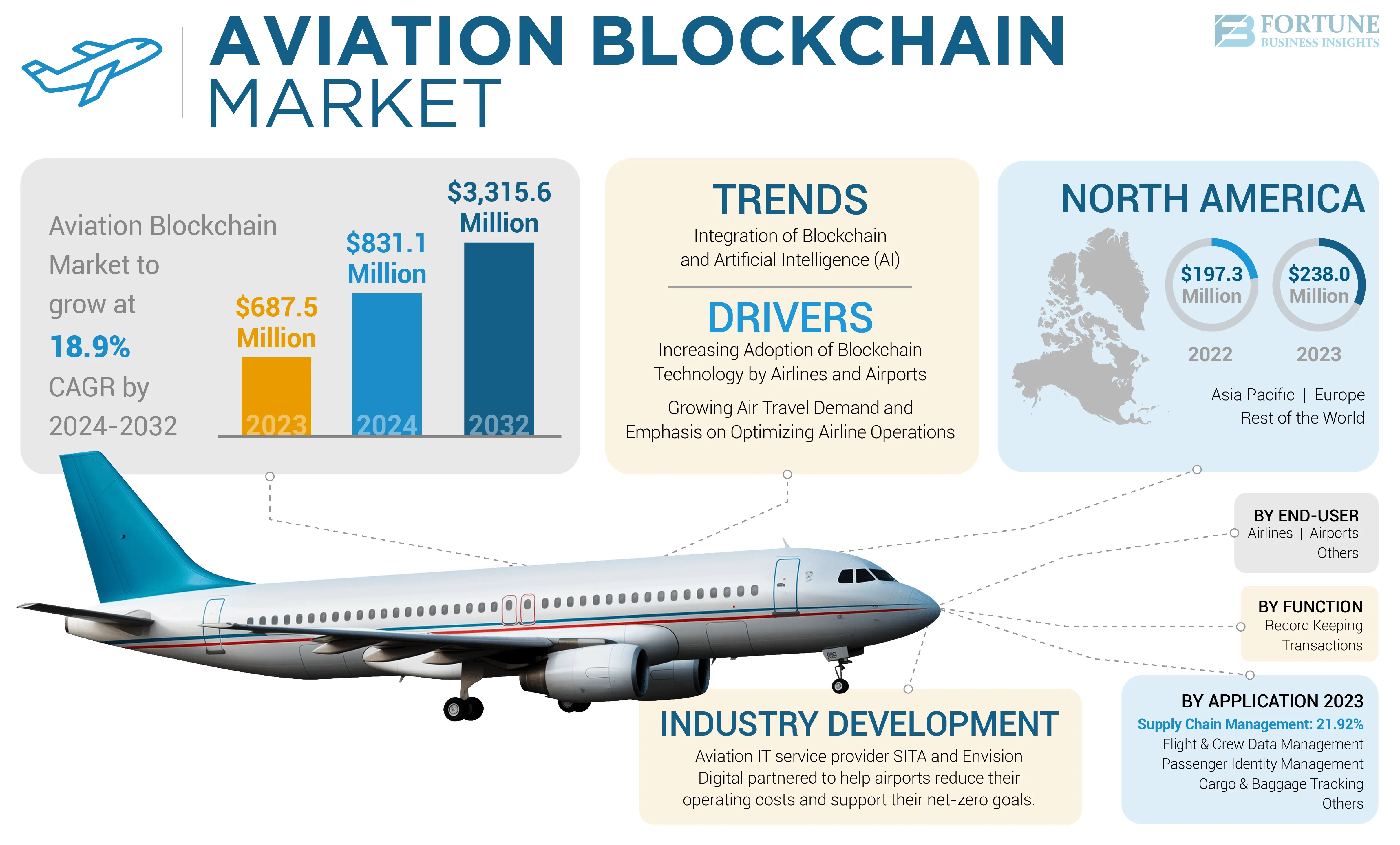

The global aviation blockchain market size was valued at USD 687.5 million in 2023 and is projected to grow from USD 831.1 million in 2024 to USD 3,315.6 million by 2032, exhibiting a CAGR of 18.9%. North America dominated the aviation blockchain market with a market share of 34.62% in 2023.

Aviation blockchain is an immutable and distributed ledger used to track assets, record transactions, and build trust between airlines and passengers. Related assets can include tangible assets (e.g., aircraft, airport infrastructure, and MRO (Maintenance, Repair, and Operations) related infrastructure) and intangible assets (e.g., data). Key elements of the aviation blockchain involve immutable records, distributed ledger technology, and smart contracts.

Aviation market operators are subject to a number of government directives and regulations to ensure the safety of passengers and other stakeholders. The use of blockchain technology ensures efficient flight transactions, optimal operational efficiency, and transparency for aviation users. Aviation blockchain finds application in airlines, airports, lessors, and MRO organizations.

The COVID-19 pandemic negatively affected the market and has highlighted the need for innovation and efficiency in the industry. As the market recovers, the adoption of blockchain technology is expected to play a crucial role in enhancing operational transparency and efficiency, positioning the industry for future growth.

GLOBAL AVIATION BLOCKCHAIN MARKET OVERVIEW

Market Size & Forecast

- 2023 Market Size: USD 687.5 million

- 2024 Market Size: USD 831.1 million

- 2032 Forecast Market Size: USD 3,315.6 million

- CAGR: 18.9% from 2025–2032

Market Share

- North America dominated the aviation blockchain market with a 34.62% share in 2023, driven by advanced technological infrastructure, favorable regulatory frameworks, and significant investments from major aviation and IT firms.

- By end use, the airlines segment leads the market due to increased adoption of blockchain for flight crew management, smart ticketing, and improved refund processing.

Key Country Highlights

- United States: Strong adoption by major airlines and MROs, along with leadership in blockchain and AI integration across aviation operations.

- Canada: Growing focus on sustainable airport operations and collaborative pilot projects with major tech providers.

- Germany: Increased digitalization initiatives at airports like Frankfurt and broader EU-backed blockchain regulation.

- United Kingdom: Innovators like Zamna Technologies are driving blockchain identity verification adoption at major airports.

- India: IT firms such as Infosys and blockchain integrators like LeewayHertz support aviation digitization initiatives.

- Singapore: Government-backed partnerships (e.g., SITA and Envision Digital) focus on integrating blockchain for net-zero and smart airport goals.

- UAE: Adoption of blockchain for air traffic data and smart contracts in cargo handling shows regional innovation.

Aviation Blockchain Market Trends

Integration of Blockchain and Artificial Intelligence (AI) is Rapidly Evolving the Market

The aviation industry is increasingly integrating blockchain and AI technologies to enhance security, efficiency, and the passenger experience. Blockchain and Artificial Intelligence (AI) are being integrated to improve the security and transparency of flight data management. Blockchain provides an immutable record of flight data, while AI algorithms analyze this data to detect anomalies and potential security threats in real-time. North America witnessed aviation blockchain market growth from USD 197.3 Million in 2022 to USD 238.0 Million in 2023.

Blockchain is used to create a tamper-proof, distributed ledger for tracking aviation parts and materials through the supply chain. AI analyzes this blockchain data, enabling predictive maintenance, improved inventory management, and enhanced regulatory compliance. Additionally, blockchain provides a secure, decentralized platform for recording air traffic data, which AI systems analyze to improve airspace management, reduce congestion, and enhance safety. Integrating blockchain and AI technologies is transforming the aviation industry by improving security, efficiency, and the overall passenger experience across various operational domains. The combination of these advanced technologies is enabling new levels of transparency, automation, and data-driven decision-making.

Download Free sample to learn more about this report.

Aviation Blockchain Market Growth Factors

Increasing Adoption of Blockchain Technology by Airlines and Airports to Streamline Operations will Catalyze Market Growth

Blockchain enables secure, decentralized identity management for passengers, allowing for faster check-ins, seamless verification, and reduced fraud. It also enables smart ticketing and loyalty programs that enhance the overall passenger experience. Blockchain provides a tamper-proof, distributed ledger to track aircraft parts, maintenance history, and supply chain data, improving operational efficiency and transparency. It also enables automated smart contracts for transactions between airlines, airports, and other partners.

Blockchain's cryptographic nature secures passenger data, flight records, and other critical information against breaches. It also enables real-time tracking of baggage, cargo, and other assets to improve visibility and reduce losses. By reducing reliance on intermediaries, automating processes, and increasing operational efficiency, blockchain has the potential to significantly reduce costs for airlines and airports.

Overall, the adoption of blockchain technology is helping the aviation industry improve the passenger experience, streamline operations, enhance security, and reduce costs - driving growth and innovation across the sector.

Growing Air Travel Demand and Emphasis on Optimizing Airline Operations is Expected to Drive Market Growth

Growing air travel demand and the emphasis on optimizing airline operations are significant factors contributing to the growth of the aviation market. The aviation blockchain market experiences significant seasonal fluctuations, with peak demand during summer and lower demand during winter. Airlines are responding by optimizing their operations, such as flexible asset management, such as adjusting crew productivity and fleet utilization, to manage capacity during peak and off-peak periods.

There is a growing trend toward leisure travel, which is creating more pronounced summer traffic peaks. This shift in demand is generating new challenges for airlines, requiring innovative solutions to manage the increased demand. The combination of growing air travel demand and the emphasis on optimizing airline operations is driving the growth of the aviation market by improving efficiency, enhancing passenger satisfaction, and reducing costs.

RESTRAINING FACTORS

Regulatory Compliance and Standardization Issues to Hamper Market Growth

Regulatory bodies such as the FAA (Federal Aviation Administration), EASA (European Union Aviation Safety Agency), and ICAO (International Civil Aviation Organization) have different mandates, which pose a significant challenge for aviation blockchain solutions. Meeting all these diverse mandates is complex and may hinder the aviation blockchain market growth.

The lack of standardization in aviation blockchain platforms arises as different sectors within the aviation industry have distant requirements and compliance standards. Therefore, the creation of a standard aviation blockchain solution is not possible, which may hinder the growth potential of the market.

Aviation Blockchain Market Segmentation Analysis

By End Use Analysis

Airlines Dominate Owing to their Increased Demand for Blockchain Technology

By end use, the market is classified into airlines, airports, and others. Airlines currently account for the largest aviation blockchain market share and are expected to maintain this position until 2032. Airlines are strongly emphasizing on improving flight crew and passenger safety by automating multiple tasks to ensure the best possible flight experience. The adoption of blockchain by airlines can also help them improve their policies for refunding passengers in case of cancellations or inconveniences.

The use of blockchain in airports will grow rapidly during the forecast period. Growing emphasis on increasing baggage and cargo tracking capabilities to reduce waste is a key factor driving the demand for air transport blockchain in this segment. Increasing availability of various blockchain solutions to improve airport operations is also contributing to market growth.

By Function Analysis

Transactions Segment to Lead Due to the Improved Transparency and Traceability

By function, the market is segmented into record keeping and transactions. The transactions segment is projected to be the leading and fastest-growing segment due to the ability of blockchain to enhance transparency, security, and efficiency in transactions. As the industry continues to embrace digital transformation, the integration of blockchain technology is likely play a crucial role in shaping the future of aviation operations.

The record-keeping capabilities of aviation blockchain, which enable secure, transparent and tamper-proof storage of critical data like flight records and supply chain information, are driving the growth of this segment. Major players have deployed blockchain for record-keeping use cases in the aviation industry.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Cargo and Baggage Tracking Segment to Dominate Owing to Increased Transparency and Traceability in the Supply Chain Management

By application, the market is categorized into cargo and baggage tracking, passenger identity management, flight and crew data management, supply chain management, and others. The cargo and baggage tracking segment is projected to account for the dominant share of the global market. Aviation blockchain integration enables transparency in supply chain management, facilitating easy tracking of cargo and baggage. Air cargo management is being revolutionized by the growing use of blockchain in cargo and baggage tracking applications. The supply chain management segment is expected to hold a 21.92% share in 2023.

The use of blockchain for passenger identity management in aviation is expected to grow at a strong CAGR during the forecast period. Travelers can have more control over their information by storing their identity on the blockchain, which has proven to be a more secure method than conventional web-based solutions.

REGIONAL INSIGHTS

In terms of geography, the market is divided into North America, Europe, Asia Pacific, and the rest of the world.

North America Aviation Blockchain Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North American is poised for significant growth in the coming years and accounted for the largest market share in 2023, driven by the region's large airline industry, rapid technology adoption, supportive regulations, and the presence of key market players. With significant investments from leading tech companies and a clear demand for innovative solutions, the region is set to remain a key player in the global aviation blockchain landscape.

Europe is experiencing rapid growth due to the increasing demand for secure and efficient data management solutions. The region is poised for significant growth in the coming years, driven by the need for secure data management, increased investment in blockchain solutions, and the potential to streamline operations and improve safety in the highly regulated aviation industry.

Asia Pacific is poised for significant growth in the coming years and will be the fastest growing during 2024-2032, driven by increasing air passenger traffic, rising adoption of advanced technologies, partnerships and collaborations, and regulatory support.

The rest of the world is still in its nascent stage, with Latin America and the Middle East showcasing promising growth compared to Africa. As the adoption of blockchain technology increases globally, the rest of the world is also expected to implement blockchain-based solutions in the aviation industry.

KEY INDUSTRY PLAYERS

Leading Players Are Focusing on Integrating Advanced Technologies to Gain Strong Foothold

The aviation blockchain market is fragmented, presenting opportunities for new companies to enter the market and gain a foothold. However, the massive presence of leading companies can create challenges for new market entrants. To succeed, blockchain companies are focusing on integrating advanced technologies to enhance additional capabilities. Players in the market can take advantage of the growing acceptance and popularity of blockchain technology to maximize their revenue potential.

List of Top Aviation Blockchain Companies:

- Aeron Labs (Belize)

- International Business Machine Corporation (U.S.)

- Infosys Limited (India)

- Leewayhertz (U.S.)

- Moog Inc. (U.S.)

- Safeflights Inc. (14bis Supply Tracking) (U.S.)

- Sweetbridge, Inc. (U.S.)

- Volantio Inc. (U.S.)

- Winding Tree (Spain)

- Zamna Technologies Limited (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Toronto Pearson Airport successfully tested a new management tool, now available for other airports. Over the past 12 months, the Greater Toronto Airports Authority (GTAA) collaborated with SITA to implement a prototype of the company's Airport Operations Total Optimizer, which integrates all airport data sources to provide a more holistic view of its operations center.

- August 2023: Aviation IT service provider SITA and Envision Digital, a global net-zero partner and artificial intelligence of things (AIoT) technology leader based in Singapore, entered into a partnership agreement to help airports reduce their operating costs and support their net-zero goals. Their solutions enable real-time IoT data streaming, allowing airports to monitor energy use, aircraft and other vehicle emissions and carbon footprint.

- April 2023: CGI and Fraport AG, operator of Frankfurt Airport, signed a five-year master agreement to accelerate digitization transformation. Fraport AG, one of the world's largest airport operators with 29 airports on four continents, has chosen CGI as its digital partner to improve the customer experience at Frankfurt Airport and develop new digital businesses.

- January 2023: Kazakhstan's Kyzylorda Airport commissioned Alstef Group to develop a "BHS" baggage handling system for the new terminal. According to the terms of the contract, Alstef is responsible for the installation of outgoing and incoming systems.

- July 2022: Air Marakanda, the operator of the newly modernized Samarkand International Airport ("SKD"), completed the first phase of contract work with TAV Technologies to fully digitize the airport's operations. TAV Technologies is a subsidiary of TAV Airports Holding, a member of international airport operator Group ADP.

REPORT COVERAGE

The report offers a detailed market analysis and emphasizes key industry players, products, and applications. Furthermore, the report provides information on current market trends and showcases important industry advancements. In addition to the factors stated earlier, the report covers various direct and indirect factors that have played a role in the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 18.9% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By End Use

|

|

By Function

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 687.5 million in 2023.

The market is likely to grow at a CAGR of 18.9% over the forecast period (2024-2032).

The market size in North America stood at USD 238.0 million in 2023.

Some of the top players in the market are Aeron Labs (Belize), International Business Machine Corporation (U.S.), Infosys Limited (India), Leewayhertz (U.S.), Moog Inc. (U.S.), and Safeflights Inc. (14bis Supply Tracking) (U.S.).

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us