Aviation Connector Market Size, Share & Industry Analysis, By Type (Fiber Optic Connectors, PCB Connectors, High Power Connectors, High Speed Connectors, RF Connectors, and Others), By Application (Avionics, Landing Gear, Cabin Equipment/Systems, Engine and Flight Control Systems, Power Distribution Systems, and Others), By Plug Type (Single-phase Plug and Three-phase Plug), By Shape (Circular and Rectangular), By End-User (Commercial Aircraft, Business Jets, Military Aircraft, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

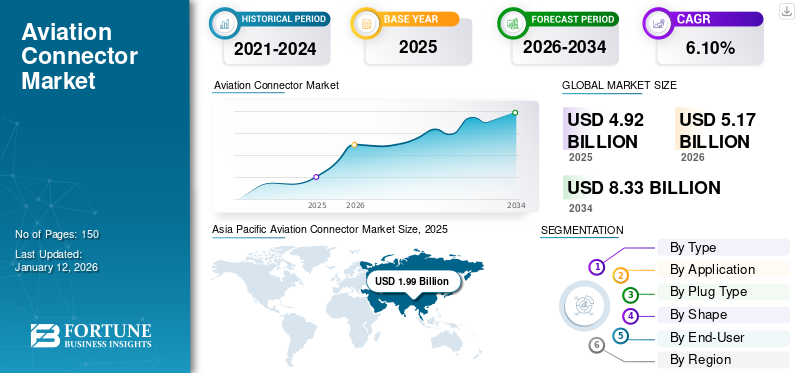

The global aviation connector market size was valued at USD 4.92 billion in 2025. The market is projected to grow from USD 5.17 billion in 2026 to USD 8.33 billion by 2034, exhibiting a CAGR of 6.10% during the forecast period. Asia Pacific dominated the market with a share of 40.40% in 2025.

An aviation connector, also known as an aviation plug, is a technical electrical connector created for dependable and secure connections in challenging conditions, especially in aerospace, military, and other fields requiring high performance and resilience. The major players included in this market are Amphenol Corporation, TE Connectivity, Eaton, Smiths Group plc, Renhotec Group, ITT Inc., Bel Fuse Inc., IEH Corporation, Apollo Aerospace Components, and Rosenberger Hochfrequenztechnik GmbH & Co. KG.

Aviation connectors are witnessing significant market growth mainly due to increasing aircraft production, fleet expansion, and rising adoption of advanced avionics systems. The industry is undergoing a significant transformation driven by the emergence of electric and hybrid aircraft. In June 2024, NASA and MagniX conducted a simulation at an altitude of 27,500 feet within the altitude chamber located at NASA’s Electric Aircraft Testbed (NEAT) facility. Engineers from MagniX showcased the potential of a battery-operated engine that could be integrated into a hybrid electric aircraft. Additionally, the increasing use of In-Flight Entertainment and Connectivity (IFEC) systems and the growing demand for military and defense aircraft upgrades are the key trends in the market.

Aviation manufacturing initiatives and distribution networks experienced a significant decline during the COVID-19 pandemic, as governments temporarily halted non-essential industry operations. The military use of aviation connectors was more robust against the impact of the pandemic.

Download Free sample to learn more about this report.

IMPACT OF GENERATIVE AI

Integration of Generative AI with Aviation Connector by Enhancing Capabilities to Fuel Market Growth

Generative AI is transforming this industry by upgrading design, maintenance, operational efficiency, and manufacturing. It accelerates the creation of lightweight and robust connectors by generating many design permutations. Therefore, it converts traditional aviation connectors into smart components that enhance aircraft performance, sustainability, and safety.

IMPACT OF RECIPROCAL TARIFFS

Reciprocal tariffs have increased costs and inconsistencies in the aviation connector industry, affecting producers and consumers. While some regions are confronting these issues by boosting domestic manufacturing, a more cautious approach is to prioritize cost resilience and leverage strategic partnerships.

MARKET DYNAMICS

Aviation Connector Market Trends

Increased Usage of IFEC Systems for Seamless Connectivity and Improved Travel Experience

The increasing adoption of IFEC (In-Flight Entertainment and Connectivity) systems create a favorable setting for aviation connectors. As airlines progressively add IEFC to improve the passenger experience, these connectors play a key role in meeting the need for seamless connectivity. This trend is expected to create opportunities for firms to invest in making high-speed connectors and fiber-optic connectors specific to aerospace use.

Market Drivers

Increasing Advancements in Aircraft Connectors for Handling Higher Power and Data Transmission Levels

Technological improvements in the aircraft industry are continuously emerging, with new technologies aimed at improving the efficiency, safety, and performance of aircraft. These high-tech upgrades in aircraft are increasing the demand for innovative aviation connectors. For instance, the increase in electric aircraft has created a requirement for connectors that can handle higher power and data transmission levels. In addition, the increased use of composite materials in aircraft design requires connectors to be lightweight and non-corrosive. The progress in aircraft technology and systems also contributes to creating new aircraft systems, such as in-flight entertainment options and collision avoidance technologies.

Market Restraints

Rise in Environmental Challenges and Manufacturing Costs Stifle Industry Growth

Environmental conditions influence the effectiveness of aviation connectors. Factors such as humidity, moisture, vibrations, and mechanical impacts affect their performance and lifespan. Damage to these connectors can lead to loss of connectivity, short circuits, and corrosion from moisture intrusion. Issues including insulation failure can occur due to mechanical stress and extreme temperatures. Moreover, making these connectors requires special materials, which raises manufacturing costs and limits the aviation connector market share.

Market Opportunities

Increasing Application in UAVs Will Open New Prospects for Market Expansion

The growing electrical complexities in Unmanned Aerial Vehicles (UAVs) present significant market opportunities. UAVs require compact and lightweight components to enhance efficiency and prolong flight duration, which requires miniature aviation connectors. Adopting additional operational systems in the aviation and military fields for surveillance and data gathering also contributes to aviation connector market growth. Furthermore, the increasing demand for electric aircraft and autonomous flight technologies, and the rapid advancement of aviation in developing regions, offer promising prospects for these connectors in UAVs.

SEGMENTATION ANALYSIS

By Type

Rising Need for High Speed Data Transmission Provided by Fiber Optic Connectors Boosts Market Demand

Based on type, the market is segmented into fiber optic connectors, PCB connectors, high power connectors, high speed connectors, RF connectors, and others.

The fiber optic connectors type segment is projected to account for 32.89% of the total market share in 2026. The aviation industry is moving toward fiber optic connectors because of the growing need for high-speed data transmission, reliable systems, and lightweight designs. Companies are launching new products to meet the increasing demand for lighter, faster, and more sustainable options. For instance, in April 2025, Nortech Systems revealed its plans to expand fiber optic connectors for aerospace and defense applications by incorporating MT connectors, which facilitate multiple fiber terminations in a compact design.

The high-speed connectors segment is expected to witness the highest CAGR throughout the forecast period. This growth is propelled by technological advancements, expanding fleets, and escalating need for reliable high-speed power transmission in increasingly connected aircraft environments.

By Application

Avionics is the Leading Application Due to Increasing Demand for Fly-by-Wire Systems and Other Features

Based on application, the market is segmented into avionics, landing gear, cabin equipment/systems, engine and flight control systems, power distribution systems, and others.

The avionics application segment is expected to hold a significant market share of 30.00% in 2026. The category of avionics produced the highest revenue in 2024. Avionics systems, including navigation, communication, weather monitoring, and others, are fundamental to modern aircraft. These applications rely heavily on fly-by-wire systems for better integration and transmission.

The engine and flight control systems segment is anticipated to register the highest CAGR during the forecast period due to its assurance of dependable power distribution and data transmission for maximum efficiency. Furthermore, the integration of enhanced aircraft engines and flight control systems equipped with advanced electronic controls promotes the expansion of the market.

By Plug Type

Single-Phase Plug Dominates with its Wide Usage in Growing Applications

Based on plug type, the market is categorized into single-phase plug and three-phase plug.

In terms of share, the single-phase plug type segment is anticipated to dominate the market with a share of 59.20% in 2026, the single-phase plug segment dominated the market as they are widely used in avionics, cabin systems, lighting, and low-power auxiliary circuits. The segment's growth is driven by the increasing integration of electronics in aircraft cabins and the need for reliable, lightweight power solutions.

The three-phase plug segment is expected to record the highest CAGR during the forecast period, driven by the transition to More Electric Aircraft (MEA) and the adoption of advanced avionics and power systems.

By Shape

Circular Shaped Aviation Connector is Highly Preferred Owing to its Robust Features

Based on shape, the market is categorized into circular and rectangular.

In 2024, the circular segment led the market in terms of share. These connectors are designed to withstand harsh conditions such as vibration, temperature extremes, and electromagnetic interference, making them ideal for aviation applications where reliability is paramount.

The rectangular segment is expected to record the highest CAGR during the forecast period, driven by the trend in miniaturization. This trend is increasing the need for rectangular connectors because of their compact and efficient design, which accommodates more contacts in a limited space, enhancing space utilization in avionics systems. This adaptability enables customization to meet specific system requirements, such as power, signal, and data needs, which is driving their demand in the aviation sector.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Commercial Aircraft Dominated Market with Increasing Need for Passenger Comfort

Based on end-user, the market is categorized into commercial aircraft, business jets, military aircraft, and others.

In terms of share, the commercial aircraft segment led the market in 2024 due to fleet expansion, enhancing passenger experience, retrofitting, and modernization. Upgrading older aircraft with modern avionics and digital systems is a major driver for connector demand. Premium cabin features and differentiation strategies are further increasing the demand.

The military aircraft segment is expected to register the highest CAGR during the forecast period due to the increase in defense budgets, advanced avionics durability, and modernization of air forces. Rising global defense spending and procurement of new military aircraft are boosting demand for high-performance connectors that can withstand harsh environments during the war.

AVIATION CONNECTOR MARKET REGIONAL OUTLOOK

Asia Pacific

Asia Pacific Aviation Connector Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific led the market in 2024 driven by growth in commercial aviation and increased aircraft purchases. China, India, and Japan are investing in improving their aviation infrastructure, which is expected to result in a greater demand for better avionics and connectivity solutions. Additionally, rising defense spending in the area has sped up military aircraft purchases, further boosting the need for strong, high-performance aviation connectors. The Japan market is projected to reach USD 0.46 billion by 2026, the China market is projected to reach USD 0.76 billion by 2026, and the India market is projected to reach USD 0.29 billion by 2026.

The aviation industry in China is expanding swiftly, leading to an increasing demand for aviation connectors within the country. The rising trends in in-flight connectivity indicate a market upsurge. In January 2023, Viasat Inc. received approval from the Civil Aviation Administration of China (CAAC) to implement Ka-band satellite connectivity systems on the Boeing 737 aircraft series. This demonstrates the growing necessity for connectors in aircraft to ensure seamless data transfer and connectivity.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is expected to grow at the highest CAGR during the forecast period. The rising presence of aircraft manufacturers, ongoing fleet modernization programs, and significant defense spending contribute to the region's market growth. The rising acquisition of advanced aircraft and retrofit initiatives in both the U.S. and Canada contribute to market expansion. The U.S. Air Force has been diligently enhancing its fleet with updated avionics and communication technologies, necessitating high-performance connectors for reliable and secure data transfer. The U.S. market is projected to reach USD 1.2 billion by 2026.

South America

The South American region has a smaller market presence. Expanding regional air travel and government initiatives have created a positive impact, while economic expansion could be challenging.

Europe

The market in Europe is expanding, driven by the rising use of new interconnect solutions in military and commercial aircraft. The strong aerospace manufacturing industry in the region, backed by major aircraft OEMs, is fueling the demand for high-performance connectors. The UK market is projected to reach USD 0.19 billion by 2026, while the Germany market is projected to reach USD 0.17 billion by 2026.

Middle East & Africa

The Middle East & Africa’s aviation connectors market is undergoing stable growth due to recent shifts in the expanding aviation infrastructure and initial government funding for research initiatives.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Companies Plan Expansion Strategies with Heavy Investments in R&D

Major companies are offering aviation connectors to provide users with high reliability, durability, and resistance to environmental factors. Acquiring or signing agreements with small and local enterprises, collaborations, mergers, and partnerships are some of the few steps that aid in a company’s expansion. In addition to the above strategies, a significant amount is invested in research and development to develop cutting-edge technologies to gain advantage over other competitors in the market.

List of Aviation Connector Companies Studied (including but not limited to)

- Amphenol Corporation (U.S.)

- TE Connectivity (Ireland)

- Eaton (Ireland)

- Smiths Group plc (U.K.)

- Renhotec Group (China)

- ITT Inc. (U.S.)

- Bel Fuse Inc. (U.S.)

- IEH Corporation (U.S.)

- Apollo Aerospace Components (India)

- Rosenberger Hochfrequenztechnik GmbH & Co. KG (Germany)

- Radiall (U.S.)

- Carlisle Companies Incorporated (U.S.)

- HUBER+SUHNER AG (Switzerland)

- Japan Aviation Electronics Industry, Ltd. (Japan)

- Littelfuse, Inc. (U.S.)

- LPA Group PLC (U.K.)

- Dynell GmbH (Austria)

- TRIAC Corporation (U.S.)

- TT Electronics (U.K.)

- AVIC Jonhon Optronic Shape (China)

…and more.

KEY INDUSTRY DEVELOPMENTS

- May 2024: Amphenol acquired Carlisle Interconnect Technologies (CIT) from Carlisle Companies Incorporated. This move enhanced Amphenol's standing in the aviation connectors market by broadening its range of engineered interconnect solutions designed for challenging environments.

- May 2024: TE Connectivity introduced NanoRF 75 Ohm coaxial/optical hybrid modules designed to meet the increasing need for high-speed and high-density connections in contemporary video transmission systems. These modules enhance signal quality and dependability in the aerospace, defense, and marine sectors, strengthening advanced connectivity solutions in the aviation connector market.

- November 2023: Amphenol introduced a durable USB Type-C connector, the USB3CFTV. This connector is engineered to endure tough conditions and high-demand uses, including military communications, aviation, aerospace, commercial aircraft, and marine contexts. It includes a tri-start threaded coupling design that protects against shocks, vibrations, and cable stress.

- May 2023: ITT Inc. declared the purchase of privately owned Micro-Mode Products, Inc. (Micro-Mode) for about USD 80 million. Micro-Mode designs and manufactures high-bandwidth Radio Frequency (RF) connectors for challenging defense and space situations.

- September 2022: Smiths Interconnect highlighted the performance and compatibility of the HPH Series connector family following extensive testing at the Centre of Excellence laboratory. The HPH Series has earned a reputation for its reliability in challenging environments, withstanding various extreme conditions while offering high current capacity, low contact resistance, and minimal forces required for insertion and extraction, all while resisting significant shock and vibration.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The market is observing investment in suppliers of advanced materials (composites, high-performing plastics, etc.) and precision manufacturing equipment. Moreover, the military is enhancing aircraft fleets by increasing its budget and investing in advanced aircraft systems. According to SIPRI, global military spending reached about USD 2,440 billion in 2023. The ongoing upgrades show the increasing need for strong, high-quality military-grade connectors because aircraft connectors must withstand tough conditions. Therefore, it presents a huge opportunity for the players in the aviation connector market.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product types, and the leading end-user of the product. Besides, it offers insights into the aviation connector market trends and highlights key industry developments. In addition to the above-mentioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 6.10% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Plug Type

By Shape

By End-User

By Region

|

|

Companies Profiled in the Report |

Amphenol Corporation (U.S.) TE Connectivity (Ireland) Eaton (Ireland) Smiths Group plc (U.K.) Renhotec Group (China) ITT Inc. (U.S.) Bel Fuse Inc. (U.S.) IEH Corporation (U.S.) Apollo Aerospace Components (India) Rosenberger Hochfrequenztechnik GmbH & Co. KG (Germany) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 8.33 billion by 2034.

In 2025, the market was valued at USD 4.92 billion.

The market is projected to record a CAGR of 6.10% during the forecast period.

By type, the fiber optic connectors segment led the market in 2025.

Rising advancements in aircraft technology and systems to aid market growth.

Amphenol Corporation, TE Connectivity, Eaton, Smiths Group plc, Renhotec Group, ITT Inc., Bel Fuse Inc., IEH Corporation, Apollo Aerospace Components, and Rosenberger Hochfrequenztechnik GmbH & Co. KG are the top players in the market.

Asia Pacific held the largest market share in 2025.

By end-user, the military aircraft segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us