Bariatric Wheelchairs Market Size, Share & Industry Analysis, By Product (Manual and Electric), By Age Group (Adult and Pediatric), By End-user (Healthcare Settings {Hospitals & ASCs, Specialty Clinics, and Rehabilitation Centers}, Homecare Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

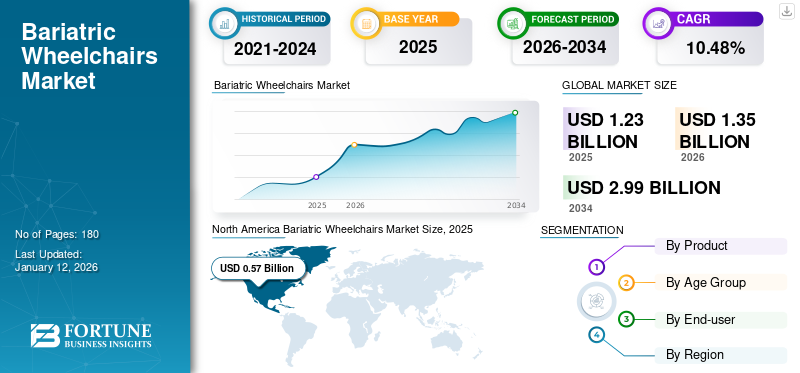

The global bariatric wheelchairs market size was valued at USD 1.23 billion in 2025. The market is projected to grow from USD 1.35 billion in 2026 to USD 2.99 billion by 2034, exhibiting a CAGR of 10.48% during the forecast period. North America dominated the bariatric wheelchairs market with a market share of 46.16% in 2025.

A bariatric wheelchair is a specialized wheelchair designed and manufactured specifically to accommodate overweight individuals who require higher weight capacities and enhanced support and comfort due to their medical needs.

The global market growth is driven by the rising obese population across the globe, which may require effective solutions to enhance lifestyle. Bariatric wheelchairs play a vital role in improving mobility, independence, and quality of life for individuals with higher weights. This is driving their adoption globally among higher-weight individuals with specific health conditions.

Some of the key players in the market include Invacare Corporation, Sunrise Medical, and Permobil. These key players are expanding their geographical presence as well as product reach through the implementation of various growth strategies, including collaboration, partnerships, and new launches.

Global Bariatric Wheelchairs Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.23 billion

- 2026 Market Size: USD 1.35 billion

- 2034 Forecast Market Size: USD 2.99 billion

- CAGR: 10.48% from 2026–2034

Market Share:

- North America dominated the bariatric wheelchairs market with a 46.16% share in 2025, driven by the strong presence of key manufacturers, a well-established healthcare infrastructure, and favorable reimbursement policies supporting the adoption of mobility equipment.

- By product type, the manual segment is expected to retain the largest market share owing to its affordability, lower maintenance requirements, and increasing adoption among overweight individuals seeking practical mobility solutions.

Key Country Highlights:

- United States: Growing demand for advanced mobility solutions driven by the increasing obese population and rising focus of manufacturers on product innovation and expansion across healthcare and homecare settings.

- Europe: Rising number of residential care and nursing homes across key countries, coupled with growing efforts by suppliers to enhance product availability in institutional care environments, is propelling market growth.

- China: Increasing government-led awareness programs focused on disability inclusion and accessibility, along with expanding adoption of bariatric mobility aids, are driving demand for bariatric wheelchairs.

- Japan: Focused initiatives by local manufacturers to introduce technologically advanced and weight-optimized mobility devices are contributing to the market expansion, alongside an aging population prone to obesity-related mobility issues.

MARKET DYNAMICS

Market Drivers

Increasing Prevalence of Obesity Among Population to Fuel Demand for Bariatric Solutions

The rising obesity rate globally is the major factor contributing to a larger pool of the disabled population. This population is at high risk of developing mobility disorders, owing to the increasing vulnerability to falls, fractures, and other conditions. Such conditions are expected to have a positive impact on the adoption of bariatric wheelchairs.

- For instance, as of 2025, the World Obesity Federation mentioned that the NCD Risk Factor Collaboration (NCD-RisC) published findings in 2024 estimating more than one billion people in the world living with obesity.

- Similarly, according to the data published by the World Health Organization (WHO), 1 in 8 people worldwide were living with obesity in 2022.

The growing adoption of unhealthy lifestyles, lack of physical activities among adults, increasing alcohol consumption, and hormonal imbalances are increasing the risk of obesity across the globe. This is, in turn, driving the demand for bariatric chairs, as increased obesity may lead to decreased mobility. Moreover, the prevalence of obesity increases with the aging population. When combined with obesity, these individuals are more susceptible to physical disabilities, creating a greater need for robust and supportive mobility solutions.

These factors are encouraging key players to be involved in collaborations and acquisitions for the development of bariatric equipment, which is expected to increase product availability, driving the global bariatric wheelchairs market growth.

- For instance, in October 2024, Yamaha Motor Co., Ltd. developed the JWG-1, a new wheelchair electric power unit, and introduced it in Europe and the U.S. market. One of the updated features of this JWG-1 is the improved unit maximum load (from 125 kg to 160 kg) when fitted to manual wheelchairs.

Market Restraints

Expansion of Certified Refurbished Markets to Limit Demand for New Wheelchairs

The increase in medical device waste, including wheelchairs, is raising environmental concerns, which is encouraging manufacturers and distributors to increase the offering of reuse and rental programs for bariatric wheelchairs. Additionally, the refurbishment service providers for wheelchairs are broadening their services to include bariatric wheelchair refurbishment and rentals.

The lower cost of refurbished wheelchairs compared to new ones is increasing the preference for these options, which is expected to hinder market growth.

- For instance, as of 2025, Americle Healthcare, Inc. provides repair and refurbishment services for all types of manual bariatric wheelchairs, such as transport and reclining wheelchairs.

Furthermore, several bariatric wheelchair providers now rent out their products and other aids, which is beneficial for short-term users. Cheaper rental rates of such products compared to new products may hamper the demand for purchasing new products, which is anticipated to hinder the market growth during the forecast period.

Market Opportunities

Rising Focus on Introduction of Mobility Schemes and Reimbursement Scenario Offers Lucrative Opportunities for Market Expansion

In recent years, the increasing demand for bariatric wheelchairs, driven by a rising population of individuals with obesity and mobility challenges globally, is prompting both market players and governments to expand initiatives and improve reimbursement options for these specialized devices. In response to this demand, there is a growing emphasis on developing new schemes and increasing financial support to enhance the accessibility and affordability of mobility equipment for users.

- For instance, the U.K. Autumn Budget 2024 allocated an additional USD 28.2 billion to the Department of Health and Social Care by 2025-2026, reflecting a broader commitment to healthcare and disability support.

- For instance, as of 2025, Surewise, a national insurance company, offers wheelchair coverage for electric models valued up to USD 2,700 and mobility scooter insurance for powered wheelchairs exceeding that value.

This investment is expected to benefit not only general mobility aids but also specialized products such as bariatric wheelchairs as part of the government's strategy to address the diverse needs of the disabled population. These efforts are expected to improve affordability and encourage greater demand for such mobility solutions, which are projected to fuel market expansion in the coming years.

Market Challenges

High Cost and Accessibility Challenges May Limit Market Growth

The high cost of bariatric wheelchairs stands as a significant challenge to their adoption, particularly impacting affordability for individuals and healthcare facilities in low-income regions. Advanced wheelchair models, which incorporate automated features and durable, lightweight materials, often command premium prices, making them inaccessible to a substantial portion of the target population.

- For instance, as of 2025, Scootaround, a provider of mobility equipment solutions, mentioned that the cost of an extra-wide bariatric wheelchair varies based on the brand and manufacturer, with most models priced between USD 400 and USD 500. However, prices can range to over USD 2000 for custom-made chairs.

Moreover, accessibility barriers also pose a significant challenge for market expansion. In many regions, there is insufficient awareness about the availability and benefits of bariatric wheelchairs, coupled with a lack of skilled technicians for maintenance and repair. Together, these factors restrict the widespread adoption of this equipment, which is anticipated to limit the market expansion.

BARIATRIC WHEELCHAIRS MARKET TRENDS

Advancements in Bariatric Wheelchairs is an Emerging Trend in Market

The bariatric wheelchairs market is undergoing significant transformation due to the growing need for specialized mobility solutions. Recent advancements focus on integrating lightweight materials such as aluminum alloys and carbon fiber, resulting in wheelchairs that are both highly durable and easier to move without compromising weight capacity. Technological innovations are also reshaping the landscape, with the adoption of automated and powered models that enhance user independence and reduce caregiver burden.

- In May 2024, Feather Mobility launched a new Feather heavy-duty wheelchair to offer unmatched durability and comfort for users with mobility challenges. This wheelchair features a reinforced steel frame for higher weight capacity yet uses lightweight materials for easier maneuverability. Additional key features include adjustable, removable armrests and customizable seat depth.

- For instance, as of 2025, the Rollee carer-controlled wheelchair bariatric has in-built safety control mechanisms such as anti-tip bars, automatic braking assistance, and controlled downhill assist.

Moreover, the focus of key players on the development of such products to increase their weight-bearing capacity is also leading to the introduction of new products. Smart features such as pressure mapping, real-time health monitoring, and connectivity are increasingly being incorporated into these products, providing a more personalized and safer user experience.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic witnessed a negative impact on the market in 2020. Many overweight or obese patients had their therapies, surgeries, or medical appointments postponed or canceled during the pandemic, reducing the immediate need for wheelchairs in clinical settings. Additionally, the pandemic caused significant disruptions in the supply chain and manufacturing processes for bariatric transport wheelchairs due to lockdowns. This led to delays in production and delivery, creating shortages that thereby reduced the market growth.

- For instance, according to the data published by the National Center for Biotechnology Information (NCBI) in June 2020, over two-thirds of preoperative patients experienced a postponement of their surgeries, and more than half had their follow-up visits delayed during the pandemic.

However, the market started regaining its growth rate due to the ease of regulations that were imposed during lockdown. This increased the bariatric patient volume in hospitals and enhanced the demand for bariatric wheelchairs, significantly contributing to market growth.

SEGMENTATION ANALYSIS

By Product

Manual Segment Led as It is More Affordable and Require Less Maintenance

Based on the product, the market is classified as manual and electric.

The manual segment dominated the market in 2024. The growth of the segment is attributed to the rising population of overweight individuals, which stimulates key players to launch new products. Manual bariatric wheelchairs are generally more affordable and require less maintenance than powered alternatives, and also offer great functionality to plus-size individuals.

- For instance, according to the data published by Karma Mobility in September 2024, manual bariatric wheelchairs are generally more affordable than electric ones.

On the other hand, the electric segment held a substantial share of the global market in 2024. Major companies are actively involved in developing technologically advanced electric wheelchairs tailored to the bariatric community, aiming to meet the rising demand among people with disabilities while enhancing user comfort. Such initiatives are projected to drive their adoption, contributing to the segment's growth in the coming years.

By Age Group

Rising Obesity and Mobility Issues Among Adults Boosted Segment Expansion

Based on age group, the market is classified into adult and pediatric.

The adult segment dominated the market in 2024. The rising alcohol consumption and sedentary lifestyle among adults are making them susceptible to several mobility issues and obesity. Bariatric wheelchair provides significant benefits, enabling them to move more freely within their home, community, and beyond, leading to greater social interaction and participation in daily activities. Such a scenario is expected to propel the demand for bariatric wheelchairs among adults over the forecast period.

- For instance, in March 2024, the World Health Organization (WHO) reported that in 2022, an estimated 2.5 billion adults aged 18 years and older were overweight, and 890 million among them were living with obesity.

On the other hand, the pediatric segment held a substantial market share in 2024. The increasing awareness about the need for specialized mobility solutions for children with mobility challenges is driving the need for bariatric wheelchairs in pediatrics. Additionally, parents and caregivers are increasingly seeking to improve the quality of life for their children with disabilities by providing them with greater independence and mobility. Such scenarios are anticipated to propel the segment's growth in the coming years.

By End-user

Increasing Demand for Home-based Care Fueled Homecare Settings Segment Growth

Based on end-user, the bariatric wheelchair market is segmented into healthcare settings, homecare settings, and others.

The homecare settings dominated the market in 2024. The growing adoption of bariatric wheelchairs in homecare settings due to increasing home-based care globally is expected to fuel the segment’s growth in the coming years. Moreover, the growing number of homecare settings in developed as well as developing countries is projected to contribute to the high adoption of such equipment, which is expected to drive segment growth.

For instance, according to the data published by CAREHOME.CO.UK in March 2025, there were around 16,566 care homes in the U.K.

The healthcare settings segment is projected to register the highest growth rate during the forecast period. The increasing number of hospitals, clinics, and other healthcare settings in emerging countries such as India, Brazil, and others contributes to segmental growth. Additionally, the improving healthcare infrastructure, which drives the demand for the availability of bariatric wheelchairs, is anticipated to fuel the segment’s growth.

The others segment held a lower share in 2024. The growth was attributed to the increasing number of research centers and other institutes globally that are surging the need for bariatric wheelchairs for overweight individuals in these settings.

BARIATRIC WHEELCHAIRS MARKET REGIONAL OUTLOOK

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Bariatric Wheelchairs Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2024. The North America bariatric wheelchairs market size stood at USD 0.57 billion in 2025. The growth is attributed to the presence of prominent players focused on the development of cutting-edge wheelchairs for overweight individuals in the region. Moreover, the established healthcare infrastructure and favorable reimbursement policy of the region are expected to support the adoption of mobility equipment in the region.

In the U.S., an increasing population pool, including overweight individuals with various mobility disorders, is supporting the adoption of such equipment in the region, thereby bolstering the country’s market growth.

- For instance, according to the data published by the CDC in 2024, roughly 12.2% of the U.S. population suffers from a mobility impairment.

Europe

The market in Europe held a substantial share in 2024. This was attributed to the rising number of residential care homes and nursing homes in key countries such as the U.K. This is driving the need for bariatric wheelchairs in these settings in the region. Furthermore, the key players focused on increasing product supply to these settings are also anticipated to fuel the regional market growth.

- For instance, according to the data published by CAREHOME.CO.UK in March 2025, there are 11,525 residential care homes and 5,041 nursing homes in the U.K.

Asia Pacific

Asia Pacific is expected to witness the highest CAGR during the forecast period. There is an increase in awareness initiatives by various national institutes and composite regional centers (CRCs) for wheelchairs, including bariatric ones, in emerging countries such as China, India, and others. These initiatives are expected to raise awareness about bariatric wheelchairs and contribute to their adoption, which is projected to surge the market growth.

- For instance, in May 2025, National Institutes and Composite Regional Centers (CRCs) under the Department of Empowerment of Persons with Disabilities (DEPwD), Union Ministry of Social Justice and Empowerment, conducted an awareness program to promote accessibility, independence, and inclusion of persons with disabilities. This highlighted the significance of wheelchairs, including bariatric ones, in the lives of users.

Latin America

The Latin American market is expected to grow at a significant CAGR during the forecast period. The growth can be attributed to the growing number of spinal cord injuries and trauma cases among adults in Brazil, Mexico, and other countries and rising awareness about bariatric mobility solutions. This is expected to favor the demand for bariatric wheelchairs in the region.

- For instance, according to a November 2022 article published by the National Center for Biotechnology Information (NCBI), there were nearly 40 new cases of spinal cord injuries (SCIs) in Brazil per year per million population, which was approximately 6,000-8,000 new cases annually.

Middle East & Africa

The Middle East & Africa region is anticipated to witness stagnant growth during the forecast period. The rising cases of Parkinson's disease among the population in the GCC countries, South Africa, and others have influenced the government and healthcare organizations to increase the provision of bariatric wheelchairs for overweight individuals. This is expected to fuel the regional market growth in the coming years.

- For instance, the South African government, through the Gauteng Department of Health, distributed a total of 38,742 assistive devices between April and September 2023 to support individuals living with disabilities. These devices included wheelchairs, hearing aids, orthoses, prostheses, and walking aids.

COMPETITIVE LANDSCAPE

Key Industry Players

Emphasis on Growth Strategies for Bariatric Solutions to Increase the Key Player’s Market Position

The market is fragmented, with prominent companies, including Ottobock, Sunrise Medical, and Invacare Corporation, accounting for a significant global bariatric wheelchairs market share in 2024.

The largest share is attributed to their strong geographic presence and the wide range of product offerings in the market. Additionally, these companies are focusing on the introduction of new products for bariatric individuals in response to the rising prevalence of obesity and mobility issues globally.

Moreover, the other key players, such as Drive Devilbiss International, GF Health Products, Inc., Permobil, Carex, and other companies, are concentrating on increasing investments, strengthening distribution networks, and collaboration & partnership agreements worldwide, which may contribute to increasing their market share.

LIST OF KEY BARIATRIC WHEELCHAIR COMPANIES PROFILED

- Ottobock (Germany)

- Sunrise Medical (U.K.)

- Invacare Corporation (U.S.)

- Drive Devilbiss International (U.S.)

- GF Health Products, Inc. (U.S.)

- Permobil (Sweden)

- Carex (U.S.)

- Pride Mobility Products Corp. (U.S.)

- Hoveround Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2024: Sunrise Medical launched the QUICKIE QS5 ultralightweight folding wheelchair with multiple frame angles and two frame versions.

- July 2024: Ottobock acquired Sahva A/S, a professional supply network for orthopedic technology in Denmark, to expand into the Danish market, providing its products, including bariatric wheelchairs.

- June 2024: Ottobock launched Juvo B7, an advanced power wheelchair for individuals with complex positioning and mobility needs.

- July 2020: Northern Health volunteers collaborated with the Northern Health Foundation to raise funds and support the purchase of a bariatric wheelchair for the Broadmeadows Hospital Dialysis Unit.

- June 2020: GF Health Products, Inc. acquired Bariatric Patient Care Equipment Manufacturer Gendron, Inc. to expand the “Made in USA” strategic initiative.

REPORT COVERAGE

The global bariatric wheelchairs market report provides market size & forecast by product, age group, and end-user segment. It covers market dynamics, market trends, and various associated factors projected to fuel the market expansion during the forecast period. It offers information on the number of disabled people, the prevalence of mobility disorders, and key industry developments. The report covers a detailed competitive landscape with information on the market share and company profiles of prominent players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.48% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Age Group

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.23 billion in 2025 and is projected to reach USD 2.99 billion by 2034.

In 2025, the market value stood at USD 0.57 billion.

The market is expected to exhibit a CAGR of 10.48% during the forecast period of 2026-2034.

By end-user, the homecare settings segment led the market.

The key factor driving the market is the increasing prevalence of obesity among the population.

Ottobock, Sunrise Medical, and Invacare Corporation are the top players in the market.

North America dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us