Biopharmaceutical CMO Market Size, Share & Industry Analysis, By Service (Manufacturing {Upstream Processing and Downstream Processing}, Fill & Finish Operations, Analytical & QC Studies, and Packaging), By Source (Mammalian and Non-Mammalian), By Product (Biologics and Biosimilars), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

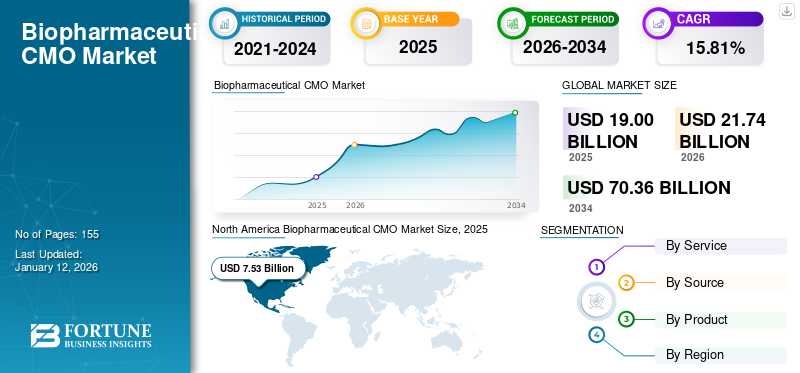

The global biopharmaceutical CMO market size was valued at USD 19 billion in 2025. The market is projected to be worth USD 21.74 billion in 2026 and reach USD 70.36 billion by 2034, exhibiting a CAGR of 15.81% during the forecast period. North America dominated the biopharmaceutical CMO market with a market share of 39.70% in 2025.

The market for biopharmaceutical CMOs has showcased strong growth, with projections indicating a continued upward trajectory in the near future. Lonza, WuXi Biologics, Samsung Biologics, and Catalent Inc. are some of the key players operating in the market.

Biopharmaceutical Contract Manufacturing Organizations (CMOs) are specialized entities that provide manufacturing services to pharmaceutical and biotechnology firms. These services include drug development, manufacturing, analytical testing, and packaging. The outsourcing of manufacturing in the biopharmaceutical industry began in the early 2000s, but demand for outsourcing services has increased in recent years due to the rise of biologics and biosimilars. This trend allows biopharmaceutical companies to emphasize core activities, such as research and marketing, while outsourcing non-clinical activities such as manufacturing and development to specialized biopharmaceutical CMOs. Additionally, technological advancements and regulatory pressures have accelerated the growth of biopharmaceutical CMOs.

The increasing demand for biologics, cost and time savings benefits offered by these contract services, and the rising partnerships between contract manufacturing organizations and biopharmaceutical companies, are some of the factors significantly driving the market growth during the forecast period.

- For instance, in November 2024, FUJIFILM Diosynth Biotechnologies signed a manufacturing agreement with TG Therapeutics, Inc. for manufacturing & supply of BRIUMVI (ublitiximab-xiiy).

Global Biopharmaceutical CMO Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 19.00 billion

- 2026 Market Size: USD 21.74 billion

- 2034 Forecast Market Size: USD 70.36 billion

- CAGR: 15.81% from 2026–2034

Market Share:

- Region: North America dominated the market with a 39.70% share in 2025. This is driven by the presence of a higher number of manufacturing facilities provided by CMOs and rising initiatives by prominent market players to expand their manufacturing capabilities in the region.

- By Service: The Manufacturing services segment held the largest market share in 2025. The segment's dominance is attributed to the increasing number of contract manufacturing projects being awarded to CMOs and the establishment of new manufacturing plants by several companies to enhance production efficiencies.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, growth is fueled by the increasing trend of offshoring outsourcing services from Western countries. The country's advanced biopharmaceutical research and manufacturing capabilities make it an attractive destination for contract services.

- United States: Market growth is supported by a high number of biopharmaceutical product approvals, including 18 biologics in 2023. The country is also a hub for strategic partnerships, with major CMOs investing heavily in expanding their manufacturing capacities, such as Fujifilm's USD 1.60 billion investment in its Texas facility.

- China: The market is driven by the increasing trend of biopharmaceutical companies offshoring their contract manufacturing requirements to the region. Studies indicate that around 50% of companies are considering China for their biopharmaceutical contract manufacturing needs.

- Europe: The market is advanced by a significant biopharmaceutical production capacity, accounting for 37.0% of the world's CMO capacity. Major players are also expanding their facilities, such as Lonza's new filling line in Switzerland and Siegfried Holding AG's new laboratory in Zurich, to meet growing demand.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Biologics and Biosimilars to Boost Market Growth

In recent years, the market for biologics and biosimilars has witnessed exponential growth. The key factor responsible for this growth is the growing shift from traditional small-molecule drugs to large-molecule biopharmaceutical drugs. The significant increase in the number of biopharmaceutical products being approved and the large number of biologics products in the companies’ development pipelines have intensely boosted the demand for these outsourcing services.

- For instance, according to the data published by the U.S. FDA in January 2024, the number of new drug products approved by the regulatory body was 55 in 2023 which includes 18 biologics products.

This surge in biopharmaceutical development has made Contract Development and Manufacturing Organizations (CDMO) more essential. This can be attributed to the fact that several biopharmaceutical and pharmaceutical companies lack the adequate capacity and capabilities required for the in-house production of these products. The confluence of all the above-mentioned factors is anticipated to boost the global biopharmaceutical CMO market growth.

Other Drivers

Outsourcing to Reduce Operational Costs and Access to Advanced Equipment

The process of development and manufacturing of biopharmaceutical drugs is a costly and time-consuming process. Thus, several small and mid-sized biopharmaceutical companies face financial strain, particularly in acquiring and operating expensive equipment for large-scale production of their biopharmaceutical product. To overcome this challenge, the operating companies are outsourcing their manufacturing to biopharmaceutical CMOs equipped with advanced facilities, equipment, and labor force to enhance the efficiency of their mass production within their business models.

Growth in Personalized Medicine and Targeted Therapies

Targeted therapies and personalized medicines are innovative and emerging disciplines intended for the treatment and prevention of various life-threatening conditions. Oncology is one the fastest growing areas where personalized medicine and targeted therapies are increasingly being studied. This strong growth prospect has supplemented the demand for contract manufacturing services.

MARKET RESTRAINTS

High Operational and Infrastructure Costs to Hinder Market Growth

A considerable upfront investment is required for the establishment of manufacturing facilities which poses a limitation to market growth. The use of stainless steel production facilities for the large-scale production of biopharmaceutical drugs results in higher manufacturing costs, in turn making the final product less affordable to the general patient population. Additionally, the need for additional equipment to scale up bio-manufacturing is the key factor limiting market growth.

Furthermore, the scale-up of bio-production capacity with the addition of new, technologically advanced equipment is also a costly process for small-scale contract manufacturing service providers. The production of microbial fermentation and mammalian expression systems that are used for the development of biopharmaceutical drugs is another costly process.

Other Restraints

Stringent Regulatory Requirements

The manufacturing of biopharmaceutical products is well-regulated across the world. Regulatory bodies such as the U.S. FDA, EMA, and others have provided comprehensive guidance on the manufacturing of biopharmaceutical products. All manufacturing facilities are required to adhere to the Current Good Manufacturing Practice (cGMP) regulations enforced by these bodies.

Supply Chain Vulnerabilities

Challenges associated with the supply of raw materials result in limiting market growth. Supply disruptions and shortages of raw materials impact the timely production of biologics and biosimilars, leading to delays in manufacturing processes and affecting revenues.

MARKET OPPORTUNITIES

Adoption of Single-Use Bioprocessing Technologies to Offer Lucrative Growth Opportunities

In recent years, Single-Use Bioreactors (SUBs) of various sizes have revolutionized biopharmaceutical manufacturing. The introduction of these bioreactors disrupted preclinical and clinical traditional stainless steel manufacturing networks as they provide modularity, flexibility, and several other advantages. Disposable equipment such as single-use bioreactors and single-user mixers, offer advantages such as shortened downtime and turnaround times, lowered risk of cross-contamination, elimination of validation issues, and others.

- In April 2021, Kemwell Biopharma announced its plans to install 3 Single-Use Bioreactors (SUBs) to further expand its current capacity.

Other Opportunities

Expansion of Manufacturing Capabilities in Emerging Markets:

With increasing demand for biopharmaceutical contract manufacturing services, industry players are focusing on expanding their market presence in untapped markets.

- For instance, in November 2020, AGC Biologics announced its plans to expand production capacity at its Copenhagen facility.

MARKET CHALLENGES

Skilled Workforce Shortages May Create a Significant Challenge for Market Growth

Even though the demand for contract manufacturing services for biopharmaceuticals is rapidly increasing, shortage of skilled workforce has created a challenge for the operating players. This is majorly due to the demographic shifts and increased demand for specialized skills. This in turn impacts the manufacturing workflow resulting in delayed production.

- For instance, according to an article published in biotech UG in September 2023, in the biopharmaceutical sector alone, there is a labor shortage of around 8% indicating a significant talent shortage.

BIOPHARMACEUTICAL CMO MARKET TRENDS

Adoption of Continuous Manufacturing Identified as a Significant Market Trend

Continuous manufacturing includes the manufacturing of a product at a single location end-to-end, with no hold-up times. Some of the advantages of continuous manufacturing include higher productivity, cost-effectiveness, increased process control and understanding, faster process development and scale-up, and others.

Along with that, the integration of advanced technologies such as Process Analytical Technology (PAT) enables identification and addressing of issues more quickly, in turn saving the overall manufacturing costs.

Other Trends

Boost in Number of Strategic Collaborations

Partnerships between contract manufacturers and biopharmaceutical developers are rapidly evolving, and are not limited to only manufacturing. In recent years, it has witnessed that an increasing number of biopharmaceutical companies have started co-investing in biopharma contract manufacturing operations. This results in leveraging a lower cost of capital in turn helping CMOs in effective manufacturing processes. Several biopharmaceutical companies are now partnering with CMOs to boost their production.

Emphasis on Digitalization

Digitalization and automation in manufacturing processes can improve workflow efficiency by optimizing bottleneck predictions, production workflows, and ensuring consistent product quality.

- In 2022, Samsung Biologics implemented a fully integrated biomanufacturing platform using advanced AI tools for process optimization.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic resulted in a positive impact on the market owing to the sudden increase in the demand for contract manufacturing services for COVID-19 vaccines. Several vaccine developers entered into manufacturing contracts with CMOs for the manufacturing of both COVID-19 vaccines and clinical candidates. As a result, market growth in 2021 and 2022 was higher compared to pre-pandemic years due to the higher demand for approved COVID-19 vaccines across the globe.

However, in 2023 & 2024, the market witnessed slower growth owing to the lesser demand for COVID-19-related products and the termination of contracts for vaccine manufacturing.

SEGMENTATION ANALYSIS

By Service

Expansion of Manufacturing Facilities Coupled with High Demand for These Services Supported Dominance of Manufacturing Segment

On the basis of service, the market is segmented into manufacturing, fill & finish operations, analytical & QC studies, and packaging. In 2024, the manufacturing services segment dominated the market with the highest share of 45.53% in 2026. The segment is anticipated to maintain its dominance throughout the study period. This dominance can be attributed to the increasing number of contract manufacturing projects being awarded to CMOs across the globe, aimed at enhancing production efficiencies. In addition, several companies are establishing their manufacturing plants across the world.

- For instance, in October 2023, Samsung Biologics partnered with Kurma Partners to develop and manufacture biologics for Kurma Partners’ portfolio companies.

- Similarly, in November 2024, Siegfried Holding AG opened a new laboratory in Zurich. This laboratory aimed to enhance the field of viral vector process development and manufacturing.

The manufacturing segment is further divided into downstream processing and upstream processing. During the forecast period, the downstream processing segment is projected to maintain the largest market share. The downstream processing of products requires advanced, technology-based equipment, which increases production costs. Thus, smaller biopharmaceutical companies tend to outsource the manufacturing of products to CMOs.

- For instance, in January 2021, Fujifilm Diosynth Biotechnologies invested USD 1.60 billion to expand manufacturing at its sites in Denmark and Texas.

The fill & finish operations segment is projected to witness a notable compound annual growth rate during the forecast period. The demand for filling and finishing services is rising as a result of the rise in regulatory approvals and biological product launches, driving segment growth.

- For instance, in October 2023, Lonza launched its new filling line for the commercial supply of antibody-drug conjugates. The new cGMP filling line at their site would enable the handling and filling of bioconjugates for commercial supply.

To know how our report can help streamline your business, Speak to Analyst

By Source

Wide Adoption of Mammalian Expression Systems Boosted Dominance of Segment

Based on source, the market is segmented into mammalian and non-mammalian. The mammalian segment held the leading position in 2026 with a share of 71.16%. Contributing factors to this dominance include the constantly increasing number of approved products based on mammalian cell cultures, and the high usage of mammalian expression systems for biopharmaceutical drug development.

- For instance, as per an article published by BioProcess International in August 2022, as of June 2022, 68% of the total commercialized biopharmaceutical products were based on mammalian sources.

On the other hand, the non-mammalian segment is also anticipated to witness considerable growth over the forecast period. Majority of the non-antibody-based biopharmaceutical products are manufactured using microbial expression systems, which has further contributed to segment growth.

By Product

Increasing Number of Approved Products in Biologics Segment to Impel Segment Expansion

Based on product, the market is categorized into biologics and biosimilars. The biologics segment accounted for the largest global biopharmaceutical CMO market share of 93.18% in 2026. A growing pipeline of biologics and an increasing number of product approvals by regulatory authorities have majorly driven the segment growth. As the number of products under development is rapidly increasing, so does the demand for contract manufacturing services. CMOs offer benefits such as the availability of specialized expertise, advanced technologies, and others, further boosting their adoption.

- For instance, in 2024, the U.S. FDA approved 18 biological entities and this number is continuously increasing.

- Similarly, as per the data published by NCBI in December 2022, biologics accounted for more than 90% of biopharmaceuticals global sales in 2021.

The biosimilars segment is expected to grow at a significant rate in the near future. Biosimilars have gained remarkable success in the past few years, especially in low and middle-income countries, due to their affordability compared to biologics.

- As of mid-2024, 53 biosimilars were approved by the U.S. FDA, out of which 42 are now available in the market.

BIOPHARMACEUTICAL CMO MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

North America

North America Biopharmaceutical CMO Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 7.53 billion in 2025 and USD 8.63 billion in 2026. The regional dominance can be ascribed to factors such as the presence of a higher number of manufacturing facilities provided by CMOs across the region and the rising initiatives by prominent market players to expand their manufacturing capabilities. The U.S. contributed the highest revenue share within North America, driven by the high adoption of innovative manufacturing technologies coupled with significant capacity expansion by key operating players. The U.S. market is projected to reach USD 7.91 billion by 2026.

For instance, in November 2022, FUJIFILM Diosynth Biotechnologies and North Carolina State University (NC State) expanded their collaboration for future innovation opportunities in the biopharmaceuticals space.

Europe

Europe is projected to witness noteworthy growth in the near future. In Europe, the production capacity of biopharmaceutical CMOs is significantly higher than in the U.S. Along with this, extensive efforts by operating players to expand their manufacturing capabilities in the region have also contributed to its growth. The UK market is projected to reach USD 1.51 billion by 2026, while the Germany market is projected to reach USD 1.75 billion by 2026.

- For example, in February 2019, according to BioProcess International, Europe accounted for 37.0% of the world's CMO capacity, with North America accounting for 35.0%.

Asia Pacific

The biopharmaceutical CMO market in the Asia Pacific region is poised to witness the fastest growth in the coming years. Growing trend of offshoring outsourcing services from the U.S. has resulted in biopharmaceutical companies to turn to this region to fulfill their contract manufacturing requirements. The Japan market is projected to reach USD 0.62 billion by 2026, the China market is projected to reach USD 1.22 billion by 2026, and the India market is projected to reach USD 0.75 billion by 2026.

- For example, in a study conducted and published by Contract Pharma in September 2024, around 50% of the respondents are looking toward China as a destination for contract manufacturing of their biopharmaceutical products.

Latin America and Middle East & Africa

Due to a relatively lower exposure of biopharma CMOs, Latin America and the Middle East &

Africa regions experienced a minimal market share in 2024. However, with improving healthcare infrastructure, the market in these regions is anticipated to witness significant growth in the coming years.

COMPETITIVE LANDSCAPE

Key Market Players

Lonza Dominates Owing to Strong Distribution Network Globally

The competitive landscape of the biopharmaceutical CMO market is highly fragmented with the presence of several well-established and emerging players. In 2024, Lonza captured the leading position in the global market, trailing Samsung Biologics, WuXi Biologics, and Catalent, Inc.

Lonza held the highest market share in 2024 owing to its robust global distribution network and strong focus on collaborations with leading biopharmaceutical companies. Furthermore, the company is concentrating on investing in expanding its production capacity and adopting novel technologies.

- For instance, in April 2024, Lonza collaborated with Acumen Pharmaceuticals, Inc. to manufacture Sabirnetug (ACU193), the first monoclonal antibody for the treatment of Alzheimer’s disease.

Other key players operating in the market include Samsung Biologics, WuXi Biologics, Catalent Inc. and others. Along with these players, the market comprises several small-scale players who are increasingly emphasizing on mergers and partnerships to expand their service offerings.

LIST OF KEY BIOPHARMACEUTICAL CMO COMPANIES PROFILED

- Samsung Biologics (Republic of Korea)

- Lonza (U.S.)

- Recipharm AB (Sweden)

- WuXi Biologics (China)

- FUJIFILM (FUJIFILM Diosynth Biotechnologies) (Japan)

- Siegfried Holding AG (Switzerland)

- Cambrex Corporation (U.S.)

- Catalent, Inc (U.S.)

- Thermo Fisher Scientific Inc. (Patheon) (U.S.)

INVESTMENT AND FUNDING TRENDS

In recent years, the market for biopharmaceutical contract manufacturing has witnessed tremendous growth, fueled by growth in venture capital investments in biopharma CMOs. According to an article published in July 2024, biopharmaceutical companies raised USD 7.6 billion in private financings across 107 investments. Additionally, increasing government funding initiatives for advanced therapies have also supported market expansion.

FUTURE OUTLOOK AND FORECAST

Complex biologics such as Gene and Cell Therapies (GCTs), innovative vaccines, and Antibody-Drug Conjugates (ADCs) are increasingly entering the development pipeline. These products are highly complex to develop and manufacture, requiring expertise across various scientific disciplines. As a result, several biopharmaceutical companies are expected to outsource manufacturing services for their products in the coming years.

Furthermore, the integration of automated processes improves data analysis and reduces human-made errors. The adoption of automation and artificial intelligence is anticipated to increase more in the near future.

KEY INDUSTRY DEVELOPMENTS

- December 2024: AGC Biologics announced that its Milan Cell and Gene Center of Excellence site has been approved by the U.S. FDA for the commercial manufacturing of Autolus Therapeutics’ AUCATZYL.

- November 2024: Samsung Biologics signed a manufacturing agreement with a pharmaceutical company based in Europe. This agreement will run through December 2031.

- October 2024: Lonza collaborated with a major global biopharmaceutical partner for the commercial-scale manufacturing of ADCs.

- July 2024: Siegfried Holding AG completed the acquisition of an early-phase CDMO in the U.S. This expanded its offering, particularly for small and medium-sized pharmaceutical companies.

- October 2023: Lonza and Vaxcyte collaborated for global commercial manufacturing of VAX-24 and VAX-31, a pneumococcal conjugate vaccines for adults and the pediatric population.

- January 2023- Lotte Biologics acquired a commercial-scale biomanufacturing facility in New York from Bristol-Myers Squibb to enter the CDMO market.

REPORT COVERAGE

The global biopharmaceutical CMO market research report provides a detailed analysis of the industry. It emphasizes key aspects, such as major companies, service types, sources, products, and a few others. In addition, it includes detailed insights into market dynamics, new product launches, and key industry developments such as mergers, partnerships, & acquisitions.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.81% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service

By Source

By Product

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 19 billion in 2025 and is projected to reach USD 70.36 billion by 2034.

In 2025, North Americas market value stood at USD 7.53 billion.

The market is expected to exhibit steady growth at a CAGR of 15.81% during the forecast period.

By service, the manufacturing segment led the market in 2025.

The increasing pipeline of biologics is one of the major factors boosting demand for biopharmaceutical outsourcing services.

Lonza, Boehringer Ingelheim, Samsung Biologics, and Catalent, Inc. are the major players in the market.

North America dominated the market in 2025.

Related Reports

- U.S. Contract Research Organization (CRO) Services Market

- Europe CRO Services Market

- ASEAN Contract Development and Manufacturing Organization (CDMO) Market

- Contract Manufacturing Organization (CMO) Market

- Contract Development and Manufacturing Organization (CDMO) Outsourcing Market

- Contract Research Organization (CRO) Services Market

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us