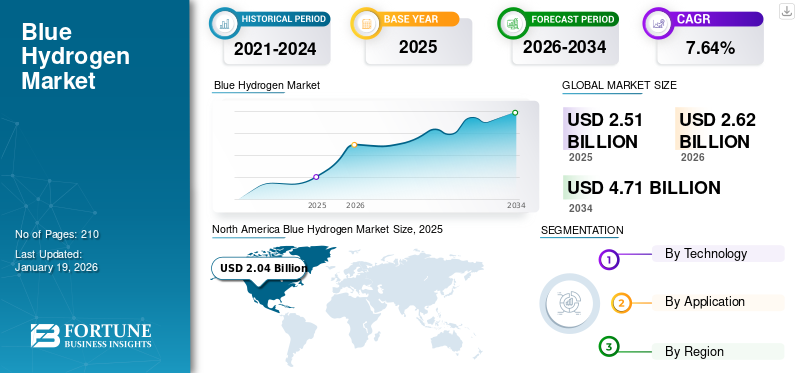

Blue Hydrogen Market Size, Share & Industry Analysis, By Technology (Steam Methane Reforming (SMR), Auto Thermal Reforming (ATR), and Others), By Application (Refinery, Chemical, and Others), and Regional Forecast, 2026-2034

Blue Hydrogen Market (2026-2034)

The global blue hydrogen market was valued at USD 2.51 billion in 2025 and its projected to grow from USD 2.62 billion in 2026 and reach USD 4.71 billion by 2034, exhibiting a CAGR of 7.64% during the forecast period. In 2025, North America leads the global blue hydrogen market, accounting for 81.16% market share.

Blue hydrogen refers to the hydrogen produced from natural gas, mainly using a process known as Steam Methane Reforming or Auto Thermal Reforming, with the combination of carbon capture and storage technology to capture the carbon dioxide produced due to hydrogen production.

The blue hydrogen industry growth can be attributed to an increasing focus on sustainable hydrogen-producing solutions and growing demand for environment-friendly energy solutions for various applications.

Technip Energies N.V. offers solutions and technologies that help their companies/customers achieve energy transition objectives. The company offers BlueH2, a suite of fully integrated, low-carbon hydrogen technology and EPC solutions designed to fulfil clients’ decarbonization and performance needs.

MARKET DYNAMICS

MARKET DRIVERS

Climate Policies and Net-Zero Goals to Favor Market Growth

The global push toward decarbonization has encouraged the use of sustainable energy transition solutions such as hydrogen. Among various hydrogen types, blue hydrogen is growingly considered as a viable mid-term solution due to its potential to reduce carbon emissions while utilizing fossil fuel resources.

North America, Europe, Asia Pacific, and other regions have pledged to achieve net-zero emissions, which require a high shift to low-carbon energy sources. Blue hydrogen integrates the carbon capture and storage to trap up to 90% or more of emissions, which significantly reduces the carbon footprint and thus makes it compliant with emission standards introduced under climate policies. As climate change is a key issue for governments and industries globally, the demand for low-carbon hydrogen is anticipated to grow in order to mitigate climate & emission challenges.

Growing Demand for Industrial Decarbonization to Drive Market Growth

There is a growing demand from hard-to-abate industries that face regulatory pressure to decarbonize. Chemicals, refineries, steel, and other sectors have high process emissions and energy requirements that can be fulfilled by utilizing blue hydrogen, as it offers an immediate and scalable solution to cut emissions.

Industrial decarbonization is a critical aspect, as low-carbon hydrogen can be integrated well into current infrastructure and processes. This type of hydrogen offers practical, timely, and cost-effective decarbonization solutions, driving robust demand across industries.

MARKET RESTRAINTS

Shifting focus Toward Green Hydrogen may Reduce Demand of Blue Hydrogen

Blue hydrogen faces challenges due to the growing prominence and potential cost reductions of green hydrogen. Green hydrogen, produced using renewable energy, offers a cleaner alternative, making low-carbon hydrogen, which relies on fossil fuels and carbon capture, potentially less attractive in the long run. This shift is driven by the falling costs of renewable energy and electrolyzers, coupled with growing concerns about the environmental impact of blue hydrogen's reliance on carbon capture and storage.

Green hydrogen, produced using renewable energy sources, is considered a zero-emission fuel source and aligns with the long-term goal of achieving net-zero emissions. Many governments and organizations are now prioritizing green hydrogen in their energy transition strategies. For instance, China, the world’s largest hydrogen producer, is rapidly expanding its green hydrogen production capacity, exceeding initial targets and positioning itself as a global leader, bringing a major impact on the blue hydrogen market.

MARKET OPPORTUNITIES

Expansion of Carbon Capture and Storage Support Market Growth

The blue hydrogen industry growth is closely related to the availability and scalability of carbon capture and storage solutions and technology. To make blue or low-carbon hydrogen, CO2 must be captured and either stored underground or used in industrial processes. The technology's ability to leverage existing natural gas infrastructure and reduce emissions from heavy transport and industrial processes is driving its adoption. The development of large-scale CCS hubs is also vital for cost-effective carbon capture, boosting the blue hydrogen market growth.

MARKET CHALLENGES

Various Associated Drawbacks to Challenge Market Expansion

Producing low-carbon hydrogen demands additional energy since the carbon capture and storage (CCS) technology must be operational throughout the production process. This "energy penalty" results in blue hydrogen requiring approximately 25% more natural gas to produce an equivalent amount of hydrogen when compared to grey hydrogen production.

CCS technology has the potential to capture carbon emissions released during the SMR process; however, it fails to address emissions related to the extraction of natural gas essential for this type of hydrogen production, such as methane leaks that occur during gas drilling, fracking, and transport via pipelines.

BLUE HYDROGEN MARKET TRENDS

Transition from Carbon-Intensive to Low-Carbon Hydrogen is a Key Market Trend

The blue hydrogen market is experiencing significant growth, fueled by increasing demand for low-carbon energy and government initiatives promoting decarbonization. This growth is also driven by the need to reduce carbon emissions and transition toward a hydrogen-based economy, with blue hydrogen being a key component in this shift.

Currently, the transition from grey to green hydrogen is expensive, where blue hydrogen is anticipated to bridge the gap due to cost-effectiveness and a low-carbon solution. Thus, this type of hydrogen is seen as a bridge fuel as it allows for a gradual reduction in carbon emissions while the infrastructure for green hydrogen is developed and scaled up. It can also leverage existing natural gas infrastructure, making the transition more convenient.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS

Tariffs can disrupt established supply chains for hydrogen production and related technologies, requiring adjustments and potentially leading to delays or increased costs. Tariffs on imported components or materials can increase the cost of blue hydrogen production, making it less competitive. Overall, while tariffs can create challenges for the blue hydrogen market, the sector is expected to continue growing due to increasing demand and the need for low-carbon energy solutions, particularly in regions with access to natural gas resources.

SEGMENTATION ANALYSIS

By Technology

Steam Methane Reforming (SMR) Dominates Owing to its Widescale and Proven Use in Hydrogen Production

Based on technology, the blue hydrogen market is segmented into Steam Methane Reforming (SMR), Auto Thermal Reforming (ATR), and others.

Steam Methane Reforming (SMR) is anticipated to have the largest blue hydrogen blue hydrogen market share of 86.05% in 2026, over the forecast period owing to its widespread and proven utilization in hydrogen production. Blue hydrogen production primarily utilizes steam methane reforming (SMR) in conjunction with carbon capture and storage (CCS) to mitigate carbon emissions.

ATR is a process that combines partial oxidation and steam methane reforming in a single reactor, converting natural gas into hydrogen and other products. This captured CO2 is then stored, making blue hydrogen a cleaner alternative to traditional grey hydrogen, which releases CO2 into the atmosphere.

To know how our report can help streamline your business, Speak to Analyst

By Application

Blue Hydrogen is Significantly Used in Refineries Due to Growing Demand for Sustainable Solutions

By application, the blue hydrogen market is divided into refinery, chemical, and others.

The refinery segment is anticipated to dominate major blue hydrogen with a market share of 66.92% in 2026. Refineries utilize hydrogen for hydroprocessing, such as hydrodesulfurization, to reduce sulfur content in fuels, particularly diesel, to meet environmental regulations and reduce harmful emissions. Hydrogen is crucial for reducing sulfur levels in fuels, which is essential for minimizing air pollution and improving engine performance. Blue hydrogen production can be integrated into existing refinery infrastructure, potentially using existing natural gas pipelines and processing units.

Blue hydrogen is also utilized as a feedstock for producing ammonia and methanol, which are crucial for fertilizers and other chemical products. Additionally, it can be used in industrial processes including steel and cement production, and for refining and synthetic fuel production.

BLUE HYDROGEN MARKET REGIONAL OUTLOOK

The blue hydrogen market has been studied geographically across four main regions: North America, Europe, Asia Pacific, and the rest of the world.

Blue Hydrogen Industry in North America

North America Blue Hydrogen Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Abundant Natural Gas Resources to Support and Ease Production in North America

The blue hydrogen industry in North America dominates the global market share owing to the presence of abundant natural gas resources, which are a primary feedstock for hydrogen production. North America dominated the market with a valuation of USD 2.04 billion in 2025 and USD 2.12 billion in 2026. This abundance lowers the production cost of blue hydrogen, making it a more economically feasible option compared to green hydrogen, particularly in the short to medium term.

Furthermore, both federal and state governments in North America have established ambitious targets to decrease greenhouse gas emissions. Low-carbon hydrogen, generated using carbon capture and storage (CCS) technology, provides a means to decarbonize various sectors. Consequently, policies focused on lowering carbon emissions are encouraging investment in low-carbon hydrogen infrastructure required for production. For instance, in December 2020, Canada revealed a federal hydrogen strategy which focuses on hydrogen as a vital aspect to fuel economic growth, achieve climate neutrality, and diversify the oil and gas sector. The strategy emphases on blue as well as green hydrogen, while accentuating Canada's advantageous conditions for producing fossil fuel-based hydrogen.

Blue Hydrogen Industry in U.S.

Supportive Government Policies Encourage the U.S. Market Growth

The demand for blue hydrogen in the U.S. is driven by federal incentives, objectives for decarbonization, and increasing industrial needs. In June 2023, the Biden-Harris Administration published the U.S. National Clean Hydrogen Strategy and Roadmap. This plan offers a detailed framework aimed at speeding up the production, processing, delivery, storage, and utilization of clean hydrogen. It highlights the U.S. government's dedication to tackle the climate emergency and reach a carbon-free electricity grid by 2035, along with a net-zero emissions economy by 2050. The U.S. market is valued at USD 1.51 billion by 2026.

Blue Hydrogen Industry in Europe

Europe’s Focus on Sustainable Solutions to Support Market Growth

The blue hydrogen industry in Europe is experiencing growth owing to robust policy support and a dedication toward developing a hydrogen economy. The Hydrogen Strategy of the European Union (EU) aims to expedite the production of low-carbon hydrogen, with blue hydrogen acting as a transitional option in conjunction with green hydrogen.

The RePowerEU initiative focuses on decreasing reliance on Russian gas while enhancing hydrogen infrastructure throughout Europe. Similarly, Germany, the U.K., and Netherlands are at the forefront of investing in hydrogen facilities equipped with carbon capture, utilization, and storage (CCUS) technology.

Blue Hydrogen Industry in Asia Pacific

Rapid Industrialization in Asia Pacific Drive Market Growth

The rapid industrialization, growth, and increasing energy demand in the region are anticipated to drive the blue hydrogen market growth. Governments in Asia Pacific are setting ambitious targets for greenhouse gas emission reductions, with hydrogen identified as a key component in their energy transition strategies.

Industrial sectors including chemicals, refineries, and fertilizers are major consumers of hydrogen, and fossil-based hydrogen with CCS offers a cost-effective way to decarbonize these industries, especially where immediate green hydrogen adoption is not feasible. This, coupled with government initiatives promoting hydrogen adoption, is fueling the market's growth in the region. The Japan market is valued at USD 0.03 billion by 2026.

Blue Hydrogen Industry in China

Vast Hydrogen Producing Capacity to Support Market Expansion

China's sheer scale of industrial activity and energy needs make it the biggest player in both hydrogen production and consumption; however, the country meets around 99% of its hydrogen demand by using grey hydrogen. Thus, there is a substantial need for the adoption of cleaner and low-emission solutions.

China's rapid industrial growth, particularly in sectors such as chemicals, refining, and steel, is a major driver for the product demand. Blue hydrogen, produced from natural gas with carbon capture and storage (CCS), is observed as a way to decarbonize these energy-intensive industries. the China market is valued at USD 0.27 billion by 2026.

Rest of the World

Gradual Growth in the Rest of the World is Expected Owing to Limitations in Adopting Technology

Although blue hydrogen is deemed to be a sustainable technology for short-term to mid-term goals, its adoption in the rest of the world is low. Lack of opportunities, inadequate proven results of projects globally, and other factors discourage the investments and adoption of low-carbon hydrogen at scale. However, in upcoming years, developments to mitigate carbon emissions are anticipated to fuel demand for blue hydrogen as a sustainable solution.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Partnerships and Collaborations among Leading Companies Play Key Role in Market Expansion

Globally, Honeywell, Technip Energies, ExxonMobil, and others, are some of the key players in the blue hydrogen market. These players offer a suite of solutions for better adoption of low-carbon hydrogen and are involved in efforts to develop and make blue hydrogen a viable solution.

Various developments are active in the market and are anticipated to support the market growth. For instance, in May 2025, Marubeni Corporation and Exxon Mobil entered into a long-term off take agreement for around 250,000 tons of low-carbon ammonia annually from ExxonMobil’s facility in Baytown, Texas. This facility is anticipated to generate nearly carbon-free hydrogen by capturing approximately 98% of CO2 along with low-carbon ammonia.

Top Blue Hydrogen Companies Analyzed:

- Shell (U.K.)

- Honeywell (U.S.)

- Lummus Technology (U.S.)

- TOPSOE (Denmark)

- Technip Energies N.V. (France)

- BP p.l.c. (U.K.)

- ExxonMobil (U.S.)

- Air Products and Chemicals, Inc. (U.S.)

- Linde PLC (U.K.)

- Emerson Electric Co. (U.S.)

- Equinor (Norway)

- Johnson Matthey (U.K.)

- Aker Solutions (Norway)

- Dastur Energy (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025 – Inpex Corporation commenced commissioning work at its integrated blue hydrogen and ammonia production and utilization demonstration test project in Kashiwazaki City, Japan. The project is the first of its kind in Japan to implement an integrated process from the production to the utilization of hydrogen and ammonia.

- September 2024 – Mitsubishi Corporation and Exxon Mobil Corporation signed a Project Framework Agreement for Mitsubishi’s involvement in ExxonMobil’s facility in Baytown, Texas, which is anticipated to produce virtually carbon-free hydrogen with approximately 98% of carbon dioxide (CO2) removed and low-carbon ammonia.

- June 2024 – ExxonMobil and Air Liquide announced an agreement to support the production of low-carbon hydrogen and low-carbon ammonia at the former’s Texas facility. The agreement will enable the transportation of low-carbon hydrogen through Air Liquide’s existing pipeline network.

- May 2024 – Energy companies Equinor, Centrica, and SSE Thermal collaborated on numerous low-carbon hydrogen projects on the north bank of the Humber. Under this effort, Equinor and Centrica proposed a multi-stage green and blue hydrogen production facility as well.

- November 2022 – Hafnia, oil product and chemical tanker owners and operator, partnered with Clean Hydrogen Works (CHW) to explore the development of Ascension Clean Energy (ACE), a global-scale, clean hydrogen ammonia production and export project, – located on the West Bank of the Mississippi River in Ascension Parish, Louisiana.

Blue Hydrogen Industry Investment Analysis and Opportunities

Development of projects and supporting infrastructure is likely to present a substantial investment opportunity in the market.

- In November 2024, the TA’ZIZ Industrial Chemicals Zone announced infrastructure funding of USD 2 billion for engineering, procurement, and construction (EPC) contracts to develop key site infrastructure, including a blue hydrogen-based ammonia export facility.

- In August 2024, Linde signed a long-term agreement for the supply of clean hydrogen to Dow’s Fort Saskatchewan Path2Zero Project. The company will invest more than USD 2 billion to build, own, and operate a world-scale integrated clean hydrogen and atmospheric gases facility in Alberta, Canada.

Blue Hydrogen Report Coverage:

The blue hydrogen market report delivers a detailed insight into the market and focuses on key aspects such as leading companies in Blue Hydrogen. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Blue Hydrogen Report Scope & Segmentation:

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.64% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology · Steam Methane Reforming (SMR) · Auto Thermal Reforming (ATR) · Others |

|

By Application · Refinery · Chemical · Others |

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 2.04 billion in 2025.

The market is likely to grow at a CAGR of 8.04% over the forecast period (2026-2034).

The Steam Methane Reforming (SMR) segment is expected to lead the market in the forecast period.

The market size of North America stood at USD 2.04 billion in 2025.

Climate policies and net-zero goals to favor market growth.

Some of the top players in the market are Honeywell, Technip Energies, ExxonMobil, and others.

The global market size is expected to reach USD 4.71 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us