Blended Cement Market Size, Share & Industry Analysis, By Type (Portland Pozzolan Cement (PPC), Portland Limestone Cement (PLC), Portland Slag Cement (PSC), and Others), By Application (Residential and Non-Residential), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

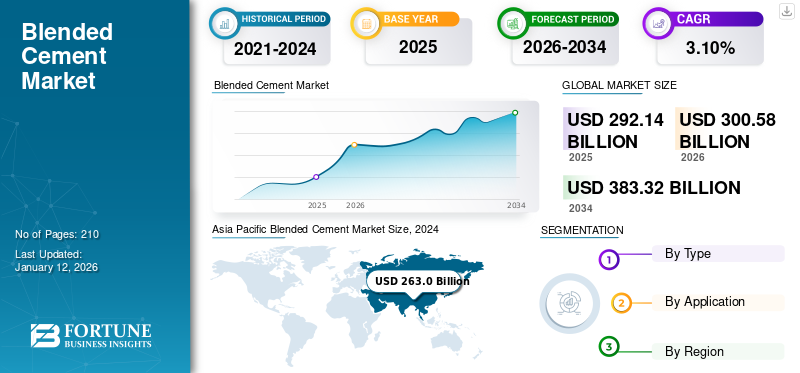

The global blended cement market size was valued at USD 292.14 billion in 2025. The market is projected to grow from USD 300.58 billion in 2026 to USD 383.32 billion by 2034, exhibiting a CAGR of 3.10% during the forecast period. Asia Pacific dominated the blended cement market with a market share of 73% in 2025.

Blended cement is a type of cement where a portion of Portland cement clinker is replaced with fly ash, slag, silica fume, or calcined clay. This mix improves durability, workability, and chemical resistance while diversifying raw material use. A key driver of demand is the construction industry's effort to lower carbon emissions. By reducing clinker content, blended cement can considerably decrease the carbon footprint compared to traditional Portland cement. This environmental advantage aligns with growing regulatory and market pressures for sustainable building practices, leading to greater global adoption of the product as companies strive to meet both performance and sustainability goals in construction projects. The major companies operating in the market include, Heidelberg Materials, HOLCIM, Cemex, Anhui Conch, and UltraTech, among others.

Global Blended Cement Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 292.14 billion

- 2026 Market Size: USD 300.58 billion

- 2034 Forecast Market Size: USD 383.32 billion

- CAGR: 3.10% from 2026–2034

Market Share:

- Asia Pacific dominated the blended cement market with a 73% share in 2025, fueled by rapid urbanization, infrastructure expansion, and strong adoption of sustainable construction materials across China, India, and Southeast Asia.

- By type, Portland Pozzolan Cement (PPC) is expected to retain the largest market share in 2025, supported by high availability of industrial by-products such as fly ash and its use in affordable, durable infrastructure and housing projects.

Key Country Highlights:

- Japan: Demand is driven by the use of high-durability blended cement in earthquake-resistant infrastructure and compliance with strict environmental regulations.

- United States: The Infrastructure Investment and Jobs Act is accelerating the use of eco-friendly materials like blended cement in national infrastructure projects.

- China: Through the Belt and Road Initiative, China remains a global leader in cement consumption and infrastructure development, supporting high blended cement demand.

- Europe: Growth is supported by the European Green Deal, which promotes low-carbon construction materials and mandates for sustainable building codes and certifications.

Blended Cement Market Trends

Rising Adoption of Sustainable Materials in Green Building Initiatives to Create Growth Opportunities

The sustainability-driven formulation is a central trend reshaping the market as industries intensify efforts to cut carbon emissions and meet global climate goals. Traditional Ordinary Portland Cement (OPC) production is highly carbon-intensive, responsible for nearly 7% of global CO₂ emissions. In response, manufacturers are increasingly adopting blended formulations that substitute a significant portion of clinker with supplementary cementitious materials such as fly ash, slag, calcined clay, and natural pozzolan. These blends can significantly reduce carbon emissions when compared to pure OPC while also enhancing durability and performance in concrete. In addition to this, many governments and regulatory bodies now incentivize the use of low-carbon construction materials, further accelerating this shift. The growing emphasis on green building certifications, such as LEED and BREEAM, is also driving contractors and developers to favor blended cement. As sustainability becomes a priority across the construction industry, developing low-carbon cement products is emerging as a key competitive advantage for manufacturers seeking to meet both regulatory requirements and market expectations.

Market Dynamics

Market Drivers

Rapid Infrastructure Development and Urbanization to Surge Product Demand

Urbanization and population growth are major drivers of global cement demand. As cities expand, especially in rapidly developing countries such as China and India, which together account for a major global cement consumption, the need for concrete infrastructure is expected to grow. According to the International Energy Agency (IEA), in India, an estimated 270 million people will move to urban areas by 2040, significantly increasing residential construction and infrastructural projects. This surge will require a massive expansion in housing, transportation networks, and public utilities. Global cement demand could rise significantly by 2050 to support these urban developments, particularly across Asia and Africa. As per the World Health Organization, by 2050, 68% of the world’s population is expected to live in cities, making durable, and high-performance construction materials essential. These cements, with their environmental and cost advantages, are well-positioned to meet this growing demand while aligning with sustainability goals in modern urban planning. Thus, consequently benefiting and witnessing blended cement market growth in tandem.

Market Restraints

Competition from Alternative Materials to Limit Market Growth

The rise of alternative materials such as geopolymer concrete, Ultra-High-Performance Concrete (UHPC), alkali-activated materials, and carbon capture technologies might limit the growth potential of the product. These alternatives offer superior strength, faster setting times, better chemical resistance, and much lower carbon emissions compared to the product. As governments and industries push for aggressive carbon reduction, investment is increasingly shifting toward these newer technologies, especially in developed markets. Large-scale pilot projects and regulatory support can further accelerate their adoption. As these materials become more scalable and cost-competitive, mixed cement may face an increase in competition, particularly in high-performance and sustainable construction sectors where advanced material properties are critical. This could gradually reduce blended cement’s demand in key applications, limiting market growth.

Market Opportunities

Adoption of Product in Megaprojects to Create Market Growth Opportunities

Infrastructure investments are the key driver of global mixed cement demand. Large-scale projects, including roads, railways, airports, and energy facilities, require durable, cost-effective materials, making this cement an ideal solution. Its enhanced durability and lower carbon footprint align with the priorities of both governments and private investors seeking sustainable, long-lasting infrastructure. Major initiatives such as China’s Belt and Road, India’s Smart Cities Mission, and the U.S. Infrastructure Investment and Jobs Act emphasize the use of eco-friendly materials, boosting product adoption. In addition to this, the economic need for resilient and low-maintenance construction further strengthens its role in infrastructure development. As sustainability standards become an integral part of project requirements, the demand for these types of cement is anticipated to expand, supporting both modernization goals and environmental commitments across emerging and developed economies. Thus, presenting a market growth opportunity during the forecast period.

Market Challenges

Raw Material Availability Constraint Creates a Challenge for Market Growth

The limited availability of Supplementary Cementitious Materials (SCM) such as fly ash and slag is a key challenge for mixed cement demand. As coal-fired power plants and traditional steel production decline due to global decarbonization efforts, the supply of these critical by-products is shrinking. This shortage could lead to higher SCM costs, quality variability, and supply chain disruption, particularly in regions dependent on imports. As a result, the traditional cost and environmental advantages of mixed cement could be lost. Without stable and affordable raw materials access, manufacturers may face production and pricing challenges, potentially slowing the adoption of these cements, especially for large infrastructure projects where consistent quality and volume are crucial. Thus, addressing raw material scarcity will be critical for sustaining market growth.

Impact of Trade Protectionism and Geopolitics

Trade War among Global Economic Powers to Influence Market Dynamics

The ongoing tariff war has disrupted the global blended cement market growth by increasing costs for imported clinker and supplementary cementitious materials. In the U.S., tariffs on cement imports from key suppliers such as Canada and Mexico have raised prices by up to 25%, squeezing profit margins for mixed cement producers. Similarly, tariffs on Chinese SCMs, such as fly ash and slag, have forced manufacturers to find more expensive alternatives. The Portland Cement Association (PCA), representing U.S. cement manufacturers, has expressed concerns that the tariffs could negatively impact energy and national security, delay infrastructure projects, and raise their costs. The tariffs are expected to increase the price of cement, potentially impacting concrete producers and the construction industry as a whole.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Abundant Availability of Industrial By-products has made PPC a Preferred Choice in Construction Activities

Based on type, the market is classified into Portland Pozzolan Cement (PPC), Portland Limestone Cement (PLC), Portland Slag Cement (PSC), and others.

The Portland Pozzolan Cement (PPC) segment accounted for the largest global blended cement market share, owing to its rising adoption in construction activity. PPC is a type of mixed cement made by mixing Ordinary Portland Cement (OPC) clinker with pozzolanic materials such as fly ash, volcanic ash, or silica fumes. PPC offers improved workability, reduced permeability, and enhanced long-term strength compared to conventional OPC. It is particularly resistant to chemical attacks, making it ideal for hydraulic structures, marine construction, and mass concreting projects. A major factor driving demand for PPC is the strong push toward sustainable construction practices, especially in emerging economies such as India and Africa. The abundant availability of industrial by-products such as fly ash and the need for durable, low-cost infrastructure solutions have made PPC a preferred choice for large-scale housing and infrastructure developments aligned with national green building mandates.

The Portland Limestone Cement (PLC) segment is expected to grow significantly during the forecast period. PLC is a mixed cement that incorporates finely ground limestone into traditional Portland cement. The addition of limestone reduces the clinker factor, significantly lowering carbon emissions during production without compromising performance. PLC offers comparable strength, better workability, and improved environmental performance. A major factor driving the surge in PLC demand is global regulatory pressure to decarbonize the construction industry.

By Application

Residential Segment Held Dominant Market Share due to Rapid Urbanization across the Globe

Based on application, the market is classified into residential and non-residential segments.

Residential construction is the largest segment of the blended cement market. This growth is driven primarily by rapid urbanization, with the global urban population projected to rise up to 68% by 2050. Expanding housing needs, particularly in Asia Pacific and Africa, are fueling large-scale residential projects that prioritize durable and cost-effective building materials. Blended cement’s affordability, enhanced durability, and lower carbon footprint make it a preferred choice for mass housing developments, ensuring long-term structural resilience while meeting sustainability targets in emerging and developed markets alike.

Non-residential segment includes commercial, institutional, and industrial construction projects such as offices, schools, transport hubs, and power plants. Growth of this segment is driven by increased infrastructure investment across Asia Pacific and the Middle East & Africa. Additionally, the growing focus on sustainable building practices, especially in green-certified projects such as LEED, is boosting demand for low-carbon materials such as mixed cement. Developers also value mixed cement for its superior chemical resistance and durability, which reduces lifecycle costs and enhances the longevity of non-residential structures in harsh environments.

Blended Cement Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, and rest of the world.

Asia Pacific

Asia Pacific Blended Cement Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 212.12 billion in 2025 and USD 218 billion in 2026. In Asia Pacific, rapid urbanization, population growth, and massive infrastructure initiatives are driving product demand. China, India, and Southeast Asian countries are investing heavily in transport, energy, and housing projects, where cost-effective, durable materials are critical. In addition to this, government regulations promoting sustainable construction have strengthened the shift toward mixed cement. Environmental impacts and energy savings also make blended products attractive, particularly as urban centers aim to lower their carbon footprints without compromising on quality or speed of development.

North America

In North America, blended cement demand is driven by a combination of sustainability goals, infrastructure modernization, and cost efficiency. The U.S. Infrastructure Investment and Jobs Act has boosted construction spending, particularly on highways, bridges, and public transit, and sectors well-suited for blended products. Environmental certifications are also shaping construction material choices, encouraging lower-carbon options. In addition to this, corporations and municipalities push builders to adopt greener practices, with mixed cement offering a practical way to reduce emissions without a major price surge. Canada’s emphasis on carbon neutrality is reinforcing similar trends.

Europe

In Europe, stringent environmental regulations and the European Green Deal are major forces behind product demand. The construction sector faces aggressive CO2 reduction targets, prompting widespread use of low-clinker, high-SCM mixed cements. Governments also incentivize green building practices through grants and certifications such as BREEAM and LEED. Furthermore, aging infrastructure in Western Europe is undergoing sustainable renovation, requiring materials that balance performance with low embodied carbon. As circular economy initiatives grow, the use of industrial by-products in cement further accelerates regional adoption.

Rest of World

Latin America’s market is expanding due to urbanization, government infrastructure programs, and cost-conscious construction practices. Countries such as Brazil and Mexico are investing in roads, affordable housing, and energy facilities, where durable and affordable materials are critical. Economic pressures push builders to seek cost-effective solutions and mixed cements. These affordable solutions often use locally available materials such as pozzolan and slag. Furthermore, there is an increasing awareness of environmental issues, accompanied by regional initiatives that encourage the use of sustainable building materials, even at a slower rate than in more developed markets.

In the Middle East & Africa, rising urbanization, large-scale infrastructure projects, and harsh climate conditions are key drivers. Mixed cements are preferred for their improved durability and resistance to aggressive environments, such as high salinity and temperature extremes. The need to build resilient, long-lasting structures economically supports their demand. Governments are also introducing sustainability guidelines into construction standards, further encouraging the adoption of low-carbon building materials such as mixed cement, driving market growth.

Competitive Landscape

Key Industry Players

Adoption of Green Initiatives to Prompt Cement Industry to Produce Blended Cement

The global market faces strong competitive rivalry, dominated by major players such as, Heidelberg Materials, HOLCIM, Cemex, Anhui Conch, and UltraTech, among others. Competition is intensified by mergers, acquisitions, and aggressive pricing strategies as companies leverage the cost advantages of supplementary cementitious materials. Differentiation using low-carbon technologies and green certifications is increasingly important. Even though capital-intensive activities create entry hurdles, regional players compete through localized blends. Volatile raw material costs and stringent regulations, such as the EU Carbon Border Adjustment Mechanism (CBAM), further increase competition. As demand grows steadily, competitive intensity is expected to drive innovation, expansion, and strategic realignment.

List of Key Blended Cement Companies Profiled

- HOLCIM (Switzerland)

- UltraTech Cement Ltd. (India)

- Cemex S.A.B DE C.V. (Mexico)

- Heidelberg Materials (U.S.)

- TAIHEIYO CEMENT CORPORATION (Japan)

- JSW Cement (India)

- Dalmia Bharat Limited (India)

- Anhui Conch Cement Co., Ltd. (China)

- Martin Marietta Materials (U.S.)

- Votorantim Cimentos (Brazil)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Heidelberg Materials has announced that it will be commissioning an MVR vertical roller mill of the type MVR 5000 C-4 from Gebr Pfeiffer at its existing plant in Airvault, France. The mill will grind and produce ultra-fine Portland cement that will be used in blended cement and other products.

- February 2025: UltraTech commissioned an additional 0.6 Million Tons Per Annum (MTPA) capacity at its existing plant in West Bengal, India. The move is part of the company’s plan to meet the rising demand for cement.

- February 2024: Martin Marietta Materials announced selling its South Texas business to CRH. The business includes its Hunter cement plant in Texas, which has a combined 2.1 MTPA capacity of cement and ready-mix concrete.

- April 2022: CEMEX announced that it has increased its production of Portland Limestone Cement (PLC) at its plant in Colorado, U.S. The move is part of the company’s initiative to meet carbon reduction goals and meet the rising demand for lower-carbon building materials in Colorado and across the globe.

- February 2022: CEMEX USA introduced eco-friendly, lower-carbon Portland Limestone Cement (PLC) produced at its plants in Brooksville, Fla., and Demopolis, Ala., across the southeastern United States. This development can offer reductions of CO2 emissions by up to 10% when compared to Ordinary Blended Cement (OPC).

REPORT COVERAGE

The global market analysis provides market size and forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on blended cement in key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.10% during 2026-2034 |

|

Unit |

Value (USD Billion), Volume (Million Ton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 300.58 billion in 2026 and is projected to reach USD 383.32 billion by 2034.

In 2025, the market value stood at USD 212.12 billion.

The market is expected to exhibit a CAGR of 3.10% during the forecast period.

The residential segment led the market by application.

Rapid infrastructure development & urbanization are expected to surge the demand for the product.

Holcim, Heidelberg Materials, Cemex, Anhui Conch, and UltraTech are some of the leading players in the market.

Asia Pacific held the largest market share in 2025.

Rising investments in megaprojects and increasing adoption of sustainable materials in green buildings favor product adoption.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us