Blockchain in Insurance Market Size, Share & COVID-19 Impact Analysis, By Provider (Application and Solution Provider, Middleware Provider, and Infrastructure and Protocols Provider), By Enterprise Type (SMEs and Large Enterprises), By Application (GRC Management, Claims Management, Identity Management and Fraud Detection, Payments, Smart Contracts, and Others (Customer Communication etc.)), and Regional Forecast, 2026 – 2034

Blockchain in Insurance Market Size

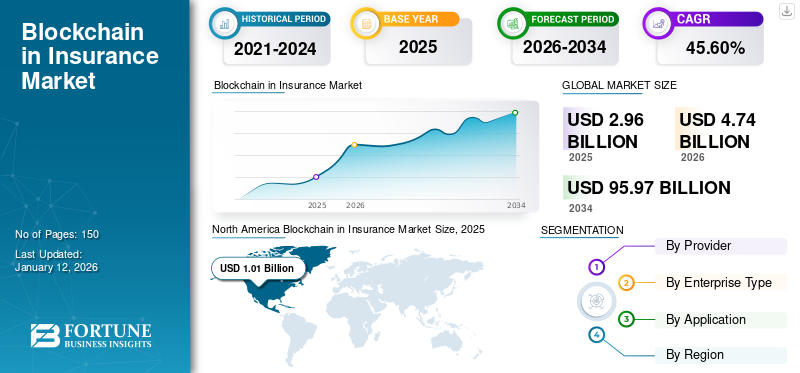

The global blockchain in insurance market size was valued at USD 2.96 billion in 2025. and is projected to grow from USD 4.74 billion in 2026 to USD 95.97 billion by 2034, exhibiting a CAGR of 45.60% during the forecast period. North America dominated the global blockchain in insurance market with a share of 34.20% in 2025.

Blockchain in insurance is a shared distributed ledger technology that garners and provides the individual’s entire transaction history. With this, end users can prevent, detect, and counter frauds that occur in their insurance claims. The primary reason that insurers benefit from implementing this technology is transparency. For instance, whenever claims are transferred to a blockchain-based ledger which is shared among carriers within a peer-to-peer network, it becomes difficult to modify and prevent any fraud from occurring.

Currently, the market is still in its nascent stage, with the majority of the projects in the concept stage. However, companies are continuously engaged in exploring the use cases of blockchain technology in the insurance industry. The primary factor driving the market apart from the increasing investments in relation to the market, is the rising popularity of automated claims management solutions. Furthermore, in the coming years, as the market matures, the technology is expected to transform the insurance industry positively.

COVID-19 IMPACT

Insufficient Demand and Lack of Proper Distribution Channels led to the Moderate Growth of the Market

The COVID-19 pandemic moderately impacted the market due to the slow adoption of the technology among insurers. Companies operating in the market were exploring the potential of applications of the technology even before the pandemic had occurred. There was a considerable spike expected to continue in terms of the growth of the market. However, as the pandemic took place, the market witnessed a slower adoption by the insurers. In addition, a company named AXA scrapped its blockchain-based platform, Fizzy, as the platform failed to meet its commercial targets and was also met by insufficient demand. This showcases that the market did not have enough end users, and the market also lacked the proper distribution channels at the moment.

Furthermore, as the pandemic progressed, companies started examining the capabilities of blockchain in insurance solutions for real-time applications. For instance,

- September 2019: Marsh introduced a pilot of Risk Exchange, which is an insurance placement platform that is based on blockchain technology. This new launch is expected to digitize payments, documents, and invoices on a blockchain to enable real-time status updates throughout the insurance placement process.

Along with this, some companies raised funding with an aim to continue transforming the insurance industry with blockchain technology. For instance,

- March 2019: According to a corporate register filling in Switzerland, the B3i raised over USD 16 million in one of its funding rounds. This funding is expected to be utilized for developing a blockchain trading platform that revolutionizes the entire insurance industry.

In the coming years, as the market matures, the growth of the adoption of blockchain-based insurance solutions will increase at an accelerated pace.

Blockchain in Insurance Market Trends

Realizing the Potential of Incorporating Blockchain Technology in Insurance Solutions

Blockchain technology has been estimated to have the potential to transform the financial service industry. However, many insurers are still slow to adopt this technology into their insurance solutions. The blockchain in insurance concept is being seen at its developing stage, where companies and authorities related to the financial service industry are continuously engaged in realizing the capabilities of this technology across insurance solutions. For instance,

- February 2023: The chairman of the Insurance Regulatory and Development Authority of India (IRDAI) confirmed that India was making moves in terms of moving toward personalized and instant insurance. This move highlighted the use of new-age technologies, including public blockchain, ChatGPT, and web 3.0, to build products that cater to these developments.

- November 2023: A Netherland-based mutual insurer is examining the capabilities of blockchain technology to improve efficiency. Along with this, the Blockchain Insurance Industry Initiative B3i has recently welcomed a new member from the International Cooperative and Mutual Insurance Federation (ICMIF), Achmea.

Thus, such recent developments are showcasing the current trends that are positively shaping the growth trajectory of the market.

Download Free sample to learn more about this report.

Blockchain in Insurance Market Growth Factors

Increasing Number of Strategic Alliances to Fuel Market Growth

- The key players operating in the market have been engaged into developing and exploring the capabilities of blockchain technology in the insurance industry. In addition, these players are increasingly searching for relevant partnerships and collaborations to carry out product developments, develop practical applications, and establish a secure insurance ecosystem. Companies adopt these business strategies to combine the best of their concepts and expertise with other relevant partners and technologies. With this, companies will be able to create insurance systems at a better speed and scale.

Several businesses are collaborating with technology experts across the globe to enhance their technical capabilities. For instance,

- August 2020: HCL Technologies collaborated with R3, which specializes in developing enterprise blockchain software. This collaboration aimed at introducing a blockchain-based platform, BUILDINGBLOCK, which enables end users to streamline business property insurance for multinational companies.

Thus, the increasing rate of relevant collaborations and partnerships is driving the market in recent years.

RESTRAINING FACTORS

Lack of Standardization, High Initial Costs, and Security Constraints to Hinder Market Growth

The restraining factors of the market include a lack of standardization, high initial costs, and security constraints. A shared and distributed system requires a high level of standardization to operate at an optimal pace. Lack of standardization may result in poor investment decisions. Furthermore, as the industry is still trying out the incorporation of the technology, failure to adopt and implement this technology correctly might result in loss of initial development cost. Several companies started solutions based on blockchain technology but had to cease their operations as the market lacked enough customers and distribution channels at the moment. Moreover, there is always a risk of new types of cyber-attacks, which might restrain the demand for blockchain in insurance solutions.

Blockchain in Insurance Market Segmentation Analysis

By Provider Analysis

Rise in Demand for Blockchain-based Insurance Solutions Among Infrastructure and Protocol Providers Led the Market Growth

Based on the provider, the market is divided into application and solution provider, middleware provider, and infrastructure and protocols provider.

Among these, the infrastructure and protocols provider segment dominated the market in 2024. As the implementation of blockchain technology in the insurance industry is still at an early stage, companies are experimenting with developing products. Thus, the infrastructure and protocol providers will gain popularity in the early stages of the industry.

However, as the market matures, it will experience a substantial rise in the adoption of solutions from the application and solution providers. Due to which, in the coming years, the application and solution providers are expected to grow at the highest CAGR. The Application and Solution Provider segment will account for 42.18% market share in 2026.

To know how our report can help streamline your business, Speak to Analyst

By Enterprise Type Analysis

Increasing Popularity of Blockchain-based Insurance Solutions among Large Enterprises Led to Market Growth

Based on enterprise type, the market is divided among SMEs and large enterprises.

Among these, large enterprises held the largest share of 46.40% in 2026. This dominance is due to the heavy adoption of blockchain-based insurance solutions in recent years. Traditionally, digital platforms based on blockchain are ideally suited for businesses that either create or finance large amounts of account receivables. Thus, the market has witnessed higher growth among large enterprises than the SMEs.

However, SMEs to showcase a slower adoption due to concerns regarding the incorporation of the technology among insurance solutions. In the coming years, as the industry matures, SMEs might bolster their adoption level of the solution, making them grow at a highest CAGR.

By Application Analysis

Increasing Inclination of End Users toward Adoption of Automated Claims Management Solutions is Driving Market Growth

Based on application, the market is divided among GRC management, claims management, identity management and fraud detection, payments, smart contracts, and others (customer communication etc.).

Among these, currently, the claims management application holds the largest share of 21.58% in 2026 owing to the increasing popularity of automated claim management solutions among end users. Along with this, the industry also witnessed a rise in demand for smart contract solutions.

In the coming years, the payment application is expected to lead the market owing to the increasing inclination of the audience toward technology-backed payments. Companies are moving toward adopting programmable payments route. For instance,

- November 2023: JPMorgan Chase is growing its B2B strategy by applying cryptocurrency-based technology as there is an increasing rise in the number of clients that prefer payment automation.

REGIONAL INSIGHTS

Geographically, the market is meticulously studied through five major regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Blockchain in Insurance Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North American

Among these, the North American market holds a major portion of the overall blockchain in insurance market share. This growth is attributed to the region’s early adoption of emerging technologies, the presence of key players, and their effective business strategies. Several companies in the region are launching blockchain in insurance solutions that have improved efficiency and reduced fraud in the insurers' complete transaction process. The U.S. market is projected to reach USD 1.16 billion by 2026.

Asia Pacific

Furthermore, in terms of highest CAGR growth in the coming years, the Asia Pacific region will grow with a notable trajectory. This positive growth is expected due to the substantial advancements among the region’s insurance companies. For instance, Sleek, based in Hong Kong, is an insurtech that examines the capabilities of emerging technologies such as blockchain and smart contracts with the objective of enhancing customer experience. The Japan market is projected to reach USD 0.26 billion by 2026, the China market is projected to reach USD 0.29 billion by 2026, and the India market is projected to reach USD 0.26 billion by 2026.

Europe

Moreover, Europe is expected to witness a steady growth in recent years owing to the increasing recent developments related to the market. In May 2022, the European Insurance and Occupation Pensions Authority (EIOPA) reacted to the region’s stakeholders’ views on blockchain and smart contracts in insurance. The authority acknowledges that the insurers have recognized the potential of applications that the technology has to offer. Moreover, the authority commented on the technology’s deployment in the European insurance sector, saying that they are still at an early stage and the majority of the use cases cited by stakeholders are still in a proof-of-concept stage, while others are small-scale. This reflects that the region’s growth in terms of blockchain in insurance will grow steadily in the coming years. The UK market is projected to reach USD 0.28 billion by 2026, while the Germany market is projected to reach USD 0.27 billion by 2026.

South America and Middle East & Africa regions

Furthermore, South America and Middle East & Africa regions are expected to grow at a slow growth rate compared to the other regions. These regions have been slower in terms of adopting advanced technologies and engaging in development strategies that contribute to the market growth.

Key Industry Players

Companies are Developing Blockchain-Based Solutions to Spur Growth Opportunities for the Market

As the market is still in its developing stage, blockchain in insurance solution providers operating in the market continue to implement blockchain technology into their insurance applications. Companies are recognizing the importance of integrating the technology as it eases and secures their insurance ecosystem. Along with this, blockchain in insurance companies are also engaging in several development strategies, such as acquiring and merging with relevant firms that can strengthen their expertise in this journey.

List of Top Blockchain in Insurance Companies:

- CONSENSYS (U.S.)

- IntellectEU, Inc. (U.S.)

- ChainThat (U.K.)

- Etherisc (Germany)

- IBM Corporation (U.S.)

- Guardtime (Estonia)

- Teambrella (U.S.)

- B3i (Switzerland)

- Tierion (U.S.)

- Deloitte (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: JP Morgan collaborated with six Indian banks with the aim to introduce a blockchain-centered platform around U.S. dollar settlements. These bank names include Axis Bank, HDFC Bank, Yes Bank, ICICI Bank, IndusInd Bank, and JPMorgan’s GIFT City. With this, the company aims to get rid of problems that revolve around traditional finance.

- December 2022: Italy selected the Algorand blockchain technology to enhance its traditional banking systems starting in 2023. With this, the country also becomes the first member nation of the European Union (EU) to incorporate blockchain with its insurance and financial systems.

- September 2022: The insurance arm of Ant Group introduced a digital operation platform that is based on blockchain technology, which is primarily developed to help insurance companies in China. This new launch, the Xingyun platform, aids insurers in enhancing their operational efficiency and customer experience.

- November 2020: B3i Services AG partnered with TCS with the intent to develop solutions that are based on blockchain technology and are dedicated to the insurance industry. These solutions are coupled with the creative capabilities of TCS and B3i’s advanced production DLT platform. With these capabilities, the solutions qualify to accelerate the digitization of insurance for a more efficient customer experience.

- July 2019: Aon collaborated with Etherisc and Oxfam to unveil a blockchain-based agricultural insurance platform for small farmers and farms in Sri Lanka. This platform provides micro-insurance to smallholder paddy field farmers who are losing their crops due to uncertain weather. Along with this, it also intends to streamline the claims process and reduce administration costs by leveraging blockchain technology.

REPORT COVERAGE

The report provides the reader with a detailed analysis of the market by primarily focusing on the key aspects, such as leading companies that are working on implementing the technology in the insurance sector, studies of newly developed product/service types, and the practical applications that the newly introduced blockchain in insurance products might cater. Besides, the report will guide the reader through the market insights that include the trends and opportunities. Along with this, the report will highlight key industry developments made by the industry players and all the other factors that directly or indirectly contribute to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 45.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Provider

By Enterprise Type

By Application

By Region

|

Frequently Asked Questions

The market is projected to reach USD 95.97 billion by 2034.

In 2026, the market was valued at USD 4.74 billion.

The market is projected to grow at a CAGR of 45.60% during the forecast period.

The infrastructure and protocols provider segment led the market in 2024.

Increasing number of strategic alliances to fuel market growth.

CONSENSYS, IntellectEU, Inc., ChainThat, Etherisc, IBM Corporation, and Guardtime are the top players in this market.

North America dominated the global blockchain in insurance market with a share of 34.20% in 2025.

By provider, the application and solution provider is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us