Cargo Drone Market Size, Share & Industry Analysis, By Type (Fixed, Hybrid & Rotary Wing), By Automation Level (Fully & Semi-Autonomous, Remotely Controlled), By Range (Very Short, Short, Medium, & Long), By Payload Capacity (Featherweight, Lightweight, Middleweight, & Heavy-lift), By Component (Camera, Sensors, Equipment, Delivery Packages), By Application (Commercial & Military Cargo), By End-User Industry (E-Commerce, Construction, Government & Defense Organization, Healthcare, Offshore & Energy), Regional Forecast Report, 2025-2032

KEY MARKET INSIGHTS

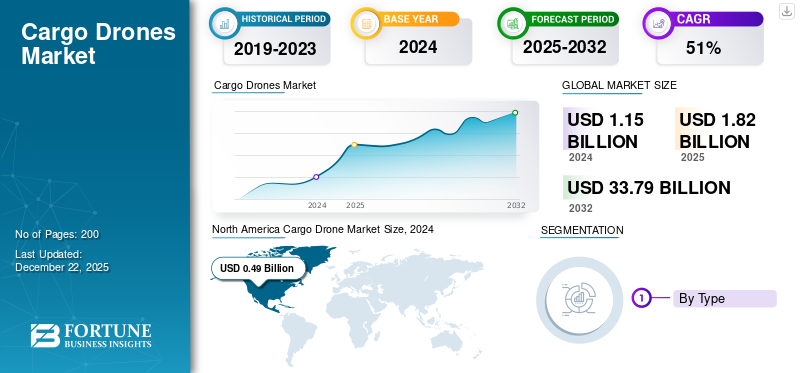

The global cargo drone market size was valued at USD 1.15 billion in 2024 and is projected to grow from USD 1.82 billion in 2025 to USD 33.79 billion by 2032, exhibiting a CAGR of 51.8 % during the forecast period. North America dominated the cargo drone market with a market share of 42.61% in 2024.

Market Size and Growth Forecast

- 2024 Market Size: USD 1.15 Billion

- 2025 Market Size: USD 1.82 Billion

- 2032 Projected Market Size: USD 33.79 Billion

- CAGR (2025–2032): 51.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing region during the forecast period

Market Trends and Strategic Insights

- North America cargo drone market held the largest share of 42.61% of the global market in 2024.

- By type, Rotary wing segment held the highest market share in 2024.

- By automation level, Semi-autonomous segment accounted for the largest market share in 2024.

- By range, Very short (up to 45 km) segment dominated the market in 2024.

- By payload capacity, Lightweight (5–45 kg) segment led the market in 2024.

The global cargo drone market is experiencing strong growth, driven by the expansion of e-commerce, technological advancements, and favorable regulatory policies. As businesses seek to improve logistics efficiency, the utilization of freight drones will rise.

Key players in the freight drone industry, such as DJI, Zipline, and Amazon Prime Air, are pushing the boundaries of innovation with cutting-edge drone technologies and widening their logistics capabilities. Shipment drones, which are remotely piloted or autonomous aerial vehicles, are used to transport goods quickly over different distances. These drones are categorized into fixed-wing, hybrid, and rotary-wing drones and are further classified based on payload sizes, range, and level of automation. Consignment drones enable expedited delivery services and form a crucial component of contemporary logistics and supply chains in e-commerce, healthcare, and the military.

Download Free sample to learn more about this report.

The outlook for the cargo drone industry is highly promising, with substantial growth projected in the coming years. As technology advances and regulatory frameworks become more favorable, the integration of freight drones into current logistics and supply networks is likely to accelerate. Cooperation between cargo drone manufacturers, logistics companies, and regulatory agencies will also be crucial in overcoming obstacles and opening up new market opportunities.

Market Dynamics

Market Drivers

Growth of E-commerce and On-demand Delivery Services to Fuel Market Growth

The expansion of online retail platforms, combined with the rise of immediate delivery services, has led to a significant transformation in logistics. The market is experiencing significant growth, driven by the acceleration of e-commerce and the rising demand for on-demand delivery services. Consumer expectations for rapid delivery push companies to develop advanced logistics technologies such as freight drones to satisfy consumer expectations. Drone deliveries provide convenience, enabling them to cut transit times, especially in urban regions.

E-commerce firms actively explore incorporating shipment drones into their logistics networks to boost performance metrics while increasing customer approval ratings. The growing consumer demand for rapid delivery services motivates businesses to implement drone technology as a competitive advantage in an increasingly overcrowded industry. Medical supplies distribution networks, food delivery services, and retail businesses are adopting this technology, contributing to increased investment and regulatory backing in the sector. The ability to align shipment drone functionalities with evolving e-commerce requirements underscores their essential role in the future of logistics and transportation, driving strong expansion trends in the market.

Supportive Regulatory Frameworks and Infrastructure Development to Amplify Product Demand

The market relies heavily on government regulations and infrastructure development as key growth drivers. Numerous nations acknowledge freight drones as transformative tools for logistics and transportation, prompting them to create supportive regulatory structures. These favorable policies encourage investment and innovation within the drone industry. Furthermore, governments' development of specialized airspace zones and charging facilities to support freight drone operations catalyze market expansion.

Market Restraints

High Startup Costs and Strict Drone Operation Regulations Restrain Market Growth

The development of the cargo market is largely constrained by high setup costs and stringent legal requirements governing drone usage. The industry's capital-intensive nature, encompassing the development of advanced drone technologies, ongoing maintenance, and the establishment of supporting infrastructure, poses significant entry barriers for new market players. Moreover, strict aviation industry regulations on safety protocols, airspace control, and operational boundaries significantly restrict the use of drones in cargo transportation systems.

Shortage of Skilled Labor and Cyber Security Risk to Hinder Market Growth

As the growing demand for superior drone technology continues to rise, the sector urgently needs a highly trained workforce capable of designing, operating, and maintaining these advanced systems. However, the existing talent base is inadequate to meet this demand, potentially causing delays in development and deployment.

The growing use of consignment drones for goods transportation introduces significant cybersecurity risks. These systems are increasingly attractive targets for hackers, with vulnerabilities ranging from data breaches and unauthorized access to flight systems to broader cyber-attacks. Such threats pose serious threats to individual drone operations and the integrity and security of the extended logistics and transport network.

Market Opportunities

Technological Advancements and Growing Need for Smarter Logistics Solutions to Favor Market Growth

Traditional delivery systems are increasingly strained, especially in hard-to-reach rural areas, prompting more businesses to explore drone-based solutions. The push for quick deliveries, cost savings, and eco-friendly options is driving the adoption of the product. Regulatory frameworks are evolving to support drone operations, further reinforcing their viability in modern delivery systems.

Plenty of opportunities exist in sectors such as e-commerce, healthcare, and food delivery, where drones can improve speed and efficiency. The advancement of urban air mobility projects signals a future in which drone deliveries become integral to smart city infrastructure and logistic planning. Companies can collaborate with local governments and tech firms to tap into innovations and broaden their services. As the need for quick medical supplies and essential items grows, consignment drones are becoming a crucial solution for urgent deliveries in healthcare.

Recent market trends show a surge in investments toward research and development, focusing on boosting drone capabilities such as payload capacity and flight range. Integrating artificial intelligence and machine learning further optimizes delivery systems by allowing features such as real-time tracking. Sustainability remains a key priority, with companies pursuing electric and hybrid drone designs to reduce logistics operations' carbon footprint.

Cargo Drone Market Trends

High Investment in Research and Development to Boost Market Growth

Significant investment in research and development (R&D) is a key driver behind the advancement of efficient delivery solutions, fueling the cargo drone market growth. As businesses across various industries recognize the transformative potential of drone technology in logistics and shipping, they are committing substantial resources to the innovation and adoption of delivery drones. These initiatives are focused on improving critical drone capabilities, such as payload capacity, flight range, battery life, and navigation systems.

The growing demand for faster and more sustainable delivery options is driving the creation of advanced algorithms and AI technologies that help optimize routing and ensure deliveries happen on time. This heightened focus on R&D leads to significant technological breakthroughs and also fosters partnerships between drone manufacturers, logistics companies, and regulatory bodies. Together, these stakeholders are working to build a well-established ecosystem that supports the broader adoption of freight drones. As a result, the market is set for impressive growth, paving the way for a major transformation in how goods are transported and delivered across various sectors.

Segmentation Analysis

By Type

Rotary Wing Drones Dominate Market due to Their Broad Adoption Across Different Industries

By type, the market is divided into fixed wing, hybrid, and rotary wing. The rotary wing segment holds the largest cargo drone market share. It is expected to be the fastest-growing segment due to its wide adoption across various sectors and relatively simple operational mechanisms. These drones are less complicated and require less investment than fixed wing and hybrid drones. Their ability to hover and easily maneuver easily in constrained spaces makes them valuable for urban deliveries and transportation.

The hybrid segment is also experiencing significant growth. Hybrid drones combine multi-rotor capabilities with fixed-wing drones, presenting advantages in urban areas and long flight paths, creating new market opportunities and driving momentum during the forecast period. Companies such as Silent Arrow and Elroy Air offer hybrid drone solutions, while companies such as Airbus and Textron invest heavily in developing hybrid freight drones, resulting in positive momentum in this segment.

For instance, in February 2025, AFWERX awarded Traverse Aero Corporation a USD 75, 000 Phase I contract to support the development of its flagship Orca Hybrid freight drone. This drone is designed to resolve critical logistic challenges for the U.S. Department of the Air Force (DAF).

To know how our report can help streamline your business, Speak to Analyst

By Automation Level

Rising Focus on Enhancing Safety, Efficiency, and Versatility Across Various Applications Fosters Semi-Autonomous Segment Growth

By automation level, the market is segmented into fully autonomous, semi-autonomous, and remotely controlled.

The semi-autonomous segment holds the major market share. These systems provide a combination of remote control and autonomous capabilities, enhancing safety, efficiency, and versatility across various applications, including military, commercial, and industrial sectors. The rapid growth in e-commerce has surged the demand for faster and more reliable delivery services, pushing organizations to explore alternative solutions for remotely controlled drones. However, these systems can be susceptible to communication losses in signal-cut scenarios, which can cause reliability.

Fully autonomous systems are expected to grow at the highest CAGR during the study period. Companies are increasingly focused on developing end-to-end, fully autonomous drone systems that reduce the risk of human errors while improving delivery speed and accuracy. With rising demand for faster, more efficient, and cost-effective deliveries, particularly within the e-commerce sector, coupled with technological advancements, the segment is expected to grow substantially.

For instance, in March 2023, Kaman Corporation entered into a long-term commercial alliance with PHI Aviation to create the KARGO UAV program for commercial flights. Aside from collaborating with Kaman on the design of the autonomous UAV, PHI agreed to order 50 aircraft. The aircraft can be flown remotely or completely on its own.

By Range

Very Short (Up to 45km) Segment Dominates Market Owing to Its Affordability

By range, the market is divided into very short (up to 45km), short (45km to 150km), medium (150km to 550km), and long (above 550 km). The very short (up to 45km) segment dominates the market, as it is used for various industrial applications such as food and beverage deliveries, e-commerce, logistics, healthcare, and retail. These drones are relatively affordable than medium and long-range alternatives and effectively fulfill these industries' essential operational requirements, contributing to their strong market presence.

With increasing geopolitical tensions and a surge in demand for long-range cargo transport, the long (above 550 km) segment is anticipated to register the highest CAGR during the forecast period. Key adopters of the long-range category are the military, logistics, and supply chain sectors, which are increasingly investing in developing these systems. Long-range drones offer critical advantages such as reliability, affordability, and faster delivery, resulting in the most rapid growth of the segment.

For instance, in September 2024, the U.S. Department of the Air Force, through its AFWERX program, awarded Silent Arrow a USD 1.25 million SBIR Phase II contract. This contract supports developments of the Silent Arrow CLS-300 (“Contested Logistics System, 300nm-500nm Range”), a consignment drone designed to address the Air Force’s most demanding logistic challenges.

By Payload Capacity

Lightweight (5-45kg) Segment Leads due to Its Affordability and Versatility

By payload capacity, the market is segmented into featherweight (0.004 to 5 kg), lightweight (5-45kg), middleweight (45-150 kg), and heavy-lift (150 kg & above). Currently, the lightweight (5-45kg) segment dominates the market with applications ranging from e-commerce to military. These drones meet essential operational requirements while offering affordable and reliable situations. For instance, the e-commerce payload ranges from 0.5 kg to 45kg max; the same goes for healthcare, offshore & energy, and other commercial applications. Only a few industries, such as construction logistics & supply chains, demand drones with higher payload capacities. In most cases, end-users prefer not to invest in heavier and more expensive systems unless necessary. This cost-consciousness approach, combined with the versatile utility of lightweight drones, significantly contributes to the segment’s dominant market position.

The heavy-lift (150 kg & above) segment is the second fastest-growing category, attributed to the growing demand in military and defense, construction, logistics and supply chain, and other heavy-lift operations. The military and logistics sectors are investing heavily in research and development to expand the capabilities of heavy-lift drones.

For instance, in January 2025, Windracers revealed its next generation of self-flying cargo aircraft, Windracers ULTRA MK2. This freight drone features a 50% surge in payload capacity, capable of carrying up to 150kg while reducing fuel costs per kg by half.

By Component

Sensors Segment Leads Due to Its Essential Role in Drone Functionality

By component, the market is categorized into camera, sensors, equipment, delivery packages, and others. The sensors segment dominates the market and is poised to experience the highest CAGR during the forecast period. Sensor category consists of sub-components such as IMUs, GPS/GNSS, remote sensing sensors (IR/thermal sensor, RGB and multispectral, hyperspectral sensors, LiDAR, and synthetic aperture radar), and others (ultrasonic sensors, gas detectors, radiation sensors, depth sensors, level sensors, and flow sensors). These sensors play crucial parts in gathering the surrounding data and further transferring that data to central computers. Some sensors, such as IMUs, GPS/GNSS, and specific remote sensing units, are essential for enhancing operational capabilities. Various end-use sectors require customized sensor configurations tailored to their specific needs, further fueling growth in this segment.

The cameras segment holds the second-largest share in the market. Cameras are important to freight drone systems due to their multipurpose applications in videography, surveillance, delivery monitoring, and safety verification. The camera segment is further subdivided into LiDAR, Multispectral & Hyperspectral, IR Camera, and Others. In this modern era, every drone comes with built-in camera systems that either stream live footage to the ground station or store it locally for post-mission review.

By Application

Commercial Cargo Segment Leads the Market Due to Its Expanding Use

By application, the market is categorized into commercial cargo and military cargo. Commercial cargo segments include last-mile delivery (food and convenience products, medical samples/supplies, and e-commerce), packages/product delivery (remote area delivery and urban area delivery), remote location cargo transport, and others (fire dowsing and intelligence, surveillance, and reconnaissance (ISR)). The commercial cargo segment holds the largest market share. Currently, the industry uses drones for various applications ranging from last-mile deliveries to remote locations in industries such as energy and construction. Recently, there has been an increasing trend toward using cargo solutions for long-distance logistics and supply chain operations, signaling a significant expansion of their role in commercial transportation.

For instance, in November 2023, Dronamics, the world's first cargo drone airline licensed to function in Europe, entered into an interline agreement with Qatar Airways Cargo. This collaboration enables Dronamics to offer cargo services from its drone ports, initially in Greece, to Qatar Airways Cargo’s global network, including major destinations such as Singapore, China, Hong Kong, and the U.S. (JFK).

The military cargo segment is anticipated to grow at the highest CAGR during the forecast period. The segment encompasses combat freight drones, logistics, intelligence, surveillance, and reconnaissance (ISR). The growth is attributed to increasing geopolitical tensions and the corresponding rise in defense spending, which has spurred strong demand for military freight drones in the industry.

By End-User Industry

Increased Investments in Advanced Technologies for Military Logistics Propels Government and Defense Organization Segment Expansion

As per end-user industry, the market is fragmented into e-commerce, construction, government and defense organizations, healthcare, offshore and energy, and others. Government and defense organizations hold the largest market share due to their significant investments in advanced technologies for military logistics, security, and surveillance and the need for rapid and cost-effective delivery solutions in a challenging environment. In addition to funding research and development initiatives, governments are actively formulating regulatory frameworks to ensure drones' safe and effective use across both military and civilian domains.

For instance, in October 2023, European Medical Drone and Dufour Aerospace signed a development cooperation and purchase agreement for 11 Aero2 uncrewed tilt-wing aircraft. The deal includes the delivery of 1 Aero2 X2.3 prototype aircraft in 2024, followed by 10 serial Aero2 aircraft, with delivery starting in 2026.

E-commerce holds the second-largest market share due to the increasing demand for faster, more efficient, and cost-effective deliveries. These drones offer a compelling solution for last-mile and cross-border logistics by bypassing traffic congestion and following direct routes, thus significantly reducing delivery times, a key factor in the competitive e-commerce landscape.

Drone deliveries can be cheaper than ground-based vehicles, especially for last-mile operations, as they require less fuel, labor, and maintenance. The rapid growth of e-commerce drives the demand for faster and more reliable delivery services, making drone technology an attractive solution for businesses looking to improve their logistics. Companies such as Walmart and Amazon are actively exploring and implementing drone delivery services to meet the growing demand for faster and more convenient deliveries.

Supply Chain Analysis

The market encompasses various unmanned aerial vehicles (UAVs) designed specifically for transporting goods. These drones can range from small delivery drones used for local deliveries to larger drones capable of carrying heavy payloads over longer distances. Several factors, including e-commerce, urbanization, and the need for reliable transportation in remote areas, influence the market's growth.

Supply Chain for Market includes Several Key Components

- Manufacturers: Companies that design and produce drones, such as DJI, Natilus, and others. These companies are responsible for technological advancements, ensuring safety, and complying with regulations.

- Components Suppliers: Consignment drones consist of various components, including propulsion systems, batteries, sensors, and navigation systems. Suppliers of these components play a crucial role in the supply chain, as they must provide high-quality, reliable parts that meet industry standards.

- Logistics and Distribution: Once produced, shipment drones must be delivered to distribution centers or customers. Logistics companies may partner with drone manufacturers to facilitate this process, ensuring that drones reach their destination efficiently.

- Operators: This segment includes businesses and organizations that operate shipping drones for various purposes, such as last-mile delivery services, medical supply transport, and agricultural applications. Operators are critical for testing and scaling drone usage in real-world situations.

- Regulatory Bodies: Government agencies and regulatory bodies establish the framework within which freight drones can operate. Compliance with regulations regarding air traffic, safety standards, and environmental impacts is essential for the entire supply chain.

Cargo Drone Market Regional Outlook

By geography, the market is studied across North America, Europe, Asia Pacific, and the rest of the world.

North America

North America Cargo Drone Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the market due to a combination of factors, including significant investment, technological innovation, a supportive regulatory framework, and the presence of major industry players and startups transforming logistics and delivery services.

The region, particularly the U.S., is a hub for technological innovation across various industries, including drone technology. The region's companies are investing heavily in developing advanced drones designed for logistics and transportation. The U.S. Federal Aviation Administration (FAA), supports the industry's growth through laws such as the Remote ID rule, which mandates that all drones be equipped with tracking and identification systems. This facilitates safer drone integration into national airspace and improves safety.

The rise of e-commerce has fueled the demand for faster and more reliable delivery solutions, creating opportunities for freight drones in the region. Major North American freight drone market players include Natilus, Kaman Corporation, and Sabrewing Aircraft Company.

For example, in May 2024, California-based drone developer Elroy Air collaborated with Leidos to highlight an autonomous cargo airplane prototype to the U.S. Navy and Marine Corps. Under the program, the group will roll out a Medium Aerial Resupply Vehicle Expeditionary Logistics (MARV-EL) system contracted to have "middle-weight" specifications.

Europe

Europe ranks as the second-largest region in the market, following North America, due to factors such as a robust aerospace sector, regulatory improvements, and well-established drone manufacturers and government-backed projects. Europe has a well-established aerospace industry, which contributes to the development and manufacturing of drone technologies. Many European governments are investing in drone technology and supporting research and development projects, which further propels the market growth.

For instance, Dynamics, a Bulgarian aerospace startup specializing in unmanned freight drones, is advancing toward commercial deployment by collaborating with international logistics provider DHL.

Asia Pacific

The Asia Pacific cargo drone market is experiencing the fastest growth globally due to increasing e-commerce activity, advancements in drone technology, and the need for efficient logistics solutions, particularly in densely populated urban areas. The surge in online shopping and the demand for fast and reliable delivery services fuel the demand for drone logistics solutions. Moreover, the region's rapid urbanization and complex logistics networks create a need for innovative solutions such as drone delivery, which can offer cost-effective and time-efficient options for last-mile delivery.

Countries such as China, India, and Japan are major hubs for drone manufacturing, further propelling the region's growth.

For instance, in February 2025, Bengaluru-based drone maker Scandron launched the CargoMax 20KHC, India's most powerful freight drone, which can carry a payload of 200kg. Built to advance aerial logistics, especially for the Indian Armed Forces, the fully autonomous drone facilitates hassle-free last-mile deliveries with a 15km operational range and a 6000m AMSL ceiling.

Rest of the World

The Middle East & Africa is experiencing substantial growth due to increasing demand for efficient and cost-effective logistics, particularly in agriculture, construction, and humanitarian aid sectors. Technological advancements and increasing government support for drone adoption further support this demand. Several countries in the region are implementing supportive policies and regulations to foster drone technology. UAE and Israel are leading countries in the drone market, leveraging strong capabilities for both civilian and military applications. For instance, in February 2025, UAE announced a bold move to transform urban transportation by launching air corridor mapping and developing regulations for manned and autonomous air taxis and consignment drones.

The Latin America cargo drone market is poised for significant growth due to factors, including an underdeveloped transportation infrastructure, complex topography, and growing demand for efficient and rapid delivery services, especially in rural areas and on-demand goods. The region's concentration of lithium reserves, particularly in the "lithium triangle" of Bolivia, Argentina, and Chile, presents a significant opportunity for the air cargo industry, including drone logistics, to connect remote mining locations with global manufacturing hubs.

Competitive Landscape

Key Industry Players

Key Players Focus on Innovations to Develop Policies for Commercial Drone Integration

Growing technological abilities and the need for advanced logistical solutions have resulted in a rapidly evolving drone market. Top cargo drone producers, such as Amazon, UPS, and Google, alongside innovative startups such as Zipline and Matternet, are exploring diverse use cases in e-commerce and medical deliveries. Regulatory frameworks play a pivotal role in shaping the market’s trajectory. Authorities such as the FAA and counterparts globally are working to develop policies for commercial drone integration within the airspace. Each company faces intense competition due to advancements in battery life, AI optimization, navigation systems, and other technology.

Strategic partnerships and collaborative ventures have proven effective for operational integration and market growth. At the same time, rising investment in the sector is fueling increased R&D efforts. However, despite its promising potential, the market faces challenges related to public perception and safety issues. With ongoing developments, shipment drones are expected to become an important part of delivery and logistical systems and redefine the future of transportation.

LIST OF KEY CARGO DRONE COMPANIES PROFILED

- DJI (China)

- Parrot SA (France)

- Natilus (U.S.)

- Dronamics (U.K.)

- Silent Arrow (U.S.)

- Sabrewing Aircraft Company (U.S.)

- Elroy Air (U.S.)

- Volocopter GmbH (Germany)

- Dufour Aerospace (Switzerland)

- H3 Dynamics (Singapore)

- Bell Textron Inc. (U.S.)

- Kaman Corporation (U.S.)

- AIRBUS (Netherlands)

- Elbit Systems (Israel)

- IAI (Israel)

KEY INDUSTRY DEVELOPMENTS

- April 2025- Piasecki Aircraft announced the acquisition of Kaman Air Vehicles' Kargo UAV, expanding its helicopter and drone portfolio. Piasecki Aircraft is committed to accelerating the development of the Kargo UAV and aims to deliver a production-ready model by late 2026.

- September 2024- Dufour Aerospace, the forward-thinking Swiss drone and eVTOL manufacturer, Areion, a leading U.S. drone innovator and successor to Spright, renewed their partnerships. As a part of the agreement, Areion purchased 40 Aero2 drones, with an option to buy up to another 100 aircraft.

- February 2023- Bulgarian freight drone firm Dronamics provided a contract of USD 3.18 million to an Australian firm, namely Quickstep Holdings. The company manufactures aerospace components for producing and supplying unmanned cargo aircraft Black Swan.

- January 2023- Ameriflight ordered 20 Natilus autonomous feeder cargo aircraft worth USD 134 Million, marking a strategic step to become the first regional U.S. carrier to pioneer a new model for the future of air freight operations.

- November 2022- The Arabian Development and Marketing Corporation (ADMC) placed an order for 52 heavy-lift cargo uncrewed aerial vehicles (UAVs) from Sabrewing Aircraft Company, Inc. This procurement follows the successful flight of the Sabrewing Rhaegal-A (Alpha) aircraft, which can carry a payload of 829 pounds (374 kilograms), marking the highest capacity to date for a commercial cargo UAV.

REPORT COVERAGE

The research report delivers a detailed analysis of the market and emphasizes key aspects such as key players, offerings, objects, and end-users of freight drones. Moreover, the report also provides information on market trends, competitive landscape, market competition, product pricing, regional analysis, market players, and key industry development. In addition to the above, the report encompasses various factors that are anticipated to contribute to the growth of the market in the forthcoming years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 51.8% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Automation Level

|

|

|

By Range

|

|

|

By Payload Capacity

|

|

|

By Component

|

|

|

By Application

|

|

|

By End User Industry

|

|

|

By Region

|

Frequently Asked Questions

According to the Fortune Business Insights study, the global market was valued at USD 1.15 billion in 2024 and is anticipated to be USD 33.79 billion by 2032.

The market will likely grow at a CAGR of 51.8 % over the forecast period (2025-2032).

The top players in the industry are DJI, Parrot SA, Natilus, Dronamics, Silent Arrow, Sabrewing Aircraft Company, Elroy Air, Volocopter GmbH, Dufour Aerospace, H3 Dynamics, Bell Textron Inc., Kaman Corporation, AIRBUS, and Elbit Systems.

North America leads the market.

The expansion of e-commerce and the increasing adoption of on-demand delivery services are poised to drive market growth.

High startup costs, strict operation regulations, a shortage of skilled labor, and cybersecurity risks hinder market growth.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us