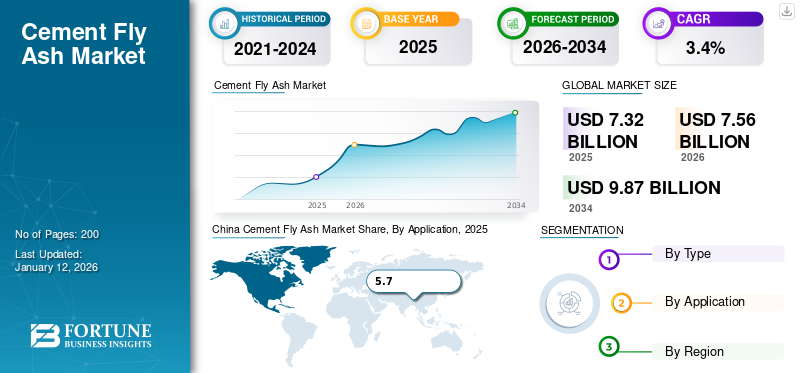

Cement Fly Ash Market Size, Share & Industry Analysis, By Type (Class F and Class C), By Application (Portland Pozzolana Cement (PPC), Blended Cement, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global cement fly ash market size was valued at USD 7.32 billion in 2025 and is projected to grow from USD 7.56 billion in 2026 to USD 9.87 billion by 2034 at a CAGR of 3.4% during the forecast period. Asia Pacific dominated the cement fly ash market with a market share of 94% in 2025.

Cement fly ash is a type of fly ash generally present in fine powder form and is a byproduct of burning coal in power plants. It is highly utilized in cement making and hence is referred to as cement fly ash. It is made up of non-combustible matter from coal and a small amount of carbon. As it is a byproduct of electricity production, hence it not only contributes to environmental advantages through the recycling of waste materials but also delivers significant enhancements when integrated into concrete. It can be mixed with various other substances to yield high-quality and cost-effective outcomes in concrete applications such as premixed concrete, pavements, sub-bases, and dams. Additionally, it has been utilized in stabilized road bases and asphalt.

Growing demand for premixed concrete drives the cement fly ash consumption. Premix concrete, also known as ready-mix concrete (RMC), is a concrete mixture that is manufactured and delivered to construction sites. RMC reduces the need for storage and maintenance, thus creating less waste than conventional concrete mixture methods. Its environmental benefits, along with extensive usage in supplementary cementitious materials (SCMs), will drive market growth during the forecast period.

Major companies such as National Thermal Power Corporation (NTPC), Boral, Ashtech India, and Titan America LLC are driving market growth through inline organic and inorganic investments. The companies are strategically investing in high-potential regions to leverage maximum market gains.

Global Cement Fly Ash Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 7.32 billion

- 2026 Market Size: USD 7.56 billion

- 2034 Forecast Market Size: USD 9.87 billion

- CAGR: 3.4% during the forecast period (2026–2034)

Market Share:

- Asia Pacific dominated the cement fly ash market with a 94% market share in 2025.

Regional Insights

- Asia Pacific: Largest market; China and India lead production and consumption. Infrastructure growth and government support drive demand.

- North America: Noticeable market share with key consumption in states like Texas, Florida, and California; faces challenges from rising costs and environmental pressure.

- Europe: Moderate growth driven by infrastructure development and sustainability focus; adoption of circular economy practices.

- Rest of the World: Growth fueled by urbanization and construction in Latin America, Middle East, and Africa.

MARKET DYNAMICS

MARKET DRIVERS

Infrastructure Development in Emerging Economies Aids Market Growth

Infrastructure development in emerging economies is significantly driving the demand for cement fly ash as it provides a cost-effective and environmentally friendly alternative to traditional construction materials. It is particularly used in large-scale projects like road building, housing developments, and bridges. Emerging economies are experiencing rapid urbanization, leading to a massive demand for new buildings, roads, and other infrastructure, creating a large market for construction materials like cement fly ash.

As fly ash is a byproduct of coal combustion in power plants, it is significantly cheaper than other supplementary cementitious materials, allowing for cost-efficient construction projects, especially in developing countries with budget constraints. It can be used in various construction applications, including concrete for roads, buildings, pavements, bricks, and others, further enhancing its demand. Rapid urbanization and infrastructural projects in countries such as India and China have escalated the need for durable and cost-effective building materials. Therefore, rising demand for cost-efficient building raw materials is driving the cement fly ash market growth.

MARKET RESTRAINTS

Presence of Alternatives and Decline in Coal-Fired Power Plants May Hamper Market Growth

Though cement fly ash has many benefits, such as improving concrete’s durability, strength, and resistance to cracking, it has many negative impacts on the environment, including air pollution, water contamination through heavy metal leaching, soil disruption, and respiratory issues due to fine particulate matter inhalation.

Additionally, being a coal-combustible product, its production may decrease in the future, as coal consumption for power generation is declining globally. This is due to the increasing use of renewable energy sources and efforts to reduce coal use. The International Energy Agency (IEA) stated that the global generation of coal should decline to around 12% by 2030. This is part of the Net Zero Scenario, which calls for immediate reductions in coal use. Therefore, stringent environmental regulations concerning the disposal and utilization of industrial byproducts can negatively impact the market. Other factors that could restrain product consumption include high carbon content in the ash and variations in product quality from different sources.

MARKET OPPORTUNITIES

Increased Focus on Sustainable Construction Practices to Create Remunerative Opportunities for Market Players

Sustainable construction projects significantly drive the demand for cement fly ash as they serve as a readily available, environmentally friendly alternative to traditional cement. It allows builders to reduce their carbon footprint by utilizing a recycled byproduct of coal combustion, thus contributing to greener building practices and meeting the growing sustainability regulations.

Replacing a portion of cement with fly ash in cement significantly lowers the overall carbon footprint of a construction project, as cement production is a major source of greenhouse gases. Efficacy in offering cost-effective and eco-friendly solutions has already gained the attention of various cement and construction industry experts. As the construction industry shifts towards eco-friendly materials, the product demand will bolster in the foreseen period. Its growing use in concrete reduces the reliance on Portland cement, thereby decreasing carbon emissions. Therefore, increased focus on sustainable construction practices creates remunerative opportunities for market players.

CEMENT FLY ASH MARKET TRENDS

Transition Toward Circular Economy to Fuel Market Growth

A "circular economy" trend signifies a growing movement towards economic systems that prioritize reusing, repairing, and recycling materials to minimize waste and maximize resource utilization. Essentially, keeping products and materials in use for a longer period instead of discarding them after a single use creates a more sustainable approach to production and consumption. Growing awareness about the need to reduce resource depletion and the environmental impact of waste generation highlights the importance of cement fly ash. It not only allows coal manufacturers to generate extra revenue but also allows them to align themselves with the circular economy. As a result, the transition toward circular economy and fly ash is a crucial part of the “coal-cement-concrete industry”.

Download Free sample to learn more about this report.

IMPACT of COVID-19

Lockdown measures, economic uncertainty, and reduced consumer spending decreased the sales of building materials and halted many construction projects, leading to lower product demand. Lockdowns led to lower electricity demand, reducing coal consumption in thermal power plants. As cement fly ash is a byproduct of coal combustion, its production declined, leading to supply shortages. The market was also impacted by a slowdown in building & construction projects, especially in the first half of 2020, which reduced the demand for cement. By mid-2021, as economies reopened, and infrastructure projects resumed, the demand for cement fly ash fueled.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Cement fly ash is mostly consumed domestically. For instance, China is the largest coal producer in the world, which results in a massive yield of the product. As a result, it is able to meet most of the domestic demand. Similarly, India produces vast amounts of fly ash annually, which makes it one of the largest manufacturers in the market, lowering its dependency on foreign markets. Therefore, trade protectionism and geopolitical tensions have minimal impact on the global market.

SEGMENTATION ANALYSIS

By Type

Class F Segment Dominated the Market Due to High Demand from Concrete Industry

On the basis of type, the market is categorized into Class F and Class C.

Class F held a dominant global cement fly ash market share of 81.08% in 2026. It is a type of fly ash made from burning bituminous or anthracite coal and is also known as low-calcium fly ash. It is mainly made of alumino-silicate glass, quartz, mullite, and magnetite. Class F cement fly ash is mostly used in cement-based products like concrete blocks, poured concrete, and fly ash bricks. Class F fly ash generally has advantages over Class C fly ash in terms of its ability to significantly reduce the heat of hydration during concrete curing, making it more suitable for large concrete pours. As a result, this type has naturally become an ideal choice for cement and concrete manufacturers, which makes it the largest consumed type in the global market.

Class C is high in calcium and is majorly used in construction. It is made from burning sub-bituminous and lignite coals and consists of calcium, alumina, and silica. Its several benefits, such as self-cementing properties and efficacy to get stronger over time when exposed to water, make it another preferable choice for end users. As a result, this type of fly ash is expected to grow moderately during the forecast period.

By Application Analysis

Portland Pozzolana Cement (PPC) Held a Majority Share Owing to Growing Demand from Emerging Countries

On the basis of application, the market is segmented into Portland Pozzolana Cement (PPC), blended cement, and others.

The Portland Pozzolana Cement (PPC) segment accounted for a major market share in 2024 and will likely continue its dominance during the forecast timeframe. PPC is a blended cement made from Portland cement clinker, gypsum, and pozzolanic materials, which mainly include fly ash. PPC is used in many construction projects, including dams, sewage pipes, and marine structures. Owing to the vast production of fly ash in emerging countries like China and India, PPC has emerged as an ideal choice for building & construction applications. Fly ash is the key ingredient in PPC production, and the growing demand for PCC in emerging countries is set to drive market growth significantly throughout the assessment period. The segment is expected to dominate the market share of 73.68% in 2026.

To know how our report can help streamline your business, Speak to Analyst

The blended cement is a mixture of Portland cement and other finely ground materials like fly ash, slag, silica fume, and volcanic ash. It is mainly used to improve the performance of concrete in terms of durability, sustainability, and strength. The partial replacement of clinker with mineral additives improves the sustainability of the material, making it another major choice among end users. The ability to reduce the amount of energy used, as well as the greenhouse gas emissions in clinker production, is set to drive the demand for blended cement moderately during the forecast period. This segment is anticipated to forecast a CAGR of 3.1% during the forecast period.

Other application segments include specialty and high-performance cement. Such applications can vary in different projects as such mixtures are customized specifically for certain applications. The growing need for application-specific materials due to diversified construction projects is set to drive this segment stagnantly.

CEMENT FLY ASH MARKET REGIONAL OUTLOOK

On the regional ground, the marke is studied across Asia Pacific, North America, Europe, and Rest of World.

Asia Pacific

Asia Pacific Cement Fly Ash Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market held the largest share of global sales revenue in 2024. The regional market value in 2025 was USD 6.84 billion, and in 2026, the market value led the region by USD 6.84 billion. The massive demand is anticipated due to widespread product usage in the cement and concrete industries. The region is rapidly developing due to various government initiatives and increasing foreign investments in the industrial sector. Ongoing infrastructure development in the region is the key driving factor that generates massive demand for the product. Additionally, the easy availability of raw materials, labor, and support from domestic governments will contribute to the market growth during the forecast period.

The presence of a large number of coal-producing companies in China and India is creating enough cement fly ash supply to meet more than half of the global demand. For instance, according to the International Journal of Environmental Science and Development, China produces 600 million tons of fly ash annually, making it the largest producer in the world. China is a large coal-producing country, and coal is used as the basic fuel for electricity production. Although the nation is changing its power energy structure, the position of the coal-fired power industry will continue to be sustained. With the needs of national development, the proportion of thermal power in the energy structure is decreasing, but the demand for electricity is growing. Therefore, it is expected that the output of fly ash will continue to grow in the future, contributing to China’s cement fly ash market growth. The market value in China is expected to be USD 5.38 billion in 2026.

On the other hand, India is projecting to hit USD 1.17 billion and Japan is likely to hold USD 0.15 billion in 2026.

China Cement Fly Ash Market Share, By Application, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

North America region is to be anticipated the third-largest market with USD 0.10 billion in 2026. This is another prominent region, accounting for a noticeable revenue share in the global market. In terms of tonnage, the top cement-consuming states remained Texas, Florida, and California, which significantly drove product consumption. U.S. is identified as the prominent market in the North American region, generating a market value of USD 84.1 million in 2024. According to the U.S. Census Bureau, the construction value in 2024 was USD 2,154.4 billion, which is 6.5% higher than in 2023. According to the Bureau of Economic Analysis, real gross domestic product (GDP) grew by 7% during the first nine months of 2023 compared to the total GDP for 2022. However, growth in the cement sector faced challenges due to rising costs for energy, materials, and services, labor and production shortages, and disruptions in the supply chain. Also, growing pressure from environmental bodies for green renewable power generation and cement production will squeeze the consumption of the product in the forthcoming years. The U.S. market is projected to hit USD 0.09 billion in 2026.

Europe

Europe is anticipated to account for the second-highest market size of USD 0.3 billion in 2026, exhibiting the second-fastest growing CAGR of 4% during the forecast period. The European market is primarily focused on utilizing cement fly ash as a key construction material, particularly in concrete production, due to its ability to partially replace Ordinary Portland Cement (OPC), thereby reducing carbon emissions and promoting sustainability within the construction sector. The European market is driven by increasing infrastructure development, stringent environmental regulations, and a growing focus on circular economy practices. With significant usage in applications like cement, concrete blocks, road construction, and mine restoration, the market will experience moderate growth over the forecast period. The market value in U.K. is expected to be USD 0.07 billion in 2026.

On the other hand, Germany is projecting to hit USD 0.04 billion In 2026 & France is likely to hold USD 0.03 billion in 2025.

Rest of the World

The rest of the world's market is primarily driven by the growing construction sector. Increasing urbanization and infrastructure development in countries like Brazil, Mexico, Argentina, South Africa, Saudi Arabia, and UAE lead to a high demand for cost-effective and sustainable construction materials like cement fly ash. Latin America region is to be anticipated the fourth-largest market with US8D 0.09 billion in 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Players are Adopting Product Innovation Strategies to Attract New Customers

National Thermal Power Corporation (NTPC), Boral, Ashtech India, and Titan America LLC are identified as key manufacturers in the global market. Players operating in the market have adopted both organic and inorganic expansion strategies to capitalize on the growing market potential. The global market is partially consolidated, with few leading players commanding significant shares in their domestic regions. Major companies such as Heidelberg Materials, Holcim, and PPC Zimbabwe are driving market growth by investing in capacity expansions and innovative production technologies. Increasing production and other sustainable efforts taken by market players will increase the product’s demand during the forecast period.

LIST OF KEY CEMENT FLY ASH COMPANIES PROFILED

- Boral Ltd. (Australia)

- Cemex (Mexico)

- Sampyo (South Korea)

- Charah, LLC. (U.S.)

- Titan America LLC (U.S.)

- Cement Australia Pty Limited (Australia)

- Ashtech India (India)

- National Thermal Power Corporation (NTPC) (India)

- Kanden Power-Tech (Japan)

- Heidelberg Materials (U.K.)

KEY INDUSTRY DEVELOPMENTS

- May 2024: Heidelberg Materials has acquired ACE Group, a provider of pulverised fly ash. The acquisition encompasses ACE Greencemt Venture, ASAS Asia, and AGP Logistics, with the existing leadership team from ACE Group continuing to oversee operations after the acquisition.

- April 2024: PPC Zimbabwe has announced that a fly ash beneficiation project at a power plant in Zimbabwe has been rescheduled to early 2025, which was originally planned for 2024. This change is attributed to delays in gaining access to the power plant necessary for finalizing the design and commercial contract, according to the cement manufacturer.

- March 2024: Holcim North America has launched ECOAsh, a Class F fly ash that has been reclaimed from landfills, as part of its Lafarge operations in Western Canada. This development reflects Holcim's dedication to sustainable construction materials and marks a significant advance in the effort to reduce carbon emissions in the construction sector.

- April 2023: Heidelberg Materials announced a U.S. acquisition of The SEFA Group, a fly ash recycling firm located in Lexington, South Carolina. The SEFA Group operates five beneficiation plants, partners with five utilities, has 20 locations, and employs over 500 individuals. It provides fly ash to more than 800 ready-mixed concrete plants across 13 states. With this acquisition, Heidelberg Materials Company has strengthened its market position in the North America region.

REPORT COVERAGE

The research report provides a detailed market analysis, focusing on crucial aspects such as leading companies, types, and applications. In addition, it provides quantitative data regarding market size, analysis, research methodology, and insights into market trends. It also highlights vital industry developments and the competitive landscape. In addition to the above-mentioned factors, it encompasses various factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) & Volume (Kilotons) |

|

Growth Rate |

CAGR of 3.4% during 2026-2034 |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 7.56 billion in 2026 and is projected to reach USD 9.87 billion by 2034.

Growing at a CAGR of 3.4%, the market is expected to exhibit rapid growth during the forecast period.

By application, the Portland Pozzolana Cement (PPC) dominated the market in 2025.

Rising demand from emerging countries such as China and India to aid the market growth.

National Thermal Power Corporation (NTPC), Boral, Ashtech India, and Titan America LLC are the top players in the market.

Momentum towards sustainable construction practices to create remunerative opportunities for market players.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us