Cement Packaging Market Size, Share & Industry Analysis, By Material (Plastics, Paper, and Jute), By Capacity (Up to 5 kg, 6 kg to 20 kg, 21 kg to 50 kg, and Above 50 kg), By Product Type (Bags, Sacks, Pouches, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

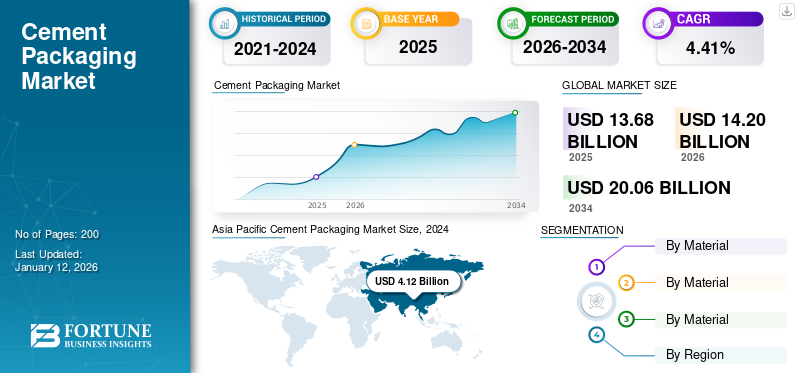

The global cement packaging market size was valued at USD 13.67 billion in 2025. The market is projected to be worth USD 14.20 billion in 2026 and reach USD 20.06 billion by 2034, exhibiting a CAGR of 4.41% during the forecast period. Asia Pacific dominated the cement packaging market with a market share of 31.38% in 2025.

Cement packaging refers to the process and materials used to contain and protect cement during storage, transportation, and sale. The growing emphasis on sustainability, demand for construction materials such as cement, and reducing plastic waste drives the development of eco-friendly packaging alternatives, thus contributing to the market growth.

Mondi and Berry Global Inc. are the leading manufacturers, accounting for the largest market share.

GLOBAL CEMENT PACKAGING MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 13.67 billion

- 2026 Market Size: USD 14.20 billion

- 2034 Forecast Market Size: USD 20.06 billion

- CAGR: 4.41% from 2026–2034

Market Share:

- Asia Pacific led the market in 2025 with a 4.29% share, growing from USD 3.95 billion in 2023 to USD 4.12 billion in 2024.

- By material, plastic held the largest share owing to superior strength, durability, and moisture resistance.

- By capacity, the 21–50 kg segment dominated due to its suitability for construction needs and efficient handling.

- By product type, bags were the leading segment with a 42.93% market share in 2024, driven by protective qualities and brand customization.

- Mondi and Berry Global Inc. were key players with substantial market share in 2024.

Key Country Highlights:

- China: World's largest cement producer, with ~2.1 billion metric tons produced in 2023, supporting demand for efficient packaging.

- India: Second-largest producer, accounting for over 8% of global capacity, driving regional packaging demand.

- United States: Produced 88 million tons of Portland cement and 2.4 million tons of masonry cement in 2023, supporting North American packaging growth.

- Brazil & Mexico: Produced 63,000 and 50,000 metric tons of cement respectively in 2023, contributing to steady growth in Latin America.

- Iran & Egypt: Among top ten global producers; Iran produced 65,000 metric tons and Egypt 50,000 metric tons in 2023, supporting Middle East & Africa market expansion.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Expansion of the Infrastructural Sector Drives Market Growth

The expansion of the infrastructural sector significantly impacts the growth of the market. As more people shift to urban areas, the demand for residential and commercial buildings and transport infrastructure (roads, bridges, airports) drives cement consumption. It leads to a growing need for efficient cement packages to transport and store cement. Companies are investing in biodegradable and recyclable packaging materials to align with global sustainability goals. With the growing number of small-scale construction projects, demand for smaller, more portable packaging options is also increasing. This shift has led to the adoption of compact packaging formats such as 20 kg and 40 kg bags, catering to local construction needs and driving the growth of the industry.

Technological Advancements and Growing Demand for Eco-friendly Packaging Propels Market Growth

Improvements in cement technology have resulted in the creation of alternative varieties of cement that are more environmentally friendly. For example, blended cement and geopolymer cement, which include slag, fly ash, or natural pozzolans, are becoming more popular due to their reduced carbon footprint. The procedure for cement packaging has progressed through advancements in automation, robotics, and innovative packaging materials, enhancing efficiency, reducing costs, and resulting in superior packaging solutions for cement.

The rising global consciousness regarding environmental sustainability has led the cement sector to implement more environmentally friendly packaging options. Regulatory demands and consumer interest in eco-friendly products drive the adoption of recyclable, biodegradable, and reusable packaging. Therefore, technological advancements and growing demand for eco-friendly packaging are bolstering the cement packaging market growth.

MARKET RESTRAINTS

Rising Sustainability and Moisture Sensitivity Concerns to Impede Market Growth

Cement is highly sensitive to moisture. Exposure to humidity or wet conditions can cause the cement to harden or set prematurely, making it unusable. Packaging must provide an effective barrier against moisture to maintain the product's integrity. Developing moisture-resistant packaging materials is essential but challenging, thus hampering the market growth. In addition, traditional cement packaging relies on plastic and non-recyclable materials, which contribute to environmental pollution. The cement industry faces increasing pressure to adopt sustainable packaging solutions, thus restraining market growth.

MARKET OPPORTUNITIES

Growing Cement Production in Developing Countries Generates Growth Opportunities

Rapid urbanization in developing regions, such as Asia Pacific, Africa, and Latin America, drives a growing demand for cement. These regions are expected to grow substantially as cement production and consumption rise. The demand for cement is primarily driven by a growing number of renovation projects, road repairs, and other public works, impacting cement packaging dynamics. The database from World Population Review states that the top ten cement-producing countries are Iran at 65,000 metric tons, Brazil at 63,000 metric tons, Indonesia at 62,000 metric tons, Russia at 57,000 metric tons, and Saudi Arabia at 53,000 metric tons.

- According to the India Brand Equity Foundation, India is the second-largest producer of cement across the globe. It accounts for more than 8% of the global installed capacity.

Therefore, increasing cement production in developing countries is expected to generate potential growth opportunities in the coming years.

MARKET CHALLENGES

Regulatory Compliance Issues and Rising Counterfeiting to Challenge Market Growth

The absence of uniform trade protection measures, such as carbon border adjustment mechanisms, can lead to market imbalances, with some regions becoming dumping grounds for cheaper, high-carbon cement imports. Cement packaging must comply with various regulations, including health, safety, and environmental standards, which can vary by country or region. Manufacturers ensuring that their packaging meets these regulatory requirements face complexity in the designing and production process, thus challenging the market growth. Due to the high demand for cement, some regions face issues with counterfeiting or theft of cement plastic bags. Packaging must incorporate security features such as tamper-proof seals or holograms to ensure the product's authenticity. Hence, the increasing theft and counterfeiting challenge the market growth.

Download Free sample to learn more about this report.

CEMENT PACKAGING MARKET TRENDS

Augmenting Demand for Sustainable Cement Emerges as a Key Trend in the Market

There's a growing shift toward eco-friendly materials, with manufacturers favoring paper-based bags over traditional plastic ones to enhance sustainability and reduce environmental impact. Cement production, traditionally associated with high carbon emissions, has increased pressure on the industry to reduce its environmental impact. The demand for sustainable cement is growing rapidly due to several factors, including the increasing global focus on environmental sustainability, climate change concerns, and the need for infrastructure development.

- Asia Pacific witnessed a cement packaging market growth from USD 3.95 billion in 2023 to USD 4.12 billion in 2024.

The increasing adoption of green building certifications, such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method), has driven demand for sustainable construction materials, including cement. These standards encourage the use of environmentally friendly materials, and as sustainable cement meets these criteria, the demand for sustainable cement increases, further boosting market growth.

- The World Economic Forum reports that worldwide cement production accounts for approximately 8% of total global CO2 emissions, and the existing trend could lead emissions from this sector to rise to 3.8 billion tons annually.

IMPACT OF COVID-19

The cement industry faced a difficult period due to COVID-19, with substantial declines in production and demand. The cement manufacturers faced difficulties with supply chain logistics, affecting raw material availability and delivery timelines. Hence, the industry declined during COVID.

SEGMENTATION ANALYSIS

By Material

Plastic Holds the Largest Market Share Due to Its Strength and Durability

Based on the material, the market is segmented into plastics, paper, and jute.

Plastic is the dominating material segment in the market. Plastic material provides numerous benefits, making it an ideal choice for cement bags. Its remarkable strength and durability allows it to bear the weight of substantial loads without tearing, thus preserving the cement's integrity throughout the handling and transportation process. Furthermore, plastic is resistant to moisture, creating a shield that blocks water penetration and maintains the quality of the cement, which is particularly important in damp environments, thus driving segmental growth. The segment dominated the market with 57.87% of the market share in 2026.

The paper material segment will experience steady growth in the forthcoming years. The paper material offers sufficient strength, can carry 50 kg of cement, and is easy to recycle. It also enhances the aesthetic appeal and offers ease of printability for the manufacturers.

By Capacity

High Demand from the Construction Sector Propels the 21 kg to 50 kg Segmental Growth

Based on capacity, the market is categorized into up to 5 kg, 6 kg to 20 kg, 21 kg to 50 kg, and above 50 kg.

21 kg to 50 kg is the dominant capacity segment. It is a standard and highly demanded range for cement packages in the construction industry. It fulfills various project needs with a flexible size for applications such as slabs, foundations, bricklaying, and plastering. Its capacity limits the unnecessary loss of cement during transport and storage production, decreases environmental impacts, enhances working conditions for operators on the cement filling lines, and makes cement handling more efficient. Rising demand from the cement sector owing to such potential advantages boosts segmental growth. The segment is expected to hold 47.17% of the market share in 2026.

The second-leading capacity segment is 6 kg to 20 kg and is estimated to witness significant growth over the forecast period. The bags and pouches with this capacity protect the quality of cement from moisture and contaminants & simplify the distribution and packaging process for manufacturers and suppliers. The segment is anticipated to grow with a significant CAGR of 4.08% during the forecast period (2025-2032).

By Product Type

To know how our report can help streamline your business, Speak to Analyst

Rising Utilization from the Building and Construction Sector Enhances the Demand for Bags

Based on product type, the market is classified into bags, pouches, sacks, and others. Bags holds the largest cement packaging market share.

Cement bags protect the cement from moisture and pollutants that can degrade the cement's quality. It also decreases the chance of spoiling and mixing with other substances. Moreover, they can be easily personalized with a company's name & logo to promote the brand and attract more consumers. Cement bags play a crucial role in the construction industry, assuring the safe and efficient transportation of cement, thus enhancing the segment’s growth. The segment is likely to capture 43.37% of market share in 2026.

The sacks product type is the second-dominating segment and is expected to grow with a CAGR of 4.22% during the forecast period (2025-2032). Cement sacks are strong and can carry heavy loads. They are also highly resistant to weather and chemicals, which thus enhances segmental growth.

Cement Packaging Market Regional Outlook

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Cement Packaging Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Well-established Cement Industry Boosts the Market Growth in Asia Pacific

Asia Pacific dominated the market with a valuation of USD 3.95 billion in 2023 and USD 4.29 billion in 2025. Major countries, such as China and India are the leading global cement producers in the region. The rising demand for cement products and the presence of major players drive the market development. China is expected to gain USD 1.47 billion in 2026.

- According to a recent World Population Review database, China currently has the highest number of cement manufacturers. In 2023, approximately 2,100,000 metric tons were produced in China, whereas India produced 410,000 metric tons of cement, which is comparatively higher than their 2022 production rate of 380,000 metric tons.

India is predicted to be worth USD 1.22 billion in 2026, while Japan is poised to reach a valuation of USD 0.85 billion in 2026.

North America

Increasing Production of Portland & Masonry Cement Drives the North American Market Growth

North America is the second-dominating region and is expected to hold USD 3.50 billion in 2026, exhibiting a CAGR of 4.45% during the forecast period (2025-2032). The U.S. is experiencing increased production of Portland and masonry cement. It thus contributes to the market growth. The U.S. market is set to reach a market value of USD 2.82 billion in 2026.

According to the U.S. Geological Survey, in 2023, the U.S. produced an estimated 88 million tons of Portland cement and 2.4 million tons of masonry cement. Texas, Missouri, California, and Florida were the top four cement-producing states.

Europe

Reduction in CO2 Emissions and High Demands for Cement Products in Drives the Market in Europe

Europe is the third-largest contributor to the market anticipated to be worth USD 2.84 billion in 2026. Rising initiatives by cement manufacturers to reduce CO2 emissions boost the demand for cement products in the construction sector. The U.K. market is expanding, estimated to reach the valuation of USD 0.52 billion in 2026.

- According to the Cembureau, the European Cement Association, the European cement sector ranks among the top-performing areas globally, consistently decreasing its emissions.

Germany is expected to attain USD 0.59 billion in 2025, while France is projected to be valued at USD 0.43 billion in the same year.

Latin America

Rising Cement Production Drives Market Growth in Latin America

Latin America is the fourth largest region, predicted to gain USD 1.96 billion in 2026. The region will experience steady growth in the projected period. The growing cement production and rising infrastructure activities across major countries have primarily enhanced the market growth in Latin America.

According to the recent database from World Population Review, in 2023, Brazil produced 63,000 metric tons of cement, whereas Mexico produced 50,000 metric tons of cement.

Middle East & Africa

Presence of Major Cement Producing Countries Aids Market Growth in Middle East & Africa

The Middle East & Africa will experience significant growth in the projected period. The region has the presence of major cement-producing countries, which increases the production and utilization of cement, thus boosting the market growth in the Middle East & African region.

- According to the recent database from World Population Review, in 2023, Iran is among the ten cement producers and produced 65,000 metric tons of cement, whereas Egypt produced 50,000.

Saudi Arabia is anticipated to be worth USD 0.44 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global market is highly fragmented and competitive. A few significant players are dominating the market by offering innovative packaging solutions. These major market players constantly focus on expanding their customer base across regions by innovating their existing range of products.

Major players in the industry include Mondi, Berry Global Inc., Smurfit Kappa, ProAmpac LLC, United Bags, LC Packaging International BV, and others. Numerous other companies operating in the market are focused on market scenarios and delivering advanced cement packaging solutions.

Key Companies Profiled

- Mondi (U.K.)

- Berry Global Inc. (U.S.)

- Smurfit Kappa (Ireland)

- ProAmpac LLC (U.S.)

- United Bags (U.S.)

- LC Packaging International BV (Netherlands)

- Uflex Ltd. (India)

- Taurus Packaging (India)

- Unisun packaging (India)

- Gascogne SA (France)

- ToolAsian Polysacks Pvt. Ltd. (India)

- Global-Pak Inc. (U.S.)

- NNZ Group BV (Netherlands)

- Advanced Industries Packaging (Ireland)

- Bischof + Klein SE & Co. KG (Germany)

- Elsepack (China)

KEY INDUSTRY DEVELOPMENTS

- In July 2023, UltraTech Cement Limited, India's largest cement and ready-mix concrete producer, enhanced its role in the circular economy by launching cement packaging bags from recycled polypropylene (rPP). The new bags of cement are composed of 50 percent rPP. In general, the implementation of rPP has contributed to a 43 percent decrease in the usage of virgin plastic.

- In June 2023, Mondi declared the launch of SolmixBag, a water-soluble bag designed for the construction sector. SolmixBag is a single-layer paper bag that holds and conveys dry construction materials, such as cement and dry mix mortar items.

- In September 2022, Starlinger launched new cement bags. Woven plastic block bottom valve bags provide a moisture-resistant and tear-proof packaging solution for dry bulk products. Still, they are also emerging as a more sustainable packaging option in this industry.

- In September 2021, Lehigh Hanson introduced a fresh bag design for its EcoCemPLC product, a Portland Limestone Cement. The updated packaging design for EcoCemPLC showcases the ‘reduced carbon footprint’ icon prominently displayed in the new bag layout to highlight EcoCemPLC’s advantage in carbon reduction.

- In May 2021, JK Cement, a prominent producer of Grey Cement in India and a top manufacturer of White Cement globally, declared its entry into the East Indian market with the official inauguration of its Grey Cement operations in Bihar. The strategic decision highlights JK Cement's commitment to enhancing its national presence and aiding Bihar's infrastructural development and economic progress.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Investment plan assessment is an essential procedure for firms seeking to enhance their financial strategies and increase returns. This activity encompasses the analysis of prospective investments, including capital expenditures, equity portfolios, or long-term initiatives, to evaluate profitability, risks, and alignment with strategic goals.

In August 2023, Shree Cement Ltd declared its plan to invest in India to increase its production capacity by 12 million tonnes. In a regulatory disclosure, the firm also announced its plan to expand into the ready-mix concrete (RMC) sector and intends to establish five RMC plants in the nation by the end of the current financial year.

REPORT COVERAGE

The market report provides a detailed market analysis. The market overview also focuses on key aspects, such as top key players, competitive landscape, product/service types, market segments, Porter’s five forces analysis, and leading segments of the product. Besides, the report offers insights into the sterile packaging market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market intelligence & growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.41% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Capacity

|

|

|

By Product Type

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 13.67 billion in 2025.

The market will likely grow at a CAGR of 4.41% over the forecast period.

The bag product type segment leads the market.

The Asia Pacific market size stood at USD 4.29 billion in 2025.

The key market drivers are rapid expansion of the infrastructural sector, technological advancements, and growing demand for eco-friendly packaging.

Some of the top players in the market are Mondi, Berry Global Inc., Smurfit Kappa, ProAmpac LLC, United Bags, and LC Packaging International BV.

The global market size is expected to reach USD 20.06 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us