Chip-on-Board LED Market Size, Share & Industry Analysis, By Product (COB LED Modules, COB LED Arrays, and COB LED Components), By Substrate Material (Ceramic Substrates and Metal Core PCBs), By Application (General Lighting (Residential, Commercial, and Industrial), Automotive (Interior and Exterior (Headlamps, Side lamps, and Rear Lights)), Backlighting (LED Televisions, Smartphones and Tablets, Monitors, Screen Display Lightings), and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

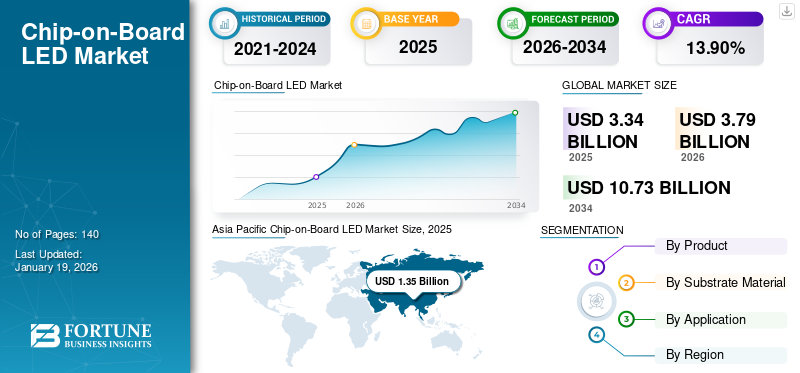

The global chip-on-board LED market size was valued at USD 3.34 billion in 2025 and is projected to grow from USD 3.79 billion in 2026 to USD 10.73 billion by 2034, exhibiting a CAGR of 13.90% during the forecast period. Asia Pacific dominated the global market with a share of 40.40% in 2025.

A chip-on-board (COB) LED is a singular unit containing multiple LED chips attached to a substrate designed for optimal heat dissipation, all covered by a consistent phosphor layer. The major players included in this market are Lumileds Holding B.V., EPISTAR Corporation, EVERLIGHT ELECTRONICS CO., LTD., Savant Systems, Inc. (GE Lighting), Lextar Electronics Corporation, Penguin Solutions (Cree LED), Luckylight Electronics Co., Ltd, Samsung Electronics Co., Ltd., NICHIA CORPORATION, and Bridgelux, Inc.

Chip-on-board LEDs are witnessing significant market growth mainly due to the increasing adoption of LED lighting technologies, IoT integration, and demand for specialty lighting applications. The industry is undergoing a significant transformation driven by the growing awareness of environmental sustainability, hence increasing the market share. The IEA projected that if LED technology were implemented worldwide, the electricity consumption for lighting could decrease by over 65%. Additionally, the shift from traditional LED packages to modern ones is driving the adoption of COB LEDs and expanding the market growth. Therefore, these elements are helping to expand the market share for chip-on-board LEDs.

The COVID-19 pandemic initially disrupted the COB LED supply chains and dampened demand in industrial segments. Simultaneously, surges in home lighting, UV-C sterilization, and e-commerce applications created new avenues for growth. The market has recovered with a short-term loss and is poised for strong long-term growth.

Download Free sample to learn more about this report.

IMPACT OF GENERATIVE AI

Integration of Generative AI with Chip-on-Board LED by Enhancing Design Capabilities to Fuel Market Growth

Generative AI is transforming this industry by upgrading design, maintenance, operational efficiency, and manufacturing. This lowers thermal performance, brightness uniformity, and energy efficiency at a much cheaper cost, allowing for a faster time-to-market and better product differentiation.

IMPACT OF RECIPROCAL TARIFFS

These tariffs have increased costs and inconsistencies in the chip-on-board LED industry, affecting producers and consumers. Some Chinese firms lost U.S. market share, while Taiwanese and South Korean producers gained due to lower tariff exposure. Regions are confronting these issues by boosting domestic manufacturing, and a more cautious approach is to prioritize cost resilience and leverage strategic partnerships.

Chip-on-Board LED Market Trends

Increased Innovations in Thermal Management to Emerge as a Key Market Trend

Thermal management is a key trend due to the closely packed LEDs in the COB LED module, leading to intense heat generation. Organizations have started utilizing advanced substrates to balance cost and thermal conductivity. Moreover, they are using computational fluid dynamics (CFD) and finite element analysis (FEA) tools to stimulate thermal flow. This also helps LED manufacturers optimize layout, material choices, and cooling paths before prototyping.

MARKET DYNAMICS

Market Drivers

Rising Demand for Energy Efficiency and High Brightness in LED Products to Aid Market Growth

Energy efficiency and high brightness with uniform light output are key drivers propelling the growth of the COB LED market. COB LEDs are very energy-efficient; they consume less power than conventional light sources, reducing operation costs. For example, COB architecture and street lighting, such as Bridgelux’s Vesta, reduce energy consumption while providing brighter and more uniform illumination. Energy efficiency is a robust driving factor due to global sustainability being supported by industries and governments. Therefore, with the higher demand for energy-efficient and effective performance lighting solutions, the advantages that come with the use of COB LEDs are driving their adoption across industries.

Market Restraints

Rise in Manufacturing Costs to Hinder Market Expansion

High initial costs are hampering the chip-on-board LED market growth. As new lighting solutions, in most instances, have a higher upfront cost than conventional LEDs, COB LEDs have also faced this situation. Advanced manufacturing processes and specific materials for the fabrication of COB LEDs (plus semiconductors and phosphors) contribute to the elevated costs.

Market Opportunities

Increasing Application of Smart Lighting and Automotive to Create Lucrative Market Opportunities

The growing trend in the usage of smart lighting systems is complemented by an increasing interest in human-centric lighting (HCL), which drives growth in the COB LED market. Smart city initiatives, such as street lighting systems utilizing COB LED parts that improve security and energy management in regions such as Asia Pacific and Europe, are set to be rolled out. The automotive industry is also incorporating COB LEDs for rear lights and adaptive front lighting systems (AFS), which necessitate compact yet high-intensity light sources. With global vehicle production exceeding 85 million units in 2023, as reported by OICA, the ongoing demand for automotive-grade LEDs is strongly supported.

SEGMENTATION ANALYSIS

By Product

Rising Need for COB LED Modules for Residential and Commercial Applications Boosts Segment Growth

Based on product, the market is segmented into COB LED modules, COB LED arrays, and COB LED components.

The COB LED modules segment dominated the chip-on-board LED market with a share of 55.15% in 2026. The strong demand for these modules within the residential and commercial applications is anticipated to drive significant growth in this segment in the coming years. Manufacturers are generating the demand for effective heat control and simple designs for holding devices, in the easy integration of HLGs into light setups, and for fewer parts needed. The accessibility and flexibility of lighting products have recently contributed to their rising popularity.

The COB LED arrays segment is expected to see the highest compound annual growth rate (CAGR) throughout the forecast period. COB LED arrays can accommodate more chips in a smaller footprint, resulting in greater light output than traditional LEDs. The close arrangement of chips in a COB LED array leads to a more consistent light output, unlike conventional LEDs that often create a mottled effect. Additionally, COB LED arrays can achieve a higher color rendering index (CRI) than traditional LEDs, allowing colors to look more real under their illumination. Companies are providing a diverse selection of products, offering more options for users and supporting the segment's growth.

By Substrate Material

Ceramic Substrates Dominated Market with Their Enhanced Characteristics in Growing Applications

Based on substrate material, the market is categorized into ceramic substrates and metal core PCBs.

The ceramic substrates led the market with the highest share of 61.91% in 2026, due to enhanced thermal conductivity, high reliability, and outstanding electrical insulation characteristics. Ceramic substrates are applicable, especially for high-power LEDs, where optimal thermal management is critical for performance, sustainability, and dependability over time. As ceramic devices exhibit greater durability in extreme environmental conditions, ceramic-based COB LEDs have been increasingly adopted in the medical lighting, automotive, and industrial sectors in recent years.

The metal core PCBs segment is expected to record the highest CAGR during the forecast period. The thermal conductivity provided by these PCBs fuels the advancement of this sector. Efficient dissipation of heat generated by COB LED chips. The increasing demand for high-power lighting and high-brightness solutions, coupled with the enhanced utilization in commercial buildings, industrial sites, and automotive lighting, will probably influence the growth of this segment in the coming years.

By Application

To know how our report can help streamline your business, Speak to Analyst

General Lighting Dominated Market with Increasing Usage in Various Environments

Based on the application, the market is categorized into general lighting, automotive, backlighting, and others.

Regarding share, the general lighting segment was the largest in the market with a share of 42.01% in 2026. The surge in demand for COB LEDs in this application sector is linked to their extensive use in lighting solutions across various environments, including hotels, residential units, hospitals, streetlights, government buildings, private offices, and more. These LEDs emit light as a unified source, which enhances their visual appeal for general lighting purposes. Moreover, COB LEDs' compact nature makes it easier to create designs just a few inches wide. This makes them even better for places such as retail displays and museums, and anywhere important where accurate color representation is crucial.

The backlighting segment is expected to register the highest CAGR during the forecast period due to its growing influence in smart backlighting, energy efficiency policies, and expanding consumer electronics.

CHIP-ON-BOARD LED MARKET REGIONAL OUTLOOK

By region, the market is divided into Asia Pacific, Europe, North America, Middle East & Africa, and South America.

Asia Pacific

Asia Pacific Chip-on-Board LED Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific led the market in 2024 due to a strong manufacturing network, rising urbanization, and significant governmental backing for energy-efficient technologies. Asia Pacific dominated the global market in 2025, with a market size of USD 1.35 billion.Many of these manufacturing facilities are located in Taiwan, China, Japan, and South Korea. These countries are a base for leading LED producers such as Samsung Electronics, Nichia Corporation, and Seoul Semiconductor. The Japan market is projected to reach USD 0.34 billion by 2026, the China market is projected to reach USD 0.55 billion by 2026, and the India market is projected to reach USD 0.21 billion by 2026.

Public infrastructure and automotive LED lighting continue to fuel growth in the Asia Pacific region, with China maintaining its status as the dominant country due to extensive public infrastructure lighting projects.

To know how our report can help streamline your business, Speak to Analyst

South America

The South American region has a smaller market presence. The increasing adoption of commercial buildings, digitization, and government initiatives has created a positive impact, while economic expansion could be challenging.

Europe

The market in Europe is expanding due to the increased need for energy-efficient lighting options in various sectors, such as automotive, commercial, and industrial. Due to strict energy and carbon emission regulations, the region is significantly influenced by sustainability and energy-saving technologies. The step toward adopting these technologies has propelled the market for COB LEDs due to their superior efficiency, durability, and compact design. The UK market is projected to reach USD 0.14 billion by 2026, while the Germany market is projected to reach USD 0.13 billion by 2026.

Middle East & Africa

The market for chip-on-board LEDs in the region is undergoing stable growth due to recent shifts in the expanding semiconductor network and initial government funding for research initiatives.

North America

North America is expected to grow at the highest CAGR during the forecast period due to the rising implementation of smart lighting solutions. Further, stringent regulations on energy efficiency have added to market growth. In the U.S., COB LEDs are leading the growth in every aspect, where retrofitting residential is increasing, besides the automotive growth between Tesla and Ford companies. Sustainable building certifications such as LEED also supported demand for high-efficiency lighting. The U.S. market is projected to reach USD 0.88 billion by 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Players to Use Merger & Acquisition, Partnership, and Product Development Strategies to Expand Business Reach

Key players in this market provide chip-on-board LED to give users higher brightness, better heat dissipation, and a more compact design. They focus on signing acquisition agreements with small and local companies to increase their business operations. Moreover, partnerships, mergers & acquisitions, and key investments will boost the demand for this technology.

List of Chip-on-Board LED Companies Studied (including but not limited to)

- Lumileds Holding B.V. (The Netherlands)

- EPISTAR Corporation (Taiwan)

- EVERLIGHT ELECTRONICS CO., LTD. (Taiwan)

- Savant Systems, Inc. (GE Lighting) (U.S.)

- Lextar Electronics Corporation (Taiwan)

- Penguin Solutions (U.S.)

- Cree LED (U.S.)

- Luckylight Electronics Co., Ltd (China)

- Samsung Electronics Co., Ltd. (South Korea)

- NICHIA CORPORATION (Japan)

- Bridgelux, Inc. (U.S.)

- Signify Holding (The Netherlands)

- Seoul Semiconductor Co., Ltd. (South Korea)

- Dongguan LEDESTAR Opto-electronics Tech. Co., Ltd. (China)

- ProPhotonix (U.S.)

- ams-OSRAM AG (Austria)

- SANAN Optoelectronics Co., Ltd (China)

- CITIZEN ELECTRONICS CO., LTD. (Japan)

- Toshiba Corporation (Japan)

- OPPLE Lighting Co., Ltd (China)

- NVC Lighting Ltd. (U.K.)

…and more.

KEY INDUSTRY DEVELOPMENTS

- April 2025: Cree LED introduced the XP-GR LEDs and XLamp XP-LR, which are customized for directional lighting applications that require better precision and high-level beam quality.

- November 2024: Cree LED unveiled its latest CV28D LEDs that feature FusionBeam Technology, marking a significant progression in the LED industry. The CV28D LED integrates cutting-edge through-hole and surface-mount (SMD) RGB LED technology, providing enhanced directionality, image clarity, and resolution in a robust and easily assembled format.

- May 2024: Daktronics introduced its Flip-Chip COB LED display technology globally. The newest member of its Narrow Pixel Pitch (NPP) product lineup offers tighter pixel spacing, enhanced durability and reliability, and reduced power consumption, leading to a significantly better customer experience.

- August 2023: Bridgelux, known for its cutting-edge LED solutions, introduced its Gen9 COBs. This is a product of their ongoing commitment to enhancing CRI80 efficiency to 200 lm/W in warm white. The Gen9 COBs come in various Light-Emitting Surfaces (LES) ranging from 6 mm to 22 mm in diameter.

- December 2022: Bridgelux disclosed a partnership with Empa Elektronik San. Ve Tic A.S. will become its new distributor for LED COB, SMD, CSP, module products, LED drivers, and MOSFET in the UAE, Turkey, Qatar, Saudi Arabia, Jordan, and Egypt.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Strategic investments in manufacturing, materials, IoT lighting, and supply-chain localization offer multiple avenues for returns, provided execution considers cost, technology, and partnership. In October 2024, the U.S. Department of Commerce recommended USD 750 million in funding through the CHIPS and Science Act to aid Wolfspeed's expansion in North Carolina and to stimulate growth in New York. Organizations can consider backing component providers and semiconductor tools that support COB ecosystems. Therefore, it presents a huge opportunity for the players in the market.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/types, and the leading application of the product. Besides, it offers insights into the chip-on-board LED market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

By Substrate Material

By Application

By Region

|

|

Companies Profiled in the Report |

Lumileds Holding B.V. (Netherlands) EPISTAR Corporation (Taiwan) EVERLIGHT ELECTRONICS CO., LTD. (Taiwan) Savant Systems, Inc. (GE Lighting) (U.S.) Lextar Electronics Corporation (Taiwan) Penguin Solutions (Cree LED) (U.S.) Luckylight Electronics Co., Ltd (China) Samsung Electronics Co., Ltd. (South Korea) NICHIA CORPORATION (Japan) Bridgelux, Inc. (U.S.) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 10.73 billion by 2034.

In 2025, the market was valued at USD 3.34 billion.

The market is projected to record a CAGR of 13.90% during the forecast period.

By product, the COB LED modules segment led the market in 2025.

Rising demand for energy efficiency and high brightness in LED products is aiding market growth.

Lumileds Holding B.V., EPISTAR Corporation, EVERLIGHT ELECTRONICS CO., LTD., Savant Systems, Inc. (GE Lighting), Lextar Electronics Corporation, Penguin Solutions, Cree LED, Luckylight Electronics Co., Ltd, Samsung Electronics Co., Ltd., NICHIA CORPORATION, and Bridgelux, Inc. are the top players in the market.

Asia Pacific held the highest market share in 2025.

By application, the backlighting segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us