Commercial Kitchen Ventilation System Market Size, Share & Industry Analysis, By Product Type (Hoods, Filtering Systems, Exhaust Fans & Ducting Systems, Makeup Air Systems, and Controls and Accessories), By Application (Restaurants and Cafes, Hotels and Hospitality Industry, Educational Institutes, Corporate and Industrial Canteens, Hospitals and Healthcare Facilities, Others Commercial Establishments), and Regional Forecast, 2026-2034

Commercial Kitchen Ventilation System Market Size and Future Outlook

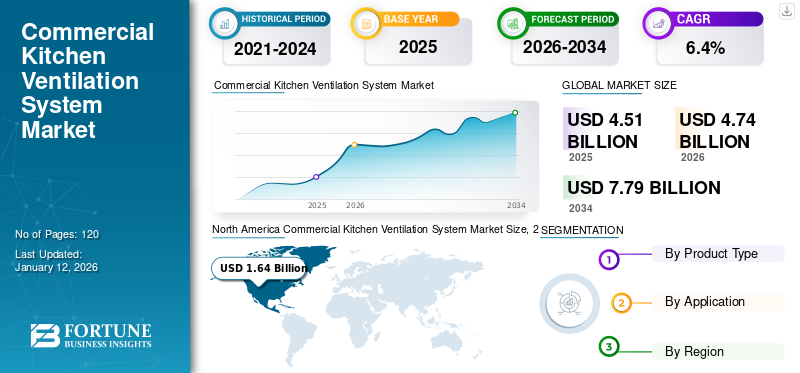

The global commercial kitchen ventilation system market size was valued at USD 4.51 billion in 2025 and is projected to grow from USD 4.74 billion in 2026 to USD 7.79 billion by 2034, exhibiting a CAGR of 6.4% during the forecast period. North America dominated the global market with a share of 36.4% in 2025.

Commercial kitchen ventilation systems play a crucial role in commercial kitchens by extracting and purifying airborne pollutants produced during cooking. They focus on safety by lowering fire risks, improving indoor air quality for employees, adhering to regulations, increasing energy efficiency, and enhancing the overall dining experience for customers. Investing in a high-quality kitchen ventilation system is essential for protecting a business’s success and reputation in the culinary field.

Global Commercial Kitchen Ventilation System Market Overview

Market Size:

- 2025 Value: USD 4.51 billion

- 2026 Value: USD 4.74 billion

- 2034 Forecast Value: USD 7.79 billion

- CAGR: 6.4% from 2026 to 2034

Market Share:

- Regional Leader: North America led global share in 2025 with 36.4%, driven by growth in quick-service restaurants, hospitality, and strict air quality standards

- Product Segment Leader: Hoods—especially wall-mounted—dominated product revenue share in 2024

- Application Leader: Restaurants and cafés held the largest application segment share in 2024, responding to rising consumer demand and regulatory compliance

- Fastest-Growing Application: Hotels and hospitality kitchens expected to register the highest growth through 2032

Industry Trends:

- Integrating IoT and smart sensors for real-time air quality tracking and automated ventilation control

- Growing adoption of energy-efficient, demand-controlled systems, including variable speed fans and heat recovery units

- Increased use of advanced filtration and UV‑C sanitization to improve indoor air hygiene and safety

Driving Factors:

- Rapid expansion of food-service sectors—restaurants, cloud kitchens, QSRs, hospitality—fueling demand for ventilation systems

- Tougher health, fire and safety compliance standards driving new installations and upgrades

- Heightened awareness of indoor air quality, hygiene, and sustainable kitchen operations

- Regulatory mandates in developed markets supporting adoption of advanced ventilation solutions

The growth of the market is consistent due to the strict regulatory standards on ventilation and air quality in commercial kitchens, the rapid growth of the food service sector, and the increased focus on energy efficiency and sustainability. Effective ventilation systems improve indoor air quality by consistently exchanging stale air with fresh air from outside. This enhancement fosters a healthier and more comfortable workplace for employees, enabling them to breathe effortlessly, work productively, and maintain their energy levels.

Adhering to health and safety regulations is crucial for any culinary establishment. An effectively designed and properly maintained kitchen ventilation system guarantees that the business complies with all required codes and standards, thereby preventing potential fines and legal complications.

Some of the key players operating in the market are CaptiveAire Systems, Accurex, Halton, Absolent Air Care Group, and Greenheck Fan Corporation among others. Top players increasingly focus on product innovation and customization to address diverse customer requirements.

The COVID-19 pandemic significantly affected the demand for commercial kitchen ventilation systems worldwide in the first and second quarters of 2020. The hospitality sector serves as a crucial economic driver, accounting for approximately 7.6% of the worldwide GDP, as reported by the World Travel & Tourism Council. This sector encompasses hotels, dining establishments, and the travel and tourism industry. The pandemic caused global travel to nearly halt, impacting thriving tourist hotspots. As attention shifted toward safety and social distancing measures, companies within the industry had to adjust or confront significant economic challenges quickly.

IMPACT OF TECHNOLOGY ON MARKET

Rapid Technological Advancements to Drive Market Growth

The commercial kitchen ventilation system sector is thriving with new technological developments. There is a strong push toward creating smarter, more energy-efficient systems that enhance air quality and minimize their environmental footprint. Integrated smart technology now enables range hoods to automatically modify their speed in response to cooking activities, providing optimal ventilation without requiring manual adjustments.

Recent advancements in ventilation technologies have made notable progress in lowering energy consumption. Models that hold Energy Star certifications ensure better air quality while also offering substantial savings on energy costs. The advent of automated systems has further refined energy efficiency. In modern range hoods, sensors can gauge the levels of heat or smoke and adjust the fan speed as needed. This means the hood only runs at its maximum capacity when it is actually required, preventing excessive energy usage during times of minimal cooking activity.

MARKET TRENDS

Integration of Smart Technologies and Internet of Things (IoT) to Fuel Market Growth

The integration of smart technologies and the Internet of Things (IoT) into commercial kitchen ventilation systems is growing. Ventilation systems that feature sensors and IoT functionalities allow for the real-time tracking of air quality, temperature, and system performance. These smart technologies improve the management and automation of ventilation systems, offering chefs and kitchen managers essential insights for efficient operation and upkeep.

- In April 2021, Halton Group, a provider of indoor environmental solutions, announced its demand-controlled ventilation solution, the Halton M.A.R.V.E.L, to commercial kitchens as a service. The Halton M.A.R.V.E.L system, integrated with IoT technology, supports uninterrupted functioning and reliable budgeting in commercial kitchens through predictive maintenance while also potentially reducing their energy expenses and environmental impact.

Due to an increased emphasis on health and safety, ventilation systems are now integrating sophisticated filtration and air purification technologies. These systems are designed to trap grease and airborne particles and tackle issues related to indoor air quality.

MARKET DYNAMICS

Market Drivers

Rapid Growth of Food Service Sector to Drive Market Growth

The rapid expansion of fast-food chains, cloud kitchens, restaurants, and cloud kitchens is expected to generate higher demand for commercial kitchen ventilation systems. For instance, India’s food services industry is valued at USD 67.89 billion in 2024. It is expected to expand at a CAGR of 8.1%, aiming for USD 92.43 billion by 2028, as reported by the National Restaurant Association of India.

The restaurant industry in China has experienced a notable recovery after the pandemic. In 2023, the Chinese food service sector achieved a value of USD 717.6 billion, representing a 20.6% increase compared to the previous year, effectively bringing the catering market back to levels seen before the pandemic. Looking ahead, the growth of China's catering sector is anticipated to stabilize, with a forecasted market size of USD 772.8 billion by 2025.

Furthermore, rapid urbanization and increasing disposable income, particularly in emerging markets such as India, Brazil, Turkey, Thailand, Mexico, South Korea, and Saudi Arabia, contribute to higher spending on dining out. This, in turn, is anticipated to enhance market growth further.

Market Restraints

High Initial Costs and Regular Maintenance Requirement to Obstruct Product Adoption

Commercial kitchen ventilation systems require a significant initial investment. Cutting-edge systems with eco-friendly features are more expensive, making them less accessible for budget-constrained businesses. This system requires regular maintenance, cleaning, and servicing for optimum performance and compliance, which further adds to the total cost of ownership. In addition, improper servicing can result in fire mishaps, grease buildup, and reduced efficiency, hindering widespread adoption.

Market Opportunities

Growth in Quick Service Restaurants (QSRs) to Offer Ample Growth Opportunities

Quick-service restaurants have notably transformed how people around the world spend their time, money, and calories. This segment of the hotel industry has undergone rapid growth, and various estimates indicate that the QSR sector will keep expanding as convenience becomes an increasingly important factor. The U.S. boasts one of the largest QSR markets globally. At present, there are 201,865 quick-service restaurants in the nation, reflecting an almost 1% increase in the first quarter of 2023, with 37% of Americans consuming fast food on a daily basis. As more consumers turn to QSR options, the demand for efficient ventilation systems is expected to increase.

SEGMENTATION ANALYSIS

By Product Type

Growing Awareness of Indoor Air Quality to Increase Demand of Exhaust Hoods

Based on product type, the market is classified into hoods, filtering systems, exhaust fans & ducting systems, makeup air systems, and controls and accessories.

Hoods is poised to dominate the market with a share of 38.82% in 2026, due to the growing awareness of indoor air quality in commercial kitchens. Cooking in a commercial kitchen can produce a significant amount of smoke, steam, and various airborne particles, particularly grease-laden vapors. Without adequate ventilation, these particles can accumulate, resulting in an unpleasant and potentially dangerous work environment. A kitchen hood aids in extracting these particles from the air, enhancing air quality and creating a safer and more comfortable atmosphere for kitchen staff. A kitchen hood plays a crucial role in fire prevention by capturing and eliminating grease and other combustible particles from the air. It also allows excess heat to escape, lowering the potential for fires, thereby making the hood a vital element of any fire suppression system. Based on hoods, the market is segmented into wall-mounted hoods, island canopy hoods, proximity hoods, and others.

Wall-mounted hoods captured the largest market share, driven by a growing number of compact commercial kitchens worldwide. These hoods are highly suitable for narrow kitchen outlets and are widely used in urban settings where space is tight. In addition, compared to other hoods, wall-mounted canopy hoods are more affordable, increasing their adoption among cloud kitchens and food trucks.

Proximity hoods to grow with the highest CAGR during the forecast period owing to their enhanced energy efficiency. These hoods reduce the volume of air that is required to be exhausted, leading to significant energy savings.

Makeup air systems to grow with the highest CAGR of 7.72% during the forecast period (2025-2032). The majority of building regulations in developed countries mandate the makeup of air in commercial kitchen operations to counteract negative pressure and ensure a safe and pleasant atmosphere. These units are typically installed on rooftops, above ceilings, or on slabs, and they can include heating and cooling features for comfort.

By Application

Stringent Health and Safety Compliance to Augment Market Growth for Restaurants and Cafes

Based on application, the market is segmented into restaurants and cafes, hotels and hospitality industry, educational institutes, corporate and industrial canteen, hospitals and healthcare facilities, and others commercial establishments.

Restaurants and cafes accounted for the largest market share, driven by the growing food service industry, stringent health and safety compliance, and changing consumer behavior. Presently, consumers expect a clean and odor-free environment. This influences restaurants and cafes to invest in kitchen ventilation systems. In addition, stringent regulations imposed by government authorities augment the demand for ventilation systems to ensure air quality and fire safety in restaurants and cafes. The segment captured 37.55% of the market share in 2026.

To know how our report can help streamline your business, Speak to Analyst

Hotels and hospitality industry to grow with the highest CAGR during the forecast period owing to growth in luxury hotels and event venues in developing countries. These venues require ventilation systems in the kitchen to manage high-capacity cooking operations.

Commercial Kitchen Ventilation System Market Regional Outlook

The market covers five major regions, mainly North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Commercial Kitchen Ventilation System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Download Free sample to learn more about this report.

North America dominated the market with a valuation of USD 1.64 billion in 2025 and USD 1.73 billion in 2026. The North American market is anticipated to dominate with the largest share during the forecast period owing to stringent health and safety regulations, the rise of quick-service restaurants (QSRs), the expansion of the hospitality sector, and technological advancements. Following the challenges posed by the pandemic, restaurant revenues in North America experienced a remarkable recovery. From 2020 to 2023, there was an impressive 47% rise in restaurant sales, showing that the industry is on the path to recovery.

U.S. Set to Dominate Market Due to Rising Urbanization and Robust Disposable Income

The U.S. population has increasingly transitioned from rural regions to urban centers and from smaller communities to larger metropolitan areas. Urbanization is anticipated to keep rising due to increasing incomes and a transition away from agricultural jobs. As the urban population grows, the demand for cafes, restaurants, and quick-service outlets also grows, driving the demand for efficient kitchen ventilation systems. The U.S. market is anticipated to hold USD 1.11 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is the second largest market anticipated to hold USD 1.18 billion in 2026, registering a CAGR of 7.96% during the forecast period (2025-2032). The Asia Pacific market is anticipated to expand with the highest CAGR during the forecast period due to the rising middle-class population in countries such as India, China, South Korea, and Japan. Various estimates suggest that by 2027, roughly 1.2 billion people in China will be classified as middle class, making up about 25% of the global figure. Chinese market is foreseen to grow with a value of USD 0.35 billion in 2026. The growth of urban populations in China and the increase in disposable income have led to a surge in the number of restaurants and cafes. The high density of living environments and space limitations have heightened the demand for ventilation systems in commercial kitchens. Furthermore, the abundance of local manufacturers of commercial kitchen equipment is creating substantial market opportunities for China to export its commercial kitchen ventilation systems globally. India is set to reach USD 0.14 billion in 2026, while Japan is projected to be valued at USD 0.2 billion in the same year.

Europe

Europe is the third largest market expected to be valued at USD 1.06 billion in 2026. The European market is poised for substantial growth due to the rising number of quick-service restaurants and fast-food outlets. The U.K. market continues to expand, projected to reach a market value of USD 0.14 billion in 2026. Businesses are investing in state-of-the-art ventilation systems to ensure a clean environment in restaurants and cafes. Additionally, the enforcement of strict building and environmental regulations by European governments is generating a significant demand for these systems to minimize fire hazards.

- For instance, in 2021, the Irish Food Board reported that there were 2,380 Subway locations, 900 KFC outlets, and 1,247 McDonald’s in the U.K. The increasing number of such establishments is fueling the need for ventilation systems in commercial kitchens.

Germany and France is anticipated to acquire USD 0.18 billion in 2025.

Middle East & Africa

The expanding travel and tourism industry and infrastructure investments largely fuel the Middle East & Africa commercial kitchen ventilation system market growth. Destinations, such as Qatar, UAE, and Saudi Arabia, are increasingly investing in resorts, luxury hotels, and restaurants. This drives the demand for commercial kitchen ventilation systems in this region.

- For instance, according to STR Inc., there was a 2% increase in the hotel count in the Middle East & Africa from September 2021 to September 2022, bringing the total to 243,613.

The GCC market is likely to acquire USD 0.10 billion in 2025.

South America

South America is estimated to be worth USD 0.43 billion in 2025. The market in South America is projected to register a consistent growth driven by the growing number of urban areas in Brazil and Mexico, coupled with their heightened investments in infrastructure.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focused on Strengthening their Market Position with Continuous Developments

The global market for commercial kitchen ventilation systems is fragmented and includes many small and large players, such as CaptiveAire Systems, Accurex, Halton, Absolent Air Care Group, Greenheck Fan Corporation, Vent-A-Hood, Kanteen India Equipments Co., Guangdong GFD Commercial Technology Co., Ltd., Revac Systems, and Purified Air Limited. These companies in the market are expanding their operations by adopting strategies such as mergers, acquisitions, product launches, collaborations, and partnerships.

List of Key Companies Studied:

- CaptiveAire Systems (U.S.)

- Accurex (U.S.)

- Halton (Finland)

- Absolent Air Care Group (Sweden)

- Greenheck Fan Corporation (U.S.)

- Vent-A-Hood (U.S.)

- Kanteen India Equipments Co. (India)

- Guangdong GFD Commercial Technology Co., Ltd. (China)

- Revac Systems (India)

- Purified Air Limited (U.K.)

- S&P Sistemas de Ventilación SLU (Spain)

- Plasma Clean Air Ltd. (U.K.)

- Melink Corporation (U.S.)

- Apollo Kitchen Equipments (India)

- ECONAIR (U.S.)

- Srihari Kitchen Equipments (India)

KEY INDUSTRY DEVELOPMENTS:

- August 2024: CaptiveAire Systems, the producer of commercial kitchen ventilation systems, announced its plans for a major expansion next to its current facilities in the Bedford County Business Park. The upcoming 120,000 square foot structure will include 16 Class A offices, along with warehouse space and potential production areas, aimed at bolstering the company’s growth.

- August 2023: Halton unveiled a solid fuel ventilation system developed to manage the various challenges associated with solid fuel cooking. This advanced hood includes KSA multi-cyclone filters and spark arrestors to reduce exhaust duct temperatures.

- March 2023: Absolent Air Care Group expanded its direct operations in Switzerland by acquiring all shares of AIRfina AG, which has previously served as a distributor for Absolent AB in the region.

- September 2022: LCS Facility Group expanded its product portfolio with a focus on NFPA Compliant Hood Exhaust Cleaning, further building on its solid experience in the restaurant and hospitality sectors.

- March 2021: Accurex partnered with Jeremias, a company that manufactures grease ducts, to supply prefabricated UL-listed grease ducts.

REPORT COVERAGE

The commercial kitchen ventilation system market analysis report provides an in-depth analysis of the market dynamics and competitive landscape. It also provides market estimation and forecast based on technology, end users, and regions. It provides various key insights into recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.4% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, Application, and Region |

|

Segmentation |

By Product Type

By Application

By Region

|

|

Companies Profiled in the Report

|

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 4.51 billion in 2025.

In 2034, the market is expected to record a valuation of USD 7.79 billion.

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.4% during the forecast period of 2025-2032.

The hoods segment is expected to lead the market over the forecast period.

The rapid growth of the food service sector and the increased focus on energy efficiency and sustainability are driving the market growth.

CaptiveAire Systems, Accurex, Halton, Absolent Air Care Group, Greenheck Fan Corporation, and Vent-A-Hood are the top companies in the global market.

North America is expected to hold the largest market share during the forecast period due to the higher disposable incomes of consumers and the growth of the food service industry.

The integration of smart technologies and the Internet of Things (IoT) to fuel market growth.

Based on application, restaurants & cafes are expected to lead the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us