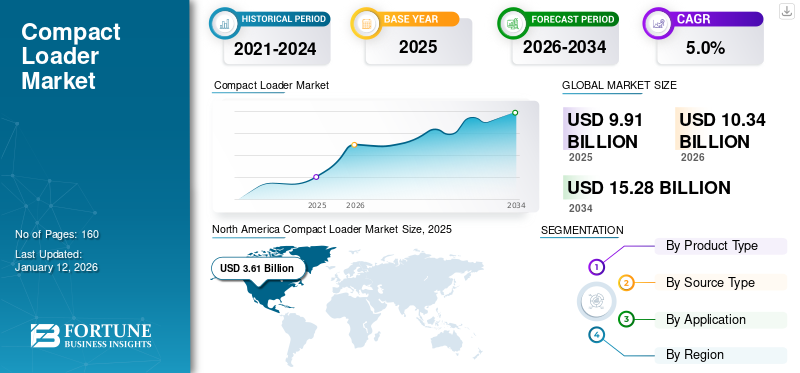

Compact Loader Market Size, Share & Industry Analysis, By Product Type (Wheel Loader and Track Loader), By Source Type (Diesel, Electric, and Hybrid), and By Application (Construction, Landscaping, Agriculture, Forestry, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global compact loader market size was valued at USD 9.91 billion in 2026. The market is projected to grow from USD 10.34 billion in 2026 to USD 15.28 billion by 2034, exhibiting a CAGR of 5.0% during the forecast period. North America dominated the global market with a share of 36.4% in 2025.

The construction, landscaping, agriculture, forestry, and material handling sectors are generating strong demand across geographies such as Asia, the Middle East, and Africa. A wide range of product offerings, such as wheeled and tracked compact loaders, offer versatile movement in confined spaces with enhanced material handling productivity. These small-sized loaders are used for tasks including demolition, site preparation, excavation, and transport of materials such as sand and gravel. Along with the construction sector, these construction equipment find their application in urban infrastructure development, landscaping activities, forestry, and snow removal, bolstering the market growth.

Download Free sample to learn more about this report.

Global Compact Loader Market Overview

Market Size:

- 2025 Value: USD 9.91 billion

- 2026 Value: USD 10.34 billion

- 2034 Forecast Value: USD 15.28 billion

- CAGR: 5.0% (2026–2034)

Market Share:

- Regional Leader: North America held the highest revenue share in 2025, driven by strong investment in infrastructure and residential/commercial development.

- Product Type Leader: Wheel loaders dominated the market, owing to their versatility in urban, mining, and construction applications.

- Source Type Leader: Electric compact loaders led the market in 2024, supported by stricter emission regulations and government subsidies.

- Application Leader: Construction was the leading application segment in 2024, followed by agriculture, forestry, landscaping, and material handling.

Industry Trends:

- Rising adoption of electric compact loaders due to environmental regulations and fuel efficiency concerns.

- Increasing demand for wheel loaders in urban infrastructure and confined space operations.

- Expanding use in secondary applications such as landscaping, agriculture, and forestry.

Driving Factors:

- Growth in global construction and infrastructure projects.

- Shift toward electric-powered equipment due to environmental mandates.

- Rising need for compact, agile machines in space-constrained environments.

- Infrastructure development in agricultural and urban sectors supporting broader application.

The agricultural sector, in particular, presents a growing market due to their ability to handle materials transportation, fence repairs, mowing, land management, and digging tasks. Common agricultural materials moved by these loaders are hay bales, fertilizers, and feed. Several international and domestic associations are focusing on the benefits of sustainable landscaping by introducing supportive programs and investments. For instance, Amazon launched a new sustainable landscape project in Guyana in April 2024, further highlighting the relevance of compact loaders in these efforts. A rise in large-scale infrastructure projects, such as highways, bridges, and urban development, further boosts the demand for equipment capable of transporting materials and handling challenging terrains.

The increasing complexity of construction sites has led to a greater focus on safety and productivity, prompting the adoption of electric and hybrid compact loaders. These loaders are designed to operate efficiently in harsh conditions, ensuring safe material and equipment handling. In the oil and gas sector, where operations take place in remote or rugged terrains, compact loaders prove essential for transporting materials and equipment, underscoring their importance in challenging environments.

The market, heavily reliant on the construction sector, experienced a considerable drop during the COVID-19 pandemic. Temporary lockdowns, supply chain disruptions, and halts in construction and forestry projects led to a decline in revenues. However, steady foreign direct investment and supportive domestic policies across industries are expected to propel the market share.

IMPACT OF SUSTAINABILITY

Supporting Regulatory Policies and High Demand for Sustainable Operations

Compact loaders with reduced carbon emissions and sustainable operations are gaining market traction, supported by favorable regulatory policies. Manufacturing companies are diversifying their product offerings and exhibiting innovations at trade shows and exhibitions. For instance, CNH inaugurated an electric compact wheel loader in July 2024 at the ConEXPO trade exhibition in Las Vegas.

IMPACT OF TARIFFS ON THE MARKET

Increased Cost of Components and Raw Materials Sourcing to Bolster Market Development

Unprecedented tariffs imposed by the U.S. have resulted in to re-evaluation of sourcing strategies, and supply chain restructuring. Uncertainty in the trade market has further resulted in additional tariffs on raw materials and components, making it challenging for market participants across regions. Components and raw materials sourcing countries, such as China, might observe an increase in cost, resulting in increased complexity across the supply chain. This might strongly impact the importing countries and increase the focus on domestic participants and supply chain players. Production and manufacturing costs have risen owing to the increased cost of components, including electronic controls, steel, aluminium, etc.

Compact Loader Market Trends

Cost-efficient Material Handling Solutions Projects to Bolster Market Development

Government spending on infrastructure projects, expansion of the construction sector, and increased awareness of rental benefits are surging demand in the rental market. Market participants and distributors are focusing on cost-efficient alternatives for material handling equipment, along with access to varied new equipment types. Rental equipment allows end users to utilize sustainable and innovative equipment at affordable prices, further propelling the compact loader market growth.

MARKET DYNAMICS

Market Drivers

Surge in Construction Spending and Foreign Investments to Boost Market Growth

In recent years, there has been substantial growth in construction spending globally. The increasing need for infrastructure development and urbanization has added pressure on construction spending. The rapid expansion of infrastructure projects is expected to drive the global compact loaders market.

Increasing investment in infrastructure, increased government capital expenditure, and other engineering projects are projected to boost demand for the product. For instance, foreign direct investment in ASEAN countries reached USD 174 billion in 2021, witnessing a growth of about 42% in comparison to 2020. Additionally, Indian investors are planning to direct their agriculture sector investment into Middle East & African countries such as Kenya and Uganda to promote economic growth and enhance food security.

Market Restraints

Market Volatility to Hinder Market Growth

Skid steer loaders are known for their small size and flexibility in confined spaces and are largely preferred for various applications. Limited bucket capacity, supply-demand dynamics, and unpredictable economic conditions might all impact the market demand for compact loaders during the forecast period. Fluctuations and price volatility can also pose significant challenges to the expansion of the market.

Market Opportunities

IoT and Telematics Integration to Boost Product Demand

The market is witnessing growth opportunities due to the rising use of advanced technologies. Manufacturers are incorporating advanced capabilities such as remote operation, GPS tracking, and automation systems to enhance operational efficiency and productivity. Moreover, the trend toward integrating Internet of Things technology and telematics systems is gaining momentum. These systems allow location tracking, geofencing, theft protection, and enhanced machine performance and durability.

SEGMENTATION ANALYSIS

By Product Type

Wheel Loaders Segment to Secure Major Market Share Owing to Rising Demand from Urbanization and Mining Facilities

By product type, the market is segmented into wheel loader and track loader.

The wheel loader segment is expected to capture the major market share during the forecast period. The segment held 73.89% of the market share in 2026. Urbanization, construction industry growth, mining facilities, and defense lands are largely generating demand for compact wheel loaders to transport heavy materials through confined spaces. Rising investment and growing urban development projects are prominently driving the market for wheel loaders owing to their versatile and efficient handling of materials. Wheeled loaders are frequently employed in various sectors, including construction, mining, agriculture, forestry, and other heavy-duty operations.

The track loader segment is projected to witness considerable growth during the projected period as a result of its enhanced performance in off-road and rough terrain conditions.

By Source Type

Changing Emission Norms and Stringent Policies to Influence the Demand for Electric Powered Loaders

Based on source type, the market is classified into diesel, electric, and hybrid.

Electric segment is preferred over other types of equipment, accounting for the highest market 50.97% share in 2026. This segment is anticipated to exhibit a CAGR of 5.17% during the forecast period. Changing climate conditions, new emission norms, and stringent policies are prominently boosting the demand for electric compact loader across regions. Government tax reforms and subsidies to electric equipment are further bolstering the market demand for battery-powered compact loader. For instance, India’s Ministry of Road Transport and Highways (MoRTH) proposed a new set of stricter safety standards in October 2024 for electric-powered construction equipment, including excavators and loaders. Fluctuating oil prices and cross-border trade tensions will further increase the demand for battery-powered loader.

Hybrid and diesel-powered loaders continue to support volume sales with steady growth in developing and emerging countries. The diesel segment is expected to dominate the market share of 41% in 2025.

By Application

To know how our report can help streamline your business, Speak to Analyst

Construction Sector to Lead Market Share Owing to Its Usage in Various Applications

By application, the market is divided into construction, landscaping, agriculture, forestry, and others.

The construction sector is projected to witness the highest revenue 54.84% share in 2026, followed by the agriculture Industry. Increasing investment in infrastructure projects, road maintenance, and other sectors is driving the growing demand for compact loaders. For instance, the Federal Government of Australia, in May 2024, announced an investment of about USD 90.6 million in the construction and housing sector. They find their extensive application in land clearing, site preparation, and road repairs, contributing to the their increasing demand. For instance, the U.S. Department of Agriculture’s Forest Service has announced a total investment of about USD 25 million in August 2024. This segment is anticipated to exhibit a CAGR of 5.10% during the forecast period.

Several other sectors, such as landscaping, forestry, industrial material handling, mining, and others, are supporting market growth. For instance, in July 2024, the Canadian Ministry of Energy and Natural Resources, in collaboration with the Ministry of Energy, Mines and Low Carbon Innovation, and the Ministry of Transportation and Infrastructure, announced an investment of about USD 195 million for infrastructure and highway projects.

The agriculture segment is expected to dominate the market share of 24% in 2025.

COMPACT LOADER MARKET REGIONAL OUTLOOK

The market, by region is diversified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Compact Loader Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The booming construction sector and heavy investment in construction activities are driving the demand for specialized material handling equipment, including compact loaders. According to the U.S. Census Bureau, construction spending surpassed USD 3.10 billion, driven by factors such as urbanization, infrastructure, and technological advancements. Growing demand for real estate, expansion of dealer networks, and increasing commercial and residential development are bolstering the demand for compact loaders in North American countries, including Canada and Mexico. Battery-powered compact loaders are largely gaining traction across the region as a result of stringent emission standards. North America region dominated the compact loaders market share in 2026 owing to several such factors. The regional market value in 2025 was USD 9.91 billion, and in 2026, the market value led the region by USD 10.34 billion.

The demand across the region is also being supported by sustainable landscaping, utility sector, and farming activities such as moving feed, handling hay bales, and cleaning barns. The U.S. will experience the highest demand due to investments in large infrastructure projects, commercial buildings, agriculture, and grounds maintenance. The U.S. market is expected to hit USD 3.10 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

South America

South America region is to be anticipated as the fourth-largest market with USD 0.48 billion in 2025. Brazil and Argentina, among other South American countries, are prioritizing investments in infrastructure projects such as rail transport, water infrastructure, and roads. The construction sector in South America has witnessed significant investment, leading to increased demand for material handling solutions. For example, Argentina has outlined plans to invest approximately USD 452 billion in infrastructure development projects related to rail, water, and road transport, with completion by 2040.

Europe

Europe region is to be anticipated as the third-largest market with USD 2.35 billion in 2026. The demand in the market in the European region is witnessing steady growth due to increasing demand from industries such as glass recycling, road maintenance, and construction sites. Manufacturing companies are diversifying their portfolio across Western and Eastern European countries, including Spain, Italy, and Belgium. Growing investment in infrastructure projects and agriculture and forestry is surging the market growth. The market value in U.K. is expected to be USD 0.46 billion in 2026. On the other hand, Germany is projecting to hit USD 0.56 billion in 2026. France is likely to hold USD 0.42 billion in 2025.

Middle East & Africa

The expansion of modern infrastructure is supported by government initiatives and policies, leading to robust market growth for tracked loaders. In June 2024, the Roads General Authority of Saudi Arabia is set to launch a highway project linking Aseer to the Jazan region, attracting 69 companies to bid for the 136-km-long project. Countries in the Middle East & Africa, including Nigeria, Egypt, Libya, and Saudi Arabia, are prioritizing oil and gas projects. Manufacturers are strengthening their presence in the region by establishing robust dealer and distributor networks to meet the increasing needs of customers. The GCC market size is estimated to hit USD 0.19 billion in 2025.

Asia Pacific

Asia Pacific is anticipated to account for the second-highest market size of USD 3.36 billion in 2026, exhibiting the second-fastest growing CAGR of 5.77% during the forecast period. Asia Pacific region to witness the highest growth during the forecast period. Increasing infrastructure development and rising demand for sustainable landscaping activities to support the market growth in Asia Pacific countries such as China and India. Several domestic governments are coming up with new programs and policies to promote sustainable landscape programs and infrastructure development. For instance, the Sustainable Landscapes Management Program (SLMP) in Indonesia has minimized deforestation, aligning with climate goals. In Australia, a USD 25 million investment in major infrastructure projects, including the Sydney metro comprising 46 stations and 113 km of new metro rail, is set to be completed by 2032. The market value in China is expected to be USD 1.25 billion in 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Investment in New Product Launches and Collaboration Strategies to Strengthen the Presence of Market Players

The market is moderately consolidated due to the presence of several key players. Manufacturers are introducing advanced technology products such as telematics systems to widen their market presence across various geographies. Companies are also launching energy-efficient, high-performing, and durable product portfolios. Key players are expanding their production facilities to meet the rising demand across developing and emerging countries. For instance, Doosan Bobcat announced an investment of about USD 300 million in a Compact Track Loader and Skid Steer Plant in June 2024.

Long List of Companies Studied

- Volvo Construction Equipment (Sweden)

- Caterpillar Inc. (U.S.)

- Komatsu Ltd. (Japan)

- Sany Heavy Industry Co. Ltd. (China)

- CNH Industrial N.V. (Netherlands)

- KUBOTA Corporation (Japan)

- Deere & Company (U.S.)

- Yanmar Holdings Co. Ltd. (Japan)

- Hitachi Construction Machinery Co. Ltd. (Japan)

- Takeuchi Mfg. Co. Ltd. (Japan)

- Liebherr Group (Germany)

- Doosan Bobcat (South Korea)

- Xuzhou Construction Machinery Group (China)

- Gamzen (India)

- Kato Works Co. Ltd. (Japan)

- Thaler Hoflader (Germany)

- Schäffer Maschinenfabrik GmbH (Germany)

- STOLL (Germany)

- ASV (U.S.)

KEY INDUSTRY DEVELOPMENTS

- August 2024: DEVELON introduced the DTL35 compact track loader at CONEXPO-CON/AGG. The DTL35 provides maneuverability and several features, such as visibility and high-end comfort.

- June 2024: John Deere launched the new P-Tier skid steer and compact track loader, along with the 331, 333, and 335 models. These loaders feature grade control capabilities and comfortable cab designs for efficient operations.

- February 2024: Yanmar Construction Equipment rolled out compact track loaders under its product portfolio TH100VS for the North American region. The new TL100 VS is designed for heavy-duty projects complying with industry standards.

- August 2023: Hyundai Construction Equipment made an entry into the compact track loaders market by launching the HS120V skid steer loader and HT100V compact track loader with large-frame size and electronic-controlled diesel engine.

- March 2023: New Holland Construction introduced the C330 vertical loft compact track loader with superior boom design and maneuverability for varied applications at residential, landscape, and construction sites.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.0% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, Source Type, Application, and Region |

|

Segmentation |

By Product Type

By Source Type

By Application

By Region

|

|

Key Market Players Profiled in the Report |

Volvo Construction Equipment (Sweden), Caterpillar Inc. (U.S.), Komatsu Ltd (Japan), Sany Heavy Industry Co. Ltd. (China), CNH Industrial N.V. (U.K.), KUBOTA Corporation (Japan), Deere & Company (U.S.), YANMAR HOLDINGS CO. LTD. (Japan), Hitachi Construction Machinery Co. Ltd. (Japan), Takeuchi Mfg. Co. Ltd. (Japan) |

Frequently Asked Questions

The market is projected to record a valuation of USD 15.28 billion by 2034.

The market is projected to record a valuation of USD 9.91 billion by 2025.

The market is projected to grow at a CAGR of 5.0% during the forecast period.

By product type, the wheel loader segment dominates the market.

Strong demand from construction, and infrastructure industries is driving the market growth.

Volvo Construction Equipment, Caterpillar Inc., Komatsu Ltd, Sany Heavy Industry Co. Ltd., and CNH Industrial N.V., are the top players in the market.

North America to cater highest revenue market share owing to increasing commercial and residential development.

By application, the construction sector is projected to witness the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us