Concrete Mixer Market Size, Share & Industry Analysis, By Type (Drum Mixers, Twin Shaft Mixers, Pan Mixers, Truck-mounted Mixers, and Others), By Mobility (Stationary and Portable), By Capacity (Up to 5 Cubic Meters, 5-10 Cubic Meters, and More than 10 Cubic Meters), By End-User (Residential Construction, Commercial Construction, and Infrastructure Projects), and Regional Forecast, 2026-2034

CONCRETE MIXER MARKET OVERVIEW AND FUTURE OUTLOOK

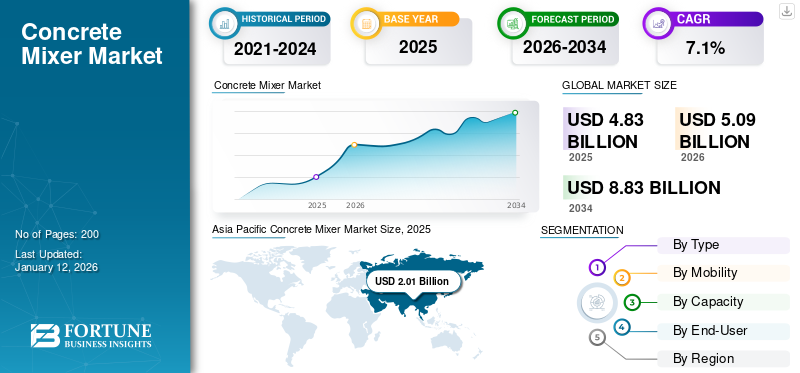

The global concrete mixer market size was valued at USD 4.83 billion in 2025 and is projected to grow from USD 5.09 billion in 2026 to USD 8.83 billion by 2034, exhibiting a CAGR of 7.1% during the forecast period. The Asia Pacific dominated global market with a share of 41.7% in 2025.

Concrete mixer is a machine used to blend cement, water, aggregate, and sometimes additional materials to create concrete. The primary function of such a mixer is used to produce a homogeneous mixture of ingredients such as cement, aggregates, and water to ensure consistent and high-quality concrete, which is essential for residential, commercial, and industrial projects.

The rising pace of infrastructure development and rapid urbanization across the developing economies such as India, China, and Brazil are driving the demand for such products. These machines play a critical role in mixing concrete and ingredients, which supports the growth of the market. For instance, according to the source of Global Infrastructure Outlook, the global GDP contribution from infrastructure development is projected to grow double by 2040 compared to 2015, with an anticipated growth rate of 3.6% from 2040 compared to 2015.

The rising need for transportation networks such as roads, bridges, and growing smart city development initiatives driving the construction demand. For instance, according to the source of the India Investment Grid, in October 2024, Indian government planned an investment of around USD 20.75 billion for the construction of 1040 smart city projects in India. Moreover, growing focus on eco-friendly concrete production methods has prompted manufacturers to produce mixers that reduce carbon emission. For instance, in September 2024, PROALL, a subsidiary of Terex Corporation launched the ProALL volumetric mixer for the construction industry. This mixer is eco-friendly which reduces the carbon emission by 8%. Such innovative and eco-friendly product launches are expected to bolster the global market growth.

The COVID-19 pandemic had a significant impact on the market due to halted construction activities, supply chain disruptions, and shortage of skilled labor, which restricted the growth of the market. However, after COVID-19 pandemic, rising technological advancements in these products, and increased investments in infrastructure development across the globe are likely to drive the growth of the industry.

IMPACT OF TECHNOLOGY ON MARKET

Automation in Mixer Systems to Drive Market Growth

A rising penetration rate of automated and self-loading concrete mixers has greatly enhanced efficiency and reduced labor costs. These mixers independently handle the entire mixing process, from loading materials to delivering mixed concrete at residential, commercial, and infrastructure construction sites. In addition, key players in the market are engaged in the manufacturing of technologically advanced mixers. For instance, in July 2024, McNeilus, a subsidiary of Oshkosh Corporation, launched a concrete mixer capable of fully automated operations. This machine manages mixing speed, slump monitoring, and other parameters that are required to boost the efficiency and consistency of the machine's mixing operation.

CONCRETE MIXER MARKET TRENDS

Technological Advancements to Fuel Market Growth

The rising adoption of automated mixers and robotic systems is enhancing efficiency and reducing labor costs by performing repetitive, physically demanding tasks and ensuring consistent product quality. In addition, modern concrete mixers are equipped with advanced safety features, such as sensors and automated controls, to prevent accidents and ensure operator safety. For instance, in October 2024, Fiori Concrete Machines India Pvt ltd launched a new self-loading concrete mixer for the construction sector. This versatile machine includes an onboard batching system, a high-capacity mixing drum, and self-loading functionality for streamlined operations. Additionally, it is environmentally friendly, fully automated, and designed to minimize maintenance and downtime. These advancements highlight the concrete mixer market trends.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rising Urbanization and Investment in Infrastructure Development to Fuel Market Growth

Rapid urbanization, especially in developing countries, creates the demand for infrastructure projects such as bridges, roads, and buildings, which boosts the demand for concrete mixers to produce ready-to-use concrete. In addition, innovation in these products such as automation, IoT integration, and industry 4.0 practices, creates mixers that are cost-effective and environmentally friendly, further driving the growth of the market. For instance, according to CXO Today, the Indian government planned to invest around USD 324 billion for infrastructure development from 2024 to 2030. All such factors collectively contribute to the global concrete mixer market share.

Market Restraints

High Capital Investment Costs to Restrict Market Growth

The cost of purchasing and setting up these products, especially for stationary plants, can be prohibitively high for small and medium-sized construction firms. In addition, technologically advanced mixers require periodical maintenance and servicing, which add to overall operational costs and can become a financial burden for some companies. The cost of such systems ranges from USD 1,500 to USD 30,000, depending on the product and the end-user.

Market Opportunities

Rising Demand for Electric and Hybrid Concrete Mixer to Provide Lucrative Opportunity for Market Players

Growing demand for electric and hybrid mixers owing to their low emission and reduced noise levels compared to diesel-powered models, is anticipated to provide lucrative opportunities for market growth. In addition, rapid urbanization and infrastructure projects in emerging economies create a high demand for such equipment. In addition, major players are focusing on technological advancements in concrete mixers, creating opportunities for market expansion. For instance, in October 2024, Volvo launched a new electric FMX mixer in Mexico, aimed to reduce carbon emissions by 2050. All such factors provide significant growth prospects for the mixer market.

SEGMENTATION ANALYSIS

By Type

Drum Mixers Segment to Dominate owing to Rising Demand from Residential and Commercial Construction Projects

Based on type, the market is classified into drum mixers, twin shaft mixers, pan mixers, truck-mounted mixers, and others.

Drum mixers are set to dominate the market during the forecast period, owing to the increasing demand from residential and commercial construction projects. An increasing spending on new construction and renovation activities globally is driving the demand for concrete mixers. The segment held 39% of the market share in 2025.

Twin shaft and pan mixers are projected to grow at a steady rate during the forecast period, owing to their availability in horizontal and vertical configurations. These mixers are valued for their efficiency, consistent product quality, and versatility. Moreover, technological advancements, such as IoT-enabled machines and automated mixing processes, will further fuel market growth.

Truck-mounted mixers are anticipated to depict a moderate growth during the forecast period, as they are commonly assembled on trucks, trailers, and skid-mounted units. Innovations such as enhanced monitoring, diagnostics through telematics systems, and precise control over concrete amounts are contributing to this growth.

The others segment, consisting of planetary mixers, is also anticipated to observe a moderate growth during the forecast period, owing to increasing demand for high-quality concrete in various residential, commercial, and industrial construction projects.

By Mobility

Stationary Mixers Segment Led the Market Owing to Its Several Benefits

Based on mobility, the market is segmented into stationary and portable.

The stationary mixer segment dominated the market in 2024, and is projected to grow significantly during the forecast period. This growth is driven by features such as higher production capacity, reduced labor requirements, and consistent mixing quality. This type of mixers are adopted in concrete batching plants and large construction sites. It finds application in commercial buildings, infrastructure projects, residential building, and rising demand for ready mix concrete, which bolsters market growth. The segment is likely to hold 66.80% of the market share in 2026.

Portable mixers are projected to grow moderately with a CAGR of 7.20% during the forecast period (2025-2032), owing to their compact, lightweight design, and ease of transportation for residential, commercial, and industrial plants. In addition, increasing construction projects globally is driving demand for such products, which, in turn, driving segment growth.

By Capacity

5-10 Cubic Meters Segment Dominated the Market Owing to Efficient Mixing Capability

Based on capacity, the market is classified into up to 5 cubic meters, 5-10 cubic meters, and more than 10 cubic meters.

The 5-10 cubic meters segment dominated the market in 2024 and is projected to grow substantially during the forecast period due to factors such as high capacity, efficient mixing capability, versatility, ease of use, and long durability. Moreover, it offers features such as cost effective solutions, and rising the number of construction projects, which subsequently rise in the demand for concrete mixers, fuels the market growth.The segment is set to reach 56.58% of the market share in 2026.

Up to 5 cubic meters is anticipated to grow at a moderate CAGR of 6.50% during the forecast period (2025-2032), as these products are commonly used in smaller-scale construction projects, providing flexibility for various applications. They are typically used for building pathways, small bridges, and constructing walls, further bolstering market growth.

More than 10 cubic meters of mixer is projected to grow decently during the forecast period, as these mixers are designed to handle high-capacity mixing tasks efficiently. In addition, rising demand for such products in large-scale infrastructure projects and rising urbanization across the globe.

By End-User

Industrial Sector Segment Dominates Due to Rising Investment in Industrial Projects

Based on end-user, the market is classified into residential construction, commercial construction, and infrastructure projects.

The industrial projects dominated the market in terms of market share in 2024, owing to rising investment in industrial projects and large infrastructure projects such as highways, bridges, airports, and industrial facilities. For instance, in July 2021, according to Savills India, the Indian government planned to invest around USD 4,510.0 billion in infrastructure by 2030.

Commercial construction is projected to experience moderate CAGR of 6.40% during the forecast period (2025-2032), due to rising urbanization, infrastructure development, and technological advancements in these products. The trend is increasing demand for such equipment across residential, commercial, and industrial sectors. The construction of new buildings and the renovation of existing ones further contribute to market growth.

Residential construction is anticipated to grow at a decent pace during the forecast period due to rising demand for sustainable housing communities and rising urbanization, which creates the demand for efficient concrete mixing solutions. For instance, according to the India Investment Grid, in October 2024, the Indian government planned to invest around USD 257.87 billion in real estate.

The infrastructure projects segment is likely to capture 41.85% of the market share in 2026.

To know how our report can help streamline your business, Speak to Analyst

CONCRETE MIXER MARKET REGIONAL OUTLOOK

The market covers five major regions, mainly North America, Europe, Asia Pacific, the Middle East and Africa, and South America.

ASIA PACIFIC

Asia Pacific Concrete Mixer Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market in terms of share valued at USD 2.01 billion in 2025 and USD 2.15 billion in 2026 and is expected to experience the highest growth during the forecast period. This growth is attributed to the growing urbanization, rising investment in infrastructure development, and increasing construction activities across India, China, South Korea, and Japan, which are fueling demand for such equipment. For instance, in 2022, the Indian government launched initiatives such as the “Home for All” project, aiming to provide affordable housing solutions. In addition, rising sustainable communities and housing initiatives across China, India, and Japan, which creates the demand for such equipment. These favorable initiatives taken by the government provide lucrative opportunities for market growth. India is set to grow with a value of USD 0.30 billion in 2026, while Japan is expected to acquire USD 0.40 billion in 2026.

China Set to Dominate Owing to Rapid Urbanization and Rising Investment in Infrastructure Development

Rising urbanization and investment in infrastructure development in China, particularly in construction activities, are driving the demand for such a system. Technological advancements in mixer technology and the rising adoption of self-loading mixers are projected to drive the growth of the Chinese market. In addition, major players engaged in offering this product across China, subsequently driving the growth of the market. For instance, in December 2023, Sicoma, based in Italy, deals in such products and related products. Sicoma India signed a joint venture in China, which caters to the South Asian and Chinese markets. Chinese market is predicted to reach USD 0.58 billion in 2025.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is the second largest market expected to gain USD 1.17 billion in 2026, exhibiting a CAGR of 23.1% during the forecast period (2026-2034). The region is projected to grow steadily, owing to factors such as investment in infrastructure projects, including transportation networks such as roads, walls, and bridges. The U.K. market continues to grow, predicted to be valued at USD 0.15 billion in 2026. In addition, Western European countries such as Germany, France, and the U.K. are the leading markets owing to their advanced construction sectors and continuous investment in infrastructure development. Germany is set to be worth USD 0.24 billion in 2026, while France is expected to hold USD 0.19 billion in 2025.

North America

North America is the third largest market set to hold USD 1.09 billion in 2026. The North American concrete mixer market is anticipated to witness moderate growth due to rapid urbanization and investment in modern infrastructure, driving demand for such products. Technological advancements such as automated and self-loading mixers enhance efficiency and reduce labor costs, which will drive the concrete mixer market growth in the region.

The U.S. market is projected to grow at a growth rate during the forecast period due to the adoption of energy-efficient and environment-friendly products to fuel market growth. Moreover, increasing construction activities and rising government investment, which enhance the demand for such products, drive the growth of the market. For instance, in March 2023, ADVANCE, a subsidiary of Terex Corporation, introduced the first all-electric mixers featuring zero carbon emissions and low noise levels, contributing to the growth of the market. The U.S. market is foreseen to grow with a value of USD 0.71 billion in 2026.

Middle East & Africa

The Middle East & Africa is the fourth largest market estimated to stand at USD 0.61 billion in 2026. The Middle East & Africa is witnessing expansion fueled by rising construction investment, infrastructure projects, and increasing urbanization, all of which increase demand for such products. In addition, rising construction of high-rise buildings in the GCC, Saudi Arabia, and UAE is further driving product demand. The GCC market is predicted to hold USD 0.17 billion in 2025.

South America

South America is anticipated to grow moderately during the forecast period supported by the growing urban population and rising adoption of advanced technologies for residential, commercial, and industrial projects.

COMPETITIVE LANDSCAPE

Key Industry Players

Major Players Focus on Product Launches to Intensify Market Competition

Market players such as Zoomlion Heavy Industry Science, Liebherr International, AB Volvo, Schwing, and Sany Group, and others, are engaged in agreements, product launches, and acquisitions as key strategies to intensify competition in the market. For instance, in September 2023, Fiori Concrete Machines India Pvt Ltd, a subsidiary of Fiori Group S.p.A. launched a new series of cement mixers such as DBS series and DBX series, with mixing capacities of 2.8 cubic per meter, and 4.3 cubic per meter respectively. It is adopted in residential, commercial, and industrial projects.

List of Key Concrete Mixer Companies Profiled:

- AB Volvo (Sweden)

- Sany Group (China)

- Liebherr International AG (Switzerland)

- Terex Corporation (U.S.)

- BHS Sonthofen GmbH (Germany)

- Oshkosh Corporation (U.S.)

- Shantui Construction Machinery Co. Ltd (China)

- Schwing GmbH (Germany)

- XCMG Group (China)

- Zoomlion Heavy Industry Science & Technology Co Ltd. (China)

- Putzmeister Concrete Pumps (Germany)

- MAN Truck & Bus SE (Germany)

- Dongfeng Motor Corporation (China)

- IVECO S.p.A. (Italy)

- Hino Motors (Japan)

- Ashok Leyland (India)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: Sany Group launched a new electric-powered mixer truck for the residential and commercial sector, featuring a 350KW battery and requiring two hours of charging. This environmentally friendly mixer reduces carbon emission by 45%, and is widely adopted in commercial, and industrial infrastructure.

- January 2024: Sany Putzmeister, a subsidiary of Sany Group launched a new series of iONTRON e-mixer for residential, and commercial projects. It has a mixing capacity of 10 cubic meters and can handle a load of approximately 17 tons.

- May 2023: Schwing GmbH launched a new series of UltraEco truck mixers for residential, commercial, and industrial projects. With a drum capacity of 3 tons and a mixing capacity of 9 cubic meters, the mixer is environment friendly and reduces carbon emission.

- September 2022: Liebherr International AG planned to open a new manufacturing plant at Plovdiv, Bulgaria, Europe. The new manufacturing facility required investment of USD 20 million to improve the product portfolio of concrete mixers.

- August 2022: Terex Corporation acquired ProAll, based in Canada, deals in volumetric concrete mixers for the market. The acquisition was made to strengthen its concrete mixer product offerings in the market.

REPORT COVERAGE

The global concrete mixer market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, type, and end-users of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021–2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Growth Rate |

CAGR of 7.1% from 2026 to 2034 |

|

|

Unit |

Value (USD Billion) |

|

|

Segmentation |

By Type

By Mobility

By Capacity

By End-User

By Region

|

|

|

Key Market Players Profiled in the Report |

AB Volvo (Sweden), Sany Group (China), Liebherr International AG (Switzerland), Terex Corporation (U.S.), BHS Sonthofen GmbH (Germany), Oshkosh Corporation (U.S.), Shantui Construction Machinery Co. Ltd (China), Schwing GmbH (Germany), XCMG Group (China), and Zoomlion Heavy Industry Science & Technology Co Ltd (China). |

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 4.83 billion in 2025.

The market is expected to reach USD 8.83 billion by 2034.

The market is projected to grow at a CAGR of 7.1% during the forecast period (2026-2034).

The drum mixers segment is expected to lead the market during the forecast period.

Rising urbanization and investment in the infrastructure development is anticipated to fuel market growth.

AB Volvo, Sany Group, Liebherr International AG, Terex Corporation, BHS Sonthofen GmbH, Oshkosh Corporation, Shantui Construction Machinery Co. Ltd, Schwing GmbH, XCMG Group, and Zoomlion Heavy Industry Science & Technology Co Ltd are the leading companies in this market.

The Asia Pacific dominated global market with a share of 41.7% in 2025.

Technological advancements is a key market trend.

Based on end-user, infrastructure projects led the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us