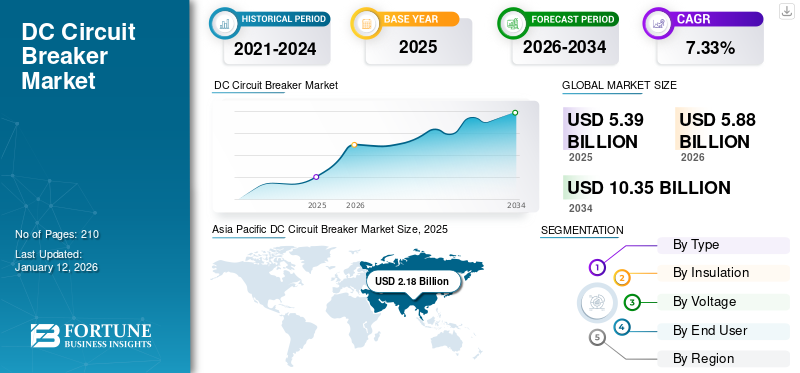

DC Circuit Breaker Market Size, Share & Industry Analysis, By Type (Hybrid and Solid-State), By Insulation (Vacuum and Gas), By Voltage (Low, Medium, and High), By End User (Transmission & Distribution, Commercial & Industrial, Renewables, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global DC circuit breaker market size was valued at USD 5.39 billion in 2025. It is projected to grow from USD 5.88 billion in 2026 to USD 10.35 billion by 2034, exhibiting a CAGR of 7.33% during the forecast period. Asia Pacific dominated the global market with a share of 40.46% in 2025.

A DC circuit breaker is a protective device designed to interrupt the flow of Direct Current (DC) in an electrical circuit when an abnormal condition, such as an overload or short circuit, occurs. Its main function is to prevent damage to the equipment and reduce the risk of fire or injury by quickly disconnecting power when faults are detected. Unlike AC circuit breakers, DC breakers must manage a constant, unidirectional flow of electricity, making it more challenging to extinguish the arc formed when interrupting the current. The DC circuit breaker market is experiencing significant growth, driven primarily by the increasing adoption of renewable energy sources, and the modernization of electrical grids. Specifically, the demand for DC circuit breakers is surging due to the need for reliable and efficient DC protection solutions in these areas.

ABB is widely recognized as one of the leading companies in the DC circuit breaker industry. The company has made significant efforts to advance DC protection technologies, particularly as the demand for DC applications grows in sectors such as renewable energy, electric transportation, and data centers. ABB has invested heavily in developing circuit breakers capable of handling the unique challenges of direct current, such as maintaining arc stability and ensuring fast, reliable interruption.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Deployment of Renewable Energies to Drive Demand for DC Circuit Breakers

The rising deployment of renewable energy is significantly boosting the demand for DC circuit breakers. Solar power systems, in particular, generate electricity in Direct Current (DC) form, which must be safely managed before storing or converting for use. As solar farms, wind turbines, and hybrid renewable systems expand worldwide, the need for effective DC protection has become critical. According to the IEA’s Renewables 2023 report, global renewable energy capacity grew by 50%, reaching nearly 510 gigawatts. Solar PV led the expansion, making up about three-quarters of new installations. China observed the most dramatic growth, adding as much solar capacity as the entire world did in 2022, along with a 66% increase in wind power additions. Europe, the U.S., and Brazil also achieved record-high growth in renewable energy deployment. DC circuit breakers play a vital role in isolating faults, protecting sensitive equipment, and ensuring the stability of renewable energy operations. Additionally, as more renewable energy sources are integrated directly into DC microgrids and battery storage systems, the requirement for advanced and reliable DC breakers is accelerating. This trend is expected to continue as countries and industries push for cleaner, more sustainable energy solutions.

Development in Industrial Automation and Railways to Lead Market Growth

In industrial settings, many automated processes rely on DC-powered equipment for precision control, energy efficiency, and integration with renewable energy sources. Reliable DC protection is critical to ensure the safe operation of robotics, conveyors, and automated machinery. Similarly, in the railway industry, especially in electric trains and metro systems, DC power is commonly used for traction and auxiliary systems. DC circuit breakers are essential in these applications to protect against overloads and short circuits, maintain system reliability, and ensure passenger and operator safety. According to the latest UITP (Union Internationale des Transports Publics) World Metro Figures, between 2018 and 2020, 14 new cities launched metro systems, bringing the global total to 193 cities. During this period, metro infrastructure worldwide expanded by nearly 25%, with the Asia Pacific contributing 21% of the growth and mainland China alone accounting for 17%. As both automation technologies and rail transport continue to expand and modernize, the need for advanced DC protection solutions grows alongside them.

MARKET RESTRAINTS

Complex Size and High Cost to Constrain Market Growth

One of the biggest challenges for DC circuit breakers is the interruption of an electric arc that forms when breaking a circuit. In AC systems, the current naturally passes through zero at regular intervals, which helps extinguish the arc easily. However, in DC systems, the current flows continuously in one direction without any zero crossing, making it much harder to break the arc once it forms. This continuous current sustains the arc longer, increasing the risk of equipment damage, fire, or system failure if not properly managed. To address this, DC circuit breakers often require complex arc management techniques, such as magnetic fields to push the arc into arc chutes or hybrid technologies that combine mechanical and electronic components. Developing reliable arc interruption solutions is essential for ensuring the safe and effective operation of DC power systems.

MARKET OPPORTUNITIES

Increasing Focus on Smart Grids to Offer Lucrative Opportunities for Market

Traditional centralized grids are gradually evolving into more flexible, intelligent networks that integrate a combination of Alternating Current (AC) and Direct Current (DC) sources. Countries worldwide are making numerous investments in the modernization and digitization of smart grids to attain maximum efficiency. For instance, at the end of 2022, the European Commission introduced the “Digitalisation of the Energy System” action plan. By 2030, around USD 633 billion is expected to be invested in Europe’s electricity grid, with about USD 184 billion dedicated to digitalization efforts, including smart meters, automated grid management, and digital tools for field operations. This shift is driven by the need to efficiently manage diverse energy inputs, including solar panels, wind turbines, battery energy storage systems, and electric vehicle chargers, a considerable number of which operate on DC power. Decentralized systems, such as microgrids and nanogrids, often rely heavily on DC distribution to minimize conversion losses and improve overall energy efficiency. As a result, there is a growing need for highly reliable and fast-acting DC protection devices that can handle a wide range of voltages and current levels. As the adoption of smart grid technologies accelerates worldwide, the role of DC protection solutions becomes even more critical to building resilient, efficient, and sustainable power networks.

MARKET CHALLENGES

Competition from alternative protection technologies to Restrain Market Growth

The market faces competition from alternative protection technologies such as fuse-based systems and advanced relay mechanisms. In some applications, particularly in solar power systems, fuse-based systems are considered a viable alternative to DC circuit breakers due to their lower cost and simpler design. Advanced relay technologies offer improved protection capabilities and can be a competitive alternative to traditional circuit breakers in certain scenarios.

DC CIRCUIT BREAKER MARKET TRENDS

Rising Demand for Electric Vehicles (EVs) to Accelerate Market Growth

The rapid growth of Electric Vehicles (EVs) is playing a major role in increasing the need for DC circuit breakers. According to the Global EV Outlook 2023, nearly 14 million electric cars were sold globally, marking a 35% increase from 2022 and bringing the total number on the road to 40 million. About 95% of these sales occurred in China, Europe, and the U.S. Electric vehicles made up around 18% of all car sales, up from 14% in 2022 and just 2% in 2018. Battery electric vehicles accounted for 70% of the global electric car fleet, highlighting the strong and steady growth of the EV market. EVs operate primarily on direct current, and both their charging infrastructure, especially fast-charging stations, and energy storage systems require reliable DC protection. As more high-power DC fast chargers are deployed to support the expanding EV market, the demand for circuit breakers that can safely interrupt high DC currents is rising. In addition, EV manufacturing plants and battery production facilities, which use large-scale DC systems, also depend on advanced DC circuit breakers to maintain safe and efficient operations. As the global shift toward electric mobility accelerates, the need for specialized DC protection solutions will continue to grow.

IMPACT OF COVID-19

The COVID-19 pandemic had a noticeable impact on the DC circuit breaker market growth. During 2020 and 2021, disruptions in global supply chains caused delays in the production and delivery of critical components needed for manufacturing DC breakers. Lockdowns, labor shortages, and transportation restrictions further slowed down project timelines, especially in industries such as renewable energy, electric vehicles, and infrastructure development, where DC breakers are essential. Many new installations and upgrades were postponed or canceled, reducing short-term demand. However, the pandemic also highlighted the importance of resilient and flexible energy systems, leading to a stronger long-term focus on investments in smart grids, renewable energy, and electric mobility. As markets recover, all of these drive renewed growth for DC protection technologies.

SEGMENTATION ANALYSIS

By Type

Lower Cost and Optimal Performance Lead to Hybrid Segment’s Growth

The market is segmented by type into hybrid and solid-state circuit breakers contributing 59.57% globally in 2026. Hybrid circuit breakers currently hold a larger share compared to solid-state circuit breakers. Hybrid breakers, which combine mechanical switching with power electronics, are widely favored because they offer a balance between reliability, cost, and performance. They are increasingly used in applications such as renewable energy grids, electric vehicles, and industrial DC networks, where fast switching and arc management are critical, but fully electronic solutions are still extremely expensive for widespread deployment.

Solid-state DC circuit breakers, which rely entirely on semiconductor components for switching, are gaining attention due to their ultra-fast response times, high reliability, and capability for precise control. However, solid-state breakers are generally more expensive. They can introduce higher energy losses, limiting their current adoption mainly to specialized or high-end applications, such as data centers, military systems, and critical grid segments, where performance outweighs cost considerations.

By Insulation

Higher Growth in Medium Voltage Transmission & Distribution Network Lines to Boost Vacuum Segment's Market Growth

Based on insulation, the market is divided into vacuum and gas with a share of 77.27% in 2026. Vacuum circuit breakers currently hold a larger market share compared to gas-insulated circuit breakers. Vacuum breakers are widely adopted due to their proven reliability, compact size, low maintenance requirements, and high efficiency in interrupting DC arcs. They are especially preferred in medium-voltage applications such as railways, renewable energy grids, and industrial power systems where cost-effectiveness and operational simplicity are important.

Gas-insulated DC circuit breakers, typically using SF₆ or other insulating gases, are favored in high-voltage and specialized applications. Gas breakers offer excellent insulation and arc-quenching capabilities, making them ideal for large-scale DC transmission projects (including HVDC systems) where space constraints and system reliability are critical. However, concerns about SF₆'s environmental impact, along with higher costs and more complex maintenance requirements, have limited their broader adoption compared to vacuum technologies.

By Voltage

Medium Voltage Circuit Breakers Dominates Due to Versatility and Cost Effectiveness

The market is segmented by voltage into low, medium, and high. Medium-voltage breakers hold the largest DC circuit breaker market contributing 48.33% globally in 2026. They are widely used across renewable energy projects, railways, industrial applications, and electric vehicle charging infrastructure, where voltage levels typically range between 1 kV and 50 kV. Their versatility, cost-effectiveness, and growing demand from sectors such as solar farms and Battery Energy Storage Systems (BESS) make medium-voltage DC breakers the dominant category.

Low-voltage DC circuit breakers, typically operating below 1 kV, also account for a significant portion of the market. They are heavily used in residential solar setups, low-voltage DC grids, data centers, and electric vehicles. The rapid expansion of EVs and decentralized energy systems is further strengthening demand in this segment. However, due to their lower individual unit cost and smaller application scale, their overall market value is smaller compared to medium voltage.

By End User

To know how our report can help streamline your business, Speak to Analyst

Transmission & Distribution Segment to Dominate Market Growth

The market is segmented by end user into transmission & distribution, commercial & industrial, renewables, and others. Transmission & distribution hold the largest share of 43.40% in 2026. T&D systems require highly reliable DC protection equipment to ensure the stability and efficiency of growing High-Voltage DC (HVDC) networks, long-distance power transmission & distribution networks, and grid modernization efforts. As countries invest heavily in upgrading aging grid infrastructure and building more resilient, flexible power systems, the demand for DC breakers in this sector remains strong.

Renewables, particularly solar PV and wind energy, are a fast-growing segment for DC circuit breakers. The rapid deployment of renewable energy projects, especially solar farms and hybrid renewable installations with battery storage, demands advanced DC protection solutions. As renewables often involve decentralized generation and variable loads, DC breakers play a critical role in ensuring safety, grid stability, and system flexibility.

DC CIRCUIT BREAKER MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific DC Circuit Breaker Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Urbanization and Clean Energy Initiatives to Foster Market Growth

Asia Pacific DC circuit breaker market holds the largest share due to an increasing focus on renewable energy, electric transportation, and HVDC transmission projects, particularly in China, India, Japan, and South Korea. In July 2024, Hartek Group, a leading EPC company, secured two major 765kV transmission projects from Power Grid Corporation of India Ltd. (PGCIL) in Indore and Kurnool. These projects aim to strengthen India's national grid by improving reliability and increasing transmission capacity in power-deficient regions. Supporting the country's growing power generation through 2030, Hartek Group plans to complete the projects within 14 to 20 months, based on each project's needs. In addition, rapid industrialization, urbanization, and government-led clean energy initiatives continue to boost demand for both low- and high-voltage DC protection devices across the region.

China

Rapid Urbanization and Government-backed Renewable Energy Projects to Fuel Market

China is one of the most dominant markets for DC circuit breakers, primarily driven by the country's aggressive expansion in renewable energy, Electric Vehicles (EVs), and large-scale industrial applications. According to the International Energy Agency, the number of new electric car registrations in China reached 8.1 million in 2023, increasing by 35% relative to 2022. The nation’s strong investment in solar and wind energy projects, along with the growing adoption of DC grids for urban power distribution, has significantly boosted domestic demand for DC circuit breakers.

North America

Investment in Modernizing Grid Infrastructure to Expand Market

North America also holds a significant share of the market, supported by growth in utility-scale renewable projects, investments in modernizing grid infrastructure, and the rapid adoption of electric vehicles. Canada installed 314 MW of new solar capacity in 2024, raising its total cumulative Photovoltaic (PV) capacity to over 5 GW, according to the Canadian Renewable Energy Association. Additionally, utility-scale solar continues to dominate the market, with 217 major solar energy projects generating power across the country as recorded in January 2025. The U.S. and Canada are leading investments in both high-voltage DC transmission systems and localized commercial DC microgrids, driving a continuous need for reliable DC protection solutions.The United States market is projected to reach USD 1.04 billion by 2026.

U.S.

Expansion of Solar Energy Farms and EVs Charging Infrastructure to Surge U.S. Market

The U.S. holds a notable position in the DC circuit breaker market due to higher technological standards and specialized applications. The key factors leading the surge in the DC circuit breaker are the expansion of utility-scale solar farms, energy storage integration, electric vehicle charging infrastructure, and the aerospace and defense sectors. According to the International Energy Agency (IEA), in the U.S., approximately 14.1 gigawatt-hours (GWh) of energy storage capacity, equivalent to around 4.3 gigawatts, was installed on the electric grid during the first and second quarters of 2024. This marks the largest first-half deployment of energy storage capacity in U.S. history.

Europe

Rising Clean Energy Targets for Curbing Carbon Emissions to Drive Product Demand

Europe's DC circuit breaker market growth is fueled by aggressive renewable energy targets, expansion of smart grids, and strong emphasis on energy transition policies. The European Commission’s REPowerEU plan aims to reduce the EU’s reliance on Russian fossil fuels quickly. Key measures include raising the 2030 renewable energy target to 45% and accelerating solar deployment, with goals of adding over 320 GW of new solar capacity by 2025 and nearly 600 GW by 2030. Countries such as Germany, the U.K., and France are deploying DC systems in offshore wind, EV charging infrastructure, and decentralized energy networks, strengthening Europe’s demand for advanced DC circuit breakers.The United Kingdom market is projected to reach USD 0.14 billion by 2026, while the Germany market is projected to reach USD 0.25 billion by 2026.

Latin America

Increasing Renewable Energy Share in Energy Mix to Propel Market Growth

The Latin America DC circuit breaker market is growing considerably, primarily due to expanding solar and wind projects in Brazil, Chile, and Mexico. As renewable energy adoption rises and energy access programs advance, the need for efficient DC circuit breakers in the region is expected to increase steadily. For instance, in 2023, fossil fuels accounted for just 9% of Brazil’s electricity, with per capita emissions well below the global average. The country had the second-lowest carbon intensity of power generation among G20 nations. Due to strong hydro, wind, and solar output, Brazil surpassed its goal of 84% renewable electricity well ahead of the 2030 target.

Middle East & Africa

Rising Renewable Energy Capacity and Electrification to Positively Impact Market

The Middle East & Africa DC circuit breaker market is growing owing to the push toward solar power, and major investments in grid modernization and electrification of remote areas are gradually creating new opportunities for DC circuit breaker deployment. For instance, the UAE boosted its renewable energy capacity by 70% in 2023, making up 27.83% of its energy mix. Key projects such as the 1.8 GW Mohammed bin Rashid Al Maktoum Solar Park and ADNOC’s carbon capture efforts are driving progress toward the UAE’s 2050 energy goals. Clean energy investments have surpassed USD 12 billion, with the country targeting 32% renewables by 2030.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

ABB’s Advancement in Product Solutions to Lead Market Growth

ABB, Eaton, Siemens, Schneider Electric, GE, and others are key players operating in the DC circuit breaker market. ABB has been a pioneer in advancing DC circuit breaker technology to support the transition toward more flexible, efficient power systems. One of its major milestones was the development of the world's first Hybrid High-Voltage DC (HVDC) circuit breaker, which combines mechanical and power electronics technologies to interrupt fault currents within milliseconds. This innovation has been crucial for enabling multi-terminal HVDC grids, which are vital for integrating large-scale renewable energy sources such as offshore wind farms. ABB continues to invest heavily in research and development, focusing on improving breaker speed, reducing energy loss, and enhancing compactness. The company is also working on solid-state DC breaker solutions aimed at applications in electric mobility, microgrids, and data centers, helping meet the growing demand for reliable DC protection in both high-voltage transmission and low-voltage industrial sectors.

List of Key DC Circuit Breaker Companies Profiled

- ABB (Switzerland)

- Siemens AG (Germany)

- Schneider Electric SE (France)

- Eaton Corporation Plc (Ireland)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Corporation (Japan)

- Larsen & Toubro Limited (India)

- Rockwell Automation, Inc. (U.S.)

- Fuji Electric Co., Ltd. (Japan)

- General Electric Company (U.S.)

- Legrand (France)

- Hyundai Electric & Energy Systems Company (South Korea)

- C&S Electric Limited (India)

- Powell Industries, Inc. (U.S.)

- Sensata Technologies Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In December 2024, Hitachi, Ltd. received an order from Chubu Electric Power Grid for five SF6-free EconiQ™ 300 kV circuit-breakers, marking Japan’s first installation of SF6-free breakers at 275 kV and above. The move supports Chubu Electric’s 2050 net-zero goal. Unlike traditional SF6 gas, which has a high global warming impact, the EconiQ™ breakers cut CO2-equivalent emissions by 99.3%. Japan currently has no regulations banning SF6 equipment.

- In December 2024, the new Horizon Europe-funded MoWiLife project will advance technology for DC wind and solar applications over three years. It focuses on developing a 2.3 kV SiC MOSFET with built-in temperature sensing and self-protection, while also exploring ultra-high voltage and ultra-wide bandgap semiconductors such as diamond for greater energy efficiency. The project includes two wind converter pilots and two university-led pilots: a TRL 5 DC-DC converter and a TRL 5 DC circuit breaker.

- In August 2024, Mitsubishi Electric and Siemens Energy signed an agreement to co-develop DC switching stations and DC circuit breaker specifications, aiming to advance multi-terminal HVDC systems for efficient renewable energy integration. Building on a previous partnership, this collaboration seeks to speed up the deployment of DC circuit breaker technology and support global decarbonization efforts.

- In April 2024, Ideal Power secured a purchase order for its Bidirectional, Bipolar Junction Transistor (B-TRAN) power switch from a leading power semiconductor company. The order includes B-TRAN devices and a circuit breaker evaluation board, supporting the customer’s development of a solid-state circuit breaker for a multi-year DC power distribution program. B-TRAN technology targets applications such as EVs, charging infrastructure, renewables, energy storage, data centers, and military systems.

- In September 2022, ABB introduced the SACE Infinitus, a solid-state circuit breaker designed to simplify protection and control of DC networks on ships. It is the world’s first IEC 60947-2-certified breaker using semiconductor technology and will be available with DNV certification for low-voltage maritime use. DC systems boost fuel efficiency by up to 20% and ease the integration of batteries and hydrogen fuel cells by eliminating AC-related losses.

REPORT COVERAGE

The report delivers a detailed insight into the market and focuses on key aspects, such as leading companies. Besides, it offers insights into the market trends & technologies and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors and challenges that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.33% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Insulation

|

|

|

By Voltage

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

As per Fortune Business Insights study, the market size was valued at USD 5.39 billion in 2025.

The market is likely to record a CAGR of 7.33% over the forecast period of 2026-2034.

By end user, the transmission & distribution segment is expected to lead the market during the forecast period.

The Asia Pacific market size was valued at USD 2.18 billion in 2024.

Rising renewable energy deployment is the key factor driving the market’s growth.

Some of the key players in the market are ABB, Eaton, Siemens, Schneider Electric, GE, and others.

The global market size is expected to reach a valuation of USD 10.35 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us