Disposable Hygiene Products Market Size, Share & COVID-19 Impact Analysis, By Product Type [Wipes, Diapers, Feminine Hygiene Products (Sanitary Napkins, Tampons, and Panty Liners), and Others], By Distribution Channel (Supermarkets/Hypermarkets, Pharmacy Stores, Online Stores, and Others), and Regional Forecasts, 2025-2032

KEY MARKET INSIGHTS

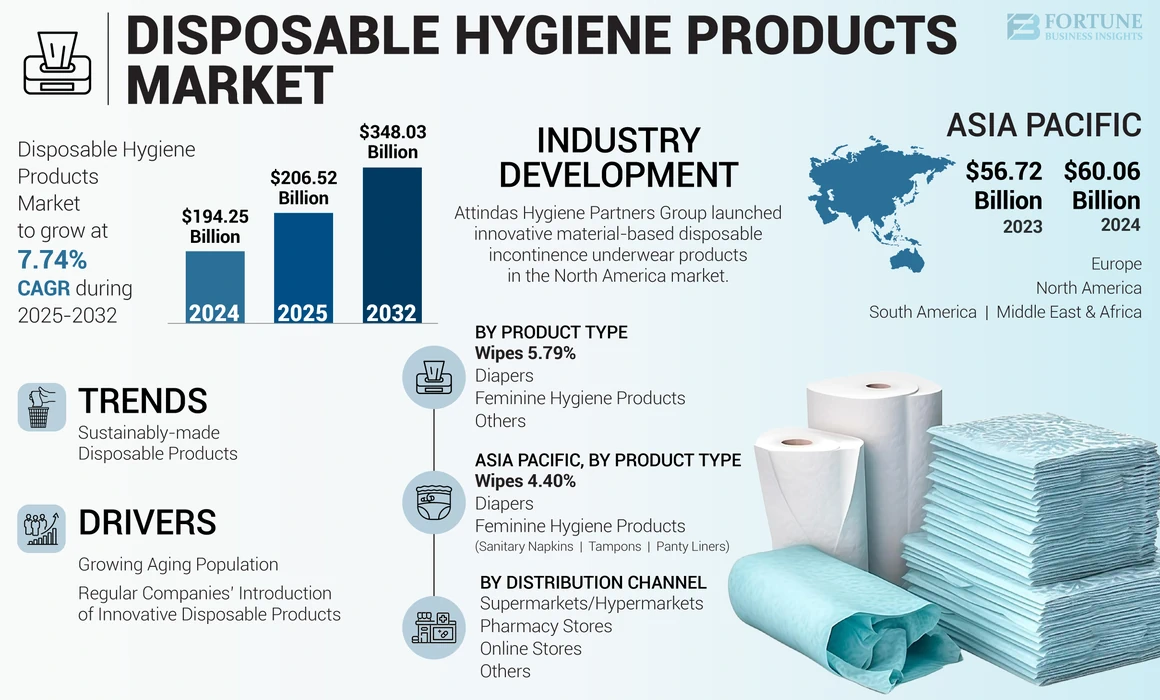

The global disposable hygiene products market size was valued at USD 194.25 billion in 2024. The market is projected to grow from USD 206.52 billion in 2025 to USD 348.03 billion by 2032, exhibiting a CAGR of 7.74% during the forecast period. Asia Pacific dominated the disposable hygiene products market with a market share of 30.91% in 2024. Moreover, the disposable hygiene products market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 79.11 billion by 2032, driven by growing health and hygiene awareness among women population to propel market size growth.

High-quality disposable hygiene products, such as diapers, toilet paper, and wipes, are super absorbent, breathable, and daycare friendly products. Nowadays, consumers prefer innovative formulation-based, value added personal care products to fulfill their hygiene needs. Therefore, key companies, such as Kimberly-Clark Corporation, Essity AB, The Procter & Gamble Company, and others, offer premium-based, high-quality diapers & napkins to meet such products’ demand.

GLOBAL DISPOSABLE HYGIENE PRODUCTS MARKET SNAPSHOT

Market Size & Forecast:

- 2024 Market Size: USD 194.25 billion

- 2025 Market Size: USD 206.52 billion

- 2032 Forecast Market Size: USD 348.03 billion

- CAGR: 7.74% from 2025–2032

Market Share:

- Asia Pacific led the market with a 30.91% share in 2024, driven by strong demand for diapers, wipes, and sanitary products across China, India, and Southeast Asia.

- Diapers dominated the product segment due to rising birth rates in developing nations and increased adoption of incontinence solutions among the elderly.

- Supermarkets/hypermarkets held a leading distribution channel share due to bulk purchasing convenience and broad product variety.

Key Market Highlights:

- U.S.: Projected to reach USD 79.11 billion by 2032; increasing hygiene awareness among women and strong preference for premium products drive demand.

- China & India: Rising income levels, awareness campaigns, and expanding baby and elderly populations support robust market growth.

- Japan & South Korea: Demand for biodegradable and organic hygiene products fuels innovation and segment diversification.

- U.K., Germany & France: High AFH (Away-From-Home) product consumption and growing investment in sustainable disposables bolster regional demand.

- Brazil, South Africa & UAE: Expanding middle class and tourism-related facilities accelerate adoption of disposable wipes, diapers, and feminine care products.

COVID-19 IMPACT

Stockpiling of Personal Hygiene Goods Amid COVID-19 Pandemic to Favor Growth

Growing trend of stockpiling personal care goods amid COVID-19 related lockdown restrictions is favoring product revenues globally. In addition, increasing hospitals, hotels & restaurants, and other away-from-home (AFH) consumers’ demand for sanitizing property-based flushable tissues & toilet papers to maintain bathroom spaces’ hygiene and infection-free is accelerating the product demand amid the COVID-19 pandemic. Furthermore, the rising adoption of online shopping of daily essential goods is driving the market growth during the pandemic. For instance, in 2021, Essity AB, a global personal care products maker, reported 15.9% jump in online sales of its personal care goods and reached USD 1.88 billion.

However, the closure of baby care shops and supermarkets due to COVID-19 related lockdown restrictions is hampering the market growth globally. In addition, travel & tourism restrictions and the closure of hospitality settings are lowering diaper and toilet paper products revenues during the pandemic.

DISPOSABLE HYGIENE PRODUCTS MARKET TRENDS

Sustainably-made Disposable Products to Create Newer Growth Prospects

Increasing demand for disposable hygiene products made of sustainable and biodegradable ingredients, such as bamboo, organic cotton, and sugarcane, will create newer market growth prospects. In addition, the growing popularity of using plant-based, alcohol-free incontinence products among the adult population to avoid skin irritation issues due to the usage of chemical-based products is favoring the product revenues globally. Furthermore, increasing millennial consumers’ preference for buying premium-based, skin-friendly, and higher absorption property-based diapers and wipes is accelerating market growth. For instance, the Procter & Gamble Company, a global manufacturer of premium disposable diapers and wet wipes, reported 5% jump in the sales of its baby, feminine & family care business segment and reached USD 19.74 billion in the financial year 2022.

- Asia Pacific witnessed disposable hygiene products market growth from USD 56.72 billion in 2023 to USD 60.06 billion in 2024.

Download Free sample to learn more about this report.

DISPOSABLE HYGIENE PRODUCTS MARKET GROWTH FACTORS

Growing Aging Population to Augment Disposable Incontinence Products Demand

The aged population essentially uses disposable diapers, pull-up pants, and pads to address incontinence issues. Therefore, the growing population aging and increasing awareness regarding the availability of incontinence products are driving the market growth. In addition, increasing working women population’s preference for premium-based tampons, panty liners, and pads to fulfill their menstruation management needs is favoring the flushable feminine care products demand globally.

Nowadays, governmental healthcare agencies are introducing personal hygiene-related awareness campaigns to spread the importance of using hygiene products among people. These governmental initiatives will support the product demand globally. For instance, in 2021, the government of U.K. in collaboration with Unilever, Plc., a global consumer goods maker, launched a global personal care campaign to spread the importance of hand washing and personal hygiene worldwide. These governmental initiatives will support the flushable gloves and toilet paper products demand globally. Furthermore, growing awareness regarding personal care and cleanliness is further driving the global disposable hygiene products market growth.

Regular Companies’ Introduction of Innovative Disposable Products to Support Market

Nowadays, key companies are regularly introducing higher absorption and skin-friendly property-based disposable hygiene products to strengthen their presence in the global personal care industry. These companies’ efforts will support in the future development of the market. For instance, in August 2021, Sani Professional, a PDI International’s subsidiary company, launched a new soft pack of 75 extra-large heavy-duty disposable wipes for global consumers. These degreasing multi-surface wipes enable commercial facilities such as healthcare and foodservices deliver a sanitized environment to their clients.

In addition, rising number of salons & spas, hotels & restaurants, and hospitals prefer giving high-quality diapers, wipes, and feminine care products to their customers, accelerating the product consumption rate globally. For instance, in November 2022, Pullman Hotels and Resorts, a French multinational hotel company expanded its presence by opening hotel facilities of 322 rooms at North Shenzhen, China.

RESTRAINING FACTORS

Health Issues due to Scented Disposable Products to Limit Product Demand

Nowadays, consumers suffer from skin rashes, cold, and headache due to the usage of chemical-based, scented disposable products. This factor will likely lower the product demand globally. Besides, higher prices of premium-based diapers will likely limit its demand among middle income population groups. Disposable hygiene products are increasingly causing water clogging and blockages issues in the water drainage systems. As per the data presented by the Women’s Environmental Network (WEN) Organization, in 2021, disposable of single use menstrual products including pads, tampons, and applicators generate 200,000 tons of waste per year in the U.K. This aspect will limit the development of the disposable hygiene products industry.

DISPOSABLE HYGIENE PRODUCTS MARKET SEGMENTATION ANALYSIS

By Product Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Diapers Segment Holds a Major Market Share due to its Significant Demand among AFH Consumers

The market analysis can be conducted based on various product types such as wipes, diapers, feminine hygiene products, and others.

The diapers segment holds a major market share due to the significant middle and higher-income parental populations' demand for soft & comfortable diapers for their babies. In addition, the rising prevalence of incontinence among the aged population and growing awareness regarding the usage of flushable diapers among them will likely favor the diapers' segmental growth.

- The wipes segment is expected to hold a 5.79% share in 2024.

The wipes segment is mainly driven by the increasing global population’s demand for personal care and home hygiene purpose flushable wipes. For instance, Kimberly-Clark Corporation, a global wet wipes maker, reported a 1.6% increase in its overall sales revenues and reached USD 19.4 billion in 2021. In addition, increasing household consumers' preference for biodegradable & compostable wipes made of natural fibers and herbal extracts, such as aloe vera, mint, rose water, lemon, and others, will offer newer segmental growth opportunities.

The feminine hygiene products segment is mainly driven by the increasing female workforce and better menstrual management literacy among them. Furthermore, the growing popularity of deodorizing property-based menstrual hygiene products among women and their increasing focus on avoiding bad smells will likely drive the feminine hygiene products segmental growth. Besides, shifting consumer preference toward buying flushable napkins made of biodegradable materials, such as corn starch, banana fiber, and water hyacinth, and growing awareness regarding sustainable personal care products are accelerating the growth of the sanitary napkins segment.

Nowadays, menstruation care products makers are increasing tampon product prices to support their product sales. In addition, they focus on enhancing the production facilities of tampons to improve their product supply rate in the global markets. These aspects will likely support the tampons' segmental growth. For instance, in 2021, Top The Organic Project, a tampon manufacturer, reported 300% rise in the cost of supplying its tampon products in the U.S. Hence, to counter the increasing operational costs, the company s invested USD 2 million to uplift its organic tampons production capacity and increase its distribution network in the U.S. Besides, rising women consumers' demand for lightweight panty liners of higher absorbent cushion design is mainly driving the panty liners' segmental growth.

The others segment includes various products such as disposable razor blades, gloves, and toilet papers. Rising consumer demand for travel-friendly non-refillable razor blades for personal grooming purposes is mainly driving the others' segmental growth.

By Distribution Channel Analysis

Supermarkets/Hypermarkets Segment to Hold a Leading Market Position due to Bulk Purchasing Option

By distribution channel, the market is segmented into supermarkets/hypermarkets, pharmacy stores, online stores, and others. Consumers can better purchase bulk volume of a variety of branded personal care products, including diapers, wipes, and feminine hygiene products under a single roof from supermarkets/hypermarkets. This aspect primarily results in the supermarkets/hypermarkets segment holding a major market share. Furthermore, an increasing number of hospitals and hotels prefer ordering bulk volumes of wipes, diapers, and tampons from pharmacy stores, thereby accelerating the pharmacy stores' segmental growth.

Besides, the rising adoption of online shopping for personal hygiene and grooming products among consumers is driving the online stores segmental growth. The others segment includes various distribution channels such as convenience stores, brick & mortar shops, and direct selling channels. The increasing middle-income population's demand for cost-effective tampons and wipes mainly drives the product demand from such stores, thereby supporting the others segmental growth.

REGIONAL INSIGHTS

Asia Pacific Disposable Hygiene Products Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The global market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

The Asia Pacific market size reached USD 60.06 billion in 2024. Asia Pacific holds the largest market share due to the Chinese and South East Asian population’s demand for personal care products such as diapers, toilet paper, wipes, and others. In addition, growing awareness regarding hygiene & cleanliness and increasing purchasing power are driving the market growth in the region. For instance, Hengan International Group Company Limited, a Chinese paper products maker, reported a tissue paper sales value of USD 727.00 million in the first half of 2021.

- In Asia Pacific, the wipes segment is estimated to hold a 4.4% market share in 2024.

The North America market is mainly driven by the significant U.S. and Canadian population's demand for the personal care products such as wipes, diapers, razors, blades, and others for their regular hygiene needs. According to the data presented by the U.S. Census Bureau, a U.S. federal governmental agency, in September 2021, health and personal care stores' sales in the U.S. reached USD 4.3 million, 0.5% up over August 2021.

The Europe market is mainly driven by the rising demand for flushable tissue paper products such as wipes, toilet papers, sanitary napkins, tampons, diapers, and menstrual management products among various away-from-home consumers such as hospitals, hotels & restaurants, and schools. Furthermore, increasing number of hospital & hotel establishments with growing hotel stays and tourist arrivals will likely favor the product consumption rate in the region. As per the data presented by the Instituto Nacional de Estadistica (INE), a Spanish statistical organization, in September 2022, overnight stays in Spanish hotel establishments increased by 39.9% compared to September 2021.

To know how our report can help streamline your business, Speak to Analyst

The South America market is mainly driven by the rising Brazilian & Argentine aged population's demand for adult incontinence products such as panty liners, diapers, and pads. The Middle East & Africa market is mainly driven by the growing awareness of the benefits of using personal care products among middle-income and higher-income groups.

KEY INDUSTRY PLAYERS

Product Innovation and Business Expansion are Key Strategies Fueling Market Growth

Key players offer higher absorption property-based, premium diapers and wipes to build their customer base. In addition, they focus on strengthening the manufacturing capacity and supply chain efficiency of their personal disposable hygiene products to increase their sales revenues from such products. For instance, as of 2022, Biogaurd, a U.K.-based manufacturer of disinfectant solutions, disposable sanitizing wipes, cleansers, and gels, expanded the retail distribution network of its products portfolio in the UAE, Kuwait, Saudi Arabia, Bahrain, and Oman to strengthen its business in the Middle East.

List of Top Disposable Hygiene Products Companies:

- The Procter & Gamble Company (U.S.)

- Kimberly-Clark Corporation (U.S.)

- Unicharm Corporation (Japan)

- Essity AB (Sweden)

- Hengan International Group Company Limited (China)

- Ontex BV (Belgium)

- DPL (Israel)

- Fujian Time and Tianhe Industrial Co., Ltd. (China)

- The Edgewell Personal Care Company (U.S.)

- Dispowear Sterite Company (India)

KEY INDUSTRY DEVELOPMENTS:

- September 2022: Eco Green Living, a U.K.-based sustainable personal care products maker launched a range of biodegradable bamboo material-based flushable baby nappies in the U.K.

- July 2022: Essity AB, a Sweden-based personal care products maker, acquired Modibodi, an Australian leakage-proof apparel maker to build its presence in the intimate this industry.

- October 2021: Ecolab Inc., an American hygiene and infection prevention solutions provider, expanded its manufacturing base by acquiring National Wiper Alliance company’s 500,000 sq. ft. disposable disinfectant wipe manufacturing facility at North Carolina, U.S.

- May 2021: The Procter & Gamble Company launched ‘Pampers Pure Protection Hybrid Diapers,’ a range of premium fabric-based diapers that can be disposed-off or reused by babies. These products are equipped with highly absorbent materials and enhanced leakage protection features.

- January 2021: Essity, a global manufacturer of hygiene products, launched a range of washable and absorbent under wares for women under its feminine care product categories.

REPORT COVERAGE

The market research report analyzes the market in-depth and highlights crucial aspects such as prominent companies, product types, and distribution channels. Besides, the report provides insights into the disposable hygiene products market trends, highlights significant industry developments, and the overall market outlook. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.74% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 194.25 billion in 2024 and is anticipated to reach USD 348.03 billion by 2032.

The global market is expected to grow at a CAGR of 7.74% during 2025-2032.

The diapers segment is expected to be the leading product type in this market during the forecast period (2023-2030).

Growing aging population is augmenting the disposable incontinence products demand and accelerating the market growth.

The Procter & Gamble Company, Kimberly-Clark Corporation, and Unicharm Corporation are the leading companies worldwide.

Asia Pacific dominated the global market in 2024.

The rising demand for sustainably-made personal hygiene products will drive the adoption of such products.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us