Printers Market Size, Share & Industry Analysis, By Type (Laser, Inkjet, LED Printer, and Others), By Technology (Serverless/Cloud and Server), By Output Type (Monochrome Color), By Application (Residential, Commercial, Educational Institutions, Enterprises, Government, and Others), and Regional Forecast, 2026-2034

PRINTERS MARKET OVERVIEW AND FUTURE OUTLOOK

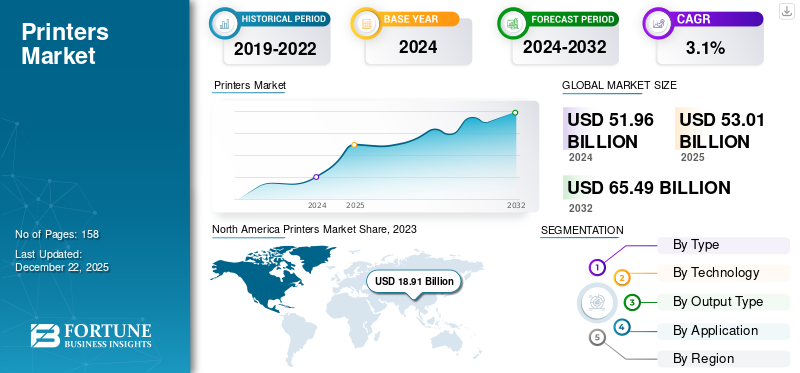

The global printers market size was valued at USD 53.02 billion in 2025 and is projected to grow from USD 54.22 billion in 2026 to USD 71.09 billion by 2034, exhibiting a CAGR of 3.4% during the forecast period. North America led the global market with a dominant share of 37.06% in 2023, driven by technological advancements and the rising adoption of high-quality printing solutions across various sectors.

A printer is an electronic device that is connected to a computer and produces a hard copy (printout) of digital documents and images in wide and large formats. It can use various technologies to transfer text and images onto paper and other print media, with the most common types being inkjet, laser printers, multi functional printers, LED, and dot matrix. It can vary in size, speed, and capability and find applications in various settings such as homes, offices, and educational institutions. In this scope, the report focuses on the net sales of inkjet, laser, LED, multifunctional, and dot matrix printer.

Global Printers Market Overview

Market Size:

- 2025 Value: USD 53.02 billion

- 2026 Value: USD 54.22 billion

- 2034 Forecast Value: USD 71.09 billion

- CAGR: 3.4% over the forecast period (2026–2034)

Market Share:

- Regional Leader: North America holding the largest share globally

- Market-Leading Printer Type: Inkjet printers led in revenue, thanks to their versatility and cost-effectiveness

Industry Trends:

- Rising demand driven by remote and hybrid work models and ongoing urbanization

- Increasing adoption of multifunctional printers (MFPs) incorporating printing, scanning, copying, and wireless connectivity

- Growing focus on sustainability, energy efficiency, and eco-friendly printer consumables

Driving Factors:

- Expansion of digital workflows and retained need for physical documentation in business and education

- Preference for cost-efficient inkjet technology in home and small-office scenarios

- Demand for cloud-based, network-ready printers that support flexible workflows, including mobile and remote printing

- Strong market dominance by major manufacturers such as HP, Epson, Canon, Brother, Xerox, and others

The growing preference for remote and hybrid work environments is expected to increase the demand for home office printer. According to the International Workplace Group (IWG) U.S. Hybrid Worker Sentiment Survey February 2023, around 67% of respondents indicated they are ready to lose some amount of salary to maintain their hybrid work arrangements. Moreover, rapid technological advancements in the digital printing industry drive the growth of the market.

Major manufacturers are bringing new technologies such as Artificial Intelligence (AI) and Internet of Things (IoT) based systems into the market, which further fuels the market. For instance, in September 2024, HP Inc. announced the launch of HP Print AI, the industry’s first AI-integrated printer designed to simplify and improve user print service experience. HP Print AI includes a "Perfect Output" feature that addresses common color printing challenges, such as inaccurate image sizing and undesirable white spaces. Moreover, the rising trend of managed print services is also contributed positively in the global printers market share.

COVID-19 pandemic impacted negatively during the forecast period owing to factors such as dropped in the net sales of printer from enterprises, and commercial sectors. However, rising trend of work from home led to the adoption of printer in residential and commercial spaces, accelerated the demand after COVID-19 pandemic, driving the printers market growth.

IMPACT OF TECHNOLOGY ON MARKET

Rising Trend of Cloud printing Solution in Residential and Commercial Sector to Drive Market Growth.

Cloud printing eliminates the requirement for printer drivers, offering users with a seamless printing experience across networks, regardless of the hardware used in printing applications. Major manufacturers are increasingly integrating cloud printing features and various proprietary services into their printer solutions. For instance, in September 2023, Seiko Epson Corporation launched two new ColorWorks series printer that integrate the Loftware Cloud platform. This integration helps enterprises to print directly from Loftware Cloud to Epson’s cloud based ColorWorks printer.

Moreover, rising government investment in AI and cognitive systems for home offices and commercial printing solutions fuels the growth of the market. For instance, according to the source of IDC Corporation, global spending on AI and cognitive systems is projected to grow by USD 204 billion by 2025. All these factors contribute to the expansion of the printers market growth.

MARKET TRENDS

Increased Consumer Demand for Sustainability To Drive Market Growth

Rising environmental sustainability across residential, commercial, and educational institutions is a key trends in the global printing market. Consumers are becoming increasingly conscious of their impact on the environment and demanding more sustainable printer. In response, key players are adopting more and more eco-friendly practices in printer manufacturing to decrease waste, conserve resources, and minimize environmental impact. For instance, in March 2023, HP Inc. announced the launch of the HP Color Jet Series of printing solutions with TerraJet Toner that offers highly energy-efficient and scalable printing for hybrid work environments. TerraJet toner offers up to 27% reduction in energy consumption. These developments reflect the growing trend toward environmentally sustainable printers in the market.

MARKET DYNAMICS

Market Drivers

Growing Shift toward Remote and Hybrid Work Models to Augment Market Growth

The growing trend of remote and hybrid work policy models by private and public companies is raising the adoption of printing systems in educational institutes and residential applications, fueling the growth of the market. As per the statement by CXOToday, around 60 to 90 million Indians will be working remotely by 2025, which equates to about 10% to 15% of the total Indian workforce.

Additionally, the proliferation of cloud computing is anticipated to increase demand for printing systems that support cloud and wireless printing. These features enable employees to print from remote locations without needing to be physically connected to the devices, offering more flexibility in work processes.

Market Restraints

Declining Demand for Paper-based Printing to Hamper the Market Growth

One of the major restraints in the printer market is the declining demand for paper-based printing. Businesses across various industries are increasingly adopting digital document management systems, cloud storage, and electronic communications, reducing the need for paper-based printing. The growing focus on paperless offices has caused a steep decline in demand for printing systems, especially in developed countries. Additionally, with the proliferation of cloud-based services, businesses are shifting toward storing and sharing documents electronically, further decreasing the demand for physical printouts, thereby restricting the printers market expansion.

Market Opportunities

Rapid Growth of Emerging Economies to Boost Market Expansion

The rapid growth of emerging economies, particularly in regions such as Asia Pacific, South America, and the Middle East, offers a significant opportunity for the printer market. As these regions experience economic developments, urbanization, and digital transformation, the demand for printing solutions is expected to increase in the coming years. For instance, according to the source of Urbanet, the degree of urbanization in India grew by 2.3% in 2024 compared to 2023. Moreover, the rising number of small and medium-sized enterprises in the Asia Pacific region, is raising the demand for printers capable of producing monochrome or color output, further fueling growth in the market.

SEGMENTATION

By Type Analysis

Inkjet Observed Significant Growth Owing to Growing Expansion of E-commerce Fuels the Market Growth

Based on type, the market is divided into laser, inkjet, LED, and others. Others consist of dot matrix.

The inkjet segment dominated the market in terms of revenue by 46.53% in 2026. This segment is projected to grow at substantial growth during the forecast period due to the growing adoption of inkjet printer for home printing in remote work and online education programs. Additionally, the expansion of the e-commerce sector is further fueling the growth of the segment.

Laser is projected to grow at steady growth during the forecast period, owing to the large adoption of such printer from educational institutes and government offices. Additionally, major manufacturers are planning to launch new energy-efficient and eco-friendly systems printers to comply with environmental policies. All these factors positively contributed to the market.

The LED segment is anticipated to grow at moderate growth during the forecast period due to factors such as energy efficiency, long durability, and lower maintenance costs. Moreover, growth in the retail, logistics, and packaging sectors enhances the demand for these printers for monochrome or color printing, bolsters market growth.

The others segment, which includes dot matrix, is anticipated to grow at a decent growth rate during the forecast period. This is due to features such as being easy to operate, cost-efficient, eco-friendly, requiring less maintenance, and able to print multiple copies at a time.

To know how our report can help streamline your business, Speak to Analyst

By Technology Analysis

Server Technology Dominate the Market Owing to Rising Adoption from Government Offices, and Large Corporations

Based on technology, the market is classified into Serverless/cloud and server.

The server segment dominated the market in terms of share of in 2023 due to large demand from banks, government offices, and large corporations that need centralized printing solutions. Moreover, the growing trend of cloud-based printing solutions and IoT-enabled systems has further boosted the demand for server printers. The segment is expected to acquire 61.36%% of the market share in 2026.

Serverless printer, also called cloud printers, are anticipated to grow at a CAGR of 3.6% during the forecast period. This is due to their growing popularity, convenience of wireless and remote printing services, and rising demand for serverless printers across the U.S., Canada, and Mexico. Moreover, growing digitalization across various companies operating in Chile, Argentina, and Brazil creates the demand for the product, fueling the growth of the segment. For instance, according to IDC, around 44% of Latin American companies increased their cybersecurity investment owing to rising hybrid work and cloud services, which has, in turn, driven the demand for serverless printer.

By Output Type Analysis

Monochrome Printer Observed Significant Growth Owing to Various Benefits Associated

Based on output type, the market is segregated into monochrome and color.

The monochrome segment dominated the market in terms of revenue in 2023, and are anticipated to experience substantial growth during the forecast period. This growth is due to various benefits associated with printer, such as high volume printing at one time, lower operating cost, ease of use, high speed, long durability, and less maintenance compared to color printers. The segment is expected to hold a CAGR of 3.4% during the forecast period. In 2026, the monochrome segment is projected to lead the market with a 63.09% share.

Color printers are projected to grow steadily during the forecast period as they are generally adopted in the education, healthcare, and retail sectors for printing brochures, manuals, flyers, and posters. Moreover, the rise of personalized printing solutions across small businesses and the e-commerce sector fuels the demand for color printer and bolsters segment growth. The color segment is likely to acquire 51% of the market share in 2025.

By Application Analysis

Commercial Application Set to Dominate the Market Owing to Rising High Volume Printing From Commercial Sectors

Based on application, the market is categorized into residential, commercial, educational institutions, enterprises, government, and others. Others include recreational facilities.

The commercial segment held the largest market share in 2023 and is projected to grow at a significant growth rate during the forecast period. This growth is driven by the rising adoption of multifunctional and cloud-based printers in the e-commerce, commercial, and retail sectors, which fuels the market growth. Moreover, the rising demand for high-volume printing, which requires more printers for taking printouts, drives the growth of the segment. The segment is expected to hit 28.44% of the market share in 2026.

The residential sector is anticipated to grow at steady growth during the forecast period due to increased remote work and hybrid work policy models, which increased the demand for home printers. The segment is likely to exhibit a CAGR of 3.4% during the forecast period.

Educational institutions, governments, and enterprises are anticipated to grow at a moderate rate during the forecast period due to rising demand for centralized printing solutions and cloud printing integration. The need for physical document printing remains high, even with the shift toward digital learning tools.

The others segment includes recreational facilities and is projected to grow decently during the forecast period. This growth is due to rising demand for printers in sports complexes, turf, and stadiums, where they are used to make brochures, posters, and suggestion forms. All such factors are enhancing the demand for printers and driving market growth.

PRINTERS MARKET REGIONAL OUTLOOK

The market covers five major regions, namely North America, Europe, Asia Pacific, Middle East and Africa, and South America.

North America

North America Printers Market Share, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America region is anticipated to dominate the market during the forecast period, driven by increasing digitalization, technological advancements in printers, and a rising demand for high-quality printing solutions across residential, commercial, and industrial applications. Moreover, strong growth in the e-commerce industry has driven the demand for custom label and packaging printer, leading to an increased need for high-quality printer for labels, packaging materials, and barcodes for shipping and fulfillment activities. The region held the largest market value of USD 19.61 billion in 2025, and in 2026, the market value stood at USD 20.05 billion.

Download Free sample to learn more about this report.

The U.S. dominates the global printer market, owing to growth in digitalization and strong expansion of the e-commerce sector, which enhances the demand for printer. For instance, according to the Toronto Business Development Center, the e-commerce sector in the U.S. is projected to grow at a rate of 12.5% from 2022 to 2027. The U.S. market value is likely to hit USD 15.06 billion in 2026.

Asia Pacific

Asia Pacific is anticipated to grow at steady growth rate during the forecast period. The region is expected to be the second-largest market with a value of USD 15.24 billion in 2025, exhibiting the second-fastest CAGR of 7.8% during the forecast period. This growth is due to rising demand for printing systems across various sectors, such as residential, commercial, educational institutes, enterprises, and government premises. Moreover, major players engaged in offering new products and acquisitions as key developmental strategies to intensify the market competition. For instance, in September 2023, Fujifilm Asia Pacific Pte Ltd, a subsidiary of Fujifilm Business Innovation Corp, introduced the A3 C3371 R, an A3 color digital multifunctional printer capable of printing 35 pages per minute. This printer promotes energy conservation and offers print, scan, and copy options.

China dominates the market in the Asia Pacific region, owing to the rising adoption of multifunctional and technologically advanced voice-controlled-assistant-enabled printer. Moreover, the growth of the e-commerce sector across China has led to a surge in demand for printer used in labeling and barcode printing applications. For instance, in September 2024, Canon Inc. introduced a new series of printer which is operated with the usage of Amazon Alexa voice assistant system. The market in China is expected to hit USD 5.86 billion in 2026. On the other hand, India is projected to hit 2.49 billion and Japan is anticipated to hit USD 3.04 billion in 2026.

Europe

Europe is projected to be the third-largest market with a value of USD 13.66 billion in 2026 and to grow at a moderate growth during the forecast period, due to growing environmental concerns in the printing industry. Additionally, rising environmental awareness among the population and growing demand for customized printer solutions in countries such as Germany, France, and Poland, are creating greater demand for printer units, which fuels the growth of the printer market. The U.K. market is expected to reach USD 2.22 billion in 2025. On the other hand, the market in Germany is likely to hit USD 2.82 billion and France is likely to hit USD 2.19 billion in 2026.

Middle East & Africa

The Middle East & Africa market is likely to be the fourth-largest market with a value of USD 2.86 billion in 2026 and is expected to register moderate growth during the forecast period. It is owing to growth in the economy, rapid urbanization, and growing trend of digitization across GCC countries, Dubai, and Qatar, which creates a demand for printer solutions. The South Africa market is likely to hit USD 1.83 billion in 2025.

South America

South America is anticipated to experience decent growth during the forecast period, owing to rising growth in the e-commerce sector and urbanization in countries such as Chile, Brazil, and Argentina. The growing middle-class population in South American countries drives the demand for affordable printers, further contributing to the growth of the market.

KEY INDUSTRY PLAYERS

Major Players Engaged in Adopting Product Launches to Enhance their Market Competition

Major players such as Canon Inc., HP Inc., Brother Industries Ltd, and Konica Minolta Inc., are engaged in adopting product development, business expansion, and acquisition as key developmental strategies to intensify the market competition. For instance, in February 2023, Canon India, a subsidiary of Canon Inc., introduced a new G series PIXMA ink-efficient printer. This printer features low ink consumption, the ability to print large volumes, high precision, and easy maintenance. These strategic initiatives are aimed at intensifying their competitive position in the printer market.

Major Players in the Global Printers Market

To know how our report can help streamline your business, Speak to Analyst

List of Key Companies Studied:

- Brother Industries Ltd (Japan)

- Canon Inc (Japan)

- HP Inc (U.S.)

- Konika Minolta, Inc (Japan)

- Kyocera Corporation (Japan)

- Ninestar Corporation (China)

- Oki Electric Industry Co. Ltd (Japan)

- Ricoh Company Ltd (Japan)

- Seiko Epson Corporation (Japan)

- Xerox Corporation (U.S.)

- Lexmark Corporation (U.S.)

- Colorjet Group (India)

- Linx Printing Technologies (U.K.)

- Avision Inc (U.S.)

- Toshiba Tec Corporation (Japan)

- Fujifilm Holdings Corporation (Japan)

- Sharp Corporation (Japan)

- Control Print Ltd (India)

- Markem-Imaje India (India)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Epson, a printer technology provider, announced the expansion of SureColour V Series with the introduction of V1070, the first UV desktop printer. This is designed to bring the power of UV printing to small businesses at half the cost of desktop flatbed UV printer.

- August 2024: Brother Industries Ltd., a prominent technology leader, launched a new laser printer range designed to improve the productivity of SOHO, SMB, and corporate segments. The company offers compact to versatile printing devices catering to the needs of businesses. The powerful range offers versatile printing needs catered to various work settings and demands with an array of efficiency-boosting features.

- July 2024: Xerox Corporation, a prominent printer supplier, launched its Xerox Altalink C8200 and Xerox Altalink B8200 series. This new class of multifunction printers (MFP) comes with AI-assisted technology that automates repetitive and complex tasks, adapting to the evolving needs of the workplace. The AI-based algorithm enables users to quickly summarize documents, convert handwritten notes, and automatically redact sensitive documents.

- May 2024: Canon India, a leading digital imaging solution provider, launched six new cutting technologies in wide format printers. This company also introduced seven new color categories as a part of the imagePROGRAF GP Series, tailored to cater to the graphics market. The LUCIA PRO II pigment is intended to deliver exceptional quality in photographs and posters.

- February 2024: HP introduced the Officejet Pro series, designed to meet the printing needs of small and medium businesses in India. The company claimed that the latest range of printers offers convenient and sustainable printing solutions that help businesses enhance productivity during remote work.

REPORT COVERAGE

The report provides an in-depth analysis of the industry dynamics and competitive landscape. The report also provides market estimates and global forecasts based on type, technology, output type, application, and region. Moreover, it provides various key insights into recent industry developments in the market such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Growth Rate |

CAGR of 3.4% from 2026 to 2034 |

|

|

Unit |

Value (USD Billion), and Volume (Units) |

|

|

Segmentation |

By Type, By Technology, By Output Type, By Application, and By Region |

|

|

Segmentation |

By Type

By Technology

By Output Type

By Application

By Region

|

|

|

Key Market Players Profiles in the Report |

HP Inc (U.S.), Seiko Epson Corporation (Japan), Canon (Japan), Brother Industries Ltd (Japan), Ninestar Corporation (China), Xerox Holdings Corporation (U.S.), Ricoh Company Ltd (Japan), Kyocera Corporation (Japan), Konica Minolta Inc (Japan), and Oki Electric Industry Co. Ltd (Japan). |

|

Frequently Asked Questions

As per Fortune Business Insights, the market was worth USD 53.02 billion in 2025.

By 2034, the market size is expected to reach USD 71.09 billion.

The market is projected to grow at a CAGR of 3.4% during the forecast period (2026-2034).

The North America is expected to hold a dominant market share, with its value standing at 18.91 billion in 2025.

By type, the inkjet printers led the market in terms of revenue.

Rising urbanization, and growing trends of remote and hybrid work policies across the globe are the key factors driving market growth.

HP Inc, Seiko Epson Corporation, Canon, Brother Industries Ltd, Ninestar Corporation, Xerox Holdings Corporation, Ricoh Company Ltd, Kyocera Corporation, Konica Minolta Inc, and Oki Electric Industry Co. Ltd. are some of the top players in the market.

The top ten players in the market constitute 82% - 85% of the market, which is majorly owed to their brand name and presence in multiple regions.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us