E-Fuel Market Size, Share & Industry Analysis, By State (Liquid and Gas), By Fuel Type (E-diesel, E-methane, E-kerosene, E-ammonia, and Others), By Application (Automotive, Aviation, Industrial, Marine, and Others), and Regional Forecast, 2026-2034

E-Fuel Market Size

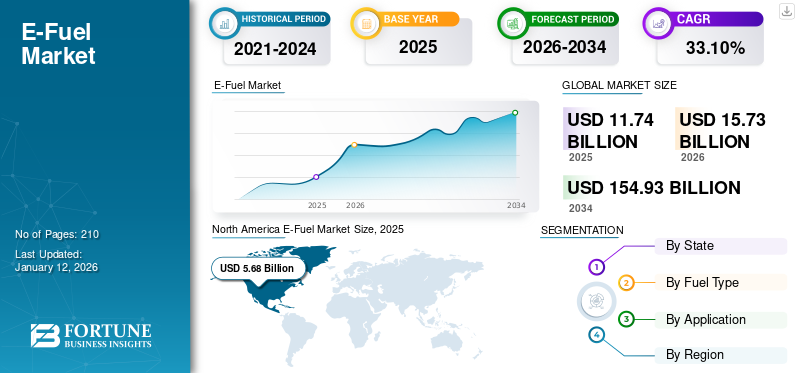

The global e-fuel market size was valued at USD 11.74 billion in 2025 and is projected to grow from USD 15.73 billion in 2026 to USD 154.93 billion by 2034, exhibiting a CAGR of 33.10% during the forecast period. North America dominated the E-fuel market with a market share of 48.38% in 2025.

E-fuel consists of hydrogen and carbon atoms similar to regular gasoline and diesel. It is a huge development as an alternative to conventional fossil fuels. Still, it is referred to as synthetic fuel produced using electricity, typically from renewable sources such as wind or solar power, to transform carbon dioxide and water into hydrocarbon fuels such as methane or synthetic gas. Synthetic fuels get their hydrogen from water and their carbon from the air through the carbon dioxide regeneration process. These fuels can be recycled in existing internal combustion engines without significant modifications and are considered a potential solution for reducing carbon emissions in the transportation sector. Production facilities, such as those in Chile, combine water and coal and reproduce the exact chemical structure of gas, diesel, or gas.

GLOBAL E-FUEL MARKET OVERVIEW

Market Size:

- 2025 Value: USD 11.74 billion

- 2026 Value: USD 15.73 billion

- 2034 Forecast Value: USD 154.93 billion, registering a CAGR of 33.10% (2026–2034).

Market Share:

- Regional Leader: North America held 48.38% market share in 2025, driven by strong regulatory support and rising demand across the automotive and aviation sectors.

- Fastest-Growing Region: Europe leads the global e-fuel market transformation through large-scale Power-to-X projects and Green Deal initiatives.

- Emerging Hub: Asia Pacific is expected to gain momentum by 2030 with hydrogen economy integration and e-fuel pilot projects in Japan, India, and South Korea.

Industry Trends:

- Power-to-Liquid (PtL) Expansion: Large-scale PtL and Power-to-Gas technologies drive the industrialization of synthetic fuel production.

- Aviation & Marine Decarbonization: E-kerosene, e-methanol, and e-ammonia adoption accelerates under global SAF and IMO mandates.

- Hydrogen Integration: Renewable hydrogen and carbon capture form the backbone of sustainable fuel synthesis.

- Circular Carbon Economy: E-fuels enable closed-loop carbon cycles, reducing lifecycle emissions across heavy industries.

- Ethanol E-Fuel Growth: Ethanol-based synthetic fuels gain traction as low-carbon blending alternatives, especially in the U.S. and Brazil.

Driving Factors:

- Stringent Climate Policies: Government frameworks such as the EU RED III, U.S. LCFS, and Japan’s Carbon Neutral Strategy 2050 boost adoption.

- Rising GHG Reduction Targets: Global decarbonization efforts drive e-fuel investments across automotive, aviation, and industrial sectors.

- 5G & IoT-Driven Industrial Automation: Digitized fuel plants utilize AI, CCUS, and IoT for optimized e-fuel production efficiency.

- Corporate ESG Mandates: Carbon-neutral targets and carbon trading mechanisms foster long-term e-fuel procurement strategies.

- Post-Pandemic Green Recovery: Infrastructure investments and stimulus packages accelerate renewable-based synthetic fuel projects.

The evolution of the e-fuel business indicates a structural movement toward circular carbon economies, where collected CO₂ and renewable hydrogen serve as the foundation for sustainable fuel synthesis. The e-fuel industry is predicted to shift from early-stage innovation to full-scale industrialization by the early 2030s, as costs in electrolyzers and carbon capture technologies continue to fall and large-scale demonstration facilities come closer to commercialization.

The COVID-19 pandemic has had both positive and negative effects on the development and diffusion of electronic fuel technologies. The pandemic interrupted supply chains around the world and affected the production and distribution of renewable energy sources, such as wind turbines, hydropower, and solar panels, needed to produce electrical fuels. This distribution made it difficult to expand the renewable energy infrastructure needed to produce electronic fuels. Despite the challenges, research and development of electronic fuel technology continued, and some companies and research institutes focused on optimizing the production of electronic fuel processes and increasing the efficiency of electronic fuel production.

In addition, post-pandemic recovery initiatives emphasizing green energy transition and decarbonization have reinvigorated investments in e-fuel pilot projects globally. Governments are integrating synthetic fuel technology into broader clean energy stimulus packages, further accelerating commercialization and scaling potential across Europe, North America, and the Middle East.

E-Fuel Market Trends

Increasing Consumer Awareness of the Need for Sustainable Energy Alternatives Due to Concerns about Air Quality issues

As consumers become more aware of air quality and environmental issues, the need for sustainable energy alternatives such as the product is increasing. For example, in areas with high air pollution, such as urban or industrial areas, consumers may increasingly choose electric vehicles instead of traditional gasoline or diesel. This change could result in reduced emissions of dangerous pollutants such as particulate matter and nitrogen oxides, improving local air quality and public health. In addition, as concerns about climate change grow, consumers may observe these fuels as a way to reduce transportation-related greenhouse gas emissions, increasing demand for this sustainable energy option. Furthermore, customers prefer products and services with a smaller carbon footprint as they are becoming more environmentally responsible. These fuels appeal to people who care about the environment because they offer a sustainable and renewable alternative to traditional fuels.

Rising participation in global carbon credit trading and offset programs is fostering corporate adoption of e-fuels, as enterprises seek to meet ESG (Environmental, Social, and Governance) compliance mandates. The expansion of voluntary carbon markets and government-backed green certificates is incentivizing businesses to integrate low-emission fuels into their operations.

Furthermore, the emergence of e-fuels as a bridging technology between conventional combustion engines and full electrification is positioning them as a strategic choice for industries that face barriers to electrification, such as aviation, shipping, and heavy-duty transport.

Download Free sample to learn more about this report.

Electronic Fuel Market Growth Factors

Introduction Of Environmental Law Promoting The Adoption E-Fuels Leading Market Growth

Environmental laws can play an important role in promoting the adoption of the product. Governments can implement regulations that require a certain percentage of renewable fuels in the total fuel supply, creating demand for electric fuels. For example, the Renewable Fuel Standard (RFS) in the U.S. requires a certain quantity of renewable fuels, including electric fuels, to be blended into transportation fuel each year. This legislation encouraged the production and use of electronic fuels, which helped reduce greenhouse gas emissions and promote sustainability in the transportation industry. In addition, environmental legislation can establish emission standards that encourage the use of cleaner fuels, such as electronic fuel, thus encouraging market adoption.

Furthermore, for the U.S. states, the California Carbon Fuel Standard (LCFS) is a regulation. It is a program that requires fuel suppliers to decrease the carbon content of automotive fuels sold in the state. This policy encourages the adoption of alternative fuels, including electric fuels, providing credits for fuels with a lower carbon intensity. As a result, electronic fuel manufacturers are encouraged to capitalize on technologies that reduce the carbon footprint of their products and thereby promote environmental sustainability.

Beyond national frameworks, transnational policies such as the European Union’s Renewable Energy Directive (RED III) and Japan’s Carbon Neutral Strategy 2050 have formally recognized e-fuels as viable contributors to renewable energy quotas. This recognition is propelling investments in large-scale electrolysis and Power-to-Liquid (PtL) facilities. Moreover, collaborations between energy producers, automotive OEMs, and chemical engineering firms are fostering ecosystem integration, aligning public regulation with private sector innovation.

Growing Demand for Reducing Greenhouse Gases Intensify the Demand for the Product

Global oil demand is expected to peak this decade as energy transitions accelerate and demand for transportation fuels slows. However, according to the International Energy Agency (IEA), due to continued growth in air travel and the use of petrochemical raw materials, total oil consumption (excluding biofuels) will increase to 102 mb/d by 2030, i.e., 5 mb/d above 2022 levels. To alleviate this harmful oil demand, alternative electronic fuel is a viable option in many countries. In addition, with the growth of the transport/automotive industry, an increase in greenhouse gases is inevitable. To reduce the impact of greenhouse gases, e-fuels appear promising for the near future.

Further, according to the IEA, private cars and vans accounted for more than 25% of global oil use and 10% of global energy-related CO₂ emissions in 2022. Light vehicles need to be reduced by around 6% annually by 2030. Electric cars are a key technology for reducing carbon dioxide emissions in road transport. Sales of passenger cars are expected to increase by approximately 8 to 10% in 2024, with 18% of all new cars sold. According to the IEA, if the growth of electric cars over the past two years continues to the year 2030, the CO₂ emission of cars will decrease under the Net Zero Emission (NZE) scenario. However, electric cars are not yet a global phenomenon. Outside of China, sales in developing and emerging economies have slowly recovered due to the relatively high purchase price of electric cars and the lack of infrastructure for charging. The increase in vehicle sales is expected to lead to a rise in GHG emissions, which can be reduced by using the product.

Sustainable Aviation Fuel (SAF) mandates across the EU and the U.S. are expected to generate substantial downstream opportunities for e-kerosene producers. Similarly, International Maritime Organization (IMO) initiatives toward decarbonization are pushing shipping firms to adopt e-ammonia and e-methanol blends as part of their long-term fuel transition strategies.

Additionally, the integration of e-fuels into hybrid energy systems is emerging as a major growth avenue. Industrial facilities are beginning to utilize e-fuels for off-grid power generation, leveraging their compatibility with hydrogen-based systems. This multi-sector adaptability positions e-fuels as a strategic enabler of the global energy transition, complementing renewable electricity generation and battery storage technologies.

RESTRAINING FACTORS

E-Fuel Production is Energy-Intensive and Expensive, Which May Hamper the Growth Of The Market

The production of so-called electric fuels (e-fuels) is energy-intensive. Therefore, the cost of electricity is very important for the levelized costs of fuels. It is, therefore, an attractive option to produce fuel in areas around the world where the fixed costs of renewable electricity are particularly low and high capacity utilization (CUP) is expected. Energy-dense fuels can then be transported to the energy consumption centers of the world at relatively low costs. The production of electronic fuels is still expensive as it depends on new technologies such as electrolysis, FT, DAC, and carbon capture. According to research conducted by the International Council on Clean Transportation, the production costs of e-jet fuel were estimated to be 7-10 times higher than traditional jet fuel. Thus, constant innovation is important to reduce costs.

Furthermore, the future e-fuel market has structural hurdles due to the scalability of renewable energy supply and the restricted worldwide capacity of electrolyzers. The existing lack of electrolyzer manufacture and heavy reliance on rare elements like iridium and platinum limit large-scale production possibilities and raise operational costs. Furthermore, because synthetic fuels have a lower energy density than fossil fuels, transportation and storage logistics are still expensive, limiting the commercial viability of the global e-fuel business in the short future.

Fluctuations in renewable electricity prices and limited government subsidies in developing regions are expected to limit near-term market growth. A lack of unified international policy for carbon pricing and emission certification systems has complicated long-term investment decisions in the ethanol e fuel market and associated synthetic fuel value chains. As a result, industry participants are focusing on collaborations and joint ventures to reduce technological risks and improve economies of scale.

E-Fuel Market Segmentation Analysis

By State Analysis

Extensive Use of Liquid Electronic Fuels to Propel Segment Growth

Based on state, the market is divided into liquid and gas.

The liquid segment dominates the market by holding a considerable e-fuel market with a share of 82.39% in 2026. The growth of the segment is driven by the widespread use of liquid electronic fuels, which do not require significant changes in current settings to make cars, generators, and industrial processes more efficient.

In case of gas, products derived from clean energy sources, such as renewable energy sources, are considered energy carriers such as hydrogen. Many fuels can come in form of gases, including alternatives such as e-methane or synthetic natural gas (often referred to as power-to-gas).Thus, these products can also act as energy storage solutions. However, hydrogen is sometimes considered an electronic fuel.

The liquid e-fuel category's dominance is reinforced by its compatibility with existing refinery and transportation infrastructure, which allows for a faster commercialization timeline than gaseous alternatives. E-diesel and e-kerosene, in particular, are expected to be significant growth drivers in the future e-fuel market due to their seamless integration into internal combustion engines and existing logistics networks.

The gaseous e-fuel segment is expected to grow significantly as countries improve hydrogen production capacity and storage technologies. This transition is consistent with government-led hydrogen strategies in Europe, Japan, and South Korea, establishing gaseous e-fuels as a valuable component of diverse clean energy portfolios. Strategic development of power-to-gas systems and methane synthesis plants will be critical in determining the long-term growth trajectory of the e-fuel market.

By Fuel Type Analysis

Growing Focus of the Automotive Sector on E-kerosene Market to Impel Segment Expansion

By fuel type, the market is divided into e-diesel, e-methane, e-kerosene, e-ammonia, and others.

The e-kerosene is the dominating segment in the market share of 68.85% globally in 2026. With limited opportunities to reduce carbon dioxide emissions and the EU's goal of reducing emissions by 35% by 2050, the e-kerosene market is a particular focus in the aviation and automotive sectors. The International Energy Agency (IEA) reported that the cost of e-kerosene could compete with biomass-based Sustainable Aviation Fuel (SAF) by the end of the decade with development in electrolyzer capacity and optimization in design. It estimates that the cost of low-emission e-kerosene can be reduced by USD 50/ GJ (USD 2,150/t), which is lower than the current level of Sustainable Aviation Fuel (SAF) produced from biomass.

Furthermore, e-diesel has promising growth in the future in the automotive sector. It has a number of potential advantages, including the capability to decrease greenhouse gas emissions from the transport sector. In addition, it can be used in existing diesel vehicles and generators without major modifications, making it a promising alternative to traditional fossil fuels.

Ethanol-based e-fuels are emerging as a competitive segment of the ethanol e fuel market, owing to the push for low-carbon liquid fuel alternatives in hybrid and plug-in hybrid vehicles. Ethanol e-fuel, when produced using carbon capture and renewable hydrogen pathways, is a scalable and cost-effective option for blending with conventional fuels, especially in regions with strong bioethanol production infrastructure, such as the United States and Brazil.

E-ammonia, on the other hand, is gaining popularity as a next-generation marine fuel because of its low carbon footprint and high volumetric hydrogen content. Collaborations between energy majors and maritime operators aim to commercialize ammonia-fueled vessels by 2030. These developments, combined with ongoing R&D investments in e-methanol production, are expected to greatly diversify the e-fuel market landscape in the coming years.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Rapid Usage of Low-emission Fuels to Bolster the Automotive Segment Growth

Based on application, the market is segmented into automotive, marine, industrial, aviation, and others.

The automotive segment is expected to be the largest shareholder in the e-fuel market during the forecast period, contributing 34.52% globally in 2026. Rapid deployment of low-emission fuels such as the product is considered critical to accelerating transport decarbonization. The road transport sector offers significant electrification opportunities, while the aviation and marine industries are still more dependent on fuel-based solutions for carbon removal. Fuels derived from electrolytic hydrogen or electronic fuels could be viable and will expand rapidly by 2030 based on the massive expansion of cheaper renewable electricity and falling costs of electrolyzers. Low-emission products can diversify options for reducing carbon dioxide emissions in aviation and shipping, and there is great synergistic potential with biofuel production, especially in the form of biogenic carbon dioxide use.

In the automotive industry, ongoing collaborations between OEMs and fuel technology companies are aimed at incorporating e-diesel and ethanol e-fuel blends into commercial fleets to meet emerging carbon neutrality targets. The increasing demand for synthetic fuels in long-distance transportation, logistics, and heavy-duty vehicles emphasizes the sector's critical role in the global e-fuel market transformation.

The aviation industry is expected to grow exponentially, driven by widespread adoption of e-kerosene as airlines transition to sustainable aviation fuel (SAF) compliance. The marine industry is also accelerating its transition to e-fuels such as e-ammonia and e-methanol, aided by new IMO emission regulations and investments in port-based refuelling infrastructure.

Meanwhile, the industrial application segment, notably in sectors such as steel, cement, and chemical manufacturing, is predicted to be a high-growth region of the future e-fuel market. To satisfy rigorous decarbonization targets, these businesses are looking into replacing fossil feedstocks with carbon-neutral e-fuels. The growing integration of e-fuels into combined heat and power (CHP) systems supports industrial energy efficiency advances, cementing their role as a crucial enabler of the worldwide energy revolution.

REGIONAL INSIGHTS

The global market has been analyzed in four key regions: North America, Europe, Asia Pacific, and the rest of the world.

North America

North America E-Fuel Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is the dominating region in the e fuels industry. The Infinium Company started the construction of a plant in Texas and got its first customer, Amazon. With the rise in demand by many e-commerce companies and government entities, the market in North America is poised to grow in the near future. The e-fuel market growth is due to government regulations and policy adoption in the automotive & aviation sectors.The e-fuel market in the U.S. is projected to grow significantly, reaching an estimated value of USD 31.36 billion by 2032, driven by the integration of renewable energy sources and decarbonization goals. The U.S. market is expected to reach USD 5.17 billion by 2026.

The United States and Canada are seeing more federal and state-level initiatives focused at increasing domestic e-fuel manufacturing capacity. The implementation of the Inflation Reduction Act (IRA) and Canada's Clean Fuel Regulations provides tax breaks and carbon credits to e-fuel manufacturers, increasing commercial viability. U.S. startups are investing in ethanol e fuel market research to convert CO₂ and green hydrogen into synthetic ethanol, strengthening the region's position in the future e fuel industry. Furthermore, strategic alliances among energy companies, airlines, and technology enterprises are establishing a vertically integrated supply chain that will facilitate the deployment of sustainable aviation fuels (SAF) and e-diesel alternatives throughout North America.

Europe

One of the most significant legislative measures to intensify EU states’ share in the European Union's energy mix and a central part of the Fit-for-55 climate compendium is the revision of the Renewable Energy Directive (RED). Except for solar energy, along with wind and hydropower, sustainable renewable fuels such as carbon-neutral products are accelerating, phasing out fossil fuels and thus significantly reducing greenhouse gas emissions. To exploit their full potential, the revised Renewable Energy Directive must establish clear incentives to invest in their large-scale production and create a level playing field for all relevant emission reduction technologies. The European Union will require electric cars to be 100% carbon neutral if they are sold after 2035, a draft document showed, as Germany pushed for electric cars to be exempted from the phase-out of new fuels. All first-hand cars sold in the EU from 2035 must be zero-carbon, according to the main EU climate policy for cars, agreed in advance by countries in 2022.

Europe continues to lead the global e-fuel market due to its strong policy framework, well-established renewable infrastructure, and accelerated adoption of Power-to-X technology. Countries such as Germany, Norway, and the Netherlands are leading industrial-scale e-fuel projects that are funded by EU Innovation Fund grants. The region's emphasis on e-kerosene and e-methanol production for aviation and maritime decarbonisation is consistent with the larger European Green Deal goals. Furthermore, ethanol e fuel market opportunities are expanding in Eastern and Central Europe as governments encourage synthetic ethanol blending to meet revised transportation emission standards. This regional momentum strengthens Europe's role as a technological and regulatory hub for the future e-fuel market. The Germany market is estimated to reach USD 1.13 billion by 2026.

Asia Pacific

Asia Pacific is experiencing a slow growth rate as many governments are delaying their crucial role in terms of law enforcement in environmental concerns. Singapore plans to import about 30% of its electricity from low-carbon sources by 2035, the Trade and Industry Minister said.

The Asia Pacific e-fuel market is expected to grow significantly during the forecast period as China, Japan, and South Korea invest in hydrogen and carbon capture utilization and storage (CCUS) technologies. Japan's "Green Growth Strategy" and South Korea's "Hydrogen Economy Roadmap" both see e-fuels as an important part of their long-term energy mix. India is exploring ethanol e-fuel market opportunities through public-private partnerships to scale CO₂-to-ethanol conversion projects using abundant biomass and renewable resources. These initiatives are expected to transform Asia Pacific into a high-potential region for e-fuel production by the end of the decade, especially in sectors where electrification is still limited.

German Clean Tech Company INERATEC GmbH goes global by signing a Memorandum of Understanding with Japanese engineering company Chiyoda Corporation (Chiyoda) to collaborate on production of electronic fuel. Together, they want to enter the markets of Japan and the Asia Pacific region to create joint electro-fuel projects. The partners promote INERATEC's innovative Power-to-X (PtX) technology in emerging and untapped markets. The Japan market is anticipated to reach USD 0.56 billion by 2026, the China market is forecast to reach USD 0.25 billion by 2026, and the India market is likely to reach USD 0.14 billion by 2026.

The rest of the world

In the rest of the world, Chile and Saudi Arabia are progressing with on-field production of the product, and other countries are far behind in terms of its use and transportation. In March 2024, INERATEC, a pioneer in the electronic fuel sector, together with the German Cooperation Agency (GIZ), announced significant results in the deployment of production facilities in Chile. The main results of the construction of the Chilean electro-fuel industry were presented at a key event in March 2024 in Santiago de Chile. This ambitious initiative is a signpost on the way to a sustainable future and highlights the power-to-liquid technology that will transform electronic fuel production in Chile and elsewhere.

The Middle East is emerging as a new center of excellence for e-fuel development, thanks to the availability of low-cost renewable energy and large-scale carbon capture projects. Saudi Arabia and the United Arab Emirates are incorporating e-fuel facilities into their national hydrogen strategies, establishing themselves as major exporters in the global e-fuel market. Latin America, led by Chile and Argentina, is also gaining traction as favorable solar and wind conditions lower production costs for synthetic fuels. Chile's Haru Oni project and new ethanol-based e-fuel pilot programs in Brazil demonstrate the region's growing influence in shaping the future e-fuel market. These developments show a geographic diversification of e-fuel production capacity, ensuring supply security and competitive cost dynamics in both emerging and developed markets.

Key Industry Players

Norsk E-Fuel is Expected to Account for a Noteworthy Market Share Owing to its Extensive Projects Working Across Europe

Norsk e-Fuel was founded in 2019 to promote the transition to renewable energy sources by producing electronic fuels, which are used in the industrial invention of sustainable fuels based on carbon dioxide and water. Aviation is one of the sectors where reducing emissions is particularly difficult, is done with great efforts by introduction of e-methanol, and it has been the fastest-growing transport sector in recent years. Together with the owners and carefully selected partners, Norsk e-Fuel plans to bring power-to-liquid production to an industrial scale.

Norwegian has entered a strategic partnership agreement with Norsk e-Fuel with the aim of securing the long-term sale of SAF and the participation of the company, in January 2024. The partnership will boost aircraft production and availability for a more sustainable aviation industry.

In addition to Norsk e-Fuel, major players driving the worldwide e-fuel industry include Infinium (U.S.), Porsche AG (Germany), Aramco (Saudi Arabia), and INERATEC GmbH (Germany). To fulfill the growing demand for low-carbon fuels in the automotive, marine, and aviation sectors, these firms are actively extending their regional presence through joint ventures and licensing agreements. Furthermore, big oil and gas companies are joining the ethanol e fuel market sector as part of diversification plans that fit with long-term decarbonisation goals. The evolving competitive environment, characterized by technology partnerships and pilot-scale deployments, demonstrates the future e fuel market's continuous industrialization.

List of Top E-Fuel Companies:

- Norsk e-Fuel AS (Norway)

- Infinium (U.S.)

- Porsche AG (Germany)

- Aramco (Saudi Arabia)

- ENOWA (U.S.)

- Audi AG (Germany)

- Ineratec GmbH (Germany)

- HIF Global (U.S.)

- Repsol (Spain)

- Orsted (Denmark)

- Sunfire GmbH (Germany)

- Uniper SE (Germany)

- Liquid Wind SE (Sweden)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Siemens Energy (Germany)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Argentina's Techint Engineering and Construction (Techint E&C) was selected by HIF Global to design and develop Chile's first large-scale electro-fuel plant. Primarily, the Argentinian project management and EPC firm is responsible for delivering the conceptual design and the development of Front-End Engineering Design (FEED) for the plant, announced HIF Global.

- March 2024: Infinium launched a commercial-scale green hydrogen e-fuel production facility in Corpus Christi, Texas. The site, known as Project Pathfinder, produces electronic fuels from captured carbon dioxide (CO2) and green hydrogen proprietary process that uses catalysts along with on-site electrolyzers. Infinium did not disclose the facility's electric fuel production capacity or green hydrogen and carbon dioxide input.

- November 2023: The first commercial export of green hydrogen-based electronic fuels produced by HIF Global in Chile was transported to the U.K. 24,600 liters of e-gasoline produced at the Haru Oni demonstration plant left Puerto Mardones before docking in St. Antonio before going to Great Britain, where Porsche used it.

- October 2023: Energy giant Saudi Aramco partnered with ENOWA to build a synthetic electric fuel (e-fuel) demonstration plant. The electronic fuel plant will produce 35 barrels of low-carbon synthetic gasoline per day using hydrogen from renewable sources and captured carbon dioxide to validate the commercial and technical feasibility of the project. It will be housed in ENOWA's Hydrogen Innovation and Development Center (HIDC).

- December 2022: Porsche and several partners began production of a climate-neutral e-fuel that aims to replace gasoline in vehicles with traditional combustion engines. The German automaker announced that a pilot plant in Chile had begun commercial operations for the production of alternative fuels. By the middle of the decade, Porsche plans to produce millions of gallons of electronic fuel. It plans to use the fuel initially in motorsports and at its performance centers, then for other uses in the coming years. Finally, the plan is to sell the fuel for distribution to oil companies and other consumers.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as prominent companies, product/service types, and leading product applications. Besides this, it offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 33.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By State, Fuel Type, Application, and Region |

|

Segmentation |

By State

|

|

By Fuel Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights study shows that the global market was USD 11.74 billion in 2025.

The global market is projected to record a CAGR of 33.10% during the forecast period.

The market size of North America stood at USD 5.68 billion in 2025.

Based on application, the automotive segment holds a dominating share of the global market.

The global market size is expected to reach USD 154.93 billion by 2034.

The introduction of environmental law promoting the adoption of the product and the growing demand for reducing greenhouse gases are key drivers of the market.

Norsk e-fuel SE, Infinium, Armaco, HIF Global, and others are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us