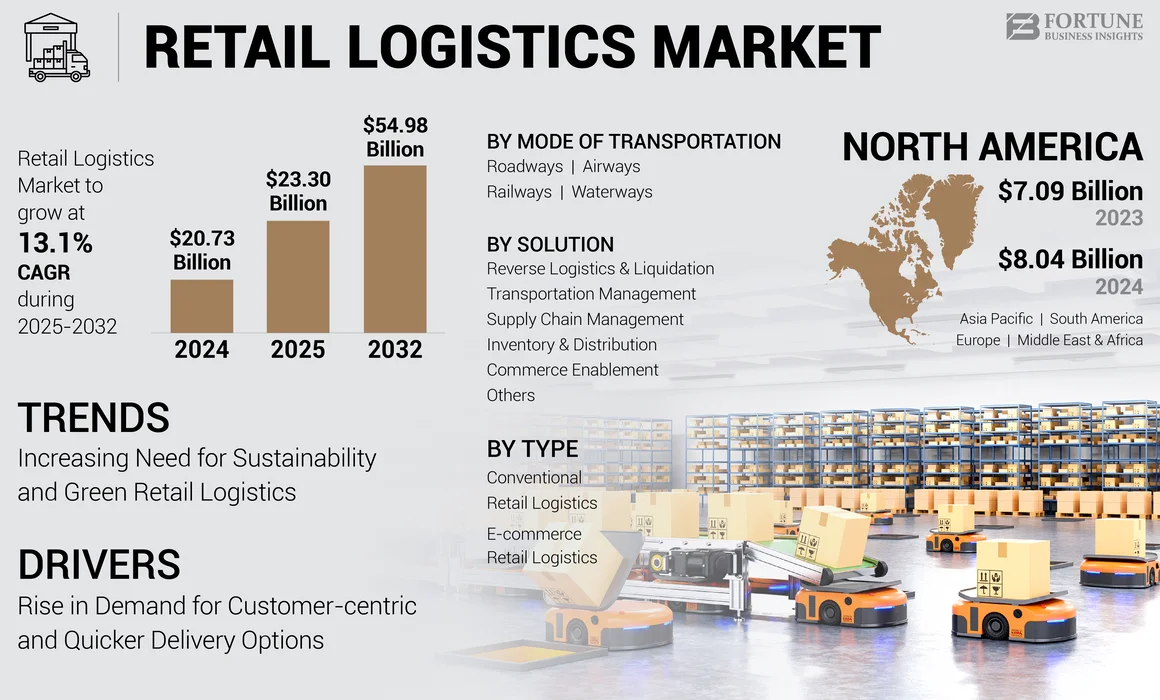

Retail Logistics Market Size, Share & Industry Analysis, By Type (Conventional Retail Logistics and E-commerce Retail Logistics), By Solution (Supply Chain Management, Inventory & Distribution, Reverse Logistics & Liquidation, Transportation Management, Commerce Enablement, and Others), By Mode of Transportation (Roadways, Airways, Railways, and Waterways), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global retail logistics market size was valued at USD 20.73 billion in 2024 and is projected to grow from USD 23.30 billion in 2025 to USD 54.98 billion by 2032, exhibiting a CAGR of 13.1% during the forecast period. North America dominated the retail logistics market with a market share of 38.78% in 2024.

Retail logistics refers to the management of the flow of goods from dealers to end-consumers. It comprises the procedure of order processing, inventory management, transportation, warehousing, and distribution. It involves coordination among various individuals and departments, simplifying and optimizing progressions. It leverages technology to ensure that the goods reach customers swiftly, without spending a significant financial capital.

The increasing need for hyper-personalized supply chains, minimized inventory loss, the requisite to provide multiple delivery choices, and improved reverse logistics increases contribute to the progress of retail logistics market growth. Thus, several market players such as XPO Logistics, Inc., DSV, FedEx, among others, are advancing and developing retail logistics solutions in the market.

Also, worldwide e-commerce is intensifying beyond national borders at an exceptional rate. Thus, it increases the demand for cross-border deliveries. For instance,

- According to industry experts, the e-commerce sector is expanding across the globe. It is anticipated that 33% of worldwide e-commerce spending will be cross-border by 2028.

Impact of Generative AI

Advanced Capabilities of Generative AI to Create Various Market Opportunities

Generative AI provides various capabilities, such as conversational AI, supplier performance benchmarking, improved training, and enhanced logistics management in retail. GenAI helps to improve supply chain management by offering more precise insights, enhanced operations, and empowering proactive decision-making.

GenAI also improves the accuracy of inventory distribution by examining demand at the store level. Warehouse and floor managers get access to actual-time understandings of stock levels, along with recommendations to adjust orders depending on changing sales patterns. Several innovations and developments integrated with GenAI capabilities are contributing to the progress of the market. For instance,

- In September 2024, UST launched the UST Retail Gen AI platform to transform retail operations with GenAI-based solutions. The platform allows businesses with end-ways operational improvements. The GenAI platform offers all-inclusive tools to enhance every aspect of retail operations, including logistics and customer experience.

RETAIL LOGISTICS MARKET TRENDS

Increasing Need for Sustainability and Green Retail Logistics to Fuel Market Progress

The retail sector plays an essential role in both the global environmental network and the economy network. Consumer responsiveness to the economic, environmental, and social influences of products and enterprises has become progressively significant. For instance,

- As per industry experts, retail holds for around 25% of worldwide greenhouse gas emissions, with the vast majority generated from the supply chain.

Retailers can adopt detailed due diligence, conduct lifecycle assessments, emphasize green packaging, ethical sourcing, collaborate with suppliers, and take many other steps with the help of retail logistics solutions. It helps them with improved brand reputation, enhanced customer loyalty, minimized risk, and competitive advantage. Thus, initiatives toward sustainability and a green economy fuel the progress of retail logistics solutions in the market.

MARKET DYNAMICS

MARKET DRIVERS

Rise in Demand for Customer-centric and Quicker Delivery Options to Drive Market Progress

The customer-centric methodology involves ensuring clear communication regarding order status, timely deliveries, and providing flexible delivery choices, among other things that aid customer satisfaction.

Effective last-mile delivery has become a crucial differentiator for retailers. Consumers expect quick deliveries and several choices, such as same-day or slotted delivery. Thus, businesses are turning to inventive solutions such as autonomous vehicles and drones for faster delivery. To meet such expectations, retailers need to adapt customer-driven last-mile solutions that provide active delivery options. For instance,

- As per the PTV Logistics Insights, 56% of shoppers give up on their shopping carts if the delivery time is too slow, and 61% are willing to pay more for same-day delivery choices.

- Average last-mile delivery costs account for 41% of total supply chain expenses, a major area of focus for innovation.

Thus, advancements and developments in retail logistics solutions drive the market progress.

MARKET RESTRAINTS

Lack of Inventory Visibility and Optimization can Hamper Market Growth

Accomplishing operational efficiency in the retail sector can be complex, particularly when there is a lack of visibility across significant business departments and silos of data exist within every business unit.

A lack of visibility in inventory management can affect both the total number of Stock-Keeping Units (SKUs) and where inventory is placed. It can hamper even the most strong retail fulfillment approaches. It also impedes the forecasting of future requirements of goods, which can lead to losses for companies.

Incorrect demand planning can result in stockouts or overstocking, affecting customer satisfaction and augmenting inventory costs. Projecting future demand needs modernized analytics and real-time data assimilation to fulfill consumer demands.

Thus, failure to accomplish inventory optimization can hamper retail logistics market growth.

MARKET OPPORTUNITIES

Integration of Predictive Analytics and Automation to Create Numerous Market Opportunities

Predictive analytics can help enhance inventory management by precisely forecasting customer demand and boosting inventory levels. Automation can transform delivery and warehousing processes, minimizing labor shortages and augmenting efficiency. These technologies empower retailers to manage logistics more efficiently, safeguarding timely order contentment and minimizing shipping costs.

Retailers are leveraging modernized analytics to modify their marketing strategies and enhance inventory management. In logistics, data-driven comprehensions help improve vehicle utilization, route planning, and whole operational proficiency. Various technologies, such as artificial intelligence-driven logistics capabilities, can dynamically adjust distribution for every center, improve shipments in real time, and eliminate unnecessary transfers between centers.

- In November 2024, Roambee enabled Tesco, the U.K. retailer, to accomplish a reduction in dwell times and improve stock precision across 3,000 locations with the help of its supply chain visibility and intelligence platform. The advanced solution leverages artificial intelligence and has offered Tesco actual-time visibility through 23,000+ distinctive container journeys. It covered more than 6.21 million miles, expanding its wide road and rail logistics network.

Integration of advanced technologies can open up numerous market opportunities.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Growing Preference for Online Shopping to Surge E-commerce Retail Logistics Progress

Based on type, the market is bifurcated into conventional retail logistics and e-commerce retail logistics.

E-commerce retail logistics is projected to grow with the highest CAGR during the forecast period, owing to the exponential rise in online shopping. With the e-commerce boom, the last-mile delivery procedure has become a vital service area for businesses in the logistics and transportation sector. Such factors increase the demand for e-commerce logistics in the market. For instance,

- In February 2025, RapidShyp collaborated with India Post on last-mile delivery of e-commerce in India. The partnership aims to offer around 19,000 postal pin code deliveries across India. The partnership allows the firm to incorporate its modernized logistics mechanism with India Post's reach, ensuring quicker and more trustworthy last-mile delivery facilities.

Conventional retail logistics accounted for the highest market share in 2024. Various benefits of traditional logistics include a simplified supply chain, better inventory management, enhanced profitability, better scalability, and others. Such advantages contribute to the higher market share of the segment. Moreover, most of the old and traditional consumers prefer shopping from offline retail stores, thereby increasing the need for the conventional retail logistics segment.

By Solution Analysis

Higher Return and Exchange Rates Increase Demand for Reverse Logistics & Liquidation

Various solutions for retail logistics include supply chain management, inventory & distribution, reverse logistics & liquidation, transportation management, commerce enablement, and others (procurement, etc.).

Reverse logistics & liquidation are anticipated to grow with the highest CAGR during the study period. The return and exchange of products is one of the prominent features preferred by online buyers. Reverse logistics is crucial for retailers as it helps to manage excess inventory, better handling of customer returns, sustainability, and cost savings. This factor increases the demand for reverse logistics & liquidation solutions in the market. For instance,

- As per the Richpanel Insights 2025, 54% of online shoppers state that free exchanges or free returns are the second major influence impacting the purchase from a brand.

- The average return rate of e-commerce is approximately 20-30%. For apparel around 10.01%, electronics 8.28%, jewelry 8.31%, and sports and outdoor goods 6.1%.

Supply chain management accounted for the highest market share in 2024. These include services such as inventory optimization, order management, and supplier collaboration platforms. Rising usage of advanced technologies such as RFID, GPS, and IoT sensors that help in real-time tracking logistics aids segment growth. Leveraging tracking data in logistics generates conditions for well-timed problem-solving as per their occurrence. It enhances supply chain management as it delivers a current database of data required for supply chain management, going from product delivery to customers.

By Mode of Transportation

Enhanced Benefits of Roadways to Propel Market Growth

By mode of transportation, the market is classified as roadways, airways, railways, and waterways.

Roadway mode of transportation dominates the market with the highest share. Road transport offers flexible routing, cost-effective options, and door-to-door service, making it a preferred mode, especially for last-mile delivery in urban areas. The higher market share is due to the flexibility and convenience of service, door-to-door service, minimized damage risk, appropriate internal transport mode, and many other benefits. Such benefits increase the usage of roadway transportation in retail logistics.

Waterway mode of transportation is anticipated to progress with the highest CAGR during the forecast period. Waterways aid in environmental sustainability as they have lower carbon emission rates, better safety as the accident rate is comparatively low, a larger capacity to carry goods, and improved flexibility when connecting different countries. These are used mainly for bulk transportation and long-distance haulage, offering cost advantages but slower delivery speeds. Thus, the usage rate of waterways for the transportation of numerous retail goods drives the segment growth. For instance,

- The usage of National Waterway 2 (Brahmaputra River) aids in cutting emissions by shipping goods more proficient than roadway transport.

Retail Logistics Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the Middle East & Africa, and South America.

North America

North America Retail Logistics Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the global market and has the highest market share. The presence of various key players, such as XPO Logistics, Inc., FedEx, C.H Robinson Worldwide, Inc., and APL Logistics Ltd., among others in the U.S., contribute to the region's retail logistics market share. Early technological adoptions such as automation, RFID, NFC, and smart sensors aid the market growth in the region.

The U.S. is a strong market supported by robust infrastructure, high internet penetration, and significant e-retail adoption. Logistics companies in the region are heavily investing in warehouse automation and real-time tracking technologies. Also, the adoption of advanced logistics solutions in Canada and Mexico drives market growth. For instance,

- In September 2024, Hellmann formed a contract logistics alliance with Lacoste, a fashion brand in Mexico. With the partnership, Hellmann handles the supply of forty-five retail locations and direct-to-consumer shipments through Mexico.

Europe

Europe is estimated to progress with a significant CAGR during the forecast period. The adoption of omnichannel approaches by retailers to deliver seamless experiences to customers, growing demand for last-mile delivery, streamlined flow of cross-border trade, and green logistics contribute to the progress of retail logistics in various countries of Europe. For instance,

- In March 2025, DHL and VinFast collaborated to offer 24-hour simplified management of its entire spare parts system as a fragment of a One-Stop Shop Logistic Solution. The partnership also empowers DHL to accelerate the delivery of vehicle parts within 24 hours, reducing customer interruption and consistently keeping VinFast VF 8 and VF 6 on European roads.

Asia Pacific

Asia Pacific is anticipated to grow with the highest CAGR during the study period, owing to the rise of e-commerce across various countries such as India, Singapore, Japan, South Korea, and others. The rise of consumers in India and South Korea fosters demand for effective logistics facilities to aid the progress of the retail sector. In addition, there is a growing adoption of technologies for real-time shipment tracking, route planning, customer satisfaction, and other activities. For instance,

- As per industry experts, approximately 51% of logistics enterprises have deployed map-based solutions with actual-time location data, predominantly for fleet tracking in Asia Pacific.

Middle East & Africa

The rise in digitization and automation across retail operations and supply chains drive the progress of retail logistics solutions in the Middle East & Africa, as well as South America. Also, the growing popularity of online shopping increases the demand for e-commerce logistics in Turkey, UAE, Brazil, South Africa, and other countries. Such factors enhance the market development in these regions.

COMPETITIVE LANDSCAPE

Key Industry Players

New Product Innovations and Collaborations by Key Players Magnify Business Expansion

Players such as DSV, FedEx, Kuehne+Nagel International, XPO Logistics, Inc., C.H Robinson Worldwide, Inc., and APL Logistics Ltd are introducing new tools to enhance their position in the market. These players are leveraging modernized technological developments, addressing varied consumer demands, and attaining a competitive edge. They prioritize enhancing solution offerings and strategic alliances, mergers, and investments to strengthen their portfolio.

LIST OF KEY RETAIL LOGISTICS COMPANIES PROFILED

- DSV (Denmark)

- XPO Logistics, Inc. (U.S.)

- Kuehne+Nagel International (Switzerland)

- FedEx (U.S.)

- C.H Robinson Worldwide, Inc. (U.S.)

- APL Logistics Ltd (U.S.)

- Nippon Express (Japan)

- United Parcel Service (U.S.)

- DHL International GmbH (Germany)

- A.P. Moller – Maersk (Denmark)

- FarEye Technologies, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2025: DCS Group, a distributor of beauty, health, and household brands, collaborated with XPO Logistics. With the partnership, DCS Group leverages XPO's IT tools to enhance its customer experience, along with the logistics provider's proficiency in the rapidly growing consumer goods (FMCG) sector.

- March 2025: FedEx collaborated with Blue Yonder for the 'Box-Free' returns program. FedEx launched a service to simplify it so that customers can send in returns. Consumers can return products without requiring to have packaging on hand or print labels.

- November 2024: Kuehne+Nagel acquired a maximum share of IMC Logistics, a U.S.-based supplier of marine drayage services. Kuehne+Nagel acquired 51% of privately held IMC, which focuses on end-to-end transport solutions to or from rail hubs or seaports, customer amenities, and inland in the U.S.

- April 2024: XPO introduced a wide-ranging fourth-party logistics (4PL) solution to worldwide crop protection provider UPL in a three-year agreement. UPL provides solutions for the complete agriculture system with a sales presence in over 130 countries, along with various production sites with key hubs in Belgium and France.

- April 2024: APL Logistics collaborated with Toys "R" Us Asia, to open a local distribution hub in Shenzhen. The alliance helps in improving the effectiveness and efficiency of Toys "R" Us Asia across supply chain operations.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications of the solution and logistics services. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 13.1% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Solution

By Mode of Transportation

By Region

|

Frequently Asked Questions

The market is projected to record a valuation of USD 54.98 billion by 2032.

In 2024, the market was valued at USD 20.73 billion.

The market is projected to grow at a CAGR of 13.1% during the forecast period of 2025-2032.

Reverse logistics & liquidation is expected to lead the market with the highest CAGR.

Rise in demand for customer-centric and quicker delivery options to drive market progress.

DSV, XPO Logistics, Inc., Kuehne+Nagel International, C.H Robinson Worldwide, Inc., FedEx, and APL Logistics Ltd are the top players in the market.

North America is expected to hold the highest market share.

By mode of transportation, waterways are expected to grow with the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us