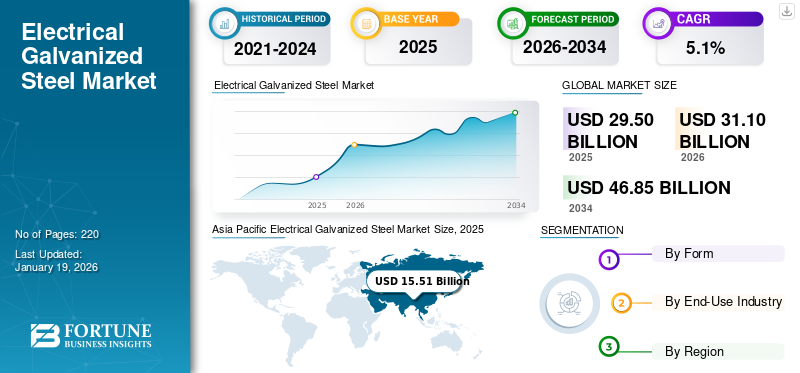

Electrical Galvanized Steel Market Size, Share & Industry Analysis, By Form (Sheet and Coil), By End-Use Industry (Construction, Automobile, Consumer Goods, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global electrical galvanized steel market size was valued at USD 29.5 billion in 2025 and is projected to grow from USD 31.1 billion in 2026 to USD 46.85 billion by 2034, exhibiting a CAGR of 5.1% during the forecast period. Asia Pacific dominated the electrical galvanized steel market with a market share of 53% in 2025.

Electrical galvanized steel is a type of steel coated with a thin layer of zinc through an electroplating process, offering excellent corrosion resistance, smooth surface finish, and formability. It is widely used in appliances, automotive components, and construction materials due to its enhanced durability and aesthetic appeal. The market is witnessing robust growth driven by rising consumer electronics and automotive demand, growing need for corrosion-resistant materials, and expanding industrial infrastructure. The push for sustainable building practices and the growing use of galvanized steel in electric vehicle manufacturing are expected to propel market expansion further. The major manufacturers operating in the market include ArcelorMittal, NIPPON STEEL CORPORATION, POSCO, JFE Steel Corporation, and China Baowu Steel Group.

MARKET DYNAMICS

MARKET DRIVERS

Rising Infrastructure Development and Industrial Growth to Boost Demand for Electrical Galvanized Steel

The increasing focus on infrastructure development and urban expansion drives the demand for electrical galvanized steel across various sectors. Its excellent corrosion resistance, durability, and smooth surface finish make it a preferred material for construction, electrical equipment, and automotive applications. With governments investing in large-scale projects such as metro networks, smart cities, and energy infrastructure, the need for reliable and long-lasting steel continues to rise. Additionally, advancements in galvanizing technology and the shift toward sustainable building materials are further accelerating product adoption. As a result, infrastructure and industrial growth are expected to drive the global electrical galvanized steel market growth.

MARKET RESTRAINTS

Fluctuating Raw Material Prices and High Capital Requirements to Limit Market Growth

The growth of the market is constrained by the volatility in raw material prices, particularly zinc and steel coils, which are critical in the galvanization process. Sudden price fluctuations impact production costs and profit margins, making it difficult for manufacturers to maintain pricing stability and long-term planning. In addition, the industry requires substantial capital investment to set up advanced galvanizing units, maintain modern infrastructure, and ensure compliance with stringent quality and environmental standards. These high initial costs pose a significant entry barrier for new players and strain smaller manufacturers, limiting market expansion over the forecast period.

Download Free sample to learn more about this report.

ELECTRICAL GALVANIZED STEEL MARKET TRENDS

Rising Adoption of Circular Practices and Sustainable Zinc Recovery

The market is witnessing a steady move toward sustainability through implementing circular production practices. Companies increasingly adopt zinc recovery methods from production scrap and end-of-life materials to reduce dependency on raw resources and lower environmental impact. This shift is driven by stricter environmental regulations and a growing push for cleaner, more responsible manufacturing. By integrating advanced recycling technologies, the industry is improving material efficiency, cutting production waste, and supporting long-term environmental and economic goals.

MARKET OPPORTUNITIES

Adoption of Advanced Coating Technologies and Smart Manufacturing to Accelerate Market Growth

The increasing implementation of advanced coating technologies and the integration of smart manufacturing processes are expected to create significant opportunities in the market. Innovations in coating methods are enhancing product durability and resistance to corrosion, and allowing for more specialized applications across various industries. At the same time, the shift toward smart manufacturing, including automation and data-driven production, is helping manufacturers improve efficiency, reduce operational costs, and ensure consistent product quality. These technological advancements enable the industry to meet evolving customer demands and support large-scale production, ultimately driving the market’s growth.

- According to India Brand Equity Foundation (IBEF), India produced 125.32 million tons of crude steel in 2023, making it the world’s second-largest producer. This strong production capacity indicates significant potential for value-added steel products such as electrical galvanized steel, which are increasingly in demand across the infrastructure, automotive, and consumer appliances industries.

MARKET CHALLENGES

Environmental Compliance and Substitution by Alternative Materials Challenge Market Growth

The market faces increasing pressure from strict environmental regulations due to emissions and waste produced during manufacturing and zinc coating processes. To meet these standards, manufacturers must invest in cleaner production methods and advanced technologies, which can significantly raise operational costs. Additionally, the rising use of alternative materials such as aluminum and composite-coated metals, which offer similar durability, is challenging the demand for galvanized steel. These factors create obstacles for market growth and push companies to focus on innovation and sustainable production practices.

Segmentation Analysis

By Form

Sheet Segment Led Due to Its Increased Adoption in Construction and Appliance Manufacturing

Based on form, the market is segmented into sheet and coil.

The sheet segment held a dominant global electrical galvanized steel market share in 2024, driven by its wide usage in the construction and consumer goods industries. Electrical galvanized steel sheets are known for their excellent surface finish, corrosion resistance, and formability, making them ideal for roofing, cladding, ductwork, and electrical enclosures. Rising urban infrastructure projects, smart buildings, and the growing popularity of energy-efficient HVAC systems fuel demand. Moreover, increasing applications, including home appliances such as refrigerators, washing machines, and ovens, contribute significantly to segment growth.

The coil segment also accounts for a substantial share of the market. Coils are preferred in the automobile and electronics sectors due to their ease of transportation, storage, and processing. Automotive manufacturers use galvanized steel coils for body panels, benefiting from their high strength-to-weight ratio and corrosion resistance. The trend toward lightweight and electric vehicles is boosting the need for reliable and efficient materials. Additionally, advancements in automated coil processing and increased demand for customized steel solutions in manufacturing further fuel the segment’s expansion.

By End-Use Industry

Construction Segment Held Dominance with Rising Infrastructure and Urban Development

Based on the end-use industry, the market is segmented into construction, automobile, consumer goods, and others.

The construction segment held a dominant global market share in 2024, due to the rising demand for corrosion-resistant and durable materials in both residential and commercial projects. Rapid urbanization, smart city initiatives, and increased investment in infrastructure and commercial buildings contribute to segment growth. Moreover, electrical galvanized steel is gaining popularity in roofing, wall panels, structural framing, and HVAC systems due to its strength, longevity, and cost-efficiency. The growing green and energy-efficient building trend further enhances product adoption across the construction sectors.

In the automobile segment, the product demand is fueled by the rising production of lightweight, fuel-efficient, and corrosion-resistant vehicles. Electrical galvanized steel is extensively used to manufacture vehicle body panels, frames, and structural components. The electric vehicle (EV) production surge and global shift toward sustainable transportation propel demand for this high-performance material. Additionally, strict safety standards and the need for crash-resistant materials are pushing automakers to increase usage.

The consumer goods segment is witnessing steady growth due to increased application in home appliances, electronics, and furniture. The material’s aesthetic finish, formability, and resistance to rust make it ideal for refrigerators, air conditioners, washing machines, and microwave ovens. Rising disposable income, rapid electrification in emerging economies, and the trend toward modern interiors and compact appliances further increase demand in this segment.

Electrical Galvanized Steel Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Electrical Galvanized Steel Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region dominates the global electrical galvanized steel market with a valuation of USD 15.51 billion in 2025 and USD 16.43 billion in 2026, driven by rapid industrial growth, expanding urban infrastructure, and rising demand across automotive, appliances, and construction sectors. Countries such as China and India are witnessing significant investments in manufacturing and infrastructure development, creating strong demand for corrosion-resistant and high-performance steel products. Government-led initiatives in smart cities, renewable energy projects, and electric mobility further accelerate the adoption of electrical galvanized steel. Additionally, rising population, increasing consumer spending, and steady foreign direct investments are supporting industrial production continues to support market expansion across the region.

North America

The growth of the market in North America is driven by infrastructure upgrades, industrial expansion, and increasing demand from the construction and automotive sector. Government investments in modernizing transportation networks, power infrastructure, and public utilities in countries such as the U.S. and Canada fuel the need for durable, corrosion-resistant steel. The rising focus on energy-efficient building and sustainable construction practices further boosts demand. Additionally, the region’s strong automotive industry and increasing residential renovations are contributing to the steady rise of the market across the region.

The market in the U.S. is growing due to growing demand for electric vehicles (EVs), renewable energy, and grid upgrades which require high-performance motors and transformers. Electrical galvanized steel improves efficiency by reducing energy loss in motors and transformers. This makes it critical for utilities and automakers who want to meet energy efficiency standards.

Europe

In Europe, the market is shaped by strict environmental regulations and a strong emphasis on sustainable industrial practices. The demand for corrosion-resistant and energy-efficient materials is rising due to ongoing infrastructure renovation, green building initiatives, and smart city developments. Countries such as Germany and France actively invest in advanced manufacturing and construction technologies, driving the adoption of high-quality galvanized steel products. The region’s well-established infrastructure ensures a steady demand for the product across key industries.

Latin America

In Latin America, the market is witnessing growth driven by ongoing infrastructure development, growing automotive production, and rising demand from the construction and consumer goods sectors. Countries such as Brazil and Mexico are attracting significant investments in housing, transportation, and industrial expansion, which is fueling the need for durable, corrosion-resistant steel. Additionally, increasing interest in electric vehicles and energy-efficient technologies further supports regional market growth.

Middle East & Africa

In the Middle East & Africa, the market is expanding due to increased infrastructure investments, industrial growth, and rising automotive production. Countries such as UAE and Saudi Arabia are leading demand through large-scale construction projects, transportation development, and expansion of energy sectors. Additionally, economic diversification efforts and growing support for domestic manufacturing further boost the demand for the product in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Investments in R&D to Introduce New Products by Key Companies to Maintain Their Dominating Positions in Market

The global electrical galvanized steel market is highly competitive. Major participants are focusing on mergers & acquisitions, technological innovations, and capacity growth to boost their market presence. POSCO, JFE Steel Corporation, ArcelorMittal, NIPPON STEEL CORPORATION, and China Baowu Steel Group are some of the key players in the market. These players compete based on purity levels, cost-effective processing methods, supply chain integration, and regional dominance while investing in sustainable extraction technologies to address environmental concerns. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, increasing competition in the industry.

LIST OF KEY ELECTRICAL GALVANIZED STEEL COMPANIES PROFILED

- ArcelorMittal (Luxembourg)

- NIPPON STEEL CORPORATION (Japan)

- LIENCHY LAMINATED METAL CO., LTD. (Taiwan)

- POSCO (South Korea)

- MST Steel Inc. (U.S.)s

- Nucor Tubular Products (U.S.)

- JFE Steel Corporation (Japan)

- CGEI STEEL (India)

- China Baowu Steel Group (China)

- voestalpine Stahl GmbH (Austria)

KEY INDUSTRY DEVELOPMENTS

- September 2022: Nucor Corporation announced a USD 425 million investment to build flat-rolled galvanizing lines in South Carolina to support growing demand in sectors such as automotive and consumer durables, which are key application areas for electrical galvanized steel. The project is expected to enhance the company’s value-added steel production capabilities.

- February 2022: Nucor Corporation completed the acquisition of a majority ownership in California Steel Industries for USD 400 million, giving the company expanded production capacity of over 2 million tons of finished steel annually, including galvanized and cold-rolled products used across construction, automotive, and energy industries.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.1% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Form · Sheet · Coil |

|

By End-Use Industry · Construction · Automobile · Consumer Goods · Others |

|

|

By Region · North America (By Form, By End-Use Industry, and By Country) o U.S. (By End-Use Industry) o Canada (By End-Use Industry) · Europe (By Form, By End-Use Industry, and By Country) o Germany (By End-Use Industry) o U.K. (By End-Use Industry) o Italy (By End-Use Industry) o France (By End-Use Industry) o Russia (By End-Use Industry) o Rest of Europe (By End-Use Industry) · Asia Pacific (By Form, By End-Use Industry, and By Country) o China (By End-Use Industry) o India (By End-Use Industry) o Australia (By End-Use Industry) o Indonesia (By End-Use Industry) o Thailand (By End-Use Industry) o Malaysia (By End-Use Industry) o Philippines (By End-Use Industry) o Vietnam (By End-Use Industry) o Rest of Asia Pacific (By End-Use Industry) · Latin America (By Form, By End-Use Industry, and By Country) o Brazil (By End-Use Industry) o Mexico (By End-Use Industry) o Colombia (By End-Use Industry) o Argentina (By End-Use Industry) o Rest of Latin America (By End-Use Industry) · Middle East & Africa (By Form, By End-Use Industry, and By Country) o Turkey (By End-Use Industry) o Saudi Arabia (By End-Use Industry) o UAE (By End-Use Industry) · Rest of Middle East & Africa (By End-Use Industry) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 31.1 billion in 2026 and is projected to reach USD 46.85 billion by 2034.

In 2025, the market value stood at USD 15.51 billion.

The market is expected to exhibit a CAGR of 5.1% during the forecast period of 2026-2034.

The key factors driving the market are infrastructure projects and manufacturing advancements.

ArcelorMittal, NIPPON STEEL CORPORATION, POSCO, JFE Steel Corporation, and China Baowu Steel Group are the top players in the market.

Asia Pacific dominated the market in 2025.

Rising demand for corrosion-resistant materials, growing applications across the construction and automotive industry, advancements in coating technologies, and increasing infrastructure investments in emerging economies are key factors expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us