Engineering Plastics Market Size, Share & Industry Analysis By Type (Polyamide (PA), Polycarbonate (PC), Styrene Copolymers (ABS and SAN), Polyoxymethylene (POM), Thermoplastic Polyester, and Others), By End-use Industry (Electrical & Electronics, Packaging, Automotive, Industrial and Machinery, Building and Construction, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

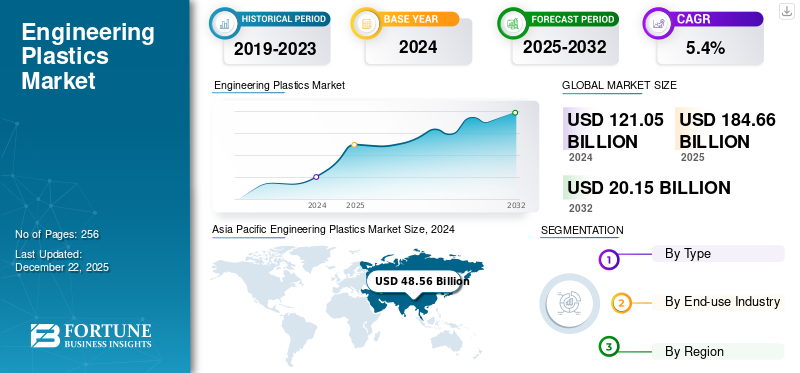

The global engineering plastics market size was valued at USD 127.86 billion in 2025 and is projected to grow from USD 135.04 billion in 2026 to USD 205.11 billion by 2034 at a CAGR of 5.4% during the forecast period (2026-2034). Asia Pacific dominated the engineering plastics market with a market share of 40% in 2025.

Engineering Plastics are high-performance polymers with superior mechanical, thermal, and chemical properties compared to commodity plastics. They are used in demanding applications such as automotive (for lightweight components), electrical and electronics (for connectors and housings), packaging (for durable films), industrial machinery (for precision parts), building and construction (for pipes and fittings). They are also applied in the medical and aerospace industries.

Key market drivers include automotive lightweighting, growth in the electronics sector, and increasing demand for sustainable materials. BASF SE, Covestro AG, Celanese Corporation, SABIC, and Dupont are the key players in the market.

Engineering Plastics Market Trends

Rising Need for High-Performance Materials Boosts Market Expansion

The healthcare sector has emerged as a transformative force in the engineering plastics market, driven by the requirements for biocompatible, sterilizable, and high-performance materials. Medical device manufacturers increasingly rely on specialized plastics that can withstand repeated sterilization cycles while maintaining structural integrity and chemical resistance. These materials are essential in producing critical medical equipment, from surgical instruments to diagnostic devices, where reliability is paramount.

Regulatory compliance and patient safety drive demand, with stringent FDA standards shaping material selection. Additionally, the shift toward minimally invasive procedures requires lightweight, durable plastics that enable the design of smaller, more ergonomic medical instruments without compromising the strength and precision required for complex healthcare delivery.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Rise of Smart Home Technologies and Wearable Devices to Fuel Market Growth

The electronics and electrical sector is a key driver of demand in the market, leveraging its specialized properties for cutting-edge applications. High-performance materials such as polycarbonates and polyetheretherketone are prized for their thermal stability and electrical insulations, making them essential for components in consumer electronics, telecommunications, and smart devices.

As devices trend toward miniaturization and increased sophistication, engineering plastics deliver the precision and durability needed for intricate parts such as connectors and circuit board housings. Their inherent flame-retardant properties ensure compliance with strict safety standards in high-volate environments, enhancing reliability across applications.

The rise of smart home technologies and wearable devices further amplifies the need for lightweight, resilient plastics capable of enduring frequent use and environmental challenges. Additionally, the industry’s focus on sustainability spurs innovation in eco-friendly material, aligning with regulatory requirements and consumer expectations for environmentally responsible electronics.

With rapid growth, especially in emerging markets experiencing increasing technology adoption, this sector underscores the critical role of engineering plastics. Their versatility continues to shape market trends, reinforcing their importance in meeting the evolving demands of the electronics industry.

Market Restraints

High Production Costs and Recycling Limitations are Hindering Product Adoption

The high cost of manufacturing polyamide, PEEK, and polycarbonates significantly restricts overall market demand. These materials require complex production processes and specialized raw materials, making them more expensive than conventional plastics or metals. This cost barrier deters adoption in cost-sensitive industries such as automotive, construction, and consumer goods, where manufacturers often prioritize affordability over advanced performance. As a result, scalability is limited, particularly in price-competitive markets, slowing widespread use despite the material’s durability and versatility.

Environmental concerns and limited recycling capabilityes also pose major challenge to the engirneered plastics market. Many of these plastics are difficult to recycle, which goes against global sustainability goals and stringent regulations pushing for circular economies. This limitation reduces adoption in sectors such as electronics and packaging, where eco-friendly alternatives are increasingly favored. The lack of efficient recycling infrastructure and sustainable options further hampers the engineering plastics market growth, as manufacturers seek greener materials to meet regulatory and consumer demands.

Market Opportunities

Increasing 3D Printing Innovations to Create Market Opportunities

The rise of 3D printing technology is unlocking significant opportunities for the engineered plastic market. High-performance materials, valued for their strength, flexibility, and thermal resistance, are increasingly utilized in additive manufacturing to create complex, customized components. This innovation is transforming industries such as aerospace, medical, and automotive, where tailored parts for prototypes, implants, or lightweight structures are in high demand. The precision of 3D printing allows intricate designs that traditional manufacturing struggles to achieve, further expanding application scope.

Morever, 3D printing with engineering plastics supports sustainability by reducing materials waste, aligning with global eco-friendly trends. As the technology becomes more cost-effective and accessible, industries are adopting it for rapid prototyping and small-batch production, driving demand for specialized plastics formulated for additive manufacturing. This trend opens new market segments, positioning engineering plastics as critical enablers of innovation and efficiency across diverse sectors, fostering significant growth opportunities.

Market Challenges

Supply Chain Volatility Disrupts Engineering Plastic Production and Pricing

Raw material price fluctuations and supply disruptions create operational instability for manufacturers. Essential plastic materials remain susceptible to geopolitical tensions, shifting energy policies, and production disruptions. Additionally, raw material shortages, transportation and logistics isses, evolving trade policies further complicate procurement planning.

These supply chain uncertainties force manufacturers to maintain expensive safety stock and implement costly hedging strategies, which directly increase production costs. The resulting price volatility makes it difficult for companies to offer stable pricing to customers, while supply delays disrupt manufacturing capabilities.

Trade Protectionism and Geopolitical Impact

Trade protectionism such as tariffs and import restrictions, disrupts the engineered plastics market by increasing costs and limiting access to raw materials. Policies such as China’s antidumping duties on U.S. and EU plastics elevate prices, affecting manufacturers reliant on global supply chains. This forces companies to seek costlier domestic alternatives or face production delays, hindering market growth.

Geopolitical tensions, including the U.S.-China trade war and regional conflicts, exacerbate supply chain vulnerabilities. These disruptions affect the availability of petrochemical feedstocks critical for engineered plastics, causing price volatility and production uncertainties, particularly in industries such as automotive and electronics.

Segmentation Analysis

By Type

Styrene Copolymers (ABS & SAN) Segment to Dominate the Market Owing to Its Toughness

Based on type, the market is classified into polyamide (PA), polycarbonate (PC), styrene copolymers (ABS and SAN), polyoxymethylene (POM), thermoplastic polyester, and others.

The styrene copolymers (ABS and SAN) segment is projected to dominate the market with 32.48% in 2026, due to their superior toughness, moldability, and excellent surface finish. Widely utilized in consumer electronics, automotive interiors, and household appliances, these materials are favored for their cost-effectiveness and versatility in applications requiring both functionality and aesthetic appeal. Their dominance stems from widespread adoption across industries seeking reliable, visually appealing components.

Thermoplastic polyester, such as PET and PBT, represents one of the fastest-growing segments, propelled by their recyclability and strong chemical resistance. Growing demand for PET in packaging, particularly for beverage bottles and films, meets the need for lightweight, durable solutions, while PBT’s growing use in automotive electrical components, such as connectors, supports the rise of electric vehicles, further driving the segment’s growth.

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Electrical & Electronics Segment Dominates the Market Due to Increasing Use in Device Miniaturization, 5G Growth, and Smart Technology

In terms of end-use industry, the market is segmented into electrical & electronics, packaging, automotive, industrial and machinery, building and construction, and others.

The electrical & electronics industry dominates the engineering plastics market share with 35.63% in 2026, leveraging materials such as polycarbonates and ABS for their insulation, flame resistance, and durability. These properties make them essential for components such as connectors and housings. Market dominance is reinforced by trends such as device miniaturization, the growth of 5G, and the rise of smart technologies, all of which support compact, high-performance materials.

The packaging segment is the fastest-growing segment, propelled by rising demand for lightweight, durable plastics such as PET for bottles and films. These materials meet the needs of consumer goods and food industries by providing versatile, cost-effective solutions for global markets. Their adaptability drives rapid adoption across diverse packaging applications.

Engineering Plastics Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Engineering Plastics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the market, valued at USD 51.53 billion in 2025. The rapid expansion of industries such as packaging, electrical & electronics, food & beverages in countries such as China, India, Thailand, and Singapore is a key growth driver. Government initiatives aimed at improving electrical & electronics further support market expansion in this region. The Japan market is projected to reach USD 8.81 billion by 2026, the China market is projected to reach USD 20.43 billion by 2026, and the India market is projected to reach USD 11.71 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

The North American market is witnessing growth due to increasing consumer awareness of hygiene and safety, particularly in electrical & electronics and food packaging applications. Innovations in antimicrobial technologies and advanced materials are expected to bolster regional demand. In the U.S., growth is further driven by key sectors such as automotive, electronics, and construction, seeking lightweight, durable, and cost-effective materials. Emphasis on fuel efficiency, electric vehicles, and sustainability initiatives further boosts adoption, alongside advancements such as 3D printing and bio-based plastics. The U.S. market is projected to reach USD 28.08 billion by 2026.

Europe

The European market is primarily driven by the automotive and transportation sector's increasing demand for lightweight, high-performance materials that enhance fuel efficiency and reduce emissions, particularly with the growing shift. Additionally, the expanding electrical and electronics industry also fuels demand for durable, lightweight plastics for advanced devices and components, driven by technological advancements and the trend toward miniaturization. The UK market is projected to reach USD 6.88 billion by 2026, and the Germany market is projected to reach USD 8.61 billion by 2026.

Latin America

Demand in Latin America is driven by increasing consumption of food and nonfood bottles, containers, and automotive components. Increasing per capita income, coupled with the growth of the consumer goods industry, is expected to impact demand for automotive and other consumer products. Additionally, increasing demand for plastic products across various end-use industries further supports market expansion in the region.

Middle East & Africa

In the Middle East and Africa, demand is driven by massive infrastructure development. The World Bank predicts that infrastructure investment in the region will exceed USD 150 billion annually by 2025, with engineering plastics increasingly used in construction applications such as pipe systems. The region’s expanding oil and gas sector contributes to growing demand for engineering plastics, while growth in the automotive industry further boosts consumption of high-performance thermoplastic components.

Competitive Landscape

Key Market Players

Sustainability and Supply Pressures to Reshape Market Position of Leading Players

Driven by rising sustainability goals and supply chain risks, major players are localizing production and investing in circular materials. Feedstock security is being strengthened through backward integration, while PCR and bio-based resins are gaining momentum. Closed-loop recycling technologies and the global restructuring of POM operations are enhancing scalability, regulatory alignment, and responsiveness in high-performance engineering plastic applications. BASF SE, Covestro AG, Celanese Corporation, SABIC, and Dupont are the key players in the market.

List of Key Engineering Plastics Companies Profiled

- BASF SE (Germany)

- SABIC (Saudi Arabia)

- DuPont (U.S.)

- LG Chem (South Korea)

- Covestro AG (Germany)

- Celanese Corporation (U.S.)

- Mitsubishi Engineering-Plastics Corporation (Japan)

- Asahi Kasei Corporation. (Japan)

- Toray (Japan)

- Ensinger (Germany)

Key Industry Developments

- May 2025: BASF would acquire Alsachimie JV to secure the supply of polyamide 6.6, strengthening its engineering plastics portfolio. This integration enhances raw material security, competitiveness, and European market presence, especially in automotive, electronics, and industrial applications.

- April 2025: Covestro launched TUV-certified PCR polycarbonates with 50% recycled content derived from end-of-life headlamps. Developed with GIZ Volkswagen and NIO, the material is validated for future vehicles, advancing automotive circularity and ensuring compliance with sustainability regulations.

- February 2025: Covestro expanded its low-carbon medical-grade polycarbonate portfolio, introducing mass-balanced RE polycarbonates. These solutions reduce the CO2 footprint in healthcare applications while maintaining quality equivalent to fossil-based grades.

- February 2025: Toray developed a proprietary chemical recycling process for nylon 66, enabling complete depolymerization and closed-loop reuse. This innovation supports circularity and raw material security in engineering plastics, meeting rising sustainability standards and reducing dependence on virging polyamide sources.

- January 2025: Covestro is investing in expanding its Hebron, Ohio, site to add multiple custom polycarbonate compounding lines. The facility would serve the automotive, healthcare, and electronics markets in North America.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, engineering plastic types, and End-use Industry. Besides this, it offers insights into the current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 5.4% from 2026 to 2034 |

|

Segmentation |

By Type · Polyamide (PA) · Polycarbonate (PC) · Styrene Copolymers (ABS and SAN) · Polyoxymethylene (POM) · Thermoplastic Polyester · Others |

|

By End-use Industry · Electrical & Electronics · Packaging · Automotive · Industrial and Machinery · Building and Construction · Others |

|

|

By Region · North America (By Type, By End-use Industry, and By Country) o U.S. (By End-use Industry) o Canada (By End-use Industry) · Europe (By Type, By End-use Industry, and By Country) o Germany (By End-use Industry) o France (By End-use Industry) o U.K. (By End-use Industry) o Italy (By End-use Industry) o Rest of Europe (By End-use Industry) · Asia Pacific (By Type, By End-use Industry, and By Country) o China (By End-use Industry) o India (By End-use Industry) o Japan (By End-use Industry) o South Korea (By End-use Industry) o Rest of Asia Pacific (By End-use Industry) · Latin America (By Type, By End-use Industry, and By Country) o Brazil (By End-use Industry) o Mexico (By End-use Industry) o Rest of Latin America (By End-use Industry) · Middle East & Africa (By Type, By End-use Industry, and By Country) o Saudi Arabia (By End-use Industry) o South Africa (By End-use Industry) o Rest of Middle East & Africa (By End-use Industry) |

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 135.04 billion in 2026 and is projected to reach USD 205.11 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 48.56 billion.

Recording a CAGR of 5.4%, the market will exhibit steady growth during the forecast period (2026-2034).

In 2024, electrical & electronics is the leading segment in the market by end-use industry.

Growing demand from the electrical & electronics industry is a key factor driving the growth of the market.

Asia Pacific is poised to capture the highest market share during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us