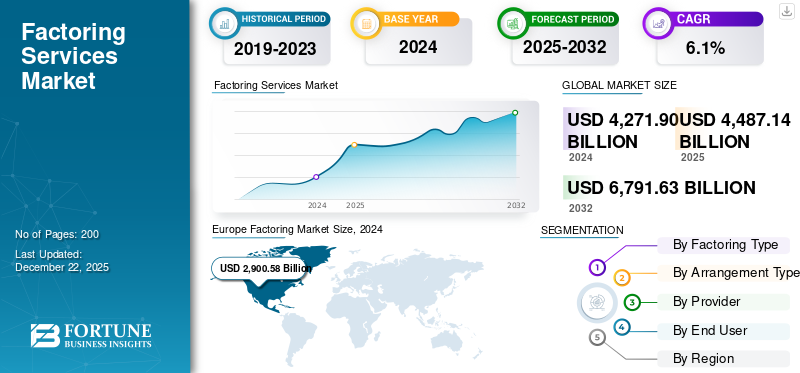

Factoring Market Size, Share & Industry Analysis, By Factoring Type (Domestic and International), By Arrangement Type (Recourse and Non-recourse), By Provider (Bank and NBFC), By End User (Manufacturing, Transportation & Logistics, Healthcare, Construction, and Other), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global factoring market size was valued at USD 4,487.14 billion in 2025 and is projected to grow from USD 4,722.58 billion in 2026 to USD 7,768.18 billion by 2034, exhibiting a CAGR of 6.40% during the forecast period. Europe dominated the market with a share of 67.80% in 2025.

The market refers to the financial service in which businesses sell their accounts receivable to a third party (a factor) to access immediate working capital and improve cash flow. It plays a vital role in supporting small and medium-sized enterprises (SMEs) by offering an alternative to traditional bank loans, especially in industries with longer payment cycles. Factoring helps businesses maintain liquidity, manage operational expenses, and invest in growth by unlocking funds tied up in unpaid invoices. With the increasing digitization of financial services, the market has witnessed advancements such as automated credit risk assessment and integration with enterprise systems. While the COVID-19 pandemics disrupted business operations and cash flow cycles, it also opened the doors for flexible financing options that increased factoring usage to help businesses find financial sustainability.

Key market players such as HSBC, BNP Paribas Factor, and Deutsche Bank invest heavily in automation, cloud infrastructure, and customer-centric tools to streamline operations and offer value-added services.

MARKET DYNAMICS

Factoring Market Trends

Rising Digital Transformation and Fintech Integration Drive Market Evolution

The digital transformation in financial services has significantly influenced the market, accelerating the adoption of cloud-based platforms and AI-driven risk assessment tools. Traditionally, manual and document-heavy factoring is revolutionized by integrating blockchain for real-time invoice verification, artificial intelligence for dynamic credit scoring, and automated client onboarding processes. These innovations enable faster, more secure transactions and reduce operational overheads for factoring firms. Fintech platforms are pivotal in reshaping the factoring landscape by offering seamless connectivity between buyers, suppliers, and financial institutions. This factor leads to greater transparency, enhanced liquidity management, and improved decision-making.

Market Drivers

Rising Demand for Working Capital Among SMEs Drives Factoring Adoption Across Sectors

The increasing demand for short-term financing solutions among small and medium-sized enterprises (SMEs) drives the factoring market growth. Traditional bank financing can be difficult because of strict collateral requirements and drawn-out funding processes, so SMEs use factoring instead. This process immediately provides SMEs with cash by converting accounts receivable into liquid funds, helping maintain business continuity, invest in growth, finance their inventory cycle, and have better liquidity.

The significant growth of digital trade and e-commerce platforms has also increased demand for invoice factoring, especially in manufacturing, retail, and consumer goods logistics supply chains. Factoring solutions that integrate with ERP systems and use real-time invoice data support seamless credit disbursement and enhance cash flow visibility for businesses globally.

Market Restraints

Regulatory Complexity and Credit Risk Limit Market Expansion in Emerging Economies

Although there are promising growth opportunities, the market limitations are largely connected to regulatory fragmentation, credit risk management, and financial literacy. The regulations affecting factoring are widely divergent, and many countries do not have formal legal regulations or a framework for electronic invoices. This is why cross-border transactions can be cumbersome and legally uncertain, adding complexity and risk. This factor creates a barrier for multinational companies to enter and limits the scalability of a factoring business at a provincial level.

Factoring offers inherent buyer default risk. In developing countries where the economic conditions are more volatile and the trade documentation is less transparent, factoring companies will either have higher NPLs and non-performing loans or to create significant risk reserves to cover their credit exposures. Furthermore, the limited adoption of credit scoring technologies and divergent supplier ecosystems tend to challenge underwriting, resulting in a very conservative lending policy and limited portfolio diversification.

Market Opportunities

Rising Digital Factoring Platforms and Embedded Finance to Open New Revenue Streams

The changing landscape of fintech infrastructure presents several opportunities for the factoring industry. Embedded finance and API development solutions enable third-party platforms (e-commerce portals, supply chain networks, ERP software) to provide working capital financing at the point of transaction. This allows providers to offer something new and provide service distribution, reaching into markets that are usually under-serviced and switching from traditional banking channels.

Moreover, blockchain-based invoice verification and AI-powered credit engines allow for greater trust, speed, and scalability of cross-border factoring. With international trade volumes projected to grow steadily over the next decade, digital trade finance ecosystems provide a compelling growth corridor for businesses looking to serve export-oriented SMEs, who are seeking faster turnarounds and less risk associated with fraud.

SEGMENTATION ANALYSIS

By Factoring Type

Ease of Compliance and Risk Mitigation Drives Domestic Factoring Dominance

By factoring type, the market is segmented into domestic and international.

The domestic segment holds the highest factoring market with a share of 74.89% in 2026. This dominance is largely due to the ease of regulatory compliance, lower transaction risks, and the comfort businesses find in dealing within familiar legal and cultural frameworks. Domestic factoring is especially favored by small and medium-sized enterprises seeking reliable short-term financing within their own countries.

On the other hand, the international segment is emerging as the fastest-growing. The increasing globalization of trade, the rise in cross-border transactions, and the demand for export-import financing are propelling the growth of international factoring. As more companies engage in global commerce, they are turning to international factoring to mitigate payment risks and ensure smooth cash flow across borders.

By Arrangement Type

Demand for Risk Protection in Businesses Leads to Non-Recourse Segmental Growth

By arrangement type, the market is segmented into recourse and non-recourse.

Non-recourse factoring leads the market with a share of 54.10% in 2026. It appeals to many businesses because it protects them from the risk of customer non-payment, as the factor predicts the credit risk. Protection from the risk of customer non-payment is extremely beneficial in uncertain economic periods or with new and less established customers. As businesses gain a growing recognition of risk management, the need for non-recourse arrangements is surging.

Recourse factoring continues to be a popular type of factoring, especially among companies focused on expense management. However, recourse factoring has limitations, as there is no protection if the customer defaults; the client is still liable. As a result, while recourse factoring will continue to be part of the market growth activity of factoring as a model, it will recede as non-recourse is growing at a faster rate.

By Provider

Banks Lead the Market due to Strong Networks and Low Cost Capital

By provider, the market is segmented into bank and NBFC (Non-Banking Financial Company).

Banks hold the largest market with a share of 87.37% in 2026, as they have a strong position due to their long-standing relationships and networks, ability to lend owing to their reputation, and access to very low-cost capital. Banks are also optimal for many companies seeking factoring solutions.

However, the overall highest growth rate in this market is held by the non-banking financial companies (NBFC). The growth of NBFCs has been linked to their lower costs, ability to make quicker decisions, and customization or considerable flexibility of services, as competition favors smaller or newer businesses seeking alternatives to secure financing from banks, where they have stronger lending guidelines regarding lending to non-bank businesses. Not only will NBFCs take advantage of existing relationships in their local markets, but their ability to leverage digital solutions to add efficiency to all aspects of their process, combined with factors including the continued evolution of alternative lenders, will help NBFC's overall importance grow in this case.

By End User

To know how our report can help streamline your business, Speak to Analyst

Demand for Working Capital in Supply Chains to Lead Manufacturing Segment Growth

By end user, the market is segmented into manufacturing, transportation & logistics, healthcare, construction, and other.

The manufacturing sector holds the largest market contributing 29.62% globally in 2026, among the end user, as it relies heavily on working capital to run long supply chains, high-volume production cycles, and inventory costs. Manufacturers often wait for delayed payments from buyers, so factoring is a valuable option for them to maintain liquidity and run their operations.

The healthcare service sector is expected to be the fastest-growing segment. A larger pool of medical providers, hospitals, and clinics are demanding more flexibility in financing, as they receive delayed payments from insurance companies or governmental organizations. The need for consistent cash flow to operate business costs and investment operations in medical establishments is supporting their use of factoring.

The transportation and logistics sector makes up a major chunk of the market, with factoring helping users manage supply networks where cash-flow gaps arise due to long economic payment cycles to freight brokers or shippers. The construction sector also utilizes factoring services. Many contractors utilize this financing option for project-based or phased billings, where payments are often delayed, primarily because of cash flow management.

The others segment includes industries such as retail, IT services, and wholesale trade, where companies use factoring to manage challenges associated with difficult seasonal demand patterns, lengthened credit terms, or rapid growth periods requiring flexibility in available funding.

FACTORING MARKET REGIONAL OUTLOOK

Europe

Europe Factoring Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market owing to the region's effective regulatory oversight, strong financial infrastructure, and established trade networks. Europe dominated the global market in 2025, with a market size of USD 3,041.21 billion. The region's strong position is supported by the economic integration of EU member states and the widespread adoption of structured credit systems that favor receivable-based financing. Germany, Italy, the U.K., and France are among those countries with strongly developed factoring industries due to their extensive manufacturing and export-based industries. Using digital financial technologies, including automated invoicing and ERP-integrated platforms, adds even greater efficiency and transparency to transactions. With high bank and non-bank provider involvement, Europe remains at the forefront of innovation, compliance, and scalability in the global market. The UK market is projected to reach USD 325.94 billion by 2026, and the Germany market is projected to reach USD 142.11 billion by 2026.

Download Free sample to learn more about this report.

Factoring is a common financial tool in France, especially for small and medium-sized companies looking to sustain their cash flow. The conducive legal framework and advanced banking sector facilitate factoring, and digital solutions make the business concept easier for potential clients and funders.

North America

Factoring is gaining momentum in North America as businesses increasingly seek flexible funding alternatives to traditional credit. In the U.S., a strong commercial sector and the rise of fintech-driven platforms have significantly improved access to receivables financing, especially for mid-sized and growth-oriented companies. The U.S. market is projected to reach USD 3,784.02 billion by 2026.

South America

In South America, factoring is growing as a viable financing option because businesses have difficulty accessing traditional credit. Economic volatility and increased trade activities are fueling demand, while fintech developments make the service more accessible to under-serviced markets.

Middle East & Africa

Factoring is becoming more established in the Middle East & Africa as enterprises search for trusted methods to finance continued operations and avoid payment delays. Diversifying local economies, increased trade, and better financial infrastructure gradually introduce factoring in key sectors as an auxiliary financing avenue.

Asia Pacific

In Asia Pacific, factoring is now a relevant approach for businesses that wish to manage receivables and balance liquidity in a region with some of the fastest-growing economies. Emerging technologies, increasing digitalization of everything, continued emphasis on small and medium enterprises (SMEs), and innovators are pushing the market toward more modern tech-enabled financing solutions. The Japan market is projected to reach USD 39.26 billion by 2026, the China market is projected to reach USD 56.39 billion by 2026, and the India market is projected to reach USD 30.28 billion by 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Digital Transformation Initiatives Are Driving Operational Innovation and Risk Reduction in Receivables Finance

The market is very competitive and combines well-respected banking institutions and specialized financial services institutions. Some of the major industry players include BNP Paribas, Société Générale, Deutsche Bank, HSBC, Citibank, UniCredit, and Crédit Agricole, along with dedicated factoring companies such as Bibby Financial Services, Hitachi Capital, and Eurobank Factors. These institutions offer a variety of receivables finance solutions across industries and sizes of businesses. Many players focus on digital transformation, such as AI, blockchain, and ERP integration, to innovate operationally, decrease risk, and better manage of cash flow. Other approaches to developing the position and reach of their market include strategic partnerships, targeting expansion in emerging markets, and building new fintech capabilities.

Long List of Companies Studied (including but not limited to)

- BNP Paribas Factor (France)

- Société Générale (France)

- Crédit Agricole (France)

- UniCredit (Italy)

- Deutsche Bank (Germany)

- HSBC Global Trade and Receivables Finance (U.K.)

- Citibank (U.S.)

- Banco Santander S.A. (Spain)

- Eurobank Factors (Greece)

- CaixaBank (Spain)

- Raiffeisen Factor Bank (Austria)

- Bibby Financial Services (U.K.)

- JP Morgan Chase (U.S.)

- Wells Fargo Capital Finance (U.S.)

- American International Group (AIG) (U.S.)

- ING Commercial Finance (Netherlands)

- China Construction Bank (China)

- Industrial and Commercial Bank of China (ICBC) (China)

- Mizuho Financial Group (Japan)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Lenvi collaborated with e-trusco's ANACONDA platform to combine continuous risk monitoring and invoice verification for receivables finance portfolios, improving fraud prevention and operational efficiency throughout the lending process.

- February 2025: Lenvi partnered with QUALCO to integrate its risk factor solution into QUALCO's ProximaPlus platform, enhancing real-time risk monitoring, fraud detection, and automated risk scoring for receivables and supply chain finance portfolios, helping lenders improve risk management and compliance.

- December 2024: Société Générale Factoring partnered with fintech CRX Markets to enhance supply chain finance offerings in Europe. The partnership integrates CRX Markets' digital platform and Société Générale's financial expertise, aiming to simplify and scale working capital solutions for large corporate clients, remove barriers to entry, and improve efficiency.

- February 2024: Tradewind Finance extended a USD 38 million factoring facility to a European steel manufacturer, enabling the funding of its largest single shipment to date, nearly USD 16 million for a full vessel of square billets. This move accentuates Tradewind's commitment to supporting the commodities sector and scaling financing solutions in line with client growth.

- March 2023: BNP Paribas collaborated with fintech Hokodo to launch a digital Buy Now, Pay Later solution for B2B transactions, offering instant credit checks, financing, and risk management to support flexible payment terms for business sellers.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, factoring type, and leading end users of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Factoring Type

By Arrangement Type

By Provider

By End User

By Region

|

|

Companies Profiled in the Report |

BNP Paribas Factor (France), Société Générale (France), Crédit Agricole (France), UniCredit (Italy), Deutsche Bank (Germany), HSBC Global Trade and Receivables Finance (U.K.), Citibank (U.S.), Banco Santander S.A. (Spain), Eurobank Factors (Greece), ING Commercial Finance (Netherlands) |

Frequently Asked Questions

The global market is projected to reach USD 7,768.18 billion by 2034.

In 2025, the global factoring market was valued at USD 4,487.14 billion.

The market is projected to grow at a CAGR of 6.40% during the forecast period.

The domestic segment leads the market in terms of share.

Rising demand for working capital among SMEs is a key factor driving market’s adoption and growth across sectors.

HSBC, BNP Paribas Factor, and Deutsche Bank are the top players in the market.

Europe holds the highest market share.

By end user, the manufacturing segment leads the market in terms of share

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us