Forensic Technology Market Size, Share & Industry Analysis, By Type (Product {Instruments, and Reagents & Consumables} and Services), By Application (DNA Analysis, Drug Testing/ Toxicology, Blood Analysis, Biometrics, and Others), By Technique (Chemical Electrophoresis, Polymerase Chain Reaction, Next Generation Sequencing, and Others), By End User (Forensic Laboratories, Pharmaceutical & Biotechnology Companies, and Others), and Regional Forecast, 2024-2032

Forensic Technology Market Overview

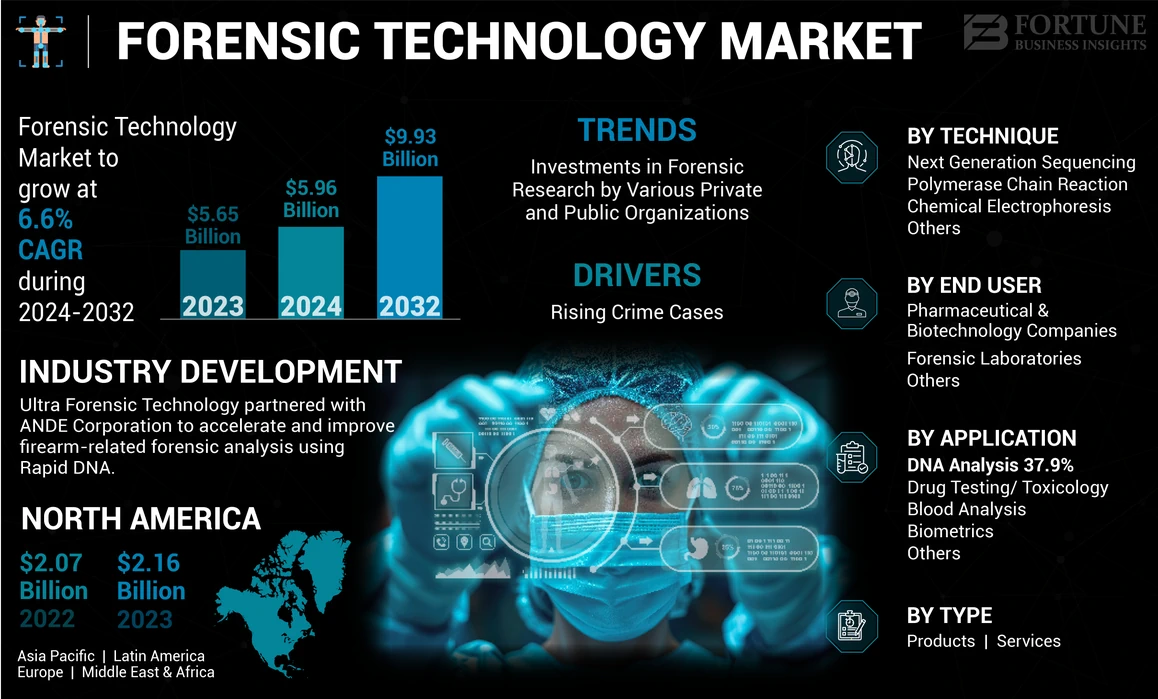

The global forensic technology market size was valued at USD 5.65 billion in 2023. The market is projected to grow from USD 5.96 billion in 2024 to USD 9.93 billion by 2032, exhibiting a CAGR of 6.6% during the forecast period. North America dominated the forensic technology market with a market share of 38.23% in 2023.

Forensic technology is a growing field that uses a variety of technologies to solve crimes and investigate crime scenes. The escalating instances of murder, theft, sexual assault, and homicide are driving the demand for forensic science technologies. A recent report by the United Nations Office on Drugs and Crime (UNODC) in 2017 showed that the average rate of murders was 6.1 per 100,000 individuals worldwide. Furthermore, the U.S. was amongst the topmost countries for this crime, followed by Africa and Asia. Additionally, the growing volume of criminal activities has resulted in an increasing number of unsolved cases, highlighting the need for the development of new forensic technologies to address these ongoing investigations.

- In October 2023, the Government of Canada allocated USD 15 million toward creating a unique Pan-Canadian genome library. Investments by government entities stimulate the development of research projects, leading to an increased need for tools and techniques that are essential for data analysis.

In terms of the impact of the COVID-19 pandemic, the global market witnessed negative growth due to the implementation of several lockdown measures. This resulted in the postponement or suspension of many ongoing criminal investigations. Furthermore, a drop in the number of crimes committed was observed in 2020. Since 2021, owing to the positive outcomes observed, forensic technology has expanded, which is anticipated to help the market grow steadily during the forecast period.

Global Forensic Technology Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 5.65 billion

- 2024 Market Size: USD 5.96 billion

- 2032 Market Size: USD 9.93 billion

- CAGR: 6.6% from 2024–2032

Market Share:

- Region: North America dominated the market with a 38.23% share in 2023. This is driven by the widespread availability of companies providing forensic technology solutions, a strong distribution network, and a growing number of programs from government and non-government organizations that are helping to boost the market’s expansion.

- By Application: DNA Analysis held the largest market share in 2023. The segment's dominance is attributed to an increasing number of companies entering collaborations to offer innovative and efficient DNA analysis products across the globe.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan is seeing market growth due to an increasing number of criminal cases, which is boosting awareness and demand for advanced forensic tools and technologies.

- United States: The market is fueled by a high number of criminal cases, with a total of 24,849 homicides reported. Growth is also supported by significant government investment in forensic research, such as the National Institute of Justice's allocation of USD 4.5 million to the Forensic Technology Center of Excellence.

- China: Growth is supported by an increasing number of criminal cases and rising awareness of forensic technologies in the Asia Pacific region, which is driving the demand for advanced solutions to support law enforcement.

- Europe: The market is advanced by a rising prevalence of cybercrimes, which has boosted the demand for digital forensic technologies. The market is also supported by a significant number of criminal cases, with magistrates’ courts in England and Wales receiving about 1.37 million criminal cases in 2023.

Forensic Technology Market Trends

Growing Investments in Forensic Research by Various Private and Public Organizations is a Prominent Trend

One of the most prevalent global forensic technology market trends is the rising investment initiatives by public and private organizations in forensic technologies. This will accelerate the development of innovative forensic technologies and help serve the public better.

- For example, in January 2022, the National Institute of Justice declared an allocation of USD 4.5 million toward the Forensic Technology Center of Excellence. The investment is aimed at offering evidence-based insights and technological resources to law enforcement bodies. Moreover, the Forensic Capability Network achieved a significant funding milestone of USD 1.15 million for forensic studies. This funding is expected to back nine research initiatives centered on leveraging Artificial Intelligence (AI) to improve the collection of evidence from crime scenes.

With the expanding frontiers of biological data, it is crucial to fund and invest in forensic research to unlock the full potential of the market.

Download Free sample to learn more about this report.

Forensic Technology Market Growth Factors

Rising Crime Cases to Surge Demand for Forensic Technology Solutions

Forensic evidence is becoming increasingly important in criminal cases as the field of forensic science advances. It can be used to prove or disprove links between suspects, victims, and crime scenes. Forensic evidence analysis involves the study of the crime scene, bloodstain patterns, forensic DNA, DNA testing, and DNA profiling. The rising number of criminal cases is augmenting the demand for forensic technology, thereby enhancing the market growth during the forecast period.

- For instance, according to statistics published by the U.S. Centers for Disease Control and Prevention (CDC), the total number of homicides was 24,849 in the U.S. Such a substantial number of criminal cases will propel the market growth.

RESTRAINING FACTORS

Presence of Lack of Skilled Forensic Professionals May Limit Market Growth

Despite the increasing demand for forensic technology, one of the major impediments is the lack of the presence of skilled forensic professionals, which may impact the process of analysis. Many developing countries are lagging in terms of availability of forensic science professionals, which leads to delays in forensic procedures. These factors are expected to restrict the forensic technology market growth.

- In November 2021, in Nigeria, out of 177 cases that required forensics, the Economic and Financial Crimes Commission’s Forensic and Crime Laboratory Services Directorate concluded that only 37 cases made five court appearances, while 140 were pending. This was due to the inadequate number of forensic experts and the non-renewal of digital forensic licenses by the commission.

These are some of the factors that may limit the adoption or penetration rate of forensic technology solutions. Hence, such instances are subsequently limiting the market growth.

Forensic Technology Market Segmentation Analysis

By Type Analysis

Launch of New Offerings Led to Services Segment’s Dominance in Market

By type, the market is segmented into products and services.

The services segment held a dominant market share in 2023. The rising initiatives by key forensic service providers to offer advanced services to users is expected to enable the segment’s growth. Moreover, the presence of various private and government forensic laboratories offering forensic services for different criminal cases across the globe will propel the segment’s growth.

- In September 2024, QIAGEN N.V. and Bode Technology became the exclusive global commercial partners of the GEDmatch PRO genealogy database, which is used to assist the police and forensic teams with investigative comparisons of genetic data.

The product segment held a notable market share due to the growing number of criminal cases and increasing demand for such forensic technologies. This segment is further sub-segmented into instruments and reagents & consumables. The strong utilization of reagents and consumables in various lab-based procedures for detecting a number of samples of criminal cases enabled its dominance in the product segment.

By Application Analysis

Significant Collaboration by Key Players Enabled DNA Analysis Segment to Dominate Market

On the basis of application, the market is segmented into DNA analysis, drug testing/toxicology, blood analysis, biometrics, and others.

The DNA analysis segment dominated the market in 2023 as increasing number of companies are entering collaborations to offer innovative and efficient products across the globe.

- In November 2023, social app Kintree entered a strategic collaboration with Mapmygenome to offer DNA test kits for users to trace their ancestry (heritage) or ethnicity.

The biometrics segment held a considerable global forensic technology market share in 2023. Biometric devices are security identification and authentication devices that use automated methods to verify a person's identity based on their biological or behavioral characteristics. The segment’s growth is attributed to the surging demand for these devices in criminal investigations.

The blood analysis segment held a notable share of the market in 2023. Blood analysis is used in criminal proceedings and is a crucial part of law enforcement investigations. Significant product launches by key players will drive the segment’s expansion during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Technique Analysis

Chemical Electrophoresis Segment Gained Market Dominance On the Account of High Public & Private Investments

Based on technique, the market is segmented into chemical electrophoresis, polymerase chain reaction, next generation sequencing, and others.

The chemical electrophoresis segment held a dominant share of the global market in 2023. It is a forensic laboratory technique that uses an electric current to separate molecules based on their size and electrical charge. The segment’s growth is attributed to the increasing investment by public and private organizations in the global forensic technology market.

Followed by chemical electrophoresis, the next-generation sequencing segment held a considerable market share in 2023. The growing strategic activities of key players are propelling the segment’s growth.

- In January 2023, QIAGEN completed the acquisition of Verogen, a leader in the use of Next-Generation Sequencing (NGS) technologies, to drive the future of human identification (HID) and forensic investigation.

The polymerase chain reaction and others segments almost held notable shares of the global market owing to the increasing number of criminal cases and growing adoption of advanced technologies across the globe.

By End User Analysis

Growing Volume of Criminal Cases Boosted Forensic Laboratories Segment’s Dominance in 2023

Based on end user, the market is segmented into forensic laboratories, pharmaceutical & biotechnology companies, and others.

The forensic laboratories segment held a major share of the global market in 2023. The growing number of forensic laboratories across the globe and an increasing number of criminal cases will enhance the segment’s growth during the forecast period.

- According to data published in the U.K., the magistrates’ courts in England and Wales received about 1.37 million criminal cases and Crown courts received about 105,000 cases in 2023. Such a significant number of cases will enhance the need for forensic testing in the market.

Moreover, the pharmaceutical & biotechnology companies’ segment held a considerable share of the global market. The segment’s growth is attributed to strategic activities, such as acquisitions and product launches by key players in the market.

REGIONAL INSIGHTS

Based on geography, the global market is segmented into North America, Europe, Asia Pacific, and Latin America, and Middle East & Africa.

North America Forensic Technology Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the highest market share and recorded a revenue of USD 2.16 billion in 2023. The region's dominance is greatly influenced by the widespread availability of companies providing forensic technology solutions and a strong distribution network. Additionally, the growing amount of programs provided by both government and non-government organizations, as well as various initiatives, are helping boost the market’s expansion in the healthcare sector for analyzing large volumes of clinical data in the region.

Asia Pacific is projected to expand at the highest CAGR during the forecast period. The increasing number of criminal cases across the region is boosting awareness regarding forensic tools, which is anticipated to surge the demand for these solutions across the region.

- For instance, in August 2020, Berkeley Research Group (BRG), based in Singapore, launched its services in Asia Pacific to provide investigations-focused technology and analytics services to clients.

Europe held a notable global forensic technology market share in 2023. The rising prevalence of cybercrimes has provided a boost to digital forensic technologies that are utilized for responding to incidents of procurement fraud, white-collar crimes, and IP infringement. This is expected to boost the market’s growth in Europe over the forecast period.

Latin America and the Middle East & Africa markets are expected to record a lower CAGR during the forecast period. Some of the reasons for the slower growth in these regions include the small number of companies offering such solutions and underdeveloped healthcare infrastructure.

KEY INDUSTRY PLAYERS

Strong Presence and Strategic Partnerships Led to Prominence of Some Market Players in 2023

The market is fragmented in nature and consists of certain players that have significant shares. Thermo Fisher Scientific Inc., Eurofins Scientific, and DNA Testing, Inc. have solidified their presence in the market with robust products and established global networks. These companies are concentrating on delving deeper into this market by forming strategic partnerships with academic and research institutes.

- In April 2020, Thermo Fisher Scientific and Hamilton Company launched a Forensic Laboratory-Qualified Automated Nucleic Acid Extraction Platform. This platform, called ID NIMBUS Presto Assay Ready Workstation, integrates Thermo Scientific’s KingFisher Presto Purification System with Hamilton’s Microlab NIMBUS for rapid processing of casework samples.

Some other prominent players include Cytiva, Illumina, Inc., Neogen Corporation, Promega Corporation, and among others. These companies have established their presence and offer a wide range of services with advanced technologies.

List of Top Forensic Technology Companies:

- Thermo Fisher Inc. (U.S.)

- Eurofins Scientific (Luxembourg)

- Agilent Technologies (U.S.)

- Cytiva (U.S.)

- NMS Lab (U.K.)

- Promega Corporation (U.S.)

- Neogen Corporation (U.S.)

- SPEX Forensics (U.S.)

- Illumina, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2023 – Promega Corporation launched the PowerPlex 35GY System, which is an eight-color DNA analysis kit that helps forensic laboratories get more information out of their most challenging samples.

- January 2023 – QIAGEN acquired Verogen, a privately held company offering Next-Generation Sequencing (NGS) technologies, to gain deeper insights into human identification (HID) and forensic investigation.

- July 2022 – Ultra Forensic Technology partnered with ANDE Corporation to accelerate and improve firearm-related forensic analysis using Rapid DNA.

- May 2022 – Promega Corporation launched the Spectrum CE System, a Capillary Electrophoresis (CE) instrument, to support its workflow with any 5-, 6- or 8-color Short Tandem Repeat (STR) analysis chemistry.

- September 2023 – LeadsOnline LLC, a provider of data, technology, and intelligence tools to the U.S. law enforcement agencies, acquired Forensic Technology Inc., a leader in 3D imagery and automated ballistic identification, from Ultra Electronics.

REPORT COVERAGE

The market’s analysis is detailed and comprehensive. The report focuses on key aspects, such as the competitive landscape, analysis of segments based on type, technique, application, end-user, and region. Besides this, it offers insights into the market drivers, trends, dynamics, and COVID-19 impact on the market. Moreover, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 6.6% from 2024-2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Technique

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global forensic technology market was valued at USD 5.65 billion in 2023 and is projected to grow from USD 5.96 billion in 2024 to USD 9.93 billion by 2032.

North America dominated in 2023, accounting for 38.23% market share and valued around USD 2.16 billion, due to strong infrastructure and widespread adoption of forensic tech.

The market will exhibit rapid growth at a CAGR of 6.6% during the forecast period of 2024–2032.

By type, the service segment held a leading position in the market in 2023.

Recent trends include growing investments in R&D, especially for next-gen crime scene evidence collection, and the establishment of public–private collaborations such as government funding for next-gen genomic libraries.

Fortune Business Insights identifies Thermo Fisher Scientific Inc., Eurofins Scientific, and DNA Testing, Inc. as among the leading companies in the global forensic technology market.

The rise in crime rates and unsolved cases globally is driving forensic technology demand. Additionally, government funding and private R&D investment support growth.

Chemical electrophoresis holds the largest share, with next-generation sequencing (NGS) technologies gaining traction through strategic acquisitions and increasing usage.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us