Fundus Camera Market Size, Share & Industry Analysis, By Product Type (Non-Mydriatic Cameras, Mydriatic Cameras, and Others), By Portability (Tabletop and Handheld), By Indication (Diabetic Retinopathy, Glaucoma, Age-Related Macular Degeneration (AMD), and Others), By End-user (Hospitals, Ophthalmic Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

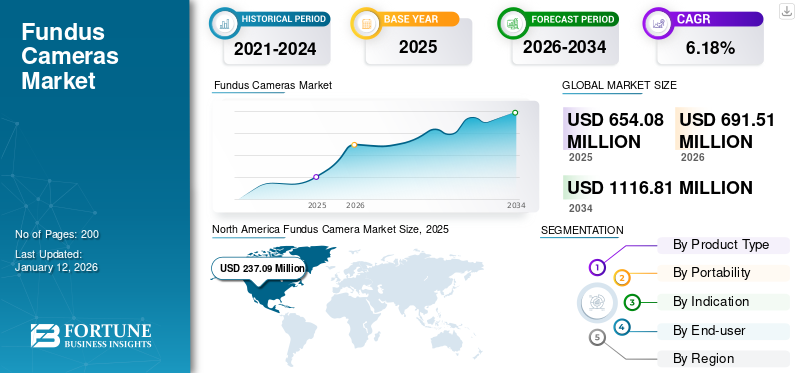

The global fundus camera market size was valued at USD 654.08 million in 2025. The market is projected to grow from USD 691.51 million in 2026 to USD 1,116.81 million by 2034, exhibiting a CAGR of 6.18% during the forecast period. North America dominated the fundus camera market with a market share of 36.40% in 2025.

A fundus camera is a specialized device used in ophthalmology to capture detailed images of the interior surface of the eye, specifically the fundus, which includes the retina, optic disc, and macula. This imaging tool is crucial for diagnosing and monitoring various eye conditions such as diabetic retinopathy, age-related macular degeneration (AMD), and glaucoma.

The global fundus camera market is anticipated to grow driven by the increasing incidence of various eye diseases such as diabetic retinopathy, age-related macular degeneration (AMD), glaucoma, retinal detachment, and other retinal diseases. Fundus photography is crucial for diagnosing and monitoring diabetic retinopathy, allowing for the identification of changes such as microaneurysms and macular edema. The clinical importance of this device is expected to drive its usage in eye care settings.

Key players in the market include Carl Zeiss Meditech AG, Topcon Corporation, and NIDEK Co., Ltd. The companies are implementing various growth strategies, such as new launches and partnerships, which may contribute to their market growth

Fundus Camera Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 654.08 million

- 2026 Market Size: USD 691.51 million

- 2034 Forecast Market Size: USD 1,116.81 million

- CAGR: 6.18% from 2026–2034

Market Share:

- North America dominated the fundus camera market with a 36.40% share in 2025, driven by high prevalence of diabetic retinopathy, advanced healthcare infrastructure, and early adoption of imaging technologies in ophthalmology.

- By product type, non-mydriatic cameras are expected to retain the largest market share during the forecast period due to their patient-friendly features, including imaging without the need for pupil dilation, and increasing use in diabetic retinopathy screening programs.

Key Country Highlights:

- Japan: Market growth is driven by a large aging population and the strong presence of domestic players such as Topcon Corporation, NIDEK Co., Ltd., and Canon Medical. These companies are actively involved in launching AI-integrated devices to aid early detection of retinal diseases.

- United States: The U.S. is experiencing high demand for fundus cameras due to the increasing incidence of diabetic retinopathy, glaucoma, and AMD. For instance, over 9.6 million Americans had diabetic retinopathy in 2021. Additionally, strong telemedicine adoption is boosting the usage of portable and AI-powered fundus imaging solutions.

- China: Growth in China is attributed to rising awareness of eye health, increasing diabetes prevalence, and government-supported eye screening programs. Companies like Mediworks are promoting cost-effective and portable fundus cameras to improve access in rural and semi-urban areas.

- Europe: Europe's growth is supported by the presence of trained ophthalmic professionals and robust demand from clinics and hospitals. The U.K. alone had 3,377 registered ophthalmologists as of 2023, enabling wide deployment of fundus imaging technologies. Additionally, initiatives in AI-assisted diagnostics are gaining traction in countries like Germany and France.

MARKET DYNAMICS

Market Drivers

Rising Prevalence of Ophthalmic Disorders Coupled with Aging Population to Propel Market Expansion

Ocular diseases are increasingly recognized as a critical global health concern, largely influenced by factors such as population aging, unhealthy lifestyle habits, and the growing prevalence of diabetes. These factors contribute to an elevated risk of conditions such as age-related macular degeneration (AMD), diabetic retinopathy (DR), glaucoma, and others.

- For instance, according to the article published by the National Center for Biotechnology Information (NCBI) in November 2021, globally, an estimated 22.2% of people with diabetes have diabetic retinopathy (DR), with 6.2% experiencing vision-threatening diabetic retinopathy (VTDR).

Moreover, the significant growth of geriatric population is contributing to the high prevalence of these diseases, prompting more patients to seek ophthalmic diagnosis across the globe. Such a scenario is driving the demand for effective diagnostic devices such, thereby driving the global fundus camera market growth.

- According to an article from Nature Scientific Reports published in March 2024, it is estimated that 65.0% of individuals aged 60 and above worldwide experience some degree of visual impairment, with 4.0% categorized as blind.

Market Restraints

High Cost of Fundus Cameras May Hamper Market Growth

Despite the high demand for fundus cameras in the ophthalmic diagnosis sector, the high cost of these devices presents a significant market restraint, particularly for smaller healthcare facilities and clinics. Advanced models, especially those equipped with AI features and high-resolution imaging capabilities, can be expensive, which makes them financially inaccessible to many practitioners in low-income regions.

- For instance, as of 2025, the cost of digital fundus cameras can range from USD 10,000 to USD 35,000, while wide-field cameras are typically priced between USD 15,000 and USD 50,000.

This price barrier limits the adoption of essential diagnostic tools necessary for addressing the increasing incidence of eye diseases such as diabetic retinopathy and age-related macular degeneration. The financial strain on healthcare providers is expected to hinder the overall growth of the market, as many facilities may opt for less advanced or outdated equipment due to budget constraints.

Market Opportunities

Increased Use of Fundus Cameras in Telemedicine to Present Significant Growth Opportunities

In recent years, the increased adoption of fundus cameras in telemedicine has revolutionized the landscape of the ophthalmic diagnostic sector. Healthcare systems worldwide are increasingly embracing telemedicine, which is driving the demand for remote diagnostic tools, particularly in ophthalmology.

The technologically advanced fundus imaging devices facilitate the capture and transmission of high-quality retinal images, enabling specialists to diagnose conditions such as diabetic retinopathy and age-related macular degeneration from remote locations.

- For instance, according to the data published by NCBI in March 2021, the Journal of Medical Imaging mentioned that using a Raspberry Pi 3 (RPi 3) to develop a fundus camera, which captures images of the retina, holds significant promise for improving telemedicine diagnosis, offering a compact, portable, and cost-effective solution for remote retinal imaging and diagnosis.

The telemedicine initiatives are particularly beneficial in rural areas where access to eye care is limited, thus expanding the potential customer base for fundus cameras. In this context, the growing focus of eye care professionals in implementing telemedicine initiatives presents lucrative opportunities for the market.

Market Challenges

Limited Technical Expertise May Hamper Market Growth

Despite several technological advancements and high awareness of ophthalmic diagnosis, the global market faces significant challenges due to the technical expertise required for proper operation. Effective use of these sophisticated imaging devices necessitates trained personnel with specialized knowledge in ophthalmic imaging. This requirement presents a substantial barrier, in regions with limited access to qualified professionals.

In many regions, the scarcity of trained eye care specialists can hinder the deployment of fundus cameras, limiting their potential impact on early diagnosis and treatment of retinal diseases. Moreover, inadequate training can lead to improper handling of the equipment, resulting in poor image quality, and unreliable diagnostic outcomes.

- For instance, according to the data published by the American Academy of Ophthalmology in February 2024, there is a projected 30.0% shortage in ophthalmologist FTEs in the U.S. by 2035.

In addition, the need for ongoing education and certification also adds to operational costs for healthcare facilities, which may deter investment in fundus imaging technology. Such a scenario may pose a significant challenge for market growth.

FUNDUS CAMERA MARKET TRENDS

Technological Advancements in Fundus Camera is a Key Market Trend

The integration of artificial intelligence (AI) in fundus cameras is emerging as a transformative trend in ophthalmic diagnosis. AI technologies enhance image analysis capabilities, enabling quicker and more accurate detection of ocular diseases such as diabetic retinopathy and glaucoma. By automating the interpretation of retinal images, AI reduces the burden on healthcare professionals and improves diagnostic efficiency, especially critical in settings with limited access to specialists.

Recent advancements have led to the development of AI-powered fundus cameras capable of autonomously screening for eye conditions with high sensitivity and specificity.

- In November 2020, Optomed launched Aurora IQ, a fundus camera with built-in AI for quicker eye inspections.

In consideration of the benefits of such advanced technology, ophthalmology care providers are moving toward data-driven solutions, which is increasing the demand for AI-integrated fundus cameras. These advancements are expected to further solidify the role of such device in modern ophthalmology.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic had a negative impact on market growth, causing a significant drop in the demand for examination and diagnostic tools, including fundus cameras. Several factors contributed to this downturn, including a reduction in patient visits to ophthalmic clinics and disruptions in supply chains for fundus cameras.

Additionally, many patients avoided healthcare facilities for eye examinations during the pandemic, resulting in decreased use of these devices. For instance, according to a survey published by the National Center for Biotechnology Information (NCBI) in May 2021, the American Academy of Ophthalmology (AAO) urged U.S. ophthalmologists to suspend non-urgent care starting in March 2020 due to the pandemic.

However, with the easing of restrictions in 2021 and a rise in patient visits to eye care facilities, the market began to regain momentum throughout 2021 and 2022. Furthermore, the market is projected to experience substantial growth during the forecast period due to the increasing prevalence of ophthalmic disorders.

SEGMENTATION ANALYSIS

By Product Type

Key Advantages of Non-Mydriatic Cameras to Surge its Adoption Rate

Based on product type, the market is classified into non-mydriatic cameras, mydriatic cameras, and others.

The non-mydriatic cameras segment is expected to hold a significant global fundus camera market share during the forecast period. The growth is attributable to several key advantages offered by non-mydriatic cameras, such as ability to capture retinal images without the need for pupil dilation. These devices offers a faster and more patient-friendly alternative to mydriatic cameras, which require the use of dilation drops. These benefits are expected to surge the adoption of non-mydriatic cameras in the coming years.

- For instance, as of 2025, Suzhou Microclear Medical Instruments Co., Ltd reported that the ability of non-mydriatic fundus cameras to capture larger and clearer pictures without pupil dilation makes them more preferable among ophthalmologists compared to mydriatic cameras.

The mydriatic cameras segment is expected to witness notable growth during the forecast period. The growth of the segment can be attributed to the increasing use of mydriatic cameras for detailed retinal examinations, particularly in diagnosing conditions such as diabetic retinopathy.

The others segment is anticipated to expand at a stagnant rate due to the increasing usage of ROP cameras and hybrid fundus cameras in various applications in ophthalmic settings.

By Portability

Handheld Cameras Segment to lead due to its Ease of Use

Based on portability, the market is classified into tabletop and handheld.

The handheld cameras segment is expected to grow significantly and lead during the forecast period. The growth is attributable to the rising adoption of product due to their portability and ease of use, making them a preferred choice for remote diagnosis. Moreover, several handheld cameras are providing better diagnostic results, especially for conditions such as diabetic retinopathy, thereby increasing its usage.

- For instance, according to the NCBI in March 2023, a study published by the Scientific Journal of the Royal College of Ophthalmologists stated that comparing a 50° handheld fundus camera with an ultra-widefield tabletop fundus camera highlighted promising results for handheld cameras in diabetic retinopathy.

The tabletop camera segment is expected to hold a substantial share of the global market in the forthcoming years. Tabletop fundus cameras are widely used for retinal imaging due to their ability to offer high-quality, detailed images, which are essential for the accurate diagnosis and monitoring various eye conditions. These devices are particularly preferred for early detection and management of conditions such as diabetic retinopathy and glaucoma in healthcare settings, contributing to the segment’s growth.

By Indication

Diabetic Retinopathy Segment to Lead due to Rising Incidence of Diabetic Retinopathy

Based on indication, the market is divided into diabetic retinopathy, glaucoma, age-related macular degeneration (AMD), and others.

The diabetic retinopathy segment is anticipated to account for a substantial market share in the forthcoming years. The growth can be attributed to the rising usage of fundus cameras for the diagnosis of diabetic retinopathy owing to its higher incidence across the globe, which requires effective diagnostic solutions.

- For instance, according to an article published by Nature in March 2023, the number of diabetic retinopathy patients is projected to reach 190.0 million by 2030.

The glaucoma segment is anticipated to grow notably during the forecast period. This is attributed to rising demand for early detection of glaucoma, due to its potential to cause irreversible vision loss. This need for timely diagnosis is expected to surge the demand for tabletop fundus cameras in ophthalmic settings.

The age-related macular degeneration (AMD) segment is projected to witness substantial growth in the forthcoming years. The growth can be attributed to the increasing aging population and lifestyle factors such as diet and smoking, which heighten the susceptibility to age-related macular degeneration (AMD).

The others segment is projected to witness steady growth due to the increasing prevalence of cataracts, hypertensive retinopathy, and other conditions that require fundus photography.

By End-user

Increase in Patient Visits Boosted Hospitals Segment Growth

Based on end-user, the market is segmented into hospitals, ophthalmic clinics, and others.

The hospitals segment dominated the market in 2024 owing to the increasing number of patients visiting hospitals, leading to the large volume of eye examinations. As a result, the demand for fundus imaging in hospital settings has risen significantly for the diagnosis and monitoring of various ocular conditions.

The ophthalmic clinics segment is projected to grow at the highest CAGR during the projection period. The global rise in the number of ophthalmic clinics is contributing to an increased number of specialized eye examinations. These clinics are increasingly adopting advanced diagnostic equipment such as fundus imaging devices to enhance diagnostic accuracy and patient care.

- For instance, in June 2024, Fernandez Hospital, in partnership with LV Prasad Eye Institute, launched a Children’s eye clinic in India.

The others segment, including academic clinics, are expected to grow significantly during the forecast period due to a high focus on partnerships with fundus camera companies.

FUNDUS CAMERA MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Fundus Camera Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2024. The fundus camera market in North America stood at USD 225.4 million in 2024. The increasing volume of ophthalmic diagnoses in the region, driven by the high burden of eye-related conditions and well-established healthcare infrastructure, is anticipated to drive regional market growth.

In the U.S., the growing burden of ophthalmic conditions such as diabetic retinopathy due to the high prevalence of diabetes is fueling the demand for effective diagnostic solutions, including fundus cameras in the country.

- For instance, as per the study published by NCBI in June 2023, there were an estimated 9.60 million people (26.43% of those with diabetes) living with diabetic retinopathy in 2021.

Europe

The market in Europe held a substantial share in 2024 due to the strong foothold of fundus camera’s manufacturing companies in the region. Moreover, the increasing number of ophthalmic professionals is contributing to increased demand for this device in ophthalmic clinics, thereby driving market growth.

- For instance, in December 2023, the Royal College of Ophthalmologists (RCOphth) reported that the specialist register in the U.K. listed a total of 3,377 ophthalmologists.

Asia Pacific

Asia Pacific is expected to witness the highest CAGR during the forecast period. The growth is attributed to the increasing focus of market players to implement eye screening programs that integrate advanced technologies such as smartphone-integrated fundus camera.

- For instance, in October 2022, Samsung's Galaxy Upcycling program aimed to screen 150,000 individuals in Indian for eye diseases by repurposing old Galaxy devices into affordable EYELIKE Fundus Cameras, addressing the need for cost-effective retinal screening in underserved areas.

Latin America

The Latin American market is expected to grow at a significant CAGR during the forecast period. Growth in the region is largely attributed to the rising prevalence of glaucoma, particularly in countries such as Brazil. The growing incidence of this condition among middle-aged and aged populations is expected to increase the utilization of fundus cameras in the region.

- For instance, according to the data published by SciELO in January 2021, a study in Brazil found that glaucoma prevalence was around 3.4% in individuals aged more than 40 years.

Middle East & Africa

Middle East & Africa is anticipated to witness stagnant growth during the forecast period. The region's growth is mainly attributable to the rising awareness of ophthalmic conditions and the expanding healthcare infrastructure in GCC countries, which is expected to enhance the adoption of fundus cameras.

- For instance, in January 2024, the International Trade Administration (ITA) announced that the Saudi Arabian government intended to allocate over USD 65.0 billion toward enhancing the country's healthcare infrastructure as part of its Vision 2030 initiative.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Strategic Initiatives and Launch of New Products to Boost their Market Share

The global market is consolidated, with major players such as Carl Zeiss Meditech AG, Topcon Corporation, and NIDEK CO., LTD. holding a significant share of the market in 2024.

This dominance is due to their strong global presence and a wide array of innovative product offerings. Companies in this sector are focusing on introducing new products to penetrate unexplored markets while prioritizing the development of advanced technological solutions.

Moreover, the other key players such as Haag-Streit Group, CANON MEDICAL SYSTEMS CORPORATION, Kowa Company, Ltd., and other companies are engaged in strategic initiatives such as partnerships and collaborations to strengthen their market presence and stay competitive in the evolving landscape.

LIST OF KEY FUNDUS CAMERA COMPANIES PROFILED

- Carl Zeiss Meditech AG (Germany)

- Kowa Company, Ltd. (Japan)

- Optomed (Finland)

- Topcon Corporation (Japan)

- NIDEK CO., LTD. (Japan)

- Haag-Streit Group (Switzerland)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Mediworks (China)

- Visionix (France)

KEY INDUSTRY DEVELOPMENTS

- December 2024: AVANT Technology and Ainnova Tech announced plans to develop a fundus camera with AI software for early disease detection, managed by Ai-nova Acquisition Corp.

- September 2024: Topcon Corporation received 510(k) clearance from the FDA for OCTA on the robotic Maestro2. This approval made the product the first and only robotic OCT color fundus camera system with OCTA available in the U.S.

- March 2023: Remidio Innovative Solutions Pvt Ltd. obtained CE mark approval from Singapore's Health Sciences Authority (HAS) for its Medios AI to detect Referable diabetic retinopathy. The algorithm can be used with desktop and smartphone-based fundus cameras that can be attached to slit lamps.

- October 2021: NIDEK CO., LTD. announced the launch of Retina Scan Duo2 OCT/fundus camera for diagnostic applications in retinal conditions & glaucoma.

- April 2019: EssilorLuxottica introduced the RETINA800 non-mydriatic fundus camera, allowing for easy screening and detection of retinal pathologies.

REPORT COVERAGE

The global fundus camera market analysis provides market size & forecast by product type, portability, indication, and end-user segment included in the report. It includes details on the market dynamics and market trends projected to drive the market during the forecast period. It offers information on the prevalence of various eye diseases in key regions/countries, key industry developments, an overview of regulatory scenarios, and COVID-19's impact on the market. The report covers a detailed competitive landscape with information on the market share and company profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 6.18% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By Portability

|

|

|

By Indication

|

|

|

By End-user

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 654.08 million in 2025 and is projected to reach USD 1,116.81 million by 2034.

In 2025, the market value stood at USD 654.08 million.

The market is expected to exhibit a CAGR of 6.18% during the forecast period.

The hospital segment led the market by end-user.

The key factors driving the market are the increasing incidence of ophthalmic disorders and technological advancements in fundus imaging.

Carl Zeiss Meditech AG, Topcon Corporation, and NIDEK CO., LTD. are the top players in the market.

North America accounted for the largest market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us