Furnace Carbon Black Market Size, Share & Industry Analysis, By Grade (Standard Grade and Specialty Grade), By Application (Tire, Rubber Products, Plastics, Inks & Coatings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

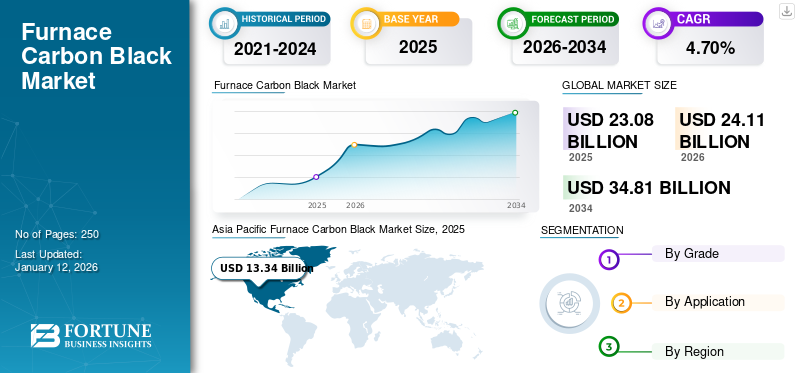

The global furnace carbon black market size was valued at USD 23.08 billion in 2025. The market is projected to grow from USD 24.11 billion in 2026 to USD 34.81 billion by 2034, exhibiting a CAGR of 4.70% during the forecast period. Asia Pacific dominated the furnace carbon black market with a market share of 58% in 2025.

Furnace carbon black is a black powder material produced through the partial heavy petroleum products. It is highly used as a reinforcing filler in tires and other rubber goods. Its importance lies in enhancing durability, strength, and resistance to wear and tear processes in industrial and automotive applications.

The market is experiencing substantial growth, mainly due to the increasing demand for high-performance tires, rising automotive production, and expanding industrial rubber usage across different sectors. Additionally, the growing need for conductive polymers, coatings, and plastics in the electronics and construction industries is further propelling the market expansion.

A few major manufacturers operating in the market include Birla Carbon, Cabot Corporation, Tokai Carbon Co., Ltd., Imerys, and Mitsubishi Chemical Group Corporation.

- According to the Department of Chemicals and Petrochemicals, Government of India, India produced 348.8 kilotons of carbon black in 2020-21, with an installed capacity of 696.0 kilotons, resulting in a capacity utilization of 55.3%.

Global Furnace Carbon Black Market Overview

Market Size & Forecast

- 2025 Market Size: USD 23.08 billion

- 2026 Market Size: USD 24.11 billion

- 2034 Forecast Market Size: USD 34.81 billion

- CAGR: 4.70% from 2026–2034

Market Share

- Regional Share: Asia Pacific dominated the market in 2025 with a 58% share, driven by rapid industrialization, increasing automotive production, and expanding rubber manufacturing capacity across China, India, and Southeast Asia.

- By Grade: Standard grade furnace carbon black holds the largest market share due to its extensive use in tire manufacturing and industrial rubber applications, supported by strong global automotive growth and high aftermarket tire demand.

Key Country Highlights

- India: Produced 348.8 kilotons of carbon black in 2020–21 with a capacity utilization of 55.3%, reflecting strong domestic demand from the tire and rubber industries.

- United States: Rising automotive production and infrastructure modernization continue to strengthen demand for carbon black in tires, rubber goods, and performance plastics.

- China: Maintains a strong position in global tire exports and automotive manufacturing, significantly boosting furnace carbon black consumption.

- Europe: Demand is driven by energy-efficient vehicles, EV adoption, and strict environmental standards that require high-performance tire and rubber products.

FURNACE CARBON BLACK MARKET TRENDS

Growing Focus on Sustainable Production and Technological Advancements to Boost Market

The market is evolving with a strong push toward environmentally responsible production and advanced technological integration. Manufacturers are increasingly adopting cleaner methods using alternative feedstock such as recovered oils and implementing carbon capture solutions to lessen harmful emissions. These efforts are driven by stricter environmental regulations and a growing global emphasis on reducing industrial carbon footprints. As a result, the industry is increasingly prioritizing sustainable practices, driving the market toward contributing to a cleaner environment.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Industrialization and Urban Expansion to Boost Product Demand

Rapid industrialization and urban growth, especially in emerging economies, are driving the demand for furnace carbon black across different sectors. As cities expand and infrastructure projects accelerate, the need for tires, rubber goods, plastics, and coatings rises, where furnace carbon black plays a vital role. The automotive sector, in particular, sees a strong demand due to increased vehicle production and urban mobility needs. Additionally, the growing focus on electric vehicles, along with improvements in material technology and manufacturing processes, is further boosting product usage. As industrial and urban development progresses, the product demand is expected to rise in the coming years.

- According to the Ministry of Heavy Industries, the Indian automotive industry produced approximately 28 million vehicles in 2023-24, a significant increase from 2 million in 1991-92. This growth in vehicle production has directly augmented the demand for tires, thereby increasing the consumption of furnace carbon black.

MARKET RESTRAINTS

Volatility in Raw Material Prices to Hinder Market Growth

Shifts in the prices of key raw materials such as carbon-rich feedstock (e.g., coal tar and petroleum residues) significantly impact the production costs and profit margins of product manufacturers. Rising feedstock prices increase manufacturing expenses, while lower prices may offer temporary relief but create long-term market instability. To mitigate cost pressures, companies are exploring alternative raw materials and improving operational efficiency. However, persistent price volatility remains a key challenge, expected to limit the market growth over the forecast period.

MARKET OPPORTUNITIES

Growing Electric Vehicle Adoption and Advanced Materials to Drive Future Market Growth

The rising adoption of electric vehicles (EVs) offers a promising future opportunity for the market. Carbon black is essential in the production of high-performance tires, battery components, and conductive polymers used in EVs. As the global EV market expands due to environmental regulations and the shift toward clean mobility, the demand for advanced, durable, and lightweight materials will grow significantly. This opens new opportunities for specialty grades of furnace carbon black tailored to meet the performance, conductivity, and efficiency needs of next-generation electric vehicles.

- According to the National Investment Promotion and Facilitation Agency of the Government of India, India’s EV market is expected to grow at a CAGR of 49% between 2022 and 2030, reaching an estimated 10 million annual sales by 2030. This surge in EV production is expected to drive substantial demand for furnace black carbon, particularly in high-performance tires, battery compounds, and conductive materials.

MARKET CHALLENGES

Hazardous Gas Emissions and Health Concerns Pose Significant Challenges to Market Growth

The market faces growing challenges due to the release of toxic gases and fine particulate matter during production, which pose health risks to workers and surrounding communities. These concerns have led to tighter environmental and occupational safety regulations, requiring manufacturers to upgrade facilities and adopt cleaner processes. The additional investment and compliance burden can hinder profitability and limit expansion efforts, making emissions control and health safety a critical obstacle for the market.

Segmentation Analysis

By Grade

High Demand for Standard Grade Carbon Black is Associated with Surging Automotive and Industrial Sectors

Based on grade, the market is classified into standard grade and specialty grade.

The standard grade segment holds the largest furnace carbon black market share. It is primarily driven by its extensive use in the automotive industry for tire manufacturing and industrial rubber applications. This grade offers excellent reinforcement, abrasion resistance, UV protection, and conductive properties in plastics, making it ideal for high-performance tires and mechanical rubber products. With the growing global production of vehicles and growing aftermarket demand, the need for durable and cost-efficient rubber materials is increasing. Thus, its cost-effectiveness and wide applicability across various end-use industries continue to support the segment's growth.

On the other hand, the specialty grade segment is also growing due to the increasing demand for carbon black in non-rubber applications such as plastics, paints & coatings, inks, and electronics. Specialty carbon black offers superior properties such as high purity, color stability, and conductivity, making it essential for high-end applications. The growth of electronics, packaging, and construction industries, along with increasing R&D in conductive and high-performance materials, is increasing the adoption of specialty grades, thereby contributing to overall market growth.

By Application

Tire Segment Dominates Market Due to Growing Automotive Production and Demand for Enhanced Performance

Based on application, the market is segmented into tire, rubber products, plastics, inks & coatings, and others.

The market is witnessing rapid growth, with the tire segment emerging as the dominant contributor due to its extensive use as a reinforcing agent in tire manufacturing. As global automobile production continues to rise, especially in emerging economies, the demand for both passenger and commercial vehicles is growing. This shift toward fuel-efficient, low-rolling-resistance tires, particularly in the electric vehicle (EV) segment, further boosts their usage. Moreover, the rising need for replacement tires, advancements in tire technologies, and stricter safety and performance standards are pushing manufacturers to rely heavily on high-quality carbon black, strengthening the segment’s dominance in the market.

In the rubber products segment, furnace carbon black is widely used during the manufacturing of industrial rubber goods such as hoses, belts, gaskets, and vibration dampers. It enhances the strength, abrasion resistance, and durability of these components, making them suitable for demanding mechanical and industrial environments. The steady growth in manufacturing, construction, and mining sectors across both developed and emerging markets is driving the demand for robust, long-lasting rubber goods, thereby driving the growth of this segment.

In the plastics segment, furnace carbon black is used as a colorant, UV stabilizer, and conductive additive to enhance the performance and appearance of plastic products. It significantly improves the durability and weather resistance of materials when exposed to sunlight, such as agricultural films, pipes, containers, and packaging solutions. As the packaging and construction industries expand globally, the demand for long-lasting, UV-resistant, and appealing plastic materials is driving the product adoption in this segment.

Furnace Carbon Black Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Furnace Carbon Black Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region leads the global carbon black furnace market, driven by rapid industrialization, urbanization, and the development of automotive and manufacturing sectors in countries such as China, India, and Southeast Asia. Government policies promoting infrastructure development, electric mobility, and industrial growth boost the demand for carbon black, particularly in tire and rubber applications. Rising population, increasing vehicle ownership, and foreign direct investments in the automotive and construction industries also contribute to market expansion. The region’s robust production capacity, supported by both domestic and export opportunities, ensures sustained furnace carbon black market growth.

- According to the World's Top Exports, China exported rubber tires worth USD 21.3 billion in 2023, accounting for 21.8% of global exports. This reflects its strong manufacturing base, enhancing product demand in the region.

North America

Market growth in North America is fueled by increasing demand from the automotive, construction, and industrial sectors. Infrastructure modernization, including road maintenance and expansion projects, drives the need for carbon black in tire and rubber applications. Government initiatives supporting sustainable manufacturing and electric vehicle production further boost market growth. In addition, the rising trend of lightweight and high-performance automotive components, along with steady growth in the polymer and plastic industries, contributes to the market expansion in the region.

- According to World's Top Exports, the U.S. exported USD 63.0 billion of cars in 2023, accounting for 6.6% of global exports. This boosts demand for furnace carbon black, which is widely used in tires and rubber applications.

Europe

In Europe, the market is driven by strict environmental regulations and a strong emphasis on sustainable manufacturing practices. The region’s market growth is affected by the automotive industry’s shift toward high-performance and energy-efficient vehicles, including the growing adoption of electric cars, which require advanced tire and rubber components. Renovation of aging infrastructure, adoption of smart city initiatives, and investments in durable, eco-friendly construction materials further boost market growth across the region.

- According to the World's Top Exports, Germany exported USD 40.1 billion worth of electric cars in 2023, accounting for 26.6% of global electric car exports, reflecting its shift toward energy-efficient vehicles and boosting demand for furnace carbon black in the region.

Latin America

In Latin America, the market is expanding due to rising automotive production, infrastructure development, and growing demand for tires and rubber products. Key markets such as Brazil and Mexico are benefiting from increased investments in transportation, housing, and public projects. Additionally, the adoption of EVs and the growth in the plastics and packaging sectors are also contributing to the market growth.

- According to the International Trade Administration, Mexico is the largest export market for U.S. automotive parts and the fourth largest producer globally, generating USD 107 billion annually.

Middle East & Africa

In the Middle East & Africa, the market is growing due to investments in infrastructure, industrial expansion, and increasing automotive production. Countries, including UAE, Saudi Arabia, and South Africa, are driving demand through large construction projects and transport networks. The rise in electric vehicle adoption and efforts to diversify economies and boost local manufacturing also support the growth of the market.

- According to Tire World Exports, the African tire market is projected to grow to USD 8.66 billion by 2030 due to the rise in passenger car and commercial vehicle sales.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Positions in Market

The market is highly competitive, with key players that focus on technological advancements, mergers & acquisitions, and capacity expansion to increase their market presence. Key global companies include Birla Carbon, Cabot Corporation, Tokai Carbon Co., Ltd., Imerys, and Mitsubishi Chemical Group Corporation. These companies compete based on purity levels, cost-effective processing techniques, supply chain integration, and regional dominance while also investing in sustainable extraction technologies to address environmental concerns. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY FURNACE CARBON BLACK COMPANIES PROFILED

- Birla Carbon (India)

- Beilum Carbon Chemical Limited (China)

- Cabot Corporation (U.S.)

- Tokai Carbon Co., Ltd. (Japan)

- Omsk Carbon Group (Russia)

- OCI COMPANY Ltd. (South Korea)

- Orion Engineered Carbons SA (Luxembourg)

- Imerys (France)

- Himadri Speciality Chemical Ltd. (India)

- Longxing Chemical Stock Co., Ltd (China)

- Mitsubishi Chemical Group Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS

- January 2025: Mitsubishi Chemical, in collaboration with Sumitomo Rubber, launched a joint initiative to commercialize sustainable carbon black by recycling end-of-life tires using coke ovens, making the world’s first-ever commercialization of such a process.

- May 2023: Orion Engineered Carbons expanded its production capacity for gas black at its facilities in Dortmund and Cologne, Germany. This move reinforces the company’s leadership in specialty carbon black solutions.

- May 2021: Birla Carbon partnered with Circtec to establish the largest and most efficient pyrolysis plant for Sustainable Carbonaceous Materials used for tire, mechanical rubber goods, and plastic industries, with production starting from the end of 2022.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.70% from 2021-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Grade

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 24.11 billion in 2026 and is projected to reach USD 34.81 billion by 2034.

In 2025, the market value stood at USD 4.04 billion.

The market is expected to exhibit a CAGR of 4.70% during the forecast period of 2026-2034.

The standard grade segment leads the market by grade.

The key factor driving the market is the rising industrialization and urban development, which boosts the demand for the automotive industry.

Birla Carbon, Cabot Corporation, Tokai Carbon Co., Ltd., Imerys, and Mitsubishi Chemical Group Corporation are the top players in the market.

Asia Pacific dominated the furnace carbon black market with a market share of 58% in 2025.

Growing demand from the automotive and electronics industries, increasing use of carbon black in EV components, and rising focus on sustainable and high-performance materials are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us