Gas Turbine Market Size, Share & Analysis, By Capacity (1-2 MW, 2-5 MW, 5-7.5 MW, 7.5-10 MW, 10-15 MW, 15-20 MW, 20-30 MW, 30-40 MW, 40-100 MW, 100-150 MW, 150-300 MW, and 300+ MW) By Technology (Heavy Duty, Light Industrial, and Aeroderivative), By Cycle (Simple Cycle, and Combined Cycle), By Sector (Power Utilities, Oil & Gas, Manufacturing, Aviation, and Others) Regional Forecast, 2026-2034

Gas Turbine Market Size

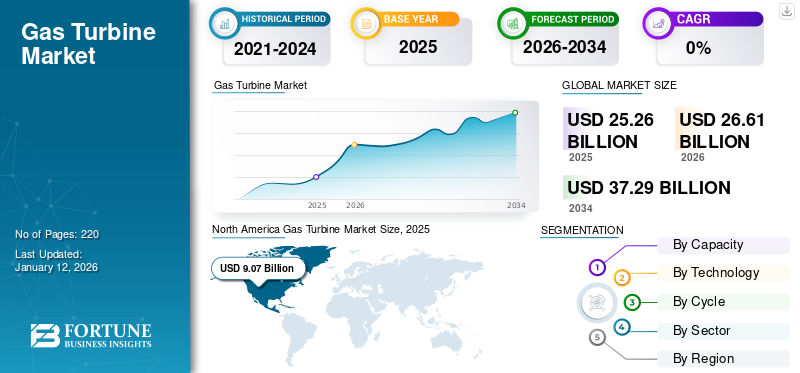

The global gas turbine market size was valued at USD 25.26 billion in 2025 and is projected to grow from USD 26.61 billion in 2026 to USD 37.29 billion by 2034, exhibiting a CAGR of 4.31% during the forecast period. North America dominated the global market with a share of 35.03%% in 2025. The Gas Turbine market in the U.S. is projected to grow significantly, reaching an estimated value of USD 4.05 billion by 2032, driven by the global transition to natural gas based power generation and technological advancement to improve the efficiency of turbines.

A gas turbine can be defined as a combustion turbine which is a type of continuous and internal combustion engine. It consists of a combustor, an upstream rotating gas compressor, and a downstream turbine on the same shaft as a compressor. There is one more component called turbo fans that is used mainly to increase efficiency and to convert power into either electric or mechanical form. These turbines are very effective and are replacing the traditional gas-fired or oil-fired power plant with combine cycle power plant using such turbines primarily running on natural gas.

Global Gas Turbine Market Overview

Market Size:

- 2025 Value: USD 25.26 billion

- 2026 Value: USD 26.61 billion

- 2034 Forecast Value: USD 37.29 billion, with a CAGR of 4.31% from 2026–2034

Market Share:

- Regional Leader: North America held approximately 35.03% market share in 2025, driven by strong natural-gas-based power generation deployment.

- Fastest-Growing Region: Asia Pacific is expected to register the highest CAGR through 2032, fueled by industrialization, urbanization, and a shift from coal to gas turbines in countries like China, India, Japan, Australia, and South Korea.

- End-User Leader: The Power Utilities sector led the market in 2023–2024, driven by large-scale replacement of coal and nuclear plants with efficient gas turbines.

Industry Trends:

- Technological advancements in ultra-high-efficiency combined cycle plants, lean pre-mixing combustors, hydrogen-fuel research, and carbon capture integration.

- Innovations in materials and predictive diagnostics to enhance turbine durability, reliability, and uptime.

- Flexible operations enabling dynamic response to variable electricity demand and renewable energy inputs.

- Expanding applications in aviation with aeroderivative turbines and hydrogen-fueled engine testing.

Driving Factors:

- Global shift away from coal and nuclear power towards cleaner natural-gas-fired turbines.

- Rising global electricity demand due to urbanization, industrial growth, and smart infrastructure projects.

- Stricter environmental policies and energy transition initiatives accelerating gas turbine adoption.

- Efficiency gains and lower fuel costs making gas turbines economically attractive for utilities.

- Increased R&D investments in clean technologies such as hydrogen fueling and carbon capture solutions.

The coronavirus (COVID-19) became a global health threat, affecting more than 200 countries. The power sector was widely affected by the pandemic and the lockdowns imposed by several countries which added to the adverse effect of the pandemic. Due to lockdown, the workforce was not available, the supply chain got immensely disrupted and several power plant projects faced investment issues. Many governments closed international borders and imposed travel restrictions due to which the machinery, the power generation equipment, and experts required to install equipment were not available. This factor delayed several projects.

Gas Turbine Market Trends

Technological Advancements to Drive the Market Growth

Manufacturers are focusing on innovations such as advanced cooling technologies, improved materials, and optimized combustion systems, leading to the development of higher efficiency gas turbines. This translates to lower fuel consumption and operating costs, making them more competitive.

Combined Cycle Power Plants (CCPPs) featuring both gas and steam turbines are constantly being improved, reaching ultra-high efficiency levels exceeding 60%. Developments in lean pre-mixing and dry low-NOx (DLN) combustors are minimizing nitrogen oxide (NOx) emissions. Research on hydrogen-fueled gas turbines holds immense potential for near-zero emissions power generation, aligning with stricter environmental regulations. Carbon Capture and Storage (CCS) technologies are being explored to capture and store CO2 emissions from gas turbines, further reducing their environmental impact.

Advancements in materials and diagnostics are enhancing the reliability and durability of gas turbines, leading to longer operating lifespans and reduced downtime. New designs and control systems are making gas turbines more flexible, allowing them to adapt to the fluctuating electricity demand and integrate with renewable energy sources.

Growing Aviation Industry and Increasing Consumption of Electricity is a Latest Trend

The electricity demand is increasing globally and governments are highly focused on decreasing the consumption of fossil fuels as they increase emissions around the world. The governments in several countries are replacing coal-fired steam plants and combined cycle power plants with such turbines. These turbines consume natural gas as their primary fuel. The gas based power produce lesser greenhouse gases.

The aviation industry is expanding rapidly across the world, thereby creating a huge opportunity for this market. Emerging economies focus on improving the aviation industry. Rising investments in the aviation sector is expected to create a growth opportunity for this market.

Some of the developments regarding gas turbine for aviation sector is as follows:

- November 2022- On a military location in England, a Rolls-Royce AE-2100A gas turbine jet engine — utilized in regional aircraft all over the globe – undergone flight tests utilizing hydrogen as fuel for the first time. The trials are being handled in corporation with airline easyJet.

Download Free sample to learn more about this report.

Gas Turbine Market Growth Factors

Increasing Focus on Nuclear and Coal Driven Turbines Replacement by Gas Turbines to Fuel Industry Growth

Coal-based power plants emit large amounts of harmful gases. The emission of such gases contributes largely to heating. The nuclear-driven turbines also generate large amounts of toxic gases which lays long-term harmful effects on the environment. Governments in several countries aim to reduce greenhouse gases and replace nuclear and coal-driven turbines with gas-driven turbines. These turbines usually emit lower toxic gases than coal power plants.

In 2019, around 2,044 GW capacity of coal-fired power plants were operating in the world. By 2021, China is operating around 1,082 coal-fired power plants which largely contributes to increasing air pollution. In February 2021, Junliangcheng Power Plant has added around 650 MW of gas-driven turbine power plant which is a step towards the transition from coal to gas.

Rising Electricity Demand Across the World Augmented Growth in the Market

The electricity demand is widely increasing around the world because of increasing urbanization and infrastructural development worldwide. Industrialization is also increasing across developing countries. In many countries, various smart building, smart cities projects have been initiated which further increases the electricity demand. To fulfill the electricity demand, the public and private sectors are increasing power plant capacity either by installing new power plants or by expanding their power plant capacity. Such projects are majorly installing gas-driven turbines as they are efficient and less harmful. Governments have also implemented stringent emission norms, provoking companies to adopt gas-based turbines on a large scale. Thus, this factor is expected to drive the growth in this market during the upcoming years.

RESTRAINING FACTORS

Volatility in Natural Gas Prices to Hamper Gas Turbine Market Growth

Natural gas prices are affected by disruptions in the supply of natural gas. Geopolitical tension is a disruptive factor that causes uncertainty regarding the availability or demand for gas. This can cause higher gas price volatility. The cost of gas within the U.S. has fallen drastically because of shale gas exploitation, but elsewhere within the world, the value remains relatively high. Most of the countries in the Middle East region account for a significant share of natural gas reserves. It is a highly unstable region due to political and cultural issues. Moreover, from the past few months, due to the Covid-19 pandemic, the demand for natural gas decreased significantly. Thus, the costs of gas also dropped, which creates a negative impact on the market growth.

Gas Turbine Market Segmentation Analysis

By Capacity Analysis

The 150-300 MW Segment Held the Largest Market Share Due to High Demand from Power Industry

Based on capacity, the market is segmented into 1-2 MW, 2-5 MW, 5-7.5 MW, 7.5-10 MW, 10-15 MW, 15-20 MW, 20-30 MW, 30-40 MW, 40-100 MW, 100-150 MW, 150-300 MW, and 300+ MW. The 150-300 MW segment dominated the market in 2026 with a share of 19.84%. These capacity turbines are primarily used in the power generation industry. As the focus of the power generation industry has been shifting to reduce harmful gas emissions due to environmental safety awareness. The use of gas-driven turbines is increasing in these capacities around the world and thus, this factor shall drive growth in the 150-300 MW segment.

By Technology Analysis

Heavy Duty Technology is Estimated to Hold Large Market Share Owing to Rise In Manufacturing Plants

In the technology segment, the market is divided into heavy-duty, light industrial, and aeroderivative. Aeroderivative technology held the major share of 42.80% the global market in 2026. The number of manufacturing plants is growing rapidly along with the integration of large-scale economic zones across developing nations. The expansion of captive generating power stations is increasing across the world due to the rising demand for electricity across the industrial sector. These power stations help in fulfilling electricity demand, which, in turn, shall drive growth in the heavy-duty segment.

The aeroderivative segment is expected to expand at a significant pace during the forecast period. The high availability of highly mobile and flexible technologies drives the growth in the aeroderivative segment. The aeroderivative segment has a diverse application portfolio that includes utility generation, marine propulsion, and district heating.

By Cycle Analysis

Combined Cycle Segment Holds Significant Market Share Due to High Demand from Power Plants

Based on the cycle, the market is segmented into simple cycle and combined cycle. The combined cycle segment held a significant market share of 70.01% in 2026. The growth is mainly attributed to effective waste heat utilization, environmental proximity, and operational efficiency. The demand for such turbines is increasing from the power plants. The combined cycle plants are built in phases, first, the simple cycle plants are constructed and then converted to combined cycle gradually.

The simple cycle segment is likely to foresee growth in this market during the forecast period. The simple cycle plants are cost-effective as compared to combined cycle plants and they are easy to construct and maintain.

By Sector Analysis

Power Utility Sector is likely to Hold the Highest Market Share Due to Rise in Coal Turbine Replacement Activities

Based on sector, the market is segmented into power utilities, oil & gas, manufacturing, aviation, and others. The power utility segment is likely to dominate the global market with a share of 46.94% in 2026. The rising focus towards the replacement of conventional steam and coal-fired turbines with gas-driven turbines in various power generating stations is growing immensely. These turbines provide high efficiency in power generation as compared to the traditional power generation plants.

The aviation segment is likely to expand at a significant CAGR during the forecast period. The use of this turbine from the aviation segment is increasing rapidly. The aviation sector is growing immensely across the world. The use of such turbines in this sector is more feasible for high-speed requirements.

The oil & gas segment is likely to grow significantly during the forecast period. The demand and consumption of oil & gas are rapidly increasing across the world. Exploration and production activities are increasing immensely around the world. Natural gases are used mostly as a primary fuel in this turbine.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL ANALYSIS

The global market can be divided into five regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America plays a significant role in the market.

North America Gas Turbine Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America has the major gas turbine market share. This region has a number of gas-driven turbine plants, which are operating mainly on natural gas as shale gas exploration activities in this region are increasing. In 2019, the U.S. Energy Information Administration (EIA) stated that more than 40% of the nation’s power comes from coal whereas nearly 25% from natural gas. The U.S. market is projected to reach USD 3.09 billion by 2026. By the end of 2019, more than 49 GW of coal plants were retired and around 14 GW boiler converted to burn natural gas and around 15 GW was replaced with natural gas combined cycle. The EIA expects natural gas to become the primary fuel for power generation by 2035.

Asia Pacific region is anticipated to grow at the highest CAGR during the forecast period. Rapid industrialization and urbanization have increased demand for energy, and demand for clean energy technologies such as renewable energy. This region is majorly dependent on coal for power production and coal combustion causes a substantial amount of pollution. The government in this region has taken several steps to lessen carbon emissions which has further increases the use of gas-driven turbines in Japan, China, India, Australia, and South Korea. The Japan market is projected to reach USD 1.19 billion by 2026, the China market is projected to reach USD 1.56 billion by 2026, and the India market is projected to reach USD 0.72 billion by 2026.

Europe region is likely to witness significant growth during the forecast period. The European region is extensively working on reducing carbon emissions and for the same, several countries in this region are deciding to phase out coal and nuclear plants from their power generation mix. The UK market is projected to reach USD 0.86 billion by 2026, while the German market is projected to reach USD 0.57 billion by 2026. The focus on gas-driven turbine plants is increasing as these turbines run on natural gas ,which can be a good alternative to coal. The contribution of natural gas is very low in emission as compared to coal. This drives growth in the Europe region in this market during the forecast period.

Key Industry Players

Key Participants Are Concentrating On New Contracts to Boost Market Share

The market is extremely uneven with the existence of several large-scale players across the world. These include a group of major companies having a wider geographical presence. Several companies are participating in organic and inorganic developments to solidify their market position across the globe. The companies are focusing on new contracts in order to increase their market share.

- For instance, In March 2021, General Electric declared to deliver the first two HA gas turbines to the UAE, which will likely be the most effective power plant in the middle east utility sector. General Electric will source in total three 9HA.01 gas-driven turbines.

- In February 2023, Mitsubishi Power accepted an order from Uzbekistan for Two Steam Turbines and Two M701F Gas Turbines for Talimarjan-2 TPP Project in Uzbekistan, Mitsubishi Power will also deliver technical advisers to the site to supervise the installation and commissioning process.

List of Top Gas Turbine Companies:

- GE (U.S.)

- Siemens (Germany)

- Mitsubishi Power (Japan)

- Ansaldo Energia (Italy)

- Solar Turbines (U.S.)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Doosan Heavy Industries & Construction (South Korea)

- Bharat Heavy Electrical Limited (India)

- OPRA Turbines (The Netherlands)

- Rolls Royce (U.K.)

- Vericor Power Systems LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2023, GE’s latest high-efficiency gas turbine will cover less natural gas, which will be implemented in the 435-megawatt Tallawarra power station in Sydney, Australia.

- January 2023, Mitsubishi Power accepts an order for H-25 Gas Turbine for Taiwan’s Chang Chun petrochemical project; additionally, conversion of the cogeneration system at the Miaoli Factory in Miaoli City to a High Power-Efficient Gas-Fired System to Decrease CO2 Emissions.

- January 2022, GE Digital’s Autonomous Tuning Speed up the Energy Transition with Machine Learning and Artificial Intelligence, which will reduce harmful emissions and fuel consumption for gas turbines. Additionally, this will cost lower machinery and operational flexibility.

- March 2021, General Electric declared to deliver the first two HA gas turbines to the UAE, which will likely be the most effective power plant in the middle east utility sector. General Electric will source in total three 9HA.01 gas-driven turbines.

- January 2021, Gruppo Arvedi awarded Ansaldo Energia a contract for the delivery and refurbishment of the new combined cycle power Plant in Servola. The plant will include an AE64.3A gas turbine equipped with the advanced generation technologies already validated to ensure low operational emissions, flexibility, and high efficiency.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.31% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (MW) |

|

Segmentation |

By Capacity

|

|

By Technology

|

|

|

By Cycle

|

|

|

By Sector

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights shows that the global market size stood at USD 25.26 billion in 2025.

The global market is projected to grow at a CAGR of 4.31% over the forecast period.

The North America market size stood at USD 9.07 billion in 2025.

Based on the sector, the power utilities holds the dominating share in the global market.

The global market size is expected to reach USD 37.29 billion by 2034.

Energy Transition Towards Greener Energy is one of the major driver of gas turbine market

The top players in the market are Siemens, GE are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us